By Chris Di Leva*

In New Zealand, most of our wealth is invested locally in the property market, share market and in New Zealand dollars. There are many factors that have driven this, ranging from wanting to invest in companies we know and trust, a preference for “real” bricks and mortar assets through to ease of access. Though one could make a case today that the latter may no longer ring true with both direct global shares and global share funds being accessible through various platforms such as Sharesies and Hatch, InvestNow and Flint.

In addition, the appetite for global investment may have simply not felt necessary. After all, the past two decades (to the end of 2020) were very kind to New Zealand share market investors, with the NZX50 return exceeding the MSCI All Country Global Share Index by 7.8% p.a. in the ten years to the end of 2020, and beating the S&P 500 index by 3.2% p.a. However, 2021 was less flattering with the NZX50 returning 17.2% less than the global index.

One could draw the conclusion from long term returns that there is no need to venture offshore as, after all, the New Zealand market has provided strong outperformance in the past. Understanding the drivers of this outperformance is key to investing going forward because, as 2021 showed, the idiosyncrasies of the New Zealand market can deliver both positive and negative outperformance.

A different kind of market

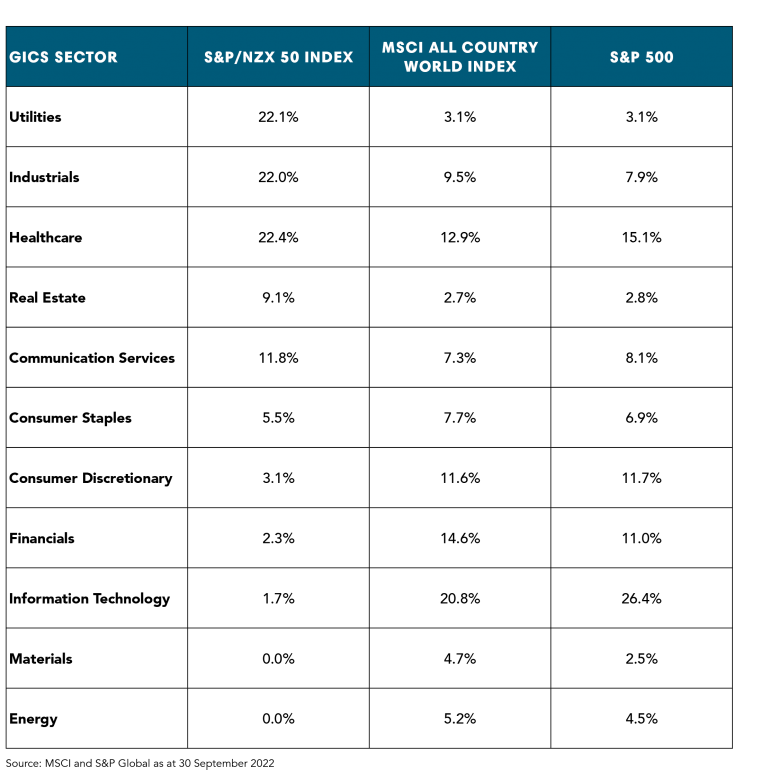

The New Zealand equity market is principally a low volatility, income-oriented market dominated by industrials (largely electricity generators), utilities and real estate. The New Zealand market is also overweight healthcare, though this tends to be skewed towards individual stock risk in larger market capitalisation stocks F&P Healthcare and Ebos, and the listed retirement village operators. In contrast global healthcare exposure tends to be more diversified including significant exposure to large pharmaceutical and biotechnology companies. The New Zealand market is also underweight financials (banks, asset managers and insurers), consumer discretionary, information technology, resource and energy companies. More detailed composition is below:

The difference in composition means exposure to different characteristics and therefore risk factors. A lower price to book ratio and higher dividend yield in the New Zealand equity market are both regarded as defensive characteristics. The New Zealand market’s higher price to earnings ratio is a result of sectoral composition with the utilities sector commanding a higher multiple globally (it also has an above-average dividend yield so contributes strongly to that measure also).

Concentration

The New Zealand market is narrower and lends itself to more stock-specific risk with the top 10 holdings of the S&P/NZX 50 Index comprising 60.2% of the overall index, compared with 16.2% of the MSCI All Country World Index.

This concentration can mean that, at times, large stocks have an outsized contribution to index performance. For example, in 2020, almost half of the S&P/NZX 50's performance was attributed to one stock, Fisher and Paykel Healthcare. In contrast, in 2021, two stocks (a2 Milk and Meridian Energy) detracted 6 percentage points from overall index performance.

Tactical idiosyncratic factors – housing, the consumer and energy

In terms of the near-term outlook for earnings, tactical consideration is required. While there is some uncertainty with respect to the New Zealand economy, we think that the consumer and housing sectors are likely to bear the brunt of a downturn. If interest rates hold to the path of current expectations there is potential for a considerable fall in housing construction, margins, and profits, and for a significant reduction in household consumption, and therefore, retail sector revenue. However, the relatively low index exposure in the retail and housing sectors, together with recent underperformance in these sectors, suggests that a global exposure to the housing and consumer influence may be a larger consideration.

For taxpaying investors, there are potential benefits in investing in New Zealand shares, with New Zealand shares being taxed on dividends versus global shares at a Fair Dividend Regime (FDR). The FDR tax regime assumes a higher level of income (5%) than the running dividend yield of the New Zealand market. In addition to this, there is a more limited set of vehicles available which can benefit from foreign tax credits in New Zealand.

Valuation levels

The different sectoral composition of the New Zealand market is unhelpful when making aggregate valuation comparisons with global markets. One could attempt to mitigate this risk by adjusting the market for different sectors, however, even then it would ignore the idiosyncratic risk that exists within each sector, with some sectors being comprised of just a few stocks.

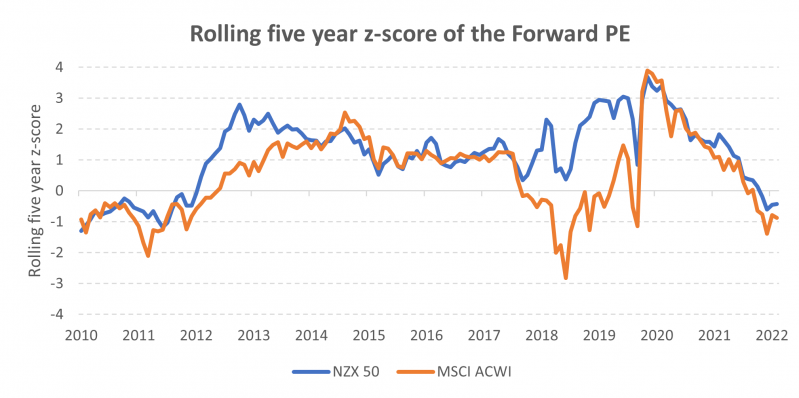

This being the case, in our view, a more favourable method of valuation is to compare a market’s valuation against itself through time. Using this method (a five-year z-score), we can see that both global and New Zealand market PE ratios are trading slightly inexpensively, consistent with uncertainty on interest rates and the economic environment.

Source: Harbour, Bloomberg

A dollar each way

Strategically, there are clear diversification benefits from being exposed to both the New Zealand and global share market from both a sectoral composition and style basis. Exposure to global shares, unless fully currency hedged, also brings further diversification by providing exposure to foreign currencies; a weak New Zealand dollar has been associated with periods of falling global equity returns and hence an unhedged global exposure has provided a partial buffer for investors.

Despite a slowing economy, New Zealand share market earnings have remained robust, though current market expectations for continued profit margin expansion seems less likely in the current environment. The global share market is expecting flatter margins (and negative margin growth in the US).

*Chris Di Leva, is a Director and Portfolio Manager at Harbour Asset Management. This article is used with permission and was first published here.

This article does not constitute advice to any person.

12 Comments

An interesting analysis. Thank you.

Excellent article.

fund management plea disguised as research ,warning against pulling your money out of their poorer performing funds.

Exactly... sales pitch disguized

There is no logical reason why you should hold anything more than a tiny percentage of your equities portfolio in NZ other than because of tax advantages or FX hedging costs. Everything else is just home bias.

I'd go further. There's a logical reason why a NZer shouldn't hold shares in NZ companies: if the national economy goes relatively tits-up, your job could be in jeopardy, so then you wouldn't want your portfolio to tank at the same time you might need to liquidate. Your salary is one big egg in the NZ basket; you don't need to add more.

alphabeatrium,

I am going to disagree with you. I was a stockmarket investor in the UK for many years before coming here in retirement almost 20 years ago. The portfolio i have built up since then is almost entirely NZ based and that is because I am first and foremost, an income investor.

That has served me very well. I am well aware of what I may have missed, but that doesn't concern me. I have enjoyed a growing income and over this time, the NZ market has produced plenty of growth. It has kept my tax affairs simple as an added bonus.

Some helpful insights into NZX. Useful article.

This is a really interesting article. Great work.

"There are many factors that have driven this, ranging from wanting to invest in companies we know and trust, a preference for “real” bricks and mortar assets through to ease of access."

This ignores the main issue of the uneven tax treatment of NZ residential property, NZ shares and direct investment in Oseas assets.

Its a complex issue that a short article can't cover but until this matter of unequal tax treatment is resolved we will continue the obsession with residential property.

Great piece. Recently I sold some USD shares at a slight loss and booked profit on the exchange rate which illustrates part of what the article says.

Clearly written, data-based and bias-free article. Great job!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.