Here's my Top 10 links from around the Internet at 10.30 am today in association with NZ Mint.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must watches today are #7 and #8 from Stephen Colbert on the Reinhart/Rogoff mistake. Hilarity ensues from a spreadsheet error. Jon Stewart at #10 on the plunge in the gold price made me LOL too.

1. The austerity obsession is ending - FT reports Italy has just elected a new Prime Minister who wants to end the European obsession with so-called 'expansionist austerity'.

This is where governments cut their spending and increase taxes to return to budget surplus in order to avoid 'crowding out' the private sector, thus driving more efficient, productive and stronger growth in the private sector. This is the John Key/Bill English plan.

It's a strategy that can work when the private sector is healthy and has headroom to grow, particularly with it debt to income ratios. But when households and businesses are deleveraging it's difficult to make 'expansionist austerity' work.

Europe has this problem in spades. Its household sectors, particularly in Southern Europe, are horribly indebted with little prospect of restructuring and the inability to use inflation to make the debt go away.

The three year experiment with austerity in Europe also seems to be coming to an end as it's simply not working and voters are working this out. Spending and tax crackdowns are actually driving European economies deeper into recession (or worse) and are increasing debt loads, rather than reducing them.

The final straw was the debunking of the key academic argument underpinning the austerity strategy. The revelations in the last couple of weeks that the Reinhart/Rogoff theory of a 90% tipping point for public debt/GDP was based on a dodgy spreadsheet has tipped the balance.

Yet this theory that government austerity is exactly what drives growth is the one being pursued by John Key and Bill English.

Outlining a programme of institutional reforms and measures to create employment, Mr Letta immediately weighed into the pressing eurozone debate, sending a strong message to Brussels and Berlin that a change of direction was needed.

“Europe’s policy of austerity is no longer sufficient,” he said, echoing similar remarks this week by Jose Manuel Barroso, European Commission president.

------------------------------------------------------------------------------------------------------------------------------------------

Keep it safe. Keep it in a New Zealand Mint safety deposit box. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

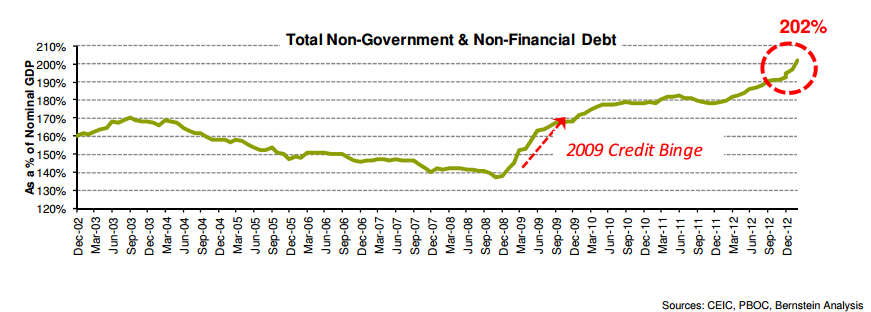

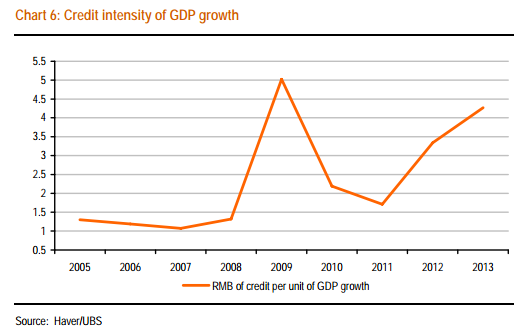

2. Two charts that tell the story - These are two cracking charts cited in FT Alphaville showing just how much China's economic growth has relied on expanding credit in the last year or so. The incremental return from the extra debt is dropping fast.

Here's the first chart and comments from UBS Economist George Magnus. The bolding is mine:

In the face of the sharp slowdown in growth in early 2012, the government decided to play safe, especially ahead of the leadership change in October, and allowed credit to reaccelerate. But if it hoped the investment side of the economy would spring to life, the outcome has been disappointing, at least so far. Instead – and it’s hard to be specific – credit expansion is taking on a more Minsky-ish character: refinancing of maturing bad debt, borrowing to service debt because of weak cash flows and negative commercial returns, and the financing of ‘investment’positions in real estate and commodities.

It is estimated, for example, that banks rolled over some RMB 3 trillion, or three quarters, of loans to local governments that matured in 2012.1 And the IMF has noted that in the broadly defined corporate sector, company profits are failing to keep up with rising interest rate expense, obliging firms to seek recourse to borrowed funds

The second chart from Berstein analysis also tells the story.

------------------------------------------------------------------------------------------------------------------------------------------

New Zealand Mint. Experts in gold & silver bullion, commemorative coins and jewellery. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

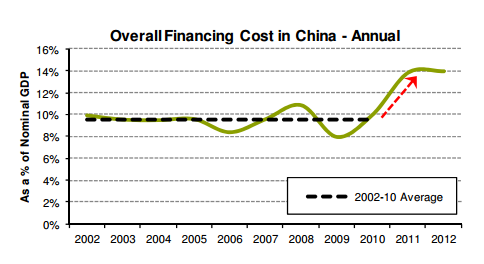

An increasing amount of the total GDP is being directed back into financing costs. Michael Werner of Bernstein, who made some of the interesting charts comparing credit growth and GDP growth rates, says it’s difficult to predict where exactly the growing debt levels may lead, there is a fairly simple mathematical truth (we’re paraphrasing him here) contained in this chart:

Rising financing costs, now at 14 per cent of GDP, underline Magnus’ point that credit is becoming less productive because it’s increasingly being directed towards financing itself.

That brings us to the third point about why the debt-to-GDP ratio is important — it’s a point specific to China. China’s investment has of course been largely credit-fuelled, and that investment has achieved a massive outsize role in its economy. It’s also been a significant contributor to China’s rapid growth rates post-2008. So, credit needs to be directed to (good) investment to create growth.

Yet both credit and investment are unsustainably high... This could end a number of ways, but it doesn’t seem that sustained high single-digit GDP growth levels is one of them.

And FTAlphaville's conclusion:

China’s rising levels of credit growth, and slowing GDP growth, don’t necessarily foreshadow a crisis. But they do provide another signal that the economy’s growth level will decelerate, one way or another, and more quickly than many are expecting. This time, growth opportunities through past mechanisms of cheap labour, exports, and investment are all increasingly tapped out.

------------------------------------------------------------------------------------------------------------------------------------------

Available now. Our brand new 1 oz Taku gold bullion coin. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

4. She may become the most powerful woman in the world - US Federal Reserve Vice Chair Janet Yellen is apparently the insiders' tip to replace Ben Bernake. Here's a useful NY Times profile. She's a bit of a dove on inflation. Good.

5. De-globalisation? - One of the great fears after the Global Financial Crisis is that governments and central banks would pull up the drawbridges and block free movements of trade and capital.

Now the Americans are forcing foreign banks with US branches to hold more capital. Some worry this will make it harder to shift large chunks of capital around or somehow make financial markets less efficient.

I'd prefer stability to efficiency most days, if that's the trade off.

It's hard to feel to sympathetic to the very-undercapitalised and struggling European banks who are using easy access to cheap Fed funds and low equity levels in an attempt to generate capital from trading on markets rather than actually raise fresh capital from shareholders or impose haircuts on their creditors...

Here's the NY Times reporting on the moves:

Until the turn of the century, American operations of foreign banks tended to receive financing from home. But as the credit party grew after 2003, those banks increasingly borrowed in America’s short-term markets and sent the money back home to the parent. When the credit crisis appeared, that financing — a significant part of which had come from selling short-term securities to United States money market funds — dried up.

“Foreign banks that relied heavily on short-term U.S. dollar liabilities were forced to sell U.S. dollar assets and reduce lending rapidly when that funding source evaporated, thereby compounding risks to U.S. financial stability,” Daniel K. Tarullo, a Fed governor, said in a speech late last year.

The foreign banks ended up needing a disproportionate share of loans the Fed handed out to stabilize banks. And since then the ability, let alone the willingness, of some countries, particularly in Europe, to provide what the Fed delicately calls “backstops” — a term that sounds much less harsh than “bailouts” — appears to have diminished.

In December, the Fed proposed new rules that have set off loud protests from overseas and are likely to provoke a flood of complaints before the comment period ends on Tuesday.

The rules would require that American subsidiaries of each foreign bank be put together in a holding company that would have to maintain capital, and liquidity, in the United States. In some cases the requirements would be greater than home countries require of the parent institutions.

6. The war of the coding error - Here's Philip Stephens at the FT looking through the rubble after the debunking of Reinhart/Rogoff and concluding that economists can't be trusted to run economies. He makes some sensible points about timing.

A heavy price must be paid for the unchecked spending and credit booms that ended in the global financial crash. But timing and pace matter. Governments with a demonstrable determination to raise long-term economic growth with supply-side reforms should be given more time to cut deficits.

During the past couple of years politicians have prized credibility with markets above real economic performance. It hasn’t worked. Bond traders such as Pimco’s Bill Gross now attack austerity, calling for measures to rekindle growth. Bond markets, like economists, are rarely known for their consistency. In this instance, though, Mr Gross is right.

The present confusion – visible in open debates at the International Monetary Fund – gives politicians and central bankers a chance to think again. The response should be a calibrated policy shift to combine accelerated supply-side reforms with flexible fiscal timetables and increased investment. To the extent fiscal restraint weighs on demand, it should be offset by policies to expand productive potential.

What circumstance now demands of politicians is the confidence to break free of the defunct, and debunked, economic theorising. Economists are not always wrong; nor does the real problem lie with dodgy data. The mistake comes when policy makers invest the findings of a faith-based discipline with the certainties of science. They would do better to rely on common sense and observed behaviour. By underscoring this fairly simple lesson, the War of the Spreadsheet Coding Error may yet do Europe a huge service.

7. Austerity's spreadsheet error - Here's Stephen Colbert on the spreadsheet error by Reinhart and Rogoff. Hilarity from a spreadsheet mistake in an academic paper. Who would have thunk it.

"If ignoring everything in New Zealand, Australia and Canada was a crime, everyone would be on death row."

The Colbert Report

Get More: Colbert Report Full Episodes,Indecision Political Humor,Video Archive

The Colbert Report

Get More: Colbert Report Full Episodes,Indecision Political Humor,Video Archive

9. Ageing and Europe - Alan Wheatley at Reuters points out the huge drag on Europe's economy, besides its household and government debt.

Long after the debt crisis is over, Europe will be grappling with an even more serious problem - how to pay for growing numbers of old people. The population of some countries is stagnant or already shrinking, notably Germany's. That will reduce savings and potential economic growth. The workers who remain are getting older and so are less productive. That will hold back living standards. And the ranks of retirees are swelling.

That will threatening the financing of pensions and health care. In the 27 countries of the European Union, each pensioner is today supported on average by four people of working age. By 2050, this old-age support ratio will have fallen to just 2:1, according to United Nations and EU projections.

10. Totally Jon Stewart on the slump in the gold price. God has a few views on gold too, it seems.

46 Comments

How about some truths about austerity/growth?

We are pumping energy into the system like there's no tomorrow - never more than now.

Even then, it just supports a rate which is not increasing - surprise, surprise.

What happens when everyone wants to produce/consume, Bernard?

What are your predictions of the extra energy needed, per % increase in activity, and where is it coming from?

How come we're still disconnecting the idea of economic growth, from the realities that underpin the possibility?

LearntoSocial has the answer for you PDK - "live in a house made out of car crates (when nz assembled cars in Thames) .... in the Coromandel bush"

It would of course mean no computer or internet connection to conduct your daily rant.

Hi Happy 123

The future I was thinking of has computers and the internet, as well as homemade houses.

I was struck when watching the demolition of some $600,000 new houses in the ChCh redzone what total heaps of sh*t they were. A little tap from the digger scoop and they collapse in a heap of tanalized pine, gib board and crumpled tin. They looked nice before they fell down. What is the % of leaky homes built recently? The more we spend, the less we get.

"The happy place" is spreading out of the TV.

That's right! Throw caution to the wind, and spend like there's no tomorrow...

This is the new road to prosperity!

HGW

Borrow and spend. Borrow and spend. Financial disaster pops up. Surprise (not)

What to do? What to do? Light bulb comes in the head of BH.

Borrow to spend !!!! Magic. !

Sorry Bernard, how can anyone say that the problem with our economy is lack of agregate demand? Or that the answer to this (non) problem is more government spending.

If lack of demand was an issue, surely we would see high savings rates (20%+), credit shrinkage and a huge drop in imports. None of this is happening so the whole argument is flawed from the get go. Our problem is an historic excess demand over income and the evidence is plain to see in our current account deficit and Net International investment Position, both among the very worst in the developed world. Try calculating GDP (domestic $ turnover + or - trade balance) with the CA balance instead of the trade balance and you get a much more realistic indication of where you are going in terms of wealth.

Our 3 or 4% nominal GDP growth quickly turns into an annual decline with the present 5% CA deficit. With the forecast -7% you are running out of options. Good luck pretending more government spending is going to help in the slightest.

#9. Shrinking population. This site, and others, seem to regard it as an economic problem. Yes we have seen old people to workers ratios before - too many times.

But I don't often see discussion on the other issue. The costs of growth. Most of the economic costs of past decades has been about how to fund the neccessary extra gear. Currently how to build transport in Auckland. (yes PDK - there is also the overiding eco limit to growth)

I would like to see some discussion on what may be some of the benefits of shrinking population. Because they certaninly exist. But strangely never discussed.

Less people = more planet per person.

The problem is that you have to work out what is ahead, and use the existing energy-source to get yourself onto the new footing - before you run it down. Electric trains may well qualify, Roads of National Insignificance obviously belong to the old era.

Roads of National Insignificance obviously belong to the old era...

That is a very good point PDK. The ownership of such roads could revert back to the owners of the adjacent land. With the roads under private care, no need for council assist...

HGW

Yes, because deciding what the future holds and directing resources towards preparing for it has always been so successful throughout history, particularly when done by Governments.

History is of limited relevance, beyond the peak of activity. It's an experiment that has been run at a local scale several well-documented times, but never globally.

Leaving it th 'the market' aka the 'invisible hand', is 100% guaranteed to fail, so every other option is statistically better,

Well certainly its even worse when done by markets, they dont intend to think ahead at all let alone try and get something right.

regards

Maybe the answer to the pop imbalance is to increase the pensions and encourage us old coots to hit the grog and take to climbing the snowy peaks in winter!

Before you go up the mountain can you leave a note as to where your spare grog can be found.

Wolly - no need to do that.

Immigration increases will help in NZ.

Will help in NZ?

Nonsense - but then, if you think sustainability means alway producing a surplus, I guess you aren't going to understand that more people actually use more resources. More fossil energy would make more sense, from your skewed perspective; it does what 300 people do, per heah, currently, and does it 24/7. One persons labour, sans food/sleep, is a poor substitute.

Help is clearly needed........

Tick, Tick, Tick ....

First off, I fully support PDK and his message, which is as obvious as the breathe we have to draw in and expell every few moments.

I wonder if the problem is that we have universally been conned into equating austerity with "bad/misery" and expansion with "good/happiness".

I remember a conversation I had with a very old guy on the Coromandel back in the 1970's. He was talking about the depression in NZ. He told me it was hard on the people in the cities, but he remembered those times with some fondness. On the Coromandel, there was plenty of food to be had, they made their own beer, and they had lots of dance parties- there was almost no work- so what can you do? have dance parties.

The nicest house I have ever lived in was made out of car crates (when nz assembled cars in Thames) and was in the Coromandel bush. It would have cost a few hundred dollars to build, and would not have rotted (it was made of hardwoods). There is a lot to be learned from the values and experiences of the hippies (IMO)

The super fit people (who can maintain it for a lifetime) live austere lifestyles. They walk or cycle to work- take the stairs- eat fresh food- keep their windows open, do not over eat or over drink. Fitness and austerity are almost synonymous.

The expansionist- the "good life", gourmand, comfortable car, door to door. Their environments are completely climate controlled- never hot, never cold. Rich food is always on hand. A life spent at the computer, at the desk in front of the computer (Always in a chair). We have defined this way of living as "grand", and the results are obvious to see. Our sidewalks are empty, the streets deadly to cyclist-, diabetes and obesity are soaring, the country is increasingly medicating with antidepressants, sky tv (our happy place),- self medicating with alcohol and K2..

We could easily turn NZ into a high tech, organic, hippy wonderland. It would be cheap, healthy, fun to live in and much fairer. What we are doing now is insane, unhealthy for the body, unhealthy for the mind- and worst of all, self destructive.

Scroll down on this link to see the Robert Crumb cartoon explaining how I see the choices we face.

In the Robert Crumb cartoon, I think we should go for "option #3"

"Overshoot, crash and dieoff is a typical response in nature when species exhaust their carrying capacity"

Yet out of the few species, man should be capable of avoiding this, yet we see from Easter island and on, he isnt.

regards

Gold up 4% in 24 hours and still rising rapidly (though it's bounce back seems to have been studiously ignored on this site). It would appear physical demand in markets such as India, allied to Central bank buying has overcome the paper selling of the previous few weeks. One would imagine if it gets past $1500 that many who are short will have to abandon their positions (and in so doing will add upward impetus).

There are some strange under currents supposidly going on - investors started pulling PHYSICAL gold out of Comex depositories in early/mid April:

http://bullmarketthinking.com/comex-gold-inventories-collapse-by-larges…

This trend appears to be accelerating:

http://bullmarketthinking.com/comex-physical-drain-accelerates-with-ove…

Where is all of that physical gold going? Conspiracists have long maintained there is not enough gold to match delivery in Comex.

Kyle Bass said as much a while back: http://www.youtube.com/watch?v=CjAeriVttw0

What happens if this drain from Comex continues and more and more want their physical gold? Is the Comex system in trouble? Something to watch, chuckle.

So if that is happening then maybe the "Comex" is buying to replace the shortfall? just who is buying?

Gold was always a way (if not the way) to store wealth through an event, who can blame ppl for wanting to have possesion of their gold, I would.

NB I assume cyprus hasnt started to dump yet?

regards

Its not 'conspiracists' andyh, its just simple maths.

The COMEX has around 5% of outstanding gold contracts as deliverable in physical. In a normal month only 1% or so stand for delivery, so normally no worries. The COMEX is just an interesting paper game, nothing more. At the end of the day they can just settle the contracts in cash (not physical), so they think thats okay, no worries.

The LBMA is a much bigger exchange, a default there will empty the COMEX supply within minutes. Oh well, that will be the paper game over with, who knows when that will occur.

I used the word with tongue firmly inserted into cheek........

Yes. A $51 upward move in 24 hours (according to the goldprice graph) is just noise.

Better to remain silent and be thought a fool rather than open your mouth and confirm it.

Better to grow up and stop trying to put ppl down because they dont agree with your views.

regards

In general we like Bill's two buckets. The must have on the right and the nice to have on the left.

Looking at the uk, we think it was Gordon B that spent more than he had. There was/is no new normal. And in Oz Wayne has spent like a drunken sailor, ie the tax money he has failed raise..

Bernard

Saying JK and BE are implementing 'austerity' is a little mischievious, I've not seen pensions slashed or public service pay rates cut, Their agenda (the part I agree with) was to reign in some of the excesses of the previous government where property developersv in wellington couldn't build fast enough to house the ever growing bureaucracy

Neven 911

The Reserve Bank says the government is tightening fiscal policy to the tune of 3.2% of GDP over the next 3 years.

That's substantial in anyone's language.

cheers

Bernard

Again I re-iterate this is not "austerity" a 3.2% drop in govt spending would still keep us in the top of the OECD, Can you come up with better evidence for your assertion please, how about you compare 3.2% against some of the eurozone Countries that have implemented "Austerity", e.g. Ireland, Greece etc.

Going into the GFC NZ was well placed with a low sovereign debt position so it was quite possible to slowly trim government expenses whilst pumping capiltal works (Keynes anyone?) which is what BE/JK did but this must end, To blithely label this policy austerity is inaccurate

It is not a substantial cut in the language of anyone capable of taking a higher overview of fiscal policy. Those folk would classify it is an orderly reversion to the 20 year average Govt spend as mean % of GDP.

Jeez Bernard, maybe you should take up macrame, or something you are more suited to.

VF

i don't think we are going to win here, I see Bernard grabbing his ball and running home

The problem with Greek style Austerity is that slashing public spending and increasing taxes to reduce deficits just crushes economic activity and increases deficits. Once in that type of trap the only way out is a currency devaluation one way or another but the Europeans cant do that because of the Euro.

None of that has anything to do with us. You cant say the Nats programme has anything to do with Austerity. They have pump primed like crazy really to keep the ship afloat while trying at the same time to reduce the weight of the public sector on the economy. Debt has sky rocketed under National but maybe with justification if they can now get the books back into balance.

Bernard contnues to adopt a schizophrenic approach to economics. Dont his pieces about the problems with debt fueled growth in China directly conflict with the piece about Austerity in New Zealand?

Virtually nothing he advocates makes any sense or is backed up with any specific proposals or much logic. It is hard to be wrong all the time but somehow he manages.

Agreed Bernard does have a history of making these kinds of statements without any indication of how it can actually be done.

what should the government be increasing spending on to encourage growth?

how can the reserve bank lower the nz dollar?

how can the reserve bank stop housing speculation?

like it JimboJ.....I'll tell you what could be done , but it won't, because too many Corporates ..I.E . Fonterra are proactive exponents of Hedge....too many volumes of currency traded for user freindly reasons

FTT's Jimbo....but that would be akin to burning Key's bible.

New Taibbi in Rolling Stone on Interest-rate swap fixing

http://www.rollingstone.com/politics/news/everything-is-rigged-the-bigg…

"at the end of March – though if you follow these matters closely, it may not have been so shocking at all – when a landmark class-action civil lawsuit against the banks for Libor-related offenses was dismissed. In that case, a federal judge accepted the banker-defendants' incredible argument: If cities and towns and other investors lost money because of Libor manipulation, that was their own fault for ever thinking the banks were competing in the first place"

it's Friday...yay.!

An infinite number of economists walk into a bar. The first orders a beer. The second orders half a beer. The third orders a quarter of a beer. Before the next one can order, the bartender says, "You're all assholes," and pours two beers.

#'s 2 and 3 re our largest market are sobering reading.

So's this....

And Charles provides a succinct and lucid explanation for why things cannot change given current settings, here. This says, so much more elegantly than I and other common taters have managed to, not only why things cannot be changed via politics and economics, but (as the title 'Way Forward' hints), what personal actions to take to mitigate things.

"If the court rules against OMT, it means the end of the euro"

Germany’s Bundesbank has issued a devastating attack on the bond rescue policies of the European Central Bank, rendering the eurozone’s key crisis measure almost unworkable.

http://www.telegraph.co.uk/finance/financialcrisis/10021894/Bundesbank-declares-war-on-Mario-Draghi-bond-bail-out-at-Germanys-top-court.html

This could be fun

"German tax authorities have bought a new CD containing bank account details of thousands of alleged tax evaders with accounts in Switzerland. They conducted 200 raids on Tuesday and expect to recoup more than half a billion euros in lost tax revenues"

http://www.spiegel.de/international/business/

ChrisJ picked this a while back....

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=10880242

Thanks 28_29, but actually I'm not sure that these figures are even remotely relevant to anything today.

So many of the insured losses have already escaped Chch that the chances of even 50% of that money being spent in the city diminishes every day. Then consider the huge amount of liabilities that insurers have weaselled their way out of by patching broken foundations, not rebuilding collapsed chimneys and offering significantly lower cash settlements or "repair" costs to homeowners. Then add in the many citizens dictatorial Cera and CCDU zonings have run out of the city, and it becomes clear that nothing remotely like that amount of money will be spent.

Chch may have lost $50 billion of assets, but it will be lucky if $15 billion of that will actually be replaced within the 10 years of the first event! From the number of "as is" sales and the number of vacant lots sold or for sale, I would suggest 80% of overcap and commercial building claims have been cashed out by some mean or another with no intention whatsoever to rebuild.

Sutton, Brownlee and co are in dreamland over future building expectations. With Parker gone later this year and Brownlee and Key gone next, we might finally get a realistic honest view of the crisis...

What a mess. You also picked the increase in the Auckland property market over the last 12 months. Any predictions for the next two years? :)

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.