Here's my Top 10 links from around the Internet at 12 pm in association with NZ Mint.

I'll pop the extras into the comment stream. See all previous Top 10s here.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I am un chien andalusia!

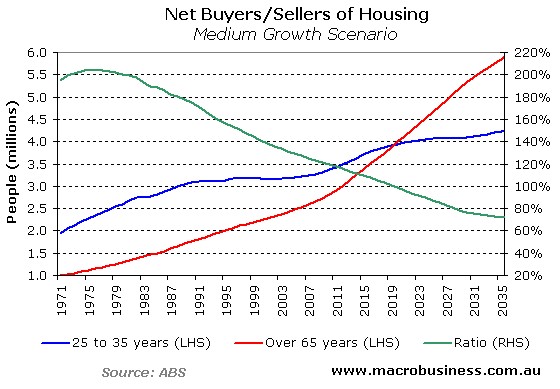

1. What the Baby Boomers might do - Leith van Onselen at Macrobusiness.com.au has done a nice piece on what the babyboomers might do with their all their assets.

Currently they own most of the assets.

The research shows they are likely to become net sellers after the age of 65.

But who do they sell to?

The proportion of the population who normally buy is getting smaller and is often in more debt (student and credit card debt).

So what happens when you have a large group selling to a small financially strained group?

Asset prices fall.

Here's Leith with an excellent chart below:

According to the ABS data, the Baby Boomers – those born between 1946 and 1965 – hold 45% of owner-occupied dwellings and 51% of other dwellings (i.e. investment properties and holiday homes). This is despite the Boomers representing only around 25% of Australia’s population. Moreover, those aged 65+ hold a further 21% of Australia’s housing wealth, taking the older cohorts’ (those aged over 45) share of Australia’s housing wealth to 67%.

It’s a similar story in relation to Australia’s financial assets: Again, the Baby Boomers (45 to 64 years old) hold 54% of Australia’s financial assets, and those aged 65+ a further 22%, taking the older cohorts’ share (those aged over 45) to 76%.

2. The Shadow is back - The New York Times reports the shadow banking system was a major cause of the global financial crisis. Now it's making a major comeback, thanks to very low interest rates and light regulation.

This can only end badly.

The shadow banking industry is back — and it could become bigger than ever, according to a new report by Standard & Poor’s. As traditional lenders and big investment banks face a wave of new rules stemming from the Dodd-Frank financial overhaul, their lightly-regulated brethren — money market funds, private investment companies and hedge funds — see an opportunity to profit, S.&P. said.

These resurgent shadow-banking firms are aiming to “bolster their balance sheets to take on business that the banks discontinue,” according to the report. While the shadow industry has benefits — like providing cheap financing to companies — it also comes with plenty of risk to investors and the broader economy. “Under certain circumstances, that might destabilize the financial system,” S.&P. warned.

3. Crisis contracts - Here's an interesting idea from Swiss professor Hans Gersbach via VoxEu for 'crisis contracts' for bankers that forces them to repay cash to the bank if their decisions blow up in shareholders' (and governments') faces.

When banks failed, the government paid up. But the bankers responsible kept their bonuses from the years of excess. This column argues for “crisis contracts”. Such contracts require that, in the event of a crisis, bank managers forfeit a portion of their past earnings to rescue the banking system.

Crisis contracts are both a simple and a drastic resource for changing the institutional framework of the financial sector in an economic system. They are unlikely to make all the other measures that have been proposed superfluous, notably the call for a substantial boost in the equity capital base of banks. But crisis contracts do have the potential to become one of the pillars sustaining a new financial system.

4. 'Better get ready' - Bloomberg reports fund manager Mark Mobius has warned another financial crisis is inevitable because the basic causes of the last one haven't been fixed.

Sound familiar? HT Andrewj in today's 90 at 9.

“There is definitely going to be another financial crisis around the corner because we haven’t solved any of the things that caused the previous crisis,” Mobius said at the Foreign Correspondents’ Club of Japan in Tokyo today in response to a question about price swings. “Are the derivatives regulated? No. Are you still getting growth in derivatives? Yes.”

The total value of derivatives in the world exceeds total global gross domestic product by a factor of 10, said Mobius, who oversees more than $50 billion. With that volume of bets in different directions, volatility and equity market crises will occur, he said.

But he sees a silver lining.

“With every crisis comes great opportunity,” said Mobius. When markets are crashing, “that’s when we’re going to be able to invest and do a good job,” he said.

That's fine for those holding cash right now...but not so much for those already invested...

5. 6 days of protest - Ekathimerini reports protestors have now been on the streets in Athens for 6 days straight. It's called the Indignant movement.

In Syntagma Square, the more active members of the movement - which has been organized via social networking sites and without the involvement of labor unions - manned stands dispensing information and food to visitors.

In Thessaloniki, a crowd gathered around the White Tower, the city’s seafront landmark which protesters have marked with a banner reading “Not for sale” - a reference to the government’s plan to sell off state assets.

In a proclamation uploaded onto the Internet, the “Indignant” movement - which takes its name from the original Spanish campaign “Los Indignados” - said that it would keep going until the politicians and technocrats it blames for the current situation “go away.”

6. Suicide of Chinese tycoon - The Economist reports on a interesting suicide case in China and how it hints at some of the financial stresses there as the formal banking sector tightens. HT Nikki via email.

Slowly, word has spread of Jin Libin, a resident of Inner Mongolia who ran a business empire encompassing supermarkets, mining and transport, who set himself on fire one day in April and burned to death. According to the Global Times, a government-run newspaper, he left private debts of $1.3 billion yuan ($191m) of private loans and another 150m yuan of loans from banks.

Still to be reflected is the impact of his collapse on his lenders, which, the Global Times says, included local banks, pawnshops and guaranty companies that had lent him money. No doubt there were also substantial loans from an impersonal network, a form of credit that is commonly used in China, though not legal. The consequences will not be trivial. Many other explosions driven by the same financial forces that brought down Mr Jin are sure to come.

7. This chart tells an amazing story - This chart contrasts growth in US corporate profits with the US trade deficit. How curious.

Could it be corporates are outsourcing operations to boost profits, creating huge movements in capital and the sort of vendor financing that created financial instability?

I'm having some real doubts about the free trading and free capital movement model for multinational shareholder-driven corporatism.

It seems biased in favour of short term thinking, consumerism, never-ending debt and continual financial crisis.

8. WTF! - The NZHerald reports the new Auckland City Super Council plans to spend NZ$576 million on a computer system over the next 10 years. So much for saving money.

Former regional IT head John Holley said no one was being held accountable for the cost blowout, which had been predicted by industry people based on the lack of an IT strategy by the transition agency.

Mr Holley said the $66 million figure to complete the Super City computer system was obviously "bollocks".

Auckland Council chief executive Doug McKay said there was no cost blowout with IT. He said the $450 million figure in the budget was for IT spending over 10 years, whereas the $126 million figure used by Mr Hide was for a day-to-day system developed by the transition agency and implemented over two years.

9. How exposed they are - Australian banks are now heavily exposed to the Australian housing market, both in terms of their lending and their profits. Leith van Onselen has another excellent peice at Macrobusiness.com.au on what's happening inside the Australian banking/housing vortex.

It helps explain the big selloff in their share prices in recent weeks.

This is how the hedge funds are starting to think...

...tick tick tick...

Clearly, Australia’s banks have painted themselves into a corner. If they attempt to belatedly limit their exposure to housing by reducing the availability of mortgage credit, then they risk causing a slump in housing demand and falling prices.

However, if the banks relax lending standards, they may succeed in keeping Australia’s housing bubble inflated for a while longer. But in doing so, they would increase their exposure to future shocks and potentially larger loan losses down the track.

They say the best way to cure a hang over is to keep drinking…

10. Totally a favourite song of mine - Thought I'd throw this in to mix it up. It's a live version of The Pixies peforming Debaser in 2008.

56 Comments

This fascinating read is from from London Banker: HT economicsnz via twitter

http://londonbanker.blogspot.com/2011/05/concentration-manipulation-and-margin.html

Four global banks are intermediaries in 85 percent of OTC derivatives transactions. The same banks dominate prime brokerage. The same banks own large equity interests in the now demutualised exchanges, clearinghouses and even warehouses of the global markets. Naturally, the same banks dominated underwriting of securitised assets. The implications have scarcely been grasped of what this portends in terms of the information asymmetries and the opportunity to manipulate markets without risk.

In October 2008 the global financial markets crashed. The story in the media is that it was a panic caused by the insolvency of Lehman Brothers. This is not the truth - or at least not all of it. The crash actually followed a $2 trillion margin call by these four global banks on their prime brokerage clients and OTC counterparties - effectively a 30 per cent increase in required margin. It was the margin call that forced liquidation of global portfolios of all asset classes - and particularly the high quality, most liquid asset classes.

We are now nearing the same global levels of leverage as prevailed in summer 2008. The political situations in the US and in Europe are unstable, and China is slowing. There is money to be made in instability.

It isn't the leverage that causes a crisis, but the margin call.

And I love this line from London Banker in the comment stream under this story.

The problem we confront is global. Australia too will implode suddenly and unpleasantly when its massive debt, property and commodities bubble bursts. It is the mechanism of debt, leverage and collapse which should be our common enemy. Taking pleasure in Britain's difficulties will not make Australia a more comfortable place to live when it too sees its public and private finances destroyed by the same forces.

egads

and NZ is selling more and more food to china so we are like OZ...when it all pops that trade stops over-night....and then what happens? Fonterra cant sell at its auctions.....its payout collapses......highly leveraged farmers get phone calls from banks....who need to re-pay money in the short term hot markets fast....etc etc....

egads indeed.

Only fools play in a game like this IMHO.

regards

Yass , we need caves , and environmentally friendly candles made from our own ear wax ............. The end is nigh ,.... the end is nearly nigh ,.... the end is ... taking longer than I thought ......

GBH- you should have listened to Dick Smith on Nine to Noon.

What did Dick have to say...? PDK...I mean just a brief encapsulation...ta I missed it too.

The all of it, really. Growth, population, resources, overshoot.

That our fiscal system requires growth, that when we got more efficient, we could have had more leisue time, but chose to work more, which required us to buy more crap, which had to fail sooner, so we could buy more soon-to-fail crap, then even that wasn't enough, we had to go into debt to keep up the exponential rate and even then it hit the wall.

Just the usual. Nothing you couldn't have gotten from me, Steven, several Andys, and a few thers here.

That it was on Nine to Noon was what was interesting......

I suppose ist almost funny about "soon-to-fail crap" coming form DSE's founder......I assuem it was him anyway...

regards

Steven - I think I have more respect for someone who came from that mindset, and ended up 'getting it', than I do for those of us who were always 'there'.

Given the peer group, it's a bigger leap of faith, and to be applauded.

I met him once, a million years ago in a different life - in Sydney, he was sponsoring a boat I was helping get ready for an Antarctic expedition. Interesting dude.

Did one of the best April Fools ever: said he'd laser-lanced an iceberg, was towing it up to the Red Sea, to cut up and distrubute. Daily updates, how it was cut like a boat to reduce drag, progress reports for several days.

Just happened that if you went to South Head about daybreak, you'd be able to see it passing....... thousands did.....

Good interview, thanks for that.

Maybe join the rapture church or what ever it is...

regards

eeyewww Gummy please leave my ear wax out of this debate ;)

cheers

Bermard

Hi Bernard.

It's all very well making the kind of claims that are made in that article, but he hasn't substantiated any of it, not even naming the four global banks.

Whilst I have suspected a conspiracy in banking for some time, I believe substantiated facts are what we need.

I am baffled by the chutzpah of the banksters. Mark Moebius says (in 4) “With every crisis comes great opportunity...” What fallacy!

The next crisis will not be like any other crises. THAT crisis will deliver 'opportunity' to another segment of populace. After Weimar the termination rate of the architects and purveyors of the collapse hyper-inflated as well; same with the depression in the 1930s.

Yes, there might be money to be made in instability. But will the scammers be able to spend their illgotten speculation? I sincerely think NOT.

This influential from the Wall St Journal. They've called a triple dip in America.

The world's largest economy may be facing a growth problem.

After a disappointing first quarter, economists largely predicted the U.S. recovery would ramp back up as short-term disruptions such as higher gas prices, bad weather and supply problems in Japan subsided.

... do we have to subscribe to the WSJ to read the guts of that article ? ..... gee , thanks a bundle Bernard !

Hey , did I sleep through the alleged second dip , are we onto the third one now ?

try googling to see if someone else has....

regards

Can I call a 4th? 12th?

Then I'll be famous for predicting the bloody obvious...

regards

Re #1 And what about all those babyboomers who were counting on the capital gains from sale of their investment properties to fund their retirement?

Silly Q, they are toast, as BH said a year or two back. All I can say is I think most will get their just deserts....

regards

Sago.

I never understood why all the baby boomers would suddenly sell all their income producing assets in order to live off the income produced by invested the proceeds from selling their assets into other assets?

If their asset is producing an income surely they would just keep the asset (all the retires I know do exactly that)? If the asset wasn't producing income then why would they have not gotten rid of it once they realised it wasn't producing income?

Seriously how many baby boomers go:

"Ohh, I just turned 65 so I will liquidate my investments that generate 10% returns and invest the money in the bank so I can get a 5% return".

Do they suddenly go senile or something? Do they suddenly decide that they should be getting a lower return?

I never understood why all the baby boomers would suddenly sell all their income producing assets in order to live off the income produced by invested the proceeds from selling their assets into other assets? If their asset is producing an income surely they would just keep the asset (all the retires I know do exactly that)? If the asset wasn't producing income then why would they have not gotten rid of it once they realised it wasn't producing income?

I'm thinking more of all those negative-gearing chickens coming home to roost. Running property investments at a loss so as to reduce income tax makes some sense when you're actually earning income (and when loopy tax laws allow you to do so). But it's not such an attractive concept once you've stopped work and have no taxes to write off against. And if you're forced to sell without being able to realise the capital gains you'd been banking on. Well...

I know a lot of baby boomers. Because of their age and stage in life they all got into property ages ago so don't have negativley geared property - they don't need to. Negativley geared property would be more a gen x or younger thing and even then I doubt it's as common as is made out.

Bob,it's not ALL about negative gearing, just some of it. Here's what happens: A working couple who have, say, 10 renters ( let's say, mortgage free), find that they are presently spending/saving the gross income that they have. It's allocated. Then one or both of them retire. Viola! That's two incomes gone, and they are left with just whatever cashflow coming in from the renters. It's not enough! As the income they have presently gotten used to is, at best, halved. So they have to sell their assets down ( they are savings for their old age, afer all?) to maintain their standard of living...or let it fall. What's the point of slaving your guts out for 45 years, just to get to the stage where you have 'free time' and have to contract your living standards? And here's another thing...when you retire your expenditure should...go up! As you have all that tiem to 'play' and spend, when previously you would have been constrained by work.

The Chinese in Siberia, its a few months old but #6 reminded me.

http://www.spiegel.de/international/world/0,1518,761033,00.html

If the Aussie banks shares get a hammering does this affect there capital ratios?

How many baby boomer places will be for sale? How many Chinese are there?

less than there would have been, thanks to a rigid one-child dictum. (I chose the word with care)

Yes, you can be sure that there will be no alternative -- real estate agents will *have* to sell boomer houses to chinese migrants. Banks will make threats of financial collapse. Rules will be loosened. Govts will do whatever it takes to keep the house prices rising. To hell with the citizens.

Then, just when the Govt thinks they've pushed the people too far and may lose their grip on power, they'll unleash the beneficiary bashing and all will be well.

Dick Smith said that his grandkids made him realised that growth for growth's sake is unsustainable and stupid and that people like GBH are sadly the flat earth society

That too. I just didn't want to hurt his feelings.... :)

Podcast link for Dick Smith on Nine to Noon for those like me who missed out

http://podcast.radionz.co.nz/ntn/ntn-20110531-1007-feature_guest_-_dick…

@Bob 2.52. Perhaps because when you retire, there is no alternative income to offset any costs against. ie: The PAYE that has been used to offset any negative gearing is gone. Besides, it's about alternative application of funds. At retirement, people do the sums. What gives a more known, secure income stream? Cash in the bank at x% or rent versus capital gain/loss over X years. And lets not forget...there's a whole life or two to be supported from income plus capital rduction over time. There's no point being planted as a squillionaire, is there!

OK, I was wrong with the exact date, but I did tell you the end of world is coming! Now there's two of us: me and Bernard Hickey! And both of us have an army of followers too!

-Harold Camping.

Bernard, one MAJOR thing you and everyone else is missing.

There are TWO different USA's. There are the "leftwing liberal" States, California, New York, Washington, Oregon, Florida. Then there is the heartland, the South, and the Bible belt, which I shall call "traditional USA".

"Traditional USA" is NOT suffering negative consequences from outsourcing. They are the RECIPIENTS of 7-figures-per-annum population shifts from "leftwing liberal" USA, with business activity to match. "Traditional USA" did not have house price bubbles at all, and if it was a separate nation, it would be about the only one in the world with no economic crisis at all right now.

If you disaggregate the "USA total" figures, debt overhang is NOT A PROBLEM in "traditional USA".

The outsourcing that you are compaining about, is almost entirely the consequence of anti-business politics in "leftwing liberal" USA - more of the "outsourcing" is going to "traditional USA" than to Asia. Boeing is going to North Carolina - just the latest and most prominent example in a several- years-long trend. Car manufacturing - and truck manufacturing, actually now more important than car - are thriving in "traditional USA".

"Traditional USA" is a testimony to something. They have not lost their reason like most of the rest of Western civilization. They still believe in Judeo-Christian culture, which is a natural fit with freedom and free markets. There are even mainstream movements in some States to make Gold legal tender in-State. This is how intuitively clever these cornpone redneck bible-bashers still are.

Traditional USA is still humanity's "last best hope", the liberal leftwing States having abandoned this role for humanity. Freedom and free markets, low taxes, low regulations, low urban land costs, no politically correct pandering. Faith, family and flag. There is nowhere ELSE in the world today WORTH emigrating to; investing in; or starting a business in. Now for that green card lottery.......

To a certain degree I agree, although I do see it as a major disadavantage that this group does not have the poltical clout of either coast. They will also get to pick up the tab....

That has to be the most misguided, idologically-driven piece of nonsense I've ever read.

Basically, if you leave it to some deity - sorry, your particular deity - and leave everything else to catch-as-catch can, you can do anything you want.

Forever.

Grow forever on a finite planet, all you have to do is believe.

"Your'e doing it, Peter".

Crash.

"Sorry, Tink, tink I got it wrong".

Belief only gets you so far.......while the goin is good.

You're a long, long way from reality, Phil Best.

Here's the reality:

http://www.chrismartenson.com/blog/past-peak-oil-why-time-now-short/583…

Tell you what - you fill your tank tomorrow. Start driving. Pray all you want, ignore the gauge, just make sure you get a bit faster every half-hour or so.

If you're still going on Saturday, I'll repent, and cough up some back-tithes to the Brethren.

For the tank, read: the planet. It's only a matter of scale.

Nuts.

yes the world is nuts but surely it is a matter how you go about things, outline the interdependencies on a level they may get or just rave :-)

I refuse to waste any more time on your lies. I have rebutted you totally over and over again.

Phil - may I wish you the very best of luck getting that green card; it would be a win-win situation for both New Zealand and the Bible Belt rednecks.

There's so much steaming wrong in this that it's hard to know where to start, so just for chuckles I turned it over to a bunch of Americans (from a variety of states) on a board unrelated to politics and economics (to avoid bias) to see what they made of it. Here are some extracts:

As a Floridian, I can say that my state is so NOT left wing liberal!

Tell that to people in Ga who lost their manufacturing jobs about 15 years ago when all the sewing plants upped stakes to Mexico and other countries further South.

Detroit might disagree with the assessment that car manufacturing is thriving. And if so, why the need for that HUGE GOVT BAILOUT? Hmmm?

And the auto manufacturing in the South is actually German based, so it’s more a case of lower production costs and less restrictive labour laws than ‘OMG, they’re doing it rite’.

The reason BMW even has a market for mid-class cars is because the US brands are more expensive, and frankly? Lower quality and that makes me have a sad. I love me an American car.

That’s so laughably wrong, I don’t even know where to start. It’s almost completely backward, as a matter of fact.

He may be an ass, but he’s an ass with an educated vocabulary; which makes him sound more believable.

To quote Arnold Rimmer “Wrong, wrong, wrong, just brimming over with wrongability!”

as I live in Trad US, no, we’re not having mass migrations in or out per se. You would not believe what happened to housing prices here! We have too much commercial due to teh bubble.

Not an economic crisis? take a look at our legislature or OK. we may not have had it hit as fast (we’ve always been broke), but trust me, it HIT. While our land may be cheaper, the local standard of living is also much less. it balances. funny that.

as for “outsourcing to here? ok, yeah, our localities will prostitute themselves to Big Business, who come in and have their way with us until they grow tired of our charms (which can’t be maintained at that price) then move on to find the next prostitute. Wal Mart has a whole division devoted to moving your business to China, so frankly the next prostitute is becoming not here or our neighbors.

I may never stop laughing.

Meanwhile, people all over “Traditional USA” are pulling so hard on their own bootstraps, they break, only to find that the social safety net has been cut out from underneath by those espousing “Faith, Family, and Flag”. And good luck emigrating here, because those same people also want to close our borders.

I know some folks who would REALLY REALLY like to know when those “outsourced” jobs are going to arrive.

Thank the gods that I finally live in a liberal left-wing state. I was thinking I should move out of Florida back to Oregon, but heh, now that Florida is liberal I guess I’ll just stay here.

So 5 out of 50 states are liberal and the “heartland” is mainstream America. That’s a whole lot of heartland. I wonder if he truly understands how the US is made.

Oh FFS. I get so bored of these arseclowns’ hypocrisy.

Look, sparky, if you don’t like left-wing liberal states getting up in your business then don’t take our frikking money. Believe me, we’d much rather keep our tax dollars that dole it out to ingrates such as yourself.

Yeah, you’re all snarly and grrr until something happens in your state, and then you can get you hand out fast enough to take a little of our cash.

Now, piss off and practice all this self-sufficieny you preach. There’s a good chap.

It’s statements like this that make you understand what ignorance really is. At least I feel a little better that WE are not alone when it comes to dumbness.

Red States receive more federal tax dollars than they pay out; they have schools that rank at the bottom of the nation; they have higher rates of divorce; they have lower percentages of the population with college or higher degrees; and more.

As for housing prices, I saw an article recently about 10 places that were housing bargains and they were all in places with high unemployment. Housing prices are higher in places with higher employment because there’s higher demand. People who are employed or looking for employment live where the jobs are. Flint, Michigan may be a housing bargain right now in terms of asking price for homes, but will you find a job when you move there?

For example, I live right outside Washington, DC, where the unemployment rate has remained remarkably low. Housing prices are high, because jobs create demand for housing.

That was kind of a tangent, but perhaps not. I think the comment that red states didn’t have a housing bubble, besides being wrong, shows a fundamental misunderstanding of how all factors interact in an economy.

FYI from Reuters on the extension of 'extend, pretend and shuffle' strategy in Europe

The European Union is racing to draft a second bailout package for indebted Greece to release vital loans next month and avert the risk of the euro zone country defaulting.

Germany, which along with some other countries had resisted extra funding, is considering concessions in efforts to support the country by dropping its push for an early rescheduling of Greek bonds, the Wall Street Journal reported on Tuesday.

And then Moody's warned it may downgrade Japan again....and said this:

“Although a JGB funding crisis is unlikely in the near- to medium-term, pressures could build up over the longer term, and which should be taken into account in the rating, even at this high end of the scale.

“Moreover, at some point in the future, a tipping point could be reached, and at which the market would price in a risk premium to government debt," it said.

Moody’s said that more specifically, factors driving the decision were:

1. The much larger than initially expected economic and fiscal costs of the March 11 earthquake are magnifying the adverse effects imparted by the global financial crisis from which Japan's economy has not completely recovered.

2. Concern that the policy framework will continue to fall short of achieving deficit reduction on a timely basis.

3. The vulnerability of a long-term fiscal consolidation strategy to worsening domestic demographic pressures, as well as to possible, renewed shocks in a fragile and uncertain, post-crisis global economic environment."

http://my.news.yahoo.com/moodys-places-japans-aa2-govt-ratings-review-possible-025347410.html

Good to see your good taste in music Bernard - did you see the Pixies in NZ???

Nah. Missed them. Decided to save my money. Sort of regret it now.

http://www.stuff.co.nz/entertainment/music/gig-reviews/3444072/Gig-review-The-Pixies-in-Auckland

cheers'

Bernard

I saw them at the Vector, Frank Black in usual laconic form - Kim Deal doing all the talking. But awesome.

For a review of the housing market in May for Auckland's North Shore, check this site out:

http://www.valuationrodney.co.nz/news.htm

Pretty informative.

Where taxes are spent...

Jobs recovery? 200 jobs going in Taranaki:

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10729272

sounds like a few bureaucrats are going to get the chop too.....

A few is not enough. Time is over for parasites of a whole people.

Good movie that... "Big Fat Greek Divorce"

Oh good, I stirred up the liberal leftist utopians and liars all right. They're not so much desperate, as simply incapable of seeing reality.

"Experience beats in vain upon the congenital progressive".

- C.S.Lewis.

I can see it from a mile away, that "Kakapo" put my comment up on some leftwing site like "The Nation" or HuffPost. I will do the same now on "Free Republic" and report back here later.

It is a fine thing that you do , my friend . Keeping the lefties agitated , stops them from meddling in everyones' lives ....... and gosh darn , it is alotta fun , watching them screech & snarl , 'cos alike their High Priestess , Herr Helen , they know best .......

.... But in their evil manipulative hearts & souls , they don't feel best !

I should particularly address this utter BS from Kakapo:

"I think the comment (from PhilBest) that red states didn’t have a housing bubble, besides being wrong, shows a fundamental misunderstanding of how all factors interact in an economy."

That about proves to me, everything I believe about leftwingers. They are pig ignorant. They lie barefacedly to suit their agenda.

By the way, I said a "house price bubble".

Here is a challenge for you. What is the VALUE of equity lost in the US house price bubble, in California? Where were the next biggest ten State-wide losses of equity?

By the way, California, which has about one eighth of the USA's total population, lost approximately HALF the total equity lost in the entire economy. I stand by what I said. The USA would not have a crisis at all if it were not for the "liberal" States ILLIBERALISM on housing development, making housing supply inelastic.

If you don't "get it", I am wasting my time. I thought this was a business/finance/economics forum, not a platform for more leftwing lies and white-anting of western civilization. If I wanted that, I'd visit "The Standard". My time is far better redeemed on international sites where the truly intelligent economists etc have actual objective discussions.

Looks like Kakapo did a right demolition job on your post PB.

Nah, wasn't me. It was a bunch of Americans from all over, and one Brit living in Kansas, on a non-political hobby site. Here's another comment that's gone up since this morning:

"So, if it was only the urban areas on the coasts that had a housing bubble, why have Philadelphia housing costs held fairly steady (I bought at the top of the market, in August 2006, and my house has fluctuated in a +/- 5-8% range) while Arizona and Nevada have been two of the worst hit states?"

There's a lot that's arse-backwards with the original load o' WTF, but one of the major fields of wrongness was the simple-minded nonsense that the USA can be neatly divided into Red/Blue, Conservative/Liberal. Doesn't take heavy googling to find that using a finer grain - county by county, every state is a patchwork. All the data is there for the 2008 election. Florida is overwhelmingly conservative, BTW, and demonstrably not left-wing/liberal. It's the posing pouch of the bible belt and full of megachurches and retirees. Taking it to an even better measure of accuracy by designating 'purple' counties, where the winning candidate scored 70% of the vote or less, the distinctions between red and blue states largely disappear. The differences in voting patterns are based more along urban/rural lines. Taking California, there are areas which are on average more liberal, but those are counteracted by areas which are very conservative.

It must be hard, reconciling fundy dogma with realities which just don't fit.

You have my sympathy with that.

But it's more important that we have a going-concern planet to hand on to our kids - and in that regard, you're a long, long way from any kind of reality.

It speaks volumes for Hugheys precarious prognostications, too, that he has to rely on such a flakey supporter.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.