Here are my Top 10 links from around the Internet at 10am. I welcome your additions and comments below or please send your suggestions for Thursday's Top 10 at 10 to bernard.hickey@interest.co.nz FYI we don't have a Pandemic Bonus for interest.co.nz.  1. You don't say - Rob Cameron, who is chairing New Zealand's Capital Markets Development Taskforce, has written an opinion piece in the NZ Herald saying out loud what many investors know: New Zealanders have given up on capital market and the NZX. He does go on to suggest some solutions, but there's no silver bullet. I'm beginning to wonder if there is any hope while the powers-that-be refuse to address the massive bias in favour of property.

1. You don't say - Rob Cameron, who is chairing New Zealand's Capital Markets Development Taskforce, has written an opinion piece in the NZ Herald saying out loud what many investors know: New Zealanders have given up on capital market and the NZX. He does go on to suggest some solutions, but there's no silver bullet. I'm beginning to wonder if there is any hope while the powers-that-be refuse to address the massive bias in favour of property.

Negative attitudes may have been shaped, initially, by the 1987 share market crash, in which New Zealand fared worse than the rest of world. More recently the failures of some finance and property companies and losses resulting from poor advice have left many with a sour taste in their mouths. And New Zealand came bottom of 16 countries in a recent Morningstar report on investors' experience of managed funds. No wonder people prefer property - as the figures show. Owner-occupied houses and rental properties account for about three-quarters of New Zealanders' household savings, according to the Reserve Bank. Even if we allow for investments in unlisted businesses and farms, which aren't included in this research, we are still out on a limb. In a number of other countries - Australia, Canada, Germany, Italy, Japan, Britain and the US - property makes up about one-third to one-half of savings. Furthermore, just three per cent of New Zealanders' savings is in direct holdings of listed shares, with the rest in other financial assets. That is also very low by international standards.

2. Borrow short, spend long - The US government staged a very successful auction of 2 year Treasury bonds overnight as spooked investors put their money in a short term safe haven. The longer term Treasury auctions are not going so well. It turns out much of the US deficit is being funded with short term bond issues. That's fine until it's not, particularly as much of the US fiscal problem is now a long term problem. Rolfe Winkler at Reuters points this out.

Timothy Geithner wants to lock in low rates for the government while he can, extending the maturity of Treasury debt to 72 months from 49, a 26-year low. It's a smart move "” if he can pull it off. To do so, he'll have to increase longer-term issuance by 40 percent, to $600 billion, according to FTN Financial estimates cited by Bloomberg. That could put pressure on interest rates, nipping the recovery in the bud. It's a risk he should take. The bigger risk is that the government continues to fund itself at the short end of the curve, requiring Treasury to roll over its obligations more frequently. With short-term rates near zero, Treasury has drastically reduced interest costs by selling so much short-term debt. At a certain point it may have to do so in a less receptive market. This week, Treasury plans a record $123 billion worth of issuance. A big buyer, meanwhile, is leaving the market: The Federal Reserve will exhaust its $300 billion purchase program for Treasuries once it buys another $2 billion. Still, demand remains healthy. Monday's 5-year, $7 billion auction of TIPS was well received. And at 3.52 percent, the current yield for the 10-year remains near historic lows. Yet demand won't be this strong forever. For one, there's demographics. As boomers age, more Treasury securities will be sold to finance retirements. The Social Security trust fund, the largest holder of U.S. government debt, will exhaust its surplus by 2016. At that point, the fund will cash in its IOUs, forcing Treasury to borrow more. That sounds like a long way off, but those estimates assume an optimistic increase in employment and payroll taxes.

3. The madness goes on - Gillian Tett from FT.com is closely watched because she was one of the commentators who was warning pre-crash about risks in global financial systems. In this piece she relates her fears about how cheap money has pumped up and supported fundamentally unstable stock prices and credit markets. What happens when central banks try to suck out the cheap money? She cites a senior banker:

"Forget about the events of the past 12 months ... the punters are back punting as aggressively as ever," he wrote. "Highly leveraged short-term trades are back in vogue as players ... jostle to load up on everything from Reits [real estate investment trusts] and commercial property, commodities, emerging markets and regular stocks and bonds. "Oh, I am sure the banks' public relations people will talk about the subdued atmosphere in banking, but don't you believe it," he continued bitterly, noting that when money is virtually free "“ or, at least, at 0.5 per cent "“ traders feel stupid if they don't leverage up. "Any sense of control is being chucked out of the window. After the dotcom boom and bust it took a good few years for the market to get its collective mojo back [but] this time it has taken just a few months," he added. He finished with a despairing question: "Was October 2008 just a dress rehearsal for the crash when this latest bubble bursts?"

4. US dollar carry trade bubble - Nouriel Roubini has latched on to the problem caused by the US dollar carry trade replacing the Yen carry trade, Ed Harrison points out at CreditWritedowns. This, of course, has implications for New Zealand. It is reassuring that the Reserve Bank has essentially intervened to prevent the banks from using the cheap hot global money too much by imposing its strict prudential liquidity policy (which seems to be being adopted by other central banks).

My view has been that the Japanese yen carry trade was a major contributor to asset bubbles globally as the Bank of Japan's excess liquidity found its way to other asset markets via the carry trade. Last August, in my post "Japan's easy money policy was the trigger for the tech wreck" I also pointed to the yen carry trade as a major factor in the Internet bubble. And I certainly see it as a major factor in this decade's housing bubbles. Now the U.S. dollar is the carry trade currency of choice, with zero percent interest rates funding asset purchases globally. This play is certainly pumping up all manner of asset prices. But as with the yen carry trade before it, I do not see this ending well. Roubini takes a similar tack: "The risk is that we are planting the seeds of the next financial crisis," said Roubini, chairman of New York-based research and advisory service Roubini Global Economics. "This asset bubble is totally inconsistent with a weaker recovery of economic and financial fundamentals."

5. Middle class debt stress - Yves Smith at NakedCapitalism carries this interesting email from a very stressed member of America's middle class. Here's a taste of what's really going on in America, which remains the world's consumption engine. Essentially, the credit cards are being hammered just to survive and now the banks are calling in the credit card debts.

Just like most everyone I know, my husband and I are in big debt with our credit card companies. My husband was laid off on New Year's Eve last year. We were in total shock. I am retired from the USAF and receive a small monthly check, and my husband began collecting a meager unemployment check. He searched all over the US and made several trips out west knocking on doors and handing out his resume. NOTHING. Anyway, we had no saving and a little bit of stock which was cashed in at an all time low. No help there. Then we started living off our credit cards. Without them, we would have not made it, period. Our daughter and her family moved in upstairs and her husband was working of a whopping $8.50 an hour. No help there. So basically we were supporting them as well. We have a mortgage payment of $1175 and $30,000 equity still in our home, but we are unable to refinance at a lower rate BECAUSE my hubby was unemployed! Getting back to my B of A card, I have NEVER been late on a payment in 10 years (until last month). I have always paid more than the minimum (until January 1st). BUT, my interest rates have inched up and up in the last few months and then, BOW! I tried to use my card about 3 weeks ago at the grocery store and it was denied. Needless to say, I walked out without the food. We don't waste anything, not money, not food, not heat or lights, nothing, but we are going down fast. The good news is that my husband got a job this week (at a much, much lower wage) and will finally get a pay next week after almost 10 months. The bad news is that B of A is killing me and will ruin me soon. I sent them a "token" $10 payment on the $450 monthly that I owed. The payment was on time, but the $10 sure didn't make them happy. They slapped a "LATE FEE" of $39 even though my "payment" was not late AND of course the dreaded overdraft fee of $39. Yesterday I got a statement from them saying that my next payment due 11/11 is $950. I can see the snowball at the top of the hill ready to roll. What do I do? Do I revolt and refuse to pay? Do I keep sending them $10 as a promise to pay? OR do I write Kenneth Lewis and say I want some of their TARP/bonus money back so I can apply it to my B of A account? It's not fair, although I know we lived off our credits cards and much of what I owe is money that I spent on essentials, BUT, the ultrahigh interests rates combined with their slap-on-every-extra-fee-we-can mentality is outrageous. We have worked all our lives to have and keep our excellent credit ratings and now all that is shot.

6 Canadians talk (some) sense - Finally someone up north is talking some sense. The Bank of Canada has said the global financial system must be changed so banks can collapse without hope of a government bailout. Meanwhile, however, the central bank has hinted it may so some of its own money printing, Reuters reported.

"We have to have a system where you could have an institution going bankrupt. One of the problems during the crisis was that each institution that goes bankrupt had to be saved, and that's not acceptable," Carney told the French division of CBC television. "It's necessary to do that (let banks go bankrupt) and it's essential that the institutions themselves think it's possible." Earlier on Monday, he had said in a speech that the risks should return to the financial institutions and no longer be borne by the government. In his speech he reiterated that the bank retained considerable flexibility, even though its rock-bottom interest rates cannot be cut further, in keeping the economy and therefore inflation on an even keel. That is code language for saying the bank could, if necessary, engage in quantitative easing, essentially printing money, particularly if the Canadian dollar rose too far too fast. But, asked if this prospect were now closer given the strong rise in the currency, he said: "Not necessarily. We just decided on our monetary policy last Tuesday and we reiterated our conditional commitment (to keep rates steady till mid-2010) and that's the appropriate policy to reach our target."

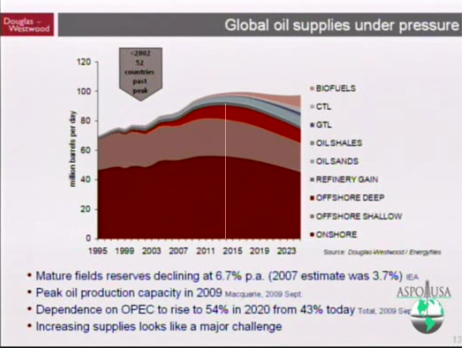

7. Peak oil - The world looks set for peak oil in 2014, according to this collection of interesting analyses from an oil industry conference, theoildrum.com reports. Remember, this is from the oil industry experts, not a bunch of greenies. The article is dense but full of useful tidbits.

Ray Leonard showed that production in the Rest of the World peaked in 2002 and by 2008 declined by 7%. With OPEC and Russia unable to increase production significantly due to politics and economics, we are nearing World Peak Oil Production. "Production peak of ultra deep water fields will allow 'peak' to be a 'plateau' in the coming decade, followed by a sharp fall" according to Leonard. Unconventional production is not set to change this situation, as his expectation is that the contribution of this category of oil will be less than 3 million barrels per day in the short to middle term. The specific path of future oil production was projected by Chris Skrebowksi using the oil megaprojects approach, wherein all the large fields expected to come on-stream in the next seven years are tabulated and compared with decline rates in current fields. In this approach, only the supply side is taken into account and the demand side is ignored. From that perspective according to Chris Skrebowksi the current plateau will continue until around 2014.

8. China myths - Newsweek has a useful piece here detailing a bunch of China myths.

The conventional wisdom is that China is steaming through the global financial crisis by building on the momentum generated by its 30-year boom. Indeed, ever since it sailed through the last big global crisis"”the Asian contagion 10 years ago"”Beijing has been feted for uniquely steady helmsmanship in financial storms. So perhaps it's natural for forecasters to assume that the Chinese supertanker of state is not turning sharply now, particularly since it continues to grow rapidly even as other economies sink in the recession. Yet this crisis is different"”bigger and more damaging than any seen in generations"”and it is exposing limits and forcing change in just about every key piece of the China model: the supremacy of the one-party state, the smart economic management, the export-driven growth, the emerging consumer class, the burgeoning private sector, the headlong focus on growth at any environmental cost, and the drive to build world-class companies.

9. Citigroup breakup? - Further to the details yesterday on Citigroup cutting off credit card customers, Ed Harrison at Credit Writedowns wonders whether the US government might be trying to break up Citi quietly.

It seems that not a day goes by when you don't hear about some asset sale in Citigroup's far-flung empire. Of all the major too-big-to-fail institutions, it is easily the most troubled: the poster child for everything that is wrong in finance in America. But, when President Obama's Pay Czar Kenneth Feinberg stepped in to limit pay at Citi and six other failed institutions living off of taxpayer largesse, I noticed something that made me wonder if there was more going on than meets the eye at Citi. I am starting to think Citigroup is being forcibly dismantled by the Obama Administration as a condition of its bailout. Could there be some bailout strings of which we are not yet aware?

10. Some amusement - This is the funniest version of an annual report from the Reserve Bank of New Zealand I have ever seen. David Haywood has written a few short stories where Alan Bollard is the key protagonist. Here's a sample.

SO ALAN BOLLARD phones me, and he's like: "I'm totally ready to sort out the Briscoes lady once and for all." And I'm like: "Too right, mate!" Then I go: "But I'll just have to phone the missus first. Not that I need to ask permission or anything,but just 'cause I like to treat my lady right." Five minutes later I hear Bollard's ute in the driveway. I get in the passenger passenger seat and he just looks at me, and asks: "Dude, why are you so totally pussywhipped?" He floors it, and I'm about to broach the subject of demand-driven fiscal policy, when he tells me that he's just sunk a dozen bottles of DB Brown. I'm like: "Dude, should you be running the economy when you're totally wasted?" And he's like: "F**k off, are you my mother or something?"

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.