October At Wharf Gate (AWG) prices for export logs reduced an average of 4-5 NZD per JASm3 from September prices. Log demand in China remains steady and log inventory is at extremely low levels. However, the log buyers are not overly concerned about the very low inventory as demand is not increasing as it usually does at this time of the year in China.

The domestic market continues to show signs of recovery with some confidence returning to the industry after the New Zealand General Election but the global demand for sawn timber is still soft.

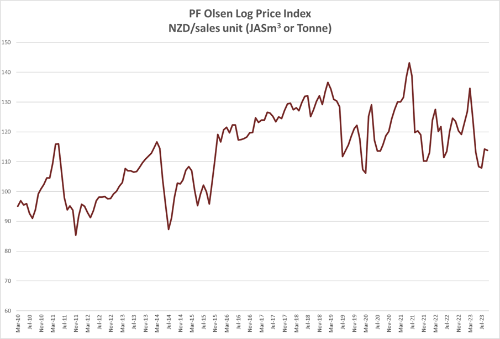

The PF Olsen Log Price Index dropped $2 to $112. The index is currently $7 and $10 below the two-year and five-year averages respectively.

Domestic Log Market

Log supply is still tight in some regions as some smaller forest owners slow down or stop harvest production. Most Quarter 4 log pricing was flat with some small price increases in structural logs in some areas due to the tight supply.

Mills report domestic orders increased within a few days of the New Zealand General Election on 14 October, so it appears there is some confidence returning in the construction industry.

Demand in Europe for clear sawn timber boards produced by New Zealand mills has continued to stall.

Export Log Markets

China

China radiata log inventory continues to reduce and is now around 1.7m m3, with total softwood inventory at about 2.7m m3. Daily port off-take has remained within the range of 65-70k m3 per day, which is in the normal range for this time of the year in China. However, the market does not anticipate significant increases in demand when China moves into its usual busier months for construction. Inventory levels falling even with the Golden Week of holidays in the first week of October shows that total log supply has reduced. Australian logs have been offered to the China market again after China lifted a two and a half year trade-ban in June, but these initial logs have been cut to Indian log lengths.

Inventory levels significantly below 4m m3 used to trigger sharp increases in log prices, but this isn’t the case with a subdued market. The October CFR price for A grade logs remains in the range of 110-117 USD per JASm3. Market forecasts for November sales are in the 115-120 USD per JASm3 range.

The China Caixin Manufacturing PMI dropped from 51.0 in August to 50.6 in September. Any PMI number above 50 signals manufacturing growth. Output expanded the most in the last four months and this is the second straight month of growth amid efforts from the Chinese Government to revive the Chinese economy. However, sentiment dropped to a 12-month low which is vey significant for the Chinese log market as this market has often previously been sentiment driven. These stimulation efforts appear to be more successful in other areas of the economy rather than the real estate market which has significant headwinds. Unlike previous stimulation packages the Chinese Government has not intervened directly in the construction sector.

India

Demand for green sawn timber in Gandidham is subdued with prices at 491 INR per CFT for South American pine and 421 INR per for Australian pine. Mills don’t want high stocks heading into the Diwali holiday period.

There is some interest in Eucalypts for core veneer. Trial shipments will arrive as part cargoes in bulk shipments from Australia and South America.

Tuticorin is receiving logs in containers from the USA. Green sawn timber is sold at about 590 INR per CFT.

Sawn timber production and demand will be low for November due to Diwali celebrations. Diwali holidays will be celebrated between the 10th and 14th of November. Work will slowly resume again from the 20th of November as workers return from their home villages.

Exchange rates

The NZD has weakened slightly against the USD through October and this will contribute about a $3 lift in November AWG pricing.

NZD:USD

CNY:USD

Ocean Freight

Freight costs have stabilized within a range of low to mid 30’s USD per JASm3 for shipping logs from the North Island of New Zealand to China. Log vessel congestion continues at Tauranga Port with an average waiting time for a berth of about 12 days.

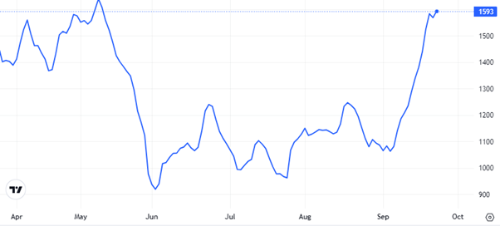

The Baltic Dry Index has fallen from its peak in mid October.

The Baltic Dry Index (BDI) below is a composite of three sub-indices, each covering a different carrier size: Capsize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in Handysize vessels, this segment is strongly influenced by the BDI.

Source: TradingEconomics.com

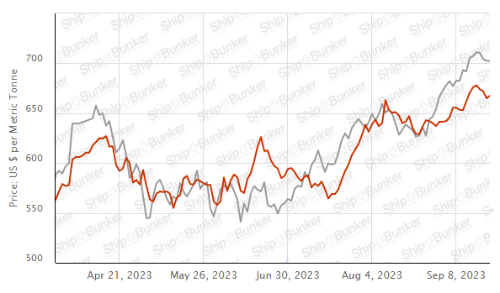

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index – October 2023

The PF Olsen Log Price Index dropped $2 to $112. The index is currently $7 below the two-year average and $10 below the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent

a broad average of log grades produced from a typical pruned forest with an

approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – October 2023

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Oct-23 | Sep-23 | Aug-23 | Jul-23 | Jun-23 | May-23 | Oct-23 | Sep-23 | Aug-23 | Jul-23 | Jun-23 | May-23 | |

| Pruned (P40) | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 180 | 180 | 183 | 150-160 | 150-160 | 160-170 |

| Structural (S30) | 120-145 | 120-145 | 120-145 | 120-145 | 120-145 | 120-150 | ||||||

| Structural (S20) | 93-100 | 93-100 | 93-100 | 93-100 | 93-100 | 98-105 | ||||||

| Export A | 119 | 119 | 120 | 105 | 105 | 110 | ||||||

| Export K | 110 | 110 | 111 | 96 | 96 | 101 | ||||||

| Export KI | 101 | 101 | 102 | 89 | 89 | 94 | ||||||

| Export KIS | 92 | 92 | 93 | 80 | 80 | 85 | ||||||

| Pulp | 46 | 46 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.