Here's my Top 10 links from around the Internet at 11.30 am today.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #5 on what China's biggest policy wonk really thinks.

1, What the Chinese are thinking - It's worth watching this escalating trade dispute between China and Europe to get a sense of how the new Chinese leadership are thinking and what they're doing with China's new bigger strategic muscles.

They're flexing them.

We can only hope this exchange doesn't turn into a modern version of the Smoot Hawley Act that worsened the Great Depression of the 1930s.

China's new leaders seem surprisingly isolationist and defensive on this stuff.

Read the tone of the comments below from the People's Daily and you can see why they were remarkably slow to react on our own little sheep and beef export documentation issue.

We are operating in an imperial environment where decisions are made on whims and emotions. I've bolded the key quote.

Here's Reuters with the quotes:

The People's Daily, the ruling Communist Party's official mouthpiece, said in a commentary that Beijing could take yet more measures against the EU.

"We have set the table for talks, (yet) there are still plenty of cards we can play," the newspaper wrote. "China does not want a trade war, but trade protectionism cannot but bring about a counter-attack."

A declining Europe needs to understand it can no longer laud it over other countries, the paper added. "Times change and power rises and falls. Still this has not changed the deep-rooted, haughty attitudes of certain Europeans," it wrote.

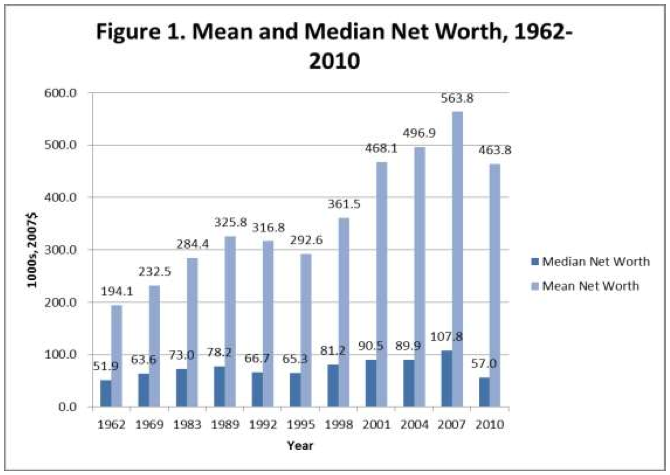

2. The differences between means and medians - They can be a good measure of widening inequality. These charts cited by FTAlphaville on American incomes certainly show that in the context of how the monetary policy activism of the Fed, the BoE and the BoJ has benefited the wealthiest most.

Last week, Pew reported that the rebound in net worth has been unevenly distributed in the economic recovery: the wealth of the richest 7 per cent of households climbed by 28 per cent on average, while the rest of the population lost 4 per cent of its wealth.

And the annual report from the St Louis Fed found that 62 per cent of the wealth recovery through the end of last year has been the result of rising stock markets — and stock ownership is concentrated among richer households.

China is now dependent as never before on the rest of the world to keep it going. Until the mid-1990s, it was more or less self-sufficient. Now it relies on other countries for oil, copper, iron ore, soya and many other commodities, without which it could not sustain its breakneck development nor satisfy its people’s rising aspirations.

Geoff Raby, former Australian ambassador to China, put it this way in a lecture at Melbourne’s Monash University last year. “China is now, for the first time in its history, utterly dependent on foreign markets and foreigners for all things to keep its economy growing,” he said. Remember the Qianlong emperor who scoffed at the wares brought by a British emissary of King George III in 1793, declaring that China had no need of foreign trifles.

Almost without realising it, China has been transformed from the mercantilist power Deng Xiaoping envisioned when he launched his Opening and Reform measures in the late 1970s to a country today wedded to the concept of Ricardian comparative advantage, or a global division of labour. That makes it, in Raby’s phrase, “a highly constrained power”. When it was growing fastest, the US, by contrast, had everything it needed to grow bar people, which it brought from Europe voluntarily and Africa involuntarily.

4. Slowing Chinese lending - This might explain China's slowing economic growth and the shift lower in Australia's economic outlook.

Here's Caijin with the report:

Chinese banks continued to slow down their pace in extending new loans in May, in line with 8-month low PMI figures which suggested a marginal weakening of manufacturing activities.

China’s “big four”, the four largest state-owned banks in the country extended CNY208billion yuan in May, compared with CNY245.5billion in the previous month and CNY 250billion in the same period last year, the 21st Century Business Herald quoted an authoritative source as saying in report.

Monthly drops in new lending from the four banks underscore weakening credit demands in an economy with slowing momentum, said the paper.

5. The wonk with the ear of the Chinese President - Here's the WSJ with a nice piece on the guy behind the guy running New Zealand's most important strategic partner.

Even in China, few people would recognize Wang Huning, head of the Communist Party's secretive Central Policy Research Office. And small wonder: The former university professor almost never talks in public, barely speaks to old acquaintances and makes a point of not associating with foreigners.

Yet party insiders and experts on Chinese politics consider him one of the most influential figures in China today, a key architect of its domestic and foreign policy over the past decade, and now of Mr. Xi's signature "China Dream" campaign that evokes a militarily and economically strong nation reclaiming its place of prominence in the world.

"Wang Huning's now got more power and will have stronger influence on foreign policy," said Huang Jing, who also attended Fudan University at the same time and is now a professor and expert on Chinese politics at the National University of Singapore. "That's good news for China, but not very good news for other countries."

Another Chinese scholar who has known Mr. Wang since the 1980s said it would be a "disaster" if Mr. Wang is given greater say in foreign policy because he is a leading advocate of the more assertive diplomacy that has alienated many of China's neighbors.

A recent Australian High Court case reveals the challenge facing national governments in trying to fix the international tax system to capture profits earned by multinationals around the world.

In this test case involving complex and technical Australian company tax rules, the High Court was asked to consider how rules these applied to the Commonwealth Bank of Australia’s controversial $2 billion capital raising in 2009.

The outcome was that CBA was legally able to reduce the cost of its capital raising – while both the Australian and New Zealand governments lost out on tax revenue.

8. America's great unwinding - This piece from the NYT about George Packer's latest bookis fun.

If you were born after 1960, Mr. Packer suggests, you have spent much of your life watching structures long in place collapsing — things like farms, factories, subdivisions and public schools on the one hand, and “ways and means in Washington caucus rooms, taboos on New York trading desks” and “manners and morals everywhere” on the other.

What has replaced them, he says, is organized money, as well as a society in which “winners win bigger than ever, floating away like bloated dirigibles, and losers have a long way to fall before they hit bottom, and sometimes they never do.”

If a solitary fact can stand in for Mr. Packer’s arguments in “The Unwinding,” it is probably this one, about the heirs to Walton’s Walmart fortune: “Eventually six of the surviving Waltons,” the author writes, “would have as much money as the bottom 30 percent of Americans.”

9. The macroeconomics of European disunion - Paul Krugman does his thing here.

(Updated with videos/cartoons/quotes)

25 Comments

The Australian construction industry has now been in contraction FOR THREE CONSECUTIVE YEARS:

Excellent piece (focused on the UK but with general applicability) on financial repression, the war on savers etc:

http://www.mindfulmoney.co.uk/wp/shaun-richards/what-are-the-economic-c…

''We see that the official response to the credit crunch in many places has been to try to shift the burden of it onto savers and away from borrowers. This has resulted in savers getting much lower returns on their money and indeed consistently and ever more negative rates if we allow for inflation and taxation.

However the question that savers should be asking their elected representatives is what good has this policy achieved? They have taken a hit for the greater good supposedly but in fact very little has got better as our economy has stagnated for several years rather than recovering partly for the reasons discussed earlier. They may reasonably ask how long this will go on for?

Should this persist then a deeper question will be asked more and more,why should anybody bother to save at all? As we need a balance between savers and borrowers such a development would be an economic disaster but we edge ever nearer it in my view.''

An idiot visits Asia!

"The eurozone crisis is over, French president Francois Hollande said as he sought to reassure Asian investors on a visit to Japan."

"What you need to understand here in Japan is that the crisis in Europe is over," he said. "And that we can work together, France and Japan, to open new doors for economic progress."

http://www.telegraph.co.uk/finance/economics/10107743/Eurozone-crisis-is-over-declares-French-president-Hollande.html

Red Alert! China's Minsky Moment? Albert Edwards is someone I take very seriously:

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/201…

Thanks for posting this Roger.

And Wei's conclusion: "the logical conclusion has to be that a non-negligible share of the corporate sector is not able to repay either principal or interest, which qualifies as Ponzi financing in a Minsky framework." sounds like home. Had a drink with a friend this morning who sells air-conditioning units for houses. Told me he is run off his feet almost as good as pre, GFC. Another couple who are into flipping houses told me they went to look at a house and were number 200 to look at and more coming.( Thats in California) Boom and bust coming to us again? The problem is going to be bigger and bigger busts. Carney wants the £ down by as much as %15 and Bernake wants a low US$, Germany appears to be the only one accomplishing it. So what next from the Fed and B of E? HTWell yield rates have been dropping for 30 years. Meaning that the productive sector of the economy has been producing less and less yield while the non productive sector has been consuming more and more debt to make up the difference with volume. Now that the minimum potential yield volume ratio is being hit. It's becoming harder and harder to live beyond the means of the productive sector of the economy. There are just too many people being sustained on borrowed time.

Great read there RW thanks. I think the process has already begun (and you can see that in the rout of the commodity currencies).

Thanks for the encouragement you two. I need it. I may sound like a bombastic idiot from time to time but I'm just trying to make sense of a wonderfully complex world.

Forbes does sometimes surprise - generally its full of happy clappy superficial garbage, but just once in a while a fine piece sneaks in - this one on energy costs:

http://www.forbes.com/sites/greatspeculations/2013/06/05/dangerous-time…

Some clued up comments follow the article as well.

It's certainly a rat's nest that one. I read the other day that the Iraq war was all about oil. It was fought to keep the price of oil up, for the benefit of the US military and their suppliers the Saudis and their owners the established wealth of America (attack dogs usually have owners you know, although in Africa they are often feral). The production cost of Iraq crude was quoted as $2 a barrel. Now where was that link?

Try this for size:

http://arcfinancial.com/research/energy-charts/todays-oil-discovery-siz…

Just remember the doomy arguments always sound more convincing cos they assume resources are limited and then go on to prove it. Sometimes they are right and sometimes a creative solution arises. Deductive types tend to assume creativity does not exist, that problems they themselves do not know the answer to cannot be solved. It's a pussle that one.

You should dig deeper on the shale (tight) oil question Roger. The dirty little secret the industry tries to ignore is the enormous depletion rates that these wells suffer (typically within 2-3 years production collapses by 80% plus).

http://www.slate.com/articles/health_and_science/science/2013/02/u_s_sh…

This means that vast numbers (we are talking thousands) of new wells are having to be drilled every year just to replace already depleting wells - it is the Red queen effect, running just to stand still. By 2015 I would rather suspect that the rise in production will be over and depletion will have won, and the US tight oil boom will be the latest in a long line of massively over hyped oil patch bonanza stories (such as the Brazilian pre-salt fields, the Kashagan Caspian fields etc etc).

I'm not argueing either way, just saying it's complex. All the doom arguments are basically circular, but not necessarily wrong. For some reason second rate academics think a complex circular argument is proof of something.

Of the four main tight oil formations in the USA , the Brakken, Niobrara, Barnett and Eagle Ford, what has been drilled so far equates to a teaspoon of water out of the Pacific. They are still basically in the 'setting up" stage. By 2015 they still won't be out of 2nd gear. They reason they are not expanding the number of wells faster is that to do so would create an oversupply and crash prices of both crude and gas.

"Rather suspect" is a poor substitute for checking out the facts.

I would think that someone who is unable to even spell the name of the principal field involved (its Bakken not Brakken) may not have quite the grasp on the facts that he/she imagines.

Since you mention the Bakken - the amount of oil produced per well looks to have actually already peaked (at 144 bpd back in June/July of last year, now down to 132bpd), a sure sign that the sweet spots have already been drilled out and that depletion is starting (already) to erode gains (they are already at the point where they have to drill more and more for less oil per well):

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

As for your contention that in some way they are not drilling faster so as to not crash the price - I am afraid this shows you have no idea of how the large number of independents who are responsible for most of the drilling in these fields in the US actually act.

andyh ...what do make of this..?? ( I don't have any knowledge about energy stuff )

Is it meaningful..??

What it should be telling you is,

a) They wouldnt go for this deep and difficult stff if there was enough fossil fuel stretching out into the future, this should scream, no there isnt any significantly higher mbpd of fossil fuels to be had.....

b) its as hard and tricky as BP's Horizon, I think that was working out at $150 a barrel so no one can pay it and the risks of blowups, huge.

c) As per BP's horizon the bpd output isnt going to be significant without Trillions being spent, just where does that money come from?

d) shale is a con....eroei 6 to 1 if lucky, its also gas and not oil.....

regards

Roelof - yes methane hydrates (I prefer the term clathrates) are real enough and they are in huge abundance. Various Asian nations, particularly Japan (who of course have very little by way of oil or gas of their own) have been 'forced' to start looking at them as a possible source of gas. However the economic feasability of harvesting clathrates is still very much unproven - there is a very good summary under 'commercial use' in the standard Wiki entry here:

R, you complain about second rate academics, then comment on some speculation that the iraq war was to keep oil prices up.....

look at Iraq's historic oil output, look at how much money american oil companies have made and that iraq, as the world's last cheap to produce major player is now ramping up production and is in control of the west....

Iraq's production on simple wells just like Saudi's Im sure was less than $5 (Ive seen $3 mentioned I think) that was really in the 1970s though, Saudi's new oil is sour and costs more like $90...and thats about the marginal rate cost throughout the world.

So lets say Iraq can produce at say $30, they can still only add about 1 mbpd per annum (give or take a bit) the deplation rate is apparantly 4~7mbpd per annum world wide...So iraq would be lucky to make 25% up of the loses elsewhere.

What should that tell you where the price will go / stay?

"doomy arguments always sound more convincing cos they assume resources are limited and then go on to prove it."

um....so its been proven, but um well? its doomy?

Shouldnt that tell you economically and financial there will be changes going to happen, so shouldnt you, um use that info?

Take Forbes their limited comment is its an opportunity to make $s....

Creative is the new word for scientific? engineering? or what? creative is art not science I'd suggest. So you are pinning your hopes on art and not science and engineering?

strange to say the least.

regards

I don't think I understand what you are saying.

My point could be expressed as follows:

Data has a nasty habit of showing you what you want to see. There are also powerful vested interested at work in this area that have corrupted politics and academia. Things may not be as you think they are.

Look, I am amazed that we still have any oil left - it should have run out years ago by all accounts. That doesn't mean it won't run out any day now. Equally there might actually be a lot more of it than we think.

Kimy,

Have you considered what you are saying? in effect, no matter what the price joe blow will pay it. Surely you can see that those with a cap on their income just cant keep paying more? At some stage they simply have to exit the "productive economy" ie quit their job as they cannot meet the cost to participate in it. This then carries on to whole countries such as Pakistan, who have nukes and the taliban next door or on their soil.

Mind you, you are not alone, such a view point was held 5 years ago by ppl who I would have assumed were intelligent enough to see that was wrong....those same ppl however were oblivious to the GFC, so I guess its to be expected.

So, its simple, money is a proxy for energy, or simpler terms money is an IOU for work.

So really when you say it costs more really its hand over more oil to get oil, so here is net less to sell and that then "costs" more and on top of that the demand is increasing.

Second point and the one most economists didnt get was the limit to what our world economy can pay for energy. In GDP terms for the US thats 6%. ie when the cost of energy to run the economy exceeds 6% GDP the US goes into recession, ergo the US with oil at $100~$120USD will never recover, let alone higher.

regards

No data is carefully analysed, sure some might cherry pick but in a peer review process that wouldnt survive and neither would the writer's reputation.

"There are also powerful vested interested at work in this area that have corrupted politics and academia." There is certianly a case that politics is now corrupted, however there is little evidence that academia is.

Lets see some...

Really now you are taking us getting into tinfoil hat territory.

and no we shouldnt have run out by any account Ive seen, peaked yes, and we probably did in 2006.

NB There is about 2.3trillion barrels, mathematically its a pretty rubust calculation to say 2.2 +/- 0.2 and we have used half at about 1.1trillion.

regards

Oh and its not "assume" recourses are limited, we are on a finite planet, therefore we have finite resources, that is mathematically a 100% robust rock solid conclusion.

regards

Listen to the chatter

Revelations in the US over the weekend about PRISM will play out in a secondary arena, the NYSE on Monday night and over the following days and nights. Could be a savage reaction. It will be interesting to see the impact on the prices of Apple, Google, Facebook, Twitter and Microsoft as users reduce their use of these services or close their accounts, or seek to go off-grid. Should be a huge free-kick for FireFox, Mozilla and Blackberry's encrypted system

That revelation is bizarre as all those social media site owners claim to know nothing of the government's PRISMs activities. So where the PRISMs system was first described as having a 'back door' into these servers, it now seems to be presented as the US Government hacking its way in. This War on Terror has been a crock from the beginning - needed as a means to spy/control ones own as well as the worlds citizens. The ideology of globalism needs a global War on Terror. All a part of the grand narrative.

RW and Kimy - at some point, it has to be pointed out that if some folk continually continue to miss the point, their continued missing may be construed as their agenda. I say that pointedly.

This is not about running out. A point which has been made before. This is about being unable to supply petajoules - or any other measure you want, BOE will do - at a greater rate. As quality declines (due to cherry-picking) you need more volume/day just to stand still. For us, there is also the fact that producing countries consume more internally, eventually becoming importers.

If Kimy would like to ascertain at which price-point for energy, Business as Usual falters, we'd be interested. Bollard suggested - and it's as good a guess as any - that $100/barrel might be it. That would explaing the EU leaders screaming about the 'price' - which Kimy seems not to have thought about.

One must assume the comments are genuine; surely you folk wouldn't waste your time playing games?????????? but it beats me how you can make them, given what has been offered here. Keep doing it, and I'll have to assume you are spin-people. Surely nobody can choose to continue in such ignorance?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.