Here's my Top 10 links from around the Internet at 10 am today.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #9 from Goldman Sachs' former chief economist on the widening gap between profits and wages. It's the sort of thing Karl Marx would point to.

1. Show us the inflation - Matthew O'Brien does a nice job at The Atlantic of wondering why there is very little inflation in the world's biggest economy despite massive money printing.

This is the central question of our age.

Where is the inflation?

My view is there is a giant DAMPENING of inflationary pressures going on. They include D for deleveraging, A for ageing, M for the middle income squeeze, P for the profit share rise, E for Equality erosion, N for new productive capacity in Asia and from high technology, and G for globalisation's drive down on unit costs.

But here's O'Brien with a good chat about the lack of inflation. He thinks government austerity is a factor too. It's certainly a factor here, as the Reserve Bank pointed out yesterday. The government sector is expected to subtract 0.6% of GDP from the New Zealand economy for each of the next three years.

That giant sucking sound you hear is the government taking demand out of the economy. As you can see on the left axis below, total government spending -- that is, federal plus state and local -- as a percent of potential GDP has been on a steady downward trend since 2010. It's a three-act story of bad policy. First, the stimulus peaked, and then reversed prematurely; then, state and local governments began slashing budgets to balance them as they are required; and now, the federal government is cutting spending in the dumbest way Congress could come up with -- the sequester.

Now, QE2 did manage to increase inflation despite some austerity, but there's more of it this time around. The chart above only shows total spending through January 2013; it doesn't include the sequester, or, for that matter, the tax side of austerity. Between the spending cuts and the expiring payroll tax cut, the fiscal contraction the past six months has probably overwhelmed any "money-printing".

2. What about default? - Perhaps Japan would be better off defaulting, suggests Noah Smith. Eventually, I suspect he thinks better of this suggestion.

A default would constitute a roll of the dice - a dramatic gamble that a collapse in the old order would be followed by a repeat of the kind of explosion of positive dynamism seen in the post-WW2 economic miracle or the Meiji Restoration. If the gamble failed, however, the consequence could be the end of the beautiful, peaceful, relatively free Japan that many of us have come to know and love.

In a stinging indictment of the American search engine giant’s financial affairs, the House of Commons Public Accounts Committee (PAC) accused the company of “aggressive tax avoidance” and said it should pay “its fair share of tax” in the country where it earns profits.

The committee, chaired by Margaret Hodge MP, dismissed Google’s defence that it pays so little tax in the UK – a total of $16m (£10.2m) between 2006 and 2011 despite generating revenues of $18bn – because its sales are actually conducted in the Republic of Ireland, claiming its argument was “deeply unconvincing.”

The comments, in a PAC report, come a month after Ms Hodge told Google’s northern Europe vice-president Matt Brittin that his company’s behaviour was “devious, calculated and… unethical.”

4. It's happening in Seattle too - There's obviously something very attractive to Chinese investors about modern, westernised cities with harbours on the Pacific.

The Seattle Times reports on a surge of cash-buying of properties in the West Coast city from Chinese investors.

China’s superrich, who have historically been drawn to San Francisco, Los Angeles and Vancouver, B.C., are investing in Seattle-area real estate in growing numbers, buying multimillion-dollar homes, rent-producing properties and land for commercial development.

In the process, they are accelerating the real-estate market’s recovery, sometimes edging out other buyers with all-cash offers, and deepening ties between Seattle and China.

While exact numbers are hard to obtain, local real-estate agents, bankers and China experts say there’s been a definite increase over the past year of rich Chinese nationals shopping for homes here, mostly on the Eastside.

5. A legal battle over the euro - Ambrose Evans Prtichard paints a dramatic picture at the Telegraph of the battle in the German constitutional court over the European Central Bank's euro-saving tactic of promising to buy all the bonds in Europe.

The two-day hearings at the constitutional court in Karlsruhe will investigate the legality of the OMT, the “game-changer” that defused the EMU debt crisis last July and has been so successful that no country has yet needed to use it. The case stems from complaints by 37,000 citizens, including the Left Party, More Democracy and eurosceptic professors, most arguing that the ECB is financing bankrupt states.

While the court has no jurisdiction over the ECB, it could prohibit the Bundesbank from taking part in bond purchases. This amounts to the same thing, since the OMT would collapse if Germany stepped aside.

6. China's middle class - Here's a useful study from McKinsey of the growth of China's middle class, which New Zealand has bet its future on.

One message from this for New Zealand exporters and tourism operators: have you built a website that Chinese consumers can read on their smartphones?

Our latest research suggests that within the burgeoning middle class, the upper middle class is poised to become the principal engine of consumer spending over the next decade.

As that happens, a new, more globally minded generation of Chinese will exercise disproportionate influence in the market. Middle-class growth will be stronger in smaller, inland cities than in the urban strongholds of the eastern seaboard. And the Internet’s consumer impact will continue to expand. Already, 68 percent of the middle class has access to it, compared with 57 percent of the total urban population.

Along with affluent and ultrawealthy consumers, upper-middle-class ones are stimulating rapid growth in luxury-goods consumption, which has surged at rates of 16 to 20 percent per annum for the past four years. By 2015, barring unforeseen events, more than one-third of the money spent around the world on high-end bags, shoes, watches, jewelry, and ready-to-wear clothing will come from Chinese consumers in the domestic market or outside the mainland.

7. Inside China's debt bubble - WSJ reports here on audit reports from inside some of China's local government debt mountains.

It's not a pretty picture.

While local governments can’t borrow funds themselves, they typically get around those restrictions by having government backed investment platforms – called local government financing vehicles – or quasi-government agencies borrow instead. The local government is still indirectly responsible for the debts, however.

The audit found that the 36 governments had taken on debt totaling 3.85 trillion yuan ($624.6 billion) as of the end of last year, up 12.9% from the end of 2010. The last such audit measured local government debt as of the end of 2010. The audit office said there had been some improvements since the end of 2010, with 24 governments having posted a reduction in their debt levels relative to their total fiscal resources. But it also said that the outstanding debt of nine provincial capitals at the end of 2012 was greater than their fiscal resources, with the level of one city reaching almost 190%, a level that rises to 220% if you take into account promises the government had made to guarantee the debts of other institutions.

The report also said that the interest and principal on loans that needed to be repaid at the end of last year by 13 provincial capitals – out of 15 in the sample – was equivalent to 20% of their fiscal resources, with the level reaching as high as nearly 68% for one unnamed city. Analysts say that in recent years, revenue for many local governments haven’t been enough to cover ordinary expenses such as wages and services, let alone debt repayments.

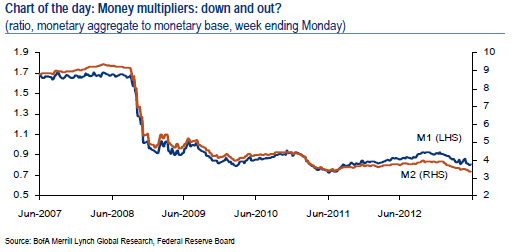

8. Money multipliers - We were all taught that that the stock of money times the money multiplier equalled economic activity. The trouble is the stock of money may have risen sharply in the last five years of heavy money printing, but it's not circulating as fast.

Here's Izabella Kaminska at FTAlphaville with a discussion and a juicy chart on the conundrum.

Markets and the financial press continue to be consumed by speculation about the Fed’s next QE3 step. But while the Fed has pumped nearly $2 trillion into the economy since 2008 through its asset purchase programs, broader measures of the money supply have not risen anywhere near as much. Indeed, as the Chart of the day shows, both the M1 and M2 money multipliers collapsed with the financial crisis and have since trended mostly lower.

Indeed, at 0.8, the money multiplier for M1 is arguably really a divisor. Since late last year — with the launch of QE3 — the multipliers have started declining again, with the M2 multiplier reaching its lowest value ever in mid-May.

9. Marx was right - About some things. Even the former chief economist of Goldman Sachs, Gavyn Davies, is worried in this FT blog about the rise in the share of income now going to profits and the mirror image fall in the wage share.

The gross profit share in the advanced economies has risen by about 10 percentage points of GDP over three decades, and the wage share has fallen by the same amount (see this analysis just published by the International Labour Organisation, well summarised by Timothy Taylorhere).

This is an enormous upheaval in the distribution of income in the global economy, and it has happened in an almost continuous straight line over the entire period. It seems to have been impervious to every kind of shock, including the decline in inflation, the technology bubble, the arrival of the BRICs, the collapse in the global financial system and two successive Ashes victories for England against Australia.

10. Totally Clarke and Dawe on the apparently obvious result of the September election.

47 Comments

Sorry off topic a bit, I saw AndyH referring to Egypt yesterday, well how about this: http://www.guardian.co.uk/world/2013/jun/13/ethiopia-egypt-nile-water-dam

Yes, Egypt's position gets worse and worse - it is not inconceivable that they will take military action against Ethiopia - the first (and I doubt the last) of the new century's 'water wars'. Israel must be viewing this all with some alarm - a disintergrating state to the east of them (Syria) may soon be followed by a failing state to the west of them (Egypt).

Worth keeping in mind that Sudan sits between Egypt and Ethiopia. Where does all this leave them?

Overflown by Dambuster aircraft?

Andy - you'd make a great Father Berkenkopf :)

Gareth is that the Sudan with the genocide and the oil and the aids and stuff? Surely they'll be a stabilising influence....

Yes. Thank your lucky stars you live in NZ; however lets try and learn from all this and not go down the road of fouling/overpopulating our own sweet nest.

#1 There is plent y of inflation....14% house price gains nationally, perhaps 20% in Auckland. China is a huge propery bubble stemming from mercantilist practises, not to mention huge overcapaciy in manufacturing.

#9 Yet on the other hand profits for the rich are soaring. Any wonder? Flood Wall St with $85bn month and that is a lot of lubricant. (but of course no inflation there)

Face it, we have all sorts of contadictions in the economy...hell I'm not sure the US can even measure it accurately. Revisions are mostly down.

Time for a time out from Keynesian claptrap and a return to market interest rates and budgets that are balanced. Spending that is necesary must be taxed for.

Cheers

NZ manufacturing running hottest since 2004:

http://www.nbr.co.nz/article/nz-manufacturing-climbs-9-year-high-may-le…

Astonishingly Spanish house prices are now crashing at the FASTEST rate on record:

http://online.wsj.com/article/SB100014241278873237343045785428902356775…

"'According to data released Thursday from the National Statistics Institute, or INE, house prices in the first quarter dropped 6.6% from the fourth quarter, the fastest pace since it began collecting house price data in 2007. The annual pace of decline was 14.3% compared with a year earlier, accelerating from 12.8% in the fourth quarter.""

That will put even more pressure on the insolvent Spanish banks.

Its a good job the Eurozone crisis is over, thats all I can say.

and the dutch story is very similar, yet they are not a PIIGS.

After a housing boom lasting almost 15 years, the Dutch housing market started to become weak in 2008, mainly due to the global financial meltdown.

- In 2008, house prices fell by 5.3% (-7.5% in real terms)

- In 2009, house prices dropped by 1.5% (-2.4% in real terms)

- In 2010, house prices rose slightly by 1% (-0.7% in real terms)

- In 2011, house prices dropped by 3.8% (-6.2% in real terms)

- In 2012 When adjusted for inflation, house prices in the country actually dropped by 9.14% over the same period.

http://www.globalpropertyguide.com/Europe/Netherlands

that is an accelerating downward trend....

and lets not mention Ireland's housing market....no lets,

"This was 54.8% down from its peak levels seen in 2008."

http://www.globalpropertyguide.com/Europe/ireland/Price-History

So if ppl have or had 90%+ mortgages they are all now under water, what % of the spanish market is that? 10%? 15%? As you say what state really are the spanish/ducth banks really in?

cant happen here of course, nope, never, HughP and Vera wont let it.

Lets compare London to Auckland,

"It is the strength of demand from overseas buyers that has driven up prices in central London boroughs and underpin this market," said Lindsay Cuthill, the head of Savills Fulham. "Prime areas – like Chelsea, Westminster, Hammersmith, Camden and Fulham – have a relatively low correlation with the rest of London, let alone the rest of the country, suggesting they really are in a world of their own."

http://www.globalpropertyguide.com/Europe/United-Kingdom

sounds familiar.

regards

PS I did mention I thought 60%~75% loss was possible in NZ, if Ireland is any indication that is a real world example unfolding.

This actualy has a very interesting set of charts on house prices over 5~6 years on a per country basis. I assume they are all normalised against each other so prices can be compared.

http://www.globalpropertyguide.com/real-estate-house-prices

#9. Marx was indeed right. And it's pertinent to the continuous debate here about foreign ownership. Marx basically said the the benefit always and ultimately flows to the owner.

Maybe thats wise guidance. Selling a productive asset might seem beneficial at times. Thats a common view in New Zealand. But I believe that the 'good deal' sale in the short term, does not stack up in the long term if you are selling productive assets.

New Zealanders don't get this (well MdM doesn't) But other cultures do. The chinese, for example, understand where the benefit lies. And thats in ownership.

So as a nation of people we need to own our own stuff, farms and companies. Or we are screwed.

http://socialsciences.arts.unsw.edu.au/tsw/WhyMarx.html

But Trainer points out Marx is a bit thin on ultimate scarcity. Watch out - there's a lurker hereabouts who comes from the McCarthy school, you'll unleash a tirade....... :)

Apart from malthus not many "economists" have actually considered this, we had Hubbert, then the "limits to growth" who clearly laid it out, all ignored or poo pooed....even today we have the ignorant, denialists and fanatical in droves......then the religious and cultural aspects that have locked in expansion....

To be fair on Marx he was really writing on aspects of an economy and didnt do a bad job considering there was so much void. Interestingly I also read some words by Keynes and I wonder if he didnt see this, just didnt come out with it up front.....

regards

Apart from malthus not many "economists" have actually considered this, we had Hubbert, then the "limits to growth" who clearly laid it out, all ignored or poo pooed....even today we have the ignorant, denialists and fanatical in droves......then the religious and cultural aspects that have locked in expansion....

To be fair on Marx he was really writing on aspects of an economy and didnt do a bad job considering there was so much void. Interestingly I also read some words by Keynes and I wonder if he didnt see this, just didnt come out with it up front.....

regards

Referencing Malthus, approvingly.....?

In-freakin-credible.

This is like praising the insight and credibility of the Decca A&R executive who didn't sign the Beatles........."I didn't like their sound....bands with guitars are on their way out....."

Steven - if you've got a psycologist in your circle of acquaintances, run some of his venting past them.

As for Malthus, the one thing that has thus far kept us from the reaches of his math, is the exponentially-increased application of energy to the system. Interesting to see that some folk address energy, but only in terms of 'buying' it. Apparently, if you have more money, you can just buy more energy. And more and more and more and more. While you're doing it, you can get more efficient, and more and more and more efficient, apparently indefinitely. This all enables us to support more and more people on our planet, apparently indefinitely. Just like that. Incredible. Haiti can't be a case of too many people depleting their already-depleted forests to cook every day, it must just be a lack of moolah in their pockets. They wouldn'y be competing with others for anything, you understand, there would just be more for them to 'buy' because they have more money. Who'd have though it? I must have missed something, somewhere.

:)

You definitely have missed something. I do agree that Haiti and presumably Easter Island, are cautionary models even for far more advanced civilisations that have got far beyond the phase of "we're stuffed at the point at which we use up the wood", but for different reasons to you.

The point is, that if it was not for a culture of scientific inquiry and commercialisation of technology via "capital" and property rights and contract law, every society in the world would have died out at the point at which they ran out of a basic resource. Population, under these conditions, is self-balancing. Humanity existed for millennia under these conditions. Easter Island and Haiti were replicated countless times all over the world.

The point at which western civilisation becomes so decadent that it "educates" its young people with propaganda that turns them against the culture that enabled their ancestors to break out of the ancient paradigm, western civilisation is also stuffed.

Followers of this forum need to be cautioned that if you sincerely believe what you are saying, then the reason you live on a lifestyle block but support high density urban growth containment for everyone else, your underlying motive is probably that you want a speedy death by starvation to come to everyone else after the great post-energy crash of civilisation. Everything you say needs to be viewed through that understanding of the kind of person you are.

Philbest

Folk here have probably had enough of me having to explain the difference between warning about something, and wishing for it.

I warn.

You are about the last to get that - it's time we moved on, it would be a solid rubber tyre in the boot of a Jappo import, which everyone would appreciate.

Haiti were pretty much unique in the world, in that when their rebellion successfully threw out the slave owners they were forced by France to agree to pay reparations to the slave owners. 90 million gold francs, approx. 21 billion in todays money though in 1838 this was reduced to 60 million francs payable over 30 years (however the French government acknowledges payment of 90 million, the last payment in 1947). From 1957 - 1980 there was the corruption of the Duvalier family, estimated at having about doubled the countries debts.

As the most significant difference in history between them and all the other Carribean countries, any consideration about the resources they can bring together as a nation to support themselves (and the differences with other Caribean countries) needs to factor how much of their resources has been shipped off paying debts.

For that matter, of the island Haiti is on, the other two thirds of the island is the Dominican Repubic, which makes this a classic example of the poorer, less educated Haiti having a larger population density.

".....The gross profit share in the advanced economies has risen by about 10 percentage points of GDP over three decades, and the wage share has fallen by the same amount....."

Yes, but I argue that the increased share going to "profits" is NOT going to the employers of Labour.

The "share of total profits in the economy taken by FINANCE" has risen in the USA, to nearly 50%. A few decades ago it was closer to 10%.

I think Marx was right about economic land rent; but it is not like he was a controversial outlier on this - it was his solution, nationalisation, that was controversial. Every classical economist agreed that rising incomes would be disproportionately captured by the land rentier class. Henry George advocated land value taxes.

It was far better understood back in those times, when these debates were fresh, that improved transport systems that made more land accessible to more participants in the economy, would dilute economic land rent. This is what rendered Marx irrelevant for decades. Deliberate policies of urban growth containment is what has restored economic land rent to a problematic position, and allowed the finance sector to become a cancer on the economy.

Henry George correctly pointed out that the employers of labour were mostly unfairly targeted by the political representatives of "labour", when in fact both of them had vital interests in common against the land rentier and financier class.

We see the same perverse and destructive thinking at work today - "look, the wages share of the economy is falling and the profits share is rising, we must screw those evil employers" - this at a time when employers are shutting up shop because they can't handle the cost pressures any longer, and switching to speculation in land or financial instruments pays off.

And the land rentier class and "big finance" are laughing all the way to the bank.

Thank you Phil. I suppose I am saying there are owners and 'ultimate owners' Which ties in with your explanation. For example you might have a clever large retail business in a mall. You are an employer and a business owner. But if, say, your town grows and your business booms, you wiil find your rent increases. You are not the 'ultimate' owner. You will find your rent increases to the maximum, or just short of that, which does keep you in business but not really making the big money. You are just a go between.

Marx felt the worker/owner thing would reach the point where revolution was inevitable. But what I take from him is the approach that as a individuals we need to own our own businesses, farms and infrastructure. I use Marx's thought on that and act local.

I hold no great belief in Government ownership. Look at electricity prices being 250% of what they should be. Government ownership has been rorting us, just as rapaciously as any private enterprise will. Although there are some things -airport - roading - which we all need to control rigourously and have absolutely working for our joint selfish benefit.

Another way of looking at this is the research about company / managerial behaviour. What this says is that companies try to tell us they are seeking efficiency. But are doing no such thing, in actual action they prefer control. Given the choice between efficiency and control, they will choose control every time. (if they are competent)

Investment advice you here shows this - where companies who can control their market, either through natural monopoly or legislative monopolies (funny - electricity comes to mind) are the successful ones.

Control is where the benefit - the money is - and control = ownership.

Culturally Chinese and others understand this. Kiwis have yet to. Acknowledging the generalisation.

A favourite quote of mine is from Cheshire and Mills, (eds) in the Introduction to “the Handbook of Regional and Urban Economics” Volume 3, 1999:

“…….If we compare communities in the US and UK that are as comparable as possible except for the constraints their systems of land use regulation place on the supply of land, we observe that the price of retail land is up to 100,000 times higher in the most constrained community…...."

And Mason Gaffney, 1964, "Containment Policies for Urban Sprawl"

".........Employers, merchants, and assorted rent-collectors are generally happy with policies that keep out untrained interlopers who might have alien ideas about competing for labor, tenants, and customers, and in general keeping the natives restful in their compounds. Negative growth containment policies have an instinctive fascination for anyone whose interest is to limit competition.

There are many groups which would like to limit competition, of course. But cities tend to fall most strongly under the sway of those who stand to gain or lose most by municipal decisions, and those whose assets are irrevocably committed to the city, that is, the landowners. The rest of the citizens are 'by comparison mere transients, outsiders and climbers whose organization and influence is seldom commensurate with their numbers.

To the dominant landowning oligarchy, few limitations on competition commend themselves with quite the same force of logic as limitations on the entry of new lands into urban use. It is therefore no accident that negative containment is the most respectable and salable kind of planning in many quarters. It harmonizes all too mellifluously with the interest of a dominant class. But from the viewpoint of social economy, of other interest groups, of the general welfare, of the region, state, and nation, and even of most urban landowners in their roles as workers and capitalists, negative containment is an instrument of monopoly exploitation......"

You get the idea. I find it deeply ironic that the politicians in every western country who CLAIM to care about "the poor" and "the worker", have the most blind faith of all regarding growth containment urban planning, and can never be persuaded that this is responsible for the greatest harm to their constituents that can be imagined from any deliberate racket at their expense. "Tory" politicians tend to understand it better, but seldom want to scare off their supporters in "big property" and "big finance".

It is the economic libertarians who are the workers only hope in this issue.

The trouble is Phil that low density combined with the motor car destroy to society which is needed to fight the rent collectors. PDK talks about the energy side but the car is also anti-social, cars and people do not mix together. Every motor car trip takes away the opportunity to meet people and converse, we don't know our neighbours anymore. There is a loss of spatial intelligence when you travel in a motor vehicle, or indeed stay cocooned up in your house watching TV or browsing the internet. Take the time to think about the potential human interactions that have been taken away by the modern lifestyle. Low density exacerbates the problem. There is no potential for the cohesion or unity required to force change, all we get is unaccounable and remote leaders who are socially removed from their constituents.

On the subject of the social cohesion of society relating to urban density, there are two papers by Glen Bramley and Sinead Power (and other co-authors) on “Social Sustainability and Urban Form”; and one by Glaeser and Gottlieb on “Urban Density and Civic Engagement”, and one by Brueckner and Largey on "Social Interaction and Urban Sprawl"; that do not find any correlation in favour of higher density. The Glaeser and Gottlieb paper comprehensively debunks Robert Putnam’s famous “Bowling Alone” paper, but that has not stopped advocates of higher density referencing it constantly.

Robert Fishman, in “Megalopolis Unbound” argues (correctly in my opinion) that modern social networks are “a la carte” and based around the motor vehicle and modern communications. Out of every household, there will be members networking with other sports players, with other musicians, with other fishermen, with fellow professionals, with workmates, with church members, with chess players, with schoolmates, with other parents of same-age children, with debating societies, with Kiwanis-type organisations, with political party members, etc etc etc.

The “a la carte” urbanism of automobile dependent society is far richer than its critics looking on from afar can discern.

High urban density is marked just as much by inter-neighbour conflict as by positive interaction. Well separated private properties enable every household to pursue its own interests without giving its neighbours cause for objection. Patrick Troy has some choice comments about all this in his book “The Perils of Urban Consolidation”. He describes a certain "nostalgia for a romanticised past that never existed".

I would suggest the reading list is substantially weighted against you, perhaps I will take the time to compile one. But since I am not clipping the ticket for my point of view it will have to wait until I can find the time. Hugh is notable for his tunnel vision in the selection of his reading. Do you realise you fight crime statistics in relation to density? The other thorn in your side is the massive change brought about in New Zealand by the clamp down on drink driving, which decentralised the traditional swill house to smaller boutique bars and cafes withing walking distance. When next in Auckland can I suggest to spend a Friday night at the Portland Public house in Kingsland, ironically a "local" type of establishment pioneered by an Englishman. That sort of establishment doesn't happen in the outer suburbs.

What is also indisputable is that when a car hits a pedestrian the pedestrian comes of second best, could also relate to a cyclist.

The other problem with what you and Hugh constantly present is that there actually aren't any good examples of urban living in the motor vehicle dominated new world. So the claimed preference for the detached suburban house is actually nonsense.

Scarfie get real. You say "there actually aren't any good examples of urban living in the the motor dominated new world" Pardon ?

The examples are legion. There millions of people and families who are just lapping up suburbia and having the the time of their lives.

So exactly where are there cities with densities of 30-60 people per acre (for 18 hours per day) with mixed use zoning where people can walk or cycle to work, school, shopping or recreation? Where are the publicly owned spaces that permit community to happen? But your answer demonstrates that you can't conceive an alternative to the status quo.

Scarfie, I know the following will be wasted on some of my opponents on this forum, but you are different. Ironically, it is in cities where the land is cheap everywhere and employment and other amenities are dispersed, where almost anyone can afford to relocate relatively close to any job they might take, or schools or other amenities they desire. This is what underlies the remarkably stable commute to work times in the highly dispersed cities - which happen to be no worse than commute to work times in long-time deliberately growth-constrained cities such as the UK's. I have pointed out before the gross "pricing out" effect in unaffordable-housing cities that forces people into ultra long commutes and robs them of precious social time as well as increasing their "housing plus transport" cost options almost exponentially.

I agree that much of the development I see as economically and socio-economically beneficial, could have been better designed, without spoiling its economic and socio-economic benefits. If a city has abundant nodes of "walkability" as well as low land costs, this is all part of the dispersion of amenities that maximises choice for those who want it. Nodes of high amenity, including "walkability", in inflated land cost cities, tend to be highly exclusionary in their pricing. And the inflated land costs result in new developments lacking amenities of all kinds that need land in the development to be sacrificed to non-saleable uses, which would inflate the price of the lots are are created and sold. A developer who has paid $1,000,000 per acre for the land is going to be a lot more reluctant to sacrifice space to something other than lots, than a developer who has paid $10,000 per acre. "The Woodlands" is an example of the latter. Examples of the former, are the ghastly suburban developments with 10 units per acre crammed in in cul-de-sacs (to eliminate space lost to intersections), footpaths as narrow as possible, roads as narrow as possible, minimal green space or public space, etc. Cycle lanes? Ha ha...... Think this through. If a developer who has paid $1,000,000 per acre, has to sacrifice one third of the total space to non-saleable uses (and one third is extremely low in real life), it will increase the "raw land" COST of every 1/10 of an acre lot from $100,000 to $150,000. If a developer who has paid $10,000 per acre sacrifices 2/3 of the total space, often voluntarily, to increase local amenity, it will increase the cost of every 1/2 acre lot from $5,000 to $15,000. Developers know that the kind of amenity created by half-acre lots and plenty of public space per household on top of that, at a cost of only $10,000 per lot, is easily recaptured in the selling prices of the houses built. The cost of infrastructure and services is about $5000 per house higher; also easily recaptured in the selling prices. In "The Woodlands", the developer actually gifted developed commercial sites to desirable employers. Jobs-housing balance was nearly instantaneous. I have been interested to note recently that Philadelphia, population 6.5 million, has generally affordable housing, has very low average density, yet has impressive walking, cycling, and public transport mode shares that actually come close to megabucks, ultra high density, Manhattan. Why? Because anyone who wants to choose to live at a location where they can exist by walking, cycling and catching transit, can afford to do so at one of the many such affordable locations. These locations are affordable because there are plenty of them, and because the land is cheap, and because there also exists, unrestricted low density fringe sprawl for the people who want to live that way. Working with rather than against the free market, actually delivers better outcomes in the very things planners claim to be seeking, than blunt-instrument planning mandates that have abundant inintended consequences.Oh I understand now Scarfie. There is absolutely nobody or family having fun in Mosgiel, Papamoa, Avondale or Henderson. I know that because you told me. Funny - but I keep bumping into them at barbeques and places. They must be paid actors.

None of those places fulfil the requirements I outlined so I don't know what you are on about. How did all those people get to the barbeque?

Drove to the BBQ in the family SUV Scarfie. Laughing all the way. Except when Mum growled at the six year old about being slow with the seatbelt, and Dad swore about the idiot parker in the supermarket parking lot when they stopped by for the Savvy B and the steaks.

Despite all the laughing they do I understand your wisdom now and see that they are really having an awful time. Suburbia must be terrible.

KH, if you jumped of a cliff, you could party all the way to the bottom, its only that last bit that hurts, a lot.

In terms of surburbia, ppl I talk to are going through 1 to 1.5 tanks of petrol a month...and that at $2 a litre taking money out of their pockets. Id also suggest that the poor tend to live quite far out as well as that is where the lower cost housing was it hurts them even more.

The Exchange rate is dropping thats going to send petrol up again. In the last 2 years you can no longer park outside the train station and even my house now because of the commuter cars. Something is giving when ppl are saving on the $200 odd a month parking in the CBD and spending it on monthly passes at $110....or actually now 10 trip tickets are rather common, I wonder how many in surburbia and really lapping it up....20 years ago, 40 years ago, yes sure.....

The one man band's of self-employed I know are also saying the same thing, ie patrol/diesel is eating their profits...

Sure the rich I accept are doing well, they earn off the incraesing debt.

regards

Yeah, so we impose planning mandates to "save" people from these dreadful petrol costs, that increases their housing costs by about five times as much as those petrol costs, and "prices them out" to locations where they have to travel five times as far as well. EG all the young people buying houses in Thames right now and commuting to Auckland - when affordable housing could have been built 1/10 of the distance away from the city.

Really, really CLEVER.

NOT.

Guess why they use a lot more petrol in the US cities that have affordable housing?

The false narrative is that these cities are lower density and therefore the residents have to travel a lot further to work. This is balls.

It is simply that everyone in those local economies has a heck of a lot more money left over after housing costs. They will be spending more on health, education, hobbies, recreation, food, clothing, and other discretionary items as well as discretionary petrol consumption (dropping kids off at the sports stadium, buying a bigger vehicle, etc - even "having kids in the first place").

And one of the classic uses of the large backyard, is the social-gathering barbecue.

"Recloose": "Mana's Bounce"

http://www.youtube.com/watch?v=YFzkHfEG0a8

Are you prepared?

"Citigroup warned in a new report that surging SHIBOR rates will cascade through the banks and damage growth later this year, with knock-on effects for commodity prices and emerging markets worldwide"

http://www.telegraph.co.uk/finance/china-business/10120716/China-braces-for-capital-flight-and-debt-stress-as-Fed-tightens.html?placement=mid2

Yes, but for what exactly?

LOL

Lots of other emerging markets are also seeing $s extracted (Brazil, Turkey(?)), I assume the USD will "magically" strengthen, unlike Peter Schiff's forecast, perverse in some ways but i dont think financial markets have ever been logical its all relaitive...Nicole Foss's predictions are starting to look really convincing...

So is this the start of the re-run of 1929? looks like it.....NZD could drop somewhat....

This is so much fun!......NOT.........

regards

I do see a close similarity to 1929, for a reason almost no-one else is spotting. 1929 was the last time for decades that urban land prices were part of the bubble.

The economic cycle of boom-bust tended to leave out urban land, for some decades; and everyone got casual about how easily bubbles and busts in the share market could be shrugged off by the economy.

Now that urban land prices are back with a vengeance as part of the bubble cycle, expect similar severity to the aftermath of 1929. Spain and Ireland are certainly proof.

The USA is not so severely affected because it did have dozens of cities and States that were not affected.

The reason for this, and the reason for urban land escaping the bubble-bust cycle for so many decades after WW2, was high elasticity of supply due to automobile based development.

I was very encouraged recently, to have evidently succeeded in convincing none other than the great Ed Glaeser with this argument; he has come around to this way of thinking:

http://www.macrobusiness.com.au/2013/05/ignoring-the-land-price-gorilla/#comment-248361

And more very helpful confirmation comes from a Prof. Nicholas Crafts of the University of Warwick:

http://www.macrobusiness.com.au/2013/05/ignoring-the-land-price-gorilla/#comment-248360

He points out that the UK actually had a brief phenomenon of development of affordable housing in the 1930's; which was curtailed for all time by the Town and Country Planning Act of 1947.

Conventionally 1929 and 2008 would be seen as the end of the 2 gilded ages where crazy debt driven ponzi schemes and speculation, popped. So really a/the housing bubble is a symptom and not a cause.

regards

It's a "symptom" same as share market bubbles and crashes are.

There have been "monetary cycles" for most of the last century.

They have included urban land price inflation sometimes and not other times.

The correlation is with elasticity of housing supply. This explanation holds good accross multiple different nations and different policy settings at different times.

Like I said, Ed Glaeser understands me. If you don't, that certainly is not going to make me doubt my grasp of the subject. It just tends to confirm my impression of your capability of grasping anything to do with economics, and your largely time-wasting irrelevance to this forum.

Regards

Its nice for you that someone else "understands me" Simple answer yes I dont grasp the economics model that is in your head it seems to be some austrian/mises but mostly made up as you go long, very uh Republican of you....

regards

Keep going, Steven, you are digging yourself deeper and deeper into a hole of consummate, unmitigated incompetence.

I am talking about the elasticity of supply of urban land, and you tell me I am "making up Austrian/Mises stuff"............

You evidently haven't even got a clue how irredeemably stupid you look in the eyes of anyone that knows much at all about economic theory, by making a comment like that.

I wish there was a kind of entry exam that one needed to pass to be allowed to comment on this forum. But I suppose some useful role is performed by terminal economic idiots who are beyond self-parody, because hopefully the kind of politics they support are discredited by their very association with it.........!

You aren't Russell Norman's chief economics advisor by any chance, are you?

Whats with the constant tirade? you are losing the plot, try putting forward arguments.

Entrance exam, indeed, that would be great, depending on who set the exam of course.

Fortunately this is a forum where economics does count and isnt your libertarian/mises viewpoint forum.

and No, I quit the Green party last year, I joined it to support Green things and not left wing things and buying votes.

regards

Full marks for bluff, Steven.

Zero for substance.

Give up. You can't even pretend to understand economics. You're only hurting the causes you claim to stand for by displaying such ignorance and then trying to bluff and bluster an appearance of confidence.

The political consequences, in history, of your type getting political control, has been sheer hell for the poor people under it. It is wrong to merely "pity" your type. You are a public danger.

dp

dpx2

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.