Tax policy

The New Zealand Tax Podcast - Should the NZ Super Fund's earnings be tax exempt? A new policy framework for managing debt owed to the Government & the PREFU’s $5 billion hole no one's worried about

18th Sep 23, 4:32pm

25

The New Zealand Tax Podcast - Should the NZ Super Fund's earnings be tax exempt? A new policy framework for managing debt owed to the Government & the PREFU’s $5 billion hole no one's worried about

Three economists think National's foreign buyers tax could come up $500 million short each year

14th Sep 23, 10:31am

126

Three economists think National's foreign buyers tax could come up $500 million short each year

National's advice says its proposed foreign buyers 'fee' could be established as a criteria for overseas investment, rather than as a 'tax'

4th Sep 23, 2:15pm

59

National's advice says its proposed foreign buyers 'fee' could be established as a criteria for overseas investment, rather than as a 'tax'

National’s self-funded tax plan relies on over $3 billion in untested tax revenue

31st Aug 23, 7:02am

166

National’s self-funded tax plan relies on over $3 billion in untested tax revenue

The National Party would cut income tax for average earners and property investors, partly funded by taxes on carbon and foreign home buyers

30th Aug 23, 1:20pm

132

The National Party would cut income tax for average earners and property investors, partly funded by taxes on carbon and foreign home buyers

[updated]

Nicola Willis says National will announce a suite of tax cuts and 'revenue initiatives', after Labour cut $4 billion from its budget

28th Aug 23, 7:34pm

146

Nicola Willis says National will announce a suite of tax cuts and 'revenue initiatives', after Labour cut $4 billion from its budget

Finance Minister says GST exemption makes sense as part of 'suite' of cost of living tweaks

16th Aug 23, 6:02pm

53

Finance Minister says GST exemption makes sense as part of 'suite' of cost of living tweaks

[updated]

An early version of Labour’s GST policy document calculated the cost of the policy beginning in October 2024, instead of April 1 as announced by Chris Hipkins

14th Aug 23, 2:38pm

9

An early version of Labour’s GST policy document calculated the cost of the policy beginning in October 2024, instead of April 1 as announced by Chris Hipkins

Labour’s full tax policy includes the GST exemption, boosted tax credits for working families, but no wealth taxes

13th Aug 23, 1:23pm

111

Labour’s full tax policy includes the GST exemption, boosted tax credits for working families, but no wealth taxes

Labour-aligned Council of Trade Unions claims National policy proposals would require cuts to public services to balance out the impact of its promised tax cuts

1st Aug 23, 4:00pm

44

Labour-aligned Council of Trade Unions claims National policy proposals would require cuts to public services to balance out the impact of its promised tax cuts

New Zealand politicians are putting fiscal responsibility at risk by being unwilling to talk about tax, Dan Brunskill says

16th Jul 23, 8:00am

214

New Zealand politicians are putting fiscal responsibility at risk by being unwilling to talk about tax, Dan Brunskill says

Chris Hipkins scrapped capital gains and wealth taxes which were being considered in Budget 2023

12th Jul 23, 11:46am

280

Chris Hipkins scrapped capital gains and wealth taxes which were being considered in Budget 2023

The Green Party would provide a guaranteed income of $385 a week, paid for with a wealth tax on assets over $2m and 45% tax on income over $180,000

11th Jun 23, 11:13am

258

The Green Party would provide a guaranteed income of $385 a week, paid for with a wealth tax on assets over $2m and 45% tax on income over $180,000

Wealthiest New Zealanders pay 8.9% effective tax rate due to untaxed capital gains, IRD report finds

Revenue Minister David Parker says IRD survey showing wealthy kiwis pay significantly lower tax rate than middle-income families will enable future discussions on tax policy to be based on solid evidence

26th Apr 23, 12:29pm

197

Revenue Minister David Parker says IRD survey showing wealthy kiwis pay significantly lower tax rate than middle-income families will enable future discussions on tax policy to be based on solid evidence

Te wiki o te tāke: the Green Party quotes Margaret Thatcher with approval, the Australian Tax Office's latest corporate tax transparency report, and the latest from the OECD on the carbon pricing of greenhouse gas emissions

6th Nov 22, 12:04pm

5

Te wiki o te tāke: the Green Party quotes Margaret Thatcher with approval, the Australian Tax Office's latest corporate tax transparency report, and the latest from the OECD on the carbon pricing of greenhouse gas emissions

Te wiki o te tāke: Inland Revenue’s annual report: the good, the not quite so good and the concerning

30th Oct 22, 1:04pm

17

Te wiki o te tāke: Inland Revenue’s annual report: the good, the not quite so good and the concerning

Te wiki o te tāke; recovering wage subsidy payments from MNCs, chasing crypto tax transparency, Frucor decision a lost cause

23rd Oct 22, 2:03pm

6

Te wiki o te tāke; recovering wage subsidy payments from MNCs, chasing crypto tax transparency, Frucor decision a lost cause

Te wiki o te tāke; The OECD proposes a crypto-asset reporting framework; new levy proposal for farmers greenhouse gas emissions; TOP’s bright idea about tax rates

16th Oct 22, 11:48am

31

Te wiki o te tāke; The OECD proposes a crypto-asset reporting framework; new levy proposal for farmers greenhouse gas emissions; TOP’s bright idea about tax rates

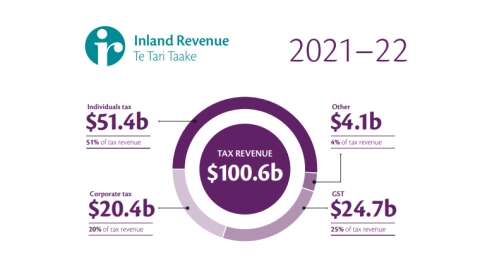

Te wiki o te tāke: Change on the way for GST recordkeeping requirements, a clear-eyed dissent by a Supreme Court justice, and tax revenue exceeds $100 bln for the first time

9th Oct 22, 1:46pm

4

Te wiki o te tāke: Change on the way for GST recordkeeping requirements, a clear-eyed dissent by a Supreme Court justice, and tax revenue exceeds $100 bln for the first time

Te wiki o te tāke: Inland Revenue gets tougher on FBT compliance, the Government ignored Treasury and Inland Revenue advice on its build-to-rent tax proposal, and the British mini-budget implications for Kiwis

2nd Oct 22, 9:28am

5

Te wiki o te tāke: Inland Revenue gets tougher on FBT compliance, the Government ignored Treasury and Inland Revenue advice on its build-to-rent tax proposal, and the British mini-budget implications for Kiwis

Te wiki o te tāke: Details on IRD's handling of the cost-of-living payments. A doomed tax case highlights the need for change. The OECD on international tax policy reforms

26th Sep 22, 9:42am

1

Te wiki o te tāke: Details on IRD's handling of the cost-of-living payments. A doomed tax case highlights the need for change. The OECD on international tax policy reforms

Te wiki o te tāke: Watch out for those tax traps, Treasury points the finger at current tax settings for housing, a long overdue AML ruling, and the Queen avoids hundreds of millions in tax

18th Sep 22, 10:15am

1

Te wiki o te tāke: Watch out for those tax traps, Treasury points the finger at current tax settings for housing, a long overdue AML ruling, and the Queen avoids hundreds of millions in tax

Te wiki o te tāke - PM's Department warns IRD off looking at a CGT. The IRD admits not having the data on non-compliance with fringe benefit tax. And residential property investment looks very undertaxed compared to other investments

11th Sep 22, 8:02pm

25

Te wiki o te tāke - PM's Department warns IRD off looking at a CGT. The IRD admits not having the data on non-compliance with fringe benefit tax. And residential property investment looks very undertaxed compared to other investments

Te wiki o te tāke - The Government backdown on GST reform is another example of how short-term politics will nearly always trump good longer-term policy

4th Sep 22, 10:01am

15

Te wiki o te tāke - The Government backdown on GST reform is another example of how short-term politics will nearly always trump good longer-term policy

Economist Brian Easton says the informed discussion on the next steps in tax policy is about improving the income tax base, not about taxing wealth directly

23rd May 22, 8:47am

7

Economist Brian Easton says the informed discussion on the next steps in tax policy is about improving the income tax base, not about taxing wealth directly