By Kevin Bennett*

- Technology and biotech companies are delivering on revenue

- After a period when share valuations adjusted to higher interest rates, share prices of fast growing companies are performing following positive announcements on growth

- These sectors may be less exposed to a slowdown in household spending and investors may become more comfortable with increasing exposure

As has been well documented, the share prices of long-dated assets such as technology and biotech companies globally suffered in 2022 as rising interest rates and the prospect of slowing economies impacted on market perceptions of underlying value. However, in the last three months investors became more comfortable about the outlook for both interest rates and the prospects of companies experiencing structural growth.

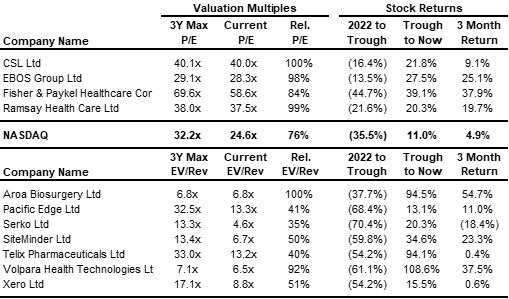

The NASDAQ index in 2022 fell from peak to trough by 36% but has since rallied 12% from this trough (albeit still down 29% from the 2022 high). Within this sector, the smaller “bleeding edge” technology opportunities have underperformed the broader and larger capitalisation stocks. Part of this derating was linked to the impact rising interest rates have on long dated cash flow assets. As the market demands a higher return (i.e. risk off) from alternate investments, such as technology and biotech assets, the risk off sentiment had a bigger detrimental value impact than for more traditional businesses generating positive cash flows.

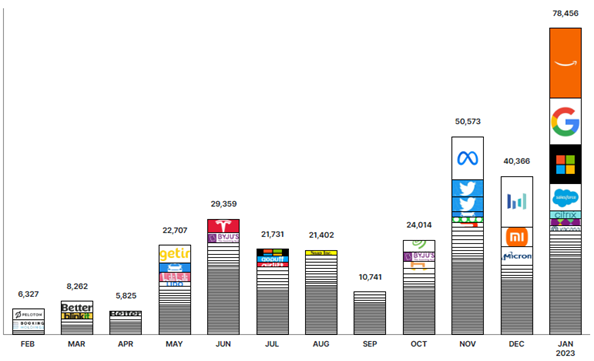

The other notable trend has seen technology companies looking to “pivot” from pure revenue growth (often funded by “free” debt and equity) to positive free cash flow (or the prospect of achieving this). This is best reflected in recent headcount reduction announcements with many companies focusing back on their core businesses.

Number of Tech Employees Let Go

Source: Trueup

The realisation that the “free” money environment of the past five plus years is over for the foreseeable future has seen many of the tech/biotech companies in New Zealand and Australia realign their models in a similar manner. Within Harbour’s investment portfolios, Volpara Healthcare had a new CEO appointed mid-year and the company has moved to increasingly focus on its core competencies. As a result, Volpara reported its first positive quarterly cash flow result in the December quarter, whilst maintaining solid revenue growth. The company share price has rebounded 100% off its lows. Likewise, Pacific Edge Biotechnology, under its recently appointed CEO, has brought a more commercial focus to the company, driving strong revenue growth quarter on quarter in 2022. Unfortunately, regulatory uncertainty over Pacific Edge’s pricing model in the US continues to overshadow the stock, and until this is resolved the uncertainty may overhang its share price.

Other tech companies within our research coverage and portfolios have stuck to their business models but have acknowledged the need to operate within tighter capital constraints. The ongoing success in delivering strong revenue growth and improving operating margins has seen companies such as Aroa Biosurgery and Telix Pharmacueticals recover 90% and 104% respectively from their share price lows, and both companies should be able to sustain their business models without returning to investors for new equity. The forementioned companies have also been beneficiaries of the Covid pandemic easing and the gradual relaxation of the associated constraints on the healthcare sector.

Arguably, we consider the healthcare sector enjoys structural tailwinds that provide a material offset to any weakness in the general economy. These companies also offer a leading product/service with global aspirations and already operate in markets that have considerable long-term growth options. The reopening of the healthcare sector also benefited larger healthcare names such as CSL, Ramsay, EBOS and Fisher & Paykel Healthcare.

One of our larger technology companies, Xero, has recently appointed a new CEO and the market is awaiting with interest whether this may see a pivot towards a more balanced business approach between new adjacencies and geographic regions whilst generating strong cash flows from its more mature business segments.

Finally, in the travel related technology markets, Serko and Siteminder are looking to balance a strong recovery in underlying demand as international travel rebounds post-Covid, whilst building new disruptive SaaS business models across multiple markets. Serko’s recent market update highlighted robustness in the travel industry, but the company has yet to demonstrate the benefits of its nascent relationship with Booking.com. Siteminder has yet to update the market on recent trading conditions, but we expect it should be also enjoying the benefits of the resurgent travel industry.

Globally, as liquidity continues to be drained from markets, and real interest rates remain positioned to dampen economic growth and inflation, the appetite for unconstrained high technology investments seems unlikely to return to the heady valuations seen in late 2020 and 2021. Instead, investors are more likely to be attracted to high-growth companies that are delivering on both revenue growth and articulating the longer-term value proposition.

The start of 2023 has given many investors a much better start for returns in higher growth stocks. The extent to which these returns are sustained may now more likely be related directly to the performance of specific corporate updates.

Healthcare, Biotech and Technology Valuations

Source: Bloomberg, Harbour

*Kevin Bennett is Head of Research at Harbour Asset Management Limited. This article is used with permission and was first published here.

This article does not constitute advice to any person.

9 Comments

Hey interest.co.nz, could the spriuking be a bit more subtle in the future, so it takes a bit longer to pick?

... what is your problem ! ... it's a perfectly balanced article , entirely relevant to the interest.co.nz platform ...

Useful article in an area I don't recall has had much coverage on interest.co. Certainly looks like a case for growth in these kinds of companies given labour shortages increasing the incentives for automation, and the big pump govts have been throwing at "health care".

"Arguably, we consider the healthcare sector enjoys structural tailwinds that provide a material offset to any weakness in the general economy." - is this code for vaccine makers getting their teeth into govt funding, and aging populations sucking up hospitals?

Anyway, I'd rather see funds flow into these sectors than yet more into real estate.

I recall a Bernard Hickey article from several years ago where he claimed that tech had plateaued , that all the gains were made already , and he bemoaned our future growth ...

... at the time I thought , utter bollocks , Bernie ...

Tech in renewable energy , EV's , AI , healthcare ... is blasting ahead ... fantastic things are happening ... and new fortunes are being made ...

Tech in renewable energy , EV's , AI , healthcare ... is blasting ahead ... fantastic things are happening ... and new fortunes are being made ...

Yes. Not sure about EVs....yet. It's a long-term plan. African kids need to work harder digging for the minerals so the Grey Lynn set get a better value proposition on their purchase (excuse the cynicism).

... we could turn our current liability around 180° , and become a leading country in innovative solutions to pot holes ... hi tech super quick super fast setting permanent patch ups ...

The extent to which these returns are sustained may now more likely be related directly to the performance of specific corporate updates.

I'm wondering if a robot wrote this?

I think there is a misunderstanding of how tech companies actually deliver value.

As a software engineer myself, business people often think we spin magic spells that generate money.

Software fundamentally solves information problems, enabling businesses to improve its value proposition by saving time. Whether it is filling forms, sharing information amongst clients and employees, managing information within organisations or performing calculations which were previously performed by humans. Firms are paying to save time and to improve organising ability.

The proposition with AI is largely improving optimisation problems which have discrete answers (i.e. statistical approaches to problems) for information processing. The image processing and impressive content generating AI will create value by limited applications in direct ways, i.e. spotting cancer on MRI images, varroa mite counting for beehives, plant disease recognition etc.

Xero solved accounting and bookkeeping problems by enabling users to keep books far easier and through a central location. It is a fantastic business model which captured a market at the right time. But it is a 17 year old company at this point.

But SaaS has really been explored extensively in the 2010s. Much of the new value propositions built on SaaS principles while applying IoT, Data Science and AI techniques to create value.

If there was anything to really look at this decade, it is IoT applied to public services, agriculture, mining and so on.

Nice comment.

The proposition with AI is largely improving optimisation problems which have discrete answers (i.e. statistical approaches to problems) for information processing.

Yes, And cluster analysis. Which I have a particular problem with. If used property it can be good for broad understanding but can ignore the outliers, which is were some of the more interesting insight and discovery can come from.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.