Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #2. It explains #1 and should blow your mind if you're interested in how technology changes economies and history. And I quite like Dilbert ;)

1. Negative bond yields - It is extraordinary that more than US$2 trillion worth of bonds are now trading in negative yielding territory. That means the investor is effectively paying another investor, a bank or a Government money to look after their money.

The numbers, as detailed in this FT explainer, are amazing.

More than 60% of German bonds are now negative yielding.

The German Government was able to issue a five year bond with a negative yield last week.

And the ECB hasn't even started printing money to buy bonds yet.

So why on earth would any investor ever buy a negative yielding bond?

The same reason anyone buys anything these days: the capital gain when they yields go even more negative.

There is another more unsettling view: that the really smart money in the deepest markets in the world are moving in some 'wisdom of the crowds' way to the conclusion that we face an epic age of deflation (see the links below for more on that).

Hence there is a very good chance bond yields will fall further into negative territory as the ECB and other central banks buy up huge amounts of debt. That will push prices higher and means investors will reap a capital gain that offsets a negative yield.

While negative bond yields are a compelling sign of a serious dysfunction, bond investors see an opportunity for capital gains or what is known as a positive total return. That is what makes bond investors very happy.

2. 'The referee would stop the fight' - John Lanchester has written a joint book review for the London Review of Books of 'The Second Machine Age' and 'Average is Over'. Both look at the impact of new technology on the nature of work, incomes and the economy. He takes a Luddite-ish view. #9 below takes the opposite view.

Lanchester points to the divergence evident in recent years between productivity and wages. He rightly points to the Apple example.

The amount of work done per worker has gone up, but pay hasn’t. This means that the proceeds of increased profitability are accruing to capital rather than to labour. The culprit is not clear, but Brynjolfsson and McAfee argue, persuasively, that the force to blame is increased automation.

That is a worrying trend. Imagine an economy in which the 0.1 per cent own the machines, the rest of the 1 per cent manage their operation, and the 99 per cent either do the remaining scraps of unautomatable work, or are unemployed. That is the world implied by developments in productivity and automation. It is Pikettyworld, in which capital is increasingly triumphant over labour. We get a glimpse of it in those quarterly numbers from Apple, about which my robot colleague wrote so evocatively. Apple’s quarter was the most profitable of any company in history: $74.6 billion in turnover, and $18 billion in profit. Tim Cook, the boss of Apple, said that these numbers are ‘hard to comprehend’. He’s right: it’s hard to process the fact that the company sold 34,000 iPhones every hour for three months.

Bravo – though we should think about the trends implied in those figures. For the sake of argument, say that Apple’s achievement is annualised, so their whole year is as much of an improvement on the one before as that quarter was. That would give them $88.9 billion in profits. In 1960, the most profitable company in the world’s biggest economy was General Motors. In today’s money, GM made $7.6 billion that year. It also employed 600,000 people. Today’s most profitable company employs 92,600. So where 600,000 workers would once generate $7.6 billion in profit, now 92,600 generate $89.9 billion, an improvement in profitability per worker of 76.65 times. Remember, this is pure profit for the company’s owners, after all workers have been paid. Capital isn’t just winning against labour: there’s no contest. If it were a boxing match, the referee would stop the fight.

3. The deflationary impact - Lanchester goes on to point out that this brave new Pickettyworld would be riven by deflation.

This world would likely be one which suffered from severe deflation. If jobs are disappearing, then there is less and less money in most people’s pockets, and when that happens, prices fall. This isn’t exactly the kind of deflation we are starting to have today in wide swathes of the developed world; that’s more to do with the oil price falling at the same time as economies stagnate and consumers lose confidence. But the different deflations could easily overlap.

Larry Page, founder and CEO of Google, is sanguine about that, as he recently said in an interview reported in the Financial Times: He sees another boon in the effect that technology will have on the prices of many everyday goods and services. A massive deflation is coming: ‘Even if there’s going to be a disruption in people’s jobs, in the short term that’s likely to be made up by the decreasing cost of things we need, which I think is really important and not being talked about.’

4. He said what! - Larry Page of Google fame has a strong view that new technology will drive prices lower, and not just for goods and services. He's one of those libertarians who think the inevitable freeing up of land supply will also drive down house prices. Here's his view in this October 31, 2014 interview with the FT, which I missed at the time.

It raises some deep questions about what happens to the people replaced by the robots. How do they earn a living? Should there be a universal basic income?

Here's Page:

New technologies will make businesses not 10 per cent, but 10 times more efficient, he says. Provided that flows through into lower prices: “I think the things you want to live a comfortable life could get much, much, much cheaper.”

Collapsing house prices could be another part of this equation. Even more than technology, he puts this down to policy changes needed to make land more readily available for construction. Rather than exceeding $1m, there’s no reason why the median home in Palo Alto, in the heart of Silicon Valley, shouldn’t cost $50,000, he says.

For many, the thought of upheavals like this in their personal economics might seem pie in the sky – not to mention highly disturbing. The prospect of millions of jobs being rendered obsolete, private-home values collapsing and the prices of everyday goods going into a deflationary spiral hardly sounds like a recipe for nirvana. But in a capitalist system, he suggests, the elimination of inefficiency through technology has to be pursued to its logical conclusion.

“You can’t wish away these things from happening, they are going to happen,” says Page. “You’re going to have some very amazing capabilities in the economy. When we have computers that can do more and more jobs, it’s going to change how we think about work. There’s no way around that. You can’t wish it away.”

5. And the societal response? - Lanchester then goes on to look at the speed of the changes involved and the likely societal response. Those jobs and incomes are not going to go away easily or without consequence.

These chilling views aren’t unusual in Silicon Valley and the upper reaches of the overlord class. The tone is inevitabilist, deterministic and triumphalist. There’s no point feeling sad about it, this is just what’s going to happen. Yes, robots will eat the jobs – all the little people jobs, anyway.

There is a missing piece here. A great deal of modern economic discourse takes it as axiomatic that economic forces are the only ones that matter. This idea has bled into politics too, at least in the Western world: economic forces have been awarded the status of inexorable truths. The idea that a wave of economic change is so disruptive to the social order that a society might rebel against it – that has, it seems, disappeared from the realms of the possible. But the disappearance of 47 per cent of jobs in two decades (as per Frey and Osborne) must be right on the edge of what a society can bear, not so much because of that 47 per cent, as because of the timeframe. Jobs do go away; it’s happened many times.

For jobs to go away with that speed, however, is a new thing, and the search for historical precedents, for examples from which we can learn, won’t take us far. How would this speed of job disappearance, combined with extensive deflation, play out? The truth is nobody knows. In the absence of any template or precedent, the idea that the economic process will just roll ahead like a juggernaut, unopposed by any social or political counter-forces, is a stretch. The robots will only eat all the jobs if we decide to let them.

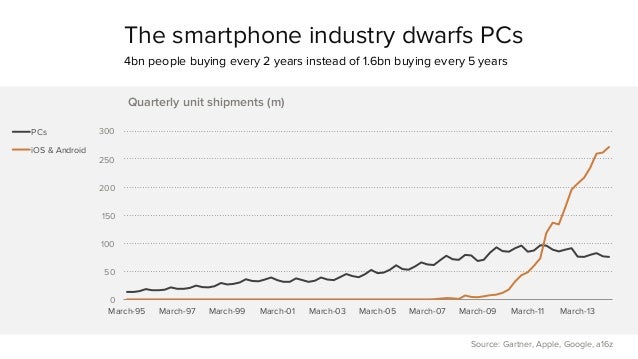

6. It's only just begun - The Economist has done a big production number on the meaning for the global economy of the smart phone. It has collated some amazing facts and figures.

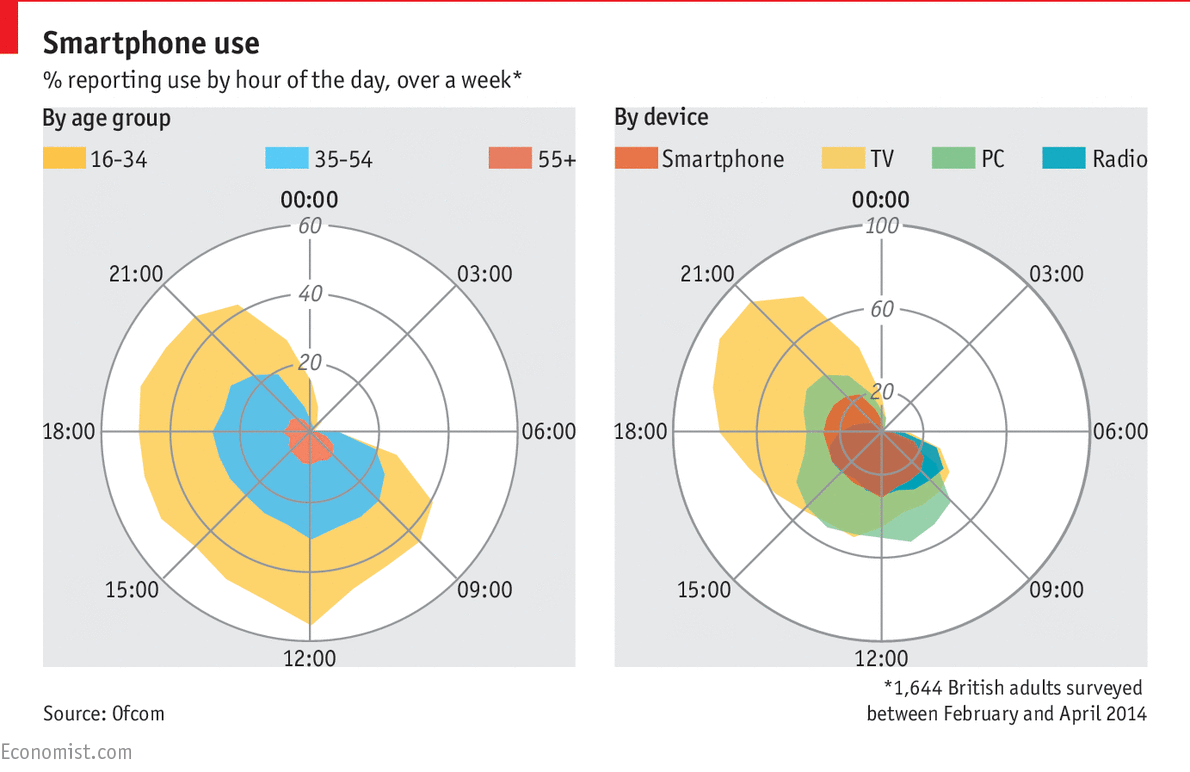

Have a look at the graphic below showing how much time 16-34 year olds are spending on their phones during waking hours (the yellow blob showing up to 60%).

The third windfall is economic. Some studies find that in developing countries every ten extra mobile phones per 100 people increase the rate of growth of GDP-per-person by more than one percentage point—by, say, drawing people into the banking system. Smartphones will remake entire industries, at unheard-of speed. Uber is a household name, operating in 55 countries, but has yet to celebrate its fifth birthday. WhatsApp was founded in 2009, and already handles 10 billion more messages a day than the SMS global text-messaging system. The phone is a platform, so startups can cheaply create an app to test an idea—and then rapidly go global if people like it. That is why it will unleash creativity on a planetary scale.

8. Couldn't have said it better myself - Here's The Economist with an opinion piece on the intergenerational wealth transfer going on in Britain. Something similar is happening here too.

Buoyed by generous pensions and decades of soaring house prices, the wealthiest fifth of pensioner households enjoy average incomes well over twice the British average: for such lucky wrinklies, the winter-fuel allowance is less an inducement to turn on the radiator than an invitation to chambrer some decent wine. And as more British home-owners approach retirement, the numbers of rich pensioners will grow. The truth is Mr Cameron is motivated less by a desire to uphold the dignity of age than to bribe pensioners—the Britons most likely to vote Tory.

Contrast their treatment with that of younger Britons, whose taxes are paying for their pampered elders. Unlike state pensions, working-age handouts have been squeezed. Child benefit, previously a universal payment to parents, is now means-tested. The Tories have promised the young even more austerity, by making them work for unemployment benefits—which are already 21% less generous for the under-25s—and denying them housing benefit.

Transfers from young to old can be justified, both because many of the old cannot work and because technological progress means youngsters are likely to end up better off than their grandparents. Yet today’s low-skilled Britons, unlike their grandparents, have seen their incomes serially squeezed. At 14%, youth unemployment is high. And for those without property to inherit, exorbitant rents and house prices—the result of decades of failed planning—have dashed the dream of home-ownership to which Britons aspire.

9. 'The Luddites are wrong' - Walter Isaacson, who wrote the book on Steve Jobs, has written this FT Op-Ed pushing back at the 'Second Machine Age' guys and others suggesting the rise of the robots could create mass technological unemployment.

If new technologies reduced the total number of jobs, we would all be out of work by now. But times of technological advance have been times of job creation. Last year, as whole new waves of robotic systems were introduced, the US added 3m jobs. The unemployment rate hit a six-year low, and average hourly earnings for private sector workers rose.

Be wary of those who lament the demise of jobs for checkout clerks and meter readers, as if preserving such jobs will lead to a healthier economy. This Luddite fallacy is based on a presumption that there is only a set amount of goods and services people want. If technology permits those things to be produced more efficiently, Luddites argue, there will be less work to do. In reality, technology leads to an increase in productivity and wealth. That in turn leads to increased demand for goods and services and thus more jobs, including ones in fields we can barely imagine.

10. Totally Clarke and Dawe on the NBN rollout and Democracy in Greece and Australia.

71 Comments

BEWARE :- The negative yield story ( No1) is the unintended consequence of QE .

QE is the nuclear weapon , the Atomic Bomb if you like, in the Currency Wars .

And it seems everyone has access to this nuclear weapon as it willing to use it , except of course New Zealand where we stick religously to Monetary Orthodoxy

And , there may be more unintended consequnces lurking out there , like severe deflation when you have debased your currency to worthlessness .

Its like being high on drugs , taking more drugs makes you feel good and maintains the high , but likely does long term damage . Taking more takes away the down side , but its shortlived until you need more , it buys some time until you either have severe withdrawl symptoms , or get really sick or drop dead

Something bad was alwys going to happen with this unorthodox experiment called QE .

Every rational human being on the planet knows instinctively that you cannot get yourself out of a debt trap by borrowing more ( issuing new and more bonds ) as the US , Japan Germany , the UK and EU and possibly even China are doing

even Keynes would be worried currently

deflation huh, in commodities maybe. Here's today's zerohedge article about the "out of control" Australian property market. Soon to be repeated in Auckland, much to the delight of the National party and cohorts.

I like zeroH for thier research and data gathering. I think they are frequently highly dubious on their conclusions however due to their "free market" bias.

Boatman

I thought debasing your currency was supposed to create hyper-inflation. Why hasn't it?

Maybe there's something else going on, which is my point.

cheers

Bernard

Hi there Bernard,

Read Warren Mosler's "Soft Currency Economics" if you get time. That and Michael Pettis.

http://blog.mpettis.com/2015/02/when-do-we-decide-that-europe-must-rest…

They both seem to identify the something else from two different viewpoints.

RE DEFLATION and the falling oil price .

Interest .co.nz should investigate this and do a detailed comparative of our pump price and Aussie pump prices

Heres the Question : -

Why , when the Kiwi $ and Aussie $ are almost at parity , are we paying almost $2 a litre for petrol when Aussies are just over $1 a litre ?

After GST some Aussies are actually paying just Aus 99cents a litre !

Okay , we will hear howls of protest like ....... We tax petrol differently , and we have ACC , but I really want to know why we are still paying so much .

Especially given our wage rates are lower , we are getting screwed by Big Oil

It's the same in all New Zealand consumption spheres - there is an embedded, legally nourished culture of ripping off the neighbour, no matter what the collective cost is.

Something is very rotten in our Commerce Commission. In setting the price for access to Chorus's copper wholesale network, it's maintaining a price $12/month higher than comparative countries. It seems to think consumers should pay $12/month more than they should have to for broadband.

What's particularly galling here is that the Commission has lost sight of its prime directive contained in the Telecommunications Act - to "promote competition in telecommunications markets for the long-term benefit of end-users of telecommunications services."

Instead, by a curious combination free market ideology and caving to political pressure, it's promoting monopoly power and a haughty "let them [the end-users] eat cake". Read more

People already have and Simon Bridges? huffed and puffed.

Oil looks to be stabiliasing for now at $50 ish but place your bets on how low it could go, $35? even $20. If I recall correctly at $25ish we should be paying $1 a litre again.

BTW that is a huge hit to Govn revenue.

in regards to #1

There is another more unsettling view: that the really smart money in the deepest markets in the world are moving in some 'wisdom of the crowds' way to the conclusion that we face an epic age of deflation (see the links below for more on that).

Is this your view Bernard..?

I agree with Boatman ...That it is an effect of the ECB bond buying program.... $60 billion euro a month.... Its a sign of dysfunction....NOT... deflation.

Only a dumbarse would lend money at a negative yield..????.... surely... and yes... I agree .. it is a compelling sign of serious dysfunction...

Interest rates set the Bar for yields in all asset classes..... wont be long before real estate Booms in Europe again...

This kind of money has to be comming from pension funds et al, the kind of structures where there are laws describing the type of investments you can make. The number one rule of investing is return of capital, so maybe they see yeilds falling lower but at the end of the day someone is going to be holding at maturity and there has to be a loss. UNLESS they are just frontrunning the ECB and the ECB will be holding at maturity, in which case taxpayers take the loss.

I stand to be corrected but I don't think the Buba has issued any negative 5y, so they are still paying interest, but they are trading at a negative yeild.

The buying is stopping a reccession and deflation, at least that is the idea.

"dumarse" lets see we have the mega financial types v you, maybe its you who dont understand?

So if we see deflaton at 10% and yields are -1% that is a 9% profit in the value of your capital. I assume also tax free?

When you see such "savvy" types pileing into Govn bonds enmass and sitting there for years it can but be in fear of loss? I mean is there any other reason?

In terms of lending, if you hold the money and the commercial banks collapse you lose it, if its lent to a Govn and they lose it, their tax payers still owe you that capital.

Hugh Hendry is worth a watch. He said at one stage when everyone is losing lots of money he only has to but lose a little to end up a giant amongst dwarfs.

Look at the real estate in the PIIGS, Ive seen mention 50~60% loses. Like bonds the profit on real estate is only realised when you exit selling to a greater fool and if you exit late you lose a packet.

What isnt answered by the second machine age is, what do we do with the 90~99% of people that are no longer needed?

Will the 1% have machines armed with machine guns killing them off? oh wait US drones. Maybe it could become the latest craze for the idle rich? kill real poor ppl via your ipad12. can you clock up 100 kills in 10minutes and earn a US medal of honour? be in to win!.

Does anyone really think that this 99% will live and die quietly in abject poverty?

So we tax the 1% at 90% PAYE and re-distribute it to the 99% needy?

doesnt sound very efficient/effective.

Anyway, what is ignored is that machines need copious quantities of (mostly fossil) energy tomake and run and that is mostly what technological advancement has been, using more energy to replace human muscle.

So I dont think so.

What do we do with them? The same thing we did with farriers, chandlers and weavers. It ended alright for them didn't it?

what? most of them lost their business, jobs, and lands. the few remaining have gone from a skilled respected industry to hobbists and boutique ornaments, or unskilled labourers.

Actually, no.

There are some interesting bits of history out there, if you look.

If I remember right, there is quite a good piece on weavers showing 3 generations of them over the start of the industrial cloth mills. They went from what looked well off as a Grandfather to almost starving as a grandson, now that was in 3 generations, or 50~75 years. The changes in our modern world will be similar but across all streams of life and in less than a decade.

Many jobs will also get unautomated when labour is cheap enough. When cheap Polish labour swamped the UK, car washes went from machines to manual labour.

Last time I was in Chongqing (admittedly several years ago) it was cheaper to get a man to deliver your fridge up the hill than a van so there was a large industry of delivery men.

As fuel costs increase, manual labour will return for low value tasks while the high-value (which can afford the cost) will continue.

No.

Because of compliance and release cost.

Your man in Chongqing didn't have permanent contract w/ 90 days period, multiple weeks annula and sick leave, guaranteed conditions, ACC and associated safety equipment and risk, possible union representation, and a government who will hold you personally responsibly for him not having a van. Neither would you be held personally responsible for any damage or offenses he incurred during his work.

that's why when I was actively an employer I keep pointing out compliance costs - The employer pays them, they come from limited sales revenues/margin, but it's money that the employee misses out on. Just like latest ACC for farming bs, the business is already making slim pickings, Fonterra is the one that sets teh sales margin, therefore any extra costs of safety must come from staff

One industry that will never go obsolete is the doom and gloom industry. Hard at it for 10,000 years and still going strong! Now they even have their own arms of the UN. You'll never automate gloomy hand wringers...

Agree, also our world will get simpler and less specialisation. So if you are a specialist without a job in the only field you know you go to the bottom, hence I call these "carrot pullers"

David stockman has a good piece on Europe and its Bond yields..

Well if smartphones are so smart that a 10% increase, gives a 1% increase in GDP why not give away smartphones? Like the home insulation scheme.

Tell me where a man gets his corn poon and I'll tell what his 'pinion is. Mark Twain

For the last 30ish years the productivity gains have gone to owners, not workers. Productivity has been rising, so has debt, wages not so much.

Now even technology, the once touted saviour of society is threat to society. I'll add that to energy, the environment and the economy. Good luck trying to spin that as good news, better get distracted by a blue and black dress.

The marginal benefit from Uber v a taxi is pretty slim, is that the best you can come up with? How often do people even use a taxi?

Driverless cars and an Uber type service could work to a point where you didn't actually need to own a car, you would just order one for when you needed it. It could make significant savings. Instead of having so many car parks, the cars could be off doing other jobs.

It all might sound a bit far fetched at this point but driverless cars are being worked on and we have the software technology for the scheduling etc. It would be a huge productivity gain.

and we wouldn't need Public Transport as we know it. Makes you wonder whether spending billions on C19 trains is such a good idea.

The other benefit is that using smart convoying techniques, we probably don't need more roading either. However we will need roads if your vision comes to pass - and personally I think it will, and come much faster than most realise, even though there is still a lot yet to happen ...

Even this week, car company execs are expressing 'fear' that Apple and Google will soon 'own' the car dashboard and quite soon. It will be a short step from there ...

Bulk Freight & passenger going by road helps transfer cost recovery on the roading system.

re: App-le & Google - no surprise they'll buy the market segment just like they have with others, and the government will lobby with them to make sure their are no viable alternatives. ("for your safety")

Apple and Google will own more than just the dashboard.

Apple will want the lot. The car. Logistics. Car Pooling on demand. Hubs, spokes. The door-to-door mini-bus or Uber-Taxi of the future

Would fix the rental-car foreign driver problem too - if all rental-cars to foreigners are Google-Cars or Apple-Cars (or vans)

what problem? it would all be subscriber service owned by the service provider

you just pay extra annual fee for upgrades in service.

I think you would still need public transport but you would have main lines only. Instead of park and ride you will have cab and ride. I can see it being like public transport but you set the time table and you get to pick the passengers. When you think about, it is very well inefficient having cars doing nothing all day while you are at work. If it could take granny to the shops while you were at work, it would be great. I see it being a little like a time share arrangement. The cost of such cars won't be much more than new cars now. The key will be getting the critical mass required to make it work. The technology will be able to be retrofitted so this may not be such a problem. The legal issues of driverless cars could well be the delaying factor

Productivity gain for sure but perversely also a gain in sleeping hours.

Well if at that point people no longer have jobs to go to, then driverless cars make sense, and who needs public transport, but if people have jobs to go to then you still have rush hour to think about, which you havn't. You also seem to assume that a driveless car is going to be cheaper then public transport, which pretty much assumes that economies of scale no longer apply.

Just another fantasy of technology worship. I've been to a few cities where you don't need to own a car, and many people don't, the trains are already driverless (have been for over a decade maybe longer), the buses are everywhere and frequent. It's so easy, yet somehow you think an armada of driverless cars will be better?

I think we will still have jobs and still have rush hour. Working from home is possible for a lot of people but working from home has a lot of disadvantages also. Full time working from home isn't a good idea in my opinion for a lot of people. You miss out on a lot of information sharing that happens by accident i.e water cooler conversations etc. You also don't build the relationships that you do in person. Being able to work from home some of the time is great.

Public transport is not as convenient as having your own car. The uber service doesn't have to be cheaper than public transport, just cheaper than owning a car you drive and park at work. Instead of paying for parking, my car could be taking granny to the shops etc.

Technology will change the nature of our jobs but there will still be work that needs to be done.

You'll end up with "jobs" because having people in "jobs" is how the population is kept under control and their labour sucked off to wealthy (either through "jobs" to pay capitalism taxes, or under allotment of "contribution" to provide important peoples lifestyles under other systems).

Its just that the jobs will be less meaningful, more specialised, and less connected to actual needs forcing reliance on the system and state/corporation to provide the necessities of life. Just as the first UK's first factory owner wanted. Workforce in his accomodations, buying his foodstuffs, next to his factory. You think automating that factory is going to free those people??

FREE THE BATTERY HUMANS !!

" gone to owners, not workers. Productivity has been rising, so has debt, wages not so much."

Process of commoditisation.

Profits is made in the workplace, returns via finance.

wages are the price of living for the consumer.

threat to whose society?

It and government have pretty much destroy my culture and society, small town rural NZ.

It's been replaced by sub-urban yuppy/dinky/nimby hell

Larry Page, founder and CEO of Google, is sanguine about that, as he recently said in an interview reported in the Financial Times: He sees another boon in the effect that technology will have on the prices of many everyday goods and services. A massive deflation is coming: ‘Even if there’s going to be a disruption in people’s jobs, in the short term that’s likely to be made up by the decreasing cost of things we need, which I think is really important and not being talked about.’

This is exactly what i have been saying.

If things are much cheaper then we need less money which means we can work less hours.

I found it interesting that a leader of the modern industrial revolution -Larry Page is speaking out about the biggest burden for the median worker -housing costs. Backtrack 170 years and a leader of the British industrial revolution -Richard Cobden spoke out about the then biggest burden for the median worker -food costs. He led a political campaign to reform the market with increased competition to lower prices.

Richard promised good things from the resulting lowering of prices.

1. He promised it would improve the manufacturing base by increasing the market from workers with a higher disposable income.

2. That workers would get more employment.

3. That it would make english agriculture more productive by stimulating demand for its products in urban and industrial areas.

4. That by introducing mutually advantagous international trade it would promote international fellowship and peace.

Richard and others -including unions representing workers were successful in this campaign -repelling the Corn Laws in 1846. Most of what Richard promised came to pass.

At the time of his campaigning he said the only thing standing in the way of the four beneficial solutions were the ignorant self-interests of landlords, the "bread taxing oligolopoly, unprincipled, unfeeling, rapacious and plundering."

Working less has been the pipe dream of futurists for at least the last hundred years, so yes it has been talked about adnausiem, I'm not holding my breath. Larry Page thinks people just need iPhones and clash of clans, has he forgotten about all the stuff that takes actual resources like food, electricity, housing, how exactly does that get cheaper once everyone owns an iPhone? The kind of stuff that is getting cheaper, is actually the stuff we don't need, like a new TV, smartphone every couple of years, which equals diddly squat from my annual spending when compared to power or food etc.

I'm 99.9% sure Larry Page doesn't think people need iPhones. He might think you need a phone running android. The smart phone has made a lot of productivity gains for users. Here is an example. I had my house and roof cleaned the other day. The guy rang me and told me that the roof was far worse than it appeared from the ground. He sent me photos via his smart phone to mine and I could see what he was talking about. I gave him the go ahead for the extra work and he completed it and sent me more photos and an invoice which I paid via internet banking. All done via smart phones. The phone didn't clean the roof however.

Great point Dave, it just a tool that (used wisely) gives us more free time, like the washing machine or dishwasher.

Oh the commodities for necessities ARE getting cheaper (by dollar value). Problem is they were already dirt cheap, so all compliance and currency devaluation push up the sell price for less return - resulting in false productivity and attempts to get supply side economics of scale (via debt or spending of the war chest) but each cycle gets harder and longer to recover that value (eg the price of farm vs milk price return, in years)

Where the modern entertainments and consumer toys is a lot more fluid and the less external constraints means the linear equations for economics match better. An half trained nail technician in make more an 6hr day what it would take someone on farm with 5 times the training a 6 day week (50hr) to earn...so why choose the hard job? Luxury always pays premium rates...

This is because the huge demand for neccessities actually _pushes_down_ the prices of commodities !!

That is a worrying trend. Imagine an economy in which the 0.1 per cent own the machines, the rest of the 1 per cent manage their operation, and the 99 per cent either do the remaining scraps of unautomatable work, or are unemployed. That is the world implied by developments in productivity and automation.

My view is that contributions to super funds will dramatically increase. Your super funds will go into these big corporations and so you will be a shareholder.

Ultimately you will still have the 0.1% who own the machines

The rest of the 1% will manage their operations

There will be a 60% middle class who will live off income from their super fund investments (even though they will be well under retirement age)

10% will do the remaining scraps of unautomatable work

20% will be unemployed and treated like scum by the middle class (just like they do now)

Governments who do not do this will be overthrown.

The conclusion of this is that it will be better to own shares in productive businesses than property

Provided in doesn't become obsolete.

The world has a major debt problem that it wants to inflate away but it has been unable to create this inflation.

The next best way to reduce debt is to pay your borrowers to borrow from you.

It doesn't help that much of the profit is created by leveraging, which is borrowing.

And to fix their debts, they try to pay it off, but the only way they have of making enough money is leveraging it, which means borrowing from somewhere...

...which to pay off requires.....

#8: Where are the data to support the assertion that "Something similar is happening here too?"

State pensions in NZ are not generous. They are (just) sufficient to keep recipients above the poverty line, provided those recipients own their home. There is no winter fuel allowance in NZ.

Yes, some old people have a lot of money. Wouldn't you expect somebody who had worked for forty years to have more wealth than somebody who had only just started to do so? What sort of social or economic arrangements would deliver any other result?

I'm not sure what is meant by unemployed people being "made to work for unemployment benefits" in the UK context but the support that is provided for NEET youths in NZ is quite a lot more sophisticated than that, involving tailored training, financial assistance, advice, help with job searches etc. http://www.youthservice.govt.nz

By comparison with many countries NZ does pretty well out of its old people. They cost less - one of the cheapest pension systems in the OECD - and they contribute more - one of the highest workforce participation rates.

When I hear,

"what is meant by unemployed people being "made to work for unemployment benefits"

I ask, what jobs?

I would suggest these are going to be un-skilled, min wage, physical jobs. What happens to the people in these jobs at present? Why it makes sense for the employer to sack them and then use the un-employed who will be in effect free. So yet more un-employed?

So what jobs out there are so worthless we in employment wont tolerate them being done for a minimum wage but actual workers with some skills but would for un-emloyment?

public gardening? surley that's done by some ppl with skills even if its not huge?

Clearing something up? how much supervision would they need?

ie I just dont see how its meant to work, maybe that is why the Pollies dont push it any more.

It was costing more to administrate than the government was making for renting out it's convicts^H^H^H..unemployed to councils etc.

They did less work, with less gear, and with a requirement for more supervisors.

Anyone trapped in the scheme couldn't get out...not even to go to employment interviews. A failure to show for a day or two meant two week suspension of dole - and the dole is supposed to be sustainance level so a two week standdown was a big problem. It also brought up issues of contracts, minimum wage, and if someone was stood down they were still contracted to turn up during the standdown period (real slave labour!)

Several supervisors were petty and power mad, as the employed people had no time or means or recourse, and a simple poor note on youf file could mean the dreaded suspension.

Workers were expected to provide all their own appropriate gear to the task, no increase in dole was allowed for this,

Getting to the work bus was the workers responsibility, many had to rely on friends or family to give them rides (as buses often didn't run at the right time, or to the right place). If there was a break down or the person owning the vehicle was unreliable, even a 2 minute late could mean a missed work bus and the standdown/suspension. There was no recourse for this as it was all required of the employed person.

No sick days.

No holidays.

The worst part (along with the job interview problem) was you weren't allowed to resign ! No two week (or 3 month) notice of termination as it wasn't deemed an "employment contract" so the _unemployed_ person had no rights and especially non under contract law.

word got around....

The lawnmower, dishwasher and laundry machines didn't usher in a new era of unemployment. The automobile put a lot of horses out of the job but created a lot of mechanics jobs. Since the creation of the computer there has been millions of jobs created, not destroyed. Even if Uber puts lots of taxi drivers out of their jobs it will (along with electric cars) take a huge amount of traffic off the road which is a big saving/productivity gain to the rest of us.

I fail to see how my smart phone will ever put me out of a job (if I had one).

less typists these days.

less hammerhands.

less university trained architectural designers (more untrained CAD operators)

less clerks.

less warehouse pickers.

less professional dishwashers (in restaruants)

many less washer women (and their caustic worn hands) - maybe not a bad thing this one, the conditions were horrendous.

And many less gardners and groundskeepers...but more private and middleclass tidy grounds - this one the machines bought the service price down from the manor born to the general population, which is why that step resulted in increase in economic behaviour.

Whole bunch of other jobs (typesetters, car painters (yes, used to be done by hand), dairy assists to strip cows after main milking) not to mention classics like the weaving/carpet industry (anecdote is a modern carpet factory is run by a man and a dog. the dog to keep the man away from the machines, and the man to feed the dog).

#9 Luiddites wrong??

What is work?

There are more commodities and real value being created by less people.

The rest is consumerism and bureaucracy - neither creeate wealth in the traditional sense - hence the world debt is become mroe of a problem, it's showing an accumulation of consumption.

#1 The infamous negative yield.

It sounds bad, and who would invest in it (apart from you, and people saving for first homes, and in banks and other retail investments). The negative yield is good when compared to even-worse yield. Why else would people put money in savings accounts when opportunity cost is higher than they can ever receive.

It's about parking up in the least damaging asset - just as a business might buy premises today (thus losing opportunity and paying rates and depreciation for a negative yield, for hopes of security and lesser expenses in the future.)

#6 Exactly what I told my bosses at Fujitsu back in 2000/2001. The first people to marry cellphone technology to personal organisers, and throw in a browser/JIT compiler are going to OWN the future market. Information, relevant and accessable, on demand (and with alarm/push functionality) and imminantly updatable. called it

Yet I as an engineer looking at the science, math and engineering just want hard facts and not wishful thinking.

The Lockheed fusion plant has been poo poo'd as an inadequate design at a fundimental level, (but then of course in some ways so was the wright brothers plane!) Apparantly the ends of the bottle cant be sealed or so the academics reckon.

The Q I ask is if this is so much a goer and is only going to take some 10s (100s) of Millions to develop but payback multi-billions and is such a winner why isnt LM funding it in-house? why does it want external capital?

If you think its great, well invest!

how do they keep the plasma off the walls of the bottle?

how do they achieve supermagnets in that heat?

Lockhead are not just famous for being big wepons guys but also for being hideously inefficient and ineffective in their systems.... a common problems for organisations with deep pocket customers.

Sigh... a nasty expensive thing that doesn't even work. And it it by some miracle did work it would be hideously radioactive! Not in my back yard thanks!

I am impressed by solid oxide fuel cells though. The company bloom has impressive prototypes in operation. The world has quite a bit of gas reserves left.

There is an assumption that any money saved with a technolgy is now ours to do what we like with, wisely or not.

This is only so in certain industries that have true competition.

But in industries that have little competition due to restrictive land policies and as the price of housing shows, there are many organisations and people that will try and capture that saving as their own before it ever reaches us.

To us its a cost to be saved, but to them its revenue to be had.

In housing it is easy to see where the savings are. Reducing land banking costs are soon captured by developers and council. Reduce council costs and the savings are captured by developers etc.

Very little of the saving is passed onto the end user.

Maybe it's when automation gets to the degree they are talking about in this article people may throw away their cell phones? What's the point of giving all our money to a few people? We deal with an insurance company that sends a person around to talk to us! It may seem kind of old fahsioned, but i quite like it. I can talk to this person find out where their kid goes to school e.t.c.. it ceates a sense of community. I would rather pay more for something and feel like i'm helping someone local.

3 - How would we ever get to the stage where technology takes over jobs en masse? At some level of unemployment it must become more beneficial to the economy to hire people, given automation is no good to a business if it can't profit from it's use. Can't make much of a profit selling to the unemployed.

The issue will be that more people will be unemployed. Taxi drivers could be obsolete. Forklift drivers and truck drivers would be few and far between. There will be more high tech jobs but not everyone will be suited to them. It is a real issue but to think that the machines will take over is taking it a bit far. It is going to take a long time before people stop going to the supermarket but they can shop online now and have it delivered. There are numerous reasons why this is. The social aspect of it shouldn't be underestimated.

Do you need a job to be valuable? Does full employment make sense when automation passes the effectiveness tipping point ? Have we already past peak jobs?

Lets investigate UBI, this should encourage more short term and part time jobs & welcome to the a PostMarket World; Long live the market!

Yes many humans consider having a job valuable to them, I certianly do.

UBI - universal base income as a key tool to fight deflation !

Hey Bernard can you run a poll on bring UBI into NZ?

Can we see your logic to the claim that UBI is a key tool in fighting deflation please?

Otherwise what you have is a method of having a more progressive society? ie more money in the hand of the poor who will then spend? is this your assumption?

I have to ask (though I might regret it) why a more progressive tax system wouldnt acheive the a similar thing, say 10% for those under 20k and 40% for those over 100k.

So just how do you "create" this money? I mean it has to have some physical undertaking of making a real good to back it up. Printing it simply doesnt do it.

What this UBI and indeed our present system ignores is the need for a robust underlying real economy to support what we want. The problem is the world's economy need cheap liquid fossil fuels in huge and incraesing quantities to function this is no longer the case in the coming decades in fact oil output will decline and GDP will decline in about the same % ie unity.

I can see how a UBI might be the "ultimate Tool" in fighting deflation...

If aq Central Bank prints money and it goes to everyone as a universal income...

Far more equitatble...far more just.... than just printing money and giving it to the Banking system... thru Bond Buying and other forms of QE...

The whole point of Printing money , in regards to a debt deleveraging, is to mitigate the effects on Aggregate demand that a debt implosion causes...

a UBI feeds directly into the real economy.... me thinks

I can see that as principle, however where I take a step back at is the printing money to fund it bit. In a zero bound trap, yes more 'money" doesnt increase inflation, however once out of that it will significantly.

QE is for me looking more and more dubious every day. it does look like its enabling a bigger and bigger asset and money tarnsfer to the top 1% for no gain.

Here's a couple of things that might interest you in particular Steven.

On economic growth and its physical impacts:

and on the UBI:

http://pundit.co.nz/content/what-is-the-problem-with-a-universal-minimum-income

I'll go read.

This is where I start to get concerned,

"Sociologist and democratic socialist Frances Fox Piven argues that an income guarantee would benefit all workers by liberating them from the anxiety that results from the "tyranny of wage slavery" and provide opportunities for people to pursue different occupations and develop untapped potentials for creativity"

la la land stuff. Except for the last 100 years the human span has really been one of a struggle to survive within the annual energy envelope provided by the sun. The "socialists" like the above seem to think what they want will be supported and "paid for" invisibly.

First piece,

"Underpinning economic growth has been a massive rise in productivity." no a massive use of cheap fossil energy which is gone by 2050.

"Most workers don't produce goods from non-renewables. In fact, three-quarters of Australians work in the service sector."

just as la la land.

Now I dont disagree on the effect of teh last 100years, we are indeed better off as humans.

of course our worl'd popualtion has also gone from fairly sattic 1.5~2billion to 7+ the effects of this are ignored in pollution and food chain.

then I cut to the author,

"This essay first appeared in Labor Voice."

oh dear.

The left and the right sing the same song ignoring the reality of energy dependancy.

--edit--

Just thinking back to the Green's campagining for green sustainability while labour says the want "just" sustainability, an oxymoron I suspect.

--edit--

Which is why I often clash with the Green party on social issues. (birth control etc)

Second piece, I tend to agree with his premis that even taxing the top 10% to 80% would give little to the bottom 10%. This is why when I see the proponents of a new system I ask them, how will it work?

BTW there isnt much evidence that raising the tax on the rich to as high as 70% as it was in the 1950s and 1960s makes much difference, but that is another thread.

What we really need is a lot less poor / unskilled people, but certianly a lot less ppl.

About UBI as a key tool - (if i might refer to a rival columnist Rod Oram, who mentioned the lack of tools that central banks have for flighting deflation his last Sunday's news papaer piece). But in a nutshell Central banks have QE and nothing else to fight deflation.

The deflation, that Bernard talks about, is a paradigm shift because you have the two trends of baby boomer retirement demographics and ground breaking automation technologies. We have to think boldly and differently -> think of post free markets era -> think about UBI.

UBI is for everyone - poor and rich alike - hence the universal part. Call that progressive if you like - but it means that people who have to care for sick relatives WILL be paid, those on the bottom will not have to accept any job, all regions of NZ will get a fairer share of the econmic pie.

Agree - Progress tax should be considered in a robust UBI debate

On creating money - think of the QE that most major countries are doing. This is printing money and your talking trillions of dollars, US has printed the NZ GDP every 2 months from 20 08 to 2014.

And as a thought some of this printerd|created money could be spent on weening us off oil.

Note my POV is money is not a physical thing but a social convention and agreement of value, if you don't over use printing of money the convetions and agreements will remain viable.

actually, 3, peak oil., trumps the lot and UBI wont have any effect on it.

Hold you horses, money is an IOU given to you for your work today but is a call on work/energy in the future. ie you cannot print for ever to fund your lifestyle.

QE is not printing, it is really debt that can be removed from the system where printed money cannot. Thus In a zero bound trap printing/QE does not produce inflation, sure but only while in the trap. In the 1970s left wing leaning Govns tried the printing route, it led to eventually to higher un-employment and great pain for ppl.

No it doesnt ween us off oil, it takes energy to make solar panels etc and they do not give us transport fuel.

Your POV is yours, my POV is its an IOU for work, it is a promise in the future to handover energy, food, clothing or work of some description for that script.

Progressive tax does not make up for the degree of cost a useful amount of UBI entails. On top of that while, yes taxes for the well off can climb to say 50% with little ill effects it has it limits.

.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.