Like a never-ending Groundhog Day, every International Monetary Fund report on the New Zealand economy suggests tax reforms would promote efficiency. For example,

“There is a sense that the asset allocation in New Zealand households has a bit too much emphasis on housing versus other investments. We think a capital gains tax at the margin would help.”

That was IMF Mission Chief Thomas Helbling in 2017.

This year, the IMF Mission noted:

“…tax policy reforms are needed to promote investment and productivity and growth increase, increase the progressivity of income tax and mobilise additional revenue in response to long term fiscal challenges. To achieve these objectives, reforms should combine comprehensive capital gains tax, land value tax and changes to corporate income tax.”

And invariably the IMF's conclusions are usually followed by a fairly dismissive response from the Minister of Finance of the day.

In 2002 it was the late Sir Michael Cullen responded to that year’s report: “The IMF's credibility is not assisted by the fact that it tends to apply the same policy template regardless of the country's circumstances”. This year Nicola Willis’s retort was “There are some things that are certain in life, death, taxes and the IMF recommending a capital gains tax.”

Associate Minister of Finance David Seymour also weighed in commenting. “I see the IMF again saying, oh, you need a capital gains tax. Every country has one. The only countries that don't have one are New Zealand and Switzerland. But I say let's be more like Switzerland.”

However, I'm not so sure that this was quite the zinger he hoped because as someone mischievously pointed out on Twitter, Switzerland has a wealth tax and a $59 per hour minimum wage in Geneva.

Deputy Prime Minister and former Treasurer Winston Peters was apparently not available for comment.

A de-facto capital gains tax – the bright-line test

Now, amidst all of the commentary about the IMF’s suggestions, one of the things that came up time and again is that in many ways, we do have a de-facto capital gains tax, except we don't call it that. The bright-line test is an example of the approach that we've adopted, which has been ad hoc and responsive based on the government of the day’s policies at the time.

As you may recall the bright-line test was brought in with effect from 1st October 2015 by the National Government and it then applied to disposals within two years. In March 2018 the Labour Government introduced a five-year period and in 2021 it was increased a 10-year period. And so, a quite confusing scenario has developed as to which bright-line test applies because some of the exemptions have changed over time as well, particularly in relation to the main family home.

In one way, therefore, the reduction of the bright-line test back to two years again from 1st July is to be welcomed because it is clarifying and simplifying what has become an incredibly complicated area.

Tax Red Flags: More than just the bright-line test to be considered

The bright-line test and taxation of land has plenty of red flags when together with the excellent Shelley-ann Brinkley and Riaan Geldenhuys and moderator Tammy McLeod, I made a presentation about tax red flags on Tuesday to the Law Association. (Formerly the Auckland District Law Society). My thanks again for the invitation to present and to my excellent co-presenters, we had a very lively session talking around this.

In short when you drill into our current land taxation rules, they are very incoherent. The bright-line test is a backup test. It applies if none of the other land taxing provisions apply. And this is something that tripped up people before the bright-line test was introduced and will continue to do so even now it's been reduced down to two years.

The particular issue to watch out for many people is the question of subdivision. If you own a property and undertake a subdivision within 10 years of acquisition it may still be caught under the existing rules, outside of the bright-line test. And in some cases, you may be caught by the combination of the provisions with the associated persons test which deem transactions to be taxable if at the time you acquired the land you were associated with the builder, dealer, or developer in land.

Sometimes the tax charge can be triggered way past the 10-year timetable since acquisition. That's particularly the case in relation to a disposal of property where building improvements have been carried out. That particular provision, section CB 11 of the Income Tax Act, deems income to arise if a person disposes of land and

“within 10 years before the disposal”, the person or an associate of the person completed improvements to the land and at the time the improvements were begun, the person or an associated person carried on a business of erecting buildings. Note, the reference to “within 10 years before the disposal.” So, you may have owned that land for considerably longer than 10 years and yet still be subject to the provision.

Just a pro tip for anyone thinking ‘Great, with a two year bright-line test coming in, I can now sign a sale and purchase agreement, make sure settlement takes place after July 1st and it's not going to be subject to the bright-line test.’ That's not the case. The sale point for the bright-line test in that case is when the sale and purchase agreement is signed and not when settlement happens. I had at least one client get caught by that very provision because they went for a long settlement thinking that got past the two year period. It didn't, and it is another case of always seek advice on transactions involving land, because as I've just outlined, the provisions are complicated.

Could a capital gains tax be ‘simpler?’

And this was the point we reinforced during our seminar. There is a lot of complexity already in our tax system around the taxation of land and in my view, in some ways a capital gains tax actually would clear away a lot of that uncertainty. It'll become clearer that, broadly speaking, if you buy something you and you sell it subsequently, any gain will be taxable.

Now, how the gain is calculated and the rate at which it's taxed are two different things. But often in the debate around the capital gains tax, those two things get conflated to run as an argument against the taxation of capital gains.

But in my view, the point still remains that we have a confusing hotchpotch approach to taxing capital gains and at some point, grasping the nettle with a CGT as suggested by the IMF and also the OECD would ultimately perhaps be a better approach.

Incidentally, doing so would be consistent with the well-established principle we have of the broad-based low-rate approach. There's nothing to say that by broadening the tax base, we could not hold tax rates at current levels or even lower. Bear in mind that the when the last tax working group recommended the capital gains tax, it was intended to keep to help keep the top tax rate at 33%.

Watch out for trustees on the move across to Australia

One of the other issues that came up in our Tax Red Flag Seminar was the question of trustees, and beneficiaries and settlors moving cross-border, particularly to and from Australia. That is something all three of us are seeing quite a bit of and it is something to watch out for as a key red flag.

The IMF on how to tax wealth

If there is a certain repetitiveness to the IMF's discourse about taxing capital, it's part of a global discourse on the topic. Earlier this month the IMF released a How to Tax Wealth note. These How to notes are “intended to offer practical advice from IMF staff members to policy makers on important issues.” And this this was a very interesting read as you might expect.

The IMF’s How to Tax Wealth note neatly coincided with the release of the UBS/Credit Suisse, Global Wealth Report for 2023. According to the report in 2022 New Zealand ranked sixth in the world with an average wealth of US$388,760 per adult. On the basis of median adult wealth per adult, again in U.S. dollars, we ranked 4th behind Belgium, Australia, Hong Kong with a median wealth of US$193,060.

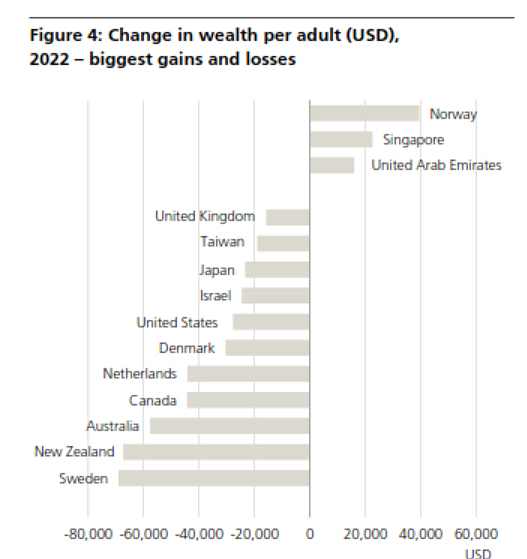

Incidentally, these rankings were after a very sharp fall from 2021 levels, where New Zealand was only behind Sweden in the biggest loss in wealth per adult.

I am genuinely very surprised to see New Zealand rating so highly for both average wealth and median wealth. On the other hand this Credit Swisse/UBS report is another example of why there's a great debate going on around the taxation of wealth not just here, but globally.

And this IMF How to Tax Wealth note is instructive in its approach. It starts by making a very obvious point, how much to tax wealth is a distinct question from how to tax wealth. The note argues that:

“returns to capital generally should be taxed for equity and possibly efficiency reasons. and that in many countries, wealth inequality and better tax enforcement strengthen the case for higher effective taxation than in the past.”

Now the IMF doesn't make any particular proposal about a specific level of tax, the note is basically about ‘here are things you should consider.’ But on the question of wealth taxes, it does come down pretty much against them noting,

“Improving capital income taxes tends to be both more equitable and more efficient compared with replacing them with net wealth taxes. Countries hence should prioritise improving capital income taxation over considering the introduction of wealth taxes”.

Then it talks about - in terms of strengthening capital taxes - addressing loopholes, notably the under taxation of capital gains in many countries. There's a passing comment, that perhaps you can use a one-off net wealth tax or maybe apply it to very, very high wealth levels.

Time for inheritance tax?

But the Note also concludes “taxing capital transfers through gifts or inheritance provides another opportunity to address wealth inequality.” The IMF comments that the efficiency costs of such taxes are modest, and notes that “inheritance taxes are better aligned with redistribution than estate taxes, since exemptions and rate structures can account for the circumstances of the heirs.”

What really makes the New Zealand tax system unique is not the absence of a capital gains tax because, as David Seymour pointed out, other countries don't have that, namely Switzerland. It's the complete absence of taxes on the transfer of wealth, which has been the case now since 1992. That's what makes New Zealand unique - we have no general capital gains tax together with no estate or gift or wealth taxes.

And this is an area where I think a lot more consideration needs to go into because as the IMF noted, we've got fiscal challenges ahead, and where might the revenue be raised from to meet those challenges.

The IMF and Climate Change Commission suggest changes to the ETS

And finally, back to the IMF again. It concluded its mission report by noting that “New Zealand's ambitious climate goals call for major reforms,” and it referenced the Emissions Trading Scheme, having helped limit net emissions by encouraging robust reductions and removals, particularly from afforestation.

But the IMF then went on to say that “significant reforms” are going to be needed to meet domestic and international targets, and these include reducing the number of available units in the ETS, pricing agricultural emissions and strengthening the incentives for gross emissions reductions within the ETS. The IMF finally note that given the ambition of New Zealand's first nationally determined contribution under the Paris Agreement, the use of international mitigation i.e.; buying credits from offshore, is likely to be required.

Now the IMF report was a week after the Climate Change Commission, pretty much said the same thing, and advised the coalition government they should halve the number of ETS units on offer in each of the next six years. The last ETS auction did not go brilliantly. That has a flow on effect in that by reducing the amount of income from emission trading unit sales, it’s going to limit crown revenue for tax cuts.

Vale Rod Oram

It’s interesting to see a confluence of opinion happening here and an appropriate time to remember the late Rod Oram someone who was a very strong environmental journalist. I was fortunate enough to know him all too briefly after we met at a panel discussion. We’d planned on him appearing as a guest on the podcast. Sadly, with his passing that will never happen now, and our thoughts go out to his family and friends.

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

55 Comments

Beardsley Ruml was a chairman of the New York Fed and had this to say about taxation,

"since the end of the gold standard, "Taxes for Revenue are Obsolete". The real purposes of taxes, he asserted, were: to "stabilize the purchasing power of the dollar," to "express public policy in the distribution of wealth and of income," "in subsidizing or in penalizing various industries and economic groups" and to "isolate and assess directly the costs of certain national benefits, such as highways and social security."

Awesome read. Thanks Terry.

I agree completely with the IMF that:

1. Wealth Taxes = not so good, while a CGT=better approach

2. "the under taxation of capital gains in many countries" - They're not kidding! In many countries, the average wage or salary earning Joe is being completely stiffed while the wealthy are laughing all the way to the bank.

(re Switzerland's wealth tax, a deserved ping.)

Switzerland is a creditor nation. F'more, their h'hold debt to GDP is approx 30% higher than in NZ (125% cf 90%).

Switzerland is Europe's Ireland - corporate tax haven.

Ireland is in the EU. Your point is understood, but Switzerland is a far more diversified economy than Ireland. And Switzerland's financial services / banking sectors are far more important than anything in Ireland.

Associate Minister of Finance David Seymour also weighed in commenting. “I see the IMF again saying, oh, you need a capital gains tax. Every country has one. The only countries that don't have one are New Zealand and Switzerland. But I say let's be more like Switzerland.”

Shut up and listen to me. We should take the deal guys. Switzerland doesn't even start taxing income until you pay 18,300CHF ($36k) and the highest rate for residents is 11.5%. GST/VAT are only 8%.

Can we ask Seymour to put it in writing for us? This deal is done.

I have no problem in listening to you when you list and account for all of Switzerland's taxes. ;-)

You're kind of proving Squishy's point there.

Example:

Total Federal, Kantonal and Municipal Income tax for a couple with 2 kids earning 500,000 CHF in Zug (~$NZ 927,000) is only 45,645 CHF, or 9.1%

Zug is an outlier with 120k population and a significant amount of commodity trading houses like Glencore, essentially subsidising the low personal tax rates.

Zurich would be 26%, Geneva 29%, and you've got compulsory health insurance on top.

Yes Zug is an outlier, but it's only a 21 minute train ride from Zurich.

And even Zurich at 26% on NZ$927,000 is much better than the 37% you'd pay on the same income in NZ.

True about the health insurance, but it's also better quality.

Basically it's not so good for low earners but superb for high earners.

"You're kind of proving Squishy's point there."

I think you'll find Squishy is overlooking many taxes and costs. To say nothing of the significant structural differences between our respective economies.

It's not a cheap country that's for sure, but tax there is low for many people. I've lived there so have first hand experience of that.

You may need to somehow geographically link us with a number of major trade partner countries and have an extensive banking history, drawing money from all over the world to profit from before we could even hope to have this.

Switzerland runs large current account surpluses of nearly 10% of GDP and this makes a huge difference to the country's accounts and while we haven't run a surplus for over half a century.

While not being called a CGT, a hefty tax is being levied in Switzerland on gains made from selling property. For those knowing German, explore 'Grundstücksgewinnsteuer'. The tax is a substantial revenue earner for any local authority. Over 20 years, the tax rate diminishes for every year a property is held until it plateaus out at about 20 percent. For this reason flipping houses has never become a lucrative activity as it did in New Zealand.

Singapore also doesnt have a capital gains tax. Which is probably more applicable to NZ than Switzerland, as its more likely rich people would move their assets to Singapore than Switzerland (joining all the Australian mining magnates that live there). It should also be noted that Switzerland also has a maximum income tax rate of 11.5%, and that the wealth tax rate has steadily decreased over the years as the cantons compete for taxpayers.

Singapore also doesnt have a capital gains tax. Which is probably more applicable to NZ than Switzerland, as its more likely rich people would move their assets to Singapore than Switzerland (joining all the Australian mining magnates that live there)

S'pore is a great place for LLC's to have the ol' rat poison on a balance sheet.

Singapore has almost 80% government provided housing too. Dealt with housing affordability and freed people up to be productive rather than leeching off existing houses.

You're mistaking Swiss federal income tax for the overall tax paid including municipal+kantonal+federal income taxes.

So if you take the distribution of wealth for Nu Zillun, the left skew is actually quite pronounced. This is actually a broad indicator of inequality.

F'more, I never considered this, but the mean and median wealth ratio relative to mean and median prices of housing is quite interesting. Broadly speaking, the cost of housing is greater than our collective "wealth," even though our wealth includes housing. That's actually a pretty bad thing IMO.

Taking this into account, you can understand why the wingnuts and the "party formerly known as Team Cindy" are terrified of implementing a capital gains tax.

"So if you take the distribution of wealth for Nu Zillun, the left skew is actually quite pronounced. This is actually a broad indicator of inequality."

Could you elaborate? Thanks.

Just a comparison of mean and median over the distribution. Considering the mean is much lower than the median, we can state that the distribution is left skewed and quite different to a normal distribution.

Thanks. I get what you're saying. It would be interesting to see the actual distribution curve. Occasionally, the shape can be astounding making the mean and median almost meaningless (although probably not in this instance).

"NZ’s problem is too much spending, not a lack of tax"

https://www.kiwiblog.co.nz/2024/03/nzs_problem_is_too_much_spending_not…

Time to means test the pension on all the old socialists eh.

The socialist loyalty scheme for having a certain number of birthdays. Claim that it's "thanks" for building the society we have today.

*looks around at crumbling society*

Insist it's only socialism when it's for the young or the poor.

'Old socialists' .. are the working class poor who cannot make ends meet on Super and who, despite the anti-boomer/oldpeople rhetoric, do not have much 'means' to test.

Sorry what? If they have very little means to test then they shouldn't be afraid of means testing because they'll fall under the "needs" case and the abatement threshold likely won't kick in. Have a look at Australia's means testing if you want an example.

Please don't use poor struggling pensioners as cannon fodder to deflect any debate around very wealthy pensioners bleeding the taxpayer dry for $1b per year, justified only by an entitlement mentality.

There are more high-net worth Americans applying for residence and citizenship-by-investment programs than citizens of any other country.

Over the past five years, inquiries from the U.S. about these programs have increased by 500%.

Probably nothing.

https://fortune.com/2024/03/19/wealthy-americans-second-citizenship-liv…

The link is paywalled. Looking at its wording why would they be looking for second citizenship options when US citizens are liable for US tax no matter where they live? To avoid it they have to give up US citizenship.

Because not all offshore assets are taxable. Depends on jurisdiction and legal set-up; for ex, an LLC may not be liable for tax in the US. Even though it's a US territory, many US citizens live in Puerto Rico for tax purposes.

All I want to know as a tax paying New Zealander is that we are sharing the burden equally. Rather than the wealthiest of my fellow citizens contributing half of what I am as is currently the case and continues to be so. This situation goes against my kiwi sense of ‘fair play’

An oldie but a goodie.

"12 per cent of individuals pay just under half of all personal taxation, and the top 3 per cent account for almost a quarter of all personal tax paid...Half of households pay no net income tax after credits" (WFF etc).

https://www.stuff.co.nz/business/opinion-analysis/114628351/an-inconven….

"This situation goes against my kiwi sense of ‘fair play" Agree: what's fair about progressive tax regimes?

Funny how you highlight WFF as the big transfer when the reality is superannuation is the thing that causes such a small percentage to end up supporting 50% of housholds. People seem to always love Bringing up the old "50% of New Zealander's aren't net taxpayers" but forgetting that part of those 50% percent are people on superannuation. It's talked about as if 50 percent of workers are contributing nothing but considering there are 842,000 over 65's who will be the ones collecting the vast majority of those "transfers".

Then another big chunk would be the accommodation supplement which is basically a landlord subsidy, then the classic jobseeker which is $3b out of a $50b budget. There aren't as many working-age people just sitting around doing nothing as it seems to be framed from looking at the data. WFF is about $2 billion, they all pale in comparison to the enormous fiscal impact that is our superannuation scheme.

The info for that is all in the below link showing what the transfers actually are and what groups are getting what. That data is also a bit out of date as it's from 2018.

https://taxworkinggroup.govt.nz/sites/default/files/2018-09/twg-bg-distributional-analysis.pdf

The social contract. We funded Super for our parents, as they had for our grandparents. Hopefully our kids will feel the same way about us. I wonder if they're raising their kids to feel the same way about them.

As i pointed out a couple of days ago:

The % of Super still working is over 20%, 5x what it was 2 decades ago.

Not because they want to keep working.

Edit: https://www.stuff.co.nz/nz-news/350218070/retirees-work-80s-90s-insuffi…

The above isn't an argument for or against superannuation it's just pointing out that the picture people like to paint of a bunch of bludgers sitting at home collecting transfers from 50% of net taxpayers isn't accurate and the vast majority of those transfers are going towards our pay-as-you-go superannuation scheme.

I know how you feel about super and I agree that we need superannuation in place for those who need it, but the problem is no matter what dubious "social contract" there is it is fundamentally unsustainable as the ratio of retirees to workers continues to grow and at some point, something is likely to break, which is probably a while into the future so another lovely hospital pass for future generations.

"An oldie but a goodie."

It is indeed. Fools many. Look up the opinion piece's definition of "personal taxation".

That link isn't working Chris?

Not a link. Underline, for emphasis. I was referring to the link you posted - which is an 'opinion piece'.

Let's abolish WFF so that everybody who is employed can have the dignity of knowing they're net tax contributors.

However, I think they'll struggle to pay the rent so we may need to legislate (in the short term) rent reductions across the board to align with people's new net income levels. A bit of a "reset" so to speak.

That has a flow on effect in that by reducing the amount of income from emission trading unit sales, it’s going to limit crown revenue for tax cuts.

I am not sure this is right Terry. ETS revenue does not change the operating balance. It is only recognised as revenue when the units are surrendered.

Capital Gains Tax rewards governments for printing money and inflating the value of assets in dollar terms, while in real terms they go backwards.

Could you explain how you came to that conclusion. Thanks.

Simple enough. The Government doesn't print its money. It sells debts to the reserve bank which issues bonds that the government has to repay with Taxation revenue. In return the reserve banks loan that money into the economy through the trading banks. Now the reserve bank knows that the only way for the debts to be repaid is by a steady stream of inflation, which means that the loan is repaid in part by that inflation.

That leads to the obvious conclusion that inflation is desired, and is in fact necessary. As a thought experiment consider this. As all money is first loaned into existance, if all debts were repaid, there would be no money in circulation.

So, with the whole system designed to generate a consistant level of inflation, then a capital gains tax is simply another way to double dip on this policy. A house is still a house - it hasn't changed. But the number of dollars needed to purchase said house keeps going up. In the eyes of the tax department, you have made a gain. What has happened is you have simply stayed even, and when you factor in the cost of the loan, maybe even gone backwards.

The wealthy have vehicles at their disposal that allows them to legally dodge this tax, so a capital gains tax simply ensures that the middle class ordenary citizens get royaly screwed out of their chance to prosper.

Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, Governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some.

As a thought experiment, consider what you have seen in your life. I have the advantahe of over 6 decades of existance. I remember the ability to go into the dairy and buy fizzy lollies at 6 for a cent. Milk was 3c a pint or approx 5c a litre, my bus fair home from school was 8c. Now you buy 10 lollies for $2, 1l of milk for about $1.90, and you pay $4.50 for a bus trip.

Consider the median income across this time period and factor the minimum wage doubled in ~10years recently. Relativity is everything. I’f the average punter was getting 30c an hour back then well everything seems affordable. By your count that would be ~6min work to earn a pint of milk, maybe a bit more after tax. Todays minimum wage is $22.70, soon to change to $23.15 an hour and even trolly kids at the supermarket get this. That makes it currently net $18.85/hr and for $4.50 a bus trip 14.3min of net pay for said trip.

Many of the capital gains taxes implemented overseas have inflation indexing to reduce the 'gain' thereby eliminating inflation's effects.

How does that fit into your logic?

"That leads to the obvious conclusion that inflation is desired, and is in fact necessary."

If it is "desired" - as you say - why isn't it set far higher?

Maybe 10%? Or 20%? Or maybe even 100% as some countries are / have been?

Poor labour gave the keys to Michael Cullen to deliver a CGT and he couldn't, or wouldn't, factor in inflation. That's what sunk the deal, paying 38% tax on currency devaluation. If he'd be able to see past it as a form of punishment to asset owners it would be a done deal.

Spoken like a true believer in the comunist manefesto, where the rich home owners are evil capitalists. Rather than blaming those who have houses for the evils of price inflation, blame instead those who generate the inflation.

Que?

Started early today did we?

If my memory serves - the biggest problem with the Tax Working Group's (TWG) design of the CGT was that an annual capital gains taxes would be collected.

For many 'asset rich, cash poor' people - and the rich people who actually weren't but could see they'd be paying more tax - that was completely unpalatable.

But from an economics perspective it makes perfect sense in that such people would need to sell the 'underperforming asset' to someone who would make it perform - or the price fell to a point that it's real economic value was reflected (rather than it's scarcity value). (Think land banking! Such a tax would kill it dead. Ditto a LVT - depending on the level obviously.) The TWG were tasked with focusing on increasing NZ Inc.'s woeful productivity and boy-oh-boy that really would have helped!

Another plus point in such a scheme was people would be very cognizant of inflation as they'd not want to be paying extra CGT because inflation was rampant. (Whether it would have an effect on keeping inflation low is a matter of much debate.)

There were ways to 'defer' the tax but nobody ever read that far. E.g. Many councils allow rates to be deferred until the owner sells or dies.

Consequently, the 'entitled' kicked up a stink and it died a death because gutless politicians refused to lead and educate. ('Democracy' sucks when people don't understand economics and/or when leaders are more interested in being re-elected than with doing what needs to be done.)

Tax on wealth zinger. Yeah, but Switzerland has federal income tax of 11.5%. And the wealth tax isn’t levied on real estate. And the wealth tax is a NET wealth tax. So just a couple of minor omissions from the article.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.