Here's my Top 10 links from around the Internet at midday in association with NZ Mint.

I welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream.See all previous Top 10s here.

What a match. I was lucky enough to go and yelled myself hoarse. I particularly enjoyed the 'Four more years' chant at the end. 'Were you listening George Gregan?'

1. Global trade falling fast - The New York Times reports on a 14.2% slump of imports into the Port of Long Beach in California in August from a year ago.

This is normally a month when supplies are arriving from China onto the West Coast ports to stock America's stores for the Christmas sales season.

A similar thing happened in late 2008 when the Lehman Brothers crisis hit.

Global trade fell around a third in the following months.

This is all crucial for China. The last time its exports to America dropped like this it unleashed a debt-fueled infrastructure building frenzy that boosted iron ore and coal prices as it pumped out steel and concrete for the boom, helping to protect Australia and therefore us.

This time around China is trying to slow its economy and may not take such drastic action to offset a slump in exports to America.

When retailers expect that Americans will be crowding into their stores, their orders pile into the nation’s ports in August and September for delivery to stores by late October. But logistics companies say that is not happening this year.

“We’re concerned, because usually at this time, you see this peak,” said Richard D. Steinke, the executive director of the Port of Long Beach in California. “We haven’t seen it.”

In fact, the five busiest container ports in the United States said that imports in August 2011 were lower than or even with 2010 volumes.

Joshua Owen, president of Ability/Tri-Modal Transportation Services, a trucking company based in Southern California, said the light volume and lack of a shipping peak did not surprise him. “In reality, when people aren’t able to even afford homes, and they don’t have jobs, they’re not going to be buying a lot of creature comforts,” he said.

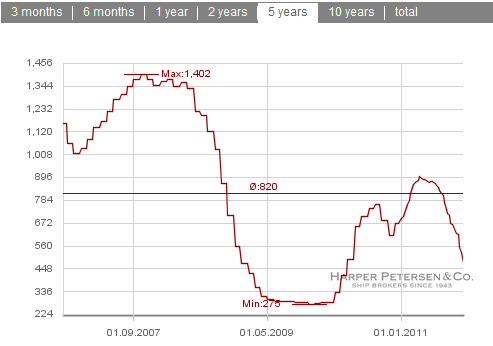

This chart below is from ship broker Harper Peterson Shipping in America, showing the last five years of brokered shipping rates and a sharp fall in recent months. HT Mish.

2. 'Would like milk with your fries?' - The Wall St Journal reports PepsiCo is planning a global push into dairy products with a joint venture with German company Theo Muller in America's fast-growing yoghurt market.

Fonterra already has a few global competitors/customers.

This may be one more of them.

It would no doubt be a buyer of Fonterra if it was ever put up for sale.

I love this line about Pepsi's ambitions to create new foods...

A key plank of PepsiCo's nutrition strategy involves "snackifying'' beverages and "drinkifying'' snacks and creating products combining fruit, grains and dairy. Already a major global player in fruit juice and oatmeal through its Tropicana and Quaker brands, PepsiCo recently launched a fruit purée in the U.S. that's thick enough to be a snack. It is testing an oatmeal-based drink in Latin America.

3. Aussie real estate agents nervous - Delusional Economics at Macrobusiness points to the largest fall in the total value of Australian house sales for at least a decade.

Surprisingly, he actually defends Keynes himself, rather than the things done and said in his name.

He's no big fan of neo-classical economics and details his view in his book Debunking Economics.

"If you want to head off fascism, you need a politician who will stand up to bankers," he said.

He wants a debt jubilee.

5. The Princelings speak - John Garnaut is writing some great stuff from Beijing for the Sydney Morning Herald. Here's the first detail I've seen reported of what the 'Princelings', the children of China's revolutionary leaders, are actually saying behind the scenes.

WHEN Ma Xiaoli arrived this month at the Hall of Many Sages with the sister of China's likely next president, she had no intention of speaking what was on her mind. After all, the Chinese Communist Party usually does not permit disgruntled citizens to gather in large numbers and challenge the party line.

But as she heard other children of former leaders push back at what they saw as the party's moral decay, its attack on civil society and its revival of destructive Cultural Revolution politics, she found that when she started talking she could not stop.

''The Communist Party is like a surgeon who has cancer,'' Ms Ma told this almost unprecedented unofficial gathering of powerful families that took place in a conference room at the China World Trade Centre on October 6. ''It can't remove the tumour by itself, it needs help from others, but without help it can't survive for long.''

Ms Ma was able to dispense with discretion because of her father's prestige as a leading revolutionary and because her family has long been intertwined with other elite families represented in that room, especially that of the anointed next president, Xi Jinping. The gathering was the starkest demonstration to date of how ''princelings'' are networking and rallying to influence personnel and ideology ahead of Mr Xi replacing Hu Jintao at the helm of the Communist Party at it's five-yearly congress a year from now.

7. This is good to see - Bloomberg reports America's Inland Revenue Service has launched an audit into Google's practices of shifting profit into low taxed offshore subsidiaries.

Google, owner of the world’s most popular search engine, has cut its worldwide tax bill by about $1 billion a year using a pair of strategies called the “Double Irish” and “Dutch Sandwich,” which move profits through units in Ireland, the Netherlands and Bermuda. Google reported an effective tax rate of 18.8 percent in the second quarter, less than half the average combined U.S. and state statutory rate of 39.2 percent.

8. Secrecy and Free Trade - Auckland University Professor Jane Kelsey says the various countries negotiating the Trans Pacific Partnership agreement have decided to keep the details secret for four years.

The parties have apparently agreed that all documents except the final text will be kept secret for four years after the agreement comes into force or the negotiations collapse. This reverses the trend in many recent negotiations to release draft texts and related documents.

The existence of agreement was only discovered through a cover note to the leaked text of the intellectual property chapter.

9. This is fun - A new Cato Institute study debunks the myth that US President Herbert Hoover was a hand-off small government type who did nothing as the The Great Depression deepened.

Politicians and pundits portray Herbert Hoover as a defender of laissez faire governance whose dogmatic commitment to small government led him to stand by and do nothing while the economy collapsed in the wake of the stock market crash in 1929. In fact, Hoover had long been a critic of laissez faire. As president, he doubled federal spending in real terms in four years. He also used government to prop up wages, restricted immigration, signed the Smoot-Hawley tariff, raised taxes, and created the Reconstruction Finance Corporation—all interventionist measures and not laissez faire.

Unlike many Democrats today, President Franklin D. Roosevelt's advisers knew that Hoover had started the New Deal. One of them wrote, "When we all burst into Washington ... we found every essential idea [of the New Deal] enacted in the 100-day Congress in the Hoover administration itself."

Hoover's big-spending, interventionist policies prolonged the Great Depression, and similar policies today could do similar damage.

10. Totally irrelevant video showing China really is the greatest - It has invented robots that play ping pong.

32 Comments

Here is a link to what the 1% do and how it has changed over time

http://politics.salon.com/2011/10/14/what_do_the_1_percent_actually_do/

good article there,at Salon, really shows the growth of the FIRE sector too

thank you

Warren Buffet won't be on that list, he only earns $120k p/a. Occupy everything isn't about wage earners specificaly though the MSM does promote that perspective. Wealth is the means of power, and that is the problem. The power is used for the benefit of a few, potentially it would be the top 0.0003% but that doesn't capture attention either.

Did the doctors, or sports/entertainment stars cause any of the problems we face today?

Did working class people cause the financial meltdowns of the past and soon to be present?

The list goes on, but it may help explain who is the 99%.

#9.....voodoo economics continues....i dont think ive seen anything from cato that wasnt total rubbish....these guys have just done it again.

regards

I’m a bit confused. How is a Cato Study about a historic position voodoo Economics? I’m a libertarian and I also disagree with Cato on some subjects. You might disagree with their politics full stop, but taking Cato’s position that Government intervention can possibly exacerbate a problem is a legitimate economic concern. I have yet to see first-hand, historically, or even anecdotally where government intervention ever solved an economic problem of this magnitude. Government intervention didn’t solve the problems of the Great Depression, fix Japan’s zombie economy, and it’s certainly not going to work now.

I can understand some people frustration in wanting to see the government “fix this”. But this isn’t a forest fire where having a government agency responsible for putting out the fire actually fixes the problem. These are systemic issues that have to unwind themselves out of system naturally. Even with forest fires sometimes the only solution is to let it burn itself out. In this situation you could be using bad money to chase worse money. So wisdom is knowing when to fight the fire and when you need to let it burn itself out.

The sooner we realize we need to let the fire burn the quicker the system will reset and growth will happen again.

Because Cato is trying to a) re-write history in order to justify its position of not 1) intervening today....and worse, 2) Going for austerity.....

and b) trying to do so by saying that,

"Hoover's big-spending, interventionist policies prolonged the Great Depression, and similar policies today could do similar damage."

http://krugman.blogs.nytimes.com/2011/07/18/herbert-hoover-was-hooveres…

So as per the last Obama stimulus hoover's stimulus/works was small....so the claim it did damage or prolonged the great depression is really without foundation IMHO...

"Government intervention didn’t solve" and yet the biggest spend of all was the ramp up to WW2....that clearly got the US out of the GD....

Japan's is a different case and they didnt fall into a huge depression...just had 20 odd years of slow drops per year from huge property bubbles...maybe they should be given credibility for not ending up in a depression.

In three years has the austerity fixed Ireland's problems? Greece's? Portugal's? UK's? nope....in fact the signs are these policies are having the effect expected by Krugman, ie pushing us into a 3rd depression. Hence Im calling Cato's claims, voodoo economics.

http://krugman.blogs.nytimes.com/2011/07/07/more-anti-austerianism/

Maybe I need to read up on the GD some more because my read of that history is not similar to Cato's.......which is par for the course.

"the quicker the system will reset and growth will happen again." This will be unlike anything anyone alive has experienced IMHO.....to start with I dont believe it will reset quickly as you contend, I think the drop will take 3 to 6 years before a bottom is reached.....it will then take at least a decade probably 2 by which time there will not be the oil about to power growth....so its a L shapped future IMHO.

"Even with forest fires sometimes the only solution is to let it burn itself out. In this situation you could be using bad money to chase worse money. So wisdom is knowing when to fight the fire and when you need to let it burn itself out."

Now here I agree with you......problem is to keep the banks and eftpos functioning while this drop occurs....

regards

Krugman is a joke, is anyone taking him seriously these days? The problem is too much debt and deficit spending, and his solution is more debt and more deficit spending, please.

Seriously, if you think Obama's stimulus has worked I suggest you open up a newspaper.

Ireland, Greece, Portugal and UK haven't had austerity yet, they have had bailouts, this has just compounded the problems. Iceland is a good example of how to combat the GFC. Their economy is taking off again after allowing their bankster's debts to be defaulted upon.

Iceland’s collapse was quick when the market is allowed to clear itself. Sort of like removing a sticking plaster really. There is a fast and a slow way.

Actually Steven I think that the study is probably correct (of course it's idealised by the Cato institute). If you look at Steve Keens site he has a pretty good go at Ben Bernanke along the lines of, 'If you are a student of the great depression, why did you repeat all it's mistakes'. Of course this includes re-capitalising the banking system.

In my opinion that is mildly unfair on Bernanke, because he just follows instructions really. The premise of considering it his mistake is that he and the Fed are in charge. I think the Fed audit report, shows that the looters are running the asylum pretty clearly.

Of course one again nobody who is called Keynsian has actually read Keynes (or Minsky). That is an obvious fact, he wrote high brow economics text, not realising his audience were a bunch of illiterate toddlers who wanted to read fairy stories.

I cant see how you are linking Cato and Bernanke. Cato is trying to re-write history to justify austerity and/or maybe shoot keynesian yet when up against the zero bound keynes has by far the best model. Now I can accept there is probably no alternative left, but as far as cato are concerned and indeed many rights wingers / austrians I think they are right for the wrong reason. Thats because they ignore or disagree with peak oil, while I accept it and what that implies....ie we past peak most thinks in 2007-8, that means we cant underwrite the spending.......

Bernankie following instructions, no, he has a concenus of other bankers of the fed committee to floow sure....but Congress for instance wnats him to stop stimulus ie QE3....so IMHO he's counter to Govn. Basically because he is all taht is left to fight a depression with....Obama is finished...congress wnats obama defeated no matter what....

The ppl who are called keynesian by the libetarians/right wingers are not actually keynesians.....so its hardly surprising they have not read him....these are the ones believing in fairy stories IMHO.

regards

I don't link the Cato institude and Bernanke particularly, though they are both extremely neo-classical and therefore parts of the same idology. I think Steve Keen paints a pretty correct picture that so far the response has been the same as to the great depression, barely any different.

It's possible to paint a different narrative to everything, for example after 1929 trade was suppost to have been restricted by government intervention (that is the story I have always been told) but following 2008 trade has dropped massively just the same way and no country has imposed significant restrictions this time. I doubt that it was any different during the great depression, but that is a completely different narrative.

All theory based on the 'Efficient markets hypothesis' in some way is completely invalid as far as I am concerned. This includes everything by the Cato institute and much mainstream stuff such as Bernanke and Krugman postulate. I have absolutely no background in economics myself, but have followed as much of what Steve Keen has written as I could read. I was absolutely horrified when I observed Paul Krugman discussing IS/LM models, and general equilibrium models at the London School of Economics which as Steve Keen points out have been completely debunked by main stream economists. He also appeared to be unaware that central banks don't control lending policy (which in my opinion explains nearly everything you need to know about this economic crisis).

As you said Bernanke is part of a committee and that includes some commercial bankers in the Fed. The key point really for me is that what happens at the commercial bank interface to the public is the primary dictator of monetary policy. As empirical evidence has shown, banks lend first and look for reserves second. This puts the central bank in the role of observing monetary policy, rather than managing it. Steve Keen also shows this quite clearly when looking at how the Australian reserve bank obviously sets it's interest rates each month.

Of course if NZ follows a policy like that proposed by the Cato institute then the recession will deepen. Having lauded Steve Keen so much I would have to question how a debt-moratorium could be organised. It seems like this might well end up putting many people on a fixed income in a very precarious situation.

I don't quite agree with your thesis that peak oil has anything to do with this crisis however. It is my personal opinion that there is enough oil above ground already to cause catastrophic ecological damage. If there is going to be a shock from diminishing oil extraction I don't believe it has effected the world economy yet.

The crisis however was purely a financial crisis, just like the great depression. The financial system should be re-structured now so it can handle future external crisis, then countries will need to look very seriously at what capitalism is doing to the planet.

"for example after 1929 trade was suppost to have been restricted by government intervention" Which is pretty much correct IMHO.....each Govn tried to restrict imports, effectively exporting un-employment...today of course in order to function the USA has to import 2/3rds of its oil.....

Steve Keen, yes spot on....Ive not seen anyone more accurate....and more logical....

"no country has imposed significant restrictions this time" but you can do that without direct legislation, ie currency manipulation.....besides which the signs are there that the USA will do so in the next year or maybe 2....

"Efficient markets hypothesis" yep, total bunk.....there is no evidence this is true, in fact counter evidence seems far more prelevent....for instance the assumption that a rational decision for a company or individual will be rational for the market or Nation is obviously not true.....you just have to look at the housing market bubble for instance to see that...just look at Ireland.

Krugman has some good models....using them he has predicted just how badly things would go....and in three years that has been borne out...as he says if you had followed the WSJ and not him you would have lost a packet. Main stream economics is what has got us in this mess, and they are very anti the likes of Krugman who is actually pretty close to Steve Keen in economics terms....

The Cato institute on the other hand doesnt do economics, it does politics and very right wing politics.....a bunch of fruity loops....

"central banks" Primarily the economy is controlled by Politicians.....central banks wear neo-con blinkers as do the ratings agencies...hence the private debt debacle was ignored....now this is where Krugman falls down and Steven Keen/minsky takes off....the latters theories cover debt, the rate of debt change and are standing up very well.....the evidence is there....unlike say Austrians who are right but for the wrong reason....but tahst another story.

Peak Oil, well there is enough evidence for me that when oil gets to 5~6% of US GDP the US goes into recession and $147US in 2008 sure caused a huge recession......if you consider that in order to sustain our ponzi econmy is must always grow and grow by 4% min, then this takes 2.5% more energy to do so....so if energy cant grow its price goes up and takes the "wind" out of expansion.......we then see a contraction. For me its pretty clear.....time will firm up taht opinion though...

Yes, this is very much a financial crisis and no they wont fix it....it will implode.....and once we have started that road down lack of energy will stop that being reversed....but I expect it will be a saw like drop for decades.

regards

People can argue all the different economic theories that they want. You can quote any economist you want. But the bottom line is that the math just doesn’t add up. When exponential debt out paces exponential grown you have an unsustainable situation. I don’t understand why anyone is surprised this is happening. The math didn’t add up even in the late 1980’s! Now that the world has approached the proverbial Minski moment there is really only one option left. The problem is that the fear of Sovereign default and debt forgiveness is somehow become more profound than the actual collapse itself. I thnk this is just the 1% trying to scare the living S#!T out of the 99% since the 1% have the most to lose in a global reset. To Quote Eddie Murphy from the movie Trading Places “The worst thing you can do to rich people…is make them poor people”. Yes, a depression is never a good thing but a few years of a depression while the world economy resets itself is much more viable option and better than a 30-50 years of stagnant zombified economics. I’m sure once the “Great Reset” happens (and it will happen) everyone will be wounding why it wasn’t done sooner.

Steven doesn’t get it. Keynesianism can kicking will only go on for so long, what can’t carry on wont carry on.

This crisis will only resolve itself when the debt is liquidated, (borrowers default on payments and companies go bust). It is only when this has happened can a genuine recovery begin.

The last time this was allowed to happen was the crash of '21 (not taught in current mainstream economics these days). This was when to dow crashed about as much as the first leg of the great depression (around 50%) drop. Unemployed went from just over 2 million to almost 5 million in about a year.

Back then there wasn't the widely accepted view that government needed to stimulate the economy, like we have now days. Instead spending was cut big time.

In fact they cut the federal budget in half! Imagine that now days. Of course companies went bust, and the debt was extinguished and the whole episode was over in about 18 months.

Contrast that with what Hoover and FDR did a few years later, spend and pretend and look at the result. Their spending policies didn’t get things going until well after the war. It is insane how people believe it will work this time around. Japan is another example.

Keeping a bubble artificially levitated at levels that couldn't occur under free market conditions through injecting cheap money and evermore regulation is not the answer.

Steven and his centrally controlled economy wizards don't get it. You can’t keep propping it up, the market eventually bites back. Given the amount of money issued recently this may come in the form of a loss of confidence in the currency, when that happens central banks will be powerless to halt a hyperinflationary event.

How about we stop labeling things neo-classical Pollies, economists are bankers are doing as keynesian. It isnt accurate or fair, the last 30 years have not been keynesian in nature, only the last 3 has some "keynesian" properties as the neo cons have turned to it in desperation (and then inadequately). For instance Alan Greenspan who is an arch-liberatarian had his infamous "put" (ie he dropped the OCR in order to offset a bust).....nothing Keynesian about Greenspan...

Now can kicking, yes I agree in these present circumstances can kicking cannot carry on for much longer, again though this isnt a failure of Keynesian economics....its a failure to address the debt built up in the previous thirty years by gross mis-management, little of it keynesian.

FDR and spending, his spending took the USA out of the GD....Hoover's spending was inadequate and this has been mirrored with Obama....Keynesian economists like Krugman have said this from the outset.....

You mix and match from all over the place cherry picking snippets that simply do not match up or simply didnt occur like you believe....and throwing unjustified doggy doo doo in the hope it will stick.....

Keynesian economics would have actually been applying brakes far earlier to the bubble (by saving for a rainy day)...the brakes should have been applied a decade ago at least, they were not instead they were porked laissez faire /Greenspan style.....'

Keyneasin was not a proponent of a centrally controlled economy, again you label Keynes with something that isnt true....and also Im not for a centrally controlled economy either (aka stalin or the loony left), at least to the degree you think I am...

Hyper-inflationary, this for me shows you up as being clueless. We are heading for a depression and deflation worse than the Great Depression or at least on a par.....but go ahead and place your money/assets on that bet of hyper0inflation....Im the opposite, lets see who survives the soon to be seen and felt outcome of the not-keynesian economic policies.....

regards

I would wager you a $1000 about what type of flation we might have in 5 years, but if I was right it wouldn't be worth anything, and if you were right I would be very poor.

You asked me to stop miss-labeling your views, sure, but please acknowlege one thing for me, Alan Greenspan is not a Libertarian, for if he was he would of shut the fed down pronto.

Sure he studdied Ayn Rand and had positive views on the gold standard at one time, but to say he is Liberterian is like labeling the pope a budest.

I suggest most liberterians believe in allowing the free market to set the value of money, ie no central bank.

Keynes was very much in favor of centeraled controlled money, and a managed economy, you say as much in the 5th paragraph above.

-bb

#10 brilliant....

LOL

regards

#4. "A statesman thinks about the next generation; a politician thinks about the next election". If there is ever going to be a time for John Key to turn into a statesman, it will be on the 27th November 2011.

A Banker thinks about sucking the life out everything living, hence the name "Giant Vampire Squid". Just remember who his friends are, and what his background is. The black budget was a giant black hole, and a sideways bailout for the insurance companies. Every dog has its day and NZ will not escape the debt trap.

Giant vampire squid bottom pic

http://www.zerohedge.com/contributed/visual-combat-daily-101511-99999999999999

Well.....Nick don't go holding your breath on that now....!

Frankly, I'd rather kiss a Frog and await the outcome.... than kiss an Ass and expect a similar result.

Steady on there Christov....im pretty picky about who I pucker up with.....

So noted Kermie...but I'd still wager you'd have more chance of pulling that little feat of magic than John Boy would have of passing a basic lie detector test.

Did I ever tell you that under Donald Trumps Quaff there is a large green frog.....Once when a stiff wind pulled back his orange mane,.... one of his close aides stood in horror and said "what the F%#k is that....?"

The Frog said ..."I dunno,it started out as a wart on my ass"

The odds are not good....

regards

Ambrose on the Eu

http://www.telegraph.co.uk/finance/financialcrisis/8830553/Lack-of-ECB-…

a commenter 3rd from top

Two avenues to explore that are similar to his mess are New Foundland and Scotland, where both lost their sovereignty over problems with massive debt. There are ways, and then there are ways.........Debt is the economy killer.

In the recent book --This Time is Different: Eight

Centuries of Financial Folly-- by Carmen M. Reinhart and Kenneth Rogoff there are comments about debt and cleptocracy and the fallacies of spending.

No nation has ever spent its way out of debt.

Another informative read is:

Here is some info on the Argentinean default:

The Argentinean default in 2002: Argentina defaulted on part of its external debt at the beginning of 2002. Foreign investment fled the country, and capital flow towards Argentina ceased almost completely. Argentina was "left out of the world." The currency exchange rate (formerly a fixed 1-to-1 parity between the Argentine peso and the U.S. dollar) was floated, and the peso devalued quickly, producing massive inflation. —Wikipedia

We know from reading Niall Ferguson’s excellent book The

Ascent of Money by Niall Ferguson’ that Argentina ran out

of money on Friday 28 April, 1989. The World Bank refused to put any more

money and accused the country of not controlling its deficits

and the printing of money forced inflation to rise to more

than 100% per month. The national debt was denominated

in dollars and soared in relation to the inflating austral.

Changes in currency did not help. There were three bailouts

by the International Monetary Fund, the IMF. Later the

bondholders were clipped down to 35 cents per dollar of

debt. By 1994 the debt reached 64% of the GDP.

This mess ended in default.

and number 1

union”, meaning extra EU powers to police budgets and punish EMU violators.

It does not mean a debt-pool, eurobonds, or shared tax and spending."

The quid pro quo for sovereign states to hand over control of their taxpayer's money and how it is spent to the Brussels Reichstag is, as Mr. Schauble well knows, debt-pooling and eurobonds.

Mr. Schauble dissembles yet again by trying to separate fiscal control from debt pooling. He is like the Wizard of Oz frantically pulling the levers behind the curtain, lying to the Bundestag, the German Constitutional Court, and the German people about the direction he is actually going in - he will make all Germans tax slaves to the rest of Europe and simultaneously say that he has done no such thing.

When will someone pull back the curtains and expose this charlatan?

Jonathan

The fish-hook with IMF loans is that they are called "special loans" an as such when the MSM uses words like haircut, they don't include haircuts on "special loans" these loans you cannot default on and must be paid. The world bank and ECB also in most cases issue "special loans" althoug I'm not sure if all ECB loans to greece were "special loans".

So when the word haircut is used it means non IMF/ECB loans which in Greece means 3 types of bondholders.

- Pension Funds (aka taxpayers)

- Greek Banks (which will become undercapitilised and hence need a bailout aka taxpayers)

- Foreign Banks (which could also require a bailout aka taxpayers)

So as you can see the taxpayer is in the firing line whatever way you spin it.

http://www.oftwominds.com/blogoct11/euro-doomed10-11.html

Erasing debt also erases assets. But if the debt can never be paid, then the asset has already ceased to exist in every way but a bogus accounting entry.

You're on to it as usual AJ. Unrepayable/unserviceable isn't worth the paper it's (not) printed on. The banks are holding it at face value in the biggest game of "let's pretend" in human history.

#6 - Spoke to our accountant re the change in gifting law. They said that in their practice (majority rural) clients are enquiring about the changes, but those (who are the majority in their practice) that set their trusts up for asset protection/sucession reasons rather than tax reasons are choosing not to gift everything over.

Now the talk is 7 trillion to save Europe

Europe's lost decade as $7 trillion loan crunch looms Europe’s banks face a $7 trillion lending contraction to bring their balance sheets in line with the US and Japan, threatening to trap the region in a credit crunch and chronic depression for a decade.

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/88300…

7Trillion sounds about right.....so pigs might fly......bearing in mind I dont think they have got to 500billion yet.

Plus I can so see Ireland for instance accepting the Greeks being allowed a 50% haircut but not them......or the Spanish, portugese or italians...then there is eastern europe....

They are fools if they think it can now be contained, 3 years ago, yes maybe.....now its looking like a killing field......only the stupid go in.....

regards

And here is the news.....idiots expected something different!

"German Chancellor Angela Merkel has made it clear that “dreams that are taking hold again now that with this package everything will be solved and everything will be over on Monday won’t be able to be fulfilled,” Steffen Seibert, Merkel’s chief spokesman, said at a briefing in Berlin today. The search for an end to the crisis “surely extends well into next year.”

For "next year" read later this century!

Meantime down here at the bottom of the planet the pollies are at the bottom of their bag of tricks..what did they find?.....a hole !

Not any old hole you understand...this hole is covered in tarlike oil thanks to pisspoor maritime nz foresight on matters concerning maritime disasters coming to a backyard near you. No radar systems in place at ports and especially not in the areas most likely to suffer from a major navigational act of drunken stupidity...welcome to the unprepared and who gives a shite nz.

The outcome.....expect maritime nz management to receive huge salary increases to reward them for doing so well.

So far this century the record includes:

1. Exposure of two decades of govt and building sector rotting filth with tens of thousands of shoddy shit turning to fungus spores promising to damage the same number of lives and cost billions to tart up.

2. Exposure of decades of pisspoor govt and local govt earthquake safety standards combined with good old Kiwi 'she'll be right' engineering and construction standards that has cost the lives of nearly 200 people.....not to mention the prospect that the uselessness will carry on 'as is' because thousands of piles of shit remain 'standing' all over the country ready to crush people in even a moderate shake.

3.Exposure of a poorly prepared grossly inadequate maritime nz system to prevent a major pollution event in pristine waters, with the promise that it will take decades to clean up and bring to an end the claim the nz is 100% pure....

anyone care to guess what's next?

One for the conspiracy theorists amongst us -

“We’re concerned, because usually at this time, you see this peak,” said Richard D. Steinke, the executive director of the Port of Long Beach in California. “We haven’t seen it.”

International shipping down. "The Rena's well insured....surplus to requirments..lets park her on some rocks at the bottom of the Pacific"

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.