By Bernard Hickey

On Thursday morning we awoke to news that the IRD has struggled to find the bank accounts of all the 2.1 million people eligible for the $350 ‘cost of living’ payments for non-beneficiaries earning less than $70,000 per year that was announced in the Budget in May.

Also, we’ve discovered IRD argued it would not be able to easily make a ‘helicopter money’ payment of $100 per person to Aucklanders, as was suggested (and then rejected) internally by the Government late last year during extended Covid lockdowns in Auckland and the Waikato.

Interest.co.nz alumni Jenee Tibshraeny reported for the NZ Herald-$$$’s that IRD initially didn’t have bank account numbers for 170,000 of the 2.1m when the $350 payment was announced in May, and has now found 130,000 of them. It thinks it will be able to get all but 11,000 of them. Jenee reported the IRD’s acting commissioner and CEO Cath Atkins told a select committee IRD had taken on 300 contractors to administer the payments over five months and expected to need as many as 750 IRD staff to handle inquiries at peak payment times.

Meanwhile, Marc Daalder reports for Newsroom that the Government considered making ‘helicopter cash’ payments of $100 per Aucklander during the extended Covid lockdown late last year, but that they decided against it after IRD warned it would struggle to roll out such a payment to all New Zealanders, let alone anything more targeted.

Citing OIA documents, Marc quotes IRD officials writing in a November 3 briefing about a suggested one-off payment to all New Zealanders that:

"Designing, implementing and administering this payment would require a significant reprioritisation of Inland Revenue's work programme. Our experience is that it would be very challenging to design and stand up an untargeted one-off payment before the end of the year.

"We need further confirmation and details on the parameters to design the payment, and to assess whether it is feasible, cost effective, and establish a timeline if Inland Revenue is asked to deliver the payment."

A week later, Marc reports ministers asked about narrowing the payment to Aucklanders only, which elicited this IRD response on November 10:

"The level of operational support required to accurately deliver a $100 payment to Aucklanders prior to Christmas would be significant and beyond Inland Revenue's current capacity.

"Given the Government's and public expectations around these [Regional Support Payment] measures, we consider there would be significant reputational fallout if progressing the one-off payment resulted in Inland Revenue failing to meet these expectations.”

Marc reports Revenue Minister David Parker saying the Government decided against the payments after the November 10 briefing. Parker is quoted as saying:

"Ministers focused on support for businesses and the CBD, which was why in the end they went with other measures including vouchers.” David Parker quoted from an email via Newsroom.

The case for a helicopter payment system instead

This highlights the issues around why the Government did not make ‘helicopter money’ cash payments to all residents during the lockdowns of 2020 and 2021. Instead, the Reserve Bank printed $55b to buy Government bonds in financial markets from banks and fund managers. The Government, in turn, used $20b of that money to pay cash directly as few-questions-asked grants to employers as wage subsidies and resurgence payments.

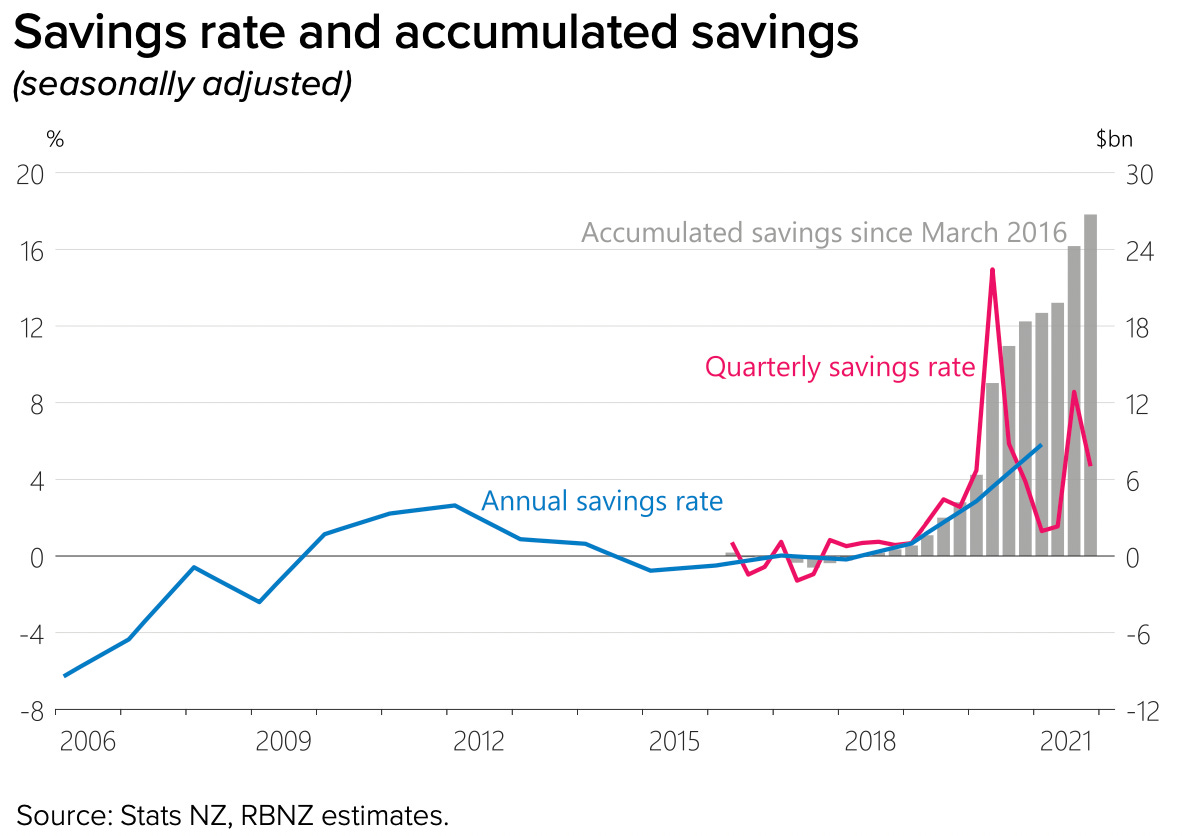

That money was crucial in the initial weeks of lockdowns in reassuring employers about cash flows and avoiding mass sackings. But it was soon evident the money was not needed and it has ended up as increased cash balances in the bank accounts of households with assets (ie home owners) and non-financial businesses, as the chart shows. It was an indirect transfer of wealth from taxpayers in general, including renters, PAYE wage earners and GST payers, to asset owners in the form of home owners and business owners. Less than $1b has been repaid and many companies, including NZME and Fletcher Building, have chosen to keep the cash and pay it out to shareholders as dividends and share buy-backs.

Why not pay it direct to everyone, not just the richest?

The Government could have instead paid that $20b in cash directly and equally to all residents, including children, to support the economy in the event of feared collapse due to lockdowns. This sort of payment was made in other countries during lockdowns, but the Labour Government chose to focus the cash grants on businesses.

One argument against such helicopter payments, as detailed above by IRD, was the logistical challenges involved in identifying residents and being able to make payments quickly into their bank accounts. Another argument is that ‘helicopter money’ funded directly by the Reserve Bank printing money and handing it directly to the Government would be seen as inflationary, reckless and unfair. That’s one reason why the Government chose the roundabout route of the Reserve Bank buying bonds on the financial markets after the Government had issued the bonds to banks and fund managers.

One result of that was the banks and fund managers capturing a margin on the way through on the money roundabout. Also, interestingly, the Government never actually spent all of the $55b in freshly printed money it received in that roundabout way. There is still $33.4b sitting in the Crown Settlement Account with the Reserve Bank, the Reserve Bank’s data shows. The difference of $22b almost exactly matches the $23b in extra household and business savings seen in the above chart.

So how could the helicopter money have been done?

My suggestion? One way to ensure immediate, fair, direct and controllable payments to all residents would be for the Reserve Bank to create accounts for every resident of Aotearoa-NZ as soon as they were born, that could be accessed by an app or debit card connected to the EFTPOS payment system.

The Reserve Bank is considering whether (and how) to develop a central bank digital currency that would effectively be able to generate New Zealand dollars independently of the banking system. These Reserve Bank-created ‘e-dollars’ would be exchangeable one-for-one with regular private bank dollars. So far, the Reserve Bank has focused on creating wholesale facilities or accounts for these e-dollars, but it could just as easily create retail accounts for each New Zealander on birth.

This could be done by creating an app and a Reserve Bank account for every individual ahead of a crisis. The bank would have to identify someone as a resident of Aotearoa-NZ and ensure that resident had a way of using that account to buy things, through an app linked to the account and/or some form of debit card linked to the EFTPOS system. If a Government was worried about how the money might be spent, it could be limited so the e-dollars could not be used to buy alcohol or for gambling, for example. Australia has issued a similar type of debit card payment system for some beneficiaries.

When the crisis hits, the Reserve Bank could then be directed to inject the fresh e-dollars equally in a one-off way to every resident to spend or convert into a ‘regular’ NZ dollar in a regular bank account. Given the e-dollars could be endowed with smart contract qualities, they could be time-limited and even given a special interest rate, which could even be negative. That would encourage people to spend it quicker, if the rate was negative and highly-enough negative.

Open Matariki accounts for all that use e-tāras

I’d propose every baby born here and everyone classified as a permanent resident be given such a ‘citizen’s dividend’ account. The ‘citizen’s dividend’ idea has been proposed overseas as a way of making universal basic income payments, or setting up endowments for children that can be used for college education.

I’d suggest the accounts be called Matariki accounts and the currency be called the e-tāra. Every child born here could be granted a starting payment of, say, $10,000, which would be linked to the parents’ or guardians’ Matariki account. That could be used to help families in those tough early years, but also create a base of usage that meant people and shops were familiar with the Matariki cards, the Matariki app and the e-tāras. In time, the accounts could be used for benefit payments and, if people chose, as their main transaction account that employers, the IRD, Government departments, ACC and others would use. Anyone being granted residency would be given a Matariki account.

Such an account would solve many of the online identity issues currently handicapping many Government and small business attempts to build the online economy. It would also provide a competitive element for private banks to keep their fees low.

Thoughts? Improvements? Have a go in the comments below.

55 Comments

For the IRD not to have your bank account number must surely mean you have evaded giving it to them ? Pretty sure in this day and age you would struggle to function without a bank account unless you lived totally off grid.

Exactly, it's such a non-issue, a solution looking for a problem. It's not hard to give IRD your bank acct number.

Yanis Varoufakis: Most dollars, pounds, euros, and yen are already digital. The digitisation of money is not the issue. The issue is the monopoly of the payments system. Today, you use digital money (phone apps or plastic cards) to buy a cup of coffee at your local Starbucks. But, to do so, you first need an account with a commercial bank. In other words, to grant you access to digital fiat money, the state forces you to fall into the embrace of the commercial banks.

So, today, the state guarantees a monopoly over payments to commercial banks. And that is only one gift to the oligarchy. A second, even greater gift, is that only commercial banks are allowed to have an account with the central bank. So, when a recession hits, and the central bank decides to stimulate the economy, the central bank lowers the interest rate of the overdraft it grants commercial bankers – who then exploit this to profit from arbitrage (by lending the money on to customers at a higher interest rate). And when the recession gets even worse (as has been the case since 2008 and now with the pandemic), the central bank prints digital dollars or euros and credits them directly into the accounts the commercial banks have with the central bank. This is the definition of exorbitant privilege!

So, this is why Wall Street prefers to see the world explode, time end, or Armageddon arrive, rather than allow the Fed to proceed with the digital dollar: because a digital dollar would mean that every resident in the US, and anyone beyond US borders trading with Americans, will be granted a digital wallet. That would be detrimental to the power of commercial banks. First, because people would no longer be obliged to open a bank account with them (think of all the lost fees!). Secondly, because there will no longer exist a rationale as to why the Fed or the ECB, etc., cannot – when they think they must stimulate the economy – drop helicopter money on everyone. Why credit dollars only to the accounts commercial banks keep at the Fed and not credit the people’s digital wallets directly? Indeed, why give money to commercial banks at all?

https://www.yanisvaroufakis.eu/2022/04/23/discussing-crypto-the-left-te…

Excellent point.

Just credit the money to our IRD account and send an email to say it’s there if you want it. Simple.

"click here for big tax refund" wouldn't sound like a scam to most people.

By now most taxpayers get a yearly My IRD email.

Regardless of what you think of the concept, one way to get the public onboard would definitely be to call it a Matariki account.

Free money and Te Reo are two subjects that absolutely wouldn't trigger about 30% of the population instantly.

That's exactly how they'll try and introduce CBDC, under the disguise that they're just trying to help us...

Who's going to turn down 'free' money, especially $10k as Bernard suggests...

It's a pity that for $10k & a Matariki account you'll be selling out your freedoms, giving away your child's privacy and helping the Government have over reaching control over their lives.

the e-dollars could be endowed with smart contract qualities

Eg. Breach the contract: You haven't done what the Governments wanted/agreed with - you can't access your money as you're deemed a bad citizen. You must do XY&Z to qualify...you have X days.

Sounds good right?

With the human population approaching 8b, maybe we need to augment social contracts?

Control the money - control the population. Refuse a CBDC or else kiss goodbye to your rights.

Sorry, you cannot access your Matariki dollars as your carbon footprint has exceeded your personal allowance. Please modify your diet and do not use your vehicle for 8 weeks upon which time we will review your suspension. Failure to comply will result in a permanent suspension.

Not that far-fetched. Whenever you shop or buy petrol you have to present your personal ID card. Any meat is recorded against your C02 allowance and your benefits monitored for complience.

It's coming, but there will also be exemptions for tangata whenua so I'm sanguine.....

... during the Covid vaccine roll out , if the government had used the carrot of helicopter money , instead of the stick of mandates , they'd have gotten to 95 % double jabbed by lunchtime , and no one should've been threatened by mandates ....

Ye gods , this government are a right bunch thickos .... if Thickonism was an Olypmic sport , Gold Medal to NZ ...

Our vaccination rate appeared to be higher than countries that tried to use carrots instead of sticks.

So it probably depends if the smartest move is to obtain high compliance or avoid upsetting people.

Maximising compliance to the government’s diktats is the primary goal for a well functioning society?

... the PM told us all to " be kind " , yet they threatened peoples jobs .... many got booted out : police , nurses , teachers .... how crackpotedly despotic & balmy is that ...

Kindness would have been : " hey guys , let's have some fun with this ... everyone gets a $ 250 voucher at their second vaccination jab " ... " let's do this ! " ...

There's was plenty of free stuff on offer during the vaccination push, especially on that super Saturday.

Offering bribes makes the reluctant even more suspicious and unwilling.

.. some people , a minority got a free burger or an ice cream.... Fulton Hogan got a free $ 200 million , which they refused to hand back , even though they didnt need it ...

Labour = The rich get richer ... the poor get a cheap sandwich or an ice block ...

... if you love the wealthy buggers , vote Jacinda !

Labour and National have become nigh on the same, sadly.

Individual accounts at the Reserve Bank for all residents would be a better way to do money printing than buying Government bonds, especially if it was done with a new digital currency, Bernard Hickey argues

A recent Bloomberg article described central bank easing with the phrase “pumping money into the economy.” That’s a misconception. Monetary easing is actually an asset swap. The public was holding savings in one form, and now it holds it in another. The Fed buys Treasury securities from the public, and replaces them with currency and bank reserves (base money) that someone has to hold, at every point in time, until the Fed sells its bonds and retires the cash. All monetary policy does is to change the mix of government obligations held by the public. Only fiscal policy – specifically deficit spending – changes the total amount of those obligations. - courtesy of Hussman

by Audaxes | 13th Dec 21, 7:27pm As part of the package of monetary policy measures announced in mid March, the Reserve Bank began to purchase government debt from the private sector, to support the three-year yield target and address market dysfunction. Around $50 billion of government bonds were bought from March to early May, and around $1 billion in early August. These bonds were purchased by the Reserve Bank from a panel of commercial banks via auction, and were paid for with newly created money credited into banks' Exchange Settlement Accounts (these balances do not count as deposits, as they are not held with the private banking sector). Some of these bonds sold by commercial banks would have been purchased from non-bank investors, generating a flow of funds into non-bank investors' deposit accounts.[5] Box D: Recent Growth in the Money Supply and Deposits

Furthermore,

Banks don't take deposits and they never lend money. They are in the business of purchasing securities. When one gets a bank loan, the loan contract is a promissory note. The bank purchases that contract from the borrower. Now the bank owes the borrower money and it creates a record of the money it owes, which we call deposits - source

An RBNZ CBDC will be a liability in need of an offsetting balance sheet asset - surely this will involve issuance of government debt to the RBNZ or private bank counterparty currrency swaps to fund high quality foreign assets.

So there are some technical and administrative issues that are surely possible to resolve. But rather than just fixing the problems, here is a radical proposal to throw huge amounts of taxpayers' money into digital bank accounts for newborns. Presumably the agenda here is to incentivize the populace to embrace a CBDC (the frightening downstream implications around controlling and punishing citizens using CBDCs are well discussed elsewhere). UBIs are also a highly controversial idea.

Why is a CBDC needed, why not just set up a KiwiSaver for every child born and put it in that, surely that would have far more positive long-term effects?

Is there really a need for a helicopter payment system? Why would we want to make it even easier to spray tons of cash to everyone in the event of a crisis (such as that created by a full societal lockdowns)? Wasn't it primarily all the QE and cash being chucked at people in 2020 (combined with the sluggish reaction to signs of inflation) that created the enormous housing bubble in the last two years, and many of the other issues we're now seeing in the economy?

And what does any of this have to do with Matariki?

China is looking more appealing by the day...

Why would we want to make it even easier to spray tons of cash to everyone in the event of a crisis (such as that created by a full societal lockdowns)?

I believe the argument goes that direct cash infusions where it's needed most yields better returns than just making debt cheaper.

Give someone struggling $10 and they'll spend it all in the economy. Give someone doing ok cheap money and they'll use to buying a mechanism to strip money from the struggling person.

One can only assume this was written for submission to the Spinoff site and accidentally posted here?

On a more serious note , one should be able to voluntarily open an account with reserve bank and and deposit money with the same benefits as the banks.

Wow imagine a bank run on the RBNZ?!

>On a more serious note , one should be able to voluntarily open an account with reserve bank and and deposit money with the same benefits as the banks.

You wouldn't want to after seeing the monthly account fee charged by a 'highly efficient' govt department.

The root of today's problems was sustained QE, and isn't this 'more of the same'?

Since at least 2000, the World has been living beyond its means. This came to a head in 2008, but the balloon was not allowed to burst, and was patched up by manufactured, artificially cheap debt. And that didn't stop when the financial system stabilised. Countries have been 'printing' constantly. Since no-one now has the productivity to back this, we have been stealing from the future, and even without Covid, the future was always going to arrive with a frightening bill.

The balloon from 2008 is still there, bigger and uglier than ever, and bursting now will hurt even more than if it had been allowed to do so then.

Instant control over spend. Oh, we see you are buying fizzy drinks, ammunition, Diesel and pitchforks. These are all subject to mandated maxima. Sorry, no more such purchases for you, for a period to be determined by a panel of experts. Kia haha.

I think that's a bit like how the Supplemental Nutrition Assistance Program (SNAP) (i.e., food stamps) programme is run in the US. You get a card - it gets topped up weekly - you use it at the supermarket checkout but the items you can buy are very restricted.

Personally, I think it makes sense!

A very poor understanding of how the governments finances operate is displayed in this article. Mainstream economist do not have a correct comprehension of central banking and government finances. Only MMT gives us a complete and accurate viewpoint on this subject.

https://www.levyinstitute.org/pubs/Wray_Understanding_Modern.pdf

So what, he wants to turn the RBNZ into Gosbank? The single bank in the USSR was a hinderance to economic activity in the USSR since capital access was controlled by central planning and in turn prevented sectors innovating outside their allocations of capital. Richard Werner has more or less proven that you want lots of small, independent banks owned by either non profit entities or publically owned with defined geographic boundaries as was the case during the high growth periods in Germany (1850 to 1960) or the US until recently.

The dominance of the big four is arguably one of the huge issues with capital allocation in New Zealand since they would rather use statistical/mathematical methods to manage speculative finance and consumption than the complex, trust based and very personal relationships used to grow businesses.

Also this matariki stuff is completely fake and imposed out of the blue. It is as fake as the grafting of Te Reo as a national language, which will never supplant English except as a signalling mechanism for how much of a leftist trend follower someone is.

Steady on. You’ll replace me as the resident bald head, privileged racist white guy.

Don't be an anti-white.

Its a skip and a jump away from Communism, I tells you.

I wanna go back to the good old days when we got to hold the world to ransom at gunpoint and own people and steal all their stuff.

Good post.

Control the money - control the population. Refuse a CBDC or else kiss goodbye to your rights.

You don't need an account number to give someone money. Just send them a non-cashable, non-transferable cheque in the mail. They can bank the cheque and...voilà!

Cheque ? ... my man , so 19'th century of you ... positively Dickensian ...

... to illuminate our bleak houses we need real moola , up to date cool & funky flash cash ... Buttcoin ! ...

Try to bank a cheque nowadays, I dare you.

Sounds horribly Orwellian

this idea is nice on paper but the devil lies in the detail. RBNZ is what I classify as wholesale or maybe one level up as the "manufacturer" Not set up for one or two million accounts and would be looking at $1billion+ to set this up, Partial duplication of data that IRD should be holding. IRD have a +$1billion database IT system that should semi-automatically handle these payments via programming, not 300 plus short term contractors and 750 existing staff to handle peak call loads. My perception is IRD CEO does not have any idea about their IT system and the low level management are not much better.

You can bet your bottom e-dollar that CBDCs are not simply something under consideration. Minds are made up; it's happening. The degree of control it would give over every aspect of the economy, right down to individual transactions, is far too tempting to ignore. The only thing left to do is convince the public that it's a good idea.

I don't quite agree with the American concept that money is equivalent to speech, but the freedom to earn, barter, and spend your money however you see fit is a freedom which needs to be defended just as vigorously as freedom of speech. In fact, it's absolutely essential for democracy. If we lose the ability to do this, it won't matter much that we get to vote.

I agree with you. The freedom to transact is of utmost importance, for if one is denied freedom to transact, most other freedoms/rights cannot be exercised in earnest. As an example, if someone's ability to transact is limited, they may not be able to travel. Travel is key to many rights, such as freedom to associate, freedom of religion, protest etc.

Interesting website tracking the global DC roll out. Who's in who's out.

If you are giving helicopter money I don’t need it but will accept it. Like most cash that comes my way it will be saved/invested and not spent.

I abhor the idea of the payment for each and every NZer. We have parent(s) bringing kids into the world simply for extra child welfare payments. The proposed $10,000 per child will make it Xmas.

Genuine question: does every proposal or Gov dept need a Maori name? Matariki was a vote buying exercise to play to a minority, and who’d refuse a new holiday? Bin Waitangi and substitute a NZ/Aotearoa day for no additional costs for employers.

Matarki is just a made up myth / legend, ( just remembered by the woke ones), designed to make some weak minded people feel good about themselves.

What a load of BS.

Unlike celebrating a rabbit that shits chocolate, or a creepy fat guy that does home invasions down chimneys?

What, like religion...

The significant cultural new year celebration no one was aware of until Labour started sliding in the polls.

Me thinks the Maori where more interested in constant trbal warfare than star gazing...

They managed to navigate the South Pacific using stars instead of straight out killing each other on their Waka. So pretty clearly some star gazing ability.

Good thing your ancestors came and civilised them.

Everyone in antiquity navigated the seas using the stars. What's so special about that?

This significant cultural event only became significant when labour needed an easy win.

All part of the 50mil paid to our 'independent' MSM media to promote using as many Maori words as possible in our everyday life.

John key used debates on flag changes.

Its a deliberate distraction. Filling up MSM with good news fluff. And now it's being used in the context of this article to dress up what is a significant monetary proposal. We screwed up our current system, how about we magic up a new digital coin? More money! Happy matariki!... Mind the inflation.

I dunno, it's hard to distinguish where your critique over the government's motivations for a new public holiday finish and your hot takes about Maori start.

Thank God for bitcoin. CBDCs are the ultimate State surveillance mechanism - the antithesis of bitcoin.

Let's hope Bernard is wrong on this, just as he's been wrong on everything else, like most fiat economist are.

I don't like it. It has a certain ring to it that makes me think about the cultist groups, that make you give all of your income to them, so that they, can carry out what ever fundamentally appalling ideas they think is their right to carry out.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.