Top 10 at 10 to 2: Queenstown empire implodes; US housing ATM; Fiscal fallout; Dilbert

12th Mar 10, 1:47pm

by

Here are my Top 10 links from around the Internet at 10 to 2. I welcome your additions and comments below or please send suggestions for Monday’s Top 10 at 10 to bernard.hickey@interest.co.nz We try to absorb everyone's workflow energy...

1. End of empire - The Southland Times reports that New Zealand Resorts Ltd, one of the companies in Ross Wensley's Queenstown property 'empire', has been placed into liquidation. It owns The Club development.

1. End of empire - The Southland Times reports that New Zealand Resorts Ltd, one of the companies in Ross Wensley's Queenstown property 'empire', has been placed into liquidation. It owns The Club development.

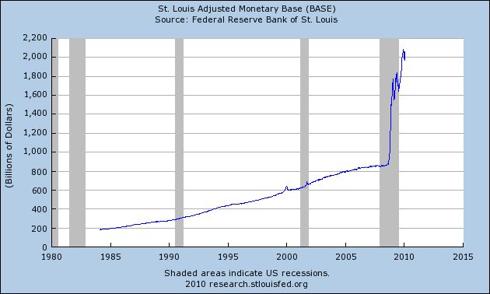

Mr Wensley's developments have been hit hard by the credit crunch and a drop in apartment prices. Last year Mr Wensley travelled to the United Kingdom to chase money owed by people who had bought apartments at the Marina Baches complex in Queenstown, leaving his company $23 million out of pocket.2. Map of doom - Check out this county-by-county interactive chart of mortgage delinquency rates in the United States. It's from the New York Federal Reserve. If you have any doubts about the scale of the disaster unfolding in the US then you need to look at this. Most of the West Coast, South West and South East have delinquency rates north of 10%. 3. Damaged credibility - Ron Hera makes the case at Seeking Alpha for eventual hyper-inflation in America and the destruction of the US dollar. There have been plenty of doomsayers predicting this, but so far the US dollar hasn't collapsed and demand for US Treasuries remains strong, partly because all the money printed is sitting idle in Federal Reserve accounts. Hera reckons it's all about credibility in the long run, rather than financial market confidence now. Eventually, the money printing will kill the US dollar, he says. It's a long read but well worth it. HT Troy Barsten via email.

Rather than a crisis of confidence, hyperinflation results from a crisis of credibility. Hyperinflation results when the social, legal and political structures that create the value of paper money break down. When a government borrows excessively and its promises to repay are contradicted by mathematical realities, the value of its currency cannot be maintained. If a government so lacks credibility that it cannot issue bonds because there are no buyers other than its own central bank, the value of its currency declines faster than money is printed to cover its obligations. Perhaps the most important indicator of impending hyperinflation is whether the statements of a government or of its central bank, e.g., with respect to the government’s budget or the central bank’s balance sheet, are evidence based or ideological. If they are not evidence based, the credibility of the government or central bank, and its currency, will weaken and eventually fail. When the balance sheets of US banks are maintained by suspending accounting rules and when banks hold financial derivatives liabilities greater than world GDP, both the stability and credibility of the banks is questionable. When US economic data consistently seems to reflect a Pollyanna bias and the US federal budget contains unrealistic projections of GDP growth and tax revenues, while public debt and government liabilities (which now include unlimited bailouts for government sponsored entities Fannie Mae (FNM) and Freddie Mac (FRE)) are obviously unworkable and the US government’s own central bank is already a major buyer of US Treasuries, the federal government’s credibility is questionable. When private financial losses and toxic financial assets are transferred to taxpayers while profits and bonuses abound on Wall Street thanks to accounting rule changes in the midst of the worst economic contraction since the Great Depression, the credibility and competency of the US Treasury and Congress, with respect to the finances of the nation, is questionable. When the US Federal Reserve defies the US Congress, resists independent auditing, engages in ongoing QE and is the lender of last resort for banks that under normal conditions would be insolvent, its credibility is questionable. When the Chairman of the Federal Reserve, who failed to detect the largest asset price bubble in the history of the world and who has been consistently wrong in his assessment of the US economy is reappointed following the worst financial and economic disaster in generations, both his credibility and that of the Obama administration are questionable. The plethora of red flags spewing from Wall Street, from the Federal Reserve and from the federal government point to a breakdown of de jure value that is already in progress, thus to a hyperinflationary outcome for the US dollar.4. UK CRE crisis - The next penny to drop in Britain is likely to be commercial real estate (CRE) , similar to the one that is crumbling in America. The Independent points to a warning from the FSA about British CRE. HT Troy.

The City watchdog has sounded alarm about the prospect of a meltdown in commercial property. Announcing much tougher stress tests for banks, the Financial Services Authority raised concerns that they are not setting aside enough to cover losses on the sector. In its overview of the financial risks facing Britain this year, the FSA said about £160bn of UK commercial property debt would mature over the next five years. During the recession, many commercial property companies were supported by forbearance from banks, which often waived conditions attached to loans, it added. However, banks could decide not to renew loans after their terms expire. "This could force liquidations and release commercial properties on to the market, possibly triggering further price falls. Leveraged loans to UK companies that were subject to buyouts also face a maturity hump and present similar refinancing changes to the banks in this sector," the rgulator's report warned.5. 'He said it' - I've called Barack Obama a liar and a fool for over a year. Now Barack Obama is saying that more than half of the letters he gets are from people who call him an idiot. The wisdom of crowds... HT Gertraud via email

"I will tell you, that my staff is very even-handed, because about half of these letters call me an idiot!'' Mr Obama said overnight, chuckling at his own joke during a rally in Saint Louis, Missouri.6. Fiscal crisis - Mohamed el Erian, The head of the world's biggest bond fund PIMCO, has again warned in the FT about the scale of the fiscal crises unfolding through much of the developed world and how it changes everything. A must read I reckon.

Every once in a while, the world is faced with a major economic development that is ill-understood at first and dismissed as of limited relevance, and which then catches governments, companies and households unawares. We have seen a few examples of this over the past 10 years. They include the emergence of China as a main influence on growth, prices, employment and wealth dynamics around the world. I would also include the dramatic over-extension, and subsequent spectacular collapse, of housing and shadow banks in the finance-driven economies of the US and UK. Today, we should all be paying attention to a new theme: the simultaneous and significant deterioration in the public finances of many advanced economies. At present this is being viewed primarily – and excessively – through the narrow prism of Greece. Down the road, it will be recognised for what it is: a significant regime shift in advanced economies with consequential and long-lasting effects. Many metrics speak to the generalised nature of the disruption to public finances. My favourite comes from Willem Buiter, Citi’s chief economist. More than 40 per cent of global GDP now resides in jurisdictions (overwhelmingly in the advanced economies) running fiscal deficits of 10 per cent of GDP or more. For much of the past 30 years, this fluctuated in the 0-5 per cent range and was dominated by emerging economies.7. Americans are saving again - This is a fascinating chart put together by the boys and girls at Calculated Risk which shows how Americans are using their houses like ATMs (via Mortgage Equity Withdrawal (MEW), but instead of withdrawing cash they are effectively depositing cash. This is important because it shows American behaviour has turned around and the global recovery should not depend on US consumers to drive it. Let's hope Chinese consumers start consuming an awful lot more. 8. The final bailout - Now it seems a bunch of Americans are lobbying the US government for a bailout for those who suffered at the hands of Ponzi schemesters Bernie (10% forever) Madoff and Allen (I just like cricket) Stanford. Peter J Henning at the New York Times' Dealbook has the story. Oy Vey. Will it ever end.

Investors who lost billions of dollars by placing their money with Bernard L. Madoff and the Texas financier R. Allen Stanford have banded together to seek relief from the last bastion of protection: Congress. These investors are lobbying senators to add a provision to the financial regulatory bill requiring banks and investment firms to pay into a fund that would be used to compensate them for a portion of their losses from Ponzi schemes. The plan involves about $4 billion, which seems like almost chump change in the current era of trillion-dollar federal deficits and is minuscule compared with the tens of billions of dollars that financial firms like Citigroup and the American International Group received from the government to keep them afloat. But should the Madoff and Stanford investors get better treatment than anyone else who falls prey to a financial scam with little prospect of any significant recovery and no insurance fund to repay at least a portion of their losses?9. Standard and Poor's warning - The ratings agency has warned that the United States' AAA credit rating is at risk without a more credible plan to control the US budget deficit, the FT reports. Are you listening Barack? Maybe not. He's too busy chuckling at his own jokes about himself. He is a joke.

The triple A rating of the US is at risk, S&P has warned, unless the country adopts a credible medium-term plan to rein in fiscal spending. In a report published on Thursday, the ratings agency said that there were risks that “external creditors could reduce their US dollar holdings, especially if they conclude that eurozone members are adopting stronger macroeconomic policies”.10. Totally irrelevant video - There were a few ... er... technical difficulties for this US news reporter when doing a live cross on a sentencing recently. Not a happy camper. Better than the Wendy Petrie fist pump.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.