Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #9 on a genuinely new idea to take some of the risks of big swings in property prices out of the global financial system. It would also reduce some of the incentives for people to chase leveraged capital gains on residential property. (Wash your mouth out!)

1. Turning Japanese - I went to an excellent presentation recently by economic demographer David Bloom about the demographic dividend that helped boost economic growth rates in the developed world from the 1950s to the 2000s, and which is now helping drive economic growth in the developing world.

Here's the column I wrote on it, which talked specifically about the risks this demographic dividend would reverse into a drag in New Zealand.

But the most striking part of his presentation was about China, which benefited from an even bigger demographic dividend than most because of its one child policy, and which is set to have an even bigger demographic drag because of that same policy.

Last year, China's working age population fell for the first time and the chart below showing the ratio of working age to non-working age in New Zealand and Australia.

The rise to a peak over the last 30 years helped boost growth. New Zealand's slides off in the coming 20 years, but not as dramatically as China.

Obviously, this has meant New Zealand has gotten a 'second wind' of sorts as we benefited from China's dividend.

There'll no doubt be plenty of growth in China in the years to come, but it may not be fueled by its demographics.

2. Everything you think you know is wrong - This Ipsos-Mori poll of public perceptions in 14 countries (unfortunately not New Zealand) found that people are usually wrong with their perceptions on issues such as teen pregnancy, unemployment, migration and murder rates.

And not just a little bit wrong.

A lot wrong.

I may have put this video below into a previous Top 10. It's worth a second look.

Although to be fair, Britain was only the 10th least informed population in the 'Index of Ignorance' mentioned above. Italy and America were worst. Thereform, I blame Silvo Berlusconi and Roger Ailes (Fox News).

4. The Power of Price - The NZIER's Chris Parker has written good note on Auckland Council's congestion charging idea. He likes the power of price and I have to say I agree with him. Although I do live in Wellington and commute to work on a bike, so I would :)

Rates and fuel tax rises are largely revenue gathering tools and would do little to reduce the excessive volumes of cars on the road. They also provide no location-specific signalling at all to alleviate particular bottlenecks. The user charge option is better for the public interest. Pricing – through its daily salience – will make people question why the projects to be funded are being done in the first place.

Yes, people don’t want to pay for roads that they have already paid for. But they already do that every day when they pay a lot of tax to fill up their petrol tank to use existing roads. The problem is that taxes are more out of sight, out of mind.

5. Gender specific - The World Economic Forum has published a gender gap map showing those with the biggest gap between the genders in things like health, income and educational achievement. New Zealand is among the worst overall and for pay equity in particular. We do very well on education though.

It's all very topical given last week's court decision. We rank 13th out of 142 countries and that's down from 5th in 2010. See our country profile on page 284.

New Zealand ranks 67th for gender equity for income.

6. Pick your poison - The worlds of inflation, interest rates, central banking and house prices appear to have gone mad. Interest rates have been virtually nil for six years in most of the developed world because inflation has been so low, even though their economies have been recovering for most of that time.

The low interest rates have stimulated lots of speculative investment in existing assets such as land and shares, but not the sort of new investment in new productive capacity that would generate lots of jobs and real economic growth.

Central banks face a real conundrum. They have to keep interest rates low because inflation for goods and services is so low, but all this cheap money is blowing up asset bubbles that threaten financial systems.

New Zealand just tried to put up interest rates in the usual way, but quickly found, like other central banks, that the old rules don't apply. To its credit, the Reserve Bank has found other tools such as the high LVR to try to calm down these asset markets, but it's not easy.

Another central bank that tried to put up interest rates -- prematurely as it turned out -- was Sweden's Riksbank. It ended up creating deflation and has just cut its rate back to zero.

Here's Ambrose Evans Pritchard with a good look at the Riksbank's conundrum and its thrashings around for a solution. It is looking at currency intervention, it seems. Sounds familiar.

Sweden’s Riksbank has torn up the rulebook of global central banking, cutting interest rates to zero even though the economy is in the grip of a credit boom.

The extraordinary step is intended to stave off deflation but it comes at a time when the Swedish economy is growing at almost 2pc and property prices are rising briskly. The bank has abandoned earlier efforts to curb asset bubbles by “leaning against the wind”.

The Riksbank cut the deposit rate to -0.75pc in what looks like a preparatory move to drive down the krona. Governor Stefan Ingves said the bank has a toolkit of extreme measures in reserve, including use of the exchange rate. The comment is the first hint that Sweden may follow Switzerland and the Czech Republic in imposing a currency floor through unlimited purchases of foreign bonds.

The Riksbank faces an acute dilemma, forced to pick between the competing poisons of deflation or an asset boom. It is a variant of the Morton's Fork faced by a growing number of central banks around the world.

7. Why stop at Zero? - There's a lot of talk that central banks have done as much as they possibly can and now they've hit the 'zero lower bound' for interest rates and they should just throw their arms up in the air and call on the politicians to use their fiscal tools to pump up growth.

Here's Martin Sandbu at the FT saying central banks could do a lot more, particularly to drag long term bond yields down towards zero. As Karen Carpenter might have sung if she was a central bankers and still alive: 'We've only just begun'.

It is wrong to think interest rates cannot fall below zero. The rate most immediately under central banks’ control – the deposit rate on reserves – can be made as negative as one wishes. There are technical questions involving incentives to hoard physical cash, but these are solvable. And with the rate on reserves sufficiently negative, the rate on other assets can be made negative as well. The only zero lower bound is one central banks impose on themselves.

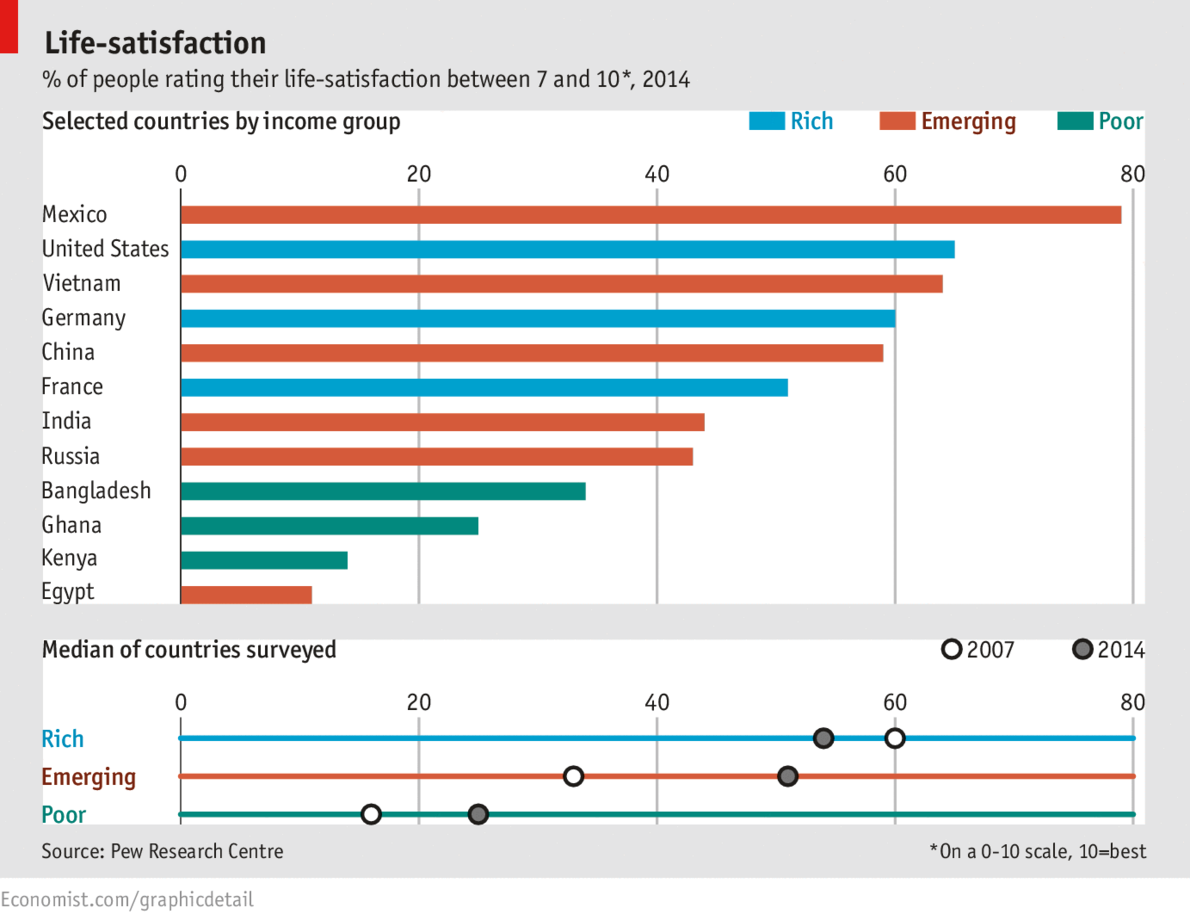

8. What's with the Mexicans? - This Economist chart shows that richer countries are not necessarily happier, but that poorer countries are catching up as they get richer.

9. 'Just regulate the banks back into a lowly leveraged box' - LSE monetary policy big wig Charles Goodhart has written an excellent piece at VoxEU that ties together the rise of debt-financed property and the rise in income inequality. He proposes a 'Chicago plan' type move to 'Shared Responsibility Mortgages', which effectively means banks would share the upside and the downside of house price rises.

It's a fascinating idea developed from the House of Debt book.

There has been a long-term downward trend in labour’s share of national income, depressing both demand and inflation, and thus prompting ever more expansionary monetary policies. This column argues that, while understandable in a short-term business cycle context, this has exacerbated longer-term trends, increasing inequality and financial distortions. Perhaps the most fundamental problem has been over-reliance on debt finance. The authors propose policies to raise the share of equity finance in housing markets; such reforms could be extended to other sectors of the economy.

10. Here's John Oliver ridiculing New Zealand's black flag idea.

And here's an even better one on Sugar.

35 Comments

#4 An excellent note from Chris and I think there is a win-win possible.

If it were technically feasible then road user charges could be implemented in a way that was largely financially neutral to most road users but delivered the benefits that Chris identifies in specific hot points like parts of Auckland, Wellington and Christchurch.

First of all you need to get over the feeling that road user charges mean you are paying to use roads that you have already paid for. Road users already pay to use roads that they may have paid to build and they do that through:

- petrol tax

- vehicle registrations

- RUC's

- roading rates

Take rates - but it could be applied to central government charges as well - and replace the rates funding for road maintenance and depreciation with funding via road user charges. So rates go down and user charges fill the gap. In most of the country you would set the charges to be financially neutral to everyone. But, you would have the option in the hot spots of varying the charges to send pricing signals to road users while still only collecting what you would have collected in total through rates anyway.

Couple of details to sort out but it looks like a good plan to me.

Technically perfectly feasible via NAIT-style RFID tagging and embedded sensors (the trillion-sensor movement, yet again). And there are analytics capable of handling the millions-of-elements across tens of dimensions: they currently get to play with the telco phone switches of entire continents, so a measly few million vehicles spread across a few thousand roads should be no biggie.

NVIT ???

But of course it begs the question of who sets the rates.......a task most unsuited to TLA's as currently constituted.

I must admit I wasn't thinking so much of the raw data collection as a technical barrier so much as the legal, procedural and cultural issues that would crop up. Like:

- reconciling funding needed v what is actually collected

- who collects and how

- crossing boundaries

none of which strike me as show-stoppers just details to be ironed out.

The biggie, as you say, is how to avoid the moral hazard of putting another "money for free" charging mechanism in the hands of councils. Quis custodiet custodes ipsos?

#1. We need to squish this nonsense that a stable population, with associated increased prevalence of older people is a problem. It's not an economic problem. A stable population is essential, and there are benefits, such as no crisis about cost of building infrastructure. As we hear in Auckland currently.

The discussion in #1 presumes producing economic activity is the essential thing. But what about Christchurch which generated such a economic rise from an earthquake. I presume we will need to keep up the level of economic progress by a similar method. How about carpet bombing some suburb every year. How about Takapuna and Northcote next ?

Read yer Insurance Policy. Acts of War are exclusions.

Bzzzt.

No payout.

Yes that is why KH's plan is so brilliant. It gets around that pesky exclusion because there would be no actual war. Our government could carpet bomb suburbs chosen via Facebook polling.The only question really is do they tell the residents effected before or after?

Bernard is being mischevious.

The graph is a ratio of WORKING AGE - TO - NON working Age.

That is a ratio of people between the age of zero (new born) and say 16 years and those over 16 years of age (people often work into their 80's)

That is, it is a ratio of school age and pre school age kids compared to those that have left school.

Bernard is manipulating the data just to wind you up.

#5 - cannot resist this little gem: income inequality caused by assortative mating.

Bad thing, letting people follow their instincts, preferences, predilections and opportunities....what we need is State Direction in these Vital Matters.

Hey, it worked for China....

Oh, wait, #1

I think I noticed an error in the report. Under the Childcare secion, it states that the percentage of salary paid out during the parental leave is 100.

.

That's wrong - the maximum is 504.10 (or your weekly gross wage, whichever is lower).

.

So definitely not 100% of salary.

.

Otherwise, interesting to see that during the recession we remained pretty much where we had been...equality/equity only started to get worse after national's 2nd term.

What one is not allowed to allude to for fear if chastisement is that there are differing levels of intelligence observable in our population. That folk of these differing levels often come together in the same pursuits and enjoy the company of their peers over that of those who hold a different depth of intellect. Technology allowing individuals to move away from an unsatisfying environment has accelerated this.

The short answer, it's not about money, it's about intellect, the top and bottom are separating like oil and water with the dopey ones getting left behind. I could have told you that for free.

#2, The demonisation of teen pregnancy is one of my pet hates, It always was and still is the natural order. Western attitudes are skewed by ridiculous notions and motivations from too many groups with very loud opinions, not correct, just loud. What is most frustrating is the denial of this natural norm and the insistance that the acceptable breeding window be shifted simply for lifestyle purposes. A whole lotta folk would do well to get over their need to control others.

#4, Rich peeps gonna love the cruisey commute once the plebs are priced off the roads, and councils get to offload another pesky cost centre so general rates can fund more monuments, and initiatives fronted by media personalities that are just so shiny and good feeling.

The natural order of things? Teen pregnancy?

Can you provide some facts to back up that statements, please?

.

Classic blinkered, indoctrinated, short memoried denial. Like, where were you for the last 200,000 years?, or does only the period since western women have been educated, started entering the workforce and accessing birth control count?

For the overwhelming majority of this time life expectancy was such that marriage and child rearing began shortly after puberty and this was considered normal, as it is with most mammals (not marriage).

Our current western luxuries allow us to defer and extend the window and social attitudes have changed as a result, but nature is nature and a few generations of privilege do not override that.

It irks me that procreation of the species is now presented as a lifestyle choice and career has replaced it as the necessity. Notwithstanding the current glut of humans, I don't think we need to make more just for the sake of it.

No doubt there is ample time for attitudes to change when (yes, it is inevitable) our race falls into decline as our habitat can no longer support us.

I just cannot take these central bankers seriously anymore. Why not by useful stuff if they want to put more currency in circulation? Instead they buy other central banks worthless rubbish aka "foreign reserves" - which have no cost of production to the foreign central bank. How stupid is it possible to be?

It used to be that central banks hoarded gold and silver but any real stuff with a real cost of production will do. Japan has an outfit called JOGMEC which stockpiles strategic reserves, you know useful stuff like oil and copper and aluminium and tin and tungsten.

Well said Roger......the fiat fiasco flounders on.

Is this just a driveby post Count? Are you just teasing us? Or are you coming back into the fray?

I'm working up to it Scarfo, long story but suffices to say I would have been here if I could.

I'm getting there now I hope....great to see you about go well.

Nice to see you back around the hustings Christov. So the reports of your demise were greatly exagerated. Go you good thing!

I've not seen your good self in the longest time either Vera....glad to see your here !!!

Glad to hear that.

Good Tidings to you also Mr Hulme....I figured you'd be writing copy around here by now...ha!

must admit, you have been missed. We do need some humor around here.

Cheers AJ looking forward to it.

Count...welcome home...to the interesting House of Horrors....

Thank You Alter Ego.....yes it can be can't it but still homely in a frightening kind of way.

And here is a Link to the best Horror House, maybe ever in your price range, dear readers.

Will not be yours for a while, but it is one way of owning your own personal McMansion, that maybe we should introduce to New Zealand.

Must be a tax free capital gain and no dead money..here..well just a little left for the little horrors...Maybe.

Might as well stir the pot...eh Count.

http://normandie.viager-europe.com/en/annonces-details/viager-normandie…

And this is the catch..

Hmm, bypassing financial institutions and denying them the opportunity to create new money, thus contracting the general money supply and shrinking the pool of money available for business. Now that would be completely irresponsible, perhaps even antisocial, to engage is such a practice AE. Cool house for a Count though.

I just cannot take these central bankers seriously anymore

They have trouble taking each other seriously.

National central bankers in the euro area plan to challenge European Central Bank chief Mario Draghi on Wednesday over what they see as his secretive management style and erratic communication and will urge him to act more collegially, ECB sources said. Read more

While I agree CB's are a joke, and yes while gold costs to dig out and refine its not much use really...so ideally yes oil etc and all the rest which I think is what china is "quietly" doing.

regards

love the gender gap index, such brazen feminist bigotry. Where there is inequality favouring women, it just hands out a '1.0', ie. top marks, dispite an obvious 'gender gap', such as a ratio of 1.46 female to male tertiary enrollment in NZ. And areas of consistent inequality favouring women simply don't get a mention, such as prison rates, suicide, workforce deaths, homelessness and so on.

On the other hand, the sooner more women are liberated from the home and have an equal participation rate in the workforce the better. I get awful lonely at the beach during work hours surrounded by housewives, it would be great to get a few mates away from work with the kids.

#7. 'these are solvable' link = Pure Bilderberg Satanism. A logical progression of QE?

Negative nominal interest rates have been ruled out by the IMF, hence the US.

On October 24, 2014, the Executive Board of the International Monetary Fund (IMF) amended the rule for setting the Special Drawing Right (SDR) interest rate by introducing a floor of 0.050 percent (5 basis points) and changing the rounding convention for calculating the SDR interest rate from two to three decimal places. Read more. The lurid version here.

Every time we get a female Prime Minister like Helen, Jenny and so on they get paid female PM rates.

And JK has more money than them

On #2 Bernard I can only assume the Question was asked of boys aged 15 to 19 explaining the discrepancy between Guess and Actual.

This comes about by way of entrapment as in.."oh BTW, I'm having your baby. !"

Further I think the question needs qualification by including termiated pregnancies and they have a bloody cheek doing an ipso-facto-poll and omiting the worlds only rock star economy.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.