Here's my Top 10 links from around the Internet at 1 pm today in association with NZ Mint.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

Today is the last Top 10 sponsored by NZ Mint. I'd just like to personally thank NZ Mint for three years of sponsorship. We'd welcome a new sponsor. Email david.chaston@interest.co.nz for details. My must read today is from Joe Stiglitz at #7.

1. The madness of low junk bond yields - It's a good time to be Graeme Hart.

New Zealand's richest man is also one of the world's junk bond kings and right now he can borrow extremely cheaply, as can many of the world's corporates who borrow with junk bonds.

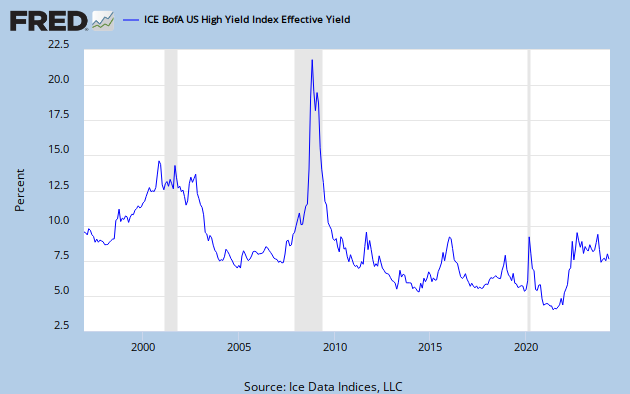

This chart below shows what has happened to 'high yield' corporate debt yields over the years, suffice to say they're now not very high.

The rush out to higher yielding assets as central banks have flooded the money with cheap money and cut interest rates is astonishing.

The build up of so-called 'covenant lite' lending to corporates is a symptom of that global hunt for yield.

This can't go on forever and when those yields rise there is going to be carnage. Just look at this chart courtesy of alephblog to get a sense of how low these rates are and what happens when they rise in a hurry.

The point of this piece is to tell you not to look at the level of risky interest rates, but to look at the rate of change in risky interest rates. It tells a lot regarding future prospects of the stock and bond markets. The rate of change matters a great deal, not the absolute level of rates.

So, the implication is watch for a sustained rise in in high-yield bond yields. When those yields cross their 10-month moving average, it is time to be gone from risk assets.

------------------------------------------------------------------------------------------------------------------------------------------

Keep it safe. Keep it in a New Zealand Mint safety deposit box. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

2. As good as it gets - Ambrose Evans Pritchard reports from The Telegraph that global growth has turned the corner and is heading down again.

------------------------------------------------------------------------------------------------------------------------------------------

New Zealand Mint. Experts in gold & silver bullion, commemorative coins and jewellery. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

3. Japanese housewives - Strangely perhaps, the Japanese housewives who have been big buyers of Australian Uridashi bonds have pulled back in recent months and have repatriated funds to invest in local stocks.

This is somewhat counter-intuitive, given the mas money printing in Japan should be forcing local investors outwards to sell the yen and buy other currencies to get better returns. Hasn't happened that way.

Here's Bloomberg on the latest Uridashi moves.

------------------------------------------------------------------------------------------------------------------------------------------

Available now. Our brand new 1 oz Taku gold bullion coin. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

4. Austerity U-turn - The Europeans are saying they're going to loosen their government spending belts to try to pull Europe out of a nosedive.

The FT reckons though it may not be enough to turn it around.

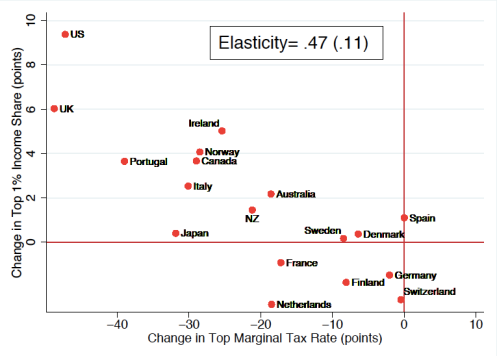

5. Do falling tax rates increase inequality? - This research via Miles Corak suggests they do. NZ gets a mention, although the data ends before the latest 'tax switch' took effect. The chart below is fun.

Countries experiencing the largest falls in top tax rates have also experienced the largest increases in top income shares.

Facundo Alvaredo, Anthony Atkinson, Thomas Piketty, and Emmanuel Saezoffer this intriguing picture in a recently released working paper called The top 1 percent in international and historical perspective.

6. Watch for a Chinese bond default - So says a Chinese credit rating agency via Caijin. This would be a shock, given one has never happened before...

The China Securities Regulatory Commission (CSRC) has also warned investors about the default risk. Last year, shortly after small and medium-sized enterprises were allowed to issue high-yield private placement bonds, or junk bonds, Huo Da, a CSRC official, told brokerage firms underwriting the bonds to pass on a message to investors.

"Local governments and exchanges will not provide any form of risk relief," he said. "So don't have any delusion about a government or exchange bailout. Default by bond issuers is a regular occurrence in the global market."

Nevertheless, in January, the Shanghai government stepped in to help a troubled solar firm by instructing its debtor banks to defer collecting their loans so the company could have breathing room to prepare for a bond interest payment scheduled for March.

But the expectation was growing that a default was bound to occur this year, and the implications would be significant, Mao said.

7. A global deal on taxes? - Joseph Stiglitz reckons in this Guardian Op-Ed that a deal to make multi-nationals pay more taxes is needed between countries. I agree.

Big corporates are gaming one nation's taxpayers against another's: we need a global deal to make them pay their way

It is time the international community faced the reality: we have an unmanageable, unfair, distortionary global tax regime. It is a tax system that is pivotal in creating the increasing inequality that marks most advanced countries today – with America standing out in the forefront and the UK not far behind. It is the starving of the public sector which has been pivotal in America no longer being the land of opportunity – with a child's life prospects more dependent on the income and education of its parents than in other advanced countries.

Globalisation has made us increasingly interdependent. These international corporations are the big beneficiaries of globalisation – it is not, for instance, the average American worker and those in many other countries, who, partly under the pressure from globalisation, has seen his income fully adjusted for inflation, including the lowering of prices that globalisation has brought about, fall year after year, to the point where a fulltime male worker in the US has an income lower than four decades ago. Our multinationals have learned how to exploit globalisation in every sense of the term – including exploiting the tax loopholes that allow them to evade their global social responsibilities.

Is it bubble time? Maybe.

There's a lot of "flipping" going on.

The concern is if these rates of increase continue. If a market is properly priced today, but follows the same path as the bottom tier of the Phoenix market and rises 50 percent over the next year, then it will be seriously over-valued in another year. Even worse, if one of these markets were to sustain the 70 percent rate of increase recently seen in the bottom tier of the Las Vegas market over the next year, then we could be looking at a market that is 70 percent over-valued.

Investors are driving prices in the markets seeing the rapid run-ups. In many cases, hedge funds and private equity investors are buying up large blocks of houses. Some may plan to rent them out for a period of time, but most undoubtedly expect to flip them for substantial profits in the near future. Similarly, many smaller investors are buying up homes, doing minor repairs, and then looking to resell them for a substantial profit a few months later, just as they did in the bubble days.

9. China's amazing credit-fueled growth - Bloomberg reports on Fitch's worry about China's extremely rapid growth in credit.

Chinese banks are adding assets at the rate of an entire U.S. banking system in five years. To Charlene Chu of Fitch Ratings, that signals a crisis is brewing.

Total lending from banks and other financial institutions in China was 198 percent of gross domestic product last year, compared with 125 percent four years earlier, according to calculations by Chu, the company’s Beijing-based head of China financial institutions. Fitch cut the nation’s long-term local-currency debt rating last month, in the first downgrade by one of the top three rating companies in 14 years.

“There is just no way to grow out of a debt problem when credit is already twice as large as GDP and growing nearly twice as fast,” Chu, 41, said in an interview.

(Updated with number 6! and cartoons)

10 Comments

Well Bernard, I humbly suggest that this piece is more important than anything you had in your top-10.

http://www.ft.com/intl/cms/s/0/ec3bb622-c794-11e2-9c52-00144feab7de.htm…

'' New technologies such as fracking in the US shale industry are boosting crude oil supplies – but these new “technological barrels” are flowing at a high cost. Sanford C. Bernstein, the Wall Street research company, calls the rapid increase in production costs “the dark side of the golden age of shale”. In a recent analysis, it estimates that non-Opec marginal cost of production rose last year to $104.5 a barrel, up more than 13 per cent from $92.3 a barrel in 2011.''

Fascinating to see what has been predicted on the peakoil sites regarding shale oil in the last 3 years being finally confirmed by Wall Streets finest. Next time you hear someone whine about the price of oil it would be worth pointing them in the direction of this piece - effectively a new floor is being put under the price of oil, which is the cost of the most expensive barrel to produce. And thats $100 plus (and probably going to keep rising). The cheap, easy to extract oil is almost all gone.

Andyh - thanks, good link.

Nobody here can claim they were't warned, and a long way out. It explains the Evans Pritchard piece, but he hasn't a clue as to the 'why';

The better alternative is to stick the needle straight into the veins of the economy - building roads, railways or nuclear power stations; but that is a subject for another column.

That's as daft as the Roads of National Insinificance idea.

Caveat chosenignorancetor? :) Have a good weekend (I can't tell the difference...)

This follows on perfectly from what they predicted in 2012:

http://ftalphaville.ft.com/2012/05/02/983171/marginal-oil-production-co…

My God, an accurate prediction from a Wall St oil analysis company!

An observation on 7, the taxes paid by large multinational corporations; is that there are two questions re their taxes: How much in total they should pay; and in what countries they should pay them.

If you assume that the functional head offices of many are in the US, and a good number of the shareholders of the companies are also US based, then the US government may bark a bit but not do much. Over time the shareholders will have to pay taxes on any dividends; and if the US government forces the corporates to pay more upfront, then dividends would reduce, such that the net taxes to the US would be roughly the same. And having the US force them to pay more tax in the US will not help NZ one iota.

Should they be paying some tax in each country they operate and receive revenues; and where to do so they are benefitting from the government funded infrastructure in that country? I would argue they should.

The UK might be more interesting to watch, as to whether they advocate any revenue based taxes on corporates.

Many people do not understand the significance of variable accounting and flexible accounting and "incremental costs" and "marginal costs"

Using an analogy of a stretch of street in a city somewhere, where there is side on metered parking in the street at $1 per space per hour. There are 50 parking spots. Then the council wakes up and realises it can squeeze a lot more revenue out of the system by shifting to angle parking. Now 70 parking spots. Densification. They increase the hourly rate to $1.10 per hour, and announce "arent we good?" we kept the increase to 10%. Yeah right. Do the math.

Now onto council rates.

Over the past how many years, the number of rateable properties has increased while the area of occupiable real-estate has not increased by the same %. High rise buildings. Unit Developments etc

Now the question is - have rates gone down? Think of how that angle parking change increased revenue without increasing the amount of available real-estate.

Where has all the money gone? Why has there never been any discussion about that?

Icono - yes there has, All they do, is oil-based. Those roads, their transport, every pipe and line.

http://www.indexmundi.com/commodities/?commodity=crude-oil&months=180

#1. Seems rates of change are pretty important then. How about the rate of change in population growth in 1961?

What Austrians Want

- Lower taxes

- Less regulation

- End of Fractional Reserve Lending

- Sound money

- Smaller government

- Work rule reform

- Pension reform

- Free trade

What Brussels Delivered

- Higher income taxes

- Higher VAT

- Proposed financial transaction taxes

- More regulation

- No free trade

- Little if any work rule reform

- Little if any pension reform

- Reluctant (at best) cuts in government jobs

- Reluctant (at best) cuts in government spending

- No sound money

- No end of fractional reserve lending

- Bailouts at taxpayer expense

Read more at http://globaleconomicanalysis.blogspot.com/2013/05/intellectual-dishonesty-and-insanity-on.html#xF6y3xvqA2qH1xQz.99

Fun to come to this doom and gloom site now and again.

World growth has stopped, China is blowing up (in about 5 different ways), US housing bubble on the way, oil running out...

Did I miss anything?

Most australian bank Internet passwords easily stolen.

http://www.scmagazine.com.au/News/345109,memory-gaffe-leaves-aussie-ban…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.