consumers

Australian financial services industry rolls out Code of Practice for buy now pay later sector designed to stave off government regulation

2nd Mar 21, 8:48am

Australian financial services industry rolls out Code of Practice for buy now pay later sector designed to stave off government regulation

British government acting on advice buy now pay later credit sector needs to be regulated 'as a matter of urgency' to protect consumers

4th Feb 21, 12:08pm

6

British government acting on advice buy now pay later credit sector needs to be regulated 'as a matter of urgency' to protect consumers

Credit bureau Equifax says 96% of all accounts previously in mortgage deferral are now up to date

4th Dec 20, 9:44am

9

Credit bureau Equifax says 96% of all accounts previously in mortgage deferral are now up to date

Commerce Commission warns BNZ after deciding issues the bank self reported 'likely breached' responsible lending and disclosure obligations under the Credit Contracts and Consumer Finance Act

2nd Dec 20, 9:24am

1

Commerce Commission warns BNZ after deciding issues the bank self reported 'likely breached' responsible lending and disclosure obligations under the Credit Contracts and Consumer Finance Act

New Zealand Bankers' Association not won over by government's case for a consumer data right, says the public is underwhelmed by open banking

24th Nov 20, 9:23am

New Zealand Bankers' Association not won over by government's case for a consumer data right, says the public is underwhelmed by open banking

Investors warned to beware of a rising volume of scams including phishing scams in dual warnings from the Financial Markets Authority and Department of Internal Affairs

19th Nov 20, 9:56am

15

Investors warned to beware of a rising volume of scams including phishing scams in dual warnings from the Financial Markets Authority and Department of Internal Affairs

Australian Securities and Investments Commission says about 20% of buy now pay later users cutting back on, or going without, essentials such as food in order to make their payments

17th Nov 20, 8:06am

Australian Securities and Investments Commission says about 20% of buy now pay later users cutting back on, or going without, essentials such as food in order to make their payments

Discussion paper from Payments NZ details the 'building blocks' for a real-time payments system for the future

4th Nov 20, 9:34am

Discussion paper from Payments NZ details the 'building blocks' for a real-time payments system for the future

RBNZ deputy governor and manager for financial stability Geoff Bascand airs concerns about open banking, sounds lukewarm on the prospect of regulating merchant service fees

15th Oct 20, 9:42am

RBNZ deputy governor and manager for financial stability Geoff Bascand airs concerns about open banking, sounds lukewarm on the prospect of regulating merchant service fees

Boss of credit bureau Centrix surprised by volume of borrowers in arrears not seeking a mortgage deferral, says credit demand fell across country when Auckland moved into new lockdown

19th Aug 20, 10:45am

20

Boss of credit bureau Centrix surprised by volume of borrowers in arrears not seeking a mortgage deferral, says credit demand fell across country when Auckland moved into new lockdown

Banking Ombudsman website to feature dashboard providing detailed information about bank customers' complaints

12th Aug 20, 5:00am

1

Banking Ombudsman website to feature dashboard providing detailed information about bank customers' complaints

MBIE sees case for government intervention to establish a consumer data right to 'help give consumers access to a wider range of products & services that better meet their needs'

5th Aug 20, 12:12pm

4

MBIE sees case for government intervention to establish a consumer data right to 'help give consumers access to a wider range of products & services that better meet their needs'

'Buy now pay later' company Laybuy is moving aggressively in the UK even as it readies to list on the Australian sharemarket

30th Jul 20, 3:15pm

'Buy now pay later' company Laybuy is moving aggressively in the UK even as it readies to list on the Australian sharemarket

Bernstein analysts look at why the pandemic inspired increases in non-cash payments and e-commerce are likely here to stay

11th Jun 20, 11:30am

Bernstein analysts look at why the pandemic inspired increases in non-cash payments and e-commerce are likely here to stay

Labour's government support partners would back regulation of retail payments as part of moves to stimulate the economy after the crushing impact of the COVID-19 pandemic

26th Apr 20, 7:31am

25

Labour's government support partners would back regulation of retail payments as part of moves to stimulate the economy after the crushing impact of the COVID-19 pandemic

In the fifth and final part of a series on New Zealand's retail payment systems Gareth Vaughan lays out a roadmap for regulating the retail payments sector and outlines why this should be done

16th Apr 20, 5:00am

8

In the fifth and final part of a series on New Zealand's retail payment systems Gareth Vaughan lays out a roadmap for regulating the retail payments sector and outlines why this should be done

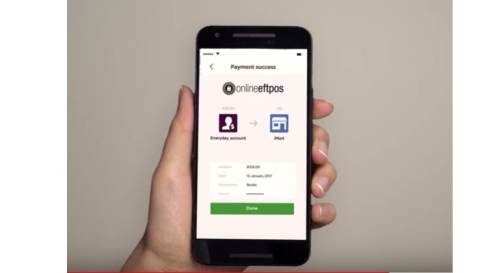

In the fourth part of a series on NZ's retail payment systems, Gareth Vaughan looks at EFTPOS and COVID-19, and finds banks in charge of implementing some of the key technologies that could crimp their revenues

8th Apr 20, 10:00am

12

In the fourth part of a series on NZ's retail payment systems, Gareth Vaughan looks at EFTPOS and COVID-19, and finds banks in charge of implementing some of the key technologies that could crimp their revenues

Big ticket purchases like property, vehicles and home appliances are the most likely to be delayed with just 45% of consumers confident in their financial situation

8th Apr 20, 9:20am

64

Big ticket purchases like property, vehicles and home appliances are the most likely to be delayed with just 45% of consumers confident in their financial situation

During the COVID-19 pandemic consumer lenders will be acting responsibly when making reasonable decisions based on the best available information in the circumstances, ComCom says

6th Apr 20, 8:42am

2

During the COVID-19 pandemic consumer lenders will be acting responsibly when making reasonable decisions based on the best available information in the circumstances, ComCom says

Commerce Commission looking at COVID-19 'mortgage holidays' through CCCFA lens, what RBNZ capital concession means & what about non-bank deposit takers?

31st Mar 20, 2:01pm

6

Commerce Commission looking at COVID-19 'mortgage holidays' through CCCFA lens, what RBNZ capital concession means & what about non-bank deposit takers?

In the third part of a series on NZ's retail payment systems, Gareth Vaughan looks at the complications of interchange & merchant service fees and finds a government minister still waving a regulatory stick

28th Mar 20, 10:32am

5

In the third part of a series on NZ's retail payment systems, Gareth Vaughan looks at the complications of interchange & merchant service fees and finds a government minister still waving a regulatory stick

In the second part of a series on NZ's retail payment systems, Gareth Vaughan looks at how New Zealand's regulatory oversight of retail payments is behind where Australia was at in 2001

22nd Mar 20, 8:40am

1

In the second part of a series on NZ's retail payment systems, Gareth Vaughan looks at how New Zealand's regulatory oversight of retail payments is behind where Australia was at in 2001

In the first part of a series on NZ's retail payment systems, Gareth Vaughan details the scale of key players Visa & Mastercard, looks at how & why they pay a miniscule amount of tax & how interchange works

21st Mar 20, 10:00am

6

In the first part of a series on NZ's retail payment systems, Gareth Vaughan details the scale of key players Visa & Mastercard, looks at how & why they pay a miniscule amount of tax & how interchange works

HSBC failure to disclose interest rate increase to borrowers affected 225 loans and 180 borrowers and sees bank warned and required to compensate borrowers about $7,000

10th Mar 20, 10:53am

6

HSBC failure to disclose interest rate increase to borrowers affected 225 loans and 180 borrowers and sees bank warned and required to compensate borrowers about $7,000

ANZ NZ to pay customers more than $35 million after admitting a breach of its responsible lending obligations in relation to a coding error within a loan calculator

2nd Mar 20, 1:35pm

3

ANZ NZ to pay customers more than $35 million after admitting a breach of its responsible lending obligations in relation to a coding error within a loan calculator