Log demand in China remained steady through November and early December but severely low temperatures this week has slowed construction activity. Log sale prices had increased due to market concerns about reduced supply from New Zealand. Higher sale prices were counteracted by slightly firming shipping costs and a stronger NZD against the USD resulting in December At Wharf Gate (AWG) export log prices to New Zealand log suppliers increasing by an average of 9 NZD per JASm3.

There is still a lot of uncertainty about construction activity for both China and New Zealand in 2024.

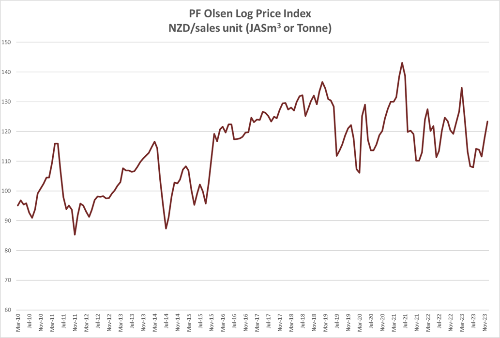

The PF Olsen Log Price Index increased $5 to $123. The index is currently $4 above the two-year average and $2 above the three-year and five-year averages.

Domestic Log Market

Log demand in New Zealand during December is always based around mill shut dates and wanting to manage log inventory levels that are held over the Christmas/New Year shutdown period. Any excess production is sold to export markets.

Export Log Markets

China

China softwood log inventory is about 2.4m m3, and daily port off-take has remained about 60-70k m3 per day. Sawmills in Northern China have closed this week due to very severe cold weather conditions and sawmills in Southern China plan to close early for the Chinese New Year. The CFR sale price for A grade pine logs in China is now in the range 127-130 USD per JASm3. The wholesale log price dropped this week as construction activity has reduced due to the very cold weather conditions.

The market expects inventory to rise to about 2.5m m3 after the Chinese Lunar New Year in February 2024, but this may increase more if activity is constrained for longer than expected due to the weather conditions.

On September 28th China Forestry Group was acquired by China Three Gorges Group. This situation is relatively rare among central enterprises, so about 500k JASm3 of log volume remains unsold as the machinations of this acquisition are worked through. Due to the low temperatures in China at the moment, this stock should still be suitable as it filters back into the market.

The volume supplied from the windthrow salvage in the Central North Island will start to slow down in 2024. Approximately 2.4m m3 of logs was supplied in 2023, and they hope to produce another 1m m3 of logs by June 2024, as they race against the logs becoming too degraded by insect and fungal activity.

The China Caixin Manufacturing PMI increased from 49.5 in October to 50.7 in November. (Any number above 50 signals manufacturing growth). Recent market stimulation efforts from the Chinese Government has increased both output and buying levels.

India

Kandla is oversupplied with logs and the market expects demand to increase in February.

The rain has stopped in Tuticorin. but there is much flooding including in log storage areas. Demand should increase in January.

Korea

Log demand is stable in Korea with prices a few dollars behind China prices. Prices in Korea follow log prices in China, so are also increasing.

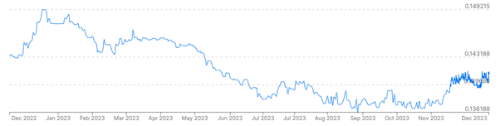

Exchange rates

The NZD has strengthened against the USD through November and December which has diminished AWG gains from log price increases in China.

NZD:USD

CNY:USD

Ocean Freight

Freight costs have firmed slightly with average shipping costs now about or just over 30 USD per JASm3 to ship logs from the North Island of New Zealand to China.

The Baltic Dry Index (BDI) below is a composite of three sub-indices, each covering a different carrier size: Capsize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in Handysize vessels, this segment is strongly influenced by the BDI.

Source: TradingEconomics.com

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index – December 2023

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent

a broad average of log grades produced from a typical pruned forest with an

approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – December 2023

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Dec-23 | Nov-23 | Oct-23 | Sep-23 | Aug-23 | Jul-23 | Dec-23 | Nov-23 | Oct-23 | Sep-23 | Aug-23 | Jul-23 | |

| Pruned (P40) | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 190 | 180 | 180 | 180 | 183 | 150-160 |

| Structural (S30) | 120-145 | 120-145 | 120-145 | 120-145 | 120-145 | 120-145 | ||||||

| Structural (S20) | 93-100 | 93-100 | 93-100 | 93-100 | 93-100 | 93-100 | ||||||

| Export A | 134 | 125 | 119 | 119 | 120 | 105 | ||||||

| Export K | 125 | 116 | 110 | 110 | 111 | 96 | ||||||

| Export KI | 116 | 107 | 101 | 101 | 102 | 89 | ||||||

| Export KIS | 107 | 98 | 92 | 92 | 93 | 80 | ||||||

| Pulp | 46 | 46 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.