By David Chaston

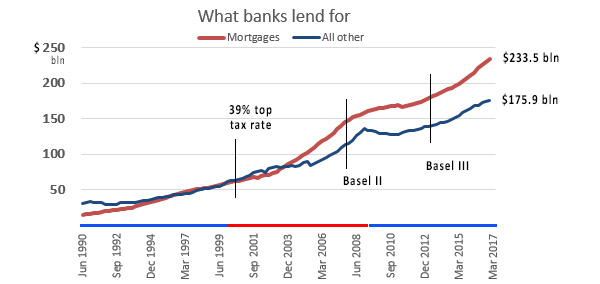

Over the past twenty five years or so, most banks have shifted the focus of their lending towards residential property.

From their point of view, houses are an asset that have a ready market. That liquidity allows them to take possession of their security if the borrower defaults and relatively easily recover their loan.

Twenty five years ago, the situation was quite different. Most banks focused on lending to businesses. Mortgage lending was a relatively small portion of their loan portfolio.

But in 2003/4 there was a substantial shift.

House prices had been rising quickly starting in 2003 and for the next four years, prices rose much faster than +10% per year.

And the market started to feel the impact of an aggressive new CEO at ASB. Ralph Norris taught NZ banking the benefits of customer service. He took a regional savings bank and made it a powerhouse of innovation, especially for mortgage lending. His successors pushed the idea, taking the bank national, and forcing all their rivals to raise their game. The chief battleground was in home loans.

And this was at a time a new higher income tax rate was introduced. Prior to 1984, New Zealand had relatively high income tax rates and this spawned a vast industry of advisers on how to minimise the burden. This all had to be done within a tight wall of isolationism. But when New Zealand was freed from these restrictions, the income tax rate was reduced substantially, making tax avoidance less attractive and not worth the costs.

However, the impulse was established. The raising of the top tax rate to 39% in 2000 and making it apply from $60,000 brought the impulse back to the mainstream.

Without a capital gains tax, "investment in houses" became a favoured alternative to mainstream investing, especially by "mum and dad" investors. Many support companies mushroomed to encourage the obvious advantages, especially when capital gains ran on for years.

And banks followed.

At the same time, the regulatory framework gave the trend a substantial boost. Regulators reduced the amount banks had to set aside in capital to support housing loans dramatically. Only half the capital was needed for a housing loan than for an equivalent business loan. The rationale was the liquidity in the real estate markets and the relative ease in cleaning up bad loans. The BIS's Basel frameworks gave international credibility to the shift.

Unbelievably, an update on the eve of the GFC saw a second shift where banks were then given permission to calculate their own risk weightings. In many cases this took the capital requirements down from a half to under 30%, where it sits today.

These two trends turbocharged mortgage lending by banks.

Lending to businesses did not stop, or even slow down. That grew as well, but just not as fast. That track gives a useful insight to how much extra has been added by the twist favouring lending for houses. By 2017, that extra has grown to almost $60 bln.

The latest data shows that we are now at a record high in our banks exposure to mortgage lending.

Another important influence has been the emergence of very low interest rates. These have been imposed on New Zealand by the aggressive use of unconventional monetary policy (money printing, or "quantitative easing") by the central banks of the world's largest economies. It started in Japan, took off during the GFC in the USA and the EU, and none of these programs have yet found an effective way to turn off the tap. Money became very plentiful and very cheap. And cheap money has driven up asset prices, including those for residential land. It is an effect keenly felt in New Zealand, even though we have never engaged in money printing. (The closest we came was through a loose fiscal policy during the GFC. That ended when substantial surpluses returned.)

Our banks have almost all been converted from balanced trading banks to essentially mortgage banks. Most of their loans are for housing. Some, like Kiwibank and the small locally-owned banks are more than 80% exposed to housing loans.

Even the big banks can now be best described as 'mortgage banks', rather than traditional trading banks. ANZ, ASB and Westpac all qualify. BNZ is the only New Zealand bank where lending for housing is a smaller proportion than its lending to businesses.

By allowing banks to follow the money, our banking supervision has permitted a substantial twist in the way we now assess economic risk to our economy.

It will take a long time to return to a more normalised balance. (And fortunately, the RBNZ seems to be wanting to move back that way.)

And in the meantime, if capital gains in housing evaporate, and housing equity levels start to fall, that twist may develop a negative feedback loop.

In that case, 'normalising' may require more pain that should have been necessary.

And that will be the cost of converting housing from 'accommodation' to being a financial investment.

(And readers may also have noticed the recent trend drop in non-housing lending in the graph above. This is not a good development.)

71 Comments

Nice work David, thanks

For a good background to explain how bank regulation has failed dismally to prevent the unfortunate outcomes illustrated above, I recommend this:

https://www.cato.org/publications/policy-analysis/capital-inadequacies-…

Your point about Ralph Norris is well said & he tried very hard to do the same at Air New Zealand. Every thing in banks aeem to go in cycles. One decade they are centralising, the next decentralising. So too with lending and past losses and hard lessons are soon shelved when profits are seen to be there for the reaping. If you go back to the deregulation of the Lange government it became apparent subsequently in 1987,that the banks did not actually know how to lend, securely that is. Up until then the RBNZ had kept what was called a corset on bank lending, and it was a tight one at that. Priority was primary production & industry. Very tight thresholds for housing and virtually no personal loans. So despite themselves the banks could not go that far wrong even if they tried to. When all that came off, the banks went at as if a colony of lemmings. Huge losses were eventually written off from the reckless lending, bringing the BNZ for one, down. Fast forward to 2008, same sort of outturns. So on that schedule it may well be coming around the mountain again.

Manufactured asset bubbles, of which the banks play a star role. Good and necessary article that the sheeple will never get through Granny Herald, Stuff, etc. Not that they would likely care anyway and they would unlikely see the dangers and implications of gaming house prices.

Ralph Norris as innovator? Do you have any examples of what he actually did that could be considered innovative?

"Ralph Norris taught NZ banking the benefits of customer service. He took a regional savings bank and made it a powerhouse of innovation"

There yo go, it's in the article above

Is 5.95% floating interest rate really a 'very low rate'?

This message that we have about very low interest rates currently seems a bit of an exaggeration.

While the OCR seems 'low' at 1.75% ( but not that low compared to other developed countries as NZ has a large premium) the actual commercial interest rates are high relative to global conditions, low wage growth, low inflation, etc.

Absolutely right, our rates are historically low but currently, internationally high. We trade in the present so I think the latter is more relevant

Is there actually any NZer dumb enough to be sitting on the floating rate when the 1 & 2yr rates are 50-100 bps lower, which in turn are maybe 50bps above Australian rates and maybe 100bps above US rates the most liquid credit market in the world (the later that can actually self fund because they have savers/investors) - what do they say about a broken record ?

Of course you can always wish for 2..00 - 2,5% European type mortgage rates, and the accompanying very low growth rate, massively high Govt debt levels, and 10% plus unemployment rates. Utopia !

Borrowers are best to think counter-intuitively. There is a reason floating rates have been pushed high - to attract borrowers to fix and fix for 2 years or more, to meet the banks goal of lock-in.

Also there is a possibility that rates will drop again, so floaters will be able to choose a lower rate sometime over the next few months, especially if Auckland housing falls. As has been the case periodically since 2008.

What service do floating rates provide for borrowers then? They were originally intended as a service for borrowers to benefit from lower rates, but with higher risk. Currently they provide high risk, and high rates! As you say, a lose-lose proposition for borrowers. Only there to push borrowers to fix, and potentially to fix at higher rates than in the near future.

The other benefit is ability to pay extra on your mortgage without penalties. Very useful where your bank doesn't offer offset.

Long term, I presume a borrower would be better off on floating than fixed. The banks probably have more idea about where rates are headed than the average borrower, so their fixed rates theoretically should be a chance for them to lock borrowers in and earn the bank more. Too cynical?

Thanks David, this is a great article and should be mandatory reading for all. When people look at house price growth over the past few decades they need to understand the underlying drivers that you describe in this article. Unless the same banking trends continue, plus even lower interest rates, even more double income households, even longer loans of 35-40 years, even more interest only loans, etc, the upward trend in house prices can't continue. It's pretty much impossible over the medium-long term.

Very true.

In electronic terms what we have seen since about the year 2000 has been the upswing of an "unstable oscillation". There was not enough damping. What we may well see shortly is the peak and then the corresponding downward under-damped slide towards god knows what.....

We may see: higher interest rates, people losing their jobs so less double income families, maybe less long term loans? banks less willing to lend on interest only terms like in Oz....etc

Thanks David for such a well articulated and inciteful analysis.

The mantra that "house prices never go down" is so very strong in New Zealand it's painful.

The run up in prices over the last several decades has been supported by the triple pillars of falling interest rates, favourable taxation treatment and, as you point out, the skew of bank lending to the residential sector. This has fueled a speculative frenzy that now looks to be reversing.

The very scary thing is that as prices reverse, banks will presumably up the risk weighting to compensate - no longer is their skin in the game as "safe as houses". This will lead to a squeeze in residential lending. In addition, falling prices will eat into the collateral available for further borrowing - both residential and business loans secured by bricks and mortar.

This has been a very lucrative scheme for the banks where they have profited handsomely from lending into a speculative frenzy aided and abetted by so called "investors". By requiring a certain level of equity the banks have given themselves a useful buffer. The borrower/landlord shoulders all the risk, has the hassle of being a landlord and acts as a mortage repayment collector for the banks. The banks make big profits and the "investors" get the reward of ever increasing house prices. The collateral damage is FHBs.

Thing is, there is nothing in it for "investors" in a period of falling prices. Over the next few years we could well be faced with the triple wammy of rising interest rates, declining mortage lending and souring buyer/investor sentiment towards residential housing. If that's not enough we're well overdue for a global "black swan" crisis. Oh happy days!

Great points, except I think it is unlikely banks will increase the risk weighting of residential lending as this will require even more capital during a period when there is pressure for more bank capital already.

I think the banks will all be playing the game of trying to keep defaults and losses low, so as to support the risk weightings given to residential property. The 'equity' buffer should be there for most defaults because of the LVR rules, however the banks still have to find buyers for mortgagee sales and if banks aren't lending, the drop in prices needed to find buyers could be large.

That makes sense ZP yet banks that don't respond to the change in the market are likely to be subject to a credit downgrade thus increasing their cost of capital. They will truly be caught between a rock and a hard place.

House prices have been out of control since 2003, from about 1963 to 2003 , 40 years , prices maybe depending which part of nz you looked doubled, from 2003 to 2016 , only 13 years , I'm not sure of the figures but parts of Auckland would be $400k to 2.5 million and other parts $300k to over a million, and I'd love to know the difference in wages or incomes over those two periods, all I know is in 1980 to now my hourly rate only doubled

Ummm ... here are some interesting examples for you to think about too...

Fisher & Paykel Healthcare Corporation shares have appreciated > 230% last 10 years

Auckland International Airport Limited shares have appreciated > 125% in last 10 years

Ryman Healthcare Limited Shares have appreciated > 340% last 10 years

Restaurant Brands NZ Limited (KFC etc) shares have appreciated > 695% last 10 years

Mainfreight Limited Ordinary Shares have appreciated > 240% last 10 years

does that have anything to do with wages and income?? ...If you have invested in these companies you would have enjoyed a much higher return than owning residential property in addition to the great amount of dividends you would have received in cash every year .

The correlation between asset prices and wages is a myth and they have never went in parallel -- the problem is that the rate of divergence and expansion of this gap has slowly increased over the years - some might argue to the point of no return to near zero, however, business cycles tend to narrow this gap -

The fact remains that assets do not appreciate only by rising of wages and income of the average workers, as there are various other money sources which push up asset prices ( like all the commodities' value added to the world's money pool, all the printed money...all the shifting of wealth and resources between individuals and Nations alike ... etc) ..

Whenever there is a lot of money around, wages fail to be the yardstick to measure against and workers cannot compete with high tide.

I agree to some degree Eco Bird yet I don't think you are comparing apples with apples. All the companies you mention have been well managed and used capital efficiently to rapidly grow very profitable businesses. Equally there will be many companies whose shares have plummeted over the last ten years or even gone bust thus very successfully destroying capital. How many houses have fallen in value or gone "out of business" in the last 10 years?

The thing with residential property is that it is very dependent on wages i.e. ability of people to pay rent or a mortgage. The returns in the last 20 years have been derived from an increase in value due to falling interest rates and speculation. All boats have been lifted - not just those that have used capital efficiently.

The interest repayments on a $1 million loan at 5% are the same as on $500,000 loan at 10%. At some point however the cost of capital will revert to mean and at that point the only value a house will produce is the rent it can attract. In Auckland that is fairly pitiful.

Agreed, and sorry, I wasn't comparing the two .. I just thought that wages do not really dictate the level of big investments like houses although it depends on loan service and rent amounts - but these are some of the factors not all.

"at that point the only value a house will produce is the rent it can attract. In Auckland that is fairly pitiful." but that is the situation of investment properties now ( well at least for savvy investors not speculators). New investments carry only 3-4% yield which is not a smart choice...unless buyers are happy to wait for rents to catch up. But ... banks will lend you on that regardless your yield, but will not lend you the same amount to invest in shares ...!

house prices have actually gained more than 300% on average in Auckland in the last 20 years - ( most have almost doubled in the last 10 years) they were as good as some of the well managed companies on the share market, and in some areas more than 400%...it's not only the interest rates' effect ...there was big value added to land because of location, scarcity and continuous development of amenities and business in main centres. these added parameters are not directly related to wages, in fact some of them were the reason for increased wages in some areas and towns like Auckland.

example: I bought a section to build my home on 18 years ago (1999) at the fringes of Auckland North Shore at that time for $85K , it is now worth over $850K ( without improvements) and the location is now considered central for everything when it was a section too far at the time ... I cannot see how this section would go back to 1/2 its current price any time soon when you cannot find similar sized sections within 10Km further North for $850K at present.

You might be correct in saying "At some point however the cost of capital will revert to mean " , but it is difficult to see that happening anytime soon ( given the current economical environment ) - there is no imminent cause for this market to collapse unless forced upon by external intervention or regulation (taxes etc) - some of that was tried in AUS and failed miserably ...

I have screenshotted your comment for posterity- it is just such classic bubble logic. Huge parallel with an interview I saw with an Irish couple in 2006. Not saying a crash is certain but Toronto prices are down 17% in 90 days. Certainly interesting times.

Well done avatar... I especially loved this comment "..wages do not really dictate the level of big investments like houses..."

If you are an afficionado of bubble quotes, I highly recommend this site. The number of times I have heard this stuff on this site, I have lost count. I am not saying what happened in Ireland will therefore happen here, but the similar language and utter confidence you can't lose is jawdropping.

This one is a doozy. April 2007.

"According to Marie Hunt, Director of Research at CB Richard Ellis “The property market is in simple terms a sub-set of economic activity and the fundamentals that have been driving the Irish housing market for many years now are completely unique and cannot be compared to other economies. No other country can boast the levels of economic growth that have been witnessed in Ireland in the last decade; no other country has generated the level of employment generation that Ireland has seen; no other country has seen the phenomenal population growth and levels of immigration that Ireland has witnessed and no other economy can match the decline in the average household size that has materialised in Ireland in recent years. It is simply technically incorrect to assume that that Irish house prices will decline significantly simply on the basis that this has occurred in other economies where the fundamentals were so different. It is also irresponsible to suggest that the ‘negative equity’ scenario that occurred in the late 1980’s in the UK could occur in Ireland considering that Irish lending institutions are working under the remit of the Central Bank and continue to stress-test potential borrowers to 2% above ECB rates."

Bobster - if this all goes kaput, interest.co.nz might be able to run a similar article with the quotes of the likes of Eco Bird, ZS, DGZ and TM2. Would make for an interesting behavioral finance piece...The stories people tell themselves to rationalise possibly irrational positions...

Did you have a look at the website? It really is quite amusing.......I mean, these are mostly smart, serious people. And nearly all of them got it completely and utterly wrong. You read a list of contributing factors to the Irish bubble. You look at our market.....and you just tick box after box after box. The one you can't tick here is an obvious over supply of new builds.

Just amazing. Lots of "animal spirits" at play there.

Yeah read the website - not sure whether it was funny or sad...its incompetence (mainly denial - which we'd never see in this country from any leader...) from people in positions of power and responsibility....I'm a bit of a fan of Robert Shiller and read his books, regular articles etc and the content of his website - as you say there are a lot of similarities - people assuming that because migration is high now that it will continue to be so in the future - which can't be guaranteed. If the housing market starts tanking, people could well pack up and head off shore in droves..the question always is, what could the trigger be? And will it be one big obvious event, or a series of smaller interdependent events that aren't obvious? Are they already happening now, we just haven't noticed them yet and won't recognise them until afterwards? At which point we'll say, ahh how did I not see that at the time?

@avatar: Yes you may also want to go on to homes.co.nz and do a screenshot of the property prices in your area, just for posterity, of the property market 'tulip fever' that took hold of cities such as Auckland.

Ahh... fond memories. I must suggest that to DGZ and Zac too when they're active, though I'm sure they'll insist that their property prices could never go down.

@ Avatar99 ... We are indeed, Toronto? the devil is in the detail - I have family there and know the story.

please remind me with this in about 5 years if we are both around .. would be very interesting to see how things turned out then (either way).

Toronto is still up 5% for the year.

Toronto is so beautiful and close to Niagara Falls so the house prices won't crash. This is just a small blip. I can imagine myself living there to be honest.

You are comedy gold, really. It's a rare talent.

Don't you know how normal correction figures work yoy , its the same up or down, as each month passes the higher months at the beginning will disappear

Yes, that's right, it's all looking good in Canada. All those strong fundamentals. Safe as houses. Right.

I think the point you are missing is that companies and houses are (normally) valued on their projected income. Therefore when we value houses we should be valuing on rental - which has only gone up slowly compared to prices. The issue of wages is that is a limit on the increase in rental.

The companies you cite have increased in value because their revenue has increased, whereas this is not true of houses.

The view of many on this site is that we are permanently (or at least, for our lifetimes) in a low interest rate environment, the rate reductions of the last 10 years are a permanent trend, rates will not rise materially, indeed the reducing cost of financing will send prices to higher and higher multiples of income, and any falls in prices will be accompanied by interest rate cuts which will automatically restore falls in prices arising from any other causes. Even if wages do not grow materially, prices will continue to grow as a multiple of incomes from 10x to a number limited only by the extrapolation of the amount of debt that can be serviced by that income at given interest rate. So therefore property remains an excellent investment even at these prices and in the medium to long term an assured one way bet.

I believe this is an accurate summary of the views of many. So long as interest rates are low and even reduce, you can't go wrong and it's a guaranteed money maker.

Go back, say, 10 years. Did you imagine in your wildest dreams that the OCR would be at 1.75% and there would be negative Interest rates in some parts of the World? Virtually no one did! That's the problem with expectations ( your " So long as interest rates are low and even reduce, you can't go wrong and it's a guaranteed money maker") No one sees what's coming.......Are interest rates going lower? probably. But that....is not a sign that 'other things' won't happen in tandem. Interest rates are like any other indicator of a stress point. Lowering them simply moves the breaking-point to another place. The Stock Market? Property Prices? Social unrest? Who knows! But by artificially removing the most easily observable indicator of stress - the price of money - via QE etc is the most dangerous of tactics that there is. Ask an Venezuelan that you run across!

Yep, agree. I think I did accurately reflect the views of many. Not saying they are my views. I don't disagree that interest rates are key to affordability, I just think there are more factors than debt service affordability.

If you are basing your bet on interest rates remaining this low for the medium to long term, that's a huge bet and if it goes wrong you will get totally wiped out. And then some. But that in aggregate is the bet we have made as a nation.

Its not the nations fault, that is what reserve banks have forced on us. They lowered rates a lot, which caused debt to rise, which caused growth to stall, which causes rates to fall, which causes debt to rise, which causes growth to stall, which causes rates to fall, which causes debt to rise, which causes growth to stall, which causes rates to fall etc.

The head of the BOE when asked if he felt sorry for the savers, responded to the effect of: 'we couldn't have been more clear that we were going to support risk assets at the cost of cash.' Which said another way is: 'We dont give a f%$k about people who cant load up on risk for whatever reason, the rich must get richer.' Because stability yeah...

I think nz is facing a GFC to the same degree as many overseas countries had and we got away from at the time, many countries said there was no way they would go there ever again and what has nz aloud to happen, just that, we just got away from a recession and not to much pain in 2008 to 2012 without to many job losses but right now is a hole different beast

Allowed. Whole. Your alarmist comment is unfounded - employment is high, & mortgages in NZ have not been packaged and resold.

What does "employment" and the fact that mortgages "have not been packaged and resold" got to do with his argument. Private debt is high and could put the country at risk

https://www.newsroom.co.nz/2017/05/08/25357/kiwis-private-debts-put-the…

As recently reported the average house price in Auckland has declined by $90, 000 - this will have an effect on peoples willingness to spend - it's called the wealth effect. If New Zealand goes into recession due to people closing their wallets then what happens. On the high employment figures - New Zealand is using an international definition of what constitutes unemployment - it doesn't include those who have given up looking , those who only looked on Seek but didn't actually apply for any jobs and a lot more - it makes international comparisons easy but doesn't actually portray the real figure on unemployment or under employment.

Additionally New Zealand banks via their Australian parents are exposed to the problems in the Australian banking industry. While there are a lot of "ifs" floating around your comment is lacking in any real substance.

....and I thought anyone was allowed to have their own opinion even if others don't like it.

While not specifically packaged and resold, 10% of NZ banks assets (via residential mortgages) can be set up as covered bonds - available only to overseas investors. As the RBNZ says "A covered bond is a debt instrument issued by a bank that is secured by a specific pool of assets (cover pool). The cover pool assets are owned by a separate company, called a special purpose vehicle (SPV)." These assets are then not available to NZ depositors should the RBNZ declare the bank to be in an OBR situation. And any non performing loans are regularly moved out of the cover pool back into the NZ bank and replaced by a performing mortgage. In a way that's worse than just reselling the mortgage (as seen by local NZ bank depositors). All risk has been placed on NZ depositors - none on the overseas purchasers of the covered bonds.

Pity more depositors do not realize this and demand more information on the risk they take to evaluate if the return is adequate - it isn't but then Banks don,t care of their customers & suppliers wellbeing just their Bonus's profits & dividends.In the event of a major failure those Bankers and Central Bankers should face the harsh music behind bars for a long time.

Upvoted for spelling.

You could well be right O4, the debt dynamic is a powerful thing. The key thing for me is the high level of credit expansion (over $30 billion last 12 months) that is currently underpinning the economy. That's a huge wad of cash being spent into the economy: one dollar in $8.50 of GDP or four times our entire dairy industry - production and manufacturing.

A big chunk of that growth is stimulated by rising asset prices; a classic Ponzi in fact. Now what happens when that stops or slows significantly, it clearly can't keep rising with debt to incomes are at an all-time record. To further put it into perspective; thirty thousand million is the annual pre tax income of 625,000 full time median wage Kiwi workers or almost one million median income (from all sources) Kiwis. I pity the poor fool that wins this election.

Yes the debt dynamic is very powerful.

One manifestation is that deposits have increased 10.4B over the last year due to money creation.

If the marginal propensity to consume (MPC) is only 50%, that represents a juicing of aggregate demand by about $5B, or about 2% of GDP (ie 2% of GDP is hot air).

Moreover, what isn't consumed is 'saved" (MPS =1- MPC) leading to pumping of asset prices.

Unsustainable is not a strong enough word.

David's charts above show how banks of exploited their licence to print money (given to them by the RBNZ) for the last 25 years, but now limits are being reached, accommodated and extended only by the RBNZ continuing to lower interest rates.What a mess!

Nice article. I guess in broad terms the article describes the mechanism of financialisation of the housing market. I’m trying to imagine what comes next? Satyajit Das speaks of false prosperity, and a future involving de-financialisation - whatever that means. Steve Keen’s best case scenario is Japan, with 20 years of stagnation and house price declines. Jim Rickards speaks of people losing faith in currency and currency collapse. I cant quite recall but I don't think any of those authors consider oil becoming a scarce resource either. Each scenario, if it comes to pass, might require a different strategy from the individual in order to maximize prosperity.

That's your normal response, ok not subprime , call it what u will , and of course employment is ok NOW, why wouldn't it be, I bet Iceland, Spain, Greece, USA , England and a heap of others thought things stacked up in 2006 as well, but there were similar sighs creating the same issue, be happy, listen to all sides and remember corrections , cycles, booms and busts happen all the time, just keep a eye on your risk to stop your stress

Absolutely fabulous article David - enjoy your style and presentation. thank you.

I think that market trends and the GFC have largely contributed to the shift in lending - we all know that business lending securities are much greater than Residential properties as risks are much higher ( obviously, so is the rate) keeping in mind that most business lending would be to SMEs and these require "personal Guarantees" which involves having more secure assets like personal Property!

We are now at a time where banks are going through every income detail and asset value when lending to property purchasing. they are equally scrutinizing balance sheets and margins on all P&L sheet presented to them for business lending - they are more rigorous on the purpose of lending nowadays than just the mechanical risk and collateral circulation.

The news or interest rates being held back and that incremental increases are pushed further afield for few more years will keep this market going as it is for a while.

I agree very good article David - I well remember when Labour put the tax rate up to 39%, it was the the first time that I really started to look at tax minimisation strategies - and Labour to this day still doesn't understand that if you create the incentive for people to do something, chances are they will - you can't blame them.

Similarly for the banks, incentivise them to increase lending to housing by halving the capital requirements compared to business lending, and guess what, you get a change in the balance of lending. Similarly again, mismanage the global economy, take short rates to zero and print money, forcing mortgage rates to global historic lows, and guess what you get, people wanting to buy houses at every increasing prices - so who's' to blame again ?

Interest mortgage rates were up at 10%+ in 2007, and yet house prices were still rising fast.

So maybe 'low' interest rates are not really the main driver of Auckland house price hyperinflation.

Since there are many lower rates in developed countries yet their house prices have not increased to the same extent as NZ and Australia. Is it the banks willingness to lend large amounts? Foreign buying? Immigration?

Or tax regime discouragement of many forms of investment / business investment compared to property investment?

Do you understand that most countries experienced a GFC, and resultant house prices collapses, NZ and Australia did not (yet)

Your argument is that low interest rates is the main cause of house price inflation. That is an uncertain correlation currently.

If high interest rates suppress house prices, how do you explain the 2006-2007 period of house inflation and quite high interest rates.

im not sure that higher interest rates alone would stop Auckland house inflation - other factors seem to be affecting that.

John key the American banker and our leader for the same period, blame him, why not, and he ran

Yes Q4, I credit him and his vast experience and business skills for not having the collapse, and only hope an academic 37 yr with no real world experience in the future will magically do the same

Key had nothing to do with NZ avoiding most of the fallout from the GFC.

That just it, not one thing got us here but a lot of things , the perfect storm, and the chances of them all happening again at the same time again are probably a million to one, but still here we are

Yes of course if key had stayed everything would be ok , yeah and over the next 13 years like the last housing would go up another 4 times in value, FHB could have a caravan as there first house on the ladder, average mortgages at $2000 a week , yeah there's no reason at all why housing couldn't keeps going , and key could have done it , poo he's gone , bugger

Yeah you're right key had the brains to leave America just before the GFC, and yeah he didnt DO ANYTHING about the mess we're in now

Uncontrolled banks and peoples greed are a terrible mix, the government needs to run things but fairly for all people

@ Q4 .... "the government needs to run things but fairly for all people"

Really? so you want to get rid of free market and back to dictatorships running things fairly? ... where is that happening ?

@Eco Bird. To get "free market' you need a strong referee. e.g. government. Last thing banks and big corporates want is free markets.

There was such a big stink in America and pointing the finger from other countries about these banks at the time of the GFC, for about 4 years later we'll control them better, but slowly they're left to control such a important part of a country, it's a bit sad if a country like nz can't do well unless house prices skyrocket , tell me which would be better . 1 , bad regulation and every 10 years we do this boom bust carry on where some in the end take others to the cleaners, family's and investors on the boom side pushed with large mortgages and the bust side job losses, stress or, 2 , good regulation, no boom or busts , house prices more stable, a better bet for borrowers, more money in everyone's pockets, as a investor myself, ok Iv made money buying low selling high but if housing was more stable I'd be a lot happier knowing my investment was always slowly going up, borrowing money all the time would be easier, lots of pluses, LVR,s need to stay and DTI needs putting in place, control the banks and people and in the end everyone wins, of course it wouldn't be bulletproof but nows the perfect time

Our banks have almost all been converted from balanced trading banks to essentially mortgage banks. Most of their loans are for housing. Some, like Kiwibank and the small locally-owned banks are more than 80% exposed to housing loans. [my emphasis]

The term you are looking for is 'building societies', where mutual ownership is expressed through government bank guarantees. Australia is a good example. Read more

Banks don't see bubbles to to late, if the lvr weren't charged the bubble would just have gone a bit longer and more out of wack, the country needs investors and rentals and 40% deposit is to high for most starting out so I think DTI,s are a better way to go, interest rate movements are ok, but they can hurt the wrong people and take money from people's pockets which isnt good, DTI targets incomes

Not only is it a risky bet on interest, if a person is that worried in the first place would mean they are taking large risks so even if for the next 5 years there mortgage payments stayed the same there are so many other things, hard to get a tenant, sickness, loss off job, you can't sell anymore because you're underwater, of course some idiot on here will say world war 3, but come on lesson your risk if you can, I could have rates go to 10% and that wouldnt worry me and thats how it should be, people will always buy on the way down seeing a reasonable deal, keep a eye on prices ,

What's a free market, having a RB, having a government anyway, manybe we should have the top 1% own everything , it's just simple rules for greed, don't over think it

It is quite terrifying how much our banks have focused on home lending in comparison to lending to NZ Business, which is actually the lifeblood of our economy. I didn't realise how much our banks had changed over the past few years. It seems that they are no longer the commercial trading banks these days and have just become a bit of a "building society bank" like the old Countrywide Bank, where I got my first mortgage at age 23. Countrywide got gobbled up by a bigger bank not long after that. It only lasted 11 years as a registered lender. Where are our banks heading?

In a way rentals are similar as commercial so 40% deposit but commercial is 15year term there's gst and outgoings on commercial and other things, investors of houses would normally fine it hard to fine 40% deposit and you don't would people tapping the family home up to much and we need a certain amount of rentals , lifting interest rates aren't fair to a certain % of people in a boom and most times unfair to commercial, farming etc, so if we keep going back to affordability and over doing risk do we get back to having a permanent and fair setting of a DTI, maybe then we could go back to a fairer LVRs for house rentals of 20% keeping new investors entering the market which is important

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.