Export prices declined by an average of $1 per JASm3 over the country. We have seen some spot increases, but this is more a reflection of exporters chasing volume for ships or looking to secure a supply chain at a port.

The expected increase in shipping costs has been offset by a slightly weaker NZD relative to the USD and some gains in the sale prices in China. A very competitive pool of exporters vying to purchase logs has maintained prices for log sellers.

The domestic clear-wood mills continue to have strong demand for good quality pruned logs. We have seen some price increases around the country, and this is often on a case by case basis.

Domestic prices for structural saw logs are stable in some regions and have increased by $3-6 per tonne where supply is tight. This is particularly evident in Northland and Southland.

There has also been some catch-up where export prices were above domestic prices in Quarter 1 of 2017. We anticipate there will be more spot increases for domestic logs as supply tightens up with the wet weather around the country further reducing supply.

Domestic Log Market

There is strong demand for good quality pruned and structural logs. There are a lot of stands being harvested before they are mature enough to be ideally suited to the domestic market. (These forest owners are taking advantage of above average export prices). Therefore even though the overall harvest level is high, there is still a lack of quality logs for the domestic mills. This shortage is exacerbated in some regions by the continued rainfall events interrupting harvesting.

Some regions have seen increases in log prices for Quarter 2 as mills seek to match export sales to ensure log supply.

The outlook is very positive for the domestic demand. There are now a record high 132 cranes in New Zealand with 72 alone in Auckland. The construction activity is a result of immigration, increased tourism numbers, solid housing activity, as well as strong manufacturing and consumer spending. So while this construction boom does increase some wage pressure for our contractors in some areas- it is very healthy for log sales.

Export Log Market

China

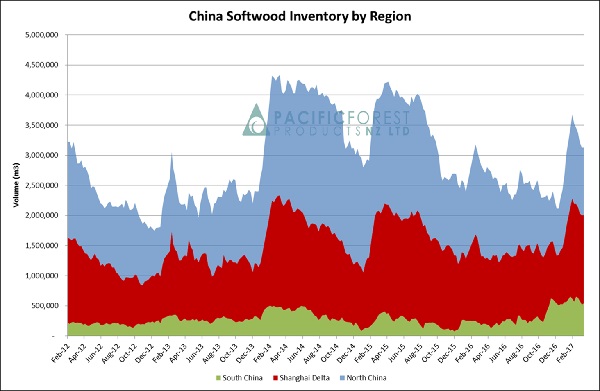

The stability continues in the log export market. Pacific Forest Products (PFP) report that China inventory has reduced by 330,000 m3 over the last 4 weeks which is favourable, but has remained on 3.13 mill m3 for the last two weeks. Offtake is high at around 68,000 m3/day but there is also a high inbound volume flow, which leaves the market very evenly balanced.

China Log Inventory. (Courtesy of PFP)

Most log exporters managed to eke out small increases in their CFR sale prices in China.

PFP had expected to see the Pacific North West (PNW) volume to China decrease as reported extreme cold weather was hindering production, but it appears the dynamics of the cross border timber trade between Canada and the USA may be encouraging more log export. It will be interesting to see how export volumes track over the next quarter and whether or not the severe winter does in fact reduce PNW volume.

As per predictions in recent Wood Matters we expect variations in AGW returns for forest owners to be due to fluctuations in shipping and foreign exchange rather than market movement.

India

There is currently an increased volume of logs heading to the Indian market. This market is still recovering from the currency demonetization, and demand is not expected to increase back to previous levels until July/August. This timing is based on the end of Monsoon season when planning for a new cycle begins, as well as the introduction of some government policies. In the meantime the Indian CFR sale price is likely to be affected by a small $1-2 drop from the extra log volume.

Freight

The surge in freight prices has recently subsided this week and several shipping commentators have reported a plateau. The Baltic Dry Index as a whole keeps creeping up and has hit its highest level since November 2014 at 1338 points. Oil prices have increased marginally but not enough to affect owners freight ideas. Poor weather in the South Pacific is adding to congestion and reducing fleet capacity. Once we get through the short term surge on fright demand (ore and grain-see March Wood Matters) there is a possibility that freight will return to previous sub 20’s levels to China. Most market insiders think freight in the low-mid $20’s will persist for the next few months.

Foreign Exchange

The NZD relative to the USD has recently remained in the 0.699 and 0.705 range which is a very tight range. When AWG prices were set for April the rate was 0.699 compared with 0.722 in late February when March prices were set.

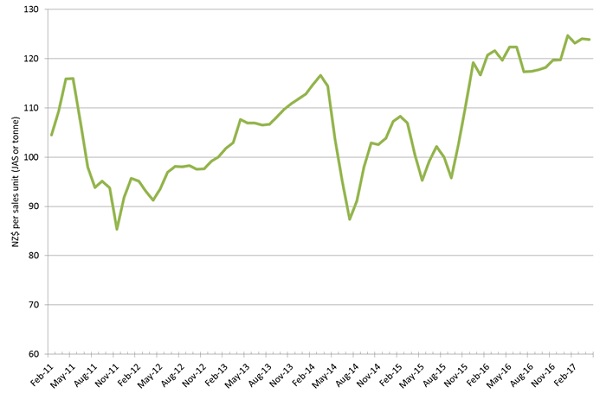

PF Olsen Log Price Index to April 2017

The PF Olsen log price index remains at $124 for April. The small drop in export prices has been matched by the gain in domestic log prices. The index is now $9 higher than the two-year average and $14 higher than the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – April 2017

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||

| Apr-17 | Mar-17 | Feb-17 | Dec-16 | Apr-16 | Apr-17 | Mar-17 | Feb-17 | Dec-16 | Apr-16 | |

| Pruned (P40) | 188 | 187 | 187 | 187 | 196 | 185 | 179 | 185 | 172 | 195 |

| Structural (S30) | 113 | 112 | 112 | 112 | 112 | |||||

| Structural (S20) | 103 | 102 | 102 | 102 | 98 | |||||

| Export A | 136 | 137 | 135 | 128 | 124 | |||||

| Export K | 129 | 130 | 128 | 120 | 118 | |||||

| Export KI | 121 | 121 | 119 | 109 | 106 | |||||

| Pulp | 50 | 50 | 50 | 50 | 50 | |||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only..

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.