Here's my Top 10 links from around the Internet at 10 am today.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #3 on the problems China faces restructuring its economy while engineering a soft landing. It's the economic equivalent of walking, chewing gum and juggling chainsaws at the same time. Messy.

1. Detroit bankrupt - The big news in America this morning is the city of Detroit filing for Chapter 9 bankruptcy protection.

This is the largest ever municipal bankruptcy filing in US history.

It's hard to believe this city was once called the 'Arsenal of Democracy' because it built many of the tanks and planes that helped the Allies win the war, and was the centre of America's once-dominant motor industry (not to mentin.

It almost went bankrupt a few years ago.

About 1.1 million people have left the city since 1950 and it has 78,000 empty buildings.

Here's the Reuters article on the news, including how city workers' pension funds are likely to be among the biggest losers as creditors get their hair cut.

And Here's a useful backgrounder from WaPo's Wonkblog on why it happened.

2. Keep an eye on Greece - The problems are brewing there again after a year or so of relative calm. Germany's Finance Minister has just visited and told the Greeks to stop whingeing and pay up. This did not go down well, as Reuters reports.

Wolfgang Schaeuble's motorcade drove through empty streets cordoned off by thousands of riot policemen and devoid of any protesters. It was his first trip to Greece since its debt problems kindled the euro zone crisis four years ago.

Unlike during German Chancellor Angela Merkel's visit last October when thousands defied a similar ban on protests, there were virtually no demonstrators to greet Schaeuble apart from a group of about eight women who shouted "Nazi, Nazi" and "Raus!" (out!) outside the finance ministry.

What we’ve seen recently appears to be the beginnings of the undoings of the most important current tool for both driving growth and creating imbalance — liquidity and credit. To explain why, let’s go back to the beginning of the imbalance/slowdown argument.

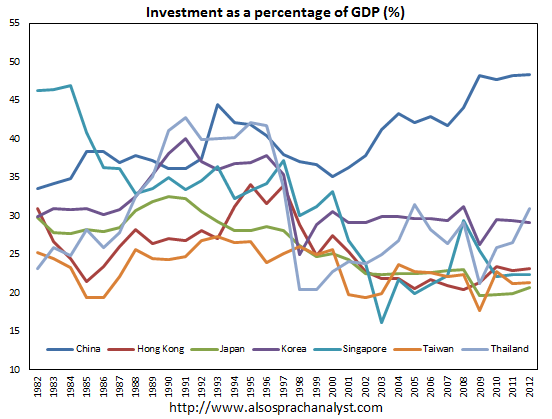

For this, we at FT AV (and increasingly, everyone else too) like to use Michael Pettis’ analysis, which is based around the economy’s ratio of investment and consumption. The investment share of China’s GDP jumped from a extremely high 42 per cent in 2007 to an absolutely amazing 48 per cent in 2010. To understand why this is an amazing, and extremely precarious, level, read Martin’s column or see Pettis himself here and here. In short, it’s unprecedented and unsustainable.

4. 500 protests a day - You hardly ever hear about them, but there are around 500 protests a day inside China. What happens when an economic downturn puts even more pressure on its political environment?

Here's the Atlantic with its thoughts, albeit from a few months ago.

It's difficult to say how many of China's demonstrations are "within-system" like those in Liaoyang or Wukan, and it's impossible to say whether 2012's protests will keep the trend or if they will turn against the Party. But many of the factors likely preventing protests from going further -- perceived legitimacy of the Communist Party for the breakneck economic growth they help create, the continued availability of enough jobs and opportunities to keep individuals wary of risking too much for lofty ideals, and the ability of CCP leadership to keep its officials working generally within the public interest -- could be at risk if growth stalls.

Right now, the economic interests of the Party leadership, local officials and industry cronies, and Chinese citizenry generally line up. It's far from equitable, but it's enough to keep the three groups working in something close enough to unison to maintain political stability. But as the Chinese economy changes, so might that three-party balance.

As the national leadership knows, it will have to begin shifting the Chinese economy from exports to domestic consumption -- in other words, it will have to retool its economy to sell to Chinese as well as to wealthier foreigners. That could pit the Communist Party against some of the Chinese firms and individuals who have been enriched (and have entrenched their influence accordingly) by three decades of export-led growth. It's not clear whether CCP will be able to take on these Chinese economic interests. Some economists, such as Nouriel Roubini, are warning that China's leadership may not be politically capable of making the necessary economic changes, and that their failure could drastically slow the country's growth. If that happens, there's no telling whether China's "within-system" protests would stay that way.

5. 'Shockingly complacent' - Ambrose Evans Pritchard has lobbed another incendiary into the mix on China's growth slowdown and a warning from the IMF about China's credit growth. The chart below is downright scary.

If you think China's Communist Party fully understands the mess it has created by ramping credit to 200pc of GDP and running the greatest investment bubble know to man, read its shockingly complacent response to warnings from the International Monetary Fund.The deeper thrust of the IMF report is that the growth model of the past 30 years is exhausted. The low-hanging fruit has been picked. If the Communist Party fails to take radical action, it will soon be caught in the middle income trap.

Charlene Chu at Fitch has a slightly higher credit ratio because she includes a broader range of shadow banking, but the IMF paints much the same picture. Loans have jumped from $9 trillion to $23 trillion since 2008, a faster pace of debt build-up than in any major episode of the past century.

6. Here's the actual IMF report on China - Just for balance's sake. The bolding is mine.

Citing the rapid expansion of credit, the report cautions that while the development of nontraditional finance in the form of trust and securities companies marks a shift to more market-based intermediation, the migration of activity to less regulated parts of the system poses risks to financial stability. Banks remain closely linked to the development of nontraditional finance. The report noted that any worsening of credit quality related to the boom in nontraditional finance could potentially lead to a credit crunch and a large fiscal burden.

“While the size of augmented government debt and overall government resources suggests that fiscal challenges are currently manageable, further rapid growth of financial sector exposures to LGFVs would increase the risk of an eventual disorderly adjustment,” said Markus Rodlauer, the IMF’s mission chief for China.

7. Exporting to Australia? - BNZ's economists are forecasting the New Zealand dollar will rise to 88.5 Australian cents by the end of the year. Just a heads up to exporters, and holiday planners ;)

Relative interest rates – the most important driver of the cross – continue to swing in the NZD’s favour. NZ-AU 2- year swap differentials have moved from -35bps in April to +35bps. We expect the yawning contrast between the respective policy outlooks of the RBA and RBNZ to produce further widening over the coming months. Our interest rate strategists expect the 2-year spread to be closer to +60bps by year end. Historically, spreads at these levels have tended to coincide with a NZD/AUD somewhere in the 0.8600-0.8800 range.

8. A long term fiscal calculator - Victoria University have come up with a great interactive tool that allows you to 'choose' the tax rates, NZ Super rates and social spending you want for New Zealand in the decades to come to close the current Long Term Fiscal gap, and then see what happens.

I had a play with it and chose to extend the retirement age to 67, impose a 1% land tax, disconnect NZ Super from the current 66% level of average wages level by just indexing it to average wage and price inflation, and allow fiscal drag to keep happening for income tax. That closed the gap without too much drama. No reduction in NZ Super payments, no crunch on education or health spending, and no increase in income tax rates.

Politically easy peasy. So why won't our baby-boomer politicians do it?

9. Inside Elon Musk's hyperloop - Theverge reports the man behind Tesla wants to create a 'hyper-loop' that would allow commuters to travel in a apparently frictionless vacuum-type tube at 600 mph from San Francisco to Los Angeles in 30 minutes. Cool. And Sucky at the same time.

The problem could be solved by sucking all the air out of the tube and leaving the cars to travel through a vacuum. "If you have a vacuum in a tube, then you have zero drag," says George Maise, fluid dynamics expert at Maglev 2000. "There's no limit on the speed, really." Musk is on record saying that the Hyperloop isn't a vacuum, but keeping a column of air traveling at nearly supersonic speeds would require a huge amount of energy to maintain — unlikely, for the kind of lightweight, solar-powered transport Musk has described. It's a puzzle, and one we're unlikely to have any firm answers for before August.

57 Comments

Trans-Pacific Partnership Agreement (TPPA) about to take place in Malaysia.

How will this affect NZ minimal wages??????????????

http://www.nakedcapitalism.com/2013/07/how-the-transpacific-partnership-...

Ulysses says:

July 18, 2013 at 11:16 am

Yes. One point not emphasized in this article is that the TPP will make it possible to challenge wage laws and other labor protections. Does Bangladesh allow a minimum wage of less than $2.50/day? Then the U.S. can be sued and forced to pay damages for presuming to maintain a minimum wage of > $7/hour. This is why President Obama’s call for raising the minimum to $9 is a completely bs attempt at covering up the fact that the TPP his administration is pushing will devastate the living standards of working Americans. The whole thing is a race to the bottom!

Here is another warning:

TPP Secret Trade Agreement Puts International Tribunal Above U.S. LawRE: #1 - including how city workers' pension funds are likely to be among the biggest losers as creditors get their hair cut.

Are you sure? - Of course, what the rest of the unsuspecting US citizenry is likely unaware of yet is that once again the municipal workers' pension plans (that face 90% losses) will be bailed-out via the Pension Benefits Guaranty Corporation (PBGC) - A US Government (ponzi) Agency. But of course, that's for the good of the whole nation... Read more

Actions taken for the "greater good" guarantee universal bankruptcy.

Rinse and repeat in places like spain as well apparantly. ie lots of state/public service pension funds are heavily into Govn and local govn debt. This is sure getting interesting....we are so recovering!

yeah right

regards

#1 - anyone who's read Mish over the years won't be at all surprised. And MoM noted years back appropos of Federal Gubmint that

"The government could confiscate all of the Walmart fortune, Bill Gates' considerable trove and knock off ol' Buffet as well, and it still wouldn't come up with enough money to cover the increase in government entitlement programs plus the new health care subsidy for ONE YEAR."

#8 follows on from the No'Mo'Mo'town meme - this leetle cube model is a good way to edumicate the masses - if the groundswell of 'someones gotta Do sumpfink' gets noisy enough, the politics will follow. Those who expect pollies to turn on a dime and recant their affirmations of the One True Faith, are in for a long wait, otherwise.

#9 - Mr Musk has clearly been reading Jasper Fforde, to whose Gravitube the Musk-Suck bears more than a passing resemblance....

#1 didnt philbest say detroit was booming or something?

Affordable perhaps? Must be a good medium multiplier there.

#8 Have had a look at the VUW tool. It is a useful way of looking at how various expenditure items impact on future deficits. I wonder if the outcomes from the tax proposals are very accurate. Worth having a look at Deningers latest piece over at Market Ticker about the Detroit situation on the impact of changes in tax rates.

What about different growth rates? PDK might be right about the world as whole being stuffed if it is depending on exponential growth but our little south seas raft probably could become more prosperous given the right policy mix and some luck. That is what National is depending on to solve the pension problem. Same with population growth. What are the outcomes of different population policies?

JP Morgan accused of doing an Enron

http://www.theatlanticwire.com/business/2013/07/heres-why-jp-morgan-bei…

and these of course are the ones found out about...

Really, forget the fines (well partially) start putting these guys in jail.

regards

#1: Apparantly one of the (many) reasons it went bust was due to being designed with cars in mind, massive sprawl, no good public transport, a city centre not worth visiting, the kind of place that isn't nice to live in. Phil and Hugh would have loved it. I'm sure house prices are cheap too ;)

Auto-City and Automobility - two concepts frequently advocated around here

The BBC has just done a retrospective on Detroit's bankruptcy.

Population shrinks by 50%. Or, how to kill a city.

(It said)

In the early 1900's the city had Trams and much public transport. When the automakers came to town they "paid" the city burghers to remove the trams, pull up the tracks, advocating freeways.

They interviewed one person who lived 14 miles from his job, and, using public transport to get from home to work and return was a 5 hour journey.

Paul Krugman likes your thinking JJ. Over here PK compares the fortunes of Detroit and Philadelphia musing that the physical structures of the two cities may have something to so with their different outcomes.

Of course Detroit City is not Detroit metro any more than Auckland City used to be Auckland before the SuperCity (TM).

Interesting, kind of contradicts HughP and philbest.....sprawl is best.

They seem to have gone quiet...

Cantabrians Unite seems to have disappeared off facebook, I would assume a severe breaking of fb rules...

regards

I think Detroit is unique and probably has more local factors than just the sprawl versus not sprawling issue.

A balanced approach to sprawl is probably best. Do not ignore amentities, do not put all your eggs in car based transport systems etc.

With all due respect PDK and Philbest are both extreme outliers in this debate and the solution is probably somewhere between them.

In general we do not understand the hierarchy of state, county, and incorporation that makes up the mosaic of US local government let alone who funds what bit of infrastructure and other local services. Each metro area will be unique in its geography so, while the PK piece is fun it's hardly definitive.

Looks like this one is about to explode in the econoblogosphere:

http://krugman.blogs.nytimes.com/2013/07/22/did-sprawl-kill-horatio-alger/

http://delong.typepad.com/sdj/2013/07/mobility-equality-geography.html#more

(the extended comment by Cynic appended to the deLong is worth reading for an alternative view)

PK graph looks quite weak to me. Take out San Francisco and Atlanta and look at the results. If you are relying on one or two results your statistical argument is weak.

Further two high density with supposedly high social mobility cities, San Francisco and LA both have high emigration of low to middle income workers, which doesn't seem to me as a good indication that people on the ground see those cities as places of opportunity. http://www.forbes.com/sites/trulia/2013/02/12/jobs-arent-leaving-california-for-texas-but-people-are/.

Probably this is just a political bun fight between the US right and left, with selective evidence from both sides to bolster their preconcieved politcal based viewpoints.

So you trust real estate agents?

"Trulia is an online residential real estate site for home buyers, sellers, renters and real estate professionals" which it looks like where the Forbes piece comes from.

As PK says look at the models....the right by and large dont have any....and their answers dont seem to stand repeated testing, ie like a stopped clock they are right twice a day.

In terms of you morfing the above PK model, well sure cherry picking works. Kind of interesting that no matter what some ppl put out, others will ignore it no matter what becaus eit dooesnt give them teh answers they just know are right.

As he does say however it raises as many Qs for a searching mind...so he's not forming a strong opinion....

regards

"So he's not forming a strong opinion".... Good advice on that evidence, the jury is still out : )

if you want to use "jury" well there would appear to be enough evidence on balance of probability to award civl damages in a civil case. But insufficient yet to send someone to jail on a criminal case.....shall we say.

It feels like you are betting against the odds....

regards

Except PDK uses the science and maths and philbest is purely libertarian type political...

Which on balance is likely to be correct? one that works to the laws of the Universe or one that doesnt? but simply wants it to be like he thinks it should be?

regards

Except PDK applies a global over use of non renewable resources to argue that NZ should power down, when in fact NZ has huge opportunities to develop renewable resources and adapt in a much more positive way.

Powering down Kiwidom is not the only option. We do not all have to retreat to our local version of the Kimogs.

While Philbest only sees car based transport as an economic option and goes very quiet when the discussion of infrastructure is raised. He does not comment on why NZ has such a low level of all types of transport infrastructure. What is the right mix of infrastructure. Who should pay for it etc.

Both PDK and Philbest are very rigid in their world views. The future for NZ in my opinion will be somewhere between these two extremes.

You still dont get it.....two things,

a) we are lucky in that we have more time than others, if the lifeboat doesnt get swamped or starved of resources as things like fuel get sold elsewhere and we cant compete due to price.

b) Husbanding what we have for future generations, the UK is mined out and almost drilled out, in 150 years it has nothing except too many ppl and too much debt, neither of which are saleable.

Compared to the rest of the world, eg UK, yes indeed we have the probability of not being anywhere as bad.

regards

Steven, I do not agree with your every pontification. So as you arrogantly say I don't get it.

But then maybe you are not all knowing and the future will be different in some ways than what you say...

I dont predict the future beyond saying what is clearly not possible from an engineering/maths view point. You on the other hand are really saying BAU with some small tweaks, not possible.

Not without a profound change of game play. We'd need a source of transport energy/fuel that is cheaper and quicker to deploy than fossil fuels, or at least no more than say $80USD a barrel equiv, or at worse EROEI of 10 to 1, and do the swap over at 4~8% per year every year from now on until the task is complete. That is decades of work and Trillions of dolalrs no one has.

This is why Im so "confident" that BAU isnt an option. We are not talking a one off 3% change but huge and profound change done in the "blink of an eye", with something we dont have....

Show me a solution to the above and then yes you can tweak to your hearts content and play with MUDs etc.....

You know I wouldnt dream of telling you how to deal with a mentally ill patient (and Ive worked in a MHU for 3 years, so I have an idea on how hard that is as a job). What I would tell you how to do safely and well is the engineering, then its up to you to, or not.

regards

Steven I am not suggesting BAU. I accept that ever increasing consumption of non-renewable resources is a physical impossibility. What I am arguing is that NZ at least has a chance to adapt. Or at least should try to adapt.

I may be a mental health nurse but I do have friends with Phd's in electrical engineering and they suggest that electricity production could be ramped up to replace the lost fossil fuel energy. They say their is a lot of disinformation about this. Some greenies have suggested that for instances without fossil fuels you couldn't make wind turbines. But when my friend did the numbers using electricity to run Glenbrook to make steel for a wind farm. The electricity required was only 3 months electrical production from the wind farm. That farm could run for 25 years before any blades etc needed major repair/replacement.

And that in NZ wind is not the easiest source of new renewalable energy -geothermal is.

What I think is that we need some combination of Philbest and PDK. Maybe we need less restrictions on new residential land, but maybe some restrictions on density/energy efficient housing. Maybe we need new transport infrastructure, but not all motorways, bus lanes, passenger rail, cycle ways good too. I still think PDK and Philbest are ouliers in this debate and we should try some middle way.

Hi,

Yes NZ has a chance to adapt, however it doesnt have a very big wndow to do so in.

This could take a long time....

The problem I have with specialists is they know a lot about a particular area and then try and do the same thing for areas they do not.

As someone said and I try and remember, an academic is a philistine in any area but his own expertese.

How do you get the electrical energy to convert to transport? Ive been quite vocal on us using trolley lines ie re-installing road trams, but not light rail. That only of course works with population density. So inside towns yes, a tram line to say Renwick from Blenheim? um....maybe not. Its scale and economic benefit. PDK says it a lot, traige....time will hurt do whats important first.

Look at the EROEI problem, for our present economic system to work we need an EROEI of 8 to 1 or better. So making hydrogen from electrical power is at best 1 to 1, so we need to get to the input to do the 8 to1.

In terms of wind turbines, you need to know the fossil fuel component into these and replace that with electrical energy. Copper for instance is now very dilute in terms of ore and usually driven out in huge catipillar trucks, that use deisel. How do you use electical power to replace? conveyor belts maybe?

Also silicon chips, probably essential to speed and output control of the wind turbines require a huge amount of energy and technology, all need a large and complex society/civilisation to make.

Solar panels? also a complex clean room technology, so yes indeed as a "greenie" I wonder (I dont rule it out) on the longivity of solar panels and wind turbines

25 years for blades? um not even a lifespan, hence I say peltic wheels and not solar power, they are still around 150 years later and are simple. think long term, 100 or more years. Now as a stop gap technology, yes maybe.

geothermal, yes a good way, but they also have a limited life I believe....even then there isnt that much.

And you go back to philbest again...a libertarian with no idea on math, engineering who rejects same, just does politics. On the one hand and someone doing math and engineering on the other....ICome up with a middle way, or balance, I wish (not that I want philb full stop) I cant see how you get a combination of the two....mutually exclusive IMHO. ie on the one hand with PDK we have physical laws and math, on the other? "how I want it to be and someone will do it for me" only we dont know what or who, does not compute IMHO.

and you go back to housing, moot....Now sure we need to change layout of what we have, but simple sprawl as per the US, no far more complex.

regards

good golly gosh - Trams - Trolley Buses

Auckland had trams until about 1955

Then they ripped out the tram-lines and killed off the trams, and introduced Trolley Buses - for about 10 years. Then Diesel came along and they ripped out all the overhead lines, killed off the trolley buses and introduced diesel buses - go anywhere - anytime

And diesel lasts for forever...

Steven I reply here to get a wider reply.

I see energy storage rather than production as a key difficulty post oil. The energy density of petrol is huge and am not sure we will ever find a battery that can store that much electricity in that little weight/volume. So electrical trolly buses and light weight electrical bicycles might be as good as it gets.

I see a limited role for biofuels for heavy duty operations that cannot be replaced -bulldozers etc.

We will have to adapt to the loss of some other key resources over time, say copper.

The big question is does NZ continue to produce agricultural products and trade it for industrial goods produced in cities overseas in a post oil world. Or does NZ produce agricultural products to trade for industrial goods produced in our cities. Is the whole of NZ a big agricultural hinterland for somewhere oversea or do we have lots of smaller agricultural hinterlands for our smaller cities here in New Zealand. I believe we would be better to aim for the latter but our history will incline us to the former.

Philbest is not just libertarian who comes from a particular economic/political viewpoint. He also has a very good understanding of history. To understand where we are in New Zealand you have to understand New Zealand's unique history. James Belich books are an excellent starting point.

The thing about the housing debate is as a country we cannot move on until we solve this problem. Economically we are stuck in a boom bust housing/consumption cycle, that has all sorts of implications for private debt levels, inequality, the braindrain, financial stabality, the exchange rate and the productive sector of the economy. People know this to a greater or lesser extent and hence housing has become a key political battle ground.

Bio-fuels, robbing peter to pay paul though, they are 1.2 to 1 EROEI, therefore we have to recover that loss from something else, but yes....bio-fuel from tallow is also possible, dont know its EROEI but its a by-product/waste product.

Trade is transport orientated, and making industrial goods energy intensive. For instance with current bunker fuel costs its cheaper to make things in the USA than make them in china and ship them over eg steel, some goods. So that is indeed a big Q, make it here? maybe so, thats good for unskilled and semi-skilled NZ jobs.

Who do we trade with? do we ship lamb straight to saudi for oil? I'd suggest so.

Ive not seen PhilB's history side, cant comment.

Housing is indeed a key political battleground, but really there are so many unknowns. For instance what is driving ownership up but not rents? PK showed another viewpoint, so its large and complex and simply not urban limits. Certianly I'd be worried on simply allowing "sprawl". The right sprawl however ie enough land to grow a houses food? thatmight be essential...so man unknowns.

regards

Steven I mentioned a limited role for biofuels because not sure what can fuel/power things like bulldozers post oil, or do we go back to Clydesdales? How do you clear a road after a flood/landslide, pull out a tree stump etc if you don't have diesel? I can see mass transit working without fossil fuels. But what about heavy machinery that needs to be mobile like bulldozers and tractors?

Housing does have many elements, Phil B and Hugh P have some solutions. I think they could work but wary they are backward looking to when oil was cheap. For most of Hughes life petrol was under $20 a barrel. So the solutions cannot be totally car dependent. But many of their ideas about urban areas being decentralised and prices of houses being lower so people can afford to relocate closer to where they need to be, work, family etc make sense.

I am surprised the Green party doesn't support Eco villages, where small urban areas can go outside MUL if they meet certain enviromental criteria, such as having enough land to grow food for a farmers market that can feed the village. Surely this would be more sustainable than isolated lifestyle blocks. Really is anyone thinking outside the square?

The divergence between rental price non inflation and house inflation is an Auckland phenenomen (which slightly annoys me because people talk about it as if it is NZ wide, NZ is more than Auckland!). Anyway it probably reflects the house crazy speculators that is Auckland.

I think trade wise we would be better off trying to replicate the success of Tait electronics for export and trying to produce as much as possible here in New Zealand. I am suspicious of how successful producing milk powder for China and welcoming Chinese tourists will be. But that is vision coming from Key. They see NZ as a giant farm. Auckland as chief point of entry for imports and where all the foreign companies will set up their local head offices. Wellington is our public sector organising town. While the rest of the country is either farming or supporting farming. Look at our sharemarket. The only new company is a Canterbury milk powder producer -Synlait.

So New Zealand has the potential to adapt well to a changing world but for whatever reason we seem to be stuck doing what we always have done.

Totally agree, Brendon. Astute comment.

Hughey isn't about 'cheaper housing', he's about no impediment to developers making money.

The Greens are hell-and-gone from where they neeed to be, and are going in the direction of away.

Trade is something you do until it falls over, at which point you have to be resilient. Good timing is going to be everything.

Biofuel I think has a slighter better energy content than "real" diesel, but has a shorter shelf life, 6 maybe 12months I think. Im not saying we wont have biofuel, we will have to its going to be essential, the issue is the EROEI is 1 to1 at best where we need 8 to 1, so we have to not do something else to make up for that energy loss, triage in effect. Tallow would certianly seem one of the better feedstocks, as its a waste/secondary product, however how much meat will be in our future? ie will there be enough feed stock?

Then look at rape seed, back in HC's time she/her Govn declined to subsidize putting in a biofuel pilot plant, that in an emergency could have supplied say our police force's needs ie accidental resiliance. I think the sums were a few 10s of millions....peanuts to guarantee our police functions.

The Green party, well I resgined in disgust shall we say....I dont believe they are clueless, but they are vote buying and not making any hard calls....eg a policy for population reduction is a fundimental, they dont have one....in fact their words suggest the opposite, support for large families on large incomes, cant work except to buy votes.

Thinking outside the square, well earthship.com is one brilliant example of lifesytle yet small blocks...catches its own water, disposes of its own effulent and food is grown around it, slef heating....maybe 1000m2 per property...not a "lifestyle block" by any means. "villages" again the Green's are not much green, they are busy buying the votes of the poor, that means BAUand here's some more jam. At some stage there will be a political backlash, they have jumped into the same basket as the rest, so they are or will be seen as a problem and not a solution.

"stucK" well its the same as for the bankers who didnt do anything about the GFC, it would cost to do something different and get it wrong, if all get it wrong, no one gets the blame, a self-centred survival strategy.

"giant farm" the Chinese consider is a nation of peasent farmers lacking sophistication and culture, ripe for the exploitation there of. We'll get what we deserve.

NZ certianly has a better opportunity to adapt, the problem will be time to adapt, willingness and external factors.

For instance this new PPTA trade agreement pretty much guarantee's we'll pay the same price for goods (food) that will become expensive as the better off like Americans, yet our high tech businesses will be crippled by American high tech and thier lawyers, foolish, but at least we can cancel that and it will be.

regards

#8: while it is true that index-linking NZS half to wage inflation and half to price inflation will not lead to an absolute decrease in NZS rates, it would mean a proportionate decrease - NZS falling further behind contemporary wages. This is on the assumption that wages continue to rise faster than prices, which on average they do - and if they don't, this move would of course increase the costs of NZS compared to what they're presently expected to do.

Given that the poverty line is calculated by reference to wage rates, and given that somebody who has no income apart from NZS (currently about 40% of NZS recipients) is only a hair's breadth above the poverty line now, that change would therefore mean more NZS recipients falling into technical poverty.

You may or may not care about that prospect, but I don't think it can reasonably be described as "politically easy peasy".

Neither is leaving fiscal drag to do its work. Is it really politically feasible to have everybody paying the top rate of income tax?

Para 8

The long term fiscal calculator is a good idea but could not more variables be given within each question with the costings associated with those variables? For example I would be happy to have the age for NZS raised to 67 but not for manual workers. In my view the age for them should be reduced. I also think that people over the age of 65 (67) who are working should not get NZS until they retire.

I would increase taxes except for those on the minimum wage. Higher taxes do not stop people from working. Look at the Scandinavian countries. When the top tax rate here was 66% it did not stop people from working.

But my choice would be the abolition of income tax in its entirety; that would get rid of the parasitic taxation industry. I would replace income tax with a turnover tax; collected by the banks on behalf of Government.

How do you specify a manual worker? and more imprtantly how long?

So for instance i could retire from my desk job at 64 1/2 and take a manula job for 6 months....get my full pension and take another desk job. Or retire from my desk job to my lifestyle block and do grape for a summer....so easy to dodge IMHO. Then there is also stress, ie its not just physical work.

So really no....That age difference is far easier to deal with by raising another top level tax, that way the ppl who are likely to live longer for those who wont, its progressive.

In regards to pension I dont agree it shouldnt be allowed, but means tested maybe, ie some ppl are forced to work passed 65 part time to suppliment their basic pension, they are not making huge amounts.

I agree with what you are saying, ie the system is un-fair and should be re-balanced, but it also has to be not possible to get around, a simple top tier tax or better a land tax isnt.

transaction tax, Ive not seen a good argument for it....land tax however, simple and hard to dodge, so yes.

regards

Re #3 and #6

How long will it be before the Chinese economy collapse and what is the impact on house prices in NZ and NZ economy?

Will house prices in NZ collapse as well?

Timing is a very hard thing to judge...I would say its certain, 100% sure....inside the next decade.

;]

The hard thing to say is is it inside 6 months, or 12months. I mean we have staggered on for 5 years, way past what I thought was possible....

NZ houses are 2x and some ppl think it will go to x3 and some even x4....so yes a 60%+ drop seems in the right order, again over what time span....2 years? 4 years? The Great Depression took 3 or 4 years to reach bottom...

regards

#8. The "Prefunding Super" (code for Kiwisaver) seems to be the option with big outcome.

Code for either Kiwisaver or ramping up the NZ Superfund. Big savings eventually, but big cost upfront

Exactly MdM. You don't get something for nothing. Wishful thinking don't do it. Magic mumbojumbo language (eg QE) don't either. To get what you want you need to buckle down and give up something now.

cullen fund...

#1

City of Houston is Bankrupt (So are California, Oregon, and Pension Plans in General)

http://globaleconomicanalysis.blogspot.com/2009/10/city-of-houston-is-bankrupt-so-are.html#DJuIeO9dgupogLPO.99 Detroit: An American Autopsy

http://www.strongtowns.org/journal/2013/7/15/detroit-an-american-autopsy.html

Note how think tanks like the NZ Initiative sneer at notions of sustainability.

I dont think they went bankrupt though, but its probably not far off...

Interesting that hughP and philbest tell us they are doing so well and they'd still be around long after NZ has gone.....doesnt look like it.

regards

I think its very daring to make simple comparisons....

I'd suggest there is no real way to compare, they are all so different not easily anyway.

regards

It would be good if people thought a few layers deeper rather than speculating, although Auckland has always been a speculators town.

There was a good reason for Auckland being a hub but that reason no longer exists. Auckland was so fertile as to be hightly desireable, but the pa built on volcanic cones while good to defend, would run short of water in a siege. The area was absent in the early 1800's because it had become too hot to handle, a byproduct of the availability of firearms. Maori welcomed the europeans and the subsequent trade as were after the peace and security this offered. 3000 acres were actually gifted.

So what have we done with this great fertile land?

Tauranga has been a much more viable place for a hub given a good port and central location. I would expect it to outgrow Auckland at some stage. Whangarei with a better deep water port and the reason the only oil refinery is located there. But with out cheap oil expect a decentralisation to anywhere with good water access. We should be building canals not roads.

This is sort of old man's wisdom stuff

http://www.truth-out.org/news/item/17605-former-mobil-vp-warns-of-fracking-and-climate-change

A fairly new group of leading heterodox economic thinkers and activists has come together as Econ4 to pioneer some new forms of popular education about economics. Their work focuses both on the fallacies of conventional economics and the promise of a new economic paradigm. Check out Econ4’s series ofintelligent and engaging short videos which explain the economics of healthcare, housing, jobs, and more. A just-released video, “The Bottom Line: A New Economy,” provides a terrific overview of the new types of peer production, cooperatives and other distributed, local, hybrid initiatives that are already taking root across the US.

For those interested in energy/ water and sustainability, a good article from the IEEE (which I haven't seen linked to yet) focusing on the 40% of U.S. fresh water that goes towards power plant cooling and the problems building up around that.

http://spectrum.ieee.org/energywise/energy/fossil-fuels/collision-betwe…

Longform article on recent British banking scandles, focusing on the PPI one

http://www.lrb.co.uk/v35/n13/john-lanchester/are-we-having-fun-yet

Foreshocks can portend big quake.

http://www.livescience.com/28134-earthquake-slow-slip-foreshocks-found.html

Wellington was already suffering from a locked earthquake re-insurance market before today's quake. Wellington has - according to reports - been declared ground zero for pricing earthquake re-insurance premiums by some of the World's biggest reinsures. This earthquake is not going to help with that.

http://www.scoop.co.nz/stories/HL1307/S00127/cook-strait-quake-this-changes-wellington-500-words.htm

"I have previously reported in this column ( Apocalypse Wellington | 500 Words Wednesday, 13 March 2013 ) how the 400-600% rises in commercial insurance premiums on Wellington buildings have the potential to destroy billions of value in the Wellington CBD and expose bank lending in the to massive impairment as insurance covenants under mortgage paper cannot be met by borrowers.

Already the distress is intensifying. Quality apartment properties in the Wellington CBD are now selling for less than 50% of the pre-Christchurch earthquake market price and it is likely that 100s, if not 1000s, of property owners in Wellington are in a negative equity situation already."

Funny but I was telling HughP this on Chch some time back, either no re-insurance, or massive premiums....oh no it couldnt happen.

So I'll repeat, If you cant get [re-]insurance on your house, you cannot get a mortgage....at least not past the land value/EQC payout the house sits on. This leaves the EQC and govn to pick up the tab, someone who's premiums would seem to be massively under insuring of risk.....

regards

steven: 15 (fifteen) comments on this thread alone!!!!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.