Here's my Top 10 links from around the Internet at 1 pm in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

The theme in today's Top 10 is 'ridiculous'. The bonus Number 11 video of 'Investorville' is hilarious in a cringey sort of way to rival the Westpac Banana Smoothies video.

1. Where have we seen this before? - Fitch Ratings has reported on the size of the Total Societal Financing in China, which includes the 'shadow' banking system there.

Chinese authorities have been cracking down on the official sources of finance to try to slow down inflation.

But many have worried in recent months that credit is squirting out through the unofficial sectors.

The curious thing about the last couple of years of growth in China is how it happened when export growth to America was so slow.

Was it created by an internal credit boom and spending on bridges to nowhere and ghost cities?

And how sustainable is that? Will those loans implode under their own weight?

This Fitch report suggests the internal credit boom is both a key for the growth and not very sustainable....

Two years after the peak of the 2009 lending boom, credit levels in China remain elevated. Although bank lending has slowed, this moderation is being offset by a burgeoning of new credit channels both within and outside the banking system. Consequently, growth of leverage continues to outpace growth of the economy.

The main components of this uncaptured financing include letters of credit (LoCs), credit from domestic trust companies, lending by other domestic nonbank financial institutions (NBFIs) and loans from Hong Kong banks. All of these are on pace to reach CNY700bn‐1trn in 2011. By end‐2011, total financing/GDP could reach 185%, up 61pp from 2007. Increases of similar magnitude have been seen elsewhere in the years leading up to banking stress, underscoring the agency’s cautious outlook on the sector.

That China’s economy is slowing while financing is still so abundant illustrates how dependent growth remains on loose financing. This is further highlighted by the continued low incremental economic return on new credit.

Pre‐crisis, a CNY1 increase in financing yielded roughly CNY0.75 in new GDP, but in 2009 this plummeted to CNY0.18. The economic return on credit is slowly rising, but still has yet to fully recover.

2. Here's what Americans think of the Debt Ceiling debate - The Washington Post asked its readers for a one word thought on the debate and then put it into a word cloud.

3. Korea buys gold - Reuters reports South Korea's central bank bought 25 tonnes of gold in the last two months in its first purchases in more than a decade.

This is what happens when America, which has the world's Reserve Currency, prints money in a beggar-thy-neighbour attempt to devalue its way out of trouble.

The RBNZ owns no gold.

The central bank of Asia's fourth-largest economy said that, with prices hovering near historic highs, gold looked less lucrative as an investment but it was the right time to buy gold because its foreign reserves had risen above $300 billion.

4. Yen's surge may wipe out Japan's recovery - Bloomberg reports on the fallout from the US dollar's slump.

This is what happens when America, which has the world's Reserve Currency, prints money in a beggar thy neighbour attempt to devalue its way out of trouble.

It will encourage yet more printing by the Japanese and Chinese.

Meanwhile, New Zealand doesn't print and our currency gains against both...

It's all nuts.

Here'swhat the Japanese are thinking:

“The strong yen is the biggest uncertainty facing Japan’s economic recovery,” said Eiji Hirano, formerly a BOJ executive director and now the executive vice president of Toyota Financial Services Corp.

“Japanese companies were doing all they could to get back on their feet, helping the nation rebound faster than expected -- the strong yen could kill all of the optimism that was built up on that.”

5. The Spanish example - Boston University Economics Professor Christophe Chamley writes at Bloomberg about the default of Spain's sovereign debt in 1575 and how it helped bring down an empire and poison views of Spain's creditworthiness for over 400 years.

Thanks to Philip’s expensive military adventures in the Netherlands and the Mediterranean,Spain’s debt had reached half of gross domestic product by 1573. At that point, the cities balked at paying higher taxes. For the next two years, they refused to budge in their confrontation with the king.

Finally, in September 1575, Philip took a circuitous route to outmaneuver the Cortes. He suspended payments not on the long-term debt, but on the short-term debt, which was owed primarily to Genoese bankers. The people cheered. Resentment against bankers ran as high then as now -- perhaps higher, because the bankers were foreigners. The upshot, however, was default and a full-blown credit crisis.

6. 'A parasite' on the global economy - Reuters reports Vladamir Putin saying America is now a parasite on the global economy. Couldn't have put it better myself.

"They are living beyond their means and shifting a part of the weight of their problems to the world economy," Putin told the pro-Kremlin youth group Nashi while touring its lakeside summer camp some five hours drive north of Moscow.

"They are living like parasites off the global economy and their monopoly of the dollar," Putin said at the open-air meeting with admiring young Russians in what looked like early campaigning before parliamentary and presidential polls.

7. The West Wing - Does its thing on how debt ceilings used to be increased.

8. The power of deleveraging - Carmen and Vincent Reinhart write at the FT.com that the debt deal doesn't fix the underlying problems in the US economy that are keeping stuck in a decade long (at least) period of Japanese style balance sheet recession.

Here the federal sector is on the hook for a number of liabilities. Some are well known, and based on legislated promises, such as the underfunded social safety net. Others are unacknowledged, but will soon hit the national balance sheet. In particular, unfinished business lingers from the financial crisis of 2007-09, mostly related to bad mortgages. Those are troubling for those institutions that hold the debt, as well as being a considerable burden for the one in five mortgage owners whose houses are now worth less than their debt.

This unfinished business has damaged the housing market and slowed growth, while also hitting state and local governments. Authorities splurged in the good years of the housing bubble, but did nothing to prepare for leaner times. Widespread deleveraging is thus still the order of the day. And when so many want to spend less than their incomes, an economy sputters. This poor performance is what we should expect from history, where post-crisis economies grow more slowly, and unemployment stays high, in the decade after a major financial crisis.

Economic data last week confirmed this, with the S&P/Case-Shiller home price index declining again, and gross domestic product expanding by less than 1.5 per cent over the past four quarters.

9. The old are more likely to default - IMF economist Ali Alichi makes this interesting comment in an IMF blog post.

Studies have shown that a country's willingness to repay is as important as whether it has the resources to repay. This willingness deteriorates as voters age because they have a shorter period to benefit from their country's access to international capital markets and become more likely to opt for default on current debt. Moreover, older voters generally benefit more from public resources—such as pension and health care benefits—which could shrink if debt is repaid. If the old are a majority, they might force default, even if it is not optimal for the country as a whole. Lenders will take this into account and reduce new lending to an aging country.

There is some empirical support for the notion that aging increases the probability of default on sovereign debt, but more work is needed to draw strong conclusions. Alichi (2008) uses a panel of about 75 countries that have had at least one episode of sovereign default during 1975–2003 and shows that, on average, younger countries (those with a higher percentage of people ages 15 to 59 years) are less likely to default.

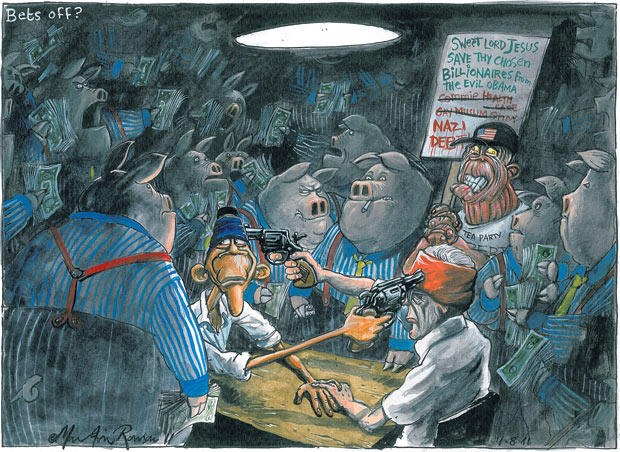

10. Totally a Taiwanese animation treatment of the Debt ceiling debacle - The Tea Partists throw their toys and other things around...a lot.

Bonus Number 11 - HT Alex and Macrobusiness for this cracker. Remember Westpac Australia's cringe-making Banana smoothies video explaining to customers why they needed higher interest rates?

Now Commonwealth Bank of Australia have created a game to encourage rental property investment in Australia...

15 Comments

And China's factory output growth slows a bit to almost contracting

The purchasing managers index (PMI) fell to 50.7 from 50.9 the previous month, the China Federation of Logistics and Purchasing (CFLP) said.

China has been taking steps to cool its overheating economy and bring down the rate of inflation.

Chinese inflation will spread over here at some point...the business I manage imports goods from China...we are seeing up to 15% price increases from our suppliers..which is concerning...the exchange rate is shielding us at the moment...but if our exhange rate drops to normal levels, expect to see many businesses increases their prices...

Stats are out on wage rates, NZ Herald "That took annual wage inflation to 1.9 per cent, lagging the 2.1 per cent forecast, and well-short of the 5.3 per cent annual pace of inflation"

"Thursday's Household Labour Force Survey, which is expected to show the unemployment rate held at 6.6 per cent in the quarter, with employment participation falling 0.3 percentage points to 68.4 per cent, according to a Reuters survey."

Wasn't John Key saying the other day that wages are moving well ahead of inflation? Dream on John.

And how about we stop paying attention to average wages and start talking median income. Average income is, increasingly, un-typical. The average and the median have been moving apart for forty years now to the point that only the top 20% are earning more than the average. Median annual income is still stuck at around $28,000. At this level there was virtually no benefit from the so called tax cuts, flat wages and inflation at 5.3%. Is it any wonder the economy is struggling - most people are just plain broke.

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10742440

Can you point me to where you got the median income as $28,000? Thanks

check this out... a bit old (June 2010) but can't imagine its changed much since.

http://www.stats.govt.nz/browse_for_stats/income-and-work/Income/NZIncomeSurvey_HOTPJun10qtr.aspx

$529 a week * 52 = $27,508

Sure Billy,

http://www.dol.govt.nz/publications/lmr/lmr-income-survey-jun-2010.pdf

This is a little dated - June 2010, it had the median income at $529 per week or $27,508 per year. Apply the 1.9% average increase and you get $28,030. The next income figures for the year to June '11 should be released in October.

Cheers,

Kiwidave.

Thanks Cam , Kiwidave.

What's the implication of the average income ($35,724) being higher than the median income ($28,000)?

Hi Billy, the average income is the total income divided by the number of earners. The median is what the middle income earner receives - 50% earn more and 50% less than the median.

Where did you get the average figure from Billy, I understood it was quite a lot higher than $35,724

Cheers.

Hi Kiwidave, Thanks. I got average from the link below. It listed average weekly income as $687.

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10742495

Graeme Hart's empire starting to feel the weight of debt?

It has been for a while - http://www.interest.co.nz/news/53948/moodys-puts-graeme-hart-firms-junk… & http://www.interest.co.nz/news/53903/graeme-hart-new-zealands-most-inde…

The exquisite timing he's renowned for in his deals may be missing this time...

Some excellent cartoons, especially air crash survivor Obama about to get guillotined by the weight of the collapsing "US economy".

You've got to love how calmly Toby recites the consequences of not raising the debt ceiling. It's a shame the real "West Wing" isn't so eloquent and effective!

FYI more on the Shadow lending in China and the authorities' (apparently failing) attempts to shut it down

http://uk.reuters.com/article/2011/08/02/uk-china-yuan-offshore-idUKTRE7710FD20110802

China's central bank has halted offshore yuan borrowing by domestic companies, official media reported, a move seen as an attempt to clamp down on hot money flows at a time when the authorities are still tightening policy.

The move is unlikely to slow the growth of the offshore yuan or "CNH" market in Hong Kong as Beijing still encourages the outward flow of yuan via trade settlements and foreign direct investment and has recently tweaked rules to encourage trade.

Citing unidentified sources, the official Shanghai Securities News reported that the People's Bank of China had told banks in mid-July that it would stop accepting applications for direct offshore yuan borrowing from mainland companies.

The step is expected to hit a growing trend among mainland companies of borrowing relatively cheap offshore yuan in Hong Kong and remitting it home for business purposes to circumvent tight domestic cash conditions in the mainland.

Just maybe, it's an indication of how dead the average Australian consumer really is. Worse; that consumer may have changed their spending habits and become accustomed to austerity; the trend having become permanently entrenched.

Last-minute US deal prevents certain death of everybody in world

(Some satire from the Daily Mash)

01-08-11THE violent death of every human being was prevented last night after some American politicians agreed to get some more money.

The eleventh hour deal means you will not now die screaming because the United States government was unable to pay the right amount of interest on some money it borrowed from some banks.

Julian Cook, chief economist at Donnelly-McPartlin, said: "The deaths would have started within seconds.

"For some it would simply have been a case of their head bursting open, perhaps on a bus or in a supermarket.

"For others it would have been a strangling sensation, much as if Darth Vader had been pointing his magic finger at them."

But some commentators have warned that even though the United States is now able to borrow non-lethal amounts of money, unless Portugal and Italy can either borrow more or less money then everybody in Europe will be dead by Thursday. And so will all trees and flowers. And the little pussycats.

Denys Finch-Hatton, chief sayer of sooths and rancid chicken gut fiddler at theDaily Telegraph, said the Great Eagle of Asgarath had been sighted on the horizon and that all must end in the fiery pit where dwelleth the five year Spanish gilt yields.

His eyes then rolled backwards in his head and he fell to the floor yelling 'buy ye gold or perish!'.

Julian Cook added: "Despite the deal, it's important to remember that we must all continue to live in constant, life-shortening fear because of this entirely abstract system we have created and could, if we had even a shred of imagination or genuine compassion for one another, dismantle right now.

"But why play jazz vibraphone and swap vegetables when you can wake up every morning with a knot in your stomach that won't go away until you finally drink yourself to sleep at 2am?"

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.