Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must-read today is #6 on political polarisation and inequality. Chickens and eggs abound.

1. Power corrupts - Jess Hill has written a useful piece at TheMonthly about power prices in Australia.

While voters and politicians were obsessing about the carbon tax, lines companies quietly ramped up infrastructure spending and lines charges.

Electricity costs went through the roof and the voters blamed the carbon tax.

This is a danger here too.

Our electricity costs have risen much faster than inflation. The blame bounces back and forth between the lines companies, Transpower and the 'Gentailers'.

We can only hope the Electricity Authority gets a wriggle on with untangling the morass of pricing and bills so we can all work out who is doing what to whom and when (and why).

Otherwise we risk something similar happening here.

Here's Hill on the Australian situation:

Thanks to the networks’ infrastructure binge, we now pay some of the highest prices in the developed world. The impact has been felt most keenly in New South Wales and Queensland, where the networks are government owned and network charges have accounted for two thirds of the price increases.

For a Coalition intent on destroying the carbon tax, the price hikes have been a gift – “proof” that the carbon tax is as ruinous as they predicted. Chris Dunstan, from the Institute for Sustainable Futures, thinks that what the networks have done over the past five years may actually be the secret to Tony Abbott’s success. “If electricity prices hadn’t doubled,” he says, “the carbon tax would not have been anything like the issue it was.”

2. What a tangled web was woven - Bloomberg reports on how China's chief auditor found US$15 billion worth of loans backed by fake gold trades.

Something tells me the China shadow financing morass is not going to untangle well.

“This is the first official confirmation of what many people have suspected for a long time -- that gold is widely used in Chinese commodity financing deals,” said Liu Xu, a senior analyst at Capital Futures Co. in Beijing. “Any scaling back by banks of gold-backed financing deals might lead to a short-term reduction in Chinese imports and also spur some sales by companies looking to repay lenders.”

As much as 1,000 metric tons of gold may have been used in lending and leasing deals in China, where commodities including metals and agricultural products are used to get credit amid lending restrictions, according to World Gold Council estimates.

3. The problem of low wage jobs - America's economy is continuing to fail to fire. Interest rates there remain low and every prediction of a rebound in recent years has been flat out wrong.

The middle class just doesn't have the income to fire up America's consumer economy. All that is keeping America's interest rates low, and makes our rates relatively more attractive -- hence the insanely-high New Zealand dollar.

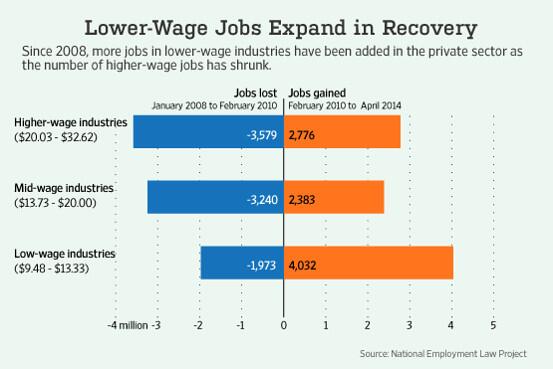

This chart tells the story about how many of the new jobs created in America in recent years are low wage jobs.

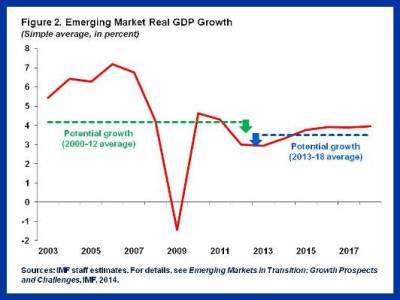

4. Not just a hiccup - The IMF writes in this piece about a surprising slowdown in emerging market growth in recent years. The IMF has lowered its longer term forecasts.

Our results suggest that emerging markets will have more difficulty sustaining the high growth rates of the 2000s in the next 3-4 years, as some of the slowdown reflects lower potential growth and is thus more permanent in nature. Estimates of potential growth rates in emerging markets for the next 3-4 years, at 3½ percent, suggest that growth would be on average 1¼ percentage points lower than so far in the 2000s, though the magnitude of the impact varies by country

5. Stick a fork in that chart - Remember the chart that used to do the rounds a few years ago that showed a very close connection between US stocks before and after 2008 with the leadup to 1929?

It's well and truly broken now thanks to endless stimulus. If only Hoover and Roosevelt had kept rates at 0% and printed money for six years their chart might have looked the same.

6. Polarised and unequal - It turns out there's some sort of correlation between polarised politics in America and income inequality.

It may be the chicken.

Or the egg.

Something's going on.

Here's Liberty Street Economics with the research:

One possible mechanism by which polarization could affect inequality involves the notion of “policy drift.” That occurs when policies remain in effect despite being outdated or ill-suited to changing circumstances because of political stalemate. For example, many policies are indexed to inflation, but others are not.

The ones that are tend to be those that benefit high earners (such as income tax structure) and those that aren’t tend to benefit individuals at the lower tail of the income distribution (such as the federal minimum wage). In a policy-drift story, polarization affects inequality because it contributes to legislative gridlock, which in turn prevents safety nets or tax policy from evolving to handle new challenges.

7. Stagnant wage growth - And we wonder why America just can't get its economic party started.

Wage growth has not kept up with productivity growth. That's a problem and is just another way of saying more of the income share is going to the owners of capital and the top 1%.

Here's Reuters with the story:

8. Facebook is a special place - Michael West writes an interesting yarn here at SMH about how Facebook decided it was not a large company under Australian tax law...

I wonder why...

Facebook meanwhile is doing a rollicking ad trade in this country even though every entity connected to it is somehow unaccountable in our tax jurisdiction. Contracts are being signed in Australia but somehow the business isn't actually happening here, says Knapp.

As Facebook founder Mark Zuckerberg once said: ''The biggest risk is not taking any risk … In a world that is changing really quickly, the only strategy that is guaranteed to fail is not taking risks.''

Clearly, ASIC and the Tax Office, along with Parliament House and Treasury, need to embark on the risk of doing something. Get connected. Awaken the giant within.

Or if all else fails, perhaps just do your job. Taxpayers are paying for it.

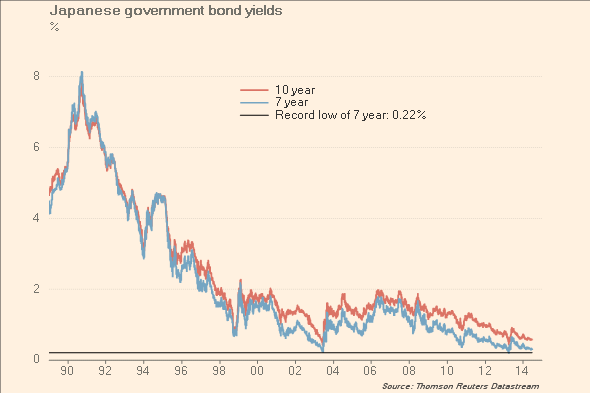

9. The widowmaker trade - Japanese inflation is rising. Arrows have been unleashed. So why are Japanese bond yields still falling? It's important from our point of view because our very wide interest rate differentials are still driving our currency higher.

James Mackintosh at FTAlphaville is vainly wondering when Japanese interest rates will rise.

Negative real yields send a signal to companies and households to consume, rather than save, which is exactly what the government wants them to do. Figures on Friday show the message has not yet got through: household spending unexpectedly plunged 8 per cent in May compared to the previous year.

At some point either inflation – anyway temporarily boosted by the tax rise – will soon drop back sharply, or bond yields must rise. Will that happen before the last of the bond bears finally capitulates?

8 Comments

#6, the "must-read" - Bernard, why would you draw our especial attention to an article which very specifically assigns US causes to a US problem without the slightest attempt at discussion, or any information, as to how far the same factors apply in New Zealand?

How exactly do you reconcile highlighting this item with interest.co.nz's avowed mission of helping us (mostly, I imagine, living, working and managing our money in New Zealand) to make financial decisions?

Good point MdM and total agreement

For 5 years that I can recall, 50%+ of the content of Bernard Hickey's Top-10-at-10's breathlessly reported the goings on in China, day after day, week after week, ad-infinitum, on the basis that what was happening there would visit itself on New Zealand

If Bernard was capable of self-reflection he could and would analise every one of those articles and check to see which ones actually (or eventually) transpired ... not very many I'm afraid .... so any decisions you may or may not have made would have been sadly astray .. you would have been misled

My limited knowledge of Aussie power regulations suggest government allowed power companies to get a 'fair' return on real investments made (as policy to try and stop price increases and rip offs). Investment meaning upgrades to infrastructure. So in the end to get higher returns power conpanies did infrastruture upgrades.

I wonder if they were needed upgrades?

Possibly another unintended consequence comes home to roost.

The Energy Regulator was required to assess and approve an ROI based on a return on capital. It didnt take the network operators very long to work out that it was in their interests to invest heavily and continuously in their networks

They ended up re-creating America's "bridges to nowhere"

In Australia they were "gold-plating" their networks, un-necessary investment, and "networks to nowhere"

The return on capital calculation allowed them to implement never-ending price increases

#3 Bernard you must not be reading the 90 at 9. It's nothing but positive news from the US for the last couple of years

Bernard - intrepid reporter

More relevant to NZ - compare to what NZ isn't doing - and how it's done

The power of a fearless investigative reporter

#1 Michael West and Bruce Robertson were the whistleblowers on goldplating of electricity networks poles and wires in back in 2012 and 2013

#8 Facebook today - Google last month

http://www.smh.com.au/business/entitlement-is-in-the-eye-of-the-beholde…

What has gone un-noticed is this

On 27th June 2014 Michael West got his teeth into Glencore-Xstrata Mining Group

$15 Billion and no tax paid

http://www.smh.com.au/business/glencore-tax-bill-on-15b-income-zip-zilc…

Resulting in this

On 3 July 2014 Federal Treasurer announces Australia to go it alone on multi-nationals tax-avoidance and not wait for OECD

http://www.smh.com.au/federal-politics/political-news/joe-hockey-moves-…

Howzat for action - West has got clout

Bernard, look at the chart in #3

Is this Lies and dam stats?

Are we comparing apples with pears?

It only gives jobs lost from 2008-2010

Then only jobs gaines 2010-2014

Should it not be net gain and net loss?

#7 "Wage growth has not kept up with productivity growth"

The aim of productivity is to reduce the input cost of production.

The easiest way of reducing input costs is to either use lower wages or eliminate wages with automation.

When we all sing for greater productivity we are all singing for lower wages or loss of our jobs.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.