Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #5 on the human faces of inequality in the United States.

1, Jobs for everyone - And pensions for everyone over 65 too.

I'm all in favour of people working in jobs for money and paying their taxes. It's what makes our worlds go around.

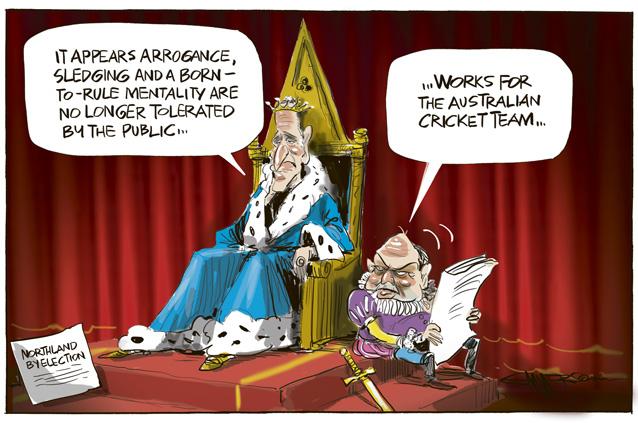

So I found the detail about the ages of people in work in the 2013 Census fascinating. Statstics NZ released the detail this week, shortly after Winston Peters, 69, declared he would stand again in Northland in 2017 at the age of 72.

It turns out the number of super-annuitants working full time has trebled to 68,652 over the last decade. That includes 1,620 people working full time in paid employment over the age of 80.

That's brilliant. All sorts of studies show people working past the age of 65 are generally healthier, more socially connected and likely to lead longer, better lives.

It also means they're paying taxes, and hopefully enough to pay for the New Zealand Superannuation benefit they'll also be receiving as an entitlement.

It does however mean they may well be working essentially tax-free after receiving their benefit, at least if they earn less than NZ$60,000 or so.

As the numbers of working super-annuitants grow and the stress of paying that benefit grows for the wider taxpaying public (under the age of 65) then the questions will grow again about retirement ages and means testing.

I don't think though that should turn into calls for those over 65 to retire or stop working. I think the more the better. I'm planning to soldier on as long as I can. I suspect also that I'll have to to because by the time I hit hit 65 in 17 years time I'll need to keep working to keep building up savings (and to pay taxes for the all the NZ Super being paid...)

The fastest growing line of Government spending for years now has been NZ Superannuation.

2. Woof, woof, wizz, wizz - Here's the world's first drone sheepdog. I grew up watching A Dog's Show and our family pet was a huntaway called Rags who was the best rounder-upper of cows we'd ever had.

So this is fascinating in some ways, and sad in others. I can imagine the 11 year old sons and daughters of sheep farmers standing on a ridge with a remote control rounding up the flock in future. Or more likely staring at a screen in the house at the front of the farm. Sad to think they'll miss out on running around the farm with a dog like Rags.

3. Quite a shock - A generation's view of the world was shaped by the quadrupling of the price of oil in 1972. Last year's halving of the oil price may have a similarly transformative effect on many parts of the global economy and polity.

Here's a useful thinkpiece from The Atlantic on the meaning of the fall in the oil price last year.

Nowhere are the second-order consequences of cratering oil prices more varied, important, and unpredictable than in the Middle East. In a Financial Timesarticle in February titled “ISIS struggles to balance books as finances are squeezed,” reporter Erika Solomon wrote, “The world’s richest jihadi group is not as flush as it once was. It has cut spending on fuel and bread subsidies, while increasingly shaking down locals for cash. Fighters themselves may be feeling the squeeze, too.”

Analyst Torbjorn Soltvedt estimated that the militant group’s revenue from selling oil had dropped to $300,000 per day, down from between $1 million and $2 million a day in 2014. “I don’t think [the oil-revenue decline] will lead to [the Islamic State’s] collapse. … But it might accelerate their implosion,” Soltvedt told Solomon. Iran, meanwhile, has entered into negotiations with world powers over its nuclear program for a variety of reasons. But the fact that Iran is one of the world’s hardest-hit oil producers is surely one of them.

4. Untenable - PIMCO, the world's biggest bond fund, reckons the euro zone is untenable. It points to some interesting history.

PIMCO used the example of the Latin and Scandinavian unions in the 19th century, which lasted an average of 50 years before breaking up, to illustrate how monetary unions were incompatible with sovereignty.

"You need to reach some sort of political agreement about how to share fiscal resources around the zone. We're a long, long, long way from designing that and getting the political backing for it," he said.

"So while you're waiting for that and you've got low growth, and high unemployment, you run the risk of letting these anti-euro parties to the forefront."

5. How much inequality can a democracy bear? - Jill Lepore has a good hard look at the science of measuring inequality in this New Yorker piece that also asks how long America's democracy can handle the record gap between rich and poor. But she also recounts some of the human stories now being collected in a bunch of books.

Aside from the anecdotes, the bulk of “Our Kids” is an omnibus of social-science scholarship. The book’s chief and authoritative contribution is its careful presentation for a popular audience of important work on the erosion, in the past half century, of so many forms of social, economic, and political support for families, schools, and communities—with consequences that amount to what Silva and others have called the “privatization of risk.” The social-science literature includes a complicated debate about the relationship between inequality of outcome (differences of income and of wealth) and inequality of opportunity (differences in education and employment). To most readers, these issues are more familiar as a political disagreement.

In American politics, Democrats are more likely to talk about both kinds of inequality, while Republicans tend to confine their concern to inequality of opportunity. According to Putnam, “All sides in this debate agree on one thing, however: as income inequality expands, kids from more privileged backgrounds start and probably finish further and further ahead of their less privileged peers, even if the rate of socioeconomic mobility is unchanged.” He also takes the position, again relying on a considerable body of scholarship, that, “quite apart from the danger that the opportunity gap poses to American prosperity, it also undermines our democracy.”

6. The Cephlapod is back - The FT's Gary Silverman looks at how Goldman Sachs' connections to US Presidential contenders are becoming an issue. By the way, a Cephlapod is a squid...

Questions are being raised about Goldman because so many of the leading White House contenders have close family ties to the Wall Street bank. Ted Cruz’s wife, Hillary Clinton’s son-in-law and Chris Christie’s brother, for example, all have worked at Goldman.

Why so many relatives of Goldmanistas are leading politicians is hard to say. Conspiracy theorists, I am afraid, will see it as evidence that Matt Taibbi of Rolling Stone was right when he compared the bank to a “great vampire squid wrapped around the face of humanity” in 2010. I suspect it probably has more to do with the very small world of the US elite. But, whatever the case, the spectre of that celebrated cephalopod is once again influencing national politics, at least for now, with consequences for Goldman and other banks.

7. If only... - Brad Delong chronicles the response of the world's policy elite to the Great Recession of 2008 and 2009 and how the triumph of the monetarists through the 80s and 90s is responsible for the timidity of that response.

Admitting that the monetarist cure was inadequate would have required mainstream economists to swim against the neoliberal currents of our age. It would have required acknowledging that the causes of the Great Depression ran much deeper than a technocratic failure to manage the money supply properly. And doing that would have been tantamount to admitting the merits of social democracy and recognizing that the failure of markets can sometimes be a greater danger than the inefficiency of governments.

The result was a host of policies based not on evidence, but on inadequately examined ideas. And we are still paying the price for that intellectual failure today.

Let’s tackle the history first. In general, trade deals today are markedly different from those made in the decades following World War II, when negotiations focused on lowering tariffs. As tariffs came down on all sides, trade expanded, and each country could develop the sectors in which it had strengths and as a result, standards of living would rise. Some jobs would be lost, but new jobs would be created.

Today, the purpose of trade agreements is different. Tariffs around the world are already low. The focus has shifted to “nontariff barriers,” and the most important of these — for the corporate interests pushing agreements — are regulations. Huge multinational corporations complain that inconsistent regulations make business costly. But most of the regulations, even if they are imperfect, are there for a reason: to protect workers, consumers, the economy and the environment.

What’s more, those regulations were often put in place by governments responding to the democratic demands of their citizens. Trade agreements’ new boosters euphemistically claim that they are simply after regulatory harmonization, a clean-sounding phrase that implies an innocent plan to promote efficiency. One could, of course, get regulatory harmonization by strengthening regulations to the highest standards everywhere. But when corporations call for harmonization, what they really mean is a race to the bottom.

33 Comments

Stiglitz says that "when corporations call for regulatory harmonisation, what they really mean is a race to the bottom".

He gives no evidence for this and in fact it doesn't really make sense. Big corporations should be quite happy with strict regulations; they can afford to meet them. It's the small companies who can't that are driven out of business, or prevented from ever getting into business in the first place, thus entrenching the market domination of the big companies, restricting consumer choice and reducing competitive pressure for innovation and quality.

Your reply is so dogmatic and blinkered its unbelievable/incredible.

Evidence, well do you recall a US company opening a plant in India that subsquently failed? (exploded?) They went there due to lax safety regulations saving them money. Or US corportations saying the RMA stopped them coming to NZ? they liked it taht we have cheap, 1st world, english speaking labour, good transport and mineral wealth but not teh RMA as but we dont like pollution, thank god for taht is all i can say.

Maybe if you looked at the US regulations or lack of them? If you are not prepared to look, then sure you will not see.

So you cannot imagine that it could ever be the case that a well-resourced corporation would prefer rules that their competitors will find it difficult to meet, over rules that everybody will find it easy to meet? You don't think incumbents in an industry would ever want to create barriers that will prevent new entrants increasing competitive pressure?

Would you see it as a desirable state of affairs, where New Zealand companies don't face much competitive pressure and therefore don't have any particular need to try to be efficient, keep prices down, improve their offering to New Zealand consumers?

Certainly, the RMA is intended to prevent pollution, an objective we can all agree with. That doesn't make it a good law. Good intentions don't automatically make for good regulation. There can be good, effective, efficient ways of achieving intended objectives, and there can be bad, ineffective, inefficient ways of achieving intended objectives which also lead to a number of unintended, undesirable consequences. I would hope we can agree that the former is preferable to the latter.

No I did not say that. In specific cirumstances sure, but not the generality you started out with.

The RMA acheives its aims from what I can see, therefore it is a good (enough) law. Now is it possible there is a better way? well never say naver I guess. For instance Peru? allows ppl to sue corporations on behalf of the environment, now that I think is a great addition that we should have.

If you believe that corporations are happy to have strict laws then why are so many of the fossil fuel industry trying to get the EPAs determination to control CO2 stopped? As a second example of reducing pollution having done so in California it seems their citizens are enjoying better health, yet the car industry etc faught this for years.

#7 Was not the moneterist just an idea proposed by economics academics which cherry picked evidence to support, and ignored evidence that challenged? The world doesn't change, if you don't agree with the "experts" (usually self appointed) you are shouted down as a heretic to be burnt at the stake. If you try to hold the wealthy and powerful to account your reputation, carreer, and life are destroyed ruthlessly. Success in this world is not about being right, but about ones ability to play politics, sway or otherwise influence others to support you, or to threaten others (Elliot Spitzer comes to mind). Thus the meaning of the earlier article that wealth and opportunity gaps actually threaten democracy.

While not a socialist, I am becoming reformed from the right wing views i normally held as i see the increasing damage being done by capitalists. I suggest sonwhere in the middle is the right place.

Some economist academics, ie the "fresh water school", not the "salt water" school. In fact if you then start to look at Moneterism you can see like Keynesiam it was usurped in turn by politicians bent on justifying their own goals.

Otherwise yes I agree with you, very much so.

In terms of "right wing views" for me what I see is the right are actually moving away to the right, certianly in the USA. The interesting thing for instance is if you look at how Obama has governed he is "lightly" right wing yet he is condemned as a "left wing muslim socialist" . Yet actually compare say President Ike with Obama and the only real difference is the decades between them. I guess my point is have you simply stopped drifting off the the right with the mass of the right? certainly when I look at the "Thus the meaning of the earlier article that wealth and opportunity gaps actually threaten democracy." I too feel this way, but I see the hard core left beckoning who "frighten" me just as much. It would also think explain why National won this time, JK seems moderate while Labour, the Greens, mana and the Internet party were truley a concern, I almost voted for WP, LOL and i think many actually did.

I agree, well put. In fact for some years now I have been describing the perception of Right Wing V Left Wing politics as beeing a straight line with the obvious left and rights. But if you consider the line as a circle instead, with the left and right right next to each other at the top the differences make more sense, as for most in power it is about protecting their own rights and priviledges, and building personal wealth, however it is achieved, but at the expense of society as a whole. So extreme left and right differ only in the colour of the clothes they wear, not what they are trying or want to achieve for society.

Hmm, broadly, yes. When not extremes the left and right do differ, a bit. The effect they have is however the same ie exploitation of resources its just the reciepients who benefit who change. Hence as you said I prefer to be centralist.

Superannuants working, can we graph that? Consider the GFC started on 2008 so that is 8 years. If like me many lost a sizable % of their pension capital plus we have had very low interest rates since, wouldnt this be forcing OAPs to work?

#6. A squid is a cephalopod but there are many other animals within its taxon. http://en.wikipedia.org/wiki/Cephalopod

"A key driver of a reduced global demand for oil is the development of technologies that are able to exploit the differential between the dollar per unit of energy price of oil versus natural gas. Even at $40 per barrel, the dollar per MMBTU price of oil is much higher than the dollar per MMBTU price of natural gas."

"The production of associated gas from oil extraction is an additional driver of fuel switching from oil to natural gas. Roughly one-third of the growth in new U.S. natural gas supplies and approximately 10 percent of total domestic natural gas production are derived from the production of oil."

http://news.stanford.edu/news/2015/march/oil-prices-wolak-033015.html

http://siepr.stanford.edu/?q=/system/files/shared/pubs/papers/briefs/Po…

Nice "hubbert" curve too.

Petrol back below $3 a gallon in California. Filled my maxima up today for $30.

Hmmm, still lots of homeless about, unemployed, beggars and such, yet the economy is meant to be picking up.

Petrol here 192.9 in our town, per litre.

NZ needs taxes on petrol/diesel/road user charges to pay for other items....

Bankers, Poll-lies, Bridges up North, Sky City, probably Americas Cup, other add ons and Pot Holes and Dust in Roads....of course to fix the gridlock too in the great big carpark, they call Awkland. Where a commute, means a life sentence, waiting for something to happen, not a shortening of the dilemma of whether to buy a leaky home, or not.

"Global oil prices may stay low for the next 10 or 20 years according to Stanford economist.."

I wonder what actual scientists like geologists and geophysicists think about this claim? For balance here's a recent post by geophysicist David Hughes (who corrected called the massive 96% downgrade of the Monterey shale reserves last year).

- Irrespective of price, geology is trumping technology in the Bakken and Eagle Ford plays.

- The widely reported ramp up in well productivity in the Bakken and Eagle Ford plays over the past year due to technology improvements does not exist when examined at the play- and county-level .

- Although some operators may have experienced productivity increases depending on the location and quality of their leases (eg. Whiting in Mountrail County of the Bakken), others have experienced correspondingly greater than average decreases.

- Well productivity in the top-producing counties of both the Bakken and Eagle Ford is declining, despite the application of the best technology. This is due both to saturation of the best parts of these counties with wells and resultant movement to lesser quality areas, and potentially to well interference as densely spaced wells cannibalize each other’s production.

- The decline in well productivity in top counties is particularly disturbing given the incentive for operators to move drilling into core areas to maximize economics given the drop in oil price.

- The widely speculated decline in shale oil production due to the fall in rig counts will not become fully evident in actual production data for a few months, due to the typical 2-4 month lag in data release, along with inevitable revisions.

- The drop in rig count will certainly affect near term production but will not significantly change the amount of oil that can ultimately be recovered from these plays. In fact it will save oil for later, reducing the post-peak rate of production decline.

- The industry’s propensity to drill its best locations first means that prices will have to go much higher to recover the last of the oil from these plays.

- Projections in Drilling Deeper may be a bit too optimistic in the short term given the decline in rig count and associated drilling rate but are on track for the longer term.

I wonder who I should trust, economist or geophysicist.

A quote I like, "An academic is a philistine in any area but his own expertese." and then there are economists.

On top of the above points,

1) Lets consider that there are increasing signs that non-profit organisations are de-vesting from fossil fuels. This means that in the future its quite likely that the oil industry is going to have problems getting funding.

2) the oil junk bond market is burning private "investors" I wonder how willing they will be for round 2.

3) USA shale will peak inside of 3 years. No where else is taking on shale en-mass.

4) Conventional oil is already down, I dont see anyone I'd trust to be honest saying that isnt the case.

So oil prices will stay low for years? hard to believe.

Barring widespread depression (which I wouln't rule-out) sustained low prices seems unlikely given that the price is far below the break-even price for many producers. In the long-term as CAPEX is removed and future production is shelved I suspect we'll see the price start to creep up again.

Personally I think 'shale' will probably peak a little later (circa 2020) but I guess that little difference is trivial in the grand scheme.

To be fair to Hubbert his prediction was made based on conventional oil reserves. In this respect his prediction was remarkably accurate. Kudos to him.

Gee if only that geophysicist predicted the shale oil boom he would have had it made. Guess he was too busy at the Post Carbon Institute. Good luck at getting by without carbon.

As for his points most are stating the bleeding obvious. His first bullet point is laughable - surely tight oil extraction is a classic example of technology trumping conventional/consensus wisdom.

Well lets see,

a) he predicted the Monterey non-event which would have saved his (if ha had invested) and many ppls shirts, a 96% downgrade....

b) the boom was only profitable while oil was expensive, now it isnt and it is a bust the only thing flowing right now is financial losses, job losses and bankruptcies. So at best you can say forcasting it early and getting out early would have been profitable, and I wonder how many ppl would have got out once they saw the money flowing in, not many I bet. If you look at some of the auctins on support vehicles they were bought new for 500K and are now being sold for $140k a pair....yes highly pofitable...for the auctioneers. The only thing that made shale profitable/possible was easily available and cheap credit, ie junk bonds from gamblers who are now losing their shirts.

Here is a piece,

http://www.postcarbon.org/revisiting-the-shale-oil-hype-technology-vers…

The thing is would you invest? seems despite your belief it was going to be a god send you did not. So where is your confidence in the rort?

Fracking has been around since ~1950's so it is hardly a 'new technology'. What enabled the large uptake was the unprecedented spike in oil price over the 2000's as production failed to match demand. Source rock wasn't worth fracking when the oil price was cheap, it took a quadrupling of price to justify going after it.

Funnily enough many tight oil wells are now unprofitable at this price and companies are going bust. Luckily for us, the large decline rate of shale wells means production won't be sustained for long in the absence of continuous fracking.

Unfortunately his points are not 'bleeding obvious' for everyone it seems, I'm surprised to hear you making this comment as I'd imagine you'd be the first to jump on the 'productivity gain = infinite production growth despite falling rig-count' train.

I should add, I imagine the people who are shouting "technology improvements" and "productivity gains" the loudest are mainly the companies who are doing their best to keep a stiff upper lip and maintain investor confidence. Got to keep selling the stock or junk bonds somehow or the whole house of cards falls down, you know, greater fool theory and all that...

and if you go back to 1980 we can see alaska came on line giving the US a second peak and then that rebound rolled over as well. So with shale we are looking at another roll over inside of three years.

It will be interesting to watch...

No point in an education on basics.

These guys could work for GS as brokers. Pay em 2squid an hour.

http://www.bloomberg.com/news/articles/2015-03-31/china-s-big-stock-mar…

Re #3

To some people the oil price crash was entirely predictable. This article from Nov 2013 predicting the scene we see today is sobering in two regards; its accuracy and worse, the scenario's painted going forward .

Some of Gail Tverbergs recent writings are not for the faint hearted.

Remember, plenty did predict the GFC, its just that they weren't taken any notice of because they didn't conform to the 'consensus view". Blaaagh!!!

http://ourfiniteworld.com/2013/11/15/whats-ahead-lower-oil-prices-despi…

'If I am indeed right about the path of oil prices being down, rather than up, the long-term direction of the economy is quite different from what most are imagining. Oil companies will find new production increasingly unprofitable, and will distribute funds back to shareholders, rather than invest them in unprofitable operations.'

'Oil companies will increasingly find that the huge amount of debt that they must amass in the hope of producing profits sometime in the future is not really sustainable.'

Re #3

To some people the oil price crash was entirely predictable. This article from Nov 2013 predicting the scene we see today is sobering in two regards; its accuracy and worse, the scenario's painted going forward .

Some of Gail Tverbergs recent writings are not for the faint hearted.

Remember, plenty did predict the GFC, its just that they weren't taken any notice of because they didn't conform to the 'consensus view". Blaaagh!!!

http://ourfiniteworld.com/2013/11/15/whats-ahead-lower-oil-prices-despit...

'If I am indeed right about the path of oil prices being down, rather than up, the long-term direction of the economy is quite different from what most are imagining. Oil companies will find new production increasingly unprofitable, and will distribute funds back to shareholders, rather than invest them in unprofitable operations.'

'Oil companies will increasingly find that the huge amount of debt that they must amass in the hope of producing profits sometime in the future is not really sustainable.'

our-oil-price-predicament.png

However few if any? predicted that the shale over-supply would be so large driven by high prices and cheap lending that we'd get such a big collapse in price. I'd suggest the nature of the Fed's low OCR policy forcing ppl to gamble in risky junk bonds has had some pretty peverse and surprising results. What gail is predicting is perfectly valid (and not just her), a recession caused by high oil prices, this is a rinse and repeat.

Oil price predicament well,

http://fractionalflow.com/2015/03/21/is-the-red-queen-outrunning-bakken…

lt lays out that the present price at the well head is $30ish

"As of writing the wellhead price in Bakken is around $30/Bbl and the point forward breakeven for the “average” well has been estimated at $65/Bbl at the wellhead, which is about $80/Bbl WTI." and we are at $50, no wonder then that instead of 1600 rigs we have 1000 or less in 6 months....where will we be in another 6 months? By june the storage is estimated to be full, so then where does the oil price fall to? 2~3months, get your pop corn in.

#1 - Superannuation is currently optional at age 65 - it is not automatic, you have to apply for it (and meet certain requirements) to receive it. Superannuation is fully taxable as well. Both of these things are good things and need not be changed.

What can be addressed however is the unfairness of someone continuing to work and receiving superannuation. There need not be asset or means testing of any sort - and no new billion dollar IRD system would be needed. IRD already generates a Statement of Earnings for everyone - which includes superannuation and paid employment as income.

What would be sensible would be a cut-off level of earnings income - beyond which superannuation attracts a higher tax rate. How about starting with $50,000 (as an example) in annual earned income. If you make more than this and apply to receive super - then a different tax rate would apply for the super. It could be incorporated into a simple one line addition to the IR3 form, and sorted out at the end of the tax year to avoid some other complications which might arise with partial years, etc.

Applying for the super would be done in many cases then upon actual retirement from the work force.

Just raising superannuation eligibility age is a shallow approach.

I dont understand why someone in full time employment after 65 will qualify for a full super payment as well. The country can't afford it so why not means test it?

You can't claim it in Aus so why here? Its not fair to pay all this tax money to a generation who doesn't need it when the younger generation are struggling with student loans etc.

Perhaps because

1. means testing would provide a disincentive to save for retirement.

2. A flat minimal pension provides full coverage for all older NZers. Largely eliminating poverty amongst elderly.

3. It's a simple solution.

4. An older age limit penalises blue collar workers & Maori

5. Most don't work after 65

6. 45+ years of work & paying tax is a good contribution.

Means testing in NZ is fraught with all sorts of complications (starting with 400,000 trusts and other ways of obscuring assets). Income testing is simple and harder to avoid. IRD produces a statement of earnings with superannuation and earned income for everyone. There may be ways to rort the earned income in some cases - but far far simpler to identify income than assets.

I dont totally disagree but, how about because many at 65 are supplimenting their pension on min wage jobs?

What is the difference between working in a job and having a private pension income? What is the difference between being a Landlord and collecting rents as your private pension income and getting interest off a deposit account? Bear in mind they are still paying tax on all of it.

And I don't totally disagree with you. :)

I just don't believe someone who turns 65 and continues in a high paying job should get the superannuation without impediment. However people supplementing their pension with minimum wage jobs should be encouraged and protected by having a reasonable level of earned income allowed before any impediment kicks in. Let's say $50,000 per year as a starting point.

The emphasis on earned income is that it is already directly measured and available to the IRD - and they will provide it to you via a Statement of Earnings. It includes taxable pensions such as the superannuation and reported earned income but does not include rents and interest from investments. Hence there is still huge incentive to save for retirement - as there should be.

Anyone who continues working at age 65 would have complete control on when they apply for the superannuation - as they do now.

Raising the retirement age for everyone is a sledge-hammer approach with unintended consequences.

Like your comments billsay. But I'd income test it from say $30k - half the average full time wage. Regarding not discouraging saving for your retirement, It's easy enough to descriminate between interest type income and employment related income as they do now with the ACC earner levy. Hopefully such changes would enable a bigger super payout as the present one is not large. Any changes along the line of increasing the age of eligibity will miss the mark as, given the lead in time , the baby boom population bulge will have passed.

@Mark L

You bring up a very good point which is not mentioned by the Old Age Pensioner bashers. The super payout is not large. I received $16,132 for the last full year from super - as my only earned income - and had $4,834 deducted from that as tax. (the amount of tax ultimately paid depends upon other things of course). So, less than $12,000 annually as super, after 43 years of full time work. I don't think $12,000 is particulary generous compared to other government payouts.

Of course, in future, KiwiSaver and the NZ Super fund may help those in retirement - and reduce the continued emphasis and rush by Mr Hickey and others to push for increasing the retirement age. It isn't necessary.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.