Here are my Top 10 links from around the Internet at 10 to 1pm, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for Monday's Top 10 at 10 via email to bernard.hickey@interest.co.nz.

I'll pop any surplus suggestions I get into the comment stream under the Top 10.

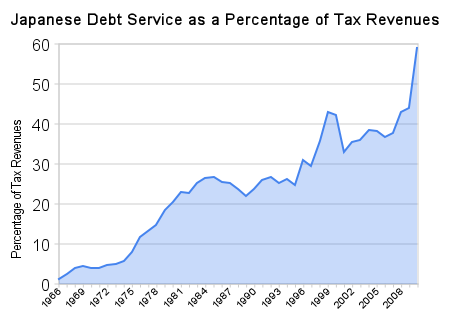

1. The problem with Japan - Burning Platform has a good old rant about the problems with Japan's mounting government debt, its ageing population and its falling savings rate.

The charts are alarming.

HT Gertraud via email.

The “nothing bad has happened so far” crowd continues to spout fallacies about the Japanese owing the debt to themselves and their high savings rates as the reason that Japanese debt can continue to grow. About 95% of Japan’s debt is held domestically, which sovereign-debt agencies have said supports the country’s creditworthiness even as borrowings have reached 200% of gross domestic product. In a sign that base is waning, Japan’s public pension fund, holder of 12% of outstanding debt, sold more government bonds than it bought for the first time in nine years.

The National Savings rate has declined from 18% in 1980 to 2% today. The days when the Japanese could issue long term bonds yielding 1% and have it all bought by Japanese citizens is over. In 2010, the Japanese government will issue an additional ¥53 trillion in government debt. At the same time tax revenues will drop from ¥46 trillion to ¥37 trillion.

If the market demands an interest rate of anything more than 3.5% to buy their debt then Japan will not have the revenue to service its debt. As the interest rate approaches 3.5% Japan must use all its tax revenue to pay interest on its debt. It becomes readily apparent that Japan will eventually be forced to default on their debt. There are no good options left. A minor uptick in interest rates will sink the 3rd largest economy on the planet. The near failure of a 3rd world country (Greece) turned the world upside down. The failure of Japan would likely touch off a worldwide crash.

2. How not to do it - Felix Salmon from Reuters rips into JPMorganChase's response to its online banking failure. A lesson for any banking IT and marketing types.

This whole episode underlines the way in which it’s silly to assume that bigger banks have more robust websites. In fact, the opposite is true, especially in the case of banks like Chase which are the result of many mergers and therefore have to cobble together all manner of disparate legacy systems.

And it also says a lot about redundancy within big corporations, or the lack thereof. The damage from this outage is many orders of magnitude less severe than the damage from the BP oil spill, but both of them are cases where any attempt at back-up plans or redundancy failed. Chase tried to update its website, but didn’t have a backup system in case the update failed

3. Fat lady has not sung yet - Nouriel Roubini explains here why the European Financial Crisis is far from over.

First, a trillion-dollar bailout package in May prevented an immediate default by Greece and a break-up of the eurozone. But now sovereign spreads in the peripheral eurozone countries have returned to the levels seen at the peak of the crisis in May.

Second, a fudged set of financial “stress tests” sought to persuade markets that European banks’ needed only €3.5 billion in fresh capital. But now Anglo-Irish alone may have a capital hole as high as €70 billion, raising serious concerns about the true health of other Irish, Spanish, Greek, and German banks.

Finally, a temporary acceleration of growth in the eurozone in the second quarter boosted financial markets and the euro, but it is now clear that the improvement was transitory. All of the eurozone’s peripheral countries’ GDP is still either contracting (Spain, Ireland, and Greece) or barely growing (Italy and Portugal).

So a eurozone that needs fiscal austerity, structural reforms, and appropriate macroeconomic and financial policies is weakened politically at both the EU and national levels. That is why my best-case scenario is that the eurozone somehow muddles through in the next few years; at worst (and with a probability of more than one-third), the eurozone will break up, owing to a combination of sovereign debt restructurings and exits by some weaker economies.

4. A Zombie economy - When home owners are under water they often hang on to try to get their money back, which stops them from moving to another place to get a better job. Ryan Avent explains at The Economist.

One story I've been telling about a potential structural source of unemployment is that negative equity is preventing households from moving to more promising job markets. To sell, these households would have to write a big cheque at closing, which they obviously can't afford to do. So they stay put.

5. Maybe we're not doing so bad - The OECD has some fresh figures that look at the rankings of income by decile to see whether the inequality of wealth is a factor skewing the averages. New Zealand does poorly on the averages, but it doesn't look so bad when you look at the top and bottom ends, because we are relatively less inequal than others. The chart tells the story. Mark Thoma has the story. HT Kevin via IM

6. 'Send lawyers, guns and money' - There's an old Warren Zevon song I quite like. Allan Hubbard has moved to hire a top lawyer in Wellington this week, Jenni McManus reports in BusinessDay.

Allan Hubbard and his wife Jean have hired a top partner at Russell McVeagh's Wellington office to act on matters relating to the statutory management of a raft of trusts associated with the couple, and a Serious Fraud Office investigation into their affairs. But the partner, Tim Clarke, will not say whether the Hubbards plan a legal challenge to the statutory management. It is also unclear who might be footing the bill.

7.Basel III's fatal flaw - Simon Johnson identifies it.

9. Americans are going for gold, MSNBC reports.

Visit msnbc.com for breaking news, world news, and news about the economy

10.Totally relevant video - Jon Stewart looks at the Tea Party movement

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Tea Party Primaries - Beyond the Palin | ||||

|

||||

25 Comments

RE: #6 - Is it just me, or have those hoards of (L. Ron) Hubbard followers been strangely silent over the last few weeks. Perhpas the earthquake has directed news interest elsewhere, but I still wonder why Hubbard seems to have to take care of things on his own of late....

Probably too busy spending their SCF windfall.

But the national party do owe their survival to earthquakes...The Canterbury quake saved them from the fallout over Double Dipton's SCF rort, and the Samoan quake and subsequent tsunami saved them from the fallout over Double Dipton's accommodation allowance rort.

So it's clear that Double Dipton causes earthquakes.

Good point. The time to shut up is as soon as you've got what you're after, and these investors will soon be paid back in full (including interest - *wince*), so why stick you neck out any more.

Dippers and his cronies got what they were after but I doubt they give a stuff about what anyone else wanted.

Arthur C Clark.. Ray bradbury.. and L Ron Hubbard, were having a Coffee..L Ron Said "Its allright for you Arthur youv'e got a real job, but I cant seem to sell much"..Arthur had a think and said "L Ron you should start a Church..Tax breaks etc"... L Ron Hubbard thought about it and thats exactly what he did...This is a true story...After a while his creative mind had developed the Church of Scientology to a Billion dollar creation. In fact you might say he wrote a reality.

The point is that if you can get creative anything is possible.".Providing the timing is right"..With Allan Hubbards religion.He got it wrong. But if the timing was right it might have been a different story.

Now consider... Gold...We dig it up at great expense, melt it into ingots and put it in a Bank vault,then trade it.. without it needing, to ever leave the vault. Why not get three independent Geological reports on how much Gold is in them thar hills..avarage the results..and get a sumnation of the amount in Troy ounces.The Gold is safe, as it would be in a Bank..absoloutly no degredation or energy has been wasted in leaving it undisturbed..and money can be created out of its potential wealth......How Green would that be?

Tesco is a tad bigger than Fonterra?

Its annual profit is about what Fonterra pays to dairy farmers for milk i.e. close to the value of NZ's milk production.

Maybe DD has a direct line to someone powerful.Re the rest of this 10 at 10 ,where`s the hopeful news?

Yes, one of his brothers is CEO of Federated Farmers. Or do you mean *gasp* even more powerful than FF??

I thought I posted this before, obviously not:

Yesterday, Douglas Carswell MP (Conservative, Clacton) introduced legislation into the UK parliament that takes the first step towards ending fractional reserve banking. The bill would have the effect of making fractional reserve banking impossible, requiring a shift to full-reserve banking (where the bank either lends your money, or keeps it safe, but doesn't claim to do both at the same time!). In plain English, it would stop private banks being able to create money as debt.

Thanks for the post and the link, it's food for thought. I wonder how much political will there is there.

Off to see who else has picked up on this story. It's either that or sit around waiting for this evening's aftershocks to hit... :-(

It’s step in right direction, to educate people. For instance, 70% of people, including myself, thought they own money they deposit in bank, but legally it is the property of the bank, rather than the account holder.

B.H. you got yourself a real problem..............get it sorted...way past reporting them it's everywhere.

sorry to use this medium to contact.

@1 My wife is Japanese,. She told me today that she was speaking to her mother and on the floor above them is a man (40 years old) who hasn't been able to find any work for a year. He has to survive on his mothers pension.

In the next weeks the world is definitely looking at the USA :

Application are invited by the Ministry for Defence for the vacant position of senior scientist...applicants should have an indepth knowledge of star wars and must have their NCEA level one certificate in science....a short list of candidates will have to be prepared to take part in a televised comedy to see who can tell the biggest lies. The winner will receive a bloated salary..and be allowed to waste hundreds of millions making dumb decisions.

Applicants should apply using the identity of a dead child of similar vintage, a ploy sure to meet with SIS approval.

And adopt the motto: "You can run but you can't HIDE".

Why would applicants of the calibre you're seeking waste their time applying for a smalltime job like that when they have such bright futures ahead of them in real estate sales, property development, the private finance industry, and politics?

Just for a smile:

Friday Funnies http://www.theburningplatform.com/blog/2010/09/17/friday-funnies-16/

Nice right wing site......ho ho supported by Ron Paul.

Lets go on the record for the right / libertnz wingers and the non-right wingers.

Right wingers, stop spending, result even more US un-employment, hello 15%+ as that piece says 24% layoffs. Result, layoff lots of ppl they no longer are consumers....this impact is I think bigger than any QE...result serious double dip and recession/depesssion and deflation....maybe serious inflation later as the recovery begins, but thats a decade if not two away.

Interesting aside from that very piece, more Americans since 2000 now claim food stamps etc....so much for the Bush years and teh Bush tax cuts making things better.....if anything the reverse is true.

Non-right wingers, keep supporting the economy, keep ppl employed.....maybe later serious inflation.....maybe not....

regards

Re#9. I see silver is finally starting to make its run. Always an indicator that we are getting to be late in the game, as those that can't afford gold opt for the cheaper alternative. Final confirmation comes with those "We buy Gold!" booths in the malls start to say "..and Silver as well".

in which case, sell...

Considering oil is now trading at about $80US, I'd consider oil stocks for a bit....Exxon or something.....black gold and all that, if we dont go into a depression anyway....everything so so unstable and jittery.....not good.

regards.........

I really should stop haranguing Chicken-Little Hickey about his incessant doom & gloom prognostications ............. The longer that the brush-beaters of doom keep the masses scared witless , the longer that I have to clean up on attractively valued investments .

When the newspapers and the Hickster start announcing glad tidings , a year or three down the track ............ By then it'll be too late in the market cycle ........And this little Gummy Bear will be counting his winnings all the way to the bank .

Cheers Bernie : Keep up with the sabre rattling and the teeth gnashing !

It's sounds as if you can default on a mortgage in the US and simply walk away without any further debt obligations. Is that true? That can't happen here, unless you go bankrupt. It would make negative equity a much bigger concern here than in the USA.

Basically you're right. In many states in the US mortgages are non-recourse loans, so a lender that forecloses on the property cannot pursue the debtor for any deficiency. Exact details vary from state to state though.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.