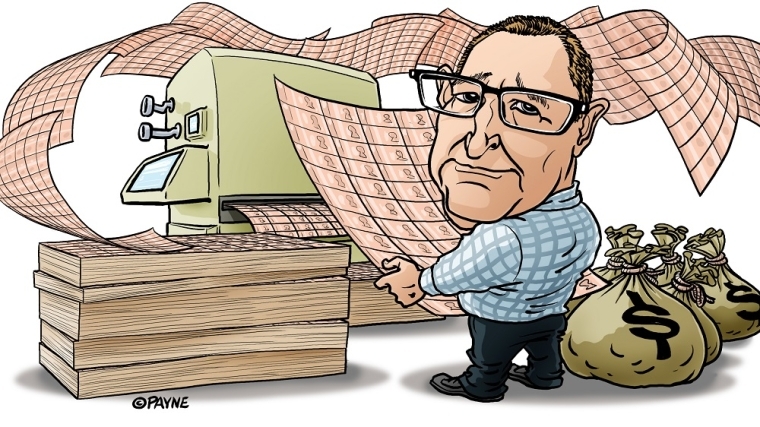

The Reserve Bank using settlement accounts for transmission of its Large Scale Asset Purchase (LSAP) programme during 2020-21 saw banks profit by about $2 billion, a consultant working on behalf of non-bank deposit takers (NBDTs) estimates.

The Exchange Settlement Account System (ESAS), owned and operated by the Reserve Bank (RBNZ), is the system for processing and settling payments between banks and other financial institutions.

In a submission to the Commerce Commission's market study into personal banking services, Buddle Findlay consultant Simon Jensen notes the advantageous position banks have through their settlement accounts, something NBDTs don't have. NBDTs Jensen represents include building societies, credit unions and finance companies that take deposits from the public. NBDTs have long sought settlement account access, something being considered by the Reserve Bank through an ongoing review of its ESAS access policy and criteria.

"By using ESAS accounts to implement quantitative easing [the LSAP] during the Covid-19 pandemic in 2020, the banks immediately benefitted from holding substantial parts of their liquidity in ESAS accounts and benefited from receiving higher margins on their deposits (particularly because of the increase to the overnight [Official] Cash Rate from 0.25% to 5.5%). It gives them an immediate margin in a risk free, zero risk weighted on call asset being the ESAS account. We understand that it potentially accounts for around $2 billion of bank profits on customer call accounts – as well as giving them a risk-free margin on funds deposited with them by NBDTs," Jensen wrote.

"By contrast, NBDTs have to deposit their funds with the banks and maintain their liquidity with the banks. These are risk weighted at 20% and prudently structured over a period of maturities to maximise returns. They do not have the luxury of earning 5.5% on call in a zero risk weighted asset. Furthermore, during Covid when some needed to break deposits to manage liquidity risk or potentially access standby facilities with banks, it became reasonably apparent that the commercial banks were unwilling to allow them to break and unlikely to actually fund under standby facilities. In contrast the banks could rely on the RBNZ for not just access to ESAS funds but the various funding and standby funding it was prepared to provide them)."

"This means that banks have a material competitive advantage in the deposit and transactional banking market because of the easy risk-free margin available to them not available to NBDTs. Given ESAS accounts must always have credit balances there is no credit related reason for the RBNZ to deny access," wrote Jensen.

"As a result of holding liquidity in banks, the NBDTs return on investment for this liquidity is lower than if liquidity was held with the RBNZ in an ESAS Account (which would attract interest equal to the OCR rather than the commercial rates offered by the banks, and for capital purposes would be risk weighted at zero). In addition, the NBDTs are subsidising the earnings of the banks (who are able to deposit NBDT funds into their own ESAS accounts and earn higher margins)."

'A major competitive advantage'

Jensen said banks thus have "a major competitive advantage" over NBDTs, whose ability to continue to invest in and grow their personal banking services is hindered because they must hold liquidity in ways that significantly reduce their profitability.

"The RBNZ should be required to provide ESAS accounts to NBDTs as well as banks now. The RBNZ should also provide equivalent funding to that which it provides banks but, on a risk, adjusted basis so that NBDTs do not have to go through the expensive exercise of securitising mortgages but can provide similar security (e.g., under the trust deed) but also pay for the funding at a risk adjusted rate (i.e., higher than banks pay residential mortgage-backed funding)."

Settlement cash balances were relatively low and stable before the RBNZ launched its LSAP programme in March 2020 at the onset of the Covid-19 pandemic, averaging around $7.5 billion in the decade up to 2020. The introduction of the LSAP saw the RBNZ issue a significant volume of settlement cash in order to buy government and local government bonds. The RBNZ's subsequent Funding for Lending Programme, through which it loaned banks $19 billion at the OCR, further increased settlement cash balances.

Settlement account balances peaked above $56 billion in late 2022, with major banks such as ANZ and BNZ holding $10 billion or more in their individual accounts. Balances have declined as the RBNZ started selling down its LSAP government bond portfolio to Treasury's NZ Debt Management unit at a rate of $5 billion per fiscal year, but remain high. The most recent figure disclosed by the RBNZ is $44.913 billion as of the end of January.

Those with ESAS accounts include ANZ, ASB, ASX, BNZ, Bank of China, China Construction Bank, Citibank, HSBC, ICBC, Kiwibank, NZX, the RBNZ, TSB, CLS (Continuous Linked Settlement), the Local Government Funding Agency, Treasury's Debt Management Office, the NZ Super Fund, Rabobank and Westpac.

The Covid-era surge in settlement account balances has led to questions over whether ESAS account holders should continue being paid at the OCR.

The RBNZ says it receives regular approaches from a variety of institutions seeking access to ESAS, noting broader access could enable and encourage welcome innovation in the financial system but may also pose risks.

Jensen's comments were made in the submission answering the following question;

'What are the specific regulatory requirements that most affect your ability to compete to provide customers with personal banking services? How and why?'

He said the Commerce Commission requested a group of NBDTs who attended a meeting last year provide specific responses on a series of topics.

Commerce Commission sets date for issuing of draft report

The Commerce Commission says it'll publish its market study draft report on March 21.

"This will include our preliminary findings and outline any options for recommendations to improve competition that we are considering. A public consultation process will follow release of the draft report, including submissions and a consultation conference hosted in Auckland and online," the Commerce Commission said.

It's required to publish its final report by August 20 this year.

"The final report may include recommendations that identify ways to improve competition in the sector for the long-term benefit of New Zealand consumers."

All deposits by repricing, source RBNZ

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

13 Comments

The LSAP programme was un-necessary and it has only created distortions in the markets; it should have never been started in the first place.

On top of that the decision to reduce the OCR to .25% was based on what data, compared to their absolute focus now on inflation data?

Maybe they learnt their lesson? Or maybe they have gone from one wrong extreme to another.

I wonder how they determine their least risk scenarios. They always seem to pick the option that looks like the most risk to me. Covid may have caused a recession or depression, but unless it was going to cause deflation or bank instability then the RBNZ wasn’t the correct party to act.

I don't think they learned any lesson. Did anyone learn from QE the first time?

Maybe we needed a healthy dose of deflation to remove decades of baked in inflation, to remove some of the complacency and reliance on these institutions to control everything, to rethink real values.

How dumb were they to not evaluate the effect of the fiscal stimulus of the wage subsidy scheme combined with a supply shock.

Monetary policy and financial stability appears so far removed from economic theory, which we already know is a flawed science.

You're making my day Gareth - a whole article on ESAS!

I can understand RBNZ's concerns here about widening access. LSAP (and QE globally) has lifted the veil on how central banks and Govt finance interlink..

Bit of context first...

The ESAS balances go up when Govt or RBNZ spend money into the economy, and down when Govt collect taxes or sell bonds to ESAS account holders (who are the only organisations that can bid at Govt bond auctions). ESAS account balances are inflated because RBNZ bought loads of bonds on the secondary market (and because of the dumbass FLP etc). RBNZ sold QE and FLP as being some kind of stimulus package. But, in reality, QE just held the interest rate down by keeping the value of Govt bonds up, and NZ being NZ, low rates just juiced the housing market to the moon.

ESAS account balances can accurately be described as the 'floating rate' component of Govt debt. Govt debt is about $130bn of mostly fixed rate bonds and $47bn of floating rate debt in ESAS. The floating rate is the OCR. When Govt sells a bond to an ESAS account holder (the only people thst can buy bonds directly), they swap some of the floating rate debt (ESAS balance) for fixed rate debt (Govt Bond) with the interest rate almost always fixed for term at the bond coupon rate. That's why Govt borrowing does not increase when Govt sells a bond - they are simply swapping the form of their debt.

Now (finally), two issues I can see on opening up wider access to ESAS

Firstly, in normal times, RBNZ and Treasury collude to ensure that ESAS settlement balances are held at a few per cent of total deposits ($7bn or $8bn) - i.e. enough to handle daily settlements / transfers between banks. They manage the total ESAS balance by sucking money out by selling bonds, collecting taxes, selling currency, and they add to ESAS when Govt spends, pays out bonds at maturity etc. If NBDTs had ESAS accounts, how would RBNZ hold the total level where they want it? Why would they allow someone to simply deposit unlimited money in ESAS to take advantage of the interest rate? That's not what ESAS is for - it is for handling daily transfers between banks and as a monetary policy instrument remember the OCR paid on settlement account balances puts a floor on the short-term interbank / market interest rates.

Secondly, widening access to what are basically RBNZ deposit accounts that pay OCR daily on balances(!) is getting dangerously close to bypassing our highy profitable banks. Why not offer RBNZ deposit accounts to any organisation or individual in NZ? Why not hold all Govt debt directly as Govt-guaranteed private sector term deposits? Cut out the middleman? I'm up for that obviously. Maybe set up the accounts as '3 Water Bonds' - the new War Bonds? Let domestic savers get the return instead of vulture financiers?

That's why Govt borrowing does not increase when Govt sells a bond - they are simply swapping the form of their debt.

If a syndicate of banks underwrites a NZ Government bond issue, the created out of thin air credit is lodged at the RBNZ's Crown Settlement Account. Simultaneously the Bank Settlement Accounts are debited the same amount for the participating underwriting banks, since they are in receipt of the accruing coupon payment from the issued bond. Once the government disburses the underwritten bank credit to eligible beneficiaries' bank accounts, the banks are re-credited the deposit credits since they have an obligation to reward the new private bank deposits. Taxes collected from depositors' bank accounts are lodged at the RBNZ's Crown Settlement Account ledger which causes the Bank Settlement Accounts to once again be debted. There is hardly any need for the RBNZ to credit OCR to the Crown Settlement Account.

I think I follow that (and see no contradiction with my comment). What perhaps this misses is the interbank lending role of settlement account balances, which, in normal times, holds the rate at which banks lend to each other at around OCR. Or, are you saying, that paying zero interest on ESAS balances would make no material difference to market interest rates?

Government borrowing does increase in the form of a new public saving vehicle in the form of additional government coupon bearing debt.

Only if you arbitrarily decide that interest earning ESAS balances that are clearly part of Crown liabilities are not 'Govt debt'. Given that they are absolutely part of every definition of Govt debt I know, and clearly listed in the Govt financial statements as such, I'll have to beg to differ.

Yes. That's true. Paying interest on settlement balances is a reasonably recent scheme. Previously the interest rate was charged on only in the bank lending.

I guess in Australia even now they don't charge interest on settlement balance? I have to double check though

Spot on. But why do you think rbnz still did all these circus?

An analogy I felt is if economy runs on bank credit (broad money )as fuel, ESAS is just oil to that vehicle. Why would they think just adding more oil will make the vehicle run more?

Also later rbnz governor mentioned that lsap give Bank more room to absorb new government bonds. But their esas did not shrink. Just lies and imaginary stories.

People selling ponzis getting richer.

100% agree with the submission by Buddle Findlay consultant Simon Jensen.

In fact, one could argue that the RBNZ is using its monopoly position to the benefit of the entrenched oligopoly.

The RBNZ should be hanging its head in shame for the simple fact that these issues have been known about for over 20 years and yet they've done diddly-squat to address them ... meanwhile ordinary kiwis - and the vast majority of kiwi businesses - pay for it!

ComCom has much work to do. And if ComCom does nothing, our useless politicians should! (No. wait. they're useless.)

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.