Inflation

[updated]

Reserve Bank holds the Official Cash Rate at 2.25% and is not forecasting a rise until either late this year or early next

18th Feb 26, 2:18pm

18

Reserve Bank holds the Official Cash Rate at 2.25% and is not forecasting a rise until either late this year or early next

Results from latest business survey for Reserve Bank show sharp rise in expectation of the level of inflation in two-year's time - the key timeframe the RBNZ looks at

17th Feb 26, 3:34pm

1

Results from latest business survey for Reserve Bank show sharp rise in expectation of the level of inflation in two-year's time - the key timeframe the RBNZ looks at

[updated]

Food prices rocketed 2.5% last month, driving the annual food price rise up 4.6%

17th Feb 26, 11:27am

26

Food prices rocketed 2.5% last month, driving the annual food price rise up 4.6%

Latest Reserve Bank quarterly Household Expectations Survey finds households expect inflation to be lower in future - but the downside is that they reckon the current rate of inflation's more than double what it is officially

16th Feb 26, 3:47pm

14

Latest Reserve Bank quarterly Household Expectations Survey finds households expect inflation to be lower in future - but the downside is that they reckon the current rate of inflation's more than double what it is officially

Roger J Kerr says local economic forecasters have been consistently underestimating the level of confidence and actual economic activity over the last two months

16th Feb 26, 9:01am

Roger J Kerr says local economic forecasters have been consistently underestimating the level of confidence and actual economic activity over the last two months

The Reserve Bank's first Official Cash Rate review for the year won't see any changes to interest rates - but there will be plenty of other things to watch out for

15th Feb 26, 6:30am

6

The Reserve Bank's first Official Cash Rate review for the year won't see any changes to interest rates - but there will be plenty of other things to watch out for

Japan’s rock star leader now has the political backing to push a bold agenda. Will she deliver?

10th Feb 26, 4:21pm

1

Japan’s rock star leader now has the political backing to push a bold agenda. Will she deliver?

Roger J Kerr says the markets are struggling to draw clearcut conclusions on whether US inflation and employment are going higher or lower

9th Feb 26, 8:49am

Roger J Kerr says the markets are struggling to draw clearcut conclusions on whether US inflation and employment are going higher or lower

ASB economists stress the importance of studying 'high frequency' economic data at a time when our official GDP figures are both lagged and containing less reliable data than they did

5th Feb 26, 2:49pm

1

ASB economists stress the importance of studying 'high frequency' economic data at a time when our official GDP figures are both lagged and containing less reliable data than they did

Stats NZ says falling interest rates helped push household living costs down below the official rate of inflation as measured by the Consumers Price Index in the past year

2nd Feb 26, 11:58am

1

Stats NZ says falling interest rates helped push household living costs down below the official rate of inflation as measured by the Consumers Price Index in the past year

Roger J Kerr says to some degree, the Warsh appointment does alleviate worries that the Fed’s independence from political interference would be compromised through Trump’s choice of the new Chair

2nd Feb 26, 9:08am

Roger J Kerr says to some degree, the Warsh appointment does alleviate worries that the Fed’s independence from political interference would be compromised through Trump’s choice of the new Chair

Australian inflation jumps, adding to chances of an RBA interest rate hike

Roger J Kerr says the RBNZ should have foreseen 'a much stronger economy and high inflation.' He is also watching the 'sell America' trade, chances of yen intervention, and the pressure piling up on the RBA

26th Jan 26, 8:27am

4

Roger J Kerr says the RBNZ should have foreseen 'a much stronger economy and high inflation.' He is also watching the 'sell America' trade, chances of yen intervention, and the pressure piling up on the RBA

[updated]

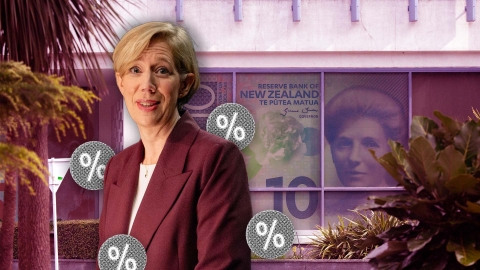

December quarter Consumers Price Index figures may show our inflation rate once again above the 1% to 3% target range. How new RBNZ Governor Anna Breman will respond to our stubborn high prices in her first OCR review next month will be keenly watched

20th Jan 26, 8:23am

20

December quarter Consumers Price Index figures may show our inflation rate once again above the 1% to 3% target range. How new RBNZ Governor Anna Breman will respond to our stubborn high prices in her first OCR review next month will be keenly watched

Roger J Kerr says Governor Breman may be forced to eat her own words that the interest rate markets have become ahead of themselves in pricing-in interest rate increases later in 2026

19th Jan 26, 8:43am

1

Roger J Kerr says Governor Breman may be forced to eat her own words that the interest rate markets have become ahead of themselves in pricing-in interest rate increases later in 2026