Here are my Top 10 links from around the Internet at 10 past 1 pm, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for Tuesday's Top 10 at 10 via email to bernard.hickey@interest.co.nz.

I'll pop any surplus suggestions I get into the comment stream.

1.' Rushing for the exits' - Australian property owners know in their bones that their market is vastly overvalued.

That's why when it seemed that prices had topped out they started rushing for the exits.

November was the month they did it.

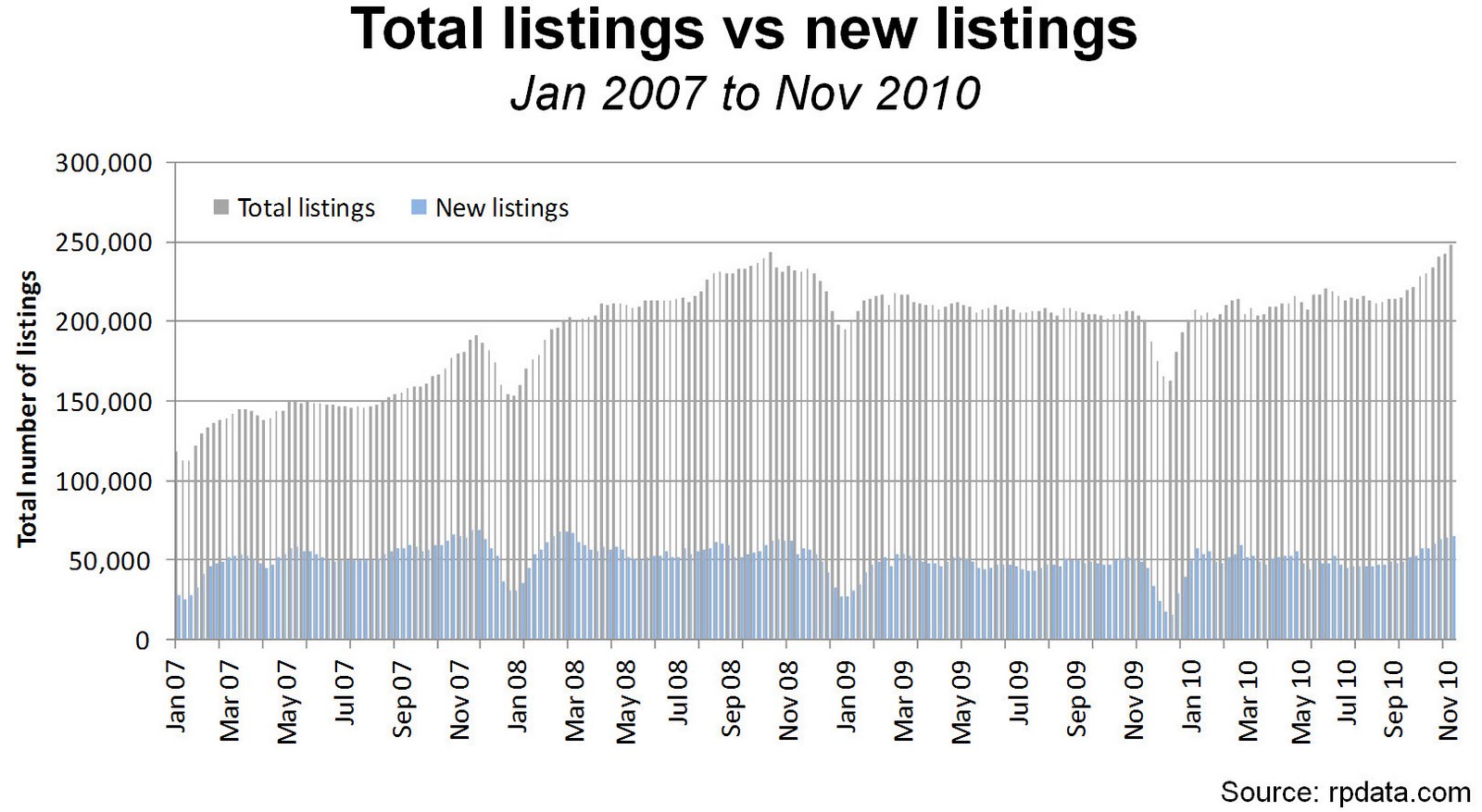

Delusional Economics reports that new listings surged in November just as house prices stalled and auction clearance rates started falling.

It's worst in Queensland.

Here's what APM had to say about the market action in Australia's property market.

During this spring, the number of properties available for sale has risen sharply at a time when housing finance volumes have been trending lower since September of last year and property value growth has been flat since June of this year.

The result of these conditions have been that at a time when fewer people have been actively looking to buy properties, a substantial amount of new stock has entered the market. Ideally, these vendors should have listed their properties earlier in the year when property values were still increasing and buyers were more active rather than waiting for spring.

And here's Delusional Economics on what it means:

The bubble it definitely bursting, although that news wouldn't be new to any of our readers. We have read over the last week or two that this all means that rents are about to "shoot to the moon".

2. 'NZX in self-perpetuating structural decline' - BusinessDesk reports Bernard Doyle from JB Were has made a submission to the Savings Working Group that the NZX is at risk of extinction.

"The current lack of IPOs (initial public offers), waning international interest and poor market liquidity are not simply a post-recession pause," Doyle said. "They are indicative of an equity market in structural decline, which has become self-perpetuating."

His industry experience suggests the equity market's decline is more advanced than many outside observers perceive, Doyle said.

"The transition from slow steady decline to a rapid irreversible wind-up may prove surprisingly rapid," he said.

3. Here comes the fifth pillar - Aussie Treasurer Wayne Swan seems determined to impose a fifth pillar on the Australian banking system, whether the market needs it or not. I think he's firing in the wrong direction. The real problem is too much debt generating too much profit, not necessarily not enough competition.

The Sydney Morning Herald reports Swan is due to put proposals to cabinet today and announce them later this week. The plans include:

* Strong measures for credit unions to help them become the fifth pillar of the banking sector.

* Steps to curb excessive bank fees and charges so they reflect costs and not contribute to bank profits.

* Abolishing mortgage exit fees.

* Tax breaks on deposits to replace complex franking credits.

"Staggering" is how a High Court judge described the behaviour of a pair of property developers and their indebtedness. Associate Judge Hannah Sargisson was left aghast at Cameron Marsh and Mark Perriam, who owed more than $146 million after the failure of their North Shore Perron Group. So she didn't hold back in saying what she thought when she refused their scheme for creditors.

"The insolvents have displayed, throughout, a lack of candour which belies their claims of integrity in commercial dealing.

It is evident in their inability to explain the staggering losses they incurred and why despite 15 years of, on their account, successful property development, their assets were so woefully small and insufficient in even beginning to meet the liabilities arising under their personal guarantees." Worse, she said the pair posed a hazard and she had no qualms about turning down their scheme, also opposed by Commonwealth Bank of Australia, which had lent them $40 million.

5. Obama is just like Hoover - US economist Thomas Palley hits the nail when he compares Obama to President Hoover, the President before Roosevelt who fiddled while the economy slumped into recession. Steve Keen has republished it on his site with comments. As I've been saying for over a year now, Obama is a liar and a fool because he promised change but kept Bush's policies and staff. HT Rob via email.

In 2008 President Obama captured the nation with a message of change, yet in office he has chosen to deliver change of style rather than change of substance. At the headline level this choice was reflected in his call for bi-partisanship that looked to split the difference with Republicans. In economic policy, it was reflected in the wholesale reappointment of the Clinton administration team led by Larry Summers and Timothy Geithner, a case of continuity not change. Now, the administration is sinking under failure of its economic policy.

That failure is due to its attempt to revive a 1990s paradigm that never worked as advertised and can only deliver stagnation. Painful though it is for Democrats to acknowledge, the reality is the economic policies of President Clinton were largely the same as those of President Bush. On this the record is clear for those willing to see.

The Clinton administration pushed financial deregulation; twice reappointed Alan Greenspan; promoted corporate globalization through NAFTA and China PNTR; initiated the strong dollar policy; spoke of the “end of the era of big government”; contemplated privatization of Social Security; and struck down a core element of the New Deal by ending the right to welfare.

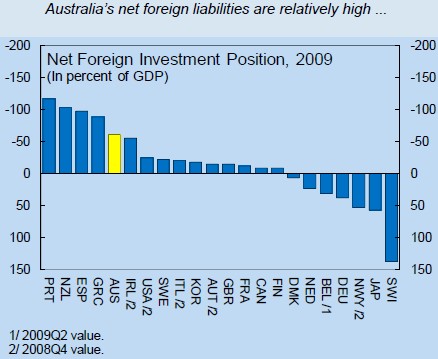

6. An Australian warning - David Murray, the boss at CBA prior to Ralph Norris, has warned Australians about their high foreign debts, that serves only to highlight how high New Zealand's net foreign debts are.

The chart shows New Zealand between Spain and Portugal, and higher than Australia, Ireland and the US. Leith van Onselen points to the comments.

The assumption that Australia could maintain a high level of foreign borrowings because the economy was underpinned by the mining boom and demand from Asia was worrying.

“That’s a very risky position”. Australia’s foreign debt position relative to the size of the economy is higher than that of the United States or France. Mr Murray admonished politicians for glossing over the risk posed to Australia’s economy from foreign indebtedness. Instead, he said, they had chosen to focus voters’ attention on abolishing government debt.

“The debate is all being run at a level that completely ignores this vulnerability”. If Australia’s economy were to slow, the ability to service those foreign borrowings could be affected. There is also the risk that the cost of foreign capital could rise further, which would be felt by many through higher domestic mortgage rates.

Banks’ foreign borrowings have funded Australia’s housing boom…

7. A letter from Dublin - Kevin O'Rourke at Euro Intelligence writes about how Ireland's taxpayers have been sacrificed to ensure the European bank holders of Irish bank debt are not sacrificed. It is the most perceptive piece I've read so far on the Irish situation. A must read I reckon.

The reaction to the news that Irish taxpayers are to be squeezed while foreign bondholders escape scot-free has been one of outraged disbelief and anger. At the start of last week, it was possible to make the argument that ‘burning the bondholders’ was irresponsible, since it would inevitably lead to contagion, and the spread of the crisis to Iberia.

That argument has at this stage lost all validity, since contagion has happened anyway. Besides, the correct response to the possibility of contagion was never to engage in make-believe, but to extend taxpayer protection to other Eurozone members as required. Swapping debt for equity in a coordinated fashion across Europe would show ordinary people that Europe is on their side.

It is no longer even certain that the budget will be passed in December. Brussels may not have a Plan B, but they had better prepare one nonetheless. Irish citizens may bring down the bailout of foreign bank creditors by voting at the ballot box, but if they do not, they will bring about a default of some kind by voting with their feet.

We now face a negative spiral in which austerity causes emigration, which increases the burden of the debt, which ultimately leads to more austerity. We need a game-changer to break the cycle, but what might it be? Since the fundamental problem is that Ireland is insolvent, the smart thing to do is to tackle our debt burden head-on, but the Europeans have vetoed this.

8. Portugal is next - This Reuters analysis explains why Portugal's bailout is now seen as inevitable.

Portugal is likely to need a rescue package of 45-60 billion euros from the European Union and the International Monetary Fund and may not get through the year without seeking a bailout. Investors believe Portugal will be the next euro zone country after Greece and Ireland to ask for help as its borrowing costs have risen above sustainable levels while its economy lacks competitiveness and growth is very slow.

Portuguese Prime Minister Jose Socrates insists Portugal can survive without a rescue and that his austerity budget of tax rises and public sector wage cuts will keep the ship afloat. But many economists believe a bailout is just a question of when, not if, and some expect it could happen before the year-end if Lisbon is persuaded to tap EU funds pre-emptively in an effort to stop the euro zone sovereign debt crisis from spreading to Spain.

"It is very likely that they will ask for a bailout -- maybe before Christmas depending on market developments in the next days," said Juergen Michels, euro zone economist at Citigroup.

9. Copper being cornered? - The Telegraph reports that a single trader has bought up 80% of the copper available on the London Metal Exchange.

There are fears of a shortfall in supply next year, as mining production is not expected to keep pace with rebounding demand following the recession. Two US investment banks and one UK company also want to launch exchange-traded funds linked to copper, which is likely to suck demand out of the market further.

10. Totally irrelevant video - A dog tries to run and jump in snow. Sort of funny. HT My 8 year old daughter who thought it was hilarious.

35 Comments

The mood in Ireland is building for a default.

Here's Shane Ross at the Irish Independent

http://www.independent.ie/business/irish/bankers-who-peddled-the-poison…

Today the Irish taxpayer is being asked to pick up the tab for the sins of Europe. Just as Anglo was culpable, so too were the originators of the funds that Anglo passed on to Ireland's property developers: German , French , Dutch and other European financial institutions .

These guys peddled the poison to Irish bankers, who in turn injected it into the Irish economy. Today Ireland's taxpayers are landed with the entire bill.

Many of the terms of the crippling deal with the IMF and Europe will be contained in the Budget on Tuesday. There is a clear duty on Fine Gael and Labour to reject the deal and renegotiate if they come to power in February. The least they could do is hold an instant referendum.

There is no shame in defaulting. As no one -- bar our tormentors in the IMF and Europe -- will any longer lend to us, we are de facto defaulters already. But part of the blame lies with those bankers who funded us when we were already flashing amber lights.

While a solid basis in truth....This does not sound representative of a Financial Hub....an industry of enlightened megabrains.....it was a potato scramble and there's somethin gooey at the bottom o the bag mum.........

Ah one potato two potato three potat...............oh..!

Who injected it to a willing money junkie in the making.......greed is just greed....big.. small hidden...open.

You pay your money ..you play the game.....you can't win em all it turns out.

bring on that financial hub John Boy....one potato...

Yet I seem to recall NZ being compared to the likes of Ireland by the rightards and how badly we were doing...funny that.......

regards

Too right Steven but no ones laughing.

Ambrose points out Royal Bank of Scotland is warning about a Chinese sovereign default. Oh boy. Mind you, RBOS is selling Credit Default Swaps and needs to scare a few punters

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/81826…

It warns that the Communist Party will have to puncture the credit bubble before inflation reaches levels that threaten social stability. This in turn may open a can of worms.

"Many see China’s monetary tightening as a pre-emptive tap on the brakes, a warning shot across the proverbial economic bows. We see it as a potentially more malevolent reactive day of reckoning," said Tim Ash, the bank’s emerging markets chief.

I really don't see any Chinese Banks or goverment default anytime soon or ever .

They have enough external balance (2.6 Trillion ?) to counter any outflows and as for the banks, they can always print and recapitalize again. (Much like what Ben is doing). They did this in the 90's before all the bank IPOs. Why can't they do this again ??

Infact I would harazd a guess that if a Chinese Sovereign Default do occur (or fear of one) it would be bad for the USD as it means there will be 2.6 Trillion of USD flooding into the world financial system again !!

Bernard : Any chance of a link or comment on Phil Goff's last speech before Christmas ?

I caught a snippet on the news . Unlike National , he will hand's-on manage the economy , improve family incomes , reduce NZ's debt , and grow the economy ............. There is a Santa Claus , and he's more than just a little bit Goofy !

"he will hand's-on manage the economy " Oh dear

"improve family incomes" How?

"reduce NZ's debt " How?

"and grow the economy " How?

rc ............. I have a niggly-naggly feeling that you don't believe in Father Christmas !

Santa, maybe.

Fill Gap single handedly turning around NZ Inc into a high wage economy by doing the aforementioned? Thats the stuff of Tui billboards.

Here we go. Thanks to Alex.

All up before the others.

cheers

Bernard

Thankyou , Alex and Bernard .

There's talk now that Europe's bailout fund needs to be much bigger.

When will this attempt to dig the developed world out of too much debt with yet more debt actually end?

Here's the Reuters report

Euro zone finance ministers meeting on Monday will face pressure to increase the size of a 750 billion euro ($1,006 billion) safety net for crisis-hit members in order to halt contagion in the single currency bloc.

Dominique Strauss-Kahn, the head of the International Monetary Fund (IMF), will call on the ministers to boost the facility and urge the European Central Bank (ECB) to step up its purchases of bonds to stem the crisis, according to an IMF report obtained by Reuters.

Bernard,

Great to see the graph above showing our true and horrific foreign obligations position.

If the Aussie are not sleeping well - God knows how we should be feeling.

Gross debt of $ 246 Billion to roll. Forget net debt !

An extreme as in extreme liquidity and interest rate risk exposure.

Bernard - Please explain to me and the masses why we measure foreign debt as a percentage of GDP which we can inflate by building prisons and fixing leaky homes - neither of which will service our foreign debt.

Why not as a percentage of export income - then we will really see our ability to service the debt which my simple mind says is the critical variable here.

Great work as usual - we all owe you a great deal.

Good call! Would be good (or maybe not so good) to see this presented in a similar graph.

rc - would be good (or may be not so good) if our politicians would face up to this.

Our Govn deb is quite low so building the odd prison is no biggee....for instance a Govn pays the un-employed a "wage" to sit around, why not pay them a % more to build a public building....

The biggee is private debt which for decades the neo-cons have ignored, they have simply assumed is all productive lending or of no consequence and this blindness has been their and our downfall. For me the private debt is insane....I dont understand it.....or I dont understand why ppl have done it to this extent....it seems OTT, so much for rational/efficient/free markets are best. .....but what the hell ppl were "makin money" naff all real goods of course just churn....

Im not so sure even taking export income v foreign debt is always that straightforward, for instance financial services have earned the UK and USA a lot of foreign income (which as one stage had all but disappeared)....its questionable however if thats real earnings to my mind....ie they have not produced something just taken money from somewhere and imported it....

regards

Here's what Bollards personal hero has said recently in a 60 mins interview:

On other issues in the 60 Minutes interview, Bernanke:

- Argued that unemployment would have been far higher - "something like it was in the Depression, 25 percent" - had the Fed not provided extraordinary aid to Wall Street firms, banks and other companies to ease a credit crisis.

- Said it could take four or five more years for unemployment, now at 9.8 percent, to fall to a historically normal 5 percent or 6 percent.

- Reiterated that the Fed is prepared to buy even more than US$600 billion in Treasury bonds over the next eight months, should it decide the economy needs the fuel of even lower interest rates.

- Argued that the risk of inflation is overblown. Bernanke said he's "100 percent" confident the Fed will be able to ward off inflation, when the time is right, by raising interest rates and unwinding its stimulative programs.

- Called the risk of deflation - a prolonged drop in prices, wages and the values of homes and stocks - "pretty low." He said the likelihood would have been greater if the Fed weren't maintaining super-low interest rates.

Talk about clueless and out of touch!

Bernard, you said at point Five above, "Obama is just like Hoover - US economist Thomas Palley hits the nail when he compares Obama to President Hoover, the President before Roosevelt who fiddled* while the economy slumped into recession..." There is no polite way to say this: This is just flat out wrong. What Palley has hit is his thumb--and yours... Far from keeping his hands off while the economy tanked, Hoover was precisely as active as you and your new interventionist mates would have liked him to be.** He intervened to keep prices up. He intervened to keep wages up. He borrowed to put deficits up. In short, he did just what Bush did, with results that were just as dismal. And instead of fixing the crash, he turned it into a full-blown depression. And then (after campaigning against Hoover's "big-spending"), when elected FDR went right on ahead and did just what Hoover did, only moreso. Just like Obama did. And instead of fixing the depression, he made it last another fifteen years. Between them, Hoover and FDR were a disaster. So if there's any historical comparisons to be made here (and there are) the only deserving one is to say that Obama is playing FDR to Bush's Hoover. And they're both a goddamned disaster. HOWEVER, if you genuinely do want to learn about a President who sat back while the economy slumped into recession, you really should learn more about the Great Depression of 1920-21--where the slulmp was even bigger than it was nine years later. But do you want to know why you don't hear more about The Great Depression of 1920-21? It's simple. It's because the government sat back, got out of the way, and allowed the economy to recover. In short, the authorities then under Harding and Coolidge did what Hoover (and Bush, and FDR, and Obama, and Greenspan, and Bernanke) should have done. Which was to get the hell out of the way. And that's why it's "The Depression YOu've Never Heard Of." Because their "fiddling" in 1920-21 while the economy slumped into recession was what allowed the economy to restructure, and recover, and get back on the road again. * Just to be clear, so there's no misunderstanding, by fiddling we all mean what Nero did -- which was "fiddling while Rome burned" -- not what Obama/Bush FDR/Hoover did, which was intervene, intervene, intervene. ** From Murray Rothbard's 'America's Great Depression: "Franklin D. Roosevelt, in large part, merely elaborated the policies laid down by his predecessor. To scoff at Hoover's tragic failure to cure the depression as a typical example of laissez-faire is drastically to misread the historical record. The Hoover rout must be set down as a failure of government planning and not of the free market. To portray the interventionist efforts of the Hoover administration to cure the depression, we may quote Hoover's own summary of his program, during his presidential campaign in the fall of 1932: '<i>We might have done nothing. That would have been utter ruin. Instead we met the situation with proposals to private business and to Congress of the most gigantic program of economic defense and counterattack ever evolved in the history of the Republic.</i>'

Harding wasn't capable of doing anything even if he had been so inclined:

"I don't know what to do or where to turn on this taxation matter. Somewhere there must be a book that tells all about it, where I could go to straighten it out in my mind. But I don't know where the book is, and maybe I couldn't read it if I found it. My God, this is a hell of a place for a man like me to be!".

Yep, he was sumpthin', was Warren G.

Harding was a man who knew his limitations.

Fortunately.

If only some other people knew theres. Folk like Ben, Bill, John, Barack, Tim, Alan, Bernard ...

There is no way to say this but, you are an out and out kook who has no grasp on reality let alone history...

regards

Good link. That's my take on it too.

Politicians need a crisis to allow them to cut government salaries. Force the civil servants to recognise their complicity in stuffing things up I say.

My income went down when my customers went bust. I count myself lucky. There needs to be this simple feedback on the civil service too.

Roger.....do you realise you are suggesting Sir Humphrey take a cut in pay....he needs his bloated handout, as do the hundreds of other 'bosses' in the state sector who are receiving gargantuan amounts of taxpayer loot....how else could they afford their mansions in wgtn...think what it would do to the wgtn property market...you wash your mouth out Roger.....no bloody knighthood for you boy!

Mary Holm's latest load of sexist clap trap!

"Something to ponder as Christmas gift giving approaches: New Zealanders apparently think they need more stuff than the people we often regard as most materialistic - Americans."

"What's more, older and male New Zealanders seem to be more into "things" than young people and females

WFF will wipe you out. The freakish minority will perish. And those that live the common way and support the country will rule. (As they do, hence centre right govt). Read it and weep ya freak.

Yes you guessed it...Ben the printer is getting ready to make it 3 in a row.....

http://www.telegraph.co.uk/finance/economics/8182554/Bernankes-QE3-faces-stiff-resistance.html

"Transcripts suggest that Mr Bernanke is sufficiently worried about the risk of an economic relapse next year - and a slide towards deflation - that he is already mulling further “credit easing” or QE3 as it is dubbed".

Queeee 4 by xmas next year anyone?

So what happens when a soverign defaults?

So conventionally new terms are agreed I believe, what happens if Ireland simply does 100% default? and says sc**w you! ?

regards

Ireland is interesting in that the vast bulk of its sovereign debt is a direct result of the government guarantee that it introduced for its own banks (most specifically Anglo Irish) in 2007. If it reneges on the guarantees, then its the irish banks that actually cop it. Which in reality mean that a lot of Irish assets (primarily property) will end up being liquidated or repossessed by UK and German banks. And the Irish have a bit of history when it comes to the English throwing them out of their homes - so that could get very interesting indeed....

Incidentally it was the Irish which sparked off the international wave of GG's in 2007, that ultimately cost the NZ taxpayer $2 billion. A fact which tempers my sympathy for their circumstance somewhat. It would have been far wiser at that point to take the Icelandic route and realise that it had all got too big for them . The Irish banks have to be allowed to fail - if that had happened 3 years ago they would be on the mend by now.

Massachusetts Institute of Technology piece on sovereign defaults. Seems that historically they are rather common Esp in Latin America and Spain is mentioned more than once :)

http://mitpress.mit.edu/books/chapters/0262195534chapm1.pdf

The net foreign debt is partly a function of our high exchange rate. I don't know the NZ equivalent to this calculation but it is relevant:

http://www.bbc.co.uk/blogs/thereporters/stephanieflanders/2010/12/if_ge…

"It's interesting to compare these numbers with the massive positive shift in the UK's balance sheet after the pound fell by 25%, on a trade weighted basis, in 2008. By the end of 2008, net foreign liabilities of £352bn had turned into net foreign assets of £92bn - even though we ran a balance of payments deficit throughout and exporters had not even begun to start taking advantage of the lower pound. Amazing what a little - OK, a large - depreciation can do."

Anyone know the NZ equivalent?

Roger the stonewalling from the RBNZ and the Ministers unwillingness to even suggest intervention is I believe due to a small number of external factors with large consequences.

The fact that no meaningful dialogue has been had with the NZMEA other than the usual rhetoric of trying to talk it down while acting in a counter productive manner...suggests a little secret lies in the fog.

Some of the doublespeak out of the RBNZ goes on to say ....some.....exporters are doing very well....I am sure they are referring to the Fonterras ....and the like..... who have undertaken serious hedging positions that may have serious consequences should the NZD be tampered with.

Another quite simply is FUEL....look where crude is headed......our transport and construction are holding their own at present......that would be destabilized with a sudden downswing.

There may be more goings on than speculation can conjure......after all we've got a smart ass at the helm who'.... I think.....would ratify a real punt with the economy.........if it came off they will shout it from the rooftops.....if not you may never even know about it.

I've been trying to point out the connect between crude and activity for years.

Crudely, for sure.

Beyond a certain price (100-120 6-months ago USD was my guess) the whole thing shudders.

We saw what happened at 147/barrel - the flow-on given that everything is underwritten by it, for instance: the majority of the food consumed in the UK is trucked across the Channel, so you add the cost to eery carrot, every pea.

It's just topped $90 now, and no hedge-money sloshing around as per '07. This is demand-driven.

There aren't many populist answers, but there are answers.... I stuck a link on '90 secs', but here it is again:

http://www.odt.co.nz/news/dunedin/139569/peak-oil-drive-changes-dunedin

they're starting to get it. Might be worth suggesting a length-of-the-country cycle-way, eh?

Could be a winner....

Ta PDK ...I was never in doubt that ...you...Steven ..could not see where this has been going .

I think there is real fear up there in Bolly's office....yes indeed......it's not a tightrope it's a razor-blade and we are bleeding as we maneuver our tenderfoot's.......... policy.

Jenny Morel knows the importance of getting onto Solar - so presumably the info isn't far away.....

Good to see a Local Authority getting stuck in, though.

I plan to remain urbane.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.