Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #2 on how the next wave of technological innovation may not be great for everyone.

1. Water 4.0 - Vox reports David Sedlak has written a book on the past, present and future of water.

He reckons much of the developed world faces a water crisis as ageing infrastructure needs replacing and the stresses of climate change will compound the issue.

This issue of replacing pipes, sewerage plants and water treatment plants is real in New Zealand, particularly in those areas where populations are flat to falling and Councils are under enormous pressure not to increase rates.

Much of this infrastructure was bought and paid for by generations who welcomed forgone consumption for the sake of future generations.

Over the last thirty or forty years though, many ratepayers hated having to pay extra to invest for future generations and are now pushing back at big ticket infrastructure items, or forcing them to be paid for by those arriving at the margins -- hence the obscene development contributions being charged these days.

Local Government New Zealand is running a review of water infrastructure called '3 Waters'.

Sedlak makes the good point that often the big investments happen after crises.

That's a pity, but probably true.

Some cities will simply have to plunk down billions to update their aging pipes and plants — although many will try to postpone fixes for as long as possible. "Historically, we've always been reluctant to spend money on water systems until a real crisis comes along," Sedlak says. "And we're starting to enter one of those periods."

Meanwhile, better conservation can help water-stressed cities — but only up to a point. Many cities in the Southwest may have to look to new technologies, such as water recycling, desalination, or even radically decentralized water systems. Some of these technologies have drawbacks (desalination uses an enormous amount of energy, for one), but they could become more common in the years ahead.

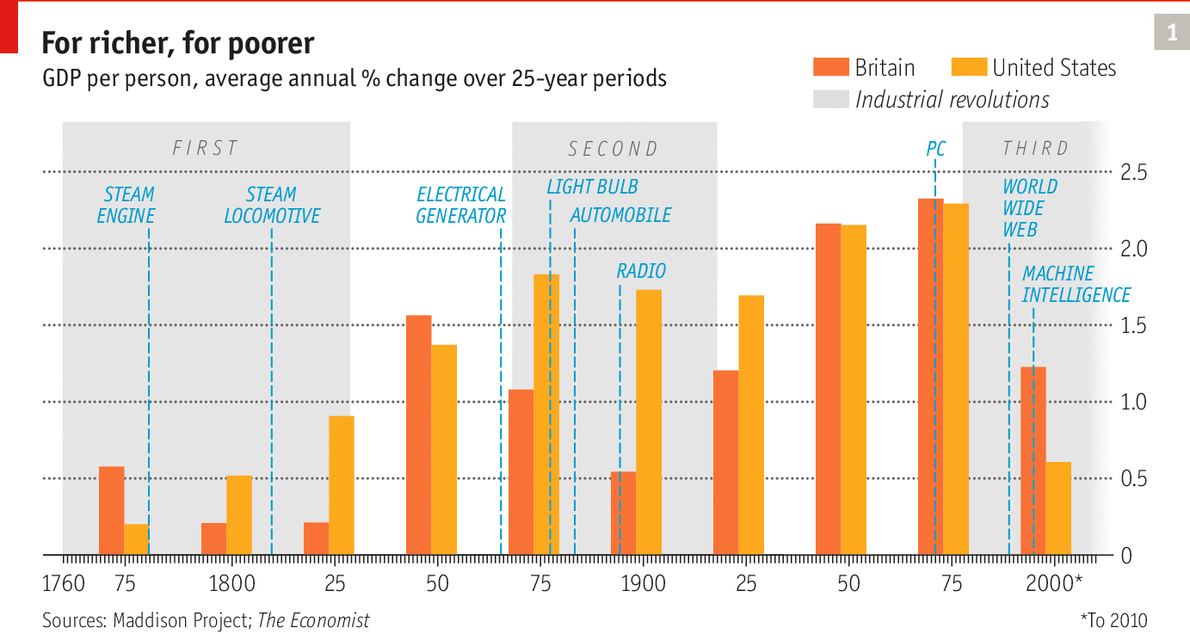

2. The third great wave - This piece in the Economist from Ryan Avent about how the third great revolution of technology may just create lots of wealth for a few is a cracking and disturbing read.

A third great wave of invention and economic disruption, set off by advances in computing and information and communication technology (ICT) in the late 20th century, promises to deliver a similar mixture of social stress and economic transformation. It is driven by a handful of technologies—including machine intelligence, the ubiquitous web and advanced robotics—capable of delivering many remarkable innovations: unmanned vehicles; pilotless drones; machines that can instantly translate hundreds of languages; mobile technology that eliminates the distance between doctor and patient, teacher and student. Whether the digital revolution will bring mass job creation to make up for its mass job destruction remains to be seen.

This special report will argue that the digital revolution is opening up a great divide between a skilled and wealthy few and the rest of society. In the past new technologies have usually raised wages by boosting productivity, with the gains being split between skilled and less-skilled workers, and between owners of capital, workers and consumers. Now technology is empowering talented individuals as never before and opening up yawning gaps between the earnings of the skilled and the unskilled, capital-owners and labour. At the same time it is creating a large pool of underemployed labour that is depressing investment.

3. Trapped in a cycle of credit booms - Martin Wolf writes at the FT about the malaise in the Eurozone in particular. He has picked up on the "Deleveraging? What Deleveraging?" report.

Without an unsustainable credit boom somewhere, the world economy seems incapable of generating growth in demand sufficient to absorb potential supply. It looks like a law of the conservation of credit booms. Consider the past quarter century: a credit boom in Japan that collapsed after 1990; a credit boom in Asian emerging economies that collapsed in 1997; a credit boom in the north Atlantic economies that collapsed after 2007; and finally in China. Each is greeted as a new era of prosperity, to collapse into crisis and post-crisis malaise.

Incredibly, the eurozone seems to be waiting for the Godot of global demand to float it off into growth and so debt sustainability. That might work for the small countries. It is not going to work for all of them. The report talks of a “poisonous combination . . . between high and higher debt and slow and slowing (both nominal and real) GDP growth”. The euro periphery, it adds, is where this perverse loop of debt and growth is severe. That is no surprise. Crisis-hit eurozone countries have been running to go backwards. The policies of the eurozone rule out needed growth.

4. Macro-prudential the cure - Wolf reckons macro-prudential policies such as the RBNZ's High LVR speed limit may have to be the cure. He's right on that.

The only way out is to regulate the banks back into the lowly-leveraged boxes where they should be, given the implicit guarantees taxpayers have effectively given them in the wake of the financial crisis.

Yet the biggest lesson of these crises is not to let debt run ahead of the long-term capacity of an economy to support it in the first place. The hope is that macroprudential policy will achieve this outcome. Well, one can always hope.

These credit booms did not come out of nowhere. They are the outcome of the policies adopted to sustain demand as previous bubbles collapsed, usually elsewhere in the world economy. That is what has happened to China. We need to escape from this grim and apparently relentless cycle. But for now, we have made a Faustian bargain with private sector-driven credit booms. A great deal more trouble surely lies ahead.

5. The Living Wage works - This paper for the Population Health Congress on the early success of the Living Wage Campaign in New Zealand is heartening.

This is one pragmatic comment cited from one employer who moved to a Living Wage:

"I think if you're taking them from a minimum wage to a living wage you'd only need them to be another 30% more productive to be cost neutral, and 30% is not a big jump in terms of most people wasting 30% of their time on facebook and texting."

6. Auckland can't afford these 'view shafts' - HT Eric Crampton for alerting me to this (not so) little issue preventing the intensification of housing in Auckland.

The Council proposed and finalised these 'view shafts' around Auckland this year that stop building of high rises that would spoil the views to various volcanic cones around Auckland.

This little graphic courtesy of the Auckland Council explains how high rises are now allowed. The Epsom electorate is heavily represented.

And here's the map showing where you now can't build up. This sort of thing is why house prices in Auckland are nuts and the rest of New Zealand is forced to live with higher interest rates and a higher currency than is necessary.

7. Breaking the euro - We all learnt about the dangers of 'breaking the buck' during the Global Financial Crisis when money market funds faced credit rating downgrades if they fell below 100c in the dollar.

Now there's a risk of something similar happening in Europe because the European Central Bank is charging interest on deposits.

Standard & Poor’s said the €500bn nexus of funds in the eurozone is facing serious stress, increasingly unable to generate profits since the European Central Bank cut its deposit rate to -0.2pc and pulled down short-term rates across the spectrum of maturities.

“Pressure is building for these funds,” said Andrew Paranthoiene, the agency’s credit director. “We’re observing portfolios on a weekly basis. If there is any deviation from our credit metrics, a rating committee would determine if rating action was appropriate. In our view, any loss of capital means that the 'safety of principal’ has been breached,” he said.

Standard & Poor’s rates all its European money market funds at AAA(m). Industry experts say it is unclear whether the funds could function for long at a lower rating, given the nature of their business as ultra-safe depositories of corporate cash.

8. The rising tide only lifts luxury yachts - This Salon piece looks at fresh research showing income inequality actually slows economic growth.

Economists believed that redistribution slowed down economic growth, and that attempts to reduce inequality would, as a result, only worsen poverty. The reasoning had at least two strands of thought: First, since the poor tend to consume most of their income, it was good for the rich to have more wealth to invest in the future — inequality would increase savings. Second, inequality provided incentives for individuals to work harder to take home more of the pie.

There is now a burgeoning literature showing that these assumptions aren’t true, and that inequality actually reduces growth. That’s because the reasons for accepting inequality were actually backward. Instead of motivating the rich to invest, higher inequality meant that the poor took on more and more debt, destabilizing the economy. Without enough poor and middle-class families consuming their products, businesses had fewer customers, and less revenue. Further, instead of providing the poor and middle class an incentive to better their lives, higher inequality gave the rich a reason to pull up the ladder, leaving the poor behind. Instead of working harder, the rich sit back on their wealth. The poor and middle class, disenchanted by lack of opportunity, have less money to invest in their own education (and are therefore are increasingly burdened by debt). Inequality thereby reduces growth by reducing both demand and upward mobility.

9. Totally Jerry Kleinfeld's speech on advertising to an audience of advertising executives last week. Some slightly nervous laughter ensued.

10. Totally John Oliver on the business of civil forfeiture in America, where the Police can take assets off people who haven't been convicted of anything. Oliver is doing a great job of publicising some great journalism.

17 Comments

For your #2 - interesting reading. Maybe we should be reconsidering the Holy Grail of paid work as a means of making a living.

New technological invntions are supposed to make our lives better and easier. Surely they are not invented in order to spawn more work?

I am not a religious person in fact I couldn't be less religious. However one line from the bible which I used to hear as a child was "the devil makes work for idle hands". Which in my mind raises many other issues in society if we are looking at moving away from work for the masses.

Who say that being not in paid employment automatically means being idle?

Where does this notion come from that people need to be kept busy with tasks they don't enjoy doing, or they'd get up to mischief or do nothing all day?

This from the link above:

"

The excessive working hours endured by most people are justified by the work ethic, as exemplified in the Conservative Party’s condescending slogan lauding “hard-working” people (the inference being that those deemed not to be “hard-working” are less deserving and less eligible for political representation).

The worship of work is as old as capitalism itself, and it is under the unique characteristics of capitalism as a mode of production that the work ethic takes hold.

Under slavery and feudalism, work was seen as a negative thing, something that was bestowed upon humans from God as punishment for original sin.

Ancient societies in Greece and Rome saw human labour as something to be avoided at any cost. Work was for the slaves — the lowest rungs of society. Before capitalism, most labour was done out of necessity.

In feudal Europe, for example, peasants produced their own food and the surplus was passed onto the lord who owned the land. Since the production of huge surpluses was not necessary, people enjoyed extended periods of leisure once they produced what was needed. Work did not define individuals, as is the case today — work was merely a means to an end.

The Protestant Reformation challenged the traditional idea of work, with Martin Luther arguing that God’s will could be fulfilled by individuals working hard.

Labour was seen as a service to God, an outlook which helped to normalise the long, gruelling working hours which defined the Industrial Revolution. "

Well - I'm not religious, I don't believe in God, and I have enough to do already without having to spend 11 hours a day labouring. I'm with the ancient Greeks and Romans in this: something to be avoided at all cost. Who has time to think, these days, what with all this working we have to do?

#4. Astounding news. Spending more than you earn leads to problems ?? ! And borrowing more to get out of that pooh, does not really work. Who wudda thunk it.

#3 Credit Booms

Debt will become sustainable. We are at the edge of a whole new world of debt.

Government debt is in the form of Bonds. Governments use these Bonds so we can pass our debt onto our children. That is the purpose of Bonds, it serves no other purpose.

In the future we will all be treated like governments.

Floating mortgages will become a thing of the past. Fixed mortgages will be converted into Bonds.

Just as our assets are divided up amongst our childred when we die so will our debts in the form of bonds.

Just as our children do not complain about accepting our debt, held by our government, they will not complain about accepting our individual personal debt.

Some people use one credit card to pay the debt on another card. Governments also take out new bonds to pay bonds falling due that they cannot pay.

We will all join this merry go round. If you cannot pay your bond just take out another. Pass this bond onto your kids and their kids and their kids. One day one of them may become wealthy enough to pay it back.

After all its only money, and lets not forget it was created from nothing in the first place.

#6

Someone should teel the Auckland Council that you do not choose to live in a city "For the view"

#2 - the issue is very very real.

There are three streams coalescing, here.

1 - the extension of IT into such jobs as Fitter/turner (now CNC lathes and drill-mills), motor mechanic (looked under your car's bonnet recently?) and farming (automated seed sowing and milking robots).

2 - the return to what Toffler termed 'prosumption' - the undertaking of production as a consumer. Pouring your own petrol is a trivial example, running your own 3D printer to make quadricopter parts is something more contemporary.

3 - electronic plumbing: the rise of solutions which link businesses, governments and value chains. One business generates an AR invoice, the plumbing sends it to the recipient business, and it turns up there as an AP invoice, already coded. If the orginating transaction was itself automated (e.g. a Web order for the goods, robotised pick/pack/dispatch in the warehouse) then the only humans involved in this transaction might well be the order person, the cartage logistics chain and the postie.

Just to get off square one in these jobs, demands abstract thinking, the ability to imagine what processes are occurring, and how one fits into them. This is not a widely distributed skill set: most people think largely in concrete, non-abstract, lizard-brain terms.

What it all boils down to is that the range of skills needed has moved to the right of the Ability bell curve. Which abilities are, by definition, sparser.

As usual, the artists spotted this decades back: Douglas Adams' Hitch-hiker noticed that, aboard the Golgafrinchan ship (Ark B) sent out from their planet, there seemed to be a lot of hairdressers and telephone handset sanitisers. Deemed useless by their parent civilisation and turfed out into space, they turned out, in one of the nicer fictional ironies, to be the sole survivors after the rest of the home planet succumbed to diseases contracted from - whodathunk - dirty telephone handsets.

In Golgafrinchan terms, we have evolved a preponderance of jobs which need Ark A skills, but we have not yet spat Ark B off into space.....

Have you tried printing your own quadracopter parts on a 3D printer (or anythign else on your 3d printer)?

I got one and tested it.

80% gimmick.

_Don't_ get a Mendel Tri-colour unless you seriously love setting things up and calbirating more than anythign else.

The mono colour is cool, and hteir Ormond-thing sounds better (bed levelling compensation).

In theory these are great for fast prototyping, and printing your own wee plastic stuff.

They're fiddly to level the Tricolour needs to be level and heads equal and level to within 0.1mm maximum, and any kind of probelm results in stripping the head off and removing the plastic build-up that with catch the job.

But the time you save is likely to be spent in cleaning/leveling, and using 3D software to produce a workable model - you did say you were a gun at 3d CAD software right? Good enough to design your own quadracopter parts.

So why so popular? The tech geeks are the ones who love and have the time to fiddle with meaningless electronics and software, and who love to put it in electronic media....

Waymad

Always a pleasure to read your comments. Made me think and then smile.

cheers

Bernard

PS Here's Carlos Slim's idea for a 20 hour work week.

http://www.washingtonpost.com/blogs/innovations/wp/2014/07/30/why-a-glo…

Bernard's been on the negs today

... Bernard is an important barometer for our investment decisions ... so long as he is gloomsterising , you know that all is well in the world , we're puddling along quite nicely , stay the course , keep your money where it is ...

The day he stops being hickeysterical , throws in the towel , and admits that he now thinks all is well in the financial world , fleeeeeeeee !!!!! ..... go to cash ASAP .... buy a bunker , rifle , ammo , candles and stock up the tins of beans ...

Gummy

I've already done my stockpiling. And I'll be selling all those things to you at a high price when you come running... ;)

cheers

Bernard

#2 "Humans need not apply" good short doco summary on this:

http://www.youtube.com/watch?v=7Pq-S557XQU

#6 Astounding.

Where do we get these idiots from? It's like something from a comedy show.

#8 sounds familiar to me for some reason.... anyone remember why?

#7 So large corporations who in effect have pillaged the planet, paid little tax and raised huge cash piles from their ill-gotten gains, in effect they are parastic. Are now threatened with some losses from the situation substantially brought about by them.

On a superficial level, we are meant to feel sorry for them?

Why should anyone especially large parasites enjoy a risk free rate of return? I mean OAPs need thier income and have no alternatives, and pay tax on it but major corporations? So called investors? really, so busy buying and selling shares forcing unrealistic P/Es to make capital gains but not making an actual good?

So beyond this, sure we see they may have losses, but what is the actual effect of this loss?

I mean this strikes me as pure bollocks,

"“Corporate treasuries are sitting on a huge amount of cash. The real worry is that they decide to lock up the money for six months or more in longer-term debt to get a positive yield. It could end up discouraging investment,” he said."

What investment? if an opportuntiy "suddenly" presents itself the CFO has an asset he can use to borrow short term against until that asset matures. But look at that cash pile, for 6 years now corporations have sat on huge cash piles not investing.....and there is nothing out there to make them. The global economy is stagnant, consumerism makes up much of it and they are crippled by high energy costs and huge debt.

So for a long term view.

Then we move on to other pieces,

"Britain’s consumer credit market is a giant ticking time bomb When interest rates rise, the shock to borrowers, practical as well as psychological, will be immense"

http://www.telegraph.co.uk/finance/economics/11026952/Britains-consumer…

So when consumers start to spend again, they will be knee capped by rising interest rates which in conjunction with rising petrol/energy prices will cripple the recovery (if one even starts) as they will stop spending.

All this suggests to me that a central bank raising Interest rates at all if there is a recovery is in for hell on earth.

So when our banks say retail / residential interest rates are going up, frankly that makes no sense at all to me.

Mind you I dont think this financial sector makes any sense at all.

regards

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.