Lifestyles of Davos' rich and famous; The Davos mistresses; Joy Division tattoo; China's cash shortage; Dilbert

Here are my Top 10 links from around the Internet at 10 past 8 pm, brought to you in association with New Zealand Mint for your reading pleasure.

I welcome your additions and comments below, or please send suggestions for tomorrow's Top 10 at 10 via email to bernard.hickey@interest.co.nz.

I'll pop any surplus suggestions I get into the comment stream.

1. What really goes on at Davos - The Big Masters of the Universe shindig is on at Davos in Switzerland.

This is a fascinating insight from Joseph Stiglitz's wife Anya Schiffrin over at Reuters.

What some people will do to network.

Wives of the Masters have to wear white name tags, which makes them nobodies.

Mistresses have their own problems.

But if wives have it bad, mistresses, who are invited under a variety of guises and usually wind up with a white name tag, have it worse. Typically their men are swallowed up by a tsunami of meetings and interviews and don’t have the time or inclination to take their mistresses around with them. Often these men go to high-level dinners to which wives and mistresses are not invited.

The skinny and beautifully dressed Davos Mistress typically hangs around the auditoriums waiting for a couple of minutes with her man. While waiting, she keeps her eyes peeled looking to search and destroy the competition.

The only thing worse than a white pass, is no pass. Rumor has it (heard first-hand from more than one jealous Davos Mistress) that there are legions of women — let’s call them the aspiring mistresses — who do not get a coveted Davos invitation and badge and so can not enter the Congress Centre but who come anyway.

They book a hotel room and prowl the streets hoping to snare their prey. They are the worst enemies of the Davos Mistress.

2. How much Davos really costs - Davos has become the rockstar of conferences. An invitation is like a pass into the hottest party (networking opportunity) in the world.

It is the ultimate symbol of everything that is wrong with the increasing concentration of wealth and power in the hands of fewer and fewer people.

Here's some detail from Andrew Ross Sorkin from the NYTimes' dealbook on the price of entry. It's obscene in so many ways.

They spend days talking about how to cure global poverty and end inequality.

Just to have the opportunity to be invited to Davos, you must be invited to be a member of the World Economic Forum, a Swiss nonprofit that was founded by Klaus Schwab, a German-born academic who managed to build a global conference in the snow. There are several levels of membership: the basic level, which will get you one invitation to Davos, costs 50,000 Swiss francs, or about $52,000.

The ticket itself is another 18,000 Swiss francs ($19,000), plus tax, bringing the total cost of membership and entrance fee to $71,000. But that fee just gets you in the door with the masses at Davos, with entry to all the general sessions. If you want to be invited behind the velvet rope to participate in private sessions among your industry’s peers, you need to step up to the “Industry Associate” level. That costs $137,000, plus the price of the ticket, bringing the total to about $156,000.

All these embedded costs have helped make the World Economic Forum a big business — perhaps the biggest conference organizer in the world. According to its annual report, it brings in about $185 million in revenue and spends nearly all of it, with almost half of its costs going toward events and the other half on personnel.

3. The problem with business leaders and inequality - Justin Fox from the Harvard Business Review writes from Davos about the issue of inequality of income and wealth.

He says big business has a big problem grappling with what is obvious the major issue of the new post-GFC world. And it's a discussion at Davos of all places.

The big rise in economic inequality over the past four decades is partly the result of impersonal economic forces — technological change, mostly — but political decisions have played a crucial role as well. Financial market deregulation, tax-code changes, and all manner of other policy choices in the have promoted inequality in the U.S., as Jacob S. Hacker and Paul Pierson demonstrated pretty convincingly in their 2010 book Winner-Take-All Politics.

And similar moves were made in much of the rest of the world. Who pushed for these changes? Well, businesspeople, of course. Often for very good reason: to spur economic growth, to increase a particular country's economic competitiveness, even to promote personal freedom in the face of a stifling government.

Assuming we're near or have passed that growth-maximizing level of inequality, in the U.S. at least, the business community as a whole would be better off if the trend toward inequality slowed or reversed. But business people are accustomed to pushing for policies that tend to increase inequality, and are loathe to reverse their stances on tax rates, free trade, and free financial markets. As a result, businesspeople who worry about inequality have over the years tended to focus on improving educational opportunities. But you can't say those efforts have made a noticeable dent in the inequality trend.

Business folks would seem to be stuck. They need a more equal distribution of wealth and income to continue thriving. But it doesn't seem to be in any businessperson's immediate interest — and in many cases contradicts deeply held beliefs — to make the sort of decisions or support the sorts of government policies that might halt the trend toward more inequality.

4. The rise of the global elite - Chrystia Freeland At The Atlantic writes this excellent piece on the rise of the new global elite. HT Vanderlei Luxembergo via email.

Through my work as a business journalist, I’ve spent the better part of the past decade shadowing the new super-rich: attending the same exclusive conferences in Europe; conducting interviews over cappuccinos on Martha’s Vineyard or in Silicon Valley meeting rooms; observing high-powered dinner parties in Manhattan. Some of what I’ve learned is entirely predictable: the rich are, as F. Scott Fitzgerald famously noted, different from you and me.

What is more relevant to our times, though, is that the rich of today are also different from the rich of yesterday.

Our light-speed, globally connected economy has led to the rise of a new super-elite that consists, to a notable degree, of first- and second-generation wealth. Its members are hardworking, highly educated, jet-setting meritocrats who feel they are the deserving winners of a tough, worldwide economic competition—and many of them, as a result, have an ambivalent attitude toward those of us who didn’t succeed so spectacularly.

Perhaps most noteworthy, they are becoming a transglobal community of peers who have more in common with one another than with their countrymen back home. Whether they maintain primary residences in New York or Hong Kong, Moscow or Mumbai, today’s super-rich are increasingly a nation unto themselves.

5. Obama's final transformation - It's now clear that the mid-term election defeat for the Democrats has pushed Obama further into the arms of the bankers and big corporate America. He's even talking about corporate tax cuts.

Here's independent banking analyst Christopher Whalen with his acerbic take on what's really going on now at the White House and with AIG, which he describes as the 'Blood Doll' of Wall St. A fun read.

Last week saw a number of important developments in Washington. General Electric CEO Jeffrey Immelt and Bill Daley were appointed as economic advisor and chief of staff at the White House, respectively, a move that signals the mutation of Barack Obama from Euro-socialist to center-right Republican. Think of the betrayal of conservative values by Richard Nixon in reverse and you've got the scale of the political transformation now underway at 1600 Pennsylvania Avenue.

With President Obama taking orders directly from former JPMorgan ("JPM"/Q3 2010 Stress Rating: "C") investment banker and Chicago fixer Bill Daley, there seems little reason for Treasury Secretary Timothy Geithner to remain at Treasury as the guardian of Wall Street.

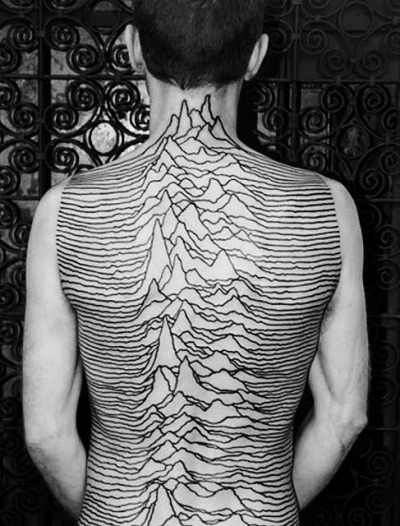

Here's a weird picture to go with some of the cartoons. Someone is a really, really big Joy Division fan. I'm a big fan, but not quite this big.

He now thinks Hubbard should have a brain scan. Quite a change of attitude.

7. A call to mobilize America's jobless starts a riot - A call from a leftist academic Frances Fox Piven for America's jobless to mobilize has caused massive ructions in America, where right wing talk show host Glenn Beck attacked the comment as calling for a violent revolution. This in turn triggered death threats aimed at Piven by Beck's gun totin' fans.

America is a not-so-funny place sometimes.

Here's her original piece, which is pretty sober and just points out that America's underclasses are not well organised or very good at protesting about their situation.

"Where are the angry crowds, the demonstrations, sit-ins and unruly mobs? After all, the injustice is apparent. Working people are losing their homes and their pensions while robber-baron CEOs report renewed profits and windfall bonuses. Shouldn't the unemployed be on the march?

Why aren't they demanding enhanced safety net protections and big initiatives to generate jobs?

8. Americans a bunch of wusses - Here Barbara Ehrenreich at the LATimes tries to understand why America's gun totin' yokels are so angry at those such as Piven who call for protest at the plutocrats in Washington.

It all beggars belief. If anything, it is the angry white men who should be protesting at the bankers and politicians and CEOs. Instead gun totin' Beck fans want to shoot those calling for protest.

But here's an attempt to explain these latest death threats. It goes a long way to get under the skin of the Tea Party movement.

There are all kinds of explanations for how Americans lost their grass-roots political mojo: iPods have been invoked, along with computer games and anti-depressants. And of course much of the credit goes to the so-called populist right of the Rush Limbaugh and Glenn Beck persuasion, which argues that the real enemy of the down-and-out is not the boss or the bank but the "liberal elite" represented by people like Piven.

But at least part of the explanation is guns themselves -- or, more specifically, the recent and uniquely American addiction to high-powered personal weaponry. Although ropes and bombs are also mentioned, most of the people threatening Piven on Beck's website referred lovingly to their guns, often by caliber and number of available rounds.

As Joan Burbick, author of the 2006 book, "Gun Show Nation: Gun Culture and American Democracy," has observed, "The act of buying a gun can mimic political action. It makes people feel as if they are engaging in politics of political protest." She quotes one gun enthusiast: "Whenever I get mad at the government, I go out and buy a gun." Jobless and overwhelmed by bills? Hunker down in the basement and polish your Glock.

9. Cash shortage - China's banks face a cash shortage before the Chinese New Year holiday. All is not well in the Chinese banking system, Bloomberg reports.

10. Totally relevant video - The Onion reports on an American official's plea for Americans to eat more vegetables....

20 Comments

Chris Lee. What a plonker. The only bloke I know who has turned being wrong into an art form.

...... which puts him in fine company , along with Barack Obama , Bernard Hickey , Alan Greenspan , Standard & Poors , Michael Cullen , Theresa Gattung , Daffy Duck , GBH .......... gosh , there are alot of us who turn being wrong into an art form ............ not you though , andyh !

I dont make my living advising folk on where to invest GBH. Apparently Chris Lee does. Considering he called the entire Finance company industry incorrectly over the last 5 years (you'll find he was an avid supporter of many of the companies that are now bust), and called the Hubbard story wrongly from day one to boot it is a wonder he is still in business.

That is true , it is a wonder that Mr Lee still has any clients ............. And yet we turn up here each day , in the shadow of Bernard Hickey , who also made some woeful calls ........... Alan Greenspan is still feted and sought out , despite his culpability in the global financial crisis ........... Michael Cullen has a nice sinecure at Kiwi-Bank / NZ Post , gifted to him by John Key , despite the fact that Cullen created the worst inequalities and imbalances in the New Zealand economy since Rob Muldoon mis-ruled the land ..........

andyh - Chris lee was lucky with SCF as he got a get out of jail free with the bailout via the Gov't Guarantee. But Strategic and St. Laurence, which were other favourites of his, went belly up and will pay only a few cents in the dollar back to its debenture holders.

Fair comment, but it is good Lee at least is prepared to admit he was wrong, like a lot of others about Hubbard. And I got a part payment for St Laurence today, but don't expect much further.

I say good on him for changing his mind given the evidence now, most people here on this site never change their mind and bang on and on with their pet theories and viewpoints.

Remember though everybody is entitled to my own opinion.

So no matter what he or his party does, no matter how vile or hypocritical or just plain idiotic, you will always find an excuse to praise him and it?

Chris Lee has a political party ? ......... We are flapping on about the 180' turn by Lee !

...... and as most of Japan's debt is internally funded , wot the feck do they care about S&P !

Not any more GBH. In 2010 Japan's net foreign bond sales went positive for the first time 30 years - Japan is aging faster and harder than any other "western" economy and the old guys are now cashing in their chips - woith insufficient wealth amongst the youth to pick up the slack. They're on their way into a major savings tail-spin..... (with a starting point of gross public debt at 230% GDP - and Bernard keeps worrying about our pissy little 28%!).

At some point in the next 3 years the Yen is going to implode in a truly spectacular manner....

Quite right

Davos is a shocking mix of nonstyle buildings - a greek salad with lovely white winter sauce to cover the rotting, smelly caviar - that's where they meet - yuppieee !

"ECB Board member Lorenzo Bini Smaghi said policy makers can no longer afford to ignore imported inflation after President Jean- Claude Trichet pledged to do what’s needed to ensure price stability."bloomberg This is the same inflation entering NZ...energy...and any other US$ priced stuff...and it means disposable incomes shrink because wage increases are not going to happen except at the senior state level and for mps. Yes the commodity exporters free of the bank chains are seeing improved earnings but they are not going to splurge with that money. They are in the main the frugal thrifty and "lazy balance sheet" owners who told the banks to eff off long ago. They are certainly not going to throw their reward at overpriced land. The average family will have less left to spend so you can see the govt revenue flow shrinking too. English is going to find the imported inflation, the high unemployment, the real GDP activity...are all reflected in his revenue stream with far more accuracy than any dated data flow from the bureaucracts. The more he acts to cut back the spend side...the greater the loss on the revenue side...this is the truth about the unbalanced economy hitting you in the face...the reliance on the export gain is misjudged and that gain is looking more unstable with every step Beijing takes to throttle its bubbles. Hate to say it again but the damage is being done by the very property bubbles being propped up by the banks with the help of govt and the RBNZ. Key made no comment about any policy measures post November, aimed at crimping the property speculative madness....not a peep! Indeed all it will take now is an announcement by govt or a promise by Goofy, that immigration is to be stepped up tenfold...to cement in place for all time the madness that is this economy.

Hey Benard could you comment about 7's article? Whats are your thoughts about what she is saying?

I agree with 7.....I find it mind boggling that ppl cant organise peacefully and democratically and cause change....18% of a population is a decent voting block.

regards

"So where are the angry crowds, the demonstrations, sit-ins and unruly mobs?"

"Local protests have to accumulate and spread—and become more disruptive—to create serious pressures on national politicians. An effective movement of the unemployed will have to look something like the strikes and riots that have spread across Greece in response to the austerity measures forced on the Greek government by the European Union, or like the student protests that recently spread with lightning speed across England in response to the prospect of greatly increased school fees."

Umm that doesn't sound peaceful, that sounds like a call to arms.

"Third, protesters need targets, preferably local and accessible ones"

Do you think orgainising the unemployed into angry mobs and giving them "targets" is really a good idea?

@#3

hilarious. The kid from harvard rails against inequality and asks

Who pushed for these changes? Well, businesspeople, of course. Often for very good reason:

which is that these bizniss "leaders" behave like this because thats the teaching of all the pricey mba schools at chicago, wharton, harvard etc

that poor drone needs to go to lincoln and study forestry, cos he can't see the wood for the trees.

Mr Hickey

I think the relevent bit of Ms Piven's essay which caused concern was not the need to do something, but her urgings to do it in a violent manner.

" An effective movement of the unemployed will have to look something like the strikes and riots that have spread across Greece in response to the austerity measures forced on the Greek government by the European Union ..."

Riots sound pretty groovy , but the Greek ones have a tendency towards fatality, such as the pregnant bank worker who died after a petrol bomb attack.

There is a movement to tackle fiscal irresponsibility in the United States that both Ms Piven, and apparently your good self, disapprove of. and that is the tea party. That it is a reasonably grass-rootsy, working/lower middle class network probably doesn't endear itself to academics but it's a reasonable example of why the US will be out of trouble well before Europe. Well, the Jerries excepted. Bloody Jerries.

billoby the tea party was established by some big time corporates

http://www.globalresearch.ca/index.php?context=va&aid=18677

http://en.wikipedia.org/wiki/FreedomWorks

http://en.wikipedia.org/wiki/Americans_for_Prosperity

theres grassroots, and theres "grassroots"

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.