Top 10 at 10: More US bank problems; Fart power; China no gold bug; Dilbert

10th Mar 10, 10:18am

by

Here are my Top 10 links from around the Internet at 10am. I welcome your additions and comments below or please send suggestions for Thursday’s Top 10 at 10 to bernard.hickey@interest.co.nz We have no use for bathtubs at Interest.co.nz

1. Fast bank runs - Yale professor Gary Gorton, who is a pillar of the establishment, has written a piece for Zero Hedge warning about the risk still in financial markets of wholesale runs on banks and shadow banks. Here's the full PDF and ZeroHedge's take below.

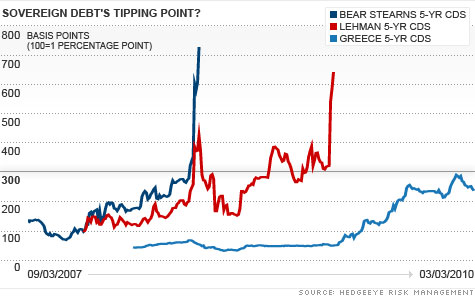

1. Fast bank runs - Yale professor Gary Gorton, who is a pillar of the establishment, has written a piece for Zero Hedge warning about the risk still in financial markets of wholesale runs on banks and shadow banks. Here's the full PDF and ZeroHedge's take below.

The scariest thing is that we have still done nothing to address the propensity for institutional panic to come back, which courtesy of money now being electronic 1's and 0's, will certainly take an even faster time to hit its plateau when it appears next. Keep in mind that post the Lehman crisis, it only took 3 days before the money markets locked up and were in need of governmental guarantees, while the broader repo market was shut down within 48 hours. As retail investors tend to enjoy obtaining physical delivery of their asset (read FRNs), for institutions, the wave can turn at a heartbeat, and next time around the administration will likely not even have 12 hours before a complete financial, systemic, and irrevocable lock-down is in place. The only backstop to this risk- the Federal Reserve.2. China rate hike? - China may be about to hike interest rates within weeks, Bloomberg reports after a survey of economist' expectations on inflation.

China’s inflation probably accelerated and exports climbed in February, according to surveys of economists, increasing the likelihood of the central bank raising interest rates from a five-year low. Consumer prices rose 2.5 percent from a year before, the most in 16 months, according to the median of 29 estimates in a Bloomberg News survey before tomorrow’s report. While the gain was likely exaggerated by seasonal factors, economists project the momentum to continue, sending the rate to as high as 4.4 percent during the year, a separate survey showed last week. Inflation, property speculation and risks for banks are among Premier Wen Jiabao’s prime concerns after a record 9.59 trillion yuan ($1.4 trillion) of loans jumpstarted growth last year. Central bank Governor Zhou Xiaochuan said March 6 that while stimulus policies must end “sooner or later,” China needs to be cautious in timing an exit because a global recovery “isn’t solid.” “The biggest danger to the economy is inflation,” said Wang Qian, an economist with JPMorgan Chase & Co. in Hong Kong. “The government needs to manage inflation expectations and may raise interest rates within weeks.”3. Collapse of Empire - Paul B Farrell from MarketWatch, which I once used to work with, has highlighted some warnings about the end of the American empire. HT Troy Barsten via email

"One of the disturbing facts of history is that so many civilizations collapse," warns anthropologist Jared Diamond in "Collapse: How Societies Choose to Fail or Succeed." Many "civilizations share a sharp curve of decline. Indeed, a society's demise may begin only a decade or two after it reaches its peak population, wealth and power." Now, Harvard's Niall Ferguson, one of the world's leading financial historians, echoes Diamond's warning: "Imperial collapse may come much more suddenly than many historians imagine. A combination of fiscal deficits and military overstretch suggests that the United States may be the next empire on the precipice." Yes, America is on the edge. Dismiss his warning at your peril. Everything you learned, everything you believe and everything driving our political leaders is based on a misleading, outdated theory of history. The American Empire is at the edge of a dangerous precipice, at risk of a sudden, rapid collapse.4. China wary of gold - Some people wonder if China will try to reduce its exposure to U.S. Treasury paper by buying gold. But it seems China is no fan of gold, according to the Head of Foreign Exchange, Bloomberg reports.

Gold is “unlikely” to be China’s primary investment to diversify its reserve holdings because of price risks, Yi Gang, head of the State Administration of Foreign Exchange, said today. The “gold price has had handsome gains in recent years,” Yi said at a briefing in Beijing today. Still, “if we look at the past 30 years, it had big ups and downs.” China is the world’s largest producer of gold and the second-biggest consumer after India. “Gold is unlikely to become a primary investment for China’s reserve,” Yi said. “The size of the world’s gold market is small. China’s purchase will push up the prices. That will also hurt Chinese gold consumers.” Private holdings in China are more than 3,000 tons, Yi said.5. When countries go out of business - Here's Daryl G. Jones, the managing director of risk management at Hedgeye, talking at CNNmoney about the risk of sovereign defaults. He refers to this chart, which shows countries or companies with Credit Default Swap spreads over 300 basis points as being in trouble. He also refers to the recent Kenneth Rogoff book 'This time it's different' which says that debt of more than 90% of GDP is a problem. New Zealand's net debt is well over 90%, but our Credit Default Swap spreads are around 60 basis points, whereas Greece's net debt is around the same as New Zealand's, but its CDS swaps are around 250 basis points.

While Greece has been in the news due to the size of its economy and its relevance to the Eurozone, a screen of credit default spreads globally (see table) suggests that there are countries that are in even worse shape. Notably, Argentina, an economy of comparable size to Greece, is currently undergoing a debt restructuring. While credit default spreads are only one metric to analyze potential default risk, there are a very important one as the do tell the real cost by large investors to insure against potential default. Now compare these spreads against Lehman Brothers and Bear Stearns before their defaults. If you look at the chart above, you can see that 3 percentage points is the tipping point. Interestingly, as sovereign debt risk has received more airtime in the business press over the last few weeks, the perceived risk by investors, according to CDS spreads, has abated. Regardless, if risk of default has diminished in the short term, the countries we have highlighted have long-term fiscal imbalances that need to be resolved. Countries, like people, cannot issue debt in perpetuity without facing the consequences. Walter Wriston, former chairman of Citibank (the same company that Rubin would later chair), once famously said, "Countries don't go out of business." That may be true, but countries with too much debt running large deficits certainly do default.6. Fart gas - California's dairy farms are keen to turn cow effluent into methane and then electricity, but bureaucrats enforcing rules on Nitrogen Oxide emission are stopping them, the Los Angeles Times reports. Does anyone know of any dairy farmers in New Zealand trying to build waste digesters to do the same here? Do we have the same nitrous oxide rules?

Last year, six dairy digesters were shut down because of regulatory or financial problems. One of them is at Ron Koetsier's dairy in Visalia. Koetsier had been using his digester and generator system since 2003 as a way to power his barns and eliminate his dairy's electrical bill. Southern California Edison, his electricity provider, had just opened the door in 2008 to buying his excess electricity when the San Joaquin Valley air district told him that his two generators violated local NOx emission standards for digesters. He contacted the manufacturer of the generators. He said he was told that it would cost $100,000 in new parts to get them in compliance, and up to $50,000 a year in maintenance fees. Koetsier shut the system down. Now the equipment is collecting dust. "They have a point. I want clean air," Koetsier said. "But it doesn't make financial sense for me keep doing this. I don't see how they can turn methane gas into electricity in California, given these rules."7. New US bank problems? - Bloomberg is reporting that a government move to auction more than US$1 billion in assets seized from failed banks next month may trigger writedowns that weaken lenders nationwide. Oh boy. It seems like the commercial real estate bust is finally hitting small banks hard. The problem for the US economy is they are not 'Too big to fail' and will be let go.

Of the $41 billion in assets seized from failed banks held by the FDIC as of the end of January, $15.6 billion are real estate loans and about 4 percent of those involve participations by other lenders, according to agency spokesman Andrew Gray. “These banks can’t believe that the regulator they pay to protect them is going to sell these loans to someone who can flip them and cause them serious losses,” said Robert Reynolds, a lawyer at Reynolds Reynolds & Duncan LLC in Tuscaloosa, Alabama, who represents 25 lenders that took part in financing the W Hotel. “Our banks just cannot believe they’re being treated in a way that ultimately hurts the FDIC’s insurance fund, because some of them are right on the edge.” “This whole thing is a mess waiting to happen across the country,” said Geoffrey Miller, a professor of securities law at New York University and director of the Center for the Study of Central Banks and Financial Institutions. “Unlike the subprime mortgage problems, which hit mostly bigger financial institutions, the commercial real estate crisis is going to hit mostly smaller and regional banks,” Miller said. “It was common for them to make these loans and buy participations. It’s a systemic problem that the FDIC has to deal with.” That view was echoed by John J. Collins, president of Community Bankers of Washington in Lakewood, Washington. Some banks in his state have expressed concern that they may have to take writedowns as a result of the FDIC sale of seized loans in which they participated, he said.8. Lost decade - A member of the European Central Bank, Jurgen Stark, has warned the global economy faces a 'Japanese style' lost decade because of a failure of many to restructure their budget situations, Marketwatch reported.

"Only partial progress has been made so far, and the distortions that led to global imbalances are still present," Stark said. Despite some stability, "substantial fragilities remain and the outlook is fraught with risks," Stark said. "Unsustainable fiscal positions" in "many countries," Stark warned, now raise the risk of a "sovereign debt crisis." Stark didn't single out Greece in his remarks. "We need sound fiscal policies supported by credible fiscal rules," Stark said. "The main priority will be to devise credible exit strategies to correct large fiscal imbalances." Earlier, Stark rejected the idea of creating a European-only stability fund to mirror the International Monetary Fund. In the German newspaper Handelsblatt, he wrote: "It would be the start of a financial leveling-off in Europe, which would become very expensive, set the wrong incentives and burden countries with more solid public finances."9. Not so fast - The idea of a European version of the International Monetary Fund (IMF) has been picked up in European circles in recent days as a way to solve the curly problem of bailing out members of the Eurozone without running into problems with voters. German Chancellor Angela Merkel, who is vary aware of the voter backlash on this, is now saying any Euro IMF would have to be approved by all EU member states in a new treaty, the FT reported. That suggests new votes. Yikes. That's not going to fly.

“Without treaty change we cannot found such a fund,” Merkel told foreign correspondents in Berlin. Any new Europe-wide treaty risks being hugely divisive so soon after the lengthy and painful ratification of the Lisbon treaty, which was initially rejected by a referendum in Ireland and only came into effect in December.9. Totally irrelevant picture - Pool in the pool 10. Totally irrelevant video - Jon Stewart blows the lid (er) off Chatroulette. This is as close as I want to get the whole ugly thing.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Tech-Talch - Chatroulette | ||||

|

||||

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.