With rising interest rates and low rental yields on Auckland houses, "something has to give", according to ANZ economists.

Writing in the bank's latest monthly Property Focus, ANZ chief economist Cameron Bagrie, senior economist Mark Smith and economist Steve Edwards, said that according to official March inflation figures, the annual increase in Auckland's dwelling rents was 2.3% - slightly above the nationwide average of 2% and less than half the 4.9% rise in Canterbury.

"One of the peculiarities about Auckland’s housing issues has been the disconnect between the shortage [of housing in the region] thesis and lack of movement in dwelling rents," the economists said.

"Other motives, including the focus on capital gain, may be behind small movements in rents, but with rental yields in the Auckland residential market (around 4% according to our estimates) already very low in relation to (rising) interest costs, something has to give. Either rents move up more sharply or prices fall," they said.

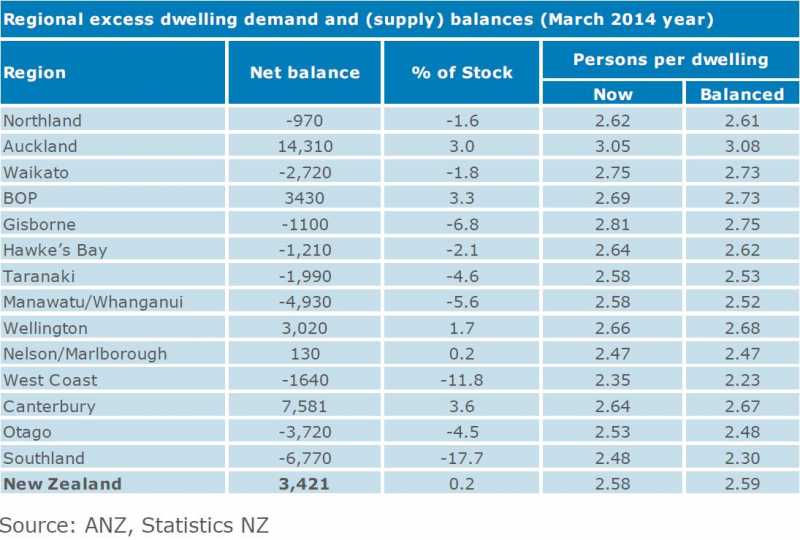

The economists have crunched the numbers, based on updated 2013 census information to look at the overall supply v demand equation for housing around the country. (See tables below)

They have concluded that nationwide there's a negligible shortage of houses, based on the latest information.

They said that in the March 2014 year, there was an ‘excess demand’ of around 3400 dwellings nationwide, equating to approximately 0.2% of the nationwide dwelling stock.

"Given the margin of error around such estimates, this suggests the nationwide situation is broadly in balance," the economists said.

"It compares to earlier estimates of a nationwide housing shortage of more than 10,000 units, with the lower positive balance largely attributable to lower than expected population numbers provided by the postenumeration figures from the 2013 Census (104,000 more persons than the provisional census estimates, but still around 125,000 persons lower than suggested by earlier projections)."

The ANZ economists said there was a shortage of 14,000 dwelling units in Auckland (3 percent of the housing stock).

This, they said, was "problematic but far from disaster material, and to some degree partially explains why the rental market has not gone ballistic".

"Recall, early estimates put the housing shortage in Auckland as high as 30,000 units; revised and updated census figures have cut that by more than half."

The economists said there were marked regional differences in the supply and demand equations, with an excess demand situation primarily in Auckland and Canterbury, but also in Wellington and the Bay of Plenty.

"In these regions the rate of household formation has clearly exceeded the construction of new dwellings. In contrast, the remaining regions appear to be in an excess supply situation."

The economists said given that the residential construction sector was still recovering from its pre-Global Financial Crisis slump it was not surprising to see that the expansion of the dwelling stock has been more modest than population growth.

"This, however, has not been a regionally uniform trend. In regions such as Auckland, the Waikato, Bay of Plenty, Taranaki, Wellington and Canterbury, the construction of dwellings has undershot resident population growth.

"In Canterbury, an estimated 20,000 fall in the dwelling stock as a result of the earthquakes resulted in more static growth in dwelling numbers. In other regions, notably Manawatu- Whanganui, Southland and Nelson-Marlborough, growth in the dwelling stock has outpaced that of the resident population."

On other property market related matters, the economists said they expected the Reserve Bank's 'speed limits' on high loan-to-value lending would remain in force until 2015.

"The RBNZ is caught between the proverbial rock and a hard place.

"The restrictions have worked a treat; had they not been enacted we would likely see interest rates 30 basis points higher.

"However, such measures cannot be kept in place indefinitely before the law of unintended consequences starts to unfold, so such a mechanism is on borrowed time. That said, we should be careful what we wish for: if they’ve saved the RBNZ having to hike by 30 basis points, bringing LVR restrictions off carries the reverse implications."

The economists said the RBNZ "must be taking heart" from recent data that had shown a slowdown in the housing sales market.

"Sure house prices haven’t been reined in as much as they’d like, but with the expectation that another OCR hike is just around the corner, this is just a matter of time.

"...Meanwhile, strong migration gains are doing their darndest to keep the demand-supply imbalance out of kilter."

61 Comments

"something has to give" do they mean - like - "POP"

Does this mean relying on capital gains for the business model, is just a little more tricky?

If landlords can significantly raise rents, why haven't they? And before every property investor replies with their own personal rent rise story, I'm talking about the 2.3% overall increase in Auckland.

Tenants can only pay what they can afford. Any more and they will squeeze more people into a house or move back in with mum and dad.

Auckland is a bubble and I think ANZ just about said as much.

Agree. If our rent went up I'd move in with family. There's a limit that I'll pay for an old, cold, damp house where you can hear the neighbour sigh!

C'mon Value Added .....don't destroy the dreams of Happy123, Big Daddy et al " rental increase scenario's" , where they will increase ad infinitum...... your just not playing the game :)

Looks like there's some squeezing happening - Auckland has the highest persons per dwelling.

Would be good to see that plotted against house prices over time. Has Auckland been getting more dense as prices went through the roof or has it always been more dense?

No doubt high house prices for families and flatmates to share when they might have otherwise gotten their own place.

But Auckland also has allot of Island and Asian residents for whom it is more a cultural norm to share with your extended family.

Having just moved (Into Mt Eden from Westmere), my rent has stayed the same. We looked at lots of rubbish however, so glad to see the building activity report this morning. Will continue to save (no intention of buying in Auckland) and watch the BigDaddys tell us rents will skyrocket.

When the banks, or anyone else, is able to collect all of the rental figures then, and only then, will they be able to make this kind of analysis. Most rent movements are not recorded by DBH, only for new tenancies, and the increases are not recorded so the data will always lag the actuals.

For example if I raise the rent on one of my tenants this is not notified to the DBH or anyone else so would not be included in the 'stats'. Only rents declared on new bond lodgement forms are included so not only do they miss all the data they miss the increases!

Hypothetical; take 5 Auckland rents:

200

250

300

275

330

Average = $271

200 (change to 210 and DBH notified)

250 (changed to 270 and DBH not notified)

300 (changed to 315 DBH not notified)

275

330

New average according to DBH $273

Actual new average $280

So ANZ think it’s a <1% increase when it’s actually a >3% increase.

No.

the DBH figures don't take the new deposits and compare them with previous actual rents. Rather they compare them against new deposits last month or last year. It's like for like.

Take 5 new deposits.

200

250

300

275

330

Average = $271

Same month next year take 5 more

220

260

310

285

330

Average = $281

Taking the ten together, assuming the first lot had no rent increases, your looking at an actual average of 276, vs, a reported 281.

But, we can assume some of the 5 from last year have either ended, and new tenancies have been reported at the newer rate, or they have had unreported rent increases to the market rates, so the actuall average will be somewhere between 276 and 281. There will be some landlords that don't increase rent in order to keep a good tenant happy, these people will be bringing the actual average a little under the reported figure. There won't be many unreported increases that are higher than the market rate, because tenants would just move elsewhere.

So in conclusion the current market rental rate is a very good indicator of actual rents paid, though actuals can be expected to slightly lag the market due to delay in some landlords increasing rents for existing tenants to market rates.

Sigh... re-read my post, you missed the key point, this analysis or any other does not consider rental increases to existing tenants. Considering that the whole point of this article is to analyse rental increases then to exclude these from the sample is ludacrous.

You can try and spin, like you always do, but you'll come right back up against this key point.

This survey does not include all rents, most notably the increases to existing tenants.

New deposits probably relate to properties with a high turn over and hence some sort of problem which further (artificially) drags down the average.

er, no. When you've got a measure that works perfectly fine around the world, and has worked perfectly fine through New Zealand history, if you are asserting the relationship has suddenly become meaningless right now in this place and at this time, then the onus is on you to come up for with the actual hard evidence that it is different.

Now rents is only one measure they are using, they are also using population density and finding the conclusions from that measure are broadly similar. So you don't just need to show (with evidence) why rents vs price is measuring different things now compared to everywhere and everywhen else, you also need to show why that difference hasn't affected related measures.

I see I’ll have to explain this in very simple terms.

You are advocating analysis on a survey that does not include all the data and the data that it excludes solely relates to increases. This skews the results and makes them meaningless.

The data it excludes does not relate solely to increases, it excludes all existing tenancies regardless if their has been an increase or not.

Haha, what are you doing posting in the middle of the night, am I keeping you up? Need a bit of time to come up with that 2 liner.

No, you re-read my post, you missed the key point that DBH only report the current market rate and ignores existing tenants.

You can't usually measure everything, it's too expensive. So you take a sample. The DBH figures take the current bond lodgings, as these are the current going rate for rent.

The DBH figures will reflect increases to existing tenants, insofar as we would expect these increases to be in-step with the market rate. Too large an increase and tenants will move to a cheaper house.

Sure there would be a slightly more acurate figure if we could collect every single actual rent paid and average it. This figure would show the average rent increase is lower than the DBH figures, as not all landlords increase rents to existing tenants on a weekly basis, and infact this is forbidden by law. There will be at least 6 months till the next increase, during this time the rent they pay will be lower than the current going rate (in a rising market). Many will only do it yearly, or often irregularly with years between increases. So on any given day, most tenants are paying less than the figure reported for new tennancies.

A rental that had a deposit set reflecting a weekly rent of 200 5 years ago, will have been included in the DBH figures once 5 years ago. Now it may have been increased over the years to the market rate of 300, and the DBH won't know that, but the DBH doesn't keep including it in it's figures at 200. Rather the DBH will reflect the 300/week market rate as it's figures are based on new tenancies, not old tenancies.

They only way the DBH figures will be underreporting rent increases, is if landlords are forcing much larger rent increases on existing tenants than they do for new tenants.

Lets say we have 100,000 people currently renting at 300/week.

Now 5 months later the going rate is 320, We have 100 people deposit a bond at 320/week. DBH figures show the market rate is 320. But what's the actual average in this scenario?

100,000 people at 300/week, + 100 people at 320/week = average of 300.02/week, yet the DBH will show 320!

Now of course in the real world, during that 5 months, some people will have had rent increases, and some people will have taken out new tenancies, but the bulk of the people will still be paying their current rent, so the actual average will be a little higher than 300.02, but it will be far closer to 300 than 320.

No

I don't have time to explain statistics to you and the obvious problems with ANZs methodology. Try and get some sleep tonight and maybe you'll learn something tomorrow.

wow, what a comeback! You've really blown away ANZs methodology with that one. Perhaps with a few more posts like that you might get lucky and get head hunted for a statisticians job?

It should be remembered that rents are strictly controlled and can only be raised 6 monthy for periodic rents and often much longer for fixed term rentals.

Hence rent increases lag behind house price rises and will continue to do so until saturation point has been reaached.

In the case of "boarding" houses which are rented by room by room the demand is huge and growing.

They are popular with both tenants ( cheaper) and with investors (no controls, fewer records) so this may be the way of the future for many.

As for the rest of you, better get used to being tenants

"As for the rest of you, better get used to being tenants" why so Big Daddy? please expand on that for us as you drop it into every comment these days?

Double Post

Rental has been flat for some years.....not some months. Now given the large capital increases over the last 2 years and given tenants will be coming agreements all the time there should be by now clear indictations of rents rising, there isnt.

regards

That's why landlords depend on their tax free capital gains when they sell in order to make it all worthwhile.

Time to put an end to that game.

It will indeed make a differnce.

When it is charged on a yearly mark to market basis.

Good point - you're very sneaky. With CGT on sale the next purchaser pays it - like when you buy a house in Australia. But as an annual expense it could fall on the renter (like the water charges did).

Not so .. in Australia .. if you have two identical residential properties side by side, both valued the same .. one is owned by a residential owner-occupier .. the other is owned by a property investor .. only the property owned by the investor will incur CGT .. if they both go to sell their properties at the same time .. the investor-owner won't be able to command a price greater than the one next door, and thus the investor will have to eat the CGT .. and obviously the new buyer will not be paying any extra for the CGT

Conversley the owner occupier is not going to sell their house cheaper than the investor just because the investor has to pay CGT. The investor will pay the CGT, the owner-occupier will pocket the equivilent and purchasers of both have payed more. Generally people try to maximise their sale prices, not minimse them.

Not really. ie you assume the purchaser can meet the additional, I sugegst not. Classic supply siders v demand siders. I would suggest that the price is already set at an effective maximum so adding the CGT cost will fall on the seller.

For for instance when I bought my last house I wrote down what I was prepared to pay, this went back and forth a few times and then just stopped at my limit, the seller sold, below what they wanted, it was simply my limit. Now if there had been a CGT on top I would have had to pay I simply allowed for that and my offer would have been lower allowing for the CGT add on.

regards

Well it depends on the market/location doesn't it? When I sold my last house the people that couldn't afford it missed out.

Besides say you've gained $200K on a $1M property so are liable for $30K at 15%. That's 3% - like agents fees. $1,000,030 or $1,000,060, hardly a deal breaker in reality. You might write the check to the agent, but you know you've covered it in sale price.

Not really, I'd suggest that the price finds the gross maximum that can be paid at best. Hence sure you could add 15% CGT to the price, but if you hve no one prepaed to buy its drop the price or remove it from teh market.

There will always be ppl that "missed out" I bid on a few properties and they went for more than I thought they were worth, I didnt consider I missed out at all.

In fact agents fees is good "proof", in effect it is the same thing as a CGT, the seller pays them.

regards

Like I said the seller writes the cheques, but the account the money comes from has been supplied by the purchaser. I needed $600K to break even (costs plus inflation plus agents fees). I wanted $800K. I got $880K. The agents got payed from the purchasers money.

If no agents were involved I'd have taken $800K. The 25k or whatever agents fee was fully paid (and more) by the purchaser.

Yep and tax rebates on "losses" for property.

regards

So you'd rather the landlord payed for insulation or repairs out of tax payed money rather than having it treated as an expense making improvements and maintenece less frequent?

Not what I said. What I said was where properties are making a "loss" landlords can claim that back by paying less PAYE (as an example) I would ring fence that and stop it.

I'd suggest that landlords already now do the minimum maintenance they can get away with, So less makes the house less rentable or sees the renter take the landlord to the rents tribunal, or teh renter moves out.

Insulation, since the landlord doesnt pay the power bill but the renter does, just how many landlords would add insulation for no or questionable gain? See above para for the answer to that one I'd suggest.

regards

I see - so you want PAYE earning landlords landlords to pay expenses from taxpaid money, but are happy for landlord businesses to claim expenses as any other business? You're on the side of the corporates?

and plenty of landlords have been adding insulation - as it can be claimed as an expense it becomes affordable (an annual improvements budget goes further when claimable - to tenants benefit).

Could you please define what you mean by 'flat'? On the other thread you said flat included 3.3%p.a. increase over inflation. Exactly how much increase is required to not be "flat"? 5%, 10%, 20%?

Rents are increasing in Auckland but like the property market it's not uniform across the whole city.

It will be soon enough.

21 February 2014

Almost all areas of Auckland and sizes of properties reported rent increases in January, according to Crockers’ latest report.

The biggest rental increase for three-bedroom properties was seen in the Birkenhead/Northcote Point area. Their average weekly rent increased 11% compared to the year before.

The City Bays region, from Mission Bay to St Heliers, posted a 15% increase in rent for four-bedroom properties.

link:

http://www.landlords.co.nz/article/4990/auckland-rents-increase

You must love that publication Big Daddy, probably covered in drool. Feb Stats, have they been updated recently?

In July last year Olly said rents would double in 5 years.

He also gave 10 reasons why LVR restrictions would not make a blind bit of diference.

Oh dear....how wrong.

Even Zanyzane is acknowledging Olly was wrong.

Interesting.

"not the newbies that need the higher rents."

Need ?.....Need ?

Only because they are borrowing too much in order to pay over the top prices.

QUALITY tenants set the market , not some over leveraged newbie landlord.

This is a lesson many will soon learn.

Newbie over-leveraged landlords are going to find themselves at the mercy of a flat market, with rising interest rates, insurance, rates, and WOF costs.

Some older landlords as well; the ones who have "re-cycled their equity" and bought multiple properties.

They will be rushing for the exits.

Spottie - you are incredibly negative! You seem to think that there is only way to do something......do you not feel any pleasure in seeing someone else get ahead in life?

Older landlords simply have time behind them in which they have either paid off debt or inflation has moved them away from their debt percentage wise.

A young farmer will be loaded with debt when he/she purchases, a young person startng out in any business is the same......you have to consider the time factor as holding relevance.

Thank you notaneconomist, well said. The jealousy and raging tall poppy syndrome in NZ is laid bare in this website.

Spottie made a prediction, no mention about about perverse pleasure in seeing someone fail. I happen to agree on that prediction, its going to be an interesting election...especially the aftermath if National loses.

In terms of "getting ahead" well I consider that we have some parasitic behaviour going on and its a big fat gamble there is a bigger fool, no good is being made now is it. While it maybe that some individuals can get rentier income that means less going elsewhere, which adversly impacts lots of ppl and businesses.

regards

Steven you're as negative as Spottie......people who get out there and give something a go might fail or they might succeed......good on them for giving it a go......it is better than sitting on your arse doing nothing.......

Your parasitic drivel comments are bollocks and you know it. Some people might want to live in their safe wee world and never extend themselves....fine.....but leave others alone who don't desire to live that way.......and have some get up and go.....geez it would be a boring damn world if we were all cloned the same way.

You have never been in business Steven so stop waffling on about business and adverse impacts they may or not have when you haven't got a clue.....money goes round it keeps circulating.....it doesn't stop.......

Rubbish. Housing is a zero sum game. Those gains you speak of have come at the expense of others not being able to own their own home. Look at the decline in home ownership rates. The only winners are the banks.

It's not about blaming those people who have done well out of housing but let's not pretend its a good thing.

Record immigration, record internal migration, supply shortage, a booming economy, a booming stock market, lowest interest rates on record, land scarcity, artificial land scarcity, shortage of skilled tradesmen to correct said shortage, rising dollar inhibiting interest rate rises. All these factors will take years, if not a decade or more to correct.

So yeah, the Auckland market is going somewhere, that’s up.

Transport is an issue though. I'm hearing of a few people leaving for the provinces because they can't take the commutes any more - even though they can afford to live in $1M Auckland houses.

Really Happy? Supply shortage not as high as expected, building supply accelerating, diary prices disappointing, interest rates on the rise, more land being rezoned increasing supply, poor rental yields, CGT, political change (Labour and greens not investment property friendly), LVR restrictions - lower cost housing taking longer to sell, falling dollar. I hardly think it will take anything like a decade IMHO.

It just part of the cycle. Auckland has had its big run up in price, it will probably slow dramactically to a crawl.... within months.

...oh and the RBNZ may look at limiting debt to income levels in the near future.

Really? I went to Mike Pero earlier this year and they said I could get $900,000, maybe a bit more (thats more than 4.5 times my income btw). My point was, to elaberate that in a competitive market banks are forced to take on more and more risk to keep market share and make a few hundred million more at the risk of depositors who had no intention of taking on such risk. In my mind anything to limit excessive loan risk across the industry is a good thing. Im all for the LVR limits and regulation limiting loans to a multiple of income.

I see your point though kimy and I hear what you are saying and agree statistics can be very misleading, and think the regulations should take all income into account (unless you count future capital gains like they did in the US and add that to income, which I disagree with).

Kimy is correct. Incomes are certainly considered, and a decent safety margin is given by the banks to make sure servicing the mortgage is not a problem.

Those arguing that flatmates help them pay the mortgage dispite low incomes obviously haven't talked to their banks about this. ALL income is considered by banks (not just salary/wage). If you have 2 flatmates (or say you will be getting 2 flatmates) at 200 a week each, then thats good enough for them. They apply a discount to that income to price in any risks involved, I dont know the exact model they use, but at a guess would say the discount applied to flatmate income is greater than that applied to wage earner, which would be greater than that applied to a salary earner.

I know for a fact that job type/sector you are in also comes into it. They model these things (actuaries, guys very good at stats, crunch numbers to assess a lot of things around income to debt risks).

The sector I'm employeed in is known for good salary progression and job security, so they consider this, and I expect I'd get a multiple higher than if I was in a trade or public sector job.

Well all I can say Simon is, I wouldn't lend me $900,000, even with my income. Thats just irresponsible.

Of course incomes are considered. I am talking really about limiting risk for the depositors and the industry. My brother was an actuary actually (in insurance industry):-). If debt to income restrictions were brought in what happened in the US would never have happened, and we are still suffering the fall out, even though their actuaries came up with all sorts of justification why extending subprime loans was a good idea as they are packaged up with good stuff and rated AAA. No one could loose. Cool. Like the LVRs income restrictions would also act to suppress interest rates as they would need to raise them as much as otherwise would be the case.

Yes when I first started out and bought my first house the bank took 50% of proposed flatmate income. Not sure what they do now, I have no flatmate income anymore but it did certainly help pay the mortgage in the early days...

Yip, really. You have given me a great opportunity to highlight to disconnect between economists and the real world. I’ve seen you and your ilk predict massive house price falls for years now; all the while we’re having steady increases. I watch you scratch your heads, shrug, then say, “it will correct eventually”.

This is the problem with people making predictions about an industry they know nothing about.

Are you a developer, investor, real estate agent? Do you even live in Auckland? Or are you just another arm chair expert…

Sorry Happy123, you dont seem that happy, who are you really? You have me confused with someone else. I think you should re-read my posts going back years on this site and you would have seen I was pro-property and a couple of years ago in AKL it was virtually a one way bet, not so now though, much of the positives have been priced into the market and virtually none of the negative. My above post was just saying its just the cycle property goes through, big deal.

Exactly where in the last few years have you seen me predict massive house price falls Happy? I haven't. Historically, if anything the opposite is true. But you have to separate what you wish the market will do and what it actually is doing.

I am a property investor, I'm 44 this year, live in Auckland, never worked for a bank or government sector. I work in the real world. Been in markets for 29 years, long enough to see people say property can only go one way - up (like you do), and long enough to see them wrong and the bears wrong too, but even I can see AKL property is stretched, so I've sold down my portfolio this year (the first time ever I have sold any property). I'm not saying the AKL market will slow, I'm saying it is slowing - ring a bunch of honest real estate agents and will tell you the same thing, but dont worry, be happy!

Ohhh now I get it, you must be kicking yourself, you’ve timed it all wrong now you’re hoping there will be a downside so there will be buying opportunities and you can get back in. Don’t worry champ, better luck next time.

Actually no Happy, you still dont get it. If I really believed AKL prices would crash I would have sold all property. Im not hoping at all there would be a crash or downside (I stand to loose many thousands in equity if that happened). Why would I even wish for that? That's silly. You keep referring to this but ignoring what I actually are saying. I think you have confused me with someone else as Ive never actually even suggested a decrease in house prices.

Look I'll spell it out for you. I think Auckland yields don't make sense and its not a good time for an investor to buy, and I have other uses for the money, (there are other things beside property you know). I dont see a crash, just the market levelling off, big deal. It goes up, goes flat then goes up again, so what? Why cant you read what I actually say? Take a deep breath and read. I am quite happy with the profit I made on what I've sold, I certainly couldn't have gotten anything like those returns anywhere given the risk.

If you've got skin in the game then I take it all back; your welcome to your prediction whether I agree with it or not.

Too many perma-bears on this site and I mistook you for one.

Are you trying to say that Auckland’s population is not increasing? Really…

If there’s no land scarcity, go find me a bare ¼ acre on the CBD fringe for under 1 million…

Interest rates are set to stay at record lows, what we see now is considered the new norm, refer Interest.co.nz, this nullifies the high debt levels.

Take a look at todays breaking news, get used to it.

Finance Minister Lou Jiwei of China has promised a gradual transition away from transaction tax on property towards a recurring taxes on property owners [url= http://blogs.piie.com/china/?p=3785] Reform is Coming? (/url]

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.