By Susan St. John*

The fiscal cost of NZS, in net terms, is relatively low by international standards at around 4.1 per cent of GDP today, rising to 6.1 per cent in 2050 and just 6.7 per cent by 2060. While this appears to be a modest increase, associated fiscal pressures from an ageing population, including healthcare costs, make the picture less benign.

NZS does not discourage saving or working since it is not income- or asset-tested, and there is no requirement to actually retire from work. Wealthy recipients of NZS may still be in well-paid work and/or have other significant private incomes and assets.

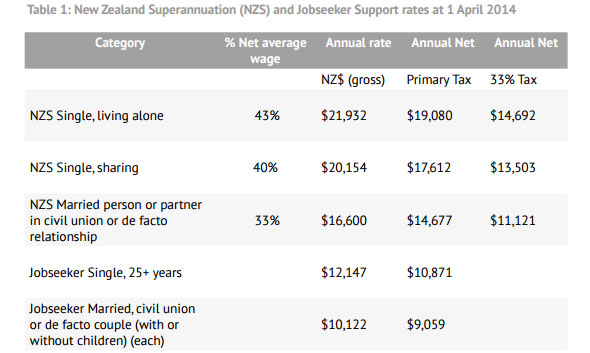

Some of this group may have accumulated their wealth with tax-free capital gains and may have benefited substantially from the 2010 income tax cuts and lower Portfolio Investment Entity (PIE) rates of tax. The amount of NZS retained, after-tax, by individuals taxed at the top income tax rate of 33 per cent – perhaps because they still work full-time – actually exceeds the net Jobseeker Support benefit rate paid to an unemployed adult (Table 1).

The argument for cost containment may become compelling over the next two decades as increasing numbers of baby boomers reach retirement with ever larger, subsidised KiwiSaver lump sums and qualify for NZS, which under the pay-as-you-go system must be funded by current taxpayers.

NZS is partially prefunded, but the New Zealand Superannuation Fund (NZSF) in itself does not reduce the cost of NZS, and accumulation in the fund has opportunity costs. A simplified visual picture of the scale of demographic change is provided in Table 2.

Future pension payments may be reduced through the use of one or more of three main levers: the age of eligibility, the level of payments, and means-testing. While raising the eligibility age is often discussed as if it were the only option, a carefully considered mix of the three levers might most effectively maintain the best features of NZS. The first two levers are briefly discussed below, followed by a more detailed proposal for use of the third lever: income-testing. This third lever has been seldom discussed seriously in New Zealand since the late 1990s when the surcharge was abolished.

Lever 1: Increase the qualifying age

The New Zealand Treasury has investigated the possibility of raising the eligibility age for NZS. This may appear inevitable in the face of an ageing population and increasing longevity. Nevertheless, caution is advised. An important disadvantage of relying on this strategy to improve NZS sustainability is that many people with physically demanding jobs are disabled or sick by age 65 and unable to work further. Others lack the required skills or education to meet market requirements, or have full-time unpaid caregiving duties, such as looking after parents or grandchildren. The savings accrued from raising the age of eligibility would need to take account of the costs of supporting such people and would require another form of state assistance. The use of conventional welfare benefits with stringent income tests may mean that those who cannot continue to work exhaust their private retirement resources before reaching the new, higher age of eligibility.

In Australia, for example, the increase to age 67 for the Age Pension will begin in 2017 and is to be achieved over only six years, with talk of a further extension to age 70 by 2035.

However, New Zealand runs some fiscal risk by being out of step internationally. In Australia, for example, the increase to age 67 for the Age Pension will begin in 2017 and is to be achieved over only six years, with talk of a further extension to age 70 by 2035. New Zealand’s current reciprocity agreements with Australia and other countries mean that individuals’ residency there can be used to qualify for NZS if they emigrate to New Zealand. This potential for people from other countries with higher qualifying ages and higher residency and/or contribution requirements for the age pension to benefit from our less stringent conditions is another risk to the future affordability of NZS.

While an increase in the qualifying age is inevitable to reflect improved average longevity, greater participation in the workforce, and to align with other countries such as Australia, if the only way to do this politically is to give a long lead-in time, there will be little or no potential for immediate savings from using this lever. To date, both major parties have shown a lack of political will to signal a timetable for any such rise.

Lever 2: Decrease the payment

A second lever to reduce the cost of NZS is to reduce the payment level. One approach is to change the indexation basis for NZS. Projections show that fiscal savings from indexing the annual payment of NZS to inflation rather than wages would lead to significant long-term savings. The real spending power of NZS would be protected but the rate of NZS would fall relative to average wages.

However, the baby boomers now aged 49-69 are very diverse in both health status and resources. Many are not well-off, and some have lost money in New Zealand’s finance company meltdown and in the leaky homes fiasco. Others have suffered through divorce and ill health.

The level of NZS needs to be high enough to prevent hardship and it does that for most, particularly for those who are home-owners, though some pensioners clearly still struggle. While the Retirement Commissioner has suggested there is a case for a moderation of the indexation formula, reducing either the level of NZS or the relativity to wages over time may undermine the desirable achievement of low hardship rates for the 65-plus group.

Another approach is to rationalise the three different rates for NZS. As shown in Table 1, there is a married rate, a single sharing rate at 60 per cent of the married rate, and a single living alone rate at 65 per cent of the married rate. As previous Retirement Commission or Periodic Report Groups Reviews have noted, these differences are hard to justify. The rates are historical and are unsuited to a modern world of flexible living arrangements and relationships. There is a case therefore to pay the same flat rate to everyone, set somewhere between the married person and single sharing rate, with an additional means-tested payment where housing costs are high.

About 27 per cent of superannuitants live alone and possibly the majority would still need accommodation assistance. Nevertheless, savings can be made here without affecting the living standards of those dependent solely on the pension. Whether or not there is a separate rate for living alone, the alignment of the married and single rates appears justified. To save costs without direct cuts, the single sharing rate could be frozen until the married rate catches up through normal annual adjustments.

In summary, apart from modernising and improving simplicity by aligning the rates of NZS, there appears little justification for reducing NZS costs by lowering the level of NZS payments as this approach risks increasing old-age hardship.

Lever 3: A means test

This leaves some form of means test – sometimes referred to as the ‘third rail’ of superannuation policy, by analogy with the potentially lethal electrified third rail of a railway track. "Touch it and you die". New Zealand’s income-test history has made it a politically unattractive option (see sidebar). Yet there is a way to apply an income test fairly, and with enough useful savings to take the pressure off sole reliance on raising the qualifying age or reducing the rate of NZS.

In Australia the means test on the Age Pension takes account of both income and assets. It is likely that New Zealanders would find that a step too far. This paper therefore concentrates on an income-based means test, but that does not preclude an attempt to include as much imputed income from assets as feasible over time.

Using 2014 figures, if there is no other income, the gross amount of NZS is taxed at the lowest tax rate and net disposable income is $14,677 for a married person (see intercept on vertical axis in Figure 1). For a superannuitant with enough other income to be in the top tax bracket, the net NZS payment after tax at 33 per cent increases his or her disposable income by $11,121.

In the context of the overall population, the net $11,121 of NZS paid to the wealthiest married superannuitant is more than the net Jobseeker Support of $9,059 (annualised) paid to an unemployed married adult. The current net gain to single sharing and single living alone wealthy superannuitants is even greater: $13,503 and $14,692 respectively, compared to $10,871 (as an annual rate) for a single person on Jobseeker Support.

Using the tax system

Finding a way for the top line to meet the bottom line in Figure 1 by reducing the generosity of net NZS at the top end may reduce the degree to which the other two main levers must be employed. The intent is to save costs by affecting only those with significant ‘other’ income, while leaving the disposable income of the vast majority of superannuitants virtually unchanged.

To make the lines meet, a ‘negative income-tax approach’ could be used. In the past, when the surcharge operated, such an approach was suggested as a sensible rationalisation. This reform option means that the flow of tax to the IRD on gross NZS and other income, and the surcharge paid by a superannuitant, is offset against the gross NZS payment from the IRD. Money would flow one way only.

However, a ‘basic income’ approach may be simpler to implement and understand. A Universal Basic Income (UBI) is already part of the current discussion in New Zealand about the future of work. The UBI is based on principles of non-conditionality and individual treatment, and changing NZS into a basic income would demonstrate how such a policy would work for the group aged over 65.

To illustrate, the basic income, called here the ‘New Zealand Superannuation Grant’ (NZSG), would be paid to all superannuitants as an unconditional weekly non-taxable basic income. Then, a separate tax scale would apply to all of a superannuitant's gross earnings, whether from wages, dividends, or interest. In this example, it is proposed that the NZSG is the same for everyone (married; single sharing; single living alone) and that any extra supplement for high housing costs would be part of the welfare system. While the NZSG could be set at any level, Figure 1 shows it as equal to the current (after-primary tax) rate of NZS: i.e. $14,677 for a married person.

A break-even point exists where the NZSG, plus extra income from work or investment, net of the new tax rate, is equal to the disposable income of an ordinary taxpayer paying the usual rates of income tax. This point is effectively where the gain from the NZSG has been offset by the new tax. Any over- payments of tax by high-income earners could be claimed back at the end of the income tax year.

Technically, this proposal differs from the surcharge of 1985-1998 in that the NZSG payment is not part of taxable income. The surcharge was exceedingly complex, applying until the net advantage from NZS was equal to the surcharge paid, and could mean different end points (when NZS had been fully clawed back) for different taxpayers. Few could follow the calculations. The surcharge was also perceived as an additional, discriminating tax that could result in marginal rates of tax exceeding 50 per cent.

Under the NZSG, an individual could either opt for the NZSG and the new tax scale for all other income, or wait until end of the tax year and take any NZSG due as a rebate. For high-income earners, whether that income is earned from paid work or from investments, the new tax scale would not remove their right to the basic income floor of the NZSG if other income reduces or disappears. Thus the NZSG is the prototype of a basic income that provides automatic income security as of right.

Given that for 80 per cent of NZS recipients, NZS provides at least 55 per cent of their income, a tiered tax structure is needed to protect those with limited extra income. Figure 2 illustrates a tiered scenario; with rates of 17.5 per cent for the first $15,000 of other income, and 39 per cent on each dollar above that.

Features of the New Zealand Superannuation Grant

The NZSG would be far less complicated than other forms of clawback such as the surcharge, a welfare type means-test directly on NZS, or even a negative income-tax approach. As with any targeting regime, an increase in the degree of targeting will result in some avoidance activity. However, the NZSG proposal is not nearly as harsh as the welfare means-test that applies to rest-home care subsidies or welfare benefits. It provides a gentle clawback using the principle of progressive taxation which, it can be argued, is the natural counterpart of the universal provision of a basic income.

Another concern may be that the NZSG would need to be carefully packaged so as not to adversely influence the decision to save. This, of course, would be much more of a problem with a full means-test that included assets than the proposed income-test operated through the tax system.

The integrity of the NZSG approach would require that the top PIE rate be aligned to 39 per cent. Alternatively, gross PIE income could be included as ‘income’ to be taxed at 39 per cent, less the tax already paid by the PIE on the member’s behalf (similar to the imputation regime). The same argument applies to income earned through trusts, companies and overseas vehicles. Treatment of current annuities and defined benefit pensions raise other complex but not insoluble problems.

Conclusion

This preliminary analysis suggests that the combined approach of adopting the two-tiered tax scenario, freezing the single-sharing rate so that over time it aligns with the married rate, eliminating the livingalone rate, and increasing supplementary assistance for accommodation costs, will result in immediate savings of more than 10 per cent of net NZS, and that this should increase gradually over time.

These savings are possible without imposing hardship or affecting those with modest additional income and can be achieved relatively quickly. The inevitable increase in the eligibility age to reflect improved longevity could be more gradual, reducing the disadvantages for individuals who, given the arduous nature of their employment, may expect to retire earlier than others. It would also continue to recognise that many older people contribute valuable unpaid caregiving and other voluntary work and should be supported by a basic income.

The proposed NZSG after a phase in period would aim to pay a single rate to all independent of relationship status or living arrangements. This would remove unfair classifications that are difficult to police. It would reduce the cost of NZS, although additional payments for those with high accommodation costs, whether living alone or not, would be required.

As with any targeting regime, efforts to maximise returns will lead to some tax planning activity. However, those who should be paying the top rate of tax of 33% already have an incentive to reduce their taxable income and some already pay little or no tax. It is debatable as to whether a marginal 39% tax rate would substantially change behaviour but there is the possibility that it could provide the impetus for a full investigation into, and exposure of, current and potential tax avoidance activities by wealthy individuals. Under the proposed NZSG, a wealthy person would need to reduce taxable income to under $15,000 to avoid the 39 per cent rate completely.

The proposed change would decrease the fiscal cost of NZS through reductions in payments to high-income superannuitants and thus allow more spending or lower taxes for younger New Zealand taxpayers. It may therefore lead to improved perceptions of inter-and intra-generational equity.

If it is agreed that the cost of NZS should be reduced by increasing the degree of targeting, using the tax system and the proposed NZSG offers several potential advantages compared with other targeting regimes. It is relatively simple to administer, and it is flexible. The choice of tax rates for other income allows flexibility and clarity in reaching a desired breakeven point and required fiscal savings. It also provides choice and clarity for high-income superannuitants who are not denied access to the basic income floor of NZSG if their situation changes.

NZSG illustrates a possible reform to NZS as a means of enhancing the sustainability of an already world-class retirement system.

Susan St John is an Honorary Associate Professor in the University of Auckland Business School's Department of Economics and Director of the Economics of Ageing Programme in the Centre for Applied Research in Economics (CARE). Her research is focused on public sector and retirement policy, including decumulation of savings, tax and poverty, and applied macroeconomics. You can contact her here.

Acknowledgements: The assistance of Dr Claire Dale, Michael Littlewood and Siu Yuat Wong, of the Retirement Policy and Research Centre, with this article is acknowledged. Thanks also to Matthew Bell, Senior Analyst at the New Zealand Treasury, for costing the options.

This article was first published in the Autumn 2016 issue of the University of Auckland Business Review, and is reproduced with the permission of the University of Auckland Business School.

19 Comments

I have no expectation of there being any significant superannuation by the time I am at retirement age. What I would want an explanation of is why I would pay more tax for something that I will never receive. There are better uses for tax money than a retirement pyramid scheme.

Those that are at the current retirement age will likely have to work unless seriously disabled by around 2030 anyway. What would be more useful is a discussion on how to handle the breaking point after politicians have kicked the can down the road as long as possible.

The explanation is that as a wealthier member of society you pay for those less fortunate. Whether its working for families, or maybe a healthcare system you dont use, my tax dollars (and yours) pay for that and thats the way the system works. Of course there needs to be a safety net for those that have not been able to save.

Why stop at half backed Socialism, its clearly not working and is unsustainable, Communism, with total government ownership, is where we are headed..

I reckon Japanese style feudalism would be the way to go. Beauty, minimalism and epic samurai battles.

you can go all the way back to muldoons national who scrapped self funded super (similar to kiwisaver) and instead lumped it into the consolidated fund.

that's the trouble with politicians they will do what is right to get them relected for another term not what is right for the country or its people in 50 years time.

Looks like I'll have to buy property then,and pay no tax, rather than pay 39% on PIE managed funds rather than the 28% I currently patriotically pay the Govt

It seems the important thing with that PIE rate is to put people off investing by specifically punishing them. Probably not the best idea when people are expected to save for a large portion of their retirement.

The PIE top rate is set at 28% to match corporation and trust tax to prevent people from using these mechanisms to reduce tax. So unless the corporation tax rate increases, the PIE rate will stay the same.

Note that all foreign investments (like most of people's Kiwisaver funds) are subject to FIF which is a capital tax. If the rate went to 39% then you would have to pay 1.95% of your assets in tax each year. The playing field for NZ capital gains would need to be levelled first.

The logical route this takes ends up at a comprehensive capital tax and UBI

The govt is choosing not to put tax money into the Cullen fund at the moment. Its got other priorities.

Including fiscal drag tax cuts. Haha. Ms St John, you are not looking at the bigger picture.

That's reality any tax take wouldn't be used for the intended purpose. National is like someone selling all of their stuff at cashconverters then getting a payday loan so they can blow the money. There's a point where there's nothing left to sell and the debts are building up to breaking point. We don't want it to be when 1/3 of the population is retirement age.

I just wish that it was compulsory for all people at any educational facility to know constitutional rights of the people...it is clearly lacking across all Universities in NZ and so we keep getting opposing concepts to those rights and unequal treatment !!!

Good ideas Susan , its obvious we need to start talking about it.

I agree the recommendations will become a necessity, although I am in the generation (nearing retirement) with most to lose. We are a pretty improvident and entitled generation and change to income related super will be painful, so there are a few other steps that'd complement recommendations.

The principles I'd start with are

1 most people need to be responsible for most of their retirement needs

2 none of us want to see people in poverty, particularly the elderly and children

3 many people will ignore 1, and take advantage of 2

4 inter generational equity will be hard to maintain as healthcare costs and life expectancies make most govt

and personal calculations invalid

5 increasing debt levels are a significant further handbrake

Consequently, KiwiSaver should be compulsory, the level increased, and home loan income restrictions and principal repayment scaled to encourage the majority of home debt to be repaid by 65 for most people. Someone will say "nanny state" but we already are that, the question is how to assist more people to manage a very difficult transition, with less pain.

Making KiwiSaver compulsory will do absolutely nothing to reduce the future cost of NZ Super unless it is combined with means testing NZ Super (ie, the more you have in your KS, the less Super you get). If that is your proposal, you should make that explicit.

Making Super affordable in the future is easy. What you do is exempt those who never really put in! Namely speculators and property hoarders who live parasitically off the working backs of others . Thus you exempt anyone who owns any second+ property into the future. The BB's etc always claim that this is why they hoard rentals so.....make that claim the reality and leave Super for those of us in society that actually worked in the productive sectors. Bang, problem solved. This will scare many but that is the future government that WILL be voted in at some point

Justice - With every comment you sound more and more like a Red Guard....

Whatever. The fact is it would work, and if you have a problem with it then it hits the target. It forces turn over of property back onto the market for FHB's to enter the market. That's a good thing for the state as more people in their own homes fixes many of the social problems we are currently witnessing. Eventually such policies will be vote winners as more and more are disenfranchised. So we can have a 'rose Revolution' or a bloody. Choice is yours

Come on Zach, you would only have to sell one of your 20 properties.

It's actually a good idea

Table 2 = People supporting other people - I don't see any mention of making the corporations like Facebook, Google, Apple pay their fair share of taxes. - I wonder why?

You say

"over the next two decades as increasing numbers of baby boomers reach retirement with ever larger, subsidised KiwiSaver lump sums"

But what happens when millions of baby boomers from around the world all stop paying into the super funds and put their hand out for their lump sum payments? - will the super funds crash under the weight of claims?.

If there are going to be jobs in the future why are we talking about a Universal Basic Income?

And what about the mushrooming global unsustainable debt?

The fact is "You cannot look at pensions in isolation" - that is a fools game.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.