Here are my Top 10 links from around the Internet at 10 to midday.

I welcome your additions and comments below or please send suggestions for Monday's Top 10 at 10 via email to bernard.hickey@interest.co.nz

1. Australia's foreign debt problem - Mark Carnegie, who is the head of Lazard's Private Equity business in Australia, has written a timely piece at BusinessSpectator warning about the growth of Australia's foreign debt and saying the day will inevitably come when the rest of the world notices.

He points out that Australia's net foreign debt has risen from 3% of GDP in 1976 to 53% now, including 100 billion euros of euro denominated debt. He says Australia's banks have borrowed as much proportionally as the Greek government did. You may have to register for BusinessSpectator to read this, but it is free and well worth it. Save your cookie.

What Carnegie doesn't say is that New Zealand's net foreign debt was NZ$156.5 billion or 85% of GDP in the March quarter, again mostly held by those same Australian banks. Luckily for us, only NZ$3.5 billion of it is denominated in euros. No worries then? Don't forget our big banks are the same ones mentioned above. We need to watch the Australian foreign debt situation like a hawk. Any warning signs will come with a blowout in spreads for Australasian corporate debt Credit Default Swaps. We have a chart of that spread, which we update daily.

Another important issue about our debt is that the share of it owed by the Reserve Bank and the general government has fallen from 35 per cent in 1980 to 3 per cent in 2008. This has lead to a political approach that says it is not the politician’s problem and in a narrow sense they are right. The private sector owes 92 per cent of the debt and the private financial corporations share has risen from 7 per cent to 74 per cent. On our behalf our banks have borrowed about the same amount as Greece did – and we say we don’t have an issue.

Finally the funding squeeze that is on in Europe is going to have a flow on in the interbank market as spreads for all credits blow out. The price we are charged for our foreign debt is going to rise. I started with sharks and I want to finish with turkeys. Currently we are like a flock of turkeys, who every day go to the foreign debt markets to get fed the foreign debt we need to keep alive and every day we get what we need. Every day the strength of the argument for foreign debt being a great diet increases, another day goes on in 'party Australia' without a problem. Every day we get fatter and happier. Until ‘CHOP’ it’s the day before Christmas and the foreigners who have fed us for so long take our fat and happy head off.

No chart with that title exists.

2. The new sovereign risk - Robert Gottliebsen at BusinessSpectator points out that the mining super tax in Australia could cause problems for Australia's banks and its housing market. HT Rob via email.

The mining industry and the 270 new projects involving investment of about $300 billion were our security blanket. They gave confidence to global institutions to lend to our banks even though Australia’s enormous overseas bank borrowing puts Australian debt into a similar range to Italy and not far behind Spain when related to GDP.

In the good times, overseas lenders did not put us in the same basket as Spain and Italy because they were optimistic about Australia. Overseas institutions view of Australia has changed now that our government has made a serious mistake by incorporating into future budget estimates a tax that makes uneconomic most of those new mining projects and will, therefore, stop bank funding. T

hen, realising its mistake, the government is now scrambling around looking to negotiate its way out. Yet the only real way out is to dramatically change its proposed resource super profits tax, including the retrospective nature of it, and, as a result, slash future revenue from the government's coffers. The fear is now spreading.

The big lenders to Australia – China, Japan, and the Middle East and European institutions – are now worried there has been a fundamental change in the sovereign risk of Australia because we have started to do silly things. This is critical because our four major banks borrow overseas to fund about 40 per cent of every housing loan.

If there are serious global problems during the next three or four years our banks will not be able to roll over the enormous amounts they have borrowed in the past unless they pay a substantial risk premium. Raising more money could be out of the question. Banks will attempt to cover any overseas shortfall by attracting local term deposits via higher interest rates.

The combination of less money and higher interest rates will bring down the value of houses because it’s the availability of bank finance and its cost as much as dwelling demand and supply that sets the level of house prices.

3. The other side - Michael Pascoe at the Sydney Morning Herald reports on a speech by Reserve Bank of Australia Deputy Governor Ric Battelino that apparently says everything in the Australian housing market is fine. There's nothing to see here. Move along now. To summarise: Battelino says Australia has a high investment rate so its foreign borrowings are being used productively; household debt is high but not ruinous, and most of the debt is held by rich people so that's ok then... Here's Pascoe's take on the speech.

Reserve Bank deputy-governor Ric Battellino quietly destroyed a bunch of major myths this week – turns out we're actually good savers, our household debt isn't a problem, the housing affordability crisis has been exaggerated and our foreign debt is sustainable. In short, most of the usual scary headlines about the domestic economy are rubbish.

4. He actually said this?! - The chairman of BP, Sweden's Carl-Henric Svanberg, has triggered a storm in the United States by coming out of a meeting with Barack Obama and saying how he cared about the 'small people' affected by the big oil spill. Just appalling politics. Here's the video below. Here's a BBC article from Mark Mardell talking about it.

BP's chairman has so far kept way in the background, letting his chief executive become the target of America's ire with the company. Today he spoke before the assembled media just outside the White House, and he may have wished he'd stayed out of the limelight.

The Swedish former boss of Eriksson, Carl-Henric Svanberg, said that although oil companies were seen as greedy, BP wasn't like that and cared about "the small people". He said it three times. OK. English is not his first language and we all know what he meant. But it didn't sound great, and I wait to see what the small people make of it.

To celebrate the joys of English as a second language for a Swedish person, here is my favourite Muppet chef, who is Swedish... The chicken is nervous.

5. The real reason for the dividend cut - Robert Peston at BBC has the real skinny on why BP cancelled its dividend. Essentially, the bond vigilantes (rather than the US government) forced them to do it. The real power in a world mired in debt is in the hands of the (still solvent) bankers and bond investor vigilantes, not the politicians or the people. Again, it's all about those Credit Defaul Swap markets.

There is a substantial market in BP credit default swaps. And the reason I'm boring on about all this is that a number of senior BP people - including members of the board - have volunteered to me that what worried them most was what was happening to the CDS price.

Here's some context: in March, before the Deepwater Horizon disaster, the CDS spreads on six-month and year loans to BP were 22 and 23.9 basis points respectively. So insuring $10m of debt back then cost just over $20,000 - which is a bit less than the debt insurance premium on a rock-solid company like Tesco.

To put it another way, the Gulf of Mexico debacle has increased the cost of insuring BP's shorter-term debt by a factor of 50. There are other ways of seeing the damage wreaked by the rise in the CDS price. It means that if BP wanted to borrow for six months or a year, the rate of interest it would have to pay would rise to almost prohibitive levels.

Also those who do business with BP on credit could be deterred by the cost of insuring that credit. To put it another way, the sharp jump in the CDS spread could have become a self-fulfilling event: if BP were unable to trade on credit, it would be bust.

6. Controls on LVR ratios? - Britain looks set to force banks to not lend for more than 75% of the value of a house, The Telegraph reports. Something we should look at here? The Reserve Bank looked at such controls in New Zealand four years ago and concluded it would be too difficult and a retreat to a Muldoon-esque past. Your views?

The Bank and its Governor, Mervyn King, would be able to prevent banks from lending too much, or to over-extended customers, if they judge that this would destabilise the economy. The precise details of the controls the Bank is to be given will be detailed fully at a later date. However, they are likely to include restrictions on the loan-to-value ratios offered to customers. For instance, families could be prevented from taking out a mortgage for anything more than 75 per cent of the value of their home.

The collapse of Northern Rock was widely attributed to its policy of lending customers up to 125 per cent of the value of their homes – despite the inability of many to repay the loans. It is hoped that the restrictions will also curb house price booms stimulated by excessive lending.

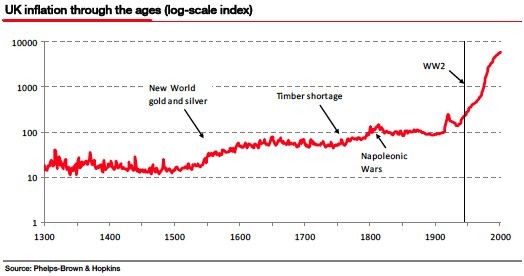

7. Our post-War inflation - Dylan Grice from Societe Generale has written at Market Oracle about inflation in the very long term and concludes that the advent of wide-spread democracy after the Second World War has caused a structural break towards systematically high inflation since then. Worth a read. He talks about Weimar Germany.

I actually don't think we'll have much of an inflation problem in the next decade because of the balance sheet recession that faces the developed world as it deleverages, similar to the one seen in Japan in the last 20 years. Japan printed like crazy but still had deflation. Your view?

The eurozone's fiscal farce offers a revealing glimpse of the future: sovereign crisis begets banking crisis begets central bank nose-holding while the printing presses roll!!

The chart below shows the UK RPI from year 1300. From it, we can see that there have been inflationary episodes - the 16th century influx of new world gold and silver, the 18th century timber shortages, the early 19th century Napoleonic Wars - but that systematic CPI inflation is relatively new, and only started in earnest after WW2.

This structural break coincides with the attainment of a voice in politics by ordinary people in developed economies: since voters rarely opt for economic pain, their elected representatives soon found they had to avoid it at all costs. Hence the relatively modern inflationary bias of "macroeconomic policy."

When that inflationary bias dictated lowering rates in the face of a threatened recession more quickly than you raised them in a recovery, it seemed harmless enough. But the crash of 2008 and its sovereign debt aftermath have changed everything.

It's difficult to exaggerate just how dirty the phrase deficit monetisation was when I studied economics at university: loaded with evil images of political irresponsibility and short-sightedness, it evoked the haunting spectre of catastrophic and ruinous hyperinflation. It's what they did in Weimar Germany; it helped cause WW2; to say it had an image problem would be a grotesque understatement. No wonder it's been rebranded as quantitative easing.

So there is virtually no new money coming into the European financial system. If a small bank goes down, the problem is solved when it is taken over by a bigger bank which injects new capital into it. If a bigger bank goes down, its problem is solved when it is taken over by the government, which injects new capital into it. If a government goes down ... well, then we're stuck.

Where does the new capital come from now? Enter central banks. In 2009, the BoE printed £200bn, thus completely financing the UK government deficit. It can't have felt good about doing it but since the alternative scenario was so scary - financial meltdown and possibly IMF support - it held its nose and did it anyway. It said it was going to sterilise the intervention, but on discovering that such was the financial system distress it was unable to, it just carried on regardless.

In the US, the Fed printed $1.25 trillion to monetise the problematic mortgage market. It also said it was going to sterilise the intervention, but like the BoE it soon found it couldn't, and like the BoE continued anyway because the alternative financial meltdown scenario was too scary to contemplate.

Today, the ECB is buying insolvent eurozone government debt which it is promising to sterilise. Yet they face the same stark calculus faced by their Anglo-Saxon cousins in 2008. You can only worry about the economy's ?price stability' if the economy hasn't already melted down! So here's my prediction: they won't sterilise, and the program will expand.

8. Going it alone - The European mess is so bad they are prepared to sacrifice their chances of becoming a global financial centre. The Europeans look set to go it alone with a bank tax. Britain is doing one too. That leaves the Americans, Canadians, Asians, Australasians and Latin Americans on their own without bank taxes. The Globe and Mail has the report.

There is a risk that if the Americans bring in a bank tax too to help fund their deficit and keep the Tea-baggers happy, Canada and Australia (and therefore New Zealand) would be left out on their own. That might attract the wrong sort of attention and bankers. Could Sydney and Toronto become the world's banking centres full of Goldman Sachers and Citibankers doing fancy things with debt? Would that be a good thing? Maybe New Zealand and Australia should have a bank tax too? Your view?

“In the G20 we will ... propose to explore and to develop the introduction of a financial transaction tax,” European Union President Herman Van Rompuy told a news conference after a meeting of leaders of the 27 EU countries. The EU will also push for a global levy on financial institutions.

“The EU should lead efforts to set a global approach for introducing a levy on financial institutions with a view to maintaining a worldwide level playing field and will strongly defend this position with its G20 partners,” EU leaders said in a statement after the meeting.

Last month, Canada mounted an aggressive campaign against European and U.S. support for a bank tax being proposed as a way to keep the G20 pledge to ensure taxpayers never pay for another bank bailout. Arguing that such a tax would unfairly punish countries that stayed out of trouble, Mr. Flaherty won enough support from countries such as Australia and Russia to keep the bank-tax lobby from gaining steam.

Because of a lack of agreement on the levy and a financial transaction tax, some EU diplomats expect the G20 summit could produce a menu of measures for countries to pick from rather than a single measure for all. Europe, however, will still strive for a global deal.

9. European debt mire - The European Commission has added Cyprus, Denmark and Finland to its list of members on its watch list for those with government deficits big enough to cause problems for the European economy, the European Commission reports. Now all but one of the EU's 27 members is on this debt watch list. HT Gertraud via email. The odd one out is that giant of the euro economy, Luxembourg.

10. Totally irrelevant video - Jon Stewart talks on The Daily Show about how the last 8 US Presidents have pledged to make the US less reliant on petroleum. Classic Stewart making a big political point in a funny way with some amazing archival footage and editing. "We've redefined success and still failed."

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| An Energy-Independent Future | ||||

|

||||

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.