Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must reads are #1 and #2 on how the baby boomers of the western world pulled up the ladder on the generations behind them, and how the young don't seemed bothered enough to revolt. This is my final Top 10 for the year. Have a great Summer.

1. Winners and losers - Columbia History Professor Mark Mazower has written this FT Op-Ed ranging through a broad sweep of economic history and concluding that the heirs of a golden age run the show and the young face blighted futures.

Mazower is referring of course mostly to the awful rates of youth unemployment in Europe and the United States, but many of the same themes resonate here.

A generation that benefitted from free tertiary education and much higher youth employment rates early in their careers are now in charge. They bought houses cheaply through the 1990s and early 2000s, winning huge leveraged (and tax free) capital gains into the 2000s. That generation then pulled up the ladder by imposing fees on students and restricting land development, which increased education and housing costs for the generations to follow. They have also pre-cooked the rules so they receive generous pensions that rise much faster than benefits for the young.

The Global Financial Crisis rammed home the yawning gap between the generations and now a second round of slumping inflation is delivering yet more windfall gains to the owners of all sorts of assets, including bonds, stocks and property. Those (mostly young) people who are without a job, who don't have savings and who don't have property are left behind. The lucky generation (accidentally on purpose) pulled up the ladder and now appear determined to hold onto what they've got.

They can rely on their much higher voting rates and their disproportionate size to vote down policies such as a later retirement age, a capital gains tax, easier land policies and any talk of lower tertiary fees.

Mazower offers a bleak assessment of the future, given the young appear disinterested in the democratic process and unaware of what is happening beneath their noses. He is mystified at the lack of a revolt.

Here's Mazower's conclusion:

Heirs of the Golden Age still run the show, and septuagenarian rock stars hog the limelight. Meanwhile the young face dismal employment prospects, insecurity if they do land a job, and soaring bills for their housing and education. Their plight is an extraordinary generational triumph for their parents’ cohort.

In the US, escalating college tuition fees have prompted little protest. Occupy Wall Street was supposed to spur a larger social revolt on the debt question but it failed. In countries on the front line of the eurozone crisis, a doomed generation – facing something in the region of 65 per cent youth unemployment – backs neither the existing parties nor any of the radical alternatives, seeing in all of them, indeed in politics itself, the expressions of the era that got them into this mess.

Understandable as this attitude might be, it is also self-defeating. For until the grievances of the young can assume a political expression more threatening to the established order, the sad truth is that nothing much will change. Modern warfare requires few soldiers. There is no ideology of youth any more, and it is not just the unemployed under-25s who have lost faith in the future. From the point of view of the modern state and its politicians, who needs the young?

2. The wealth of generations - Even in Australia, the Grattan Institute is looking at similar issues.

The housing boom plus rapid increases in government payments on pensions and services for older people risks creating a generation of young Australians with a lower standard of living than that of their parents at a similar age. The generational bargain, under which each generation of working Australians supports retirees while still improving its own standard of living, is under threat.

The report finds that most age groups are richer than they were in 2003. An average 55 to 64-year old household was $173,000 richer in real terms in 2011-12 than was a household of that age in 2003-04. The average 65 to 74-year old household was $215,000 better off over the same period.

However, the average 35 to 44-year old household was only $80,000 richer. Worst affected were 25 to 34-year olds who had less wealth than people of the same age eight years before – even though they saved more than did people of that age in the past.

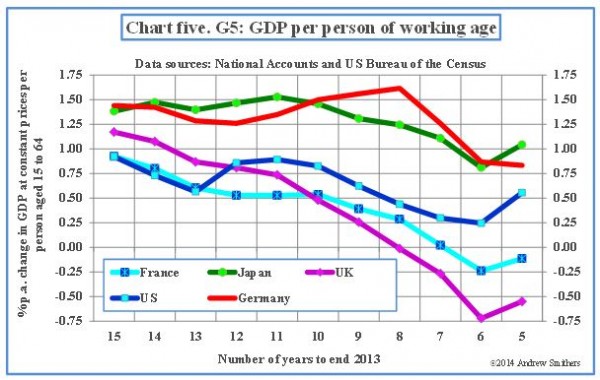

3. It's structural, not cyclical – The biggest debate in the world of economics and markets at the moment is whether the surprisingly low inflation we're seeing all around the world is permanent or just a (downward) blip. Renowned British economist and fund manager Andrew Smithers argues here in this FT blog that it's structural.

He points in particular to the role of aging populations and this chart below showing GDP per working age person is truly devastating.

"As the origin of such changes lies largely in changes in birth rates dating back many decades, a major part of the post-recession slowdown must be attributed to secular rather than cyclical changes."

4. The price of a name – I had no idea, but there's a branch of science called Systematics that is all about the naming of organisms.

Landcare's Systematics Team Leader Dr Peter Buchanan takes a look via sciblogs at the implications identified in the Dean report on the botulism scare of getting the names Clostridium sporogenes and Clostridium botulinum mixed up. The cost was about NZ$100 million.

Ouch.

5. Black swans and fragility – Ambrose Evans Pritchard has picked up on a BIS report that warns about the dangers of a jump in the US dollar given offshore lending in US dollars has surged to US$9 trillion in recent years.

The rouble slump and the drop in the Indonesia rupiah in recent days reinforces the fragility of the system. See 8 below for an idea of what happens when petro-dollar exporters who borrowed heavily in US dollars are hit by a currency slump and a rise in in interest rates at the same time as an oil price slump. The chart below tells the story.

Cross-border lending in dollars has tripled to $9 trillion in a decade. Some $7 trillion of this is entirely outside the American regulatory sphere.

"Neither a borrower nor a lender is a US resident. The role that the US dollar plays in debt contracts is very important. It is a global currency, and no other currency has this role," he said. The implication is that there is no lender-of-last resort standing behind trillions of off-shore dollar bank transactions. This increases the risks of a chain-reaction if it ever goes wrong. China's central bank has ample dollar reserves to bail out its companies - should it wish to do so - but the jury is out on Brazil, Russia, and other countries.

This flaw in the global system may be tested as the Fed prepares to raise interest rates for the first time in seven years.

6. Ghost cities and bridges to nowhere – Jamil Anderlini has a cracking account of the US$6.8 trillion that China estimates it wasted during its credit-fuelled construction binge from 2008 to 2012. And remember, this is what the Chinese Government is saying about China…. And our second largest trading partner, Australia, depends on sales of iron ore and coal to China to fuel that construction...

In 2009 and 2013 alone, “ineffective investment” came to nearly half the total invested in the Chinese economy in those years, according to research by Xu Ce of the National Development and Reform Commission, the state planning agency, and Wang Yuan from the Academy of Macroeconomic Research, a former arm of the NDRC. The bulk of wasted investment went directly into industries such as steel and automobile production that received the most support from the government following the 2008 global crisis, according to the report.

Mr Xu and Ms Wang said ultra-loose monetary policy, little or no oversight over government investment plans and distorted incentive structures for officials were largely to blame for the waste. “Investment efficiency has fallen dramatically [in recent years],” they say in the report.

“It has become far more obvious in the wake of the global financial crisis and has caused a lot of over-investment and waste.”

7. Wellington is a dying city – Full disclosure. I moved to Wellington at the beginning of last year for family and work reasons and I have enjoyed it. We bought a house in Wellington and have enjoyed it. But Wellington's economy has kept diverging sharply from Auckland over that period, and it's expressing itself in all sorts of interesting ways, including in house prices. But also in attendance at expensive events. John Key famously said Wellington was a dying city, and it looks like he's right.

Here's another sign.

Steve Tew and the NZRU quietly bailed out the Wellington Rugby Union over the last week to ensure it wasn't slammed by poor sales for the Sevens next year, the DomPost reported.

Here's Tew wondering what's wrong with Wellington:

"It's challenging in Wellington at the moment and it's not just the sevens, it's everybody. "Go and talk to the Phoenix," he said.

"We are not unlike other promoters in the city in that we are nervous. The appetite of Wellingtonians to go to events has changed, hopefully not permanently, but certainly significantly and it's going to put some things at risk, it really is."

NZ Rugby's current agreement with World Rugby (previously the International Rugby Union) to keep the tournament in Wellington was not set in concrete post 2016. "Is the city losing its appetite for events? It appears to be. We've sold as many tickets to people outside of Wellington as we always have, so the people who haven't bought them are Wellingtonians.

"At some point, if that's the case, events will go elsewhere."

8. The rubble of the rouble - Ambrose has scary story to tell about the latest plunge in the value of the rouble and the desperate attempts by Putin's cronies to protect themselves. This may not end well.

Here's Ambrose saying Russia is at risk of a Soviet style collapse. Crikey.

Neil Shearing, from Capital Economics, said the spectacular failure of the rate shock may bring matters to a head. “If a rise of 650 basis points won’t do the job, we are near the end. That means stringent capital controls,” he said.

Michal Dybula, from BNP Paribas, said the rouble's plunge risks setting off a systemic bank run. “A large-scale run on deposits, once under way, would make capital controls pretty much unavoidable,” he said, adding that the authorities may start by forcing state-controlled companies to sell foreign assets and repatriate funds.

9. Woop woop - The billion prices project in the United States is a fascinating real-time measure of inflation and it is flashing red in a dis-inflationary way, thanks it seems to the plunging oil price.

It's all very topical given the Fed's latest murmurings about maybe, patiently raising interest rates. It's not going to happen if inflation keeps headed in this direction.

Here's the WSJ with the detail. Again, the chart tells the story.

10. Totally Clarke and Dawe on growth creation. It's all about growth. One of my favourites of the year.

77 Comments

"A generation that benefitted from free tertiary education and much higher youth employment rates early in their careers are now in charge. They bought houses cheaply through the 1990s and early 2000s, winning huge leveraged (and tax free) capital gains into the 2000s. That generation then pulled up the ladder by imposing fees on students and restricting land development, which increased education and housing costs for the generations to follow. They have also pre-cooked the rules so they receive generous pensions that rise much faster than benefits for the young"

This is stating the matter quite simply. Massive deregulation in the finanical world, and the rise and rise of neo liberal capitalism are largely to blame for the chasm between the ultra rich, and the rest of us (and most boomers are part of 'the rest of us').

.

Yes, the flow of wealthy has gone up instead of down, and yes, the boomers who are now in charge have imposed increased education cost and housing cost, and living cost overall to try and balance the books. But this is not the cause. This is merely the reaction to the cause.

.

The cause is capital, and how it is gained and kept, in today's economic culture. Articles like the above only serve to obfuscate the facts, and distract us from what we, the 99%, need to do. And that is to revolt together aganst the 1% and demand fair redistribution of the world's wealth.

I disagree. If market mechanisms ("neo liberal") had been allowed to do their rightful job, e.g. SCF would have NOT been bailed out and a lot of rich people would have become less rich. Similarly, if the Fed, ECB, BoE, BoJ etc would not interfere with markets by money printing and outright market transactions, there would be no cheap money and hence no Auckland house bubble 2.0.

It is massive meddling by governments, money elites and banksters that is breaking society. We have too little market and not too much.

Also, the boomers are often simply a selfish and hyper-materialistic lot. Decency and sacrifice do not rate highly with them. They do not even care much about their own kids. Squander their ill gotten money on bloody stupid cruises on the Danube or hanging around Florence rather than giving their kids a head start.

However: "He is mystified at the lack of a revolt." This is the key statement. The young must revolt if they do not want to be trashed be the boomers. When I even look around here (Davies etc) all I see is adventurous calculations to the effect that maybe somehow one can still win in a game stacked against oneself. For most this will not work.

You obviously have no idea of who invested in Finance companies and the follow on effects.

a) Most finance money is or was OAPs capital chasing a retirement income.

b) The finance companies lend mostly to small businesses who cannot get money any other way.

c) "rich" ppl invest in hedge funds as they expect far better returns not in tiny NZ finance companies.

So SCF going down would have decimated OAPs, the money would have exited even faster leaving no method for many small businesses to get funding.

Our economy would have staggered.

The neo-liberal model is an utter failure. Rogernomics did nothing for us, ample evidence of that and indeed around teh world, it just increased in-equality.

NB there is no "society" in a neo-liberal market, its purely dog eat dog.

"stacked game" indeed its known as peak oil, throw a 0 x into your calc, we all lose.

regards

PeterPen we often hear this from neolibs - that we needed MORE free market and less govt. But I think that's why you guys are just as idealistic as communists and anarchists: If your system was introduce in a pure form it would have worked, but the pesky real world got in the way. So unfair!

Sorry Peter the world is a messy mix of interests and biases and neolib economics might be a nice ideal but in practice it's had 3 decades to work and it's done more damage than good.

Also, you say " the boomers are often simply a selfish and hyper-materialistic lot". Selfishness and materialism are as much a symptom of neoliberalism as they are of boomers. I agree the boomers are to be blamed for many ills, but their faults are inexorably intertwined with neoliberal policies as they have happened in the real world.

I respect your ideals of freedom and so on, but bud you need to acknowledge the real world cockup that has happened here.

At some point the baby boomers are going to have to sell their houses and cash in their pension plans to pay fro their burgeoning health care and retirement costs. Lots of sellers will erode a lot of those capital gains.

2015 ain't looking so flash..

LOL, yes....oh bugger....

D:

But here the thing. The meaning of the oil crash is that the central bank fueled bubble of this century is over and done. We are now entering an age of global cooling, drastic industrial deflation, bubble blow-ups and faltering corporate profits.

http://davidstockmanscontracorner.com/im-not-buying-it-not-the-wall-str…All you cattle farmers out there, something wierd happened on the way to the cattle market today.

My friend has a ranch and farms Angus cows. Last year when we lost a calf we would go for a ride to a large dairy farm in the Valley and get a bull calf to mother on, last year we paid $10-20.

Last night he lost a calf and so we trundle over to the dairy farm to get offered a bull calf at $450. Apparently with the beef shortage the US farmers have clicked onto dairy beef and are snapping up the lot. Hmmm, what the effect going to be on us, cheap grain, cheap dairy beef... oh no Santa.

I had heard that there were feedlots fatening dairy beef in Texas but needed confirmation, I think I just got it.

Have a good Christmas from a very wet ,soddenCalifornia. ( Dam is filling fast)

USDA, Last week East Coast

Return to Farm Holstein Calves: When compared to last week's sale, Holstein bull calves sold mostly steady with good demand. Heifers sold 25.00- 50.00 higher with moderate demand. All calves are Holstein unless otherwise notes. All prices per cwt. Holstein Bull Calves: Number 1 95-115 lbs 435.00-460.00; 80-90 lbs 450.00-485.00. Number 2 115-125 lbs 300.00-375.00; 75-110 lbs 425.00-450.00. Number 3 70-115 lbs 350.00-400.00. Utility 80-125 lbs 100.00-250.00; 70-85 lbs 20.00-50.00. Holstein Heifer Calves: Number 1 90-100 lbs 300.00-375.00. Number 2 85- 95 lbs 200.00-300.00; 65-80 lbs 130.00-150.00. Non-Tubing/Utility 60-85 lbs 30.00-100.00.

good news about the Dam. And from what I am hearing it's happening all over the state.

Bloody wet everywhere, surface flooding tonight, yellow crops.

The beef industry is facing a crisis, I've just spent an hour with a dairy farmer, it's about sex selection. He is getting %80 heifers from his top cows, rest Angus X. Being paid $6-700 as they drop ( drop calves). This is going to seriously screw with the beef industry. They won't need us anymore.

Isn't it about time we moved away from agriculture as our primary money maker? I believe we are the only nation in the developed world that relies on agri exports as our primary industry.

.

R&D in clean green technologies, grants for science degrees to attract the best and brightest (international) students.

That's the way to go. I reckon.

Why? It's something we do very well, where we have natural advantage, and for which there's no particular reason to think demand is likely to dry up. If it does, then market signals - ie falling prices - will encourage people and resources out of agriculture and into other areas.

If you think you know different, and before the market does, where there will be better money to be made in future - by all means invest your own money in it. If you're right you will make a fortune and then you will be able to fund as many degree courses in basket weaving as you like. But there is a long and inglorious history of complete failure by Governments that think they know how to direct a nation's resources.

I don't think we have a 'natural' advantage. I think we have a history of it. NZ has been too far away from everywhere else to develop any other (value added) exports, in any meaning ful way.

And as Andrewj pointed out above, the fact that Asia has developed a taste for (and can afford to pay for) meat and dairy, means there's money to be made, now. So the big players are muscling in. And the US and Europe have a bit more cash to throw at these things if they decide they want a piece of the pie. They can easily price and prodcuse us out of the market

Besides, I didn't say we should stop altogether, I just think it's a bit hazardous to have all ones eggs in one basket. Apart from tourism, we don't have anything else meaningful to fall back on. it only makes sense to diversify.

So the DFTBA plan is to stop the thing we do well at and make money at. Difficult as that is. And rely on activities that many bright people, despite their best efforts, have not be able to make work to any significant extent.

Sounds like a plan. Or is it - Foot. Gun. Shoot ?

No, think you compleely misread my posts.

I commented on Andrewj's statement 'they don't need us any longer", which I took to mean that NZ's golden run where dairy and beef exports are concerned, is over.

I then pointed out that it is not a good idea to - as a nation - only have 1 industry that powers the economy - far more sensible to diversify.

.

Again, I didn't say we should stop, I said we should be looking at making money in other ways, too.

.

And "activities that many bright people have not been able to make work", I assume you mean by that clean green technologies/energy?

This just needs a cash injection, a sustained cash injection. Which nobody has been doing, due to the massive oil lobby/industry out there.

.

Also, why stop at clean green? Computers and algorithms now rule nearly every aspect of our worls - hence the massive demand for people wo can code, and the push to get more students to take up science subjects.

.

I don't understand this stubborn mind set that farming, and only famring, is what we're good at. It's not.

And intensifying farming is destroying the draw card for our 2nd largest industry: clean green environment which gets the tourists here.

.

Something's gotta give, somewhere, and doing it slowly, by choice, at our own pace, is going to be far less painful than the alternative.

.

I don't see that as shooting muself in the foot, no.

OK there is specialisation in the global econmy. I had found a brililant Youtube 60 seconds video that explained it well ... and explained that the Philips curve was a specific effect not a universal one.

Basically it goes that income, interest, inflation are three point, if you push two the other tends to move. If we export we can increase peoples incomes and thus local spending is stimulated...so if we then shift the inflation then interest rates will shift and vice versa.

Old school thinking is that to do well if we all save more. but that means no one is spending, and if noone is spending then banks and investments do poorly, and thus interest rates must be high to pay for the expense of saving institutions. Also means that wages are low because of low business revenue, and that means government tax take is low. This is the mentality that strangled NZ to near death in the 60's 70's.

So the next theory was if the government spent up big, then there would be money entering into the economy to make up for the low business revenues and lack of wages. Unfortunately governments don't create money, so it has to be sucked back...and it doesn't get pulled from the ones making the biggest benefit

The next unpublished attempt was to introduce "created money" in the the middle tier via super cheap loans. This all got poured into investments that are dead equity, created inflation on purchases that were going to happen anyway - worse than the previous cycle the benefactors of this cycle don't know the money game that was being played...so when the music stopped...we call this experiment "GFC" and good luck finding the evidence....

What has been noted is that many countries like to produce everything. this was important in times of war - when someone might cut off your supply lines. It was also a basic need as transport and politics meant unstable trade borders. The current experiment is to have "Free Trade Agreements" to allow exported income to increase. this creates incomes at home, improving economies - the subsequent globalisation has the side effect that a country that specialises will do well when trading it's best margin product, and less effectively for products that compete with neighbours and trade partners. This means that countries pioneering this approach like NZ will tend to rely on a single product or two, and other countries will likewise adapt - except NZ is a very poor country, and other countries are much larger and richer so don't have to limit themselves to one or two items, and can either vetically intergrate or diversify easily. Note that a refusal to play the global game is likely to result in reprisals and trade sanctions..... bad news when you're betting everything on one horse, or have a large import demand.

The next step which has been pioneered by Germany, is pressure towards a common currency, to stop the interest rate advantages that globalisation creates. Understandably as been proven since the GFC failure and fried POORK (well roasted PIIGS) some countries are hesitant to sell their sovereign currency rights to Germany/Banks. Although with most of us tied up in either EU or TPPA there is little escape. This would give ultimate control of interest rate policy to the currency masters, and many local economies would be reduced to rouble.

your second largest industry...is the same one as many other pacific island nations. Can we compete with Fiji or Caledonian islands, or the Carribean? Without extra business to keep the place together? Do tourist traps do well for their people? What are the home lives of those staff I see helping at Singapore hotels? Hong Kong is also a popular tourism spot; what are conditions like for their tourist serving population?

Purely respondng to your comments on Tourism:

Yes, I think we can compete with Fiji or Caledonian islands, or the Carribean. We offer something else entirely, we're not a tropical island.

But you are right: a tourist destination can be hell to live in as a local - I used to live in ne, and now live in another. Luckily the current one seems to be only ridiculously popular 6 weeks of the year. it is something hotly debated in the community, though, to attract more tourists, or not.

My view on that is to diversify in tourism, too. It's not just about beaches, people like to cycle, mountain bike, kayak, tram, wine&dine, get spa treatments, etc.

You'll get different tourists for different reasons at different times of the year, or even day.

.

I've only ever been through Singapore, never been to it. Hong Kong I've been to for work, not pleasure.

I don't tend to pick cities as holiday destinations, but maybe that's just me....

I grew up in a tourist destination. The place is still doing well, and has not really any other main industries. Mind you, tourism is big one, from hotels, motels, back packers and inns, to restaurants, museums, music festivals, arts and crafts etc....tourism itself can be a powerful economic engine.

.

Also - I don't have any spare money for speculating/investing - sorry.

But we do have a history of jumping on band wagons and poor investment decisions.

Deer until they changed their tax status, then Kiwi fruit was on a roll, goats were interesting, Ostrich didn't get too far, lots of apple trees got pulled out around us.

Deer have struggled on and some appear to making a go of it. Kiwi fruit has became a proper industry, although selling cuttings offshore wasn't smart in hindsight.

Its the financialisation of farming and housing that is concerning me most. Dairy has a future but with this much debt and a rapidly changing market and with new technology in production making it very hard to adjust to change fast enough( sexed semen). New ideas in agriculture have a ready source of funding at very low cost.

The NZ bull beef industry has been a life saver for many farmers its been a winner since the late 60's. Now it looks like Sexed Semen will allow the usa to be self sufficient in beef production. Our quota to the USA for our Bull beef and Dairy cows created a very stable market, now with record beef prices the farmers in the USA are using the dairy industry as a source of prime beef and there are a lot of dairy cows in the States who up to recently had worthless bull calves.

Now those calves are selling for up to $700 many large dairy farms find they have a new million dollar source of income.

Keith Woodford was ahead of the game, but its the insability which will catch a lot of us out, as we adapt to less stable markets in Asia.

Seismic shift in global beef industry http://www.stuff.co.nz/business/farming/beef/9701866/Seismic-shift-in-g…

Um no....I think you are wrong.

a) 7Billion and climbing and wanting more meat is a long term money maker, if costs can be contained.

b) Green tech, well that has a sucky EROEI and many are decades ahead of us.

c) Attracting the best? with $s no not really. Govn throwing money they/we dont have at the problem they dont know about has been a failure for many decades, they throw it at the voters to get re-elected, nothing more.

Cognitive globalization.... Just whose patch you think we're good enough to take?

Sharemilker here sending cull cows to the works. Getting over $900 - previously unheard of in his short(ish) sharemilking career.

CO, how would he feel if his bobbys were worth $700 US?

Well he wouldn't be complaining Aj. ;-) But ask any dairy farmer what happens when prices go up quickly and the wise ones will know not to get too caught up in the hype - the price can drop just as quickly as it went up.

Guaranteed Milk Price offer closes today. will be interesting to see what the interest in it is.

I'd go with on that CO, except Angus weaners are selling for $1700 US so a $700 angusXfresian drop calf, is considered a bargain and they can rear them cheaper than us.

I just don't now how much of a game changer it is, but I don't think they can put the rabbit back in the hat.

Feedlots have discovered a cheap way to source beef and dairy farmers are elated.

Damn. i asked them to contact me when that GMP opened.

I don't use their god awful ugly website so they probably emailled me there if at all.

Can item 7 and its link be fixed please

Re #10 Growth.

This little YouTube clip will show the impossibility of continuous growth.

May I introduce:

The Impossible Hamster

https://www.youtube.com/watch?v=Sqwd_u6HkMo

"There are reasons in nature, why things dont grow indefinitely. As things are in nature, sooner or later, so they must be in the economy. As economic growth rises, we are pushing the planet ever closer to, and beyond some very real environmental limits. With every doubling in the global economy we use the equivalent in resources of all of the previous doublings combined."

1 & 2. Stating the obvious, very nicely too. Let's teach it in schools - depends on who sets the syllabus of course. I'm wondering if the rise in multiculturalism has created a certain disregard

#3

Hard to understand how he reaches that conclusion. It is interesting to note that Germany and Japan have preseved a positive growth rate of GDP per person despite their populations decreasing (ie probably a growing proportion of older people), while all the other countries that have reduced and tipped over into negative GDP growth per person have growing populations

# 7 Wellington Dying

Well it is not surprising; when National took power they put the brakes on the runaway growth in the numbers and salaries of government servants. See Davids piece on the reduction of the Govt Dep CEO salaries

So growth stopped due to austerity. So when that austerity happens on a bigger scale? ie much bigger austerity, a Nation's economy stumbles.

Classic really.

What has Auckland got going for it? a housing bubble, when that pops whats left?

ho hum.

Exactly. Big cities get used to the regular revenue stream and extra compliance related income (eg reports and presentations, centralized managers and oversight). That and the velocity of money makes them what they are. It also allows them to develop local economies that are more in line with luxury, due to the influx of passive or unearned income ( money they don't have to work for, invest in, or compete for...they just demand it and it rolls in). As the passive income shrinks, Velocity of money tightens up some of the luxury matkets, some of those start to struggle as their market shrinks. What is being done by Wellington to diversify in light of their reduced cash cow?

#2 is a typically disingenuous warping of figures to present one point of view.

The fact that wealth in the 55-64 age rose from $911k to $1.086m ie 19.2% and for the 35-44 age rose from $490k to $572k ie 16.8%, is not really a big shock - 8 years of 2% inflation is 17.2% and variations around that are just "noise" in the numbers.

So why do we have to put up with phoney reports based on crappy numbers purporting to proclaim the veracity of untrue propositions!!

The fact is, go back to 2000 and you will find dozens of articles deriding the high price of houses and that young people will never afford them!

In fact a few years ago I found an old newspaper from the 1960s, while renovating a house and low and behold, in front of me an article bemoaning the high cost of houses and that young people could never afford them!! Sound familiar?

All this rubbish about houses being too expensive is codswollop. It's all perception, houses are always expensive, get over it!

Back in 2008, I told you Mr Hickey that my prediction was that the market will be flat for a few years and then in 5 years time Mr Minus Thirty Percent will be moaning about the next boom!

What happened... Exactly that.

It's all perception, until you look at the numbers. Of course housing is always an expensive asset, there's always allot of land, materials and labour need to build it.

The point is it's a lot more expensive now than it was on any number of measures. What measures show you that housing is not more expensive that it was 30 years ago?

Factor in high interest rates 25-30 years ago, factor in "equivalent" houses (ie not comparing 250m2 new houses of today with 130m2 new houses of 1985), factor in tax changes (move to GST) and the affordability numbers are surprisingly similar.

As an example, thinking of 1989/90 prices, a middling new home in a middling suburb in Chch was about $200,000. Today similar costs $550,000. Interest rates were 14%ish, today 6%ish, on that basis alone affordability is not much worse even before considering real wage increases and inflation, increased number of households with more than one income, and lower income taxes.

Looking at average prices is meaningless as houses today have more gizmos, fancier features etc etc than previously. Think of all the dungers that have been replaced with new homes, the thousands spent on renovations on houses, the fact new homes on average are much bigger and you see that averages are not a good measure of comparing current and past prices.

An ageing population also means that current averages include many more homes of older generations (ie more bigger homes where owners have spent more money on lavish renovations) and less basic first home buyer homes. Again leading to averages skewing perception.

So whingers, stop whinging. Houses are affordable. Get over it.

14% on 200k is much more affordable than 6% on 550k.

instead of shooting you mouth off, pull out a spreadsheet. And setup a long table to show the whole payment schedule. Then factor in things like second job, lifestyle changes, redundancy, and impact of regular principle contribution.

i await your apology.

What twaddle cowboy!

Assuming 25 year table mortgages (standard in both 1990 and today) and 20% deposit in 1989 you'd pay $443 (=$771 [2014 dollars]) per week and in 2014 you'd pay $652 (= $382 [1989 dollars]) per week.

Therefore considering just CPI inflation it's more affordable today than 25 years ago (ie 384<443). Excluding inflation it's actually not much worse as I said (652>443). When real wage increases, lower income taxes and rising number of workers in the household are considered, it is a lot more affordable today.

You should be apologizing!

I'm curious, how long were rates at 20% for?

I'll go out on a limb here and say probably not long when compared to the average duration of a mortgage? Quoting 20% certainy sounds impressive though, I guess if the figures are twisted enough some people claim unfordability is unchanged. Talk about a disconnect with the current reality!

http://www.rbnz.govt.nz/statistics/key_graphs/mortgage_rates/

Actually, StatsNZ has archived a longer interest rate series that the RBNZ had kept of B3 data.

It shows data from Feb-1964 to Nov-2004. (MSExcel)

In the almost 41 year period covered, for 19 years floating mortgage rates were over 10%.

For eight years in that period they were over 15%.

For just 8 months of that period they were over 20%. The highest was 20.5% in June 1987.

While the Super high Credit Card type mortgage rates peaked at 20.5% in one year 87, they only slowly started falling over the next few years back down to 10-11%. - In the meantime the high interest rates ruined farmers, orchardists, and wrecked sections of the economy - all in the name of inflation-busting. The inflation just hid, and reappeared within capital gains and fixed charges now.

A 60,000$ mortgage at 20.5% is probably == to a current $350k mortgage at 6% relative to wages.

They were floating rates over 20%.

I actually remember depositing my savings at United Bank and earning 24% pa for a 3 month term investment!

Chris was that before or after you had to stand in the line out the door trying to get your money back during the run on that bank ? Oh for those 24% days again :-)

At our Freemasons Lodge they brought a rule in that if people paid 5yrs fees in lump sum they got excused for fees for life.

It came up for vote a couple years ago because several brethern were concerned about it (in our modern 2,7 and 3% days). They wanted to remove that from our bylaws but I spoke that since then many members of the fund had Ceased Labour and those few remaining were on fixed income so it stood to reason that we should just make the minor amendment that "application to that fund be closed until further notice pending favourable interest rates" and that existing members probably do have their fees fully covered by that fund anyway so no need to remove or close the fund.

and the next 30 years? 1/3rd that, or should be....

but then human's go and get in the way.

regards

Do the table and you'll find out.

Aqnd yes, I _used_ to think that the higher amount was more affordable as a percentage until I actually did the figtures and noticed, (a) the 5 and 10 points, (b) the risk, (c) the % against disposable income, and especially (d) the impact of extra payments.

Cowboy, you make no sense whatsoever. It is irrelevant what happens in the future when comparing affordability on two particular points in history.

in 1990 you didn't know interest rates would be relatively stable averaging 7 or 8% for the next 25 years. In 2000 you didn't know house prices would double or triple within 15 years...

The fact is a standard mortgage for a standard house is cheaper now than in 1990.

Also a fact is that some houses have barely doubled in value in both Auckland and Chch over the past 25 years (particularly high end brand new houses on small sites or outer suburbs) which makes them seriously much more affordable now than 25 years ago.

That is where you are making your mistake.

Sadly most of NZ is in a state of financial ignorance as you are, it takes actually effort and real world experience to find out the truth in such matters - but you can run a model (eg on a spreadsheet).

Do you real think it is feasible to do a 15 - 30 year investment with no future projection ?

And if I was selling I might telling you the same thing (about affordability) if you were a qualified buyer. Aye the numbers look the same, and the percentage of income looks advantageous.

In 2000, yes I did know. although I picked 2009, not 06-07. and in the 90 I did know they were going to be stable....because it was post-war and the FED weren't looking for cash.

What I didn't pick - was in the Tararua Milk Coop merger with Longburn then into Fonterra was that our (Tararua) top employees would just throw in the towel, when our farmers and many directors and boardmembers were picking them for the top spots. We had some real quality personnel, winning international awards - but they just felt "unappreciated" where their more mortal competitors felt more motivated to keep their jobs. Same with any voluntary redundancy really. those with top skills and vision can get work anywhere, so you get stuck with the poor performers and the paper chasers.

But do the spreadsheet. The 17% seems like a lot. it might even be 40% of income.

But in that kind of environment a small wage increase, second job, or even lifestyle change is guaranteed - think about it - 17% = 40% of your income...whats your incentive to improve your odds? What's your reward? pretty damn good.

Where if the 6% of "capitalised rental expense into an asset" = 35 % of income, then yes you can try to save a few things, get another job... but why have they only gone to 35% commitment? wouldn't 40% pay it down so much faster? Chances are the other expenses are also higher so that extra 5% just isn't actually disposably there.

And even if it is, get another job.... whats your reward? you only save 6% for every extra dollar paid off principal. That 6% can even be rapidly sucked in by the cost of the other job or lifestyle change (as many people find to their dismay!)

Throw in risk aversion. you going to be more careful when you know your debt is costing you 17% or 6% ?

Seriously do the table, it's sobering stuff.

I also have another table, which is time on the x-axis, payment on the y-axis. linked to a graph. the spreadsheet has a cell which holds a Interest Rate, and Period (eg 52 payments per period). the table has borrowing across the top row from 10k to 2M, and number of periods down the column (from 1 period to 400 periods) using the PMT() function (on one table, and NPER() on the other)... it identifies the best rate to be paying off a loan based on numbers alone. the importance is looking at the "knee point", going in one direction we get faster payoff (less cost of money, but less use of OPM), in the other direction the cost of money is higher, but one gets better use of their own money.

These two tables (the loan cost one, and the former %service cost) are very useful in this kind of work.

Cowboy, clearly you have a spreadsheet looking at the long term cost of owning a property, but the point I am trying to make is that the long term cost is not entirely relevant to a decision to buy a house.

That is because rent has to be paid anyway and as real interest rates (market interest rate less inflation) is always 4-5%, then if that amount is affordable relative to the rent of the day, then there is no issue in regards affordability in the future either.

Only in a period of prolonged deflation greater than -2 to -3%pa would an issue occur for existing home owner. (Which is extremely unlikely).

Given that inflation will erode the value of the debt and increase the income of the borrower so that debt can be reduced faster and given that inflation is constrained to be positive, then these facts make property ownership essential for anyone needing to occupy a property.

In fact, assuming 2% inflation, if one rented for 60 years, they would have paid 114 times the current annual rent in total rent over that time and have nothing to show for it. If one owned a property that cost 15 or even 20 times annual rent and paid another 10 or 15 times in interest costs over the life of the mortgage, then it seems a very cheap option and affordable option.

Do the spreadshhet.

Create the model.

most of all do the limit testing.

remember to have the whole schedule in front of you, not just a single NPER

Then calculate in the boomers grandparents inheritance. or even a small payrise.

Don't call back until you complete your homework.

Cowboy, you realise that I can't use telekinesis to construct the same erroneous spreadsheet that you have in front of you and then use it to let you know where you went wrong!!

Facts are:

1. Someone who needs a house will have to pay rent indefinitely into the future to have a house if they don't buy one.

2. Any affordability comparison can be done comparing the rent you would have had to pay with what a house (and or it's mortgage) costs.

3. Any consideration of redundancy, inheritance income growth etc etc is all redundant and irrelevant as that affects the both the renter and the owner.

4. Whether renting is truly more affordable or ownership is affordable can be determined knowing just the real interest rate, inflation, the ongoing ownership costs, the house price on day one and the rent on day one. Determining what would turn out to be the better financial decision also would consider any real change in house prices over time.

cowboy you need to pare back your calculation. Adding fluff about the homeowner's future income is irrelevant and demonstrates a lack of understanding - certainly not even a B grade effort...

Ok so you started claiming houses were not more expensive when they are,

So then you moved to houses being not less affordable when they are,

So now rather than think of affordablilty as, how much of my paycheck is this going to take, you turned it into, what is a better long term investment?

Well, i'm afraid unless you have a crystal ball for future capital gains of house vs alternative investment categories, we can only really look rent, prices and debt servicing costs. We already know the debt servicing costs are much higher, as a proportion of income. The rent to price ratio meanwhile has gotten way outta whack compared to 89/90. May i direct you to the graph at the top of page 4

http://www.propertynz.co.nz/media/wysiwyg/pdf/Grant_Spencer.pdf

Facts are...until you do your simple homework you have no credibility whatsoever.

If you'd done your homework which is actually very simple... so simple in fact that it proves that you don't know what you're talking about when you call it erroneous

Future income is _entirely_ relevant. you can't have _affordability_ between two different purchase points without proper future predictions (sensitivity analysis).

That you claim it is irrelevant shows you are talking rubbish, take it a blog or somewhere you can do minimal harm.

The 6% and 17% are exposure to environmental risk.

Affordability of an investment must take into accord that risk.

On top of the basic cost factor itself, when you are dealing with differing time periods (like when talking different countries) because REAL cost of living and disposable income/cost of rent must also be comparable for proper analysis (in this case of affordability).

Or are you the type that gives advice that fits one set of numbers then walks away saying any resulting failure is simply the investors problem.... (sell many ag swap rates much?)

Chris_J

Yes indeed, the essence of what you are saying is house prices and interest rates travel inversely to one-another and one drives the other -and there-in is the risk. So long as interest rates are falling. Affordability on a mortgage (borrowing) basis remains relatively stable. If mortgage interest rates rise in the near future, the serviceabiity of the loan will change, incomes won't rise immediately, so house prices will need to stabilise or fall

this is another red herring.

It works for banks and sovereign fund investors, but it doesn't work on the normal coal face.

"house prices" may shift inverselt to interest rates, but if you are a buyer, you lock that in for a time and are already paying down principal, and it is the whole market that shifts not just your property - your house price is locked in - which is why "you make the money when you buy, not when you sell".

Likewise the interest rates might change while you are watching the market, but once you're committed you have options on a single loan, limited options, and the sooner you can deleverage that one the more control you have. especially if you fix for a period.

Two otherguys, because rents generally follow CPI inflation, and as interest rates reflect CPI plus 4-5% almost always (certainly for the past 150 years in NZ), then if you can afford the mortgage on day one, you should be able to afford it if interest rates rise because that would be roughly equivalent to the rent increase you otherwise would have had.

There is not too much risk if the property is affordable on day one.

Yes exactly, so the 20% interest rate in the 80s a red-hearring. The problem is the 'affordable on day one' part. Not so many affordable houses around these days.

I was talking about a 14% interest rate in 89/90 (you seem to be confused with a 20% deposit).

Apart from Central Auckland standalone houses (which make up probably only 2% of all NZ homes), the rest of the country is pretty affordable.

It's not just auckland (though auckland is certainly the worst).

http://www.interest.co.nz/property/house-price-income-multiples

Inflation was also about 7% (CPI) 1989/1990. And I guess pay rises were probably matching.

So that $200,000 principle debt was losing 7% in real terms. Compare that to the $550,000 only losing 1% at todays CPI.

Houses are not affordable when a professional earns only about $70,000.

Work has been devalued.

exactly

Guido, think about it, we are not considering anything other than the cost of the mortgage on the day of purchase, other considerations (ie inflation) just reinforce why property is so important to own for your financial security, it doesn't change the cost of the mortgage...

Also 32 year old school teachers can earn about $70k. Professionals in Auckland CBD jobs (ie those who need to live in Central Auckland) can earn well into six figures, this is why people pay $800 to $1200 to rent nice houses in Central Auckland...

But you're not just paying for it on the day of purchase, maybe 10 years of payments pre mid 90's, 25 years now. Inflation, interest rate and payments will change during that period.

I think most people know owning your own property is so important because of inflation. But housing has more than doubled compared to wages already, the horse has already bolted. Housing is unaffordable and people not owning a home including professionals face poverty in retirement.

About 5% of the population earn $100K+. Average Salary in New Zealand $55K,

Guido, the whole point of buying a house is that it locks in your future costs. Future inflation and to some extent interest rates (as real interest rates are always about the same) are irrelevant.

BTW of the 5% who earn over $100k most live in Central Auckland don't they...

Housing is roughly as affordable as it always has been. Get over it.

How can you consider affordability when you are looking only at 'future costs'? You need to look at future income too (which we can only do with hindsight).

You aren't locking in future costs anyway. Imagine if someone locked in a 25 year 20% mortagage in 1989. When inflation settled down a few years later and their wages stopped increasing so fast they would be stuffed!

why would anyone purchase a 25yr 20% mortgage??

Theres a reason they veered off that failure, and pumped credit in (eg float) and locked down pirces and rents to try and stop inflation.

1989 it took roughly 2x median household income to buy a median house. It now takes 5.6x. Therefore house is roughly 2.5 times less afforable than when you were suffering with your 24% term deposit rate.

http://www.interest.co.nz/property/house-price-income-multiples

You have just said that future inflation and interest rates are irrelevant (interest rates - inflation = 5-6 %) assuming pay rises at inflation, OK. But that still leaves the principle… 2 * household income vs 5.6 * household income, 280% more expensive! How can you say it is roughly as affordable? That $200,000 house in 1990 would be $560,000 at today’s affordability ratios. Would you be in your own home now if that was the case? But that is the reality for Kiwi FHB’s today.

That will take a lot longer to pay, more years of interest payments.

And of course it should have all gone bust in 2008, but for international ZIRP, QE, and Bank bailouts which debased the real value of money to keep asset prices high. New Zealand is interconnected and along for the ride.

I won’t be getting over it.

Meanwhile 2014 looks to be the hottest on record,

http://www.theguardian.com/environment/climate-consensus-97-per-cent/20…

#1 - The boomers were lucky enough to be part of a boom in population and a high working proportion of the population. Can't blame them for their parents having six kids and their kids only having 2, thereby ending the golden run and reducing the working age % of population.

The kneejerk reaction would be to eye up the wealthy like a pack of vultures, but what do you do when you've consumed the capital, or driven up inflation by putting the money in the hands of consumers, not producers?

And so there we have it, to all those who complain young people want it all and could easily save for a house if they weren't so busy jetting off on overseas holidays

"Worst affected were 25 to 34-year olds who had less wealth than people of the same age eight years before – even though they saved more than did people of that age in the past."

Re No 8. Ambrose EP while no doubt a clever bastard, is a shill for the US$. Like so many journalists he prefers to prostitute himself rather than tell the truth about American financial manouverings. It was easy to spot these people when Mh17 was downed as they were the first on board toeing the US line that "Putin dun it"

Russia has very little overseas debt when compared to countries like USA, UK, and the EU menagerie. It is resource rich. It has brokered huge energy deals with China and has important trade connections with India,Iran and others. It is the favourite sport of people like AEP to denigrate Russia as they try to curry favour with the bosses of whatever US-centric media they work for. Any truthful economic journalist would be reporting on the currency war, instigated by USA , that Russia appears to be losing because the Russian Central Bank is controlled by people who wish to see the Russian economy dominated by their friends in the western banking system.No doubt huge pesonal rewards are in the offing for them just as the American politicians, who play ball with wall street end up well rewarded.

How Putin reacts in the next little while will be interesting. Hopefully it involves sticking a Buk missile up AEP's arse and sending him to the moon.... (sorry, thats the beer talking.)

Happy Christmas everyone

#7 - maybe Wellington isn't a thriving city - but also maybe look slightly beyond the headline to see why the over-priced and over-hyped 7's is considered to be at risk. A $600,000 anticipated loss it says. With the good guys, the NZ Rugby Union riding to the rescue.

But reading further, the article says that the NZRU is charging the Wellington 7's a minimum guaranteed $3,000,000 license fee each year. So for 30,000 paying patrons, that works out to be $100 per person for the event in transfer payment to the Rugby Union.

No wonder the Wellington Sevens have to have high admission prices and high prices for their main attraction - which seems to be the beer.

The young party animals took over and the older genuine rugby followers gave up. Now they are trying to get the rugby people back and clamping down on the younger party animals so they have lost both audiences.

When commentators ask why people no longer go to live events, cost is a big one. The Phoenix want $30 entry fee and up until this year have been boring to watch. People now have big screen TVs, cheep beer at home, no rain down your back, no boorish behaviour to put up with etc. to go to a game costs the thick end of $100. Entry fee, parking, travel, food and drink etc.

#8 thought Putin said he'd fought Bears before....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.