Here are my Top 10 links from around the Internet at 10 past 10.

I welcome your additions and comments below or please send suggestions for Wednesday's Top 10 at 10 via email to bernard.hickey@interest.co.nz

1. Where have the bond vigilantes gone? - Bloomberg does a great job of explaining why US Treasury yields are so low when there is so much talk about the US government being bankrupt in the longer term. Surely, many would ask, US interest rates should be rising on fear that the US will eventually default, either through a bond auction failure or through money printing.

Essentially, Ben Bernanke's decision to keep the US Federal Funds rate at an "exceptionally low level for an extended period" is fuelling the biggest carry trade in the history of the world. US banks borrow from the US Federal Reserve at 0.25% and then lend to the US government at 2%.

It's magic. I suspect a large number of bankers are going to ask for large bonuses for this piece of genius. And they're doing it with big fat government guarantees because they're Too Big to Fail. No wonder American voters are revolting. Bloomberg titles its piece: "Free markets show US has tamed the bond vigilantes."

I suspect that have been quietened down in America, but as soon as Bernanke starts putting the Fed Funds rate up all bets are off. Literally. There will be a rush to the exits like we've never seen before.

“Central banks by keeping rates near zero have basically covered the bond vigilantes in duct tape,” said Edward Yardeni, who coined the term in 1983 for investors who protest inflationary monetary or fiscal policies by selling bonds and driving up government borrowing costs. “They have stymied them from expressing their displeasure over runaway government deficits and social welfare spending,” Yardeni said.

“We are not getting any votes of protest from the bond vigilantes in the U.S. because short-term rates are so low.” “The reality is that most bond vigilantes live in a gated community -- called the yield curve,” Yardeni said. “It’s either bonds or money-market instruments. So, you have to swallow your pride and all your anxieties about out of control fiscal policy and buy the bonds anyway because the alternative is zero percent.”

“The famed bond vigilantes are fast asleep,” Joachim Fels, co-head of global economics at Morgan Stanley in London, said in a June 2 report. “But this is not new: bond markets also took years to take onboard the ‘Great Inflation’ of the 1970s and the big disinflation of the 1980s and 1990s.”

2. Unravelling the Reagan legacy - Jim Quinn from The Burning Platform writes at Zerohedge about the damage done during the Reagan era. Quinn starts off with some apocalyptic jargon, but his points are valid. He also has some good charts. HT Troy Barsten via email. He essentially says the Baby-boomers in the Reagan era chose to go on a 2 decade long spend-up (interrupted by the Clinton era) that exploded America's debts, cut taxes and increased government spending. It was all to disguise a massive shift in wealth to the richest. The middle classes borrowed to cover up a long term fall in their real earnings.

The reality is that government debt as a % of GDP was on a downward trajectory for 30 years, bottoming in the late 1970s at 45%. Reagan cut taxes and doubled spending during his eight year reign. This initiated the launch procedure for a US government debt rocket. It sent a message to the world and to its citizens that debt was not a bad thing. Interest rates were in the midst of a quarter century long decline, so the debt became more serviceable as time progressed.

There was no reason to save and invest when government and consumers could borrow and buy what they wanted today. This was the attitude that began to emanate during the early 1980s. Total government debt as a % of GDP skyrocketed from 45% to 80% during Reagan’s eight year presidency.

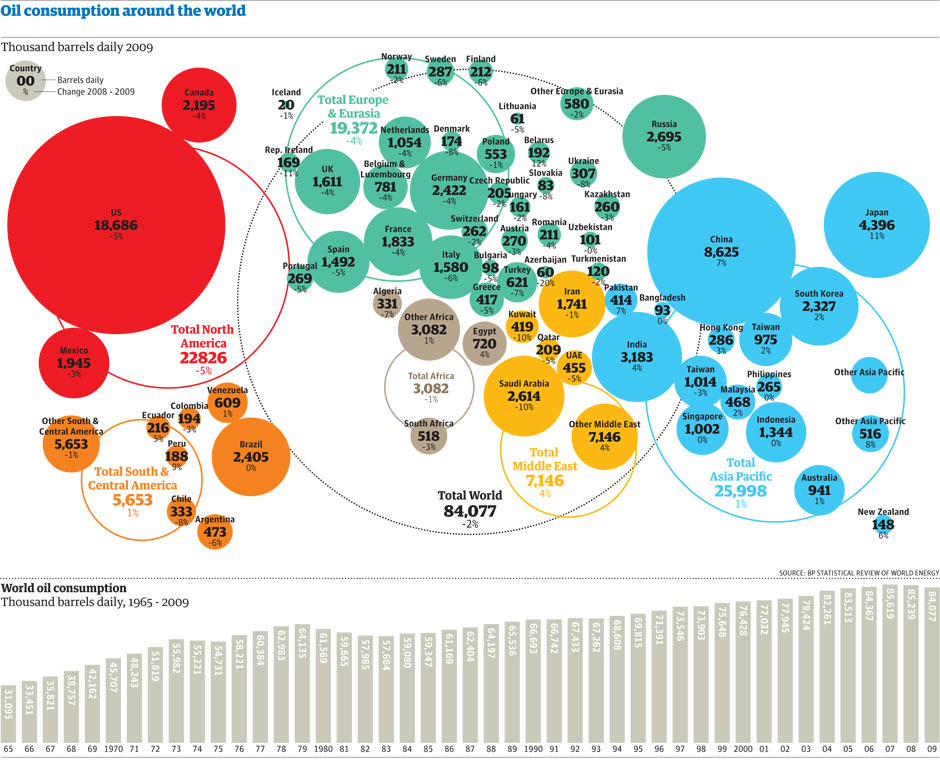

3. America's thirst for oil - It's starting to register with the Americans that their consumptive lust is now coming home to roost. The BP oil spill has got a few people thinking about what it means, including Jim Kunstler. HT Nikki via email.

America is going to lose a whole lot more of its own oil production. Smaller companies may shut down altogether from the cost of complying with new safety rules and an inability to get insurance. The oil from deep water in the Gulf of Mexico was how we hoped we would offset the ongoing depletions in Alaska. We're going to have to import even more oil than the two-thirds-plus we already depend on.

One thing President Obama -- nor anyone else with an audience or a constituency -- will speak a word about is our massive, incessant purposeless motoring. Pretty soon, the oil missing from the Gulf will leave a message at the 7-Eleven stops in Dallas and Chattanooga, and before the year is out the cardboard signs that say "Out Of Gas" may hang on the pumps. A great hue and cry will rise out of the Nascar ovals and righteous lady politicians with decoupaged hair-doos will invoke the New World Order and the Book of Revelation in their rise to power. Reasonable men with moderate views will dither on the sidelines, afraid to offend one faction or another.

4. Bigger than 9/11? - Even Barack Obama is saying that the BP oil spill has as big a meaning for Americans' view of oil security as 9/11 did for America's view of its own physical security. In my view, this means Americans have to consume less by driving smaller cars for a start. Anyone who has travelled to America is stunned by sheer size of everything. It's way too big to be healthy for anyone. HT below to Gertraud for the great chart.

"In the same way that our view of our vulnerabilities and our foreign policy was shaped profoundly by 9/11…I think this disaster is going to shape how we think about the environment and energy for many years to come," he said. President Obama went on to say, ahead of a two-day tour of the three affected Gulf states, that it is important the US "draw[s] the right lessons from this disaster".

5. Maybe there is hope - It seems like one of the tougher proposals to break up or at least contain the Too Big to Fail banks may actually get through Congress, the FT.com reports at CNN. Paul Volcker, who proposed a real break up of the banks, seems to be backing this latest rearguard action to fight back at the bank lobbyists.

Blanche Lincoln, the Senate agriculture chairman, is the lead proponent of the plan, which would force banks to create a separately capitalised subsidiary to house the derivatives dealing operations -- a significant source of profits for big banks, such as JPMorgan Chase. The expensive restructuring could drive activity out of the largest Wall Street banks and into more lightly regulated rivals and overseas competitors, according to the Federal Reserve and Federal Deposit Insurance Corporation, which oppose the plan.

Mr Volcker -- who has become a talisman of the financial reform effort ever since the "Volcker Rule" to force banks to end proprietary trading was embraced by Barack Obama, US president, in January -- previously opposed the Lincoln provision.

Mr Volcker, 82, has told members of Congress that he is cancelling his normal salmon fishing trip to be on hand to provide advice. "Normally I go to Canada -- where the banking system is all healthy and straightforward," he said.

6. Maybe there is hope Part II - Now BIS Shrapnel, one of the biggest supply side spruikers in the Australian housing market, is acknowledging that Australian house prices might not rise as much. The SMH has the report.

House prices will not fall though, and rents are tipped to continue to rise because of a lack of supply, BIS Shrapnel says in its Residential Property Prospects, 2010 to 2013 report. BIS senior project manager Angie Zigomanis said first home buyer activity had dropped after the expiry of the boost to the first home owners grant at the end of 2009.

''With interest rates quickly lifting from these emergency levels, and the current variable rate of 7.4 per cent now being close to long-term trends, the recent levels of price growth cannot be maintained,'' Mr Zigomanis said.

| The Colbert Report | Mon - Thurs 11:30pm / 10:30c | |||

| The Word - P.R.-mageddon | ||||

|

||||

7. More debt upon debt - Fannie Mae and Freddie Mac, the now US government owned mortgage providers who do more than 90% of America's mortgages, may need a bailout that could top US$1 trillion, Bloomberg reports. Where is the money going to come from? The US taxpayer in the future, or via the printing press. Yet Treasury yields are still 2%...

The cost of fixing Fannie Mae and Freddie Mac, the mortgage companies that last year bought or guaranteed three-quarters of all U.S. home loans, will be at least $160 billion and could grow to as much as $1 trillion after the biggest bailout in American history. Fannie and Freddie, now 80 percent owned by U.S. taxpayers, already have drawn $145 billion from an unlimited line of government credit granted to ensure that home buyers can get loans while the private housing-finance industry is moribund.

That surpasses the amount spent on rescues of American International Group Inc., General Motors Co. or Citigroup Inc., which have begun repaying their debts. “It is the mother of all bailouts,” said Edward Pinto, a former chief credit officer at Fannie Mae, who is now a consultant to the mortgage-finance industry.

8. This could complicate things - America has discovered US$1 trillion worth of valuable minerals in Afghanistan, the New York Times reports. Oh dear.

The previously unknown deposits — including huge veins of iron, copper, cobalt, gold and critical industrial metals like lithium — are so big and include so many minerals that are essential to modern industry that Afghanistan could eventually be transformed into one of the most important mining centers in the world, the United States officials believe.

An internal Pentagon memo, for example, states that Afghanistan could become the “Saudi Arabia of lithium,” a key raw material in the manufacture of batteries for laptops and BlackBerrys.

9. Debtors prison - There are moves afoot in America to bring back debtors prisons to combat a nationwide movement by people to diliberately default on their debts, Yves Smith at Naked Capitalism points out.

The rise of strategic defaults (and perhaps even more important, the increasingly positive coverage it is getting in the media and the blogosphere) is generating heartburn among the banking classes. One of the tidbits we pointed to was a YouTube snippet of Peterson Institute spokesman David Walker speaking fondly of debtors’ prison and the need to “hold people accountable when they do imprudent things.”

A couple of readers complained that I was being unfair, while others said they’d be happy to see the return of debtors’ prison as long at the executives at the TBTF banks were at the head of the queue. Be careful what you wish for. Reader bill clued us in that people who fall behind on debt payments are being incarcerated in six states. While this is generally short-term, it is nevertheless a troubling development, since these are all involve private contracts and look to be an abuse of the court system.

10. Totally irrelevant video - Cats enact the BP oil crisis. Sorry.. Couldn't help it. It involved cats.

1 Comments

KanucK

You seem remarkably convinced that voters eventually would vote to keep bond holders rich and themselves poor?

What happens when the US government is overthrown by angry voters who want to punish the banks holding these Treasuries.

There's a remarkable complacency in the corridor between Manhattan and Washington.

You might be surprised. Not this year or next. But just wait a decade or so when all those social security and medical costs bankrupt the US government.

Might be different then. 30 year bond worth holding on to then?

cheers

Bernard

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.