Heartland Bank

ANZ offers 3% pa for a three year term deposit term, the first time in this cycle a 3% offer for three years has appeared. But banks are raising term deposit rates slower than mortgage rates, and the difference is the widest on record

23rd Nov 21, 10:11am

23

ANZ offers 3% pa for a three year term deposit term, the first time in this cycle a 3% offer for three years has appeared. But banks are raising term deposit rates slower than mortgage rates, and the difference is the widest on record

BNZ raises its term deposit offers sharply, and is now the market-leading main bank, even offering a 3% rate for a five year term. These sharp moves might have an outsized impact on challenger banks

27th Oct 21, 10:31am

44

BNZ raises its term deposit offers sharply, and is now the market-leading main bank, even offering a 3% rate for a five year term. These sharp moves might have an outsized impact on challenger banks

ANZ's term deposit rate increases are probably just for show because the resulting rate offers are far below inflation, and still meaningless to most savers, especially in a rising rate market

21st Oct 21, 10:22am

6

ANZ's term deposit rate increases are probably just for show because the resulting rate offers are far below inflation, and still meaningless to most savers, especially in a rising rate market

Reserve Bank says thematic review of banks' compliance with its liquidity policy highlights gaps in banks’ liquidity risk management frameworks

9th Sep 21, 11:25am

3

Reserve Bank says thematic review of banks' compliance with its liquidity policy highlights gaps in banks’ liquidity risk management frameworks

Heartland Bank saw a 43% rise in reverse mortgage loan repayments in the past year as customers took advantage of the roaring house market to sell up and pocket gains

25th Aug 21, 10:00am

22

Heartland Bank saw a 43% rise in reverse mortgage loan repayments in the past year as customers took advantage of the roaring house market to sell up and pocket gains

Heartland Group is shooting for a profit of between $93 mln and $96 mln in the coming year as it looks to extend its reach through digital platforms

24th Aug 21, 9:57am

2

Heartland Group is shooting for a profit of between $93 mln and $96 mln in the coming year as it looks to extend its reach through digital platforms

A kick higher in ANZ's raised term deposit offers may just be the start of rising rates for savers even if they are starting from an under-water position, below inflation

17th Aug 21, 12:14pm

9

A kick higher in ANZ's raised term deposit offers may just be the start of rising rates for savers even if they are starting from an under-water position, below inflation

New Zealand's largest bank comes through with some modest term deposit rises, essentially matching those its rivals have already adopted. Just ignore the inflation comparison (and tax) to remain sane

20th Jul 21, 5:50pm

20

New Zealand's largest bank comes through with some modest term deposit rises, essentially matching those its rivals have already adopted. Just ignore the inflation comparison (and tax) to remain sane

Term deposit rates are moving up, but not to levels for fixed terms that will attract many savers. However the lowest point may have past

14th Jul 21, 11:01am

13

Term deposit rates are moving up, but not to levels for fixed terms that will attract many savers. However the lowest point may have past

HSBC trims its one year home loan rate to just 2.09% even as wholesale swap rates start moving up at the short end. It raised all rates for two years and longer

1st Jul 21, 10:59am

29

HSBC trims its one year home loan rate to just 2.09% even as wholesale swap rates start moving up at the short end. It raised all rates for two years and longer

ANZ follows ASB with a deeply discounted floating rate for home loans for new built houses, and it's cash back offer also applies for first home buyers and for homes with a 6+ Homestar rating

27th Jun 21, 6:40pm

18

ANZ follows ASB with a deeply discounted floating rate for home loans for new built houses, and it's cash back offer also applies for first home buyers and for homes with a 6+ Homestar rating

The Coop Bank drops its fixed one year first-home buyer special by -10 bps to 1.99%. It has cut other short rates, but raised most longer fixed rates

16th Jun 21, 1:42pm

9

The Coop Bank drops its fixed one year first-home buyer special by -10 bps to 1.99%. It has cut other short rates, but raised most longer fixed rates

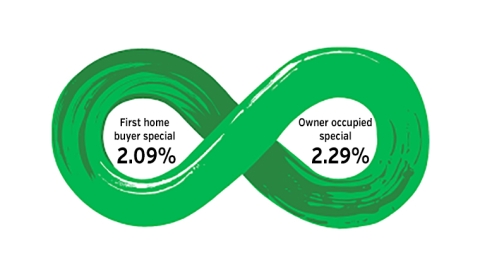

In a surprise move, Heartland Bank has sharply cut its floating and one year fixed home loan rates to levels that will cause its rivals to have a double-take

12th May 21, 2:18pm

21

In a surprise move, Heartland Bank has sharply cut its floating and one year fixed home loan rates to levels that will cause its rivals to have a double-take

Some banks are improving their term deposit rate offers slightly, but savers are yet to be impressed enough to hold more of their growing cash funds with term commitments; BNZ now joins the up trend

27th Apr 21, 1:56pm

26

Some banks are improving their term deposit rate offers slightly, but savers are yet to be impressed enough to hold more of their growing cash funds with term commitments; BNZ now joins the up trend

HSBC ends its 1.99% fixed home loan offers, raising them to 2.25% after a two month run at the unusually low level. All eyes are on how the RBNZ will react to rising international benchmark rates

6th Apr 21, 3:55pm

6

HSBC ends its 1.99% fixed home loan offers, raising them to 2.25% after a two month run at the unusually low level. All eyes are on how the RBNZ will react to rising international benchmark rates

Kiwibank becomes the first bank to access the Reserve Bank's Funding for Lending Programme for a second time

31st Mar 21, 4:00pm

2

Kiwibank becomes the first bank to access the Reserve Bank's Funding for Lending Programme for a second time

RBNZ's Funding for Lending Programme not a good fit for Heartland Bank, CEO Chris Flood says, as group continues mulling splitting Marac out as a standalone subsidiary

23rd Feb 21, 9:08am

RBNZ's Funding for Lending Programme not a good fit for Heartland Bank, CEO Chris Flood says, as group continues mulling splitting Marac out as a standalone subsidiary

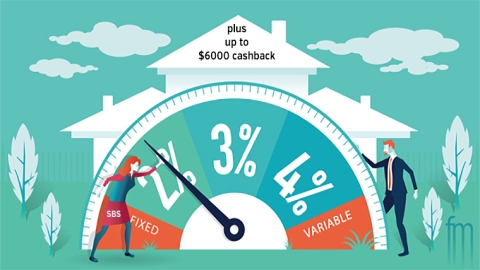

SBS Bank extends its 2.29% home loan rate out to terms of 18 months and two years fixed, making the two year offer the lowest in the market. It is also offering up to $6000 as a cash incentive

12th Feb 21, 4:02pm

15

SBS Bank extends its 2.29% home loan rate out to terms of 18 months and two years fixed, making the two year offer the lowest in the market. It is also offering up to $6000 as a cash incentive

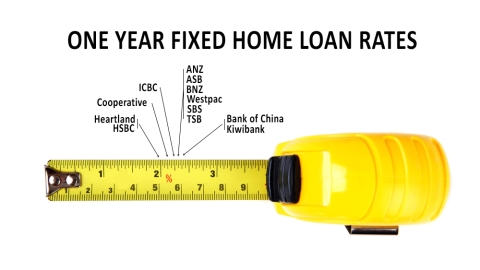

Another challenger bank goes below 2% for mortgages, as the 2021 home loan market swells on sharply rising demand. These challenger banks have opened up a 30 bps rate advantage over the main banks

10th Feb 21, 10:10am

5

Another challenger bank goes below 2% for mortgages, as the 2021 home loan market swells on sharply rising demand. These challenger banks have opened up a 30 bps rate advantage over the main banks

A challenger bank offers first home buyers a one year fixed rate well below the main banks, raises two term deposit rates to well above the main banks as well

27th Jan 21, 3:30pm

6

A challenger bank offers first home buyers a one year fixed rate well below the main banks, raises two term deposit rates to well above the main banks as well

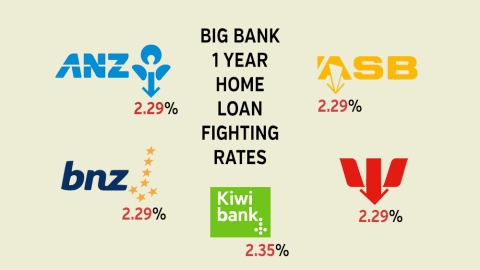

More big banks slip into line with lower one year fixed rate home loan offers. BNZ is the latest, then ASB. But challenger banks still have lower rates on the table

22nd Jan 21, 8:37am

42

More big banks slip into line with lower one year fixed rate home loan offers. BNZ is the latest, then ASB. But challenger banks still have lower rates on the table

Another big bank has cut a key home loan rate, signaling that a new round of mortgage rate cuts are on their way. The RBNZ's FLP gives them the low cost funds to do this if they apply

19th Jan 21, 6:22pm

26

Another big bank has cut a key home loan rate, signaling that a new round of mortgage rate cuts are on their way. The RBNZ's FLP gives them the low cost funds to do this if they apply

Encouraged by the RBNZ, one major bank offers a 2.29% one year fixed home loan rate. It is almost certain to signal a new round of mortgage rate cuts that will juice up the already-hot housing market

11th Jan 21, 8:18am

159

Encouraged by the RBNZ, one major bank offers a 2.29% one year fixed home loan rate. It is almost certain to signal a new round of mortgage rate cuts that will juice up the already-hot housing market

Heartland Group Holdings' project aiming to 'optimise value within the Group' mulls idea of pulling vehicle financing arm out of Heartland Bank as stand-alone subsidiary

1st Dec 20, 9:30am

1

Heartland Group Holdings' project aiming to 'optimise value within the Group' mulls idea of pulling vehicle financing arm out of Heartland Bank as stand-alone subsidiary

The bank with the lowest floating home loan rate has cut it aggressively again, setting it about 200 basis points lower than most rivals - provided you apply online (and without a broker)

9th Nov 20, 11:20am

16

The bank with the lowest floating home loan rate has cut it aggressively again, setting it about 200 basis points lower than most rivals - provided you apply online (and without a broker)