At most other ports they fell $3-6/JAS m3.

Wellington now boasts some of the top prices in New Zealand which is a big change from previously trading at a considerable discount to other ports such as Tauranga and Napier.

Domestic log prices either flat-lined, or were up marginally (mainly pruned log supply). All grades are well-sought after in almost all regions, underpinned by a strong domestic housing market, strong domestic non-residential construction activity and continued strong demand for wood products from Australia, the USA and parts of Asia.

With the relative stability in the markets at present, Wood Matter’s Log Market report digresses a little this month to contemplate the significance of the global trend of more multi-storey wooden buildings (immediately below) and we also report on a mill visit to Taranakipine (New Plymouth) – later in this report.

Why is the trend of building taller wooden buildings of relevance to NZ forest owners?

Around the world, there is an emerging trend to construct taller wooden commercial/high-density residential buildings. Whilst this might seem to have little relevance to forest owners in New Zealand, there is good reason to be interested and excited in this development.

NZ Radiata pine performs relatively poorly as an unmodified structural sawn lumber (in comparison to, say, Douglas fir and other pines). However, it performs very well as the base wood-fibre for components of multi-storey buildings (and other structures).

The high-strength pruned log pruned log supply to Tenon for the construction of two massive 40m bridges in the Netherlands is one such example - see "Close collaboration with industry leader".

Such wood components include cross-laminated-lumber – CLT, laminated veneer lumber – LVL and finger-jointed, edged-glued beams). If you then add the environmental sustainability of NZ Radiata pine (most plantations in NZ are FSC® certified) and the environmental benefits of building with wood (CO2 sequestration, low imbedded energy and good thermal qualities), you can quickly become quite excited about the prospects for NZ Radiata pine. This is important, as these new [global] markets are going to be needed to absorb the increase in harvest forecast to come out of New Zealand over the next 10-15 years - see “Wall of Wood”.

A recent visit by PF Olsen to Taranakipine (below) reinforces the viability of Radiata pine in remanufactured structurally-orientated applications.

"It’s only a matter of time until the first timber skyscraper is built”, says Simon Smith of Smith and Wallwork engineers. This picture shows a conceptual rendering of a 300m tall timber skyscraper located in the Barbican, London. Researchers from Cambridge University have teamed up with engineers and architects to propose this unique timber structure to the Mayor of London, Boris Johnson. If constructed, this 80-storey building will dwarf the world’s current tallest building which is 14-storeys (source: Engineering and Technology Magazine).

Export Log Market

Log stocks at Chinese log ports are reported at around 2.7m m3, a continuation of a strong downward trend and much lower than many commentators predicted this soon after Chinese New Year. Daily offtake (demand/consumption) has increased through March, averaging 58,000 m3 per day; this level is expected to continue through April and May at least.

Indian and Korean demand is stable and continues to attract NZ log supply.

Export log supply from New Zealand is stable with little increase expected over the winter months. Most other supply sources are also stable at lower-than-peak levels. Australia is the outlier with supply volumes up. This however, is not expected to offset the current declining log stock trend in China.

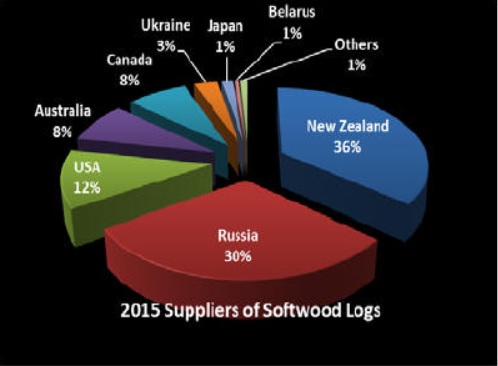

Supply sources of softwood logs to China. With the exception of Australia and New Zealand, other sources are expected to be either stable or declining (source: globalwood).

Pruned log demand is proving a little softer than other grades with log stocks in northern China remaining relatively high compared with the Shanghai and Southern China regions. This may be related to China moving into the “sapstain season” where the northern hemisphere summer increases the expression of sapstain on logs which have not been anti-sapstain treated.

The reduction in NZ$ at-wharf-gate prices in April were due almost entirely to unfavourable movements in NZ$ currency and ocean freight rates.

The NZ$:US$ cross rate has moved from 0.66 at the start of March to 0.69 at the start of April, having a potential unfavourable NZ$8.00/m3 impact on “A” grade log price (at-wharf-gate NZ port), depending on the degree of hedging an exporter might have. As reported above, the actual impact on log prices was much lower than this. Sentiment on the outlook is generally on the weak side for the NZ$, which will be supportive of log price.

As reported last month the ocean freight rate firmed a little in March and a firmer tone continued into April. Vessel availability is reported to be a little lower as fewer supra/handy-size vessels are opening in New Zealand with lower fertiliser, feed and mineral imports. A firming oil price and higher consequently bunker prices (fuel oil for log vessels) is adding marginally to higher ocean freight rates. However, the fundamental over-supply of supra/handy-size vessels is expected to keep ocean freight at historically very low rates for the foreseeable future.

The consensus outlook is stable export log pricing for the next few months. There could, however, be some pricing pressure in June as construction slows during the hot season and harvest time in China.

Domestic Log Market

After a three month slump in prices, REINZ figures this last week showed the median house price in Auckland surged $70,000 to $820,000 – the first time to break $800,000. This will be stimulatory for the economy in general, and the house construction and renovation market in particular. In addition, recent media reports (“Here come the Jafas” headlined the Herald on Monday 18 April) Aucklander’s being responsible for around 20% of house sales in nearby regions and the main centres. It appears that most of the activity is investment-related with purchaser’s not able to afford residential property investment in Auckland turning to the provinces for lower-priced, higher yield investment properties.

Australia, the USA and parts of Asia continue to be strong markets for NZ wood product exporters although the recent appreciation in the NZ$ is crimpling export receipts. In addition, come domestic processors are feeling the pinch at having to pay higher log input costs and not being able to pass these on in competitive markets such as Australia. This could be exacerbated as the Australian property market shows signs of declining.

Visit to Taranakipine, New Plymouth

As a first step to commencing operations in the Taranaki Region, PF Olsen met with Tom Boon, CEO of Taranakipine.

Tom kindly showed Richard Cook, PF Olsen Southern North Island Manager and Peter Weblin, PF Olsen Chief Marketing Officer around the mill.

The first thing that hits you is that the site is clean and tidy and everyone seems busy and knows what to do. Tom reinforces this “culture” by stooping down from time to time to pick up and dispose of loose items - a short piece of plastic strap or a stray piece of bark.

The second thing is the manufacturing process. As Tom explained “the first part of the mill is pretty conventional, we are breaking down the log. Then we cut out the bits that down-grade the lumber, and focus on putting it back together.” The result is a wide range of finger-jointed, edge-glued components, many for structural applications (e.g. beams and posts) and many of which have been LSOP treated and paint-finished.

The main markets for Taranakipine are Australia, New Zealand and the USA. The mill is FSC® certified and Tom is always on the look-out for more FSC® certified log supply which he says can attract a premium price.

Tom Boon (CEO Taranakipine) and Richard Cook (PF Olsen Southern North Island Manager) inspect finger-jointed lumber awaiting edge-gluing in Taranakipine’s state-of-the art laminating plant.

After the logs are broken down in a conventional head-rig/resaw and defected, they are then dried, finger-jointed and dressed to produce high-quality, strong and dimensionally stable remanufactured pine.

The value-added transformation is completed when the wooden pieces are LSOP treated and then painted. These pieces are destined for the Australian market.

PF Olsen Log Price Index to March 2016

The PF Olsen log price index fell two points from $122 last in March to $120 this month. It is now $33 higher than its low of $87 in July 2014 and $15 above the two-year average and $17 above the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices - March

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||

| Apr-16 | Mar-16 | Feb-16 | Dec-15 | Nov-15 | Apr-16 | Mar-16 | Feb-16 | Dec-15 | Nov-15 | |

| Pruned (P40) | 196 | 196 | 195 | 175 | 171 | 195 | 198 | 198 | 195 | 185 |

| Structural (S30) | 112 | 112 | 112 | 106 | 103 | |||||

| Structural (S20) | 98 | 99 | 99 | 98 | 96 | |||||

| Export A | 124 | 128 | 127 | 128 | 111 | |||||

| Export K | 118 | 122 | 120 | 121 | 106 | |||||

| Export KI | 106 | 110 | 108 | 108 | 94 | |||||

| Pulp | 50 | 51 | 51 | 50 | 50 | |||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

This article is reproduced from PF Olsen's Wood Matters, with permission.

8 Comments

The first cross laminated timber manufacturer in the Southern Hemisphere is a company called Xlam and it is based in Nelson http://www.xlam.co.nz/. There is a Wellington architecture firm called Makersof Architecture which specialises in using this product http://www.makersofarchitecture.co.nz/.

This article is quite right. The wall of wood production from NZ in the coming decades is a huge opportunity. Whether NZ can utilise it is another matter?

NZ producers have a culture of poor management, low tech, minimal investment in research and development and a commodity producing mentality. The only way our current crop of business leaders can conceive of increasing pricing is by monopolising the market to achieve dominance/arrogance -i.e the Fonterra model. If that fails our businesses become submissive price takers.

For NZ to benefit from this wall of wood we need to turn it into a high value product -we need to add value to to it in such a way that it becomes highly desirable.

One way would be to make NZ cities housing markets much more elastic -by accepting a much more liberal planning rules. This will encourage a building boom as the increased demand is translated into more houses being built rather than higher prices.

The wood industry needs to campaign for that and once that is achieved be prepared for for a competitive cluster of businesses competing on price and quality from investing in innovation.

A strong home market -with competitive prices and increasing quality would then have strong firms which would be internationally competitive. They could take on, for instance Finlands Honka -which export thousands of kitset log homes to Japan after the recents disasters Tsunami/earthquakes http://www.honka.com/ .

Ownership structure of milling / logging companies in NZ?

PanPac, Napier & now South Island is 100% Japanese owned.

Jobs for NZers but profits where?

Originally Carters owned.

to be fair CHH was owned by a kiwi who asset stripped It, the new Japanese owners are rebuilding the company and are investing millions into new buildings and plant.

it will take them years to recoup what they are investing they will own long term and the workers are now a lot happier under the new owners

They are shutting steel mills down all over the world because of oversupply. How can milling and processing wood be cheaper than steel? Wood is great for low level single dwellings but not multiple occupancy tall buildings. How will this fly?

Agreed. The bit of this article about lots of tall buildings made in wood in the future is wishful thinking. Downright scary too. How thick would the columns have to be? 3m square? And how could the connections to the (presumably reinforced concrete) foundations be made earthquake proof?

There's nothing new in this. If it was economic and didn't create massive structural problems then we would be using timber instead of the combination of steel and concrete that's for many reasons.

The columns and beams would likely be too large, interfere with running services and keeping the size of each floor economic. I get the feeling that the building concept for London is on a cost doesn't matter basis due to the finished property value being ridiculous.

With rising sea levels there must be an opening for wooden ark construction I reckon, big gap in that market.

I wonder if the ark will come with a free flying wooden pig...........

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.