By John Hawkins*

Bitcoin boosters like to claim Bitcoin, and other cryptocurrencies, are becoming mainstream. There’s a good reason to want people to believe this.

The only way the average punter will profit from crypto is to sell it for more than they bought it. So it’s important to talk up the prospects to build a “fear of missing out”.

There are loose claims that a large proportion of the population – generally in the range of 10% to 20% – now hold crypto. Sometimes these numbers are based on counting crypto wallets, or on surveying wealthy people.

But the hard data on Bitcoin use shows it is rarely bought for the purpose it ostensibly exists: to buy things.

Little use for payments

The whole point of Bitcoin, as its creator “Satoshi Nakamoto” stated in the opening sentence of the 2008 white paper outlining the concept, was that:

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

The latest data demolishing this idea comes from Australia’s central bank.

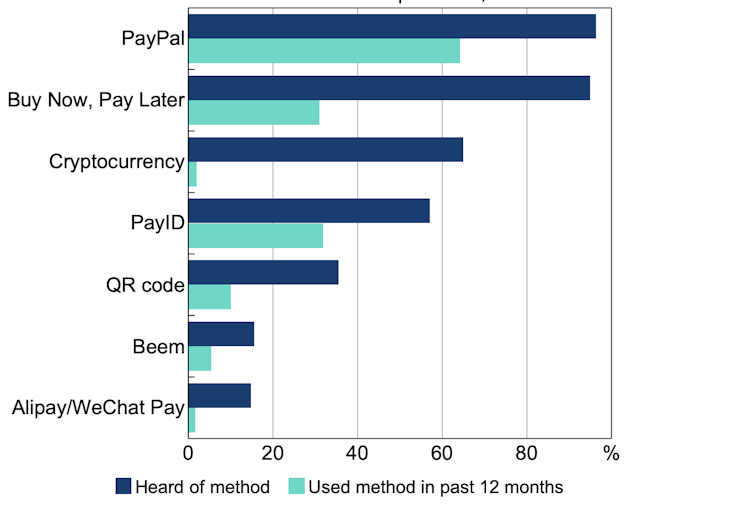

Every three years the Reserve Bank of Australia surveys a representative sample of 1,000 adults about how they pay for things. As the following graph shows, cryptocurrency is making almost no impression as a payments instrument, being used by no more than 2% of adults.

Payment methods being used by Australians

By contrast more recent innovations, such as “buy now, pay later” services and PayID, are being used by around a third of consumers.

These findings confirm 2022 data from the US Federal Reserve, showing just 2% of the adult US population made a payment using a cryptocurrrency, and Sweden’s Riksbank, showing less than 1% of Swedes made payments using crypto.

The problem of price volatility

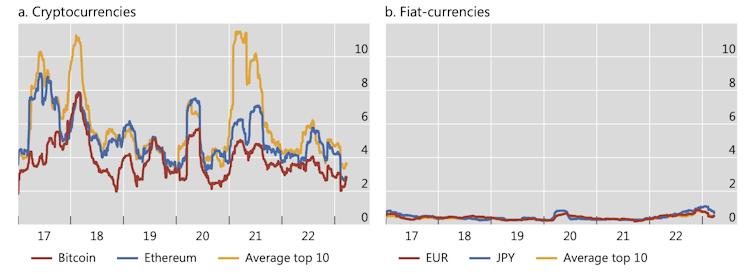

One reason for this, and why prices for goods and services are virtually never expressed in crypto, is that most fluctuate wildly in value. A shop or cafe with price labels or a blackboard list of their prices set in Bitcoin could be having to change them every hour.

The following graph from the Bank of International Settlements shows changes in the exchange rate of ten major cryptocurrencies against the US dollar, compared with the Euro and Japan’s Yen, over the past five years. Such volatility negates cryptocurrency’s value as a currency.

Cryptocurrency’s volatile ways

There have been attempts to solve this problem with so-called “stablecoins”. These promise to maintain steady value (usually against the US dollar).

But the spectacular collapse of one of these ventures, Terra, once one of the largest cryptocurrencies, showed the vulnerability of their mechanisms. Even a company with the enormous resources of Facebook owner Meta has given up on its stablecoin venture, Libra/Diem.

This helps explain the failed experiments with making Bitcoin legal tender in the two countries that have tried it: El Salvador and the Central African Republic. The Central African Republic has already revoked Bitcoin’s status. In El Salvador only a fifth of firms accept Bitcoin, despite the law saying they must, and only 5% of sales are paid in it.

Storing value, hedging against inflation

If Bitcoin’s isn’t used for payments, what use does it have?

The major attraction – one endorsed by mainstream financial publications – is as a store of value, particularly in times of inflation, because Bitcoin has a hard cap on the number of coins that will ever be “mined”.

As Forbes writers argued a few weeks ago:

In terms of quantity, there are only 21 million Bitcoins released as specified by the ASCII computer file. Therefore, because of an increase in demand, the value will rise which might keep up with the market and prevent inflation in the long run.

The only problem with this argument is recent history. Over the course of 2022 the purchasing power of major currencies (US, the euro and the pound) dropped by about 7-10%. The purchasing power of a Bitcoin dropped by about 65%.

Speculation or gambling?

Bitcoin’s price has always been volatile, and always will be. If its price were to stabilise somehow, those holding it as a speculative punt would soon sell it, which would drive down the price.

But most people buying Bitcoin essentially as a speculative token, hoping its price will go up, are likely to be disappointed. A BIS study has found the majority of Bitcoin buyers globally between August 2015 and December 2022 have made losses.

The “market value” of all cryptocurrencies peaked at US$3 trillion in November 2021. It is now about US$1 trillion.

Bitcoins’s highest price in 2021 was about US$60,000; in 2022 US$40,000 and so far in 2023 only US$30,000. Google searches show that public interest in Bitcoin also peaked in 2021. In the US, the proportion of adults with internet access holding cryptocurrencies fell from 11% in 2021 to 8% in 2022.

UK government research published in 2022 found that 52% of British crypto holders owned it as a “fun investment”, which sounds like a euphemism for gambling. Another 8% explicitly said it was for gambling.

The UK parliament’s Treasury Committee, a group of MPs who examine economics and financial issues, has strongly recommended regulating cryptocurrency as form of gambling rather than as a financial product. They argue that continuing to treat “unbacked crypto assets as a financial service will create a ‘halo’ effect that leads consumers to believe that this activity is safer than it is, or protected when it is not”.

Whatever the merits of this proposal, the UK committtee’s underlying point is solid. Buying crypto does have more in common with gambling than investing. Proceed at your own risk, and and don’t “invest” what you can’t afford to lose.![]()

*John Hawkins, Senior Lecturer, Canberra School of Politics, Economics and Society, University of Canberra. This article is republished from The Conversation under a Creative Commons license. Read the original article.

69 Comments

Said it before and i'll say it again. An article on Bitcoin from someone working at a Central Bank is like asking a person working at Blockbuster if they think Netflix is a good idea.

Todays Price: $48,820 NZD. Bitcoin Runtime: 5285 Days

48820 / 5285 = $9.23 NZD increase per day.

Totally depends on when you purchased it, you must have missed the bit above about all the people that lost money between 2015 and 2022. The fact the high was $67K and now its only $30K tells you all you need to know.

If you bought in 2015 when BTC was around $200 nzd and have lost money I don't know what to say

An article on Bitcoin from someone working at a Central Bank is like asking a person working at Blockbuster if they think Netflix is a good idea.

You can equally question any Bitcoin spruikers words because of their vested interests.

For around a decade I've been hearing all these arguments about 'why bitcoin', and most of them havent come to pass. Its barely being used as money for the purchase of goods and services, and more as a collectable.

Pointing out the appreciation of BTC isn't an endorsement for it as actual currency, just that enough people think it might be at some point. It's worth what, about the same as Microsoft?

Said it before and i'll say it again. An article on Bitcoin from someone working at a Central Bank is like asking a person working at Blockbuster if they think Netflix is a good idea.

John Hawkins is no longer working at the RBA, BIS, Treasury, or the Hong Kong Monetary Authority.

Surplus to requirements.

He's now an 'assistant prof.' Big come down.

Lol, If so confident would you be willing to buy bitcoin at a bargain price off me with delivery in the future? Effectively an options contract..... I'd offer a purchase price of 25% of market price in USD and delivery 25 years after contract start. Any sane person would take that same deal on Cocacola shares for example. Thus would you take it on, buy 10 Bitcoins off me now for 75% discount with delivery in 2048? Im thus willing to bet i can pick them up for nothing in 25 years.

No sane person would take the same deal on Cocacola either.

The danger with Crypto is when cash dry's up and that's exactly what is happening right now. Because its not a currency people will be pulling their "Money" out to pay the bills. Its just a matter of time before there is a massive run on Bitcoin. Just watch those exchanges suddenly shut up shop and stop you getting your cash back because there is not anything backing it up.

I agree, the fundamental issue with cryptocurrency is the fact it is not a currency.

If it is not a commodity, and not a currency - then what is it?

digital casino chip.

A collectable. Like beanie babies or baseball cards. But without the variation or exclusivity.

A whole bunch of millennial and gen Z males are going to wake up one day in their 40s and 50s and question why they expended so much of their mental and financial energy on something that does nothing.

Beanie babies were awesome

Its a "speculative asset". You rely on the bigger fool theory with a whole lot of greed thrown in for it to increase in perceived value.

If it is not a commodity, and not a currency - then what is it?

https://www.cnbc.com/amp/2015/09/18/bitcoin-now-classed-as-a-commodity-…

https://cointelegraph.com/news/cftc-chief-says-bitcoin-is-the-only-comm…

I agree in the sense it can be purchased and sold. But...

commodity

noun

noun: commodity; plural noun: commodities

a raw material or primary agricultural product that can be bought and sold, such as copper or coffee.

What exacty is produced using crypto?

What exacty is produced using crypto?

Bitcoin is a commodity. "Crypto" largely refers to digital currencies that are "securities" that pass the Howey Test.

What is produced by Bitcoin?

What is produced by Bitcoin?

Commodities are physical goods that are traded on exchanges in wholesale quantities. These can include agricultural products like corn and wheat, as well as precious metals like gold and silver.

The CFTC argues that BTC is a commodity under the Commodity Exchange Act (CEA). The underpinning argument is that because BTC bitcoin is interchangeable on exchanges – each bitcoin is of identical worth, just like how a sack of corn is of equal worth to another sack of corn of the same grade – it is a commodity.

Just watch those exchanges suddenly shut up shop and stop you getting your cash back because there is not anything backing it up.

This is what most normies believe about BTC - that it is held on exchanges for its owners. Like a bank.

The BTC 101 maxim is 'not your keys, not your coins.' OGs do not hold their assets on exchanges.

If exchanges shut up shop and you lose your stack, you only have yourself to blame.

OGs do not hold their assets on exchanges

'OG'?

I can see why people are queueing up to join the club.

BTC is up 85% this year. Seems to be the opposite effect to what you think. We had the run last year. Now black rock is stepping in.

If you want to use crypto as money, it is almost exclusively for privacy and anonymity. Monero is the default standard for crypto as currency. Bitcoin is effectively digital gold, acting as a store of value. Using normal banking payments is entirely more useful for domestic, same currency transactions.

Where BTC is very useful is remittances and overseas payments. You can settle a transaction with a person in another country for almost no cost compared to remittance based payments or the currency exchange prices. It is equivalent to settling a payment over the internet with digital gold instead of government fiat.

In the Crypto community, advocacy for one particular currency to resolve a particular problem is generally referred to as 'maximalism'. Bitcoin Maximalists all believe in the 'halving' prophecy where prices for BTC peak within some date range of the next halving of the output of mined BTC, based on past performance of BTC through its last three halving cycles.

These professors are always ~5 years behind the consensus in the Crypto community.

Monero is the default standard for crypto as currency.

Don't know who told you this VM, but it's not true.

Where BTC is very useful is remittances and overseas payments. You can settle a transaction with a person in another country for almost no cost compared to remittance based payments or the currency exchange prices. It is equivalent to settling a payment over the internet with digital gold instead of government fiat.

Correct. The economist who wrote this article is somewhat of a normie. Even though payments can be made with BTC, it's ultimately a base layer for payments.

Monero is the currency of illegal transactions, hacking ransoms and the drug trade. It is also the favourite of every privacy minded crypto user because of its particular properties. It is also relatively stable.

It is the only cryptocurrency which is used explicitly as currency rather than as a store of value or a speculative investment.

I know what it is. Have a look at its mkt cap and circulating supply, then tell me whether or not you think it is the primary crypto for payments.

Monero volume traded in 24hrs $75m USD, Bitcoin traded $16.7B USD

It isn't about volume, in terms of usage for the purpose of a currency, no other coin comes close.

How are you measuring Monero transactions VM?

Once central banks start using own digital currency Bitcoin and crypto coins will become a novelty. The whole system is based on nothing just the same as the tulip mania. One day people will wake up and a Bitcoin would not even buy them a coffee how can a few digital numbers be worth anything.

Its not worth anything because it has nothing backing it. What do you think your $30K bitcoin would actually be worth tomorrow if everyone tried to sell it all at once ? That's right a fraction of your $30K, the price would plunge exponentially as the withdrawals increased.

Its not worth anything because it has nothing backing it. What do you think your $30K bitcoin would actually be worth tomorrow if everyone tried to sell it all at once ? That's right a fraction of your $30K, the price would plunge exponentially as the withdrawals increased.

What would it be worth? That all depends my little sock puppet. If the likes of Blackrock and HNWIs are hoovering up BTC in the high $20Ks, they're likely to be buying again in the future. But you need to understand that 66% of BTC is 'not for sale' - that is equivalent to the amount of BTC not sold over the past 12 months. So ultimately it doesn't really matter if the price is $5 or $500K, much of it is not for sale.

Two years ago, the Managing Director of Credit Agricole (one of the largest banks in Europe) Phillippe Brassac said the ol' rat poison would be worth less than a dollar by 2025.

Yesterday his bank received approval to custody Bitcoin for their clients.

https://thecurrencyanalytics.com/finance/credit-agricole-credit-mutuels…

https://www.reuters.com/technology/credit-agricoles-caceis-registers-fr…

What does that make gold then¿

Bitcoin is digital scarcity. It's a protocol with all the key attributes of hard money. It's a store of value that can also be used to transact. What's not to like?

Gold is better as a store of value, but still not great, gold isn't a currency either, can't exactly take it into any store near me and buy anything with it, except at the local gold merchant. Mostly it has the same problems as bitcoin, but does at least have some commodity value for it physical uses, - Jewelry, electronics and thermal control.

Bitcoins advantage is you can send it anywhere quickly and cheaply, but a store of value.. not so much when said value is about as stable as the average interest.co.nz commenter shown a picture of Tony Alexander :)

Gold is better as a store of value, but still not great, gold isn't a currency either, can't exactly take it into any store near me and buy anything with it, except at the local gold merchant

Digital gold tokens are a potential means of exchange. PMGT (Perth Mint Gold Token) is being discontinued and is fully exchangeable for gold bullion.

Maybe because it's been diluted and Perth Mint don't want to buy diluted gold back.

The main reason why I like having some Bitcoin is for financial security reasons. When I travel overseas, I've always got access to it. It's a bit of diversification. It's an inflation hedge. I am looking forward to the day when more people accept it as a form of payment. As it stands I offer to accept crypto as payment for everything I sell on trademe, but have yet to have one person pay me that way. I think most people just want to hang onto their crypto. It kind of shows why you need an inflating currency to maintain money velocity.

A BIS study has found the majority of Bitcoin buyers globally between August 2015 and December 2022 have made losses.

Just ran the numbers on this. DCA'ing fixed sum monthly ($100) into BTC from Aug 15 to Dec 22.

Total investment: $ 8,900

Total Value: $77,525

ROI: 771%

Lol, If so confident would you be willing to buy bitcoin at a bargain price off me with delivery in the future? Effectively an options contract..... I'd offer a purchase price of 25% of market price in USD and delivery 25 years after contract start. Any sane person would take that same deal on Cocacola shares for example. Thus would you take it on, buy 10 Bitcoins off me now for 75% discount with delivery in 2048? Im thus willing to bet i can pick them up for nothing in 25 years.

No bitcoin bro has yet been able to put their money where their mouth is on their principle of "the currency of the future". I'd do a deal 1-10 Bitcoins

Lol, If so confident would you be willing to buy bitcoin at a bargain price off me with delivery in the future?

Why would I do that? Gambling on BTC futures is not the same as buying BTC and keeping it in self custody.

I’d absolutely take you up on that.

My concern would be that you won’t be able to afford to buy 10 btc in 25 years.

If you purchased today and locked in a multi signature or smart wallet with a release date in 25 years id take you up on it.

I’m not an expert but I know some that could set this up.

Even if it btc becomes a nostalgic novelty item like Pokémon cards are today, It will still be worth good money in 25 years.

It states in the paper that the result is likely because some big investors timed the market and got out at the right time, taking the profit from the many more small investors. Your basic maths does not disprove the study.

Not everyone DCA's when they see the bottom falling out of the market, they panic sell. People also tend to put more in when they see it going up fast. The big fish pump and dump and win the jackpot. Like Elon and his blatant and repeated manipulation of the crypto market, I am sure a lot more of that is going on in the background with big players in less obvious ways.

Somebody has to pay for the yachts and lambo's that the winners get.

It states in the paper that the result is likely because some big investors timed the market and got out at the right time, taking the profit from the many more small investors. Your basic maths does not disprove the study.

The 'basic math' shows the value over the time period accounting for all the market behaviors. Nothing more, nothing less.

OK, I thought you were trying to say the study was incorrect. If not, then I am not sure what your post was about.

Their conclusion is based on their weak methodology, before onchain analytics platforms like Glassnode emerged. It's a general given that those who accumulate consistently through a BTC halving cycle (trough to peak to trough) are typically ahead.

Bitcoin could be worth nothing next week.watch out when big company’s start buying pushing up price by 20% get some FOMO going then just sell out quickly leaving the small investors stuffed. Everyone should be aware digital dollar is on the way so many other ways government’s and central bank can trash crypto over night, no way are they going to let Bitcoin take any of their action people should be very cautious at the moment.

Bitcoin could be worth nothing next week.watch out when big company’s start buying pushing up price by 20% get some FOMO going then just sell out quickly leaving the small investors stuffed.

Who are they selling to? If there are no buyers, no sale. Why would Blackrock or anyone buy in the high $20Ks to sell at a loss?

You're not making much sense.

No hard to work out buy at 25k sell at 30k quick profit every time this goes on over and over each time creating FOMO seems they always find another bunch of bigger fools if they buy 25 million in Bitcoin sell for 30 million 5 million profit each time they have the funds to create FOMO and push price up quickly them pull the plug

You folks realise that while we're having this lovely discussion, the Bitcoin price is literally at an all time high... in Argentine Pesos. That's 45 million people dealing with the results of negligent currency management. Any bets on who might be next?

Yep, stashing cash under your mattress your whole life will not make you rich. We all agree there.

However there are much more sound investments than cryptocurrency.

However there are much more sound investments than cryptocurrency.

I'm open to hearing your recommendations. 60/40 portfolio?

Hard assets that provide the basics of your existence, even if the economy does an Argentina.

Worst case you'll save a lot on food and utilities in the long run.

Inflation at 100%. Issues with securing contracts eg rent denominated in US$. Sell in pesos and devalues instantly. They need a military coup and Kirchener sent to the wall.

Just food for thought, over 80 million BTC wallets. How many hold NZD?

Just food for thought, over 80 million BTC wallets. How many hold NZD?

Zero. BTC wallets hold BTC.

I meant how many people hold NZD compared to how many people hold BTC. But then again you knew that...

I missed the whole BTC wave. I just follow the Warren Buffet idea of not investing in something I don't understand too closely.

I missed the whole BTC wave. I just follow the Warren Buffet idea of not investing in something I don't understand too closely.

For sure. If you're not prepared to put in the time, only allocate to BTC what you can afford to lose. Say that is an equivalent of NZD100. At least what I will do is introduce you to the world of digital currencies. A cold storage device will be worth more than $100 so you will not get to experience that side of things.

For sure. If you're not prepared to put in the time, only allocate to BTC what you can afford to lose.

At this point there's probably an inverse correlation between time invested in BTC and the actual returns. So you've put in way too much time, and not made any money. Because you're now balls deep in sunk cost fallacy.

When I see the bitcoin Bitcoin spruikers trying so hard on here it makes me a bit depressed. But that's OK, because when they start speaking down to people as 'normies' it makes me laugh and laugh.

Most bitcoin commentators are trying to educate you...but this site is full of ludites, who think EVs and BTC are just a fade like tulips.

Buttcoin is. EV are here for a few decades at least. Even the hydrogen heads are finally admitting defeat.

https://thedriven.io/2023/06/23/nothing-can-compete-finkel-concedes-bat…

For every iPod and E-bike there's many Microsoft Zunes and Segways.

Bitcoin creates more problems than it solves and lacks the basic foundations to make it a mass market 'item' for want of a better term. Come out with a digital currency that's easier to use than regular money, is the same or more widely accepted and marries up with all existing economic institutions like insurances, laws and lending and maybe there's a case.

Like gold, the value of bitcoin is based on a thought system. There's no discipline in ascribing value.

I have a number of gatekeeper rules when it comes to investing.

One,which many here may consider simplistic, is if those who promote the scheme/commodity have to resort to ridicule, such as you have Baywatch with your use of the word luddite, then I stay well away.

It has served me well thus far.

Yes maybe only 2% of legal transactions are made with Bitcoin but how many of the underworld illegal transactions are made this way.......?

Yes maybe only 2% of legal transactions are made with Bitcoin but how many of the underworld illegal transactions are made this way.......?

Or bribes to politicians and people in power?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.