Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #1 from Ryan Avent on his grand theory of secular stagnation. Read it to make you think about why secular stagnation may be happening in the developed world, if not how to fix it.

1. A broader theory of troubles - Ryan Avent has written an excellent Free Exchange post at The Economist that brings together some thinking on secular stagnation, rising inequality, savings gluts, falling productivity, falling labour market participation and jobless recoveries.

It's an almighty puzzle for many of the world's central bankers and finance ministers and policy makers.

What's going wrong?

How is it we are still inventing amazing new technologies that should make most people better off, yet real household wages seem to stagnate.

Why is it central banks are pumping fuel into the engine and it's just not firing?

Here's Avent with a fascinating post on the counterintuitive idea that central banks should let inflation rise a bit:

The broader takeaway, however, is that apparent rapid progress in technological capabilities is not at all inconsistent with lacklustre productivity growth.

Distributional issues are key in this narrative. If we assume that purchasing power is allocated via market wages, then the task facing central banks immediately becomes impossible. If they try to maintain low and stable inflation, then competition for low-skill work will place downward pressure on the wages of low-skill workers, but wages will be too rigid to provide employment for all willing workers. The result is a stagnant real wage for all but those at the high end of the income spectrum and a growing number of frustrated workers pushed out of the labour force due to lack of work. Productivity growth will follow a middle path. It will be lower than it could be, because society will still be trying to employ everyone by reducing the real wage of less skilled workers until they are competitive at tasks machines could reasonably do. Indeed, efforts to employ everyone by reducing their real wage will retard cost declines in industries, like health care or education, that should be subject to rapid displacement of workers by capital, thereby leaving real wages for workers not immediately at risk of displacement lower than they could be. But productivity will be higher than it would be in a high inflation scenario.

But in general, the benefits of growth will flow to high-income workers and owners of capital. Since they have low propensities to spend, central banks will find it difficult to generate adequate demand, except by nurturing unsustainable borrowing by workers with stagnant incomes. Central banks cannot have adequate demand and low inflation.

On the other hand, if central banks are willing and able to raise inflation rates, then real wages will be more flexible, and firms will be more willing to use labour to do tasks that could reasonably, or even easily, be automated. In this scenario the central bank succeeds in generating adequate demand; because low real wages encourage less substitution of capital for labour, a higher share of income flows to labour, to workers with a high propensity to spend. But adequate demand is incompatible with a low rate of inflation. It may also be unsustainable, since many central banks will interpret the high inflation necessary to boost employment as evidence the economy is running at capacity.

It's enlightening and disappointing at the same time. That's because no-one in New Zealand public life is talking about this at all.

It's as if the world has passed us by.

First, the new technologies will bring good and bad. We can shape the good and manage the bad.

Second, education is not a magic wand. One reason is that we do not know what skills will be demanded three decades hence. Also, if Mr Frey and Prof Osborne are right, so many low- to middle-skilled jobs are at risk that it may already be too late for anybody much over 18 and many children. Finally, even if the demand for creative, entrepreneurial and high-level knowledge services were to grow on the required scale, which is highly unlikely, turning us all into the happy few is surely a fantasy.

Third, we must reconsider leisure. For a long time the wealthiest lived a life of leisure at the expense of the toiling masses. The rise of intelligent machines makes it possible for many more people to live such lives without exploiting others. Today’s triumphant puritanism finds such idleness abhorrent. Well, then, let people enjoy themselves busily. What else is the true goal of the vast increases in prosperity we have created?

Fourth, we will need to redistribute income and wealth. Such redistribution could take the form of a basic income for every adult, together with funding of education and training at any stage in a person’s life. In this way, the potential for a more enjoyable life might become a reality. The revenue could come from taxes on bads (pollution, for example) or on rents (including land and, above all, intellectual property). Property rights are a social creation. The idea that a small minority should overwhelming benefit from new technologies should be reconsidered. It would be possible, for example, for the state to obtain an automatic share in the income from the intellectual property it protects.

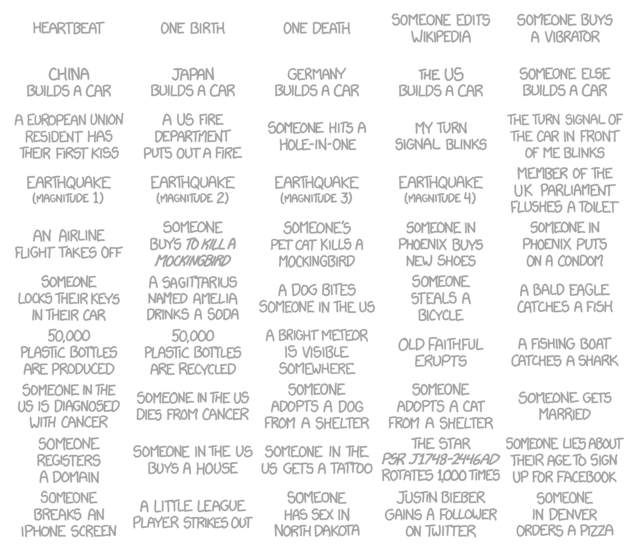

3. Frequency - This XKCD 'cartoon' on frequency made me smile. It's a gif so click through to see it in all its smiley glory.

4. We know which side of our bread is milk powdered - I see from David's 90 at 9 this morning that Australia seems to have missed out on a chance of a Free Trade Agreement with China this year because of its criticism of China's creation of an air defence zone over the Senkaku/Diaoyu Islands.

New Zealand has taken a much softer line on the Senkaku/Diaoyu Islands than Australia. Phew.

Ayson also makes the point our now historic nuclear free stance in the mid 1980s has probably helped us in our China connections. Oh the irony. A National party that once threatened the nuclear free policy with 'gone by lunchtime' now needs to emphasise its independence from America to support its largest trading relationship.

Here's some interesting background via Robert Ayson at Victoria University on the differences opening up between Australia and New Zealand in our China...ahem...diplomacy.

The gap in New Zealand and Australian views on China was evident in this week’s annual Leadership Forum between the two countries in Sydney. Several cabinet Ministers from both countries were active participants in this business-focused meeting. Prominent members of the Aussie contingent continually referred to New Zealand’s success in signing and implementing a Free Trade Agreement with Beijing. In typically understated fashion, the kiwis hinted that it had been useful to have a good political relationship with China and also to have an independent foreign policy. The second of these points is normally code for not getting too close to the US (a reputation which New Zealand’s nuclear disagreement with Washington since the mid-1980s had helped to maintain).

5. Forex crackdown - Global foreign exchange dealing rooms are abuzz with talk of mass sackings and clampdowns on trading as regulators target all sorts of LIBOR-style rigging.

Now it looks like the banks themselves have started to crack down on traders betting their own money on currencies.

The UK’s Financial Conduct Authority is probing the use of private accounts by forex traders, the Financial Times revealed in November.

This probe is ongoing and comes amid allegations that some traders might have used private accounts to place bets based on information gleaned by exchanging details about client orders with rivals, one person close to the situation said.

The queries are part of efforts by more than a dozen regulators across Europe, the US and Asia to investigate more than 15 banks over possible manipulation of the $5.3tn a day foreign exchange market.

6. Only God and Xi knows - What is really happening inside the bowels of the Chinese banking system and in shadows is a mystery to most. Even the experts can't make up their minds from the latest figures, FTAlphaville reports.

But we should all keep watching closely.

Here's UBS' Wang Tao:

This latest set of data shows that despite recent bouts of liquidity tightening (initiated by the central bank) and increasing market concerns about the sustainability of certain shadow banking products such as trusts, credit growth remains rapid. This may have been because the central bank allowed credit conditions to ease somewhat in January, especially via bank lending, as the government still wants to protect investment and GDP growth and wants only moderately slower credit growth.

In hindsight, the PBC’s tightening moves within the interbank market before the Chinese New Year were perhaps meant to prevent bank lending from growing at an even faster pace or from spiralling out of control, rather than to aggressively tighten as markets had feared at the time.

7. Our debt was just like Ireland's in 2007 - This startling accusation from London hedgie Stephen Jen this week that New Zealand was just like Ireland in 2007 was immediately rejected by Finance Minister Bill English.

Here's what the minister said to us yesterday: "Ireland had a banking crisis and they have got massive public debt. Ours is at reasonable levels. Where they are relevant is this talk about the fact that New Zealand has what appears to be a reasonably high exchange rate and that our households still have relatively high level of debt."

"I think both of those things are in my view correct, but New Zealand's in good shape to deal with the adjustments needed if the exchange rate comes down. There's elements of truth in what they say, that we have relatively high levels of household debt, our housing market is still more expensive than it needs to be, but New Zealand's households and businesses have shown that they are able to handle those pressures," he said.

The trouble is Ireland's public debt in 2007 was actually lower than New Zealand's pubic debt is now. Ireland's household debt in 2007 was a tad higher than ours is now, but not much more.

The reason Ireland got into so much trouble is it used that low public debt position in 2007 to bail out its banks in 2008.

Despite what the Government and the Reserve Bank say about imposing haircuts on depositers and 'Open Bank Resolution', we all know that the Government would use its strong balance sheet to rescue one or all of our big four banks if there was an enormous housing bust and they got into trouble.

No Prime Minister is going to stand up in the Beehive Theatrette and tell New Zealand savers that he is going to give their savings a haircut to save a bank.

The one big difference between Ireland and New Zealand is we have a floating currency and Ireland is stuck in the euro.

That flexibility in the New Zealand would cushion some of the blow of a foreign crisis triggering a domestic crisis, as it did in 2008 and 2009. But it would still put the banks under pressure because it would be much more difficult to roll over that hot foreign funding, which still funds about 20% of New Zealand's loans. But last time around the Reserve Bank came to the rescue and created a lending facility to tide them over until the markets unfroze.

It all depends on your view on how over-valued New Zealand's housing market is relative to Ireland's. Back in 2007 Ireland's median house price was about six times household disposable income, while ours is just under five now. The Economist house price tool (see below) also shows that Ireland's house prices were almost double the long term average relative to incomes back in 2007, while ours are about 60% above the long term average.

So our house prices are not quite as over-valued as Ireland's were in 2007. So we're OK then? Hmmm.

Here's a bunch of juicy charts to chew over while you muse on comparison.

8. There will be a price to pay - Here's Michael Pettis explaining in more detail why he thinks a Chinese growth slowdown is inevitable. Well worth a read.

These reforms, and others – like attempts to protect the environment – will ensure that even as China’s real economic productivity improves, its GDP growth numbers will drop as the reforms are implemented. Most commentators argue that by increasing productivity, real reform will ensure a soft landing of GDP growth rates of 7-8 percent during the rest of President Xi Jinping’s administration. A growing minority worries, however, that rapidly rising debt will force China into a hard landing.

9. Flighty Capital - Here's John Lee at Business Spectator on the issue of capital flight out of China.

Another weekend and another couple of days filled with anecdotes about Chinese buyers snapping up residential homes in Sydney, Melbourne and Brisbane. What are Chinese private citizens up to? Why are they so eager to buy non-liquid foreign assets – such as residential real estate – in countries like Australia?

Much of this is driven by push factors arising out of China, rather than pull factors emanating from Australia. To be sure, Australia is seen as a stable, comfortable, environmentally clean and rule-of-law country that is inherently attractive to many Chinese compared to the dynamic but politically and economically uncertain environment that is China. It is why more than half of China’s millionaires, according to a recent Huron Report survey of 980 people worth over $US1.6 million ($1.8 million), are looking to leave China for a Western country.

10. How it's done - Lee explains how some of that capital flight happens.

Chinese citizens have become quite clever and skilled at ‘illegally’ transferring large amounts of money out of the country. This is done through schemes such as ‘over-invoicing’ of legitimate or false trading activity (i.e. effectively using a complicit trading company outside mainland China to exploit looser current account restrictions in order to take money out of the country), or else using financial services firms to set up complicated schemes to bypass capital account controls. For example, a 2012 report by Global Financial Integrity suggested that about $US3.79 trillion left China illegally through ‘over-invoicing’ of trade settlements alone.

Why are they buying such large assets as Australian residential property for themselves or their children, many of whom are students in Australian universities?

One is that over-paying for an Australian residential home will hardly register on the personal balance sheets of the Chinese ultra-rich. Another is that real deposit interest rates remain close to zero or negative in China, as the government remains stuck in a pattern of encouraging investment over consumption (despite what the official press is saying). Why not speculate on a home in Sydney’s Chatswood or Melbourne’s St Kilda when the few million dollars would be losing value in the domestic banking system? Besides, local Chinese citizens realise that the fundamentals of the Chinese residential housing market are even more precarious than so-called bubble housing markets in countries such as Australia. In Australia, there is at least a housing shortage in major urban residential areas. In China, there is a huge housing surplus following the construction boom from 2009 onwards.

99 Comments

Re 9 & 10 just watched two Chinese bidders (one phone bidder, other possibly) overpay on a Meadowbank property. New record of 2.47M for 1850 m2 and a cracking view, crappy house. But overpaying is subjective - the winner is probably thinking he's got a bargain relative to Shanghai prices. Rational thinking developers all dropped out at 2M. Not an easy site to develop.

it does feel like it's the last few entrants to the party. My question? Do land bankers bail out and sell if there investment drops 20%? I don't think a Chinese based investor would care if it's a small part of portfolio and not getting it out of country might cost a lot more.

Any insight here on the mindset of a wealthy investor in China phone bidding and overpaying?

The guy on the phone was speaking what sounded like Chinese? Duh

I was sat right next to phone bidder 1. But you are right, buyer on phone may have been next door but was conversing in Mandarin and was likely non-resident. I had done my research into the bidders beforehand! 2 of 3 were non-resident so I had a feeling the locals were going to be outgunned.

But yes, may have been a Irish pig farmer dialling in to diversify his portfolio away from bacon.

I have no issue with the nationality etc. But I am interested in what a wealthy non-resident would be looking to achieve in long run...

On #7 & Ireland -

Bankers have been blanketing Ireland in search of cheap assets and lucrative deals, and few firms have been as aggressive as the Blackstone Group.

From snapping up hotels to advising the government on what to sell and when, Blackstone deal makers seem to be everywhere.

http://dealbook.nytimes.com/2014/02/18/lending-where-banks-cant-blackst…

If you have cash, it's all going very cheap. But some think the worst is yet to come with the Euro crisis playing out in one last tragic act. There is still a reluctance to get back to investing in property even though all infomration suggests a floor has been reached.

So some Jumped up Paddy hedge fund manager is talking down the Kiwi economy and the Kiwi$ for us .

Then when we fall over they come in like vultures and Wild Dogs to pick up our assets for nought .

Good luck to him and his crew of rogues , we are not a bunch stupid Irish potato farmer Peasants lurking on some windswept island here in the South Pacific .

We are more like the Icelanders , we already allow banks and businesses to fail , to go into liquidation , or defualt , and we will continue to do so .

We dont use public funds to bail out businesses and Banks

Anyway our Banks are funded out of Sydney , and John Key is not that stupid that he will bail out anyone .

Bring it on .

He is not Irish, possibly dutch or Danish but based in London.

But to respond on your comparisons / contrast between NZ and Ireland:

Stupid: No comment.

Potato farming: Seriously? Does your knowledge of all countries based on mid-ninetheenth century data? NZ must win this if you include Kumara?!

Peasants: I think the economy in Ireland, even post-crash is stronger than NZ and certainly more diversified. Are you sure about this one?!

Windswept: Pot, kettle, black. Even west coast of Ireland doesn't match NZ's windiness!

I hope NZ Govt won't use public funds - the public debt in Ireland came about because of a very cosy relationship between government and mates in banks and one ill fated late night meeting where they agreed to guarantee all debts. You've got a banker running your Govt, one involved closlely in Ireland's "miracle" economy and a big fan at the time. So I'm not sure that Iceland is the model that will be followed. I hope your faith in Key to not rescue his mates is well-placed and the stupidity isn't more concentrated here.

Anyway our Banks are funded out of Sydney , and John Key is not that stupid that he will bail out anyone .

Unless those exposed are well connected. e.g. South Canterbury Finance .

Fox News was reporting earlier that the world's major oil companies are slashing exploration budgets after 2013 was a bust year for them, with companies such as Statoil admitting 'oil is getting harder and harder to find' - recent results have also confirmed that their production is in significant decline

Do you want to know just how bad the decline in oil production is for the companies that comprise Big Oil? Then cast your eyes over this wee table:

http://www.platts.com/news-feature/2014/oil/western-oil-production/west…

Thats right, your eyes dont deceive you - BP oil production down 30% in 4 years, Total down 15%, and an average 12.4% decline since 2009 for the Big 7.

And their response to these declines? Well it is to cut exploration, so they aint going to stop their falling production that way. The one thing feeds off the other.

One would almost think they are throwing the towel in.

I'm over the housing market being driven by speculators, it's about time the laws around housing reflected what it truly should be, and that is, the place where people live and call HOME! Even in Hamilton I could take you to houses, often more than one either close together or even side by side, with the exact same tell tale signs of no-one home, nothing on windowsills, venetians closed and not a single object outside like a hosereel, to suggest anyone lives there, gardens untended or no garden at all. And like that not just for a week or so, as you might expect for houses in between tenants

Here is a comment i made the other day and worth mentioning here.

"Just one BIG thing missing - "What about the damage interest rates cause?"

Ask yourself

If money is the cost of borrowing money

Then, what if

TV's were the cost of borrowing (hiring) TV's

Smart phones were the cost of borrowing (hiring) smart phones

Cars were the cost of borrowing (hiring) cars

And so on

If you dont understand what i mean then you should learn about it before you talk about interest rates

Interest rates are a money cost on money and that is what stuffs everything up.

Put another way

If a borrower has to

Use money as a method of payment for the use of borrowed money

Use TV's as a method of payment for the use of borrowed (hired) TV's

Use Smart phones as a method of payment for the use of borrowed (hired) Smart phones

Use cars as a method of payment for the use of borrowed (hired) cars

What would the outcome be? because it is the same outcome as money."

And i add

That is bank economists and the government keep saying we need more growth. Now that growth is for more people, so that the TV rental companies (banks) can use up all thase surplus TV's (money) that have been created as interest.

Surely, from what i have said, people can see the real problem interest rates cause

If money is the cost of borrowing money

That's a new one to me... How did u come up with that definition.???

For me... Money is defined by 3 qualities.

1/ Medium of exchange

2/ Unit of account/measure

3/ store of value.

In my view ..using anything else can send one down the garden path.

Thank you Roelof. It is by questioning comments that we either disagree with or do not understand that we are able to increase our knowledge.

May i suggest that you read, very carefully, what i have said and then think about it.

I agree with your points 1, 2 and 3 however that is not my point.

If you go to the bank and borrow, say $1,000. The bank charges you for the use of that borrowed money.

When the loan period has ended you will have given back to the bank the $1,000 you borrowed PLUS extra money, called interest, for the use of that money.

Note the bank does not ask for, say, a 24 pack of beer for the use of the $1,000, NO they want extra money.

Just try and think for a moment if this happened with, say, cars.

You own a business and have, say 100 hire (leese) cars. If the cost of borrowing these 100 cars was say 5 cars just think of the mess. That is, you borrow 100 cars but have to pay back 105 cars. Thats maddness but it is what we do with money which is also maddness.

I hope you give this some thought because it is important and the more people that understand it the better.

It is the finaciers that get the extra 5 cars. Works well until the 5 cars can not be produced anymore.

Indeed, interest forces the economy to constantly in order to service debt. Seeing as the economy is tied to physical resources, this should ring alarm bells in anyone which half-a-brain. The physical underwrite cannot expand infinity to 'grow' the economy.

Sure, the system worked well while we could expand. Those days are in the rearview mirror I suspect. Looks like we'll keep banging our heads against a wall though trying.

Plutocracy... Why are u blaming interest rates..???

Why not blame Population growth.... or consumerism..??

It is not the interest on the debt that has caused the incessent growth... It is the growth of the debt itself... ( increasing money supply in the form of credit)

I call this form of Capitalism "creditism"... It has been thru unfettered credit growth that the Global economy has grown at such unprecedented rates.

The incessent credit growth is like a form a form of gluttony.

It has lead to gross overconsumption, over capacity, over investment....etc.., over -exploitation of resourses... it has fathered the "age of consumerism"...

Really... the world needs to suck it in and let it all unwind...

If the Global Economy is a fat person ( over consumption ), the best way to lose weight is to eat less... ie. consume less and deleverage.

That is the problem the world is in now... we have maxed out on the "visa card" and can no longer spend tomorrows income today....

Really..the world needs to go on a diet..... but the "staus quo" powers that be.... want us to keep growing.

The Global Monetary system is totally f*#ked up... and has lead to the Financialization of the Western world... but that is not the fault of interest rates...per say.

Interest and burgeoning credit work hand in hand. Interest is what enables finance, think of how it might work if you could not charge interest.

yes.. but that is only because the current Monetary system works that way....

Its not , so much, interest that has "enabled finance".... it is the private sector banking systems ability to create money thru the creation of credit. ( that is the distinction between a finance company like Hanover and a Bank )

If there was no interest charged and we still had unfettered credit growth..... you tell me how things would go..??

I'd be off to the Bank, as quick as I could, before everyone else to borrow $1 billion ... to buy as many assets as I could....

In my view the problem is the credit growth( money supply growth ) NOT the charging of interest.

The link I think you are missing is the unearned income, which is why finance lends money. They achieve that via the interest, how else could they earn money and why else would they lend you a $Billion?

Take it back a level to the merchant (also unearned income). Would they sell to everyone at cost?

Not that I have any beef with you about the ability to create money, that is as crooked as hell.

Interest is not unearned income.

Merchantilism is not unearned income either.

If I need to borrow money off a mate... I'm happy to pay him for the use of it.

If I but products from the local dairy...I'm happy to pay more because of the convienience.

Just because someone is not a "producer"... does not mean his income is unearned.

even commodity speculators can play a legitimate role... A producer might want to hedge his risk by selling his crop before harvest... he transfers the risk to a speculator, by way of a derivative ...and if the speculator profits, ... then his income has been "earnt".

I do agree about un earned income when it come to economic rent and "land".. ( land being a metaphor for all natural resources )

I'm interested in the ideas of Henry George ...but dont understand them and have not reallly studied him.... so can't really comment.

Much of hte interest on the $Billion is earned money. The external to the deal profit from inflation/speculation is unearned. As you say, can a merchant afford to operate selling at breakeven or cost? (they can't because at breakeven they will slowly wind down and have no resources for strategic investment or replace unplanned breakages/losses)

Roelof I am not sure whether to put this in here or not, but what the heck as a parting shot for today I will.

Imagine you have a surplus of 50 bushell of grain, the ultimate surplus being food for coming years should they be lean. Keep in mind it is a surplus of food that underwrites all economic activity. All those workers producing cars and tv's need to be fed.

Now your opportunity cost on that surplus of grain is really a load of nonsense, the term itself is a fallacy and I will hightlight why.

If you were to store that grain yourself (put you money under the mattress) then it is going to cost you and there are risks involved. First of all you need to build the facility to store it, that will probably cost you. If the grain gets wet it will spoil so your storage needs to be of a good quality. There is the risk of vermin also, and also that surplus might attract a thief. Now if I were to borrow that 50 bushells then I assume all those risks for you. But if I lose the grain to any of those circumstances outlined I still have the debt to you that needs to be repaid. You should be paying me for taking the risks on that you are passing to me.

Not a surplus of food that underwrites trade. Surplus of time and energy.

Food is a consumable that costs to store, like banks borrowing bulk to lend retail. Likewise calculations done using food will be Once removed from primary resources - as can be noted that one must invest time, energy and resources to create harvestable food (even as gatherer of wild leaves & roots). Time and energy can't be directly stored, food can. (electricity can, but that's processed energy, processing requires time & energy & tech)

And yes we are paying you for taking the risk, by charging you less interest than the risk entails.

Opportunity cost is very real. I save my families grain, lend you 50 Yen worth. My stores get destroyed. I'm suddenly 50 Yen of grain short to feed my family - are you going to immediately surrender it? What if my grain isn't spoilt because of my foresight in planning, and everyone elses' is... I might get 100% promised return on that 50 Yen worth which you have already taken, and I doubt you would be paying 100% interest. Thus that is the opportunity cost,

"There is the risk of vermin also, and also that surplus might attract a thief. Now if I were to borrow that 50 bushells then I assume all those risks for you. But if I lose the grain to any of those circumstances outlined I still have the debt to you that needs to be repaid. You should be paying me for taking the risks on that you are passing to me."

gosh... ok.. lets use common semse.

1/ No wheat would EVER be loaned if the lender had to pay the borrower... ( simple common sense)

2/ There is "risk" everywhere.... NOTHING is "risk free"... because storing wheat, which is a "consumable' , is "risky".... Money was invented...and the surplus was sold at market... but then money can be stolen.... so then Banks came about to safely store the gold.... and then insurance was invented... ( mitigation of risk played a role in the evolution of money and banking and insurance, amongst other thing )

3/ If my crop failed and I needed to borrow your surplus to feed my family, with the promise of repaying with my next crop.... I would naturally expect you to want to be paid back more than you loaned.. ( even if u were my best mate, and wanted to help)... I would understand that u need to be compensated... it would be a negotiation.. ( not everyone is charitable)

scarfie

You and roelof have managed to sabatage my point about interest rates.

Both of you are on the WRONG track

The credit expansion is about Fractional Reserve Banking and that is, in part, about poor lending regulation.

Please get back on track as this is too important to stuff up.

Thank you

Roelof

You have NOT read AND understood what i said.

YOU have now sucessfully changed the subject from interest rates to Fractional Reserve Banking which is a different topic. They are NOT the same thing

Please, please, please read what i said about INTEREST RATES

Thank you

Mike b ... sorry... but its the only way I can reconcile your view on interest rates.

"what is the damage interest rates cause"... that was ur headline.

"Interest rates are a money cost on money and that is what stuffs everything up."

Ok ... maybe I don't understand what u saying..

Hi Roelof

On the surface economics is a very complex subject.

If you look at mathematics, some furmula are so complex they appear to be too difficult to solve. How a mathematician deals with such complexity is that they break it down into much smaller and managable parts. It is by solving these individual parts that the complex problem can be solved. It is also how Super computers work. They have complex problems like climate change. The Super computer has hundres of CPU's each solving a small piece each. Then it is all put together and problem solved.

If you mix money growth with both interest rates and fractional reserve banking then your argument remains complex, confusing and a big turn off. That is people will not read what you have to say because it is too confusing.

It is hard but you have to try and keep things simple.

Interest rates and money expansion through fractional reserve banking should, in my opinion, be dealt with as two separate topics. That makes them less complex and more easily understood.

I used TV's, cell phones and cars as extream examples in the hope that, if people remaind focused on those, then they would be able to follow it to a logical conclusion. Maybe i choose wrong but i do not know what else to use.

Looking back at the car hire. When it comes to paying for the use of the borrowed cars. If the lender demands that you pay for the loan of the cars with more cars then you have a problem. Same as a bank demanding that you pay for the loan of money with more money.

Further, as the person who hires the cars also has control of car output then they have you by the short and curlys. Same with borrowed money. The bank demands you pay for the loan of money, which they control, with more money which they control. They have you by the short and curlys.

Most of a Nation borrows money. Governments, Councils, State owned enterprised, Corporations, SME's, People for motgages and consumption and so on.

Imagine (extream for hopefull clarity) most of a Nation used hire cars and the cost of hireing those cars (interest) was more cars. Not only would the car producers have us in perpetual debt to them but they would also build up an additional supply of cars due to interest (money in the case of banks). Growth is needed so the car controllers can soak up their build up of cars. If they do not get growth then their (over) supply of cars becomes worthless (inflation). And banks need growth so they can soak up the extra money (interest). If you do not have growth then you have inflation (due to the build up of money) and the money the bank made from interest looses value.

All this happens because of interest rates, regardless of the ammount of credit. Credit expansiond just increases the total amount of interest paid and so increases the problem

When interest rates rise then fewer people borrow money but pay hire interest rates so the total amount of interest paid can remain constant. That is

Few people & high interst rates = lots of people & low interest rates

So to speak. Anyway the banks dont loose out.

Sorry i cannot explain this any other way so i hope you can follow.

Hi ZZ

Sorry but you totally miss the point.

Unfortunately we have become so used to thinking in a particular way that we are blind to reality.

Stop thinking in the conventional way and start to think outside the box otherwise i am wasting my time trying to explain.

Mike I have been trying to present this issue for a couple of years now and I am just so glad that you get it. Keep hammering away at it buddy, hopefully you can find a better way of getting through to people than I have managed. You are absolutely right.

FYI there are trends that can be predicted based on the cumulative nature of interest as a portion of the money supply. Firstly interest rates will trend down(go to the graphs here and look back 30 years and you will see what I mean). Velocity will also slow but prices will rise. They will have to keep expanding the money supply. I made predictions at the start of the year on this so it will be interesting to see how they pan out.

As the government gets drawn deeper into the trap I think we are going to see some interesting actions to try and prevent the inevitable.

Thank you scarfie

It is so sad to see so many people who just keep following the traditional line and will not allow themselves to see another angle.

I am trying to go through the process of interest rates and their effect but people keep talking about barter and everything else and that's not what i am about. Urrrg, frustrating

I try to keep my explanations as close as i can to the real world. Once you start blabing on about PQ= da da da and so on it is a big turn off and means nothing.

I am not so sure there will be "an inevitable". As long as they control the worthless digits in a computer they will hold onto power.

Remember - Not always easy but important to KEEP IT SIMPLE otherwise a big turn off.

MIke I have put together a four page document that outlines in simple language that a 12 year old would understand how that equation works. Bernard has it so see if he will flick you a copy, or get my email from him or David and I will send you a copy myself.

Thank you scarfie and i look forward to having a look.

Must admit i find all that formula stuff a big turn off. Hard enough trying to explain the real world without complicating things further with charts and formula.

I guess the only economics tool i really use is suply and demand because i find it can answer an awful lot of so called complex questions.

However will read and give you my opinion.

ZZ - not often I bother answering you, but that's one worth bothering.

They didn't charge interest, for good reason. Their resources (read 'Daughter of the Desert' and 'Seven Pillars of Wisdom') were a couple of goats, a tea-pot, and a prayer-rug. A tent was serious wealth. The rest was sand.

How the hell can interest be charged in that lot? What's going to be traded? So they had to have a system which fitted their resource-supply - or lack of it. Someone smart wrote the rules which fitted the circumstance (just like Moses, really. The mob don't think, hey can barely cope with 10 bullet-points on an A4).

It's a precursor for all of us. Interest has to go. If it doesn't, it will more and more displace something else, until there is nothing else.

There is only one other option: that inflation equals interest - which is the same thing as not charging interest but it might fool the mass into thinking they're 'richer'. As they do now, when their house 'value' increases.

agree, for interest you need a readily convertable system of exchange. normally favours and oaths would be given but it all tends to end up Third World, or owned by The Patriarch of the group

and you just have to listen to them to realsie they dont want to know...because in the future there is no place for them.

regards

Mike B.... thks for the response

Still not really sure what u are saying....

Are u arguing that charging interest on borrowed money is madness..??

With the beer and Car examples the only reason they want money and not more beers or cars is because of the transactional value of money..ie. medium of exchange... They are able to buy whatever they want with money... ( It would be alot more difficult for them to barter their cars and beer for what they might want ).

Off my head , I can think of 2 reasons why interest and the charging of it is legitimate in a business sense and in an economic sense.

1/ It prices risk ( or It should.... In todays money printing , low interest rate environment risk is badly mispriced )

2/ It compensates for the time value of money.

The big issue I have is in the way new money enters the system as credit .( a loan with interest charged)... I find this immoral, corrupt and a form of wealth transfer.

In my world I would have a constant money supply ( and would simply introduced smaller denominations of currency to accomodate for the deflationary effects of productivity gains )

If I had to increase the Money supply I would introduce it into the economy by giving everyone an equal amount, ... (as a universal basic payment/wage)... ( any other way of growing the money supply leads to a increase in the division of wealth ... in my view)

cheers Roelof

Roelof,

Stop and think about what interest rates are doing

Paying LIKE for LIKE

MONEY paid for the loan of MONEY

TV's paid for the loan of TV's

Cars paid for the loan of CARS

Paying like for like is MADNESS

I suspect this "like-for-like" theory falters when you apply Roelef's definition of money:

- Medium of exchange.

- Store of value.

Goods are goods but the medium of exchange is not (edit; not ONLY) a good.

You also don't seem to have addressed the link between the reverse a bank is legally required to hold, the cost of the holding that reverse and its direct effect on interest rates. Just saying it makes for hard conversation is to risk reducing the issue beyond the logically possible.

He is perfectly right Roelof. Sort of what I have been trying to get through on this forum for some time. (M.V)+i=P.Q models it.

Scarfie... I know and understand what u mean by the (M.V)+i=P.Q... but it is wrong.

M.V=P.Q... thats it.. That formulae is an expression of the quantity theory of money .... ( which I generally agree with ).

adding interest to it would make it false...

BUT.. I'm not the smartest cookie in the jar... this is just my view based on what I know.

cheers Roelof

Lol. Think of how Steve Keen talks about economics when he says the profession does everything it can to exclude the effect of finance and is thus a fraud. That equation is putting the interest into the Quanty Theory of Money, or economics, which is itself a fraud if it doesn't account for interest. This is actually really important as interest detracts from the money supply, where as the conventional thought is that interest enables it. Interest is curmulative and it is a mathematical certainty (as my equation shows) that a money supply bearing interest will eventually collapse. That even goes for gold. The money that is used to pay interest IS a part of the money supply, it adds to price but subtracts from velocity. So any economic theory without it has to be viewed with deep suspicion.

He's right about the (M.V)i = P.Q ... for the credit money system. By contracting tomorrows interest paid income (the ratio as a percentage, i) we are declaring that tomorrow will have more inflated money (P.Q) than we have current cash today (M.V).

Which considering all the money right now is MV=PQ, and we are promising i(MV) tomorrow it doesn't take a genius to follow just why things are going to wind down and keep winding down, even with continual introduction of more time and energy and consumption.

That's why scarfie's "unearned income" is an issue.

In my microcosm (business/community) I borrow and am willing to pay interest because I know the value to my consumers will easily cover the interest + profits. That means my consumers are willing to create using their time&energy&resources enough value to more than pay tomorrows i cost.

The danger with true unearned income is that the consumer doesn't create/introduce (even through arbitrage) any value, thus there is no created time&energy&resources to cover the systems loss through interest. Instead the system is devalued through a chain of created tomorrows promises, each worth less than the last.

Some non-labour income is valuable (eg self-insurance, real market opportunity cost,strategic advantage) but some eg house prices rocketing because of artifical market controls causing house prices to rocket, are not (eg create no extra value, just price speculation)

cowboy... hes' not right.

total money x Velocity = total prices x total quantity ... that equatiion equalizes..

the cost of money would go under the "price" "P" part of the equation..

Interest is not money.

Adding interest to the left side of the equation ...and it no long equalizes..

I do get what u guys are saying thou.... I do like Steve keens perspective...

and I do see the effects of the burden of excessive debt.

just my view..

In reference to your complexity comment above as well as my equation, it does simplify something that others have presented in a more complex manner. This article says pretty much the same thing in a convoluted way. Comes from raf's outfit, who I have not seen post here for some time. I wonder if he finds it too frustrating?

http://sustento.org.nz/wp-content/uploads/2007/05/The-Ripple-Effect.pdf

Thks for the link... will print out and study over the w/end

"The borrowers would usually borrow in the expectation that doing so would increase their productivity or their fortune in some other way. For example, buying an ox or workhorse might dramatically increase production from a farmer’s land. The increased production created by using the ox or the workhorse would more than offset the interest on the loan. Both parties were better off as a result of the investment made by using the borrowed money."

This is from the paper Scarfie linked to and is what I was trying to explain above. Interest creates the need for the economy to grow in order to service debt. If the real economy (physical goods / services) can't grow due to physical constraints (expensive energy, limited resources etc..) then the ponzi has to collapse. This is about near where we are at now. Trying to paper (print) over the deficit will only make the inevitable worse.

1. The quoted example does not fit the definition of a Ponzi Scheme;

http://en.wikipedia.org/wiki/Ponzi_scheme

"pays returns to its investors from existing capital or new capital paid by new investors"

2. .. Interest creates the need for the economy to grow ..

But in the investment sense this is the logical conclusion of the good investment that was a win-win for both parties because production increased.

Meh, semantics! Ponzi scheme? pyramid scheme? Self-destructive destablizing positive feedback loop? Call it what you will, all ends the same way.

Meaning does matter:

Half Truth -- Lie

Weed -- Flower

Incentive -- Bribe

It all depends on what the meaning is "is" is...

Bill Clinton.

Raf Manji got elected to the Christchurch City Council. He is now very busy in that world.

Roelof, The system we current use "money" isn't money it's debt, debt is money + interest.

therefore you end up with money x Velocity = PQ. But since money is created debt :.

(money+interest)xVelocity = PQ. interest is normally given as % so I use a scalar to scarfie's linear " +i "

PQ is quantification of all existing prices over all existing goods. it doesn't include interest because interest isn't paid today, that's why it can be leveraged, it's tomorrows money today.

And no it doesn't equalise, that's the problem, and that's why things are winding down.

It's like a company trying to operate as breakeven, it can't sustain it when there are real external pressures - in this case interest (or taxes) creating inflation.

I thought we'd educated enough folks on here enough to recognise things.....

Interest is indeed the cost of borrowing money.

A CONSUMER earns and spends _money_ - liquid unit of exchange.

Either they earn and hold that money (costing them work to do so, opportunity costs, risk, and deflation) OR they can pay an outsider contractor to advance them the contractors stored money. If you're hiring contractors, you are will pay something (or a lot of something).

What you pay in...is lquid units of exchange...be it IOU,metals or items of value,paper,#in a computer.

So yes, cost of TV's is TV's. Smart phones, smart phones. etc. but in liquid tradeable form.

One can even take a step further into the supply-side economics, and the cost of selling TV's - as TV's are current inventory and thus an investment - are an "advance interest" of HAVING TO produce more TV's than you've sold.

You're dealing with debt (consumption) in your example.

Consumers have the option of paying for "have now" contracts - it's their consumption, are they not allowed to make that choice with their earnings? The sale goes to those who better complete the consumers desires. no sales = no revenue = no tv's = big cost to everyone.

I actually agree with Scarfie. Interest, especially compounding interest on financial assets is both unearned income and dangerous to the broader economy.

Your argument in defense of charging interest on credit is based on a model of banking and finance that no longer exists. Credit and savings are fundamentally immaterial and exists only in the form of binary code on a bank's computer database. Savings are merely financial claims with no material existence. They're just legal claims against a borrowers earnings. There is no store of money to back a borrower's debt. Why do you think we have State guaranteed deposit insurance? Have you not heard the howls of protest by depositors now that governments of the world are now introducing bail in provisions in international finance regulation? If deposits don't back borrower's debt, why should they be paid interest in return for the loan? Credit is wholly emphemeral. Its just an entry on a bank ledger book. In times past depositors were paid interest in return for depositing real gold with a bank, but obviously this practice no longer stands. So please tell me why a borrower should pay money to "savers"?

To cover the loss from inflation

Anderwj,

Inflation is a seperate issue to the quantity of money. The overall trend in terms of prices since the 18th Century has been downward, which only changed in the 1930s after corporate chiefs took advantage of the Great Depression to convince Roosevelt to instigate their programme of economic reforms, which had the objective of cartelizing U.S. industry in order to prevent "destructive competition" and control prices to ensure "stability" of the U.S. economy. Since then with developments in technology have allowed enterprises to grow and absorb or destroy their competition so that the direct intervention of the government is no longer needed, though make no mistake many of those same technologies would not have existed without the involvement of the U.S. government.

not all banking and borrowing are done through loans.

If you believe interest is unearned, do you think loans should be interest free too?

Are you willing to lend me 1 million dollars interest free? Or does your belief only stretch to other peoples' money?

They should pay to savers because the borrower wishes to have the money. borrower wants, borrow is consumer, borrower should pay. Why do wanks want to borrow from "savers"? Because the government won't let them operate if they don't.

That should be _bank_ loans.

The _real_ value of loans, debts and currency is one of contract. That's why even the most minimalist liberatarin government revolves around the protection of Contract. Contract _is_ trade, without trade we would still be in caves throwing rocks and sticks at our neighbours.

That's why governments etc come up with such convoluted contracts to extort/rort advantage from others. This is known as "social contract".

Notice you haven't agreed to fronting up with that interest free 1million dollar loan Anarkist....

having difficulties finding the spare change?

and yeah that should have been "Why do _banks_ want...". Apparently my Freudian Slip is showing....

Cowboy,

You seem to be under the misapprehension that the modern banking system works like a credit union, where banks are purely financial intermediaries between depositors who have spare money and borrowers who need money now. In actual fact banks are the creators of money and borrowers, simply by entering a debt in the name of the borrower on their bank ledger and crediting their account. The banks freely admit this.

"Nowadays banks do not lend the physical cash. They provide the borrower with a credit facility such as a loan account or an overdraft on a customer’s current account. If the customer opts for an overdraft, they will make use of the credit facility by drawing on the account and using the funds to purchase something. The person or business receiving the funds will in most cases receive a deposit in an account at a bank. This moves the funds along the deposits part of the money and credit creation circuit again. The banking sector now has assets in the form of the loan and cash in its vault, which are matched by liabilities to the original depositor and to the new depositor.

By providing alternative means of settling transactions to cash and by acting as financial

intermediaries, banks have created a new entity called deposit money. A drawing on an

account is an instruction to a bank to shift deposit money from the account of one of its

customers to someone else’s bank account."

http://www.johnpemberton.co.nz/Banking_in_NZ-06-final.pdf

The only virtue of a "saver" is that by not defering consumption they allow spare capacity in the economy and play a role in stabalising prices, but this does not justify any claim by depositors to a borrowers income. The pragmatist in me suspects that banks use the social convention of sharing borrower's interest payments with depositors as a means to give them a stake in the banking system.

Now for homework, for giving foolish examples:

Redo my example using

(a) stored cash (give number of years likely needed for average employee with rental payments to build capital)

(b) utilising leverage (as opposed to consumer debt).

Compare with (a) and (b) and tell me of the evils of interest then!!

1 - I can tell them what's going wrong. In real terms, they're getting less energy per day, than they did. It might look like a tad more being delivered, but it's taking a helluva lot more to produce.

Their problem is that they were trained in a non-real world. They took a 'currently happening' paradigm, and assumed it'd be forever. Ignored 'externalities'. Let's face it - were ignorant, full stop.

And now they're lost. Well, hello........

And MikeB, above, is quite correct. You have to remove interest, if you're to get to a steady-state economy. If you don't (and banks won't go without a fight) then something else will be commensurately curtailed. At an exponentially-increasing rate.

Starting with Bangladesh, moving on through Glen Eden, heading for.......

I think we have told them for 6? years now.

No one wants to listen and we get the likes of profile busily peddling mantra, "free market" is the solution and all will be well, just ignore the Math, trust the snake oil salesmen. Meanwhile things just carry on getting a bit worse, while we borrow from our future just to tread water....

At some point I suppose ppl will wake up, maybe after we have dropped off the cliff into collapse.

1930s redux, add it in spades anyone?

regards

While #3 is good, the click through links to the static png file. You might be after the desination link

... thanks dh .... that's a whole lot of fun ...

They must put up a " Bernard buggers the link " onto that page .... see it light up .... haaaaaaaaaaa ...

Oh, the perfect link for epileptics.

Bernard , who are these " one or all of our big four banks" that we will bail our when ... oooops , I mean " if " the NZ housing market swan dives a'la Ireland ?

... does NZ have " 4 big banks " ....

I know the Australians do .... and if any one of them got into strife because of overlending into the NZ residential property market , I'd say " tough luck ... you took the mega profits out of NZ mortgage holders when the going was good .... if you've got problems now , suck it up .... we ain't bailing you out ! "

The question I've often pondered is whether the government would bail out Kiwibank if there were to be a property meltdown. If that were to be the case, would the Aussie banks go cap in hand to our government expecting the same?

A very good Q...

Even with the OBR in place to keep us fed most of not all banks will be insolvent, the walking dead in effect.

That means the RB? has to step in and manage them so the chequing accounts and busineses can still happen or we wont have an economy and then society at all.

So in extremis which we are taking about here can the Govn not step in?

About all you can say is the OBR might/should put shareholders, lenders, CEOs and bank depositors inline first, where they should be rather than see them escape...then the voter.

regards

they'd try and sell it first.

The problem is if ppl lose confidence in the banks then there is a bank run and the banks become insolvent, close their doors and no one can buy food, or anything else. So our entire economy ceases and maybe the odd riot and looting event....a few dead ppl maybe. Kind of not where I for one want to go. After that "fun" day or so, we'll find our housing market collapsing, no one will lend to us and its all short term.....billions of it....boy does it get nasty.

Hence really the OBR.

Now I totally agree on shareholders and bank CEOs taking the losses, indeed depositors they gambled and took the profits and risk, they should pay.

The problem is the side effects as above.

regards

Ralph - it uses a lot of words to miss the point.

It overlooks the underwrite (note Plutocracy up-thread).

Sure, it mentions labour (the old Smith/Marx label for energy) but that is as far as he gets. He's a man who was taught by a deck-chair specialist. The sinking - the thing which is making the deckchairs slide - is outside his ken.

So it's not intelligent - it's a misuse of intelligence (which he clearly has) due to a failure to adequately scope the problem. I could equally spend a whole article arguing that the accelerator must need adjusting, the brakes backing-off, or the passengers re-shuffled in the back seat, to explain the slowing of the vehicle. Indeed, I could probably write a similarly intelligent appraisal of all those.

But if I stood back, and noted that the vehicle was ploughing through metre-deep mud ?

Scoping - there's nothing like it. He failed to include energy, while discussing work. Seriously, that's stupid.

For sure there is a lot missing, but I don't think that makes it unintelligent. Your analogy is good but assumes two things;

(i) we have all the facts; and

(ii) we know how the machine works.

My assumptions are; we don't have all the facts *and* an incomplete knowlegde of how it works because I think these assumptions better describe the reality. And from that position it makes a lot of sense to think outside the box.

As you pointed out he didn't bring in energy and as I pointed out he didn't bring in morality. Still, he raises interesting points in an unusual order.

... what was your point there PDK, without out all the hooks and pokes, insinuations and insults. Couldn't spot the forest for the thorn bushes....

Economists ignore that the real economy is really an energy equation. In simple terms: Declining inputs = declining outputs. Less energy = less work. Work = ability to do / make / grow things. If they don't understand this then of course they'll fail to realize why things are struggling to 'grow' again.

Not just economists, all pollies do as well, bu then they are mostly lawyers....so what do you expect.

regards

I am not sure they ignore it - rather they deny it matters.

A central tenet to neo-classical economics is that 'economic growth has no physical limits'.

And then they go on to want economics to be accepted as a science.

Please provide a link to a neo-classical economist stating that economic growth has no physical limits?

Show us the opposite.

Sometimes its in how ppl behave and not in what they say....or maybe the word Im looking for is intrinisic or "no need to state"

regards

Can you explian yourself in words of one syllable please?

What Im saying is, where do the neo-classicals, or yes indeed many of the schools recognise that there are physical limits. Really very few do....very few.

Steve Keen springs to mind, any Austrians?

regards

look at the number of different definitions of "economic growth"

I too struggled to believe the staement when I first read it. It was made by Wolfgang Kasper, professor of economics emeritus and a senior fellow of the Centre for Independent Studies, Sydney.

He made the statement in work he was commissioned to do by the Business Roundtable. That work was a review of Jared Diamond's book Collapse: How Societies Choose to Fail or Succeed.

The following is a link to the page on Business Roundtable's website that includes what appears to be a link to a PDF of the paper:

http://nzinitiative.org.nz/shop/Library+by+type/Review+of+Jared+Diamond…

For some reason the link doesn't take you to Wolfgang Kasper's paper but to an html page that doesn't mention Kasper's statement about economic growth having no physical limits.

I have certainly highlighted that quote on this site a number of times in the past.

It may be an attempt to manage perceptions. Claim academic credibility, summarise a preferred message but don't provide access to the real paper. You could try buying the hard copy if that option works.

Checking the internet wayback machine, is this what you werte thinking of:

http://web.archive.org/web/20050915000000*/http://www.nzbr.org.nz/docum…

{click on the highlighted date in december 2005 for the pdf as it was then}

I see in it he puts himself on the Simon side of the Simon-Ehrlich bet, which Simon won in the short term, but would have lost in the long term

http://en.wikipedia.org/wiki/Simon%E2%80%93Ehrlich_wager

Thanks dh.

And if you go there and open the PDF from the original link you wil find on page eleven:

"Whilst there is entropy in the physical world, economic growth can be open-ended."

Now, over to Ms de Meanour?

You should have gone wayer back. Simon is looking pretty good. A pity population is peaking.

http://www.aei-ideas.org/wp-content/uploads/2013/01/djaignew-600x345.jpg

Hello my little cherry picker. Read GMO, there is a reversal in that trend after 2000, just when fossil fuels started to rise in cost. In fact you can see a curve starting in the 1980s. In fact you could turn that upside down and check it against crude oil production.

Population rate of growth is slowing, peaking wont happen for decades, not in a BAU anyway. Now in a post peak oil world, 10 maybe 20 years its going to drop and big time...if we dont mitigate a few things. See "Limits of growth" for that one,

regards

"Among the most vigorous critics of LtG have been radical free-market economist Julian Simon and futurist Herman Kahn, who charged that the LtG models had "been damned as foolishness or fraud by every serious economic critic."

"Continued growth is for many not an issue for debate; it is an indispensable condition of economic life."

http://www.thesolutionsjournal.com/node/569

How about yourself?

regards

Within a week of its (limits to growth) publication, in Newsweek magazine, Yale economist Henry C. Wallich, dismissed the book as “a piece of irresponsible nonsense.”

http://en.wikipedia.org/wiki/Henry_Wallich

http://rexweyler.com/2008/11/28/attacking-margaret-atwood-are-limits-to…

"“There are no great limits to growth,” U.S. president Ronald Reagan declared in 1985, “when men and women are free to follow their dreams.” He added later, “because there are no limits of human intelligence, imagination, and wonder.”

This inspiring Reaganism serves as the official Neocon rebuff to any talk of environmental limits"

regards

I think one area possibly overlooked when talking about housing bubbles is the local per capita GDP.

Many tourist destinations, such as Queenstown have high property prices, but then they have a lot of tourist $$$$ going into the area. That is there is more $$ going into the area than out so the per capita GDP is higher and so are property prices.

You can go to many other towns in New Zealand were the people do not even spend their money locally. They travel some Km to go to the Supermarket, Warehouse and so on.

More money leaves the local economy than comes in and so the GDP per capita is lower and so are property prices.

Many issues outlined above but are they causes or symptoms?

We have been conditioned/programmed/led to believe in specific definitions of success, prosperity, standards of living and wealth. Financial wealth has become the forefront/focus of our current materialistic society and yet this I believe is only a symptom.

What is the cause? Always wanting more. Our wants will never be met, will never be fullfilled, the ego cannot be satiated and in the meantime we are overlooking/ignoring our needs, the needs of those around us and the needs of those still to be born. It is as if the mantra of todays society is "as long as I get what I want who cares about anyone else".

"An old Cherokee is teaching his grandson about life. "A fight is going on inside me," he said to the boy.

"It is a terrible fight and it is between two wolves. One is evil - he is anger, envy, sorrow, regret, greed, arrogance, self pity, guilt, resentment, inferiority, lies, false pride, superiority, and ego." He continued, "the other is good - he is joy, peace, love, hope, serenity, humility, kindness, benevolence, empathy, generosity, truth, compassion, and faith. The same fight is going on inside you - and inside every other person, too."

The grandson thought about it for a minute and then asked his grandfather, "Which wolf will win?"

The old Cherokee simply replied, "The one you feed."

#4 The CEO gets 300 times the wage because their job is to protect and maximise the shareholders assets. If the company does well, then the shareholders are saved millions or billions, if the company fails....

Will's job is to full a task for a client, his client pays X to the company. A portion of that goes towards the shareholders return. Will takes a cut no matter what.

CEO gets paid to protect billions.... Will gets peanuts to produce a small about to a larger whole. I agree that if Will creates higher value for the company, and thus better facilities for his coworkers to increase the value of company to them to use the companies resources (a labour effectively hires a company to provide equipment, clients, and brand for a end consumer that the labour can sell their time, energy and skill to.)

#5...just big companies and governments going scalp hunting to butter their own bread.

#1 such attempts to allow the economy to work properly will be halted in NZ by RBNZ needing to meet it's political mandate no matter the reason for the economic growth

No, they cant make it go because the cost of energy is sucking out the "profit/ecess"

regards

I'm referring to things like a boom in dairy sales creating money in dairy industry leading to modernisation of practices and equipment because there's now liquidity to make those purchases (which often use less energy/resources than the earlier gear)

But since that creates a rise in wages to staff, and increase in quality good being sold, it shows as natural inflation. Velocity of money means more of the economy picks up, jobs created, bills bad, more people updating their aged processes/equipment.

Can't have anyu of that say RBNZ, we must keep house prices down in Auckland, thus acts to slow economic growth, slowing borrowing and business investment, reducing velocity of money by channelling more interest back to banks on existing loans. thus not so much spending, not so much wage increase especially at the lower end... and house prices in auckland go up because everywhere else is not really performing as well as they should - competing demand pushes up property speculation returns ...

Has the RB raised rates? no, not yet at least. Its introduced a LVR to try and curb property rather that raise theOCR. So I'd suggest you are wrong on this IMHO.

regards

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.