Here's my Top 10 links from around the Internet at 9 pm in association with NZ Mint.

I welcome your additions in the comments below or via email tobernard.hickey@interest.co.nz.

I'll pop the extras into the comment stream. See all previous Top 10s here.

Sorry it's so late today. I'm in Wellington with Alex covering PREFU etc. Went to the parade in Auckland yesterday. I personally told Stephen Donald I was sorry I ever doubted him. He looked at me funny, smiled, waved and then gave me the fingers. Or maybe it was a victory sign. (When I say personally told, I mean I muttered under my breath while 300 people around me cheered 'Beaver, Beaver, Beaver')

1. More debt to solve a problem of too much debt - The deck chair shuffling is continuing in Europe.

The Telegraph's Louise Armitstead reports German Chancellor Angela Merkel is now begging her own parliament to accept a 'big bazooka' fund to bail out Southern European governments that does not use German money or the European Central Bank.

Brilliant.

Instead it will be a special purpose vehicle or a special fund that guarantees buyers of bonds against losses and encourages other sovereign wealth funds to lend to this fund to buy other bonds.

Eseentially the big bazooka is an off balance sheet vehicle that is leveraged up to buy other debt.

Off balance sheet bond insurance schemes have a chequered history... I think Angela needs to have a chat to the folks who used to run Lehman Bros and AIG.

Why does anyone believe a problem of too much debt can be solved with more debt?

The German Chancellor, who must secure the Bundestag's approval before European bail-out plans can proceed, briefed politicians on plans to increase the firepower of the European Finance Stability Facility (EFSF) from €440bn (£383bn) to more than €1 trillion.

She assured them that Germany would not have to stump up more cash because financial engineering would be used to boost the bail-out fund.

Eurozone countries are discussing two methods to boost the EFSF: a special-purpose fund to buy troubled bonds and/or another fund that would guarantee bondholder losses.

On the other key areas that leaders have to agree on Tuesday, there was continued wrangling over the writedowns private bondholders will have to take on Greek debt and the extent of the bank recapitalisation programme.

2. It's a great idea for a SPIV - Seriously. Here's how Reuters described the idea for the specially turbo-charged fund. I learned a long time never to buy turbo-charged cars. Their engines blow and their resale value plummets.

The euro zone wants to boost the firepower of its 440 billion euro bailout fund without putting more money into it.

The euro zone should combine two proposals for increasing the firepower of its rescue fund -- an insurance model and a special purpose investment vehicle (SPIV) -- according to an EU paper for the mid-week summit obtained by Reuters on Monday.

The paper said neither option would require politically-difficult changes to the existing European Financial Stability Facility (EFSF), which has been approved by national parliaments after some problematic debates.

3. Here's an idea - Just in case anyone thinks I only refer to nutty ideas from crazy lefties, here's one from the current executive director of financial stability at the Bank of England, Andrew Haldane, who has said bankers should be paid on the value of the assets they manage, rather than the profits they make from them.

Here's the thinking via The Telegraph:

The near ten-fold rise in bank chief executives' pay from an average of $2.4m (£1.5m) in 1989 to $26m by 2007 could have been restrained to $3.4m if pay had been linked to the return made on assets said Andrew Haldane, executive director of the Bank.

Mr Haldane said the return on equity targets employed by most banks had warped the industry's compensation structure and led to a situation where the average pay of top executives had risen to 500 times the median US household income.

"It would be a relatively small step for banks to switch from ROE [return on equity] to ROA [return on assets] targets in their capital planning and compensation. Yet the effects on risk-taking and remuneration could be large," said Mr Haldane, speaking at the Wincott Annual Memorial Lecture in London on Monday. He said that while the rewards for bankers had been "kept privately", the risks had been "widely spread socially".

4. The amazing Olympus story - This one has been brewing in Japan for a few weeks and is a cracker.

A big brand, Olympus, appears to have paid some shady characters hundreds of millions for something...ie The Yakuza

When the British CEO of Olympus blew the whistle on his Japanese board, he was sacked for 'cultural insensitivity'. The share price fell 45% and now all hell has broken loose. Here's the Reuters version.

Here's William Pesek at Bloomberg

Japan’s corporate culture of denial, of ignoring problems and letting them fester, keeps running up against a globalized world that values agility, innovation and transparency. Olympus demonstrates all too painfully how much Old Japan tolerates a lack of accountability among senior executives; inadequate disclosure; a disinclination to challenge authority and absolute deference to corporate boards regardless of share performance.

The inadequacies of Japan’s corporate-governance system deserve scrutiny. Boards in Japan get less heat, partly because executives aren’t paid as obscenely as American ones. Shareholders assume directors are smart, devoted people working for the good of Japan Inc. Tough questions are rarely asked.

5. Too right - Stuff reports a strategist at Investec, Michael Power, has warned Bill English that he has to do something about our over valued exchange rate or we'll suffer a particularly Kiwi version of Dutch Disease. It's a bit late for that...

Power said the central bank "needs to think a little bit harder" about whether it should stay out of the way.

"This sort of hands up in the air, let the chips fall where they may, and let the currency fall where it will, is actually very, very short-term, benign, neglect."

Power argued that resource rich countries should use sovereign wealth funds to intervene in the currency markets, buying foreign currency to cope with future problems, which would help weaken the dollar.

Otherwise New Zealand would face problems similar to those of the Netherlands in the 1970s, which boomed as gas supplies provided an alternative fuel during the oil crisis, sending the currency soaring and leading to the "Dutch disease" of free spending as industry was eroded.

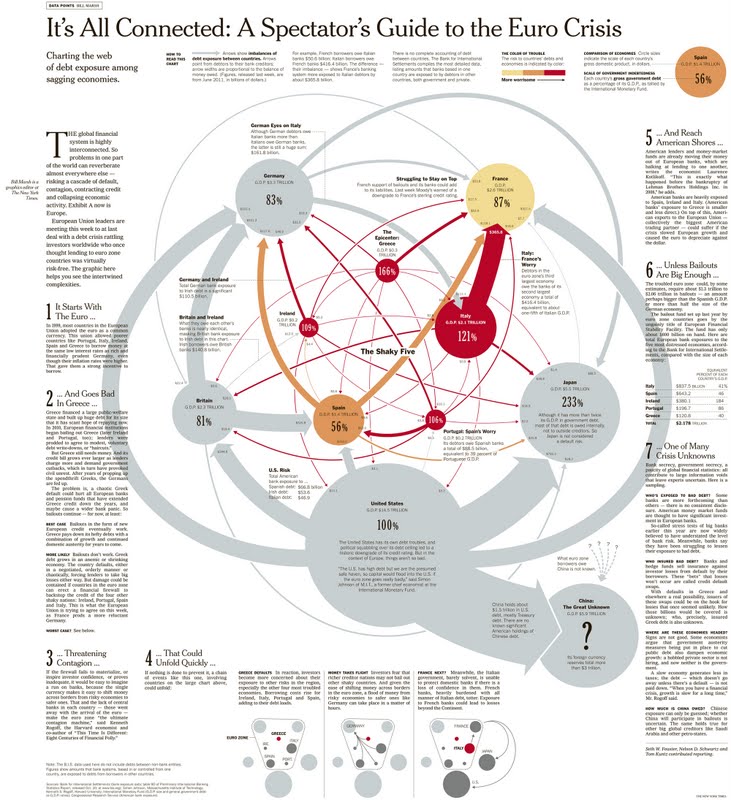

6. Interconnections - Here's a cracking graphic at the New York Times showing the interconnections in the European crisis.

Click on the image for a bigger more readable version.

7. Maybe default is the answer - Here's an academic paper saying that Argentina's sovereign default in 2001 was actually a great thing for the economy. HT Yves Smith at Naked Capitalism.

The paper makes the point that losing foreign investors and creditors is not always a disaster. Iceland's remarkable recovery suggests something similar.

As a result of the default, and the refusal of a minority of creditors to accept the eventual restructuring agreement in 2005, and subsequent legal action by these creditors and “vulture funds,” Argentina has faced difficulties borrowing in international financial markets over the last nine years. Since it has not been able to settle its debt with the government creditors of the Paris Club, it has also been denied some export credits. FDI has remained limited, averaging about 1.7 percent of GDP over the past eight years, with a number of serious legal actions taken by investors against the government.

Yet in spite of all of these adverse external conditions that Argentina faced during the past nine years, the country experienced this remarkable economic growth. This should give pause to those who argue, as is quite common in the business press, that pursuing policies that please bond markets and international investors, as well as attracting FDI, should be the most important policy priorities for any developing country government. While FDI can clearly play an important role in promoting growth through a variety of mechanisms, and foreign capital in general can, in some circumstances, boost growth by supplementing domestic savings, Argentina’s success suggests that these capital inflows are not necessarily as essential as is commonly believed. And it also suggests that macroeconomic policy may be more important that is generally recognized.

8. The secretive and huge world of commodity traders - Joshua Schneyer does a nice job at Reuters of exposing the enormously wealthy and well paid commodity traders at a few mostly Swiss-based companies that trade the world's commodities. HT Greg.

Here's some detail:

They form an exclusive group, whose loosely regulated members are often based in such tax havens as Switzerland. Together, they are worth over a trillion dollars in annual revenue and control more than half the world's freely traded commodities. The top five piled up $629 billion in revenues last year, just below the global top five financial companies and more than the combined sales of leading players in tech or telecoms. Many amass speculative positions worth billions in raw goods, or hoard commodities in warehouses and super-tankers during periods of tight supply.

U.S. and European regulators are cracking down on big banks and hedge funds that speculate in raw goods, but trading firms remain largely untouched. Many are unlisted or family run, and because they trade physical goods are largely impervious to financial regulators.

How big are the biggest trading houses? Put it this way: two of them, Vitol and Trafigura, sold a combined 8.1 million barrels a day of oil last year. That's equal to the combined oil exports of Saudi Arabia and Venezuela. Or this: Glencore in 2010 controlled 55 percent of the world's traded zinc market, and 36 percent of that for copper. Or this: publicity-shy Vitol's sales of $195 billion in 2010 were twice those at Apple Inc.

9. Suspended - China's NTDTV reports China's Ministry of Railways has suspended work on 6,000 miles of railways and many of the six million migrant workers on the projects have gone unpaid for months because of a funding squeeze. HT Macrobusiness.

10. Totally irrelevant Jon Stewart video on Rick Perry's nipple and why Eric Cantor is scared of the public. It made me laugh.

28 Comments

why on earth is the worlds economy in the poo.I was told that if we won the rwc then

unemployment would end

the sick would be healed

and the dead would rise.

Methinks we have been hoodwinked.

hey ngakonui if the dead did rise that would negatively impact the employment figures, which i think we should avoid.

if it did happen, i would take a long position on braaaaaaaains

I enjoyed the New York Times graphic. Based on their colour to risk relationship, I might have made Germany a bit darker colour than the US. I thought the most recent article by Paul Krugman had a nice take on the Euro Crisis: http://www.nytimes.com/2011/10/24/opinion/the-hole-in-europes-bucket.html

Nicely put with,

"The broader problem, however, is that the whole euro system was designed to fight the last economic war. It’s a Maginot Line built to prevent a replay of the 1970s, which is worse than useless when the real danger is a replay of the 1930s."

regards

#5 so true, still they only make a small group of people so have limited votes to offer regardless of their contribution.

#6 Best ive seen yet

#8 Wife is good friends with a couple overseas, he is a CEO in a large company in the US, she works a commodity trading house. He goes on how he makes no money like her..she is earning mutiple time what he can earn and it is a family business...

The PREFU says that there is a one in five chance of NZ doing worse that their rosy outlook. Reportedly, Bill English is not worried. All NZ needs is a Christchurch rebuild and commodity prices to stay up.

I'd have much more faith in the Treasury predictions if they had printed their bets for the World cup final (before Sunday!)

If you are on the ground and understand how a lot of the commercial insurance outcomes are writtern.......combined with the nature of the event is expected to play out..... you do wonder if they understand the weighing of risk with respect to the Christchurch rebuild.

Concerning commodity prices it is harder to forecast however I follow the money and wonder can there be much much more upside.

Delayed proofreading.... 'than their rosy outlook', not 'that'

Number 1

Come on Bernard. You can do better than that. Why not go for the jugular. Very astute though. A Euro version of AIG. Off-balance-sheet stuff (here we go again). How long have they been hiding this stuff. How much of it is there. It's too big. They're too scared to tell the proles. It'll frighten the lemmings. And Geithner has already told her how to do it, and for goodness sake, whatever you do, don't scare the lemmings.

What this is saying is the de-leveraging isn't over. In fact it hasn't begun. After four years of safety-nets and bail-outs, and postponements, the "political elites" have finally woken up to the fact the "financial elites" gave them a hospital pass of massive proportions, suckered them, but the problem is so big the politicos don't have the skill or the know-how to solve it. And their solution is the AIG solution? Phew.

Number 1

Who are the banks. Who are the shareholders? Who are the REAL beneficiaries of this.

This is a sophisticated modern-day protection racket. Once upon a time the crime syndicates were into boot-legging, numbers rackets, prostitution, drugs and protection. Then in the 1970s they went legit, buying up legitimate businesses and laundering their illegal money through those genuine businesses. And what better business than a bank. The modern day version is the banksters send their muscle round to the "politcal elites" and demand protection money from them, and if the protection money is not ponied up, they, the banksters, will pull the pin and bring the world to a grinding halt.

yeah they were forced to takes Timmy advice LOL

Would still like to know who these private banks are.

Sarkozy said after the marathon negotiating session the leaders had reached agreement with Private Banks on a "voluntary" 50 per cent reduction of Greece's debt in the hands of private investors.

The remainder after the haircut is to be guaranteed is still a lot of money.

The real beneficiaries, with Bank of America as the example:

Total Reported Assets = $2.261 trillion

Liabilities to depositors = $1.038 trillion

Liability to securities obligated to repurchase = $239 billion

Liability to trading account/derivatives = $129 billion

Liability to accured expenses = $155 billion

Total Liabilities so far = $1.561 trillion

The remaining 31% of Bank of Americas liabilities are obligations to bondholders and the equity of it's shareholders.

NZ economy awakes to the next chaotic example of poor planning...what a GAS.

In a liquidity trap - Tripling the monetary base is and has not been inflationary.

"I’m glad to see some people noticing that those of us who have taken the basic theory of the liquidity trap seriously have done very well at calling the economy these past three years. This was big stuff: predicting that a tripling of the monetary base would not be inflationary, that deficits exceeding a trillion dollars a year wouldn’t drive up interest rates. In a rational world, the way things have panned out would add a lot of credibility."

http://krugman.blogs.nytimes.com/2011/10/24/praise-is-always-welcome/

So this lays out why I dont agree with banksterbasher? et al.

regards

That is pretty much spot on overall, though there has definitely been price inflation in some areas. I think this is mostly caused by businesses taking advantage of a crisis (where they have a monopoly) and other businesses facing a choice of increase prices (and hope) or end up bankrupt. Some of it might be due to increased commodity speculation as well.

Good luck convincing the public of this however, they are used to the CPI meaning of inflation where (most) wages go up, house prices go up, profits go up, but everything else stays in 0-2%. But now (most) wages are flat, house prices are flat or falling and everything else appears to be going up. No wonder people are confused.

Of course in the longest term this is going to be inflationary, because it's repairing (or trying) to repair a system where almost all money is created as a debt. This is the primary driver of inflation so once the economy escapes the liquidity trap and recovers then we can expect to see eventually 4%-6% year on year inflation again. So the Austrians will eventually be right again of course, but you shouldn't give people like Peter Schiff more credit than due. He might have picked the crisis, but he's not the messiah, he's a very naughty boy.

Paul Krugman gets an award for realising that there was a crisis and that economics didn't see it coming and this means there is a problem with economics. In that sense he is quite open, but hardly laudable. I have been pretty suspicious of him since I saw his lectures to the LSE where he used several ideas which Steve Keen has highlighted to be completely flawed. Krugman is still in neo-classical la, la land as far as I can see. I have never seen him admit anywhere that fraud actually happens.

#1 I cant believe how porky that is.....If this is the best Merkel can come up with, which is a downright lie to the German ppl and indeed the EU she should be kicked out........This is really Greece and GS all over again except its now the EU she's gambling with and not "just" Greece.

Conclusion, every pro investor out there must see how stupid this is to get caught when the musical chairs game stops.....in the meantime its make a lot of money....FFS just accept the coming Depression.....its done and dusted anyway.

regards

Finally the brain comes up with the image....rats trapped in a hole with a big hungry Python and a Cobra at the bottom...watch them rats climb over each other to escape the squeeze and the fangs.

#2 - Turbo-charged cars, Ive had and built some.......water cooled 500 hp vw bettle anyone? 650hp Datsun 240Z? Also a 230hp real Ur-Quattro.....never had an issue with them. Some simple rules, let them warm gently for the first 5~10km minimum, use synthetic mobile1 oil and good plugs and change them every 12months and watch them for oil and water leaks like a hawk....turbos are very hot....its just taking care.

regards

#7 Argentina - PK has a few lines.

http://krugman.blogs.nytimes.com/2011/10/24/unacceptable-success/

This is yet another reason I consider the right to be voodoo economics....performance in getting predictions right...

Come back when you can show real world correct results...

regards

#1 Reality is unavoidable, you can try and put this off for years, and years, preventing the next lehman. Someone will trip up, and "financial engineering" will be reveald as the disaster it really is. Any engineer worth his salt, knows that to build a complex structure you need high grade materials and a solid foundation. School kids know this, so obvious, I am confident that S will HTF, and big time. The weakest link will break, and once the dust clears we will see who's labour has value, and who's labour is worthless. Currently the productive sector is being punished by the destructive/speculative sector, tides turn, night becomes day, you can't hold back reality.

The economy was built on a shaky foundation, now engineers are trying to make it bigger and even more unstable. What they should be doing is looking at the foundation, and working out the cost of repairs, or if it is even worth fixing. "Financial engineers" What a joke.

Leverage is a two edeged sword - Warren Buffet.

#3 What exactly is a bank asset? Thats right debt, so incentivising managers by rewarding them for increasing assets makes for an even worse situation then we are currently in. The banking sector has never created value, they just destroy value. How much is that worth?

Wait till it becomes time to repay all our overseas debt, then watch as the NZD returns to intrinsic value. Who will be calling for a lower exchange rate when it comes time to pay the piper?

#7 If I have learnt anything from the GFC, it's that noone cares about the country or economy, its all about saving investors.

#8 Is brilliant, lazzis fair, free market, capitilism, how does the end game look? 0.00001% using thier wealth to f the poor.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.