Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #1 on Apple's non-payment of taxes in Australia. #10 made me laugh a lot.

1. No wonder it has an enormous cash pile - This Australian Financial Review investigation into how much profit Apple really made in Australia over the last decade and how much tax it didn't pay in Australia is a fascinating hint into the situation in New Zealand.

The AFR got hold of some documents from Apple's Irish subsidiary and found Apple had actually made A$8.9 billion in un-taxed profit from Australia in the last decade. That's billion with a b.

It goes on to explain the surprisingly simple way Apple shifts profits around to lower its tax bill just about everywhere.

The implications for New Zealand are clear.

These Companies Office documents show Apple Sales New Zealand reported NZ$564 million in sales last year, but paid just NZ$3.9 million in tax.

This is all about Base Erosion and Profit Shifting (BEPS), which the OECD and G20 are getting very grumpy about.

One of the interesting side-effects of New Zealand's much-touted presence at the G20 leaders summit in Brisbane in November is that whoever is Prime Minister will have to think hard about BEPS and have shown the other big wigs that New Zealand is with the BEPS programme.

Here's the gory detail via the AFR:

The G20 meeting in Sydney last week gave US tech giants Google, Microsoft and Apple a deadline to reform their tax arrangements, warning that “by the Brisbane summit [in November], we will start to deliver effective, practical and sustainable measures” against international tax avoidance.

Apple Sales International has reported more than $US100 billion ($112 billion) of profits in the last five years. Its accounts show it has paid less than 50¢ in tax on every $1000 of income. The company was the focus of a scathing report last May by the US Senate’s Committee on Homeland Security and Government Affairs, Permanent Subcommittee on Investigations.

“What is truly surprising in the Apple case is its brazenness,” high-profile US tax commentator Lee Sheppard told the Financial Review from Los Angeles. “We’re not easily shocked by transfer pricing practices that the US government accepts, for better or worse,” she wrote last year in Tax Notes International.

“We’re talking gross worldwide revenues the size of the California state budget, and no tax being paid anywhere on a huge chunk of profits.”

2. All about GDP - A new book (GDP: a brief but affectionate history) about Gross Domestic Product has been written and here's the FT review. It looks fascinating. I do need to get out more.

After all qualifications, it is better to be rich than to be poor. This applies at a national as well as a personal level. There is also a qualification to be made about the less immaterial forms of growth. We cannot go on producing more and more “stuff” until there is standing room only on the planet.

But if I recite poetry to you and you play the harp to me, the performances could in principle continue to improve without any threat to the environment, the planet or any higher good. The cult of GDP has given economic growth a bad name.

3. Iron oreful - HT Macrobusiness for the cheesy headline. Theft is the law on the Internet. :) But the 10% slump in iron ore prices in the last week is big news in Australia and we should be watching it closely.

It says the investment side of the Chinese economy is really starting to slow down. New Zealand is much more reliant on the consumption side of the Chinese economy than the Australians, but it's still worthy of our attention.

Here's the Guardian with the latest and the chart below shows the connection between iron ore prices and Chinese industrial output:

Figures showing an 18% fall in Chinese exports in February amplified fears of a slowdown in the world’s No. 2 economy, sending raw material prices plunging.

Iron ore for immediate delivery to China fell 8.3% to $104.70 a tonne, its largest one-day percentage fall in four and a half years, data compiled by The Steel Index shows.

Iron ore is a key ingredient in steelmaking and is the top revenue earner for Australia’s large mining concerns, BHP Billiton and Rio Tinto.

The spot price has fallen 22% this year and the companies took a battering during Monday’s trading sessions in Sydney and London as investors weighed the impact on their profitability.

4. The Dual Dragon - Andrew Sheng and Xioa Geng write here at Project Syndicate about the risk of a hard landing in China. They're quite positive and their reasons are good news for New Zealand. It's a nice and balanced overview.

Any strategy for mitigating the threat of a sharp slowdown must account for the dual nature of China’s economy. On the one hand, Chinese cities are becoming increasingly modern and globally engaged. Indeed, China’s 17 most dynamic cities – which together account for 11% of the population and about 30% of GDP – have already reached high-income status, as defined by the World Bank, and the country is set to overtake the United States as the world’s top e-commerce market.

On the other hand, half of China’s population remains rural, deriving a large share of income from agricultural activities. According to MasterCard, 25% of consumer payments are still made in cash, implying that China’s informal economy remains much more robust than believed.

This duality has positive implications for China’s economic prospects. While its coastal manufacturing activities have fueled much of the economy’s growth over the last few decades, the country’s rural, inland economies will remain strong drivers of growth as domestic consumption rises. In other words, China has an even larger and more diversified economic base than many realize – implying a degree of growth momentum that would be difficult to lose.

5. A money making machine - Charles Hugh Smith is much less balanced at OfTwoMinds, but is just as interesting. He argues the US Federal Reserve's money printing has simply enriched the bankers and the 0.1% of the population who benefited most from a surge in asset prices and the stock market in particular. His charts are well worth a look, including the one below.

How about financial sector profits? Hey, now we're finally getting somewhere-- these are through the roof. We finally found something with a positive correlation to Fed policies--financial profits are hitting all-time highs.

The most charitable assessment we can make of Fed policy is that the "prosperity" it created is at best, ahem, grossly concentrated in the most parasitic and politically powerful sector: finance. Why should we be surprised that the Fed, itself a servant of the banking sector, should devise policies that enrich the bankers and financiers?

Let's be clear about one thing (to quote the president): the Fed's policies have been an unqualified success for financiers and an abject failure for everyone who has to work for a living. The Fed has not just failed to rectify the nation's obscene inequality in wealth and income; it has actively widened it by handing guaranteed returns to the banks and financiers while stripmining what's left of the middle and working classes' non-labor income, i.e. interest on savings.

6. QE = share market boom - This blog post from Andrew Smithers at the FT has basically the same message. The stock market boom of the last couple of years is not real. It's all about money printing. Smithers explains well how the Fed's QE programmes help share prices.

QE consists of the US Federal Reserve buying assets, which expands the monetary base. The chart shows that the expansion of the Fed’s balance sheet has moved with the US stock market. This is not just an accident. When the Fed buys assets the sellers have money and, unless they wish to increase their cash holdings, they will attempt to spend the money on other assets. Unless there is a rise in liquidity preference, which is when investors want to hold more cash, this will push up asset prices.

I pointed out in blog two that households have been persistent sellers of shares, but their selling pressure has probably been eased in recent years by the Fed buying assets. Equally, companies have been major buyers and have issued a lot of debt to help finance these purchases and, as the Fed have been buying other forms of debt, the sellers have been eager buyers of company debt.

This provides a good explanation of how QE has pushed up the stock market. Now QE is being reduce it is likely that the push will become less strong, but I think it will continue to be a help for some months. QE is not ending, it is just slowing.

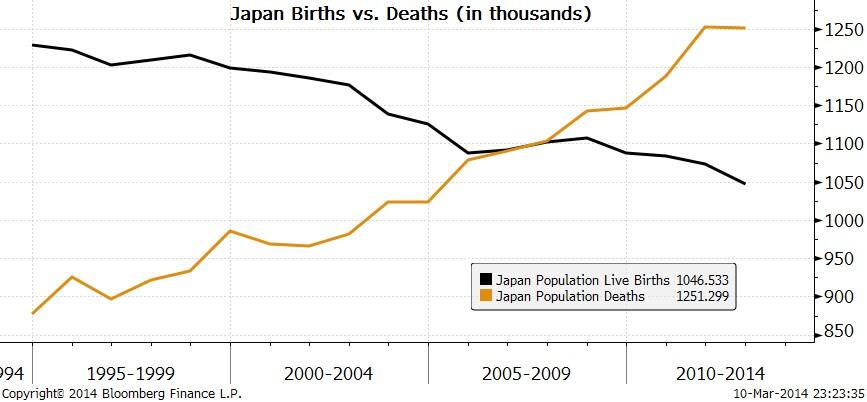

7. China's shadow banks grind to a halt - Ambrose Evans Pritchard over at The Telegraph is an excitable fellow and his latest from the China shadow banking situation is a cracking read. The chart below from Japan is eye-opening as well. No wonder Abenomics is struggling. And that has a spillover effect in China too, given the interconnectedness of the world's second and third largest economies.

Fresh loans in China’s shadow banking system evaporated to almost nothing from $160bn in January, suggesting the clampdown on the $8 trillion sector is biting hard.

“It seems that rising default risk has started to erode Chinese investors’ confidence,” said Wei Yao, from Societe Generale. “Together with continued regulatory tightening on banks’ off-balance-sheet activity, we are certain this slowing credit trend has further to go and will inflict real pain on the economy.”

The renewed jitters in China come after the authorities allowed solar company Chaori to default last week, the first ever failure in the country’s domestic bond market. The episode is a litmus test of President Xi Jinping’s new regime of market discipline, though the central bank has been careful to cushion the blow by engineering a fall in interbank interest rates. “Such adjustments are necessary for China in the long run, but are nothing if not risky in the short term,” said Ms Wei.

It is extremely hard to calibrate a soft landing of this kind, and the sheer scale of China’s credit boom now makes it a global headache. China accounts for half of all the $30 trillion increase in world debt over the past five years.

8. China default watch - Bloomberg has a useful roundup here of the latest from inside China's default-pocalypse as coal miners, solar power companies and others go bust as the shadow bank's trust products mature this year. We should all be watching this space.

The number of trust products tied to miners maturing this year will almost quadruple, according to Cnbenefit, a consulting firm based in the southwest city of Chengdu. Products linked to property face a 50 percent jump in repayments this year, according to estimates from Haitong.

“You’re going to see trust products default, you’ll see wealth management product defaults, you’ll see bond defaults like we just did, you might even see local government financing vehicles teeter on the brink,” Leland Miller, the New York-based president of China Beige Book International, said in a Bloomberg Television interview today. “It’s injecting risk into the Chinese system. It’s very positive but it might make investors a little bit nervous in the meantime.”

9. And don't forget copper - The WSJ has a good look here at the copper prices and how the Chinese industrial slowdown and the connection between metal warehousing and credit growth is affecting demand for copper.

Much of the copper stored in China, the world's biggest consumer of the metal, is used by companies and investors as collateral for loans from banks and other lenders. They then invest the money in higher-yielding assets. Some investors are concerned that the recent sharp drop in copper prices could lead to a downward spiral in the market. As prices fall, borrowers could come under pressure to post more collateral, forcing them to sell copper to raise money. Banks could also become less willing to accept copper as collateral.

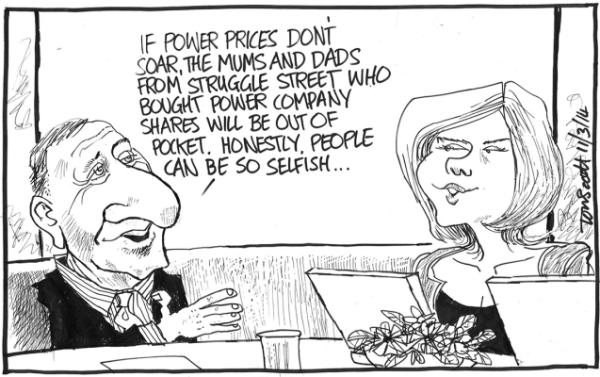

10. Totally Clarke and Dawe - Tony Abbott is a feminist, it seems. I haven't laughed so much for a while.

)

12 Comments

Apple avoids paying tax to us.

Well. We could simply levy all payments out of New Zealand. All payments for everything. Not so difficult as it all comes down foreign currency bank transactions. They do it, for example with withholding tax on your bank deposit interest.

Would have effect on Apple. To get the cash out they have to transfer it. It would also work on most companies that do the transder pricing dodge. Possibly the big four banks.

It would catch the payments that we each make when buying online from overseas. It won't be the level of GST (15%), but it would help a bit.

It would cut down the huge and dangersous speculative trading in NZ currency.

It would make imports more expensive but not harm exports.

It would of course make my holidays more expensive. But, well, you gotta be patriotic.

Would percentage should be charge on those payments though? 1%? 5%? Suggestions please.

You are getting perilously close to a Tobin Tax with that, which the government has absolutely vetoed as being horrible for the country as we would be deserted by the international financial sectors of the economy that shuffle money around without it being tied to production.

And we could never become the financial hub of the Pacific if we started instituting Finacial Transaction Taxes like Singapore, Switzerland, or the United States. Why do you hate our country so?

But seriously, from memory proponents of a Tobin Tax recon a level between 0.1% and 1% for replacing all other taxation. Let's call them optimists and say 1.2%

Yes. It is a Tobin tax, And quite a bit more.

And tragic indeed for the money shufflers. The percentage is hard to calculate as the shuuflers will depart. But if the likes of Apple want to do business here, and they do, they will have to get their money out, and the levy will catch that nicely.

Yes Yes Yes

This Apple situation has all gone a bit pear shaped , hasn't it .... we've finally sorted out the cheating jolly old Australians , refusing access of our Apples to their market ...

... and now the Yanks are not paying their Apple taxes to us ... It's all a bit thick isn't it ...

Think I'll have a banana instead ..... wot's that you say ? .... we got no bananas !!! ..... oh shag !!!!!!!

Another dry well for Anadarko and another $300m of oil industry CAPEX vanishes into thin air:

http://www.stuff.co.nz/business/industries/9818674/Anadarko-still-has-o…

Jeez this oil and gas stuff is getting hard to find, must be why the oil industry is slashing its forward investment:

http://www.arabianoilandgas.com/article-11941-exploration-budgets-slash…

And I guess if you dont keep spending to try and find the new stuff maybe the supply of the old stuff runs low?

I have lost count of the number of dry holes drilled off shore around NZ in the last 24 months. It surely is a lot, and it is putting JonKeys wet dream of NZ becoming a sizeable hydrocarbon player straight to bed.

It seems to me that Steve Jobs was far more billiant than anyone ever imagined, or even begin to imagine today.

Microsoft dominated the PC market. Now that market is shrinking while Apple are booming. What happened?

Each year Apple upgrades all its iphone and ipad software. It then installs this upgraded software onto its existing ipad and iphone (maybe with a few minor modifications). They are then sold as "The new ipad2 and iphone 2. Then ipad 3 and so on.

Each year people are throwing away their ipad's and iphone's and buying another, exactly the same ipad and iphone, but with upgraded software.

Apple make a fortune selling the same hardware over and over again each year. Because selling harware is more profitable than selling the sofware upgrades.

All the new features you get each year are sofware upgrades but they get you to throw away your perfectly good hardware and buy the same hardware back but with the upgraded software.

Microsof have now realised that they have to get out of selling software and start selling hardware with their sofware installed or loose out completely to Apple.

My iPhone 5s goes much better than my 5, 4s and 4 which I simply handed onto my wife and daughter. My phone is my office in semi retirement and I want it to perform consistantly as iPhones do.

"‘Hope to be bankrupt for Christmas’: Irish mortgage debtors see insolvency as way out"

Indeed.....coming to NZ....

All your wanton building boom would do is make the collapse even worse.

regards

Steven you really need to understand the concept of elasticity of supply.

Hugh doesn't want to blindly build like the speculators did in Ireland with their ghost estates miles away from where people want to live and work.

The idea is to have a system whereby genuine housing demand is met by the market with elastic supply. So prices don't bubble.

You don't get the delayed price influenced speculative boom in inappropriate places like Ireland and then of course the later crash.

Yes indeed, worse of course he gave a tax cut to ppl that didnt really need it and they sunk it into housing...

Of course in terms of sorting HC's brigade should take the blame for not fixing it, though if we'd had a National Govn it would have been no better.

Irelend popped due to its financial mis-management, there were hosues being built that were never finished, the Q is where did the ppl go that needed those houses ie it was a mad speculative bubble that should have been fixed with no real demand.

regards

So they only have one weapon to deflate a housing bubble, as they will not increase supply by intensifying housing in Aucland, and that is to increase interest rates. This will result in overseas money flooding in increasing the value of the NZ$ and ensuring our export sector loses out. Bring on the financial transaction tax. International money will just have to invest in Greece, or maybe Ukraine. I think that New Zealands' value to investors as a safe, uncorrupt, stable democracy is worth something.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.