By Bernard Hickey

We've been here before.

Back in late 2003 and early 2004 Reserve Bank Governor Alan Bollard spoke out about the high New Zealand dollar and its suppressing effects on inflation.

Here's what he said in September 2003 when holding the OCR at 5%: "Looking forward, there is a possibility that the current strength in the domestic economy proves stronger and more enduring than we are anticipating. Conversely, further appreciation of the exchange rate could potentially exert an even greater braking effect on the external sector. We will closely monitor the balance of pressures across these two sectors and their implications for the medium term inflation outlook as we update our policy outlook over the months ahead."

Then again in December 2003 when holding it at 5% he said this: "We will pay close attention to the path of the domestic economy, which has proven more robust over 2003 than we expected. We will also be closely monitoring the path of the New Zealand dollar, with a particular focus on what it means for the export sector and the medium-term path of inflation."

That high New Zealand dollar (around similar levels to now in TWI terms) allowed the Reserve Bank to keep interest rates lower than would otherwise have been the case. Some people argue it tempted the Reserve Bank into leaving interest rates lower than they should have been for longer than they should have been. They say it contributed to the boom in house prices New Zealand saw from 2003 to 2007 and the associated build-up in foreign debt, both of which transformed our economic landscape.

The accusation is the Reserve Bank was asleep at the wheel when the signs of a boom in the housing market were evident with surging mortgage applications and fast-rising house prices in Auckland. Sound familiar?

This inaction in late 2003 eventually led to the Reserve Bank having to hike the OCR to 8.25% by mid 2007 in a desperate attempt to try to slow down the housing market and get inflation under control. It had tried to let the high New Zealand dollar do the hard work of keeping inflation under control and failed. All it did was sacrifice the export sector to help borrowers and consumers carry on the housing boom for that little bit longer.

The Catch 22

This episode in New Zealand's monetary policy history showed the problems with our pure inflation targeting regime run in conjunction with a free-floating currency and no capital controls. It created a Catch 22 situation. High interest rates make the New Zealand dollar attractive, which sucks in foreign capital and pushes up economic activity and the currency even more. This in turn keeps imported inflation low and keeps the export sector from booming and creating inflation.

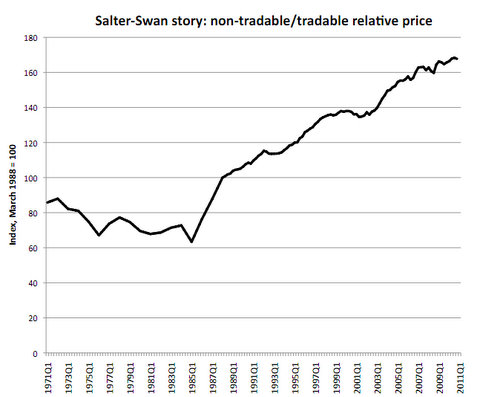

Essentially this encourages the growth of prices and activity in the non-tradable sector (government, financial services, real estate, construction, telecommunications) at the expense of growth in the tradable sector (exporting, manufacturing, import competition).

This first chart below, courtesy of Victoria University economy Geoff Bertram, shows that rebalancing of prices since the late 1980s. See our August 2011 article on Bertram's comments on the need for the Reserve Bank to force banks to stop borrowing offshore for more on this problem.

So here we are again in early 2012 with the Reserve Bank Governor speaking out about the high New Zealand dollar

This policy led to the following massive shift in our economy.

Our tradeable sector (blue line) atrophied at the expense of the non-tradable sector (red line). It's no surprise by the way, I think, that the lines start diverging in early 2004, shortly after the Reserve Bank governor's first murmurings about the high currency.

This chart is one of Bill English's favourite charts, yet nothing much as changed in New Zealand's policy settings to turn this around. The tax changes for property investors have done little to quench the demand for housing of those who are now doubly scared of investing in stocks and finance companies. Low term deposit rates leave older investors with few options but rental property. The income tax cuts for those on the highest tax bracket has actually fueled extra property buying in Auckland, leveraged up with extra foreign debt.

Here we go again

So here we are again with a painfully high exchange rate that the Reserve Bank (or government) seems unwilling or unable to do anything about. In fact, the government's heavy offshore borrowing over the last three years has helped boost the exchange rate, as has an inflow of foreign capital looking to buy other assets such as land (which the government would like to approve the sale of).

And here we are again with a Reserve Bank Governor trying to jawbone it lower. He even threatened today to cut the Official Cash Rate if the currency rose any more because it would further ease inflationary pressures.

Meanwhile, there are signs brewing again that the same old house price inflation and non-tradable sector inflation is kicking in. Local body rates have risen twice as fast as inflation rates over the last decade and my own Auckland rates are likely to rise at least 10% next year. Education cost inflation is rampant and construction cost inflation is expected to surge, albeit due partly to the earthquake rebuild.

There were NZ$3.251 billion worth of mortgages approved in the three weeks to March 2 and NZ$3.206 billion approved in the three weeks to December 16. The last time we saw that same sequence of heavy late summer, early autumn house lending was in December 2007 and March 2008 just as the housing boom was peaking.

Earlier this week Barfoot and Thompson reported Auckland house sales volumes growing at more than 20% a year and prices rose 23% in February from a year ago in the leading indicator area of the Eastern Suburbs. The BNZ-REINZ survey of estate agents out yesterday also picks up on the increasingly bubbly sounds emanating from Auckland. This survey points to the Auckland surge leading 'the next upswing in the housing market.'

Is the Reserve Bank watching?

If it is watching, it doesn't seem that worried. The Monetary Policy Statement issued today

Instead, the Reserve Bank focuses on the tame overall growth in housing credit, which is due largely to homeowners who are staying put repaying their mortgages early. It disguises the low-equity lending growth happening at the fringes.

Analysis by Gareth Vaughan at interest.co.nz shows a NZ$2.9 billion rise in residential mortgages held by the big five banks with LVRs above 90% to NZ$14.2 billion in the year to September 30 last year. Aside from ASB, the biggest growth came from BNZ and Westpac. ASB's 80% plus lending grew NZ$667 mln in the December quarter alone to 19.5% of its book. Westpac, ASB and BNZ are all aggressively lending at 95% again, so much so that ANZ's CEO warned of the potential problems of such lending here.

The Reserve Bank is convinced New Zealanders have changed their ways and are off the real estate-equity fueled spending bandwagon.

However, even the bank is noticing something is stirring in consumer-land that it can't quite put its finger on here in the MPS:

Yet there are some recent signs that households may have reduced their rate of saving, albeit temporarily. Retail sales growth was strong over the second half of 2011, partly a result of RWC spending. However, the level of expenditure using domestic electronic cards, and strong spending on durables, suggest some near-term strength in consumption.

It may be that this current relative strength in consumption reflects recent appreciation in the New Zealand dollar and consequent price reductions by retailers. In which case, any further rebalancing of the economy may be delayed by the current high exchange rate.

So there we have it. Yet again the strength in the currency is blocking the rebalancing we need to have.

But yet again all we get is talk

Here's the key jawboning section in the Monetary Policy Statement:

The March projection assumes the New Zealand dollar TWI depreciates modestly over the next few years. Should this not occur, all else equal, the Bank would see less need to increase the OCR through this time. While helping contain inflation, the high value of the New Zealand dollar is detrimental to the tradable sector, undermines GDP growth, and inhibits rebalancing in the New Zealand economy.

You bet it's detrimental.

So do something about it.

Instead, yet again, the Reserve Bank is bluffing because it is locked into its straightjacket of a CPI-index inflation targeting regime with a free floating currency and no capital controls. If it cuts the OCR to punish the currency traders it risks repeating the mistakes of 2003 and 2004 when it allowed the housing market to get away on everyone.

The bank could, however, intervene to push the currency down. Bollard has done it before, but has been very, very reluctant to do it again.

That would be a much better option than yet more pointless jawboning.

However, there are other more structural options that would reduce the size of this 'Catch 22' problem of capital flows pushing up the currency and inflation targeting killing off the export sector.

Other options

The Reserve Bank could target non-tradable inflation. It's heartening to see the central government finally talking with some aggression about trying to control local government inflation, although the first attempt to do it through the creation of a Super City in Auckland seems to have failed miserably. My rates may rise 18% next year.

The Reserve Bank could also use some macro-prudential controls to limit the sort of low equity borrowing and foreign funded lending going into the housing market. It could impose loan to value ratio limits on housing lending. It could increase capital requirements for housing lending.

The bank's existing core funding ratio is helping to reduce the amount of hot money flowing into our housing market, but a higher ratio and a focus on domestic rather than foreign funding would help.

By the way, these sorts of macro-prudential policies are ones sactioned by the IMF (of all people) for those economies that struggle with capital inflows distorting the structure of their economies.

What will it take for New Zealand to try to break this Catch 22?

No chart with that title exists.

25 Comments

You miss the point Bernard...."prices and activity in the non-tradable sector"....here is where the parasites can cream off the fatter profits....they don't do so well on the tradable!....so now you know why the RBNZ is into "jawbone economics" and unwilling to prevent another property bubble which is exactly what the banks are demanding....and exactly what the govt is willing to see happen...because a bubble boom is just as good as an export boom when it comes to harvesting the votes come election time.

Welcome Bernard, to the greater farce that is the NZ economy.

A very good point Wolly, but will that bubble ever pop or is the government cheerleading going to keep it inflated forever? What will be the cost to NZ in either case?

Mandalay...the govt is the puppet not the puppet master...direct your question to Bernanke at the Fed, King at the BoE and the new liar at the ECB. They together with Beijing and OPEC are the puppet masters. The media are happy to go along with the game.

Right now thanks to the awful lack of economic understanding by billions or people, the liars are able to fool most of the people most of the time....one day that will come to an abrupt end.

If the pawns in wgtn keep the game going, the downside hits the younger gens who do learn when they are rorted by pollies promising recovery and growth and employment...but deliver endless BS.

The best are leaving and taking skills with them. Hence the obvious shortage of skilled labour in chch. And the promised chch rebuild is not going to be the bonanza and economy saving event you have been promised. The reason is because the rest of the regions are in very deep shite.

If and when the credit bubble game comes to an end...sorry but it will not be a pleasant event.

There are way too few chairs for the bums to sink onto when the music stops.

Lots of options Bernard but as Wolly says they are ignored due to the vested interest in asset values – I fear this will continue to the point we own nothing and no-one will lend to us.

The external deficit will not matter then as there will not be one.

As you indicate all we lack is the will to rebalance the economy.

Why is it the RB's task? like where the heck is the Govn? oh wait happy to do diddly otherwise it might cost votes...

regards

It is what the Reserve Bank was established to do , to make sensible decisions on interest rates , free from any political bias .

Snigger. I bet your'e still a virgin and saving yourself for nice young man, eh Gummy. (Get a grip.)

I never said that is what the ruddy Reserve Bank does do , ..... merely that which it is meant to do ..........

........ shag it all , Les , we're only paying Bolly half a million $ per year , whaddya expect for that , .. competence ?

I get very tired of these loosely worded tirades from Bernard. They dont do the organisation he works for any credit. Has the Sunday News got any vacancies? It might suit him better.

How about a bit of precision and spelling out exactly what he has in mind.

What capital controls and how would they work? Is he proposing going back to the days when you could only buy a new car if you had overseas funds. All the cockies got to drive a new car for a year and then sell it at a profit. Import Licensing? That was a goodie.

All these regulations are subject to the law of unintended consequences but if Bernard has been thinking about this for months he must have a clearly thought out programme he wants implemented and is prepared to put out there for comment.

No time like the present.

The good governor just has to put the core funding ratio up from 75% to 80%. I mean he's not going to fall asleep at the wheel again is he? Er, is he?

Yeah like the RBNZ is 'independent' harrrrrrhaaaaaaahaaa

it was a typo Wooly ...Roger meant was not is....

Well if I had my way he'd be holding aces n eights......the cornswagling lilly livered varmit.

Bollard is as incapable of bluff as he is of decision making....when someone says, do nothing he says "well yeah ok that works for me.......the longer the better"

if you hadn't noticed Bernard he's even run out of bothering with cliches to excuse his lack of credibility on the overvalued currency issue.....

gone, are the my hands are tied .....rock and hard place....etc...etc...in fact it now appears certain that Allan has the bankers right where they want him.....he's a no fuss guy, quietly seeing off his time for the fat pension....

Don't bother with another book Allan ...none of it was memorable.....or if you do , a title of ...Ten Years of Nothing......my bewilderness adventure.

FYI from a reader via email:

Didn't the British Banks over- lend in the 90s,100% lending with the resulting crash? The goldie locks economy arrives when they are giving away money. Now you have the added sucking sound of manufacturing jobs disappearing to the East.read all about it

http://gregpytel.blogspot.co.nz/2009/04/largest-heist-in-history.html

ta for the link AJ......he looks like a man too far in to get out now don't he....

Print money and buy gold. When currency falls sell gold.

The OCR is probably the best tool for controlling the housing market, yet it is not used for that. GST has a massive and immediate impact on the CPI, yet the RB can ignore it (wish I could too). The OCR is the wrong tool for inflation targetting IF you define inflation as the CPI. It's like turning up to build a house and your tooldbox is full of cooking utensils.

CPI is the wrong way to define inflation, and has suckered most people into believing that prices are rising at the same speed as incomes. Fillet steak left the CPI years ago.

An engineer, a biologist and an economist are washed ashore on a desert island. After a few days without food they are starving. Eventually, they stumble on a can of beans on the beach. They spend a few minutes considering how they might feed themselves. The engineer is the first to speak: "We could hit the can with a rock until it opens." The biologist counters, "We could suspend the can in a seawater solution and wait for erosion to work its magic." The economist is last to contribute: "Let's just assume we have a can-opener." OK, so it's not the funniest joke in the universe. But it has the ring of truth.

That truth being ... that some situations call for different skills than other situations!

Wow, that was profound. Let me try another.

An engineer,a biologist and an economist are asked for advice on the likely impact, in the short, medium and long term, on economic growth, the net national investment position and wealth inequality, if the Government introduces a compulsory private savings scheme. The engineer and the biologist do not know where to start, whereas the economist does.

Get me a chair, somebody - I'm so convulsed with laughter that I think I'm going to pass out ...

Well, for a start, the engineer might know that your 'long term economic growth' is not attainable.

http://physics.ucsd.edu/do-the-math/

So might the biologist:

But the economist?

"I have been accelerating and haven't hit the brick wall, therefore I won't". Not surprising some are religious, it's a belief thing alle same.

Oh, tell me another one please do.

The government couldn't figure out who the best economist was, so they talked to three who all disagreed.

The Austrian economist insisted that it woud only work if everybody saved in gold, then he gave the government a thorough rebuke for debasing the money with their income tax.

The free market economist insisted that it would only work if everybody invested their savings on the share market, then he have the government a thorough rebuke for selling bonds.

The third economist gave the most convincing presentation, he brought a mathematical model. It was a slight simplification, there was one household, one government, one sharemarket, one employer, one bank. When he modeled the economy the government made the one household save 10% of his income each year, and the household did. Each year the savings (in the model) accumulated by exactly 2% each year. Everyone lived happily ever after.

The end.

Epilog: The government subsidised the savings scheme and were duely re-elected in 2 years.

The bigger question is why do we allow our governments to be involved at all in this kind of thing anyway. Treating the cause of the illness & not the symptons works well in medicine, why has that thinking never been applied to economics?

that's dead right ...... too hard basket ......

that's dead right ...... too hard basket ......

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.