Here's my Top 10 items from around the Internet over the last week or so at 10 am. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #10 for a nuanced look at the return of Karl Marx to the global economic and political debate.

1. Some competition? - Many people have waited a long time for something like Facebook or Google that comes out of nowhere to whack the banking system's monopoly on payments.

In America, Square is making an attempt.

It's a mobile phone based system that allows small businesses to take credit card payments without having to sign up the to usual banking-driving systems.

Now the AFR is reporting Square is coming to Australia.

There'll be a few people hoping Square jumps the Tasman.

Surely it's a matter of time before someone creates a truly global and mobile phone-based system to replace all those fees on credit cards and bank payments. Some are hopeful that Bitcoin is the one.

No doubt the Reserve Bank and the banks are watching closely. But it seems the heavy use of chip cards in Australia and New Zealand might trip up Square.

Mr Fadaghi said regulatory and technical hurdles had been thought to mean Square would struggle to launch in Australia. The prevalent use of encrypted chips on credit cards, rather than traditional magnetic strips is a problem as Square’s card readers currently do not support them.

Use of the chip is due to be mandated in Australia from 2015. He said if Square decided to launch it must not under-estimate the strength of incumbents, local vested interests and the conservative nature of businesses in Australia.

2. This is what happens when you devalue your currency - America's weak economy and heavy money printing have had one beneficial effect.

The slump in the US dollar in recent years, along with lower energy prices because of the fracking boom, have encouraged American companies to 'on-shore' or 're-shore' their manufacturing operations, thus creating new jobs.

A sharp rise in the cost of labour in China and rising transporting costs have also been factors.

Here's a useful backgrounder from NPR on the subject, which also suggests deflation rather than inflation is on the horizon globally.

For years, GE outsourced manufacturing of the water heater to a company in China. In 2009, GE did the math and, considering rising wages overseas as well as climbing transportation costs, decided to bring production back to the U.S.

The company wanted more control of the product, especially the technology that goes into it, says Freeman. To maximize savings, the appliance had to be completely redesigned.

GE ripped apart one of six massive factories at the complex in Louisville, and built a water heater assembly line. It worked out a new, lower-wage structure for employees, and brought in experts to help reduce waste and time. Everything was geared to reducing costs.

3. China tightening - Everyone has been watching the will they-won't they debate on whether China would blink and bail out a big shadow bank due to default on Friday. In the end China did blink and engineer a bailout, but there is a determination to slow things down, either through monetary policy or fiscal policy.

Here's Reuters with an intriguing look inside how China's government combines fiscal and monetary policy:

China made an unusual about-turn on tax policy last year to tighten its grip over sloppy lending that Beijing fears facilitates unhealthy growth in high-risk shadow banking.

The Ministry of Finance (MOF) reversed its "active" fiscal policy, in which tax revenues are redeployed into the monetary system to support growth, central bank data shows.

It vacuumed up cash instead, complementing similar efforts by the People's Bank of China (PBOC), as regulators clamped down on runaway shadow banking activity.

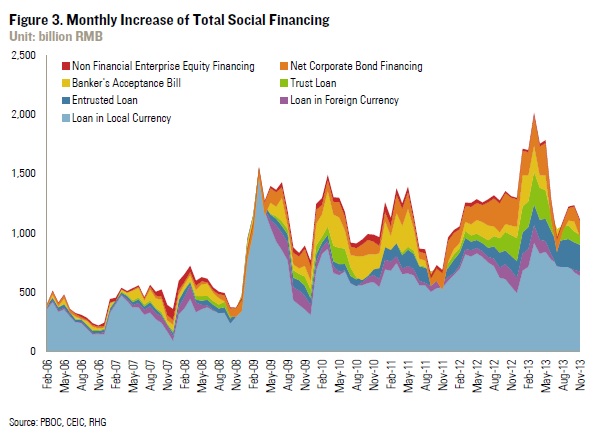

4. Tighter than many think - This detailed assessment by RHG of how China is tightening monetary policy and bringing the shadow banks to heel is a comprehensive, sober and useful look at the issue.

In response to the financial crisis huge industrial and property investment kept China sailing relatively smoothly, underwritten by largely unregulated shadow bank lending. Off-balance sheet activity and over-investment in China are two sides of the same coin, and if Beijing is determined to tackle either of them then the either side will be affected too.

The most productive real economy firms in China – the ones that have to pay the bills and create the sustainable jobs going forward – are completely tangled up in this legacy. Cutting through this in 2014 is going to be messy.

5. Breaking business models - I'm fascinated by this idea that a 'Second Machine Age' driven by smart phones could create the same sort of long term productivity boost we saw early in the industrial revolution. The short run may not be so smooth or positive for everyone.

Here's GigaOm with an OECD report into how, for example, the new streaming media companies such as Netflix may not break the internet, but will break a few business models. It seems, however, 'peering' or how telecommunications networks share the loads of all this streaming, could be a limiting factor.

There's an awful lot of tapering and tightening and selling of bonds back into the market that has yet to happen.

7. Secular stagnation - This debate kicked off by Larry Summers late last year is dominating the econosphere.

Here's Michael Spence over at Project Syndicate with his view and a useful chart showing a growing gap between median and mean incomes in America, showing indeed there is a problem with rising income inequality there.

The growing concentration of wealth, together with highly uneven educational quality, is contributing to declines in intergenerational economic mobility, in turn threatening social and political cohesion. Though causality is elusive, there has historically been a high correlation between inequality and political polarization, which is one reason why successful developing-country growth strategies have relied heavily on inclusiveness.

Labor-saving technology and shifting employment patterns in the global economy’s tradable sector are important drivers of inequality. Routine white- and blue-collar jobs are disappearing, while lower-value-added employment in the tradable sector is moving to a growing set of developing economies. These powerful twin forces have upset the long-run equilibrium in advanced economies’ labor markets, with too much education and too many skills invested in an outmoded growth pattern.

All of this is causing distress, consternation, and confusion. But stagnation in the advanced countries is not inevitable – though avoiding it does require overcoming a daunting set of challenges.

8. Is your job safe - Further to the 'Second Machine Age' meme and the idea that robots are hoovering up white collar jobs, here's The Atlantic with a piece on what jobs might go, and what might stay.

Where do machines work better than people? Tractors are more powerful than farmers. Robotic arms are stronger and more tireless than assembly-line workers. But in the past 30 years, software and robots have thrived at replacing a particular kind of occupation: the average-wage, middle-skill, routine-heavy worker, especially in manufacturing and office admin.

Indeed, Frey and Osborne project that the next wave of computer progress will continue to shred human work where it already has: manufacturing, administrative support, retail, and transportation. Most remaining factory jobs are "likely to diminish over the next decades," they write. Cashiers, counter clerks, and telemarketers are similarly endangered.

9. Where is the money? - Increasingly, some of that recently printed money is being hoarded in bank accounts by cashed-up corporates who have engineered a structural increase in their profit share. In theory, they should now be investing it in new products and jobs to recycle the money.

But they're not.

Here's the FT with a good look at corporate cash hoarding.

The pile of unspent corporate cash that has built up since the start of the financial crisis is being held by an increasingly concentrated pool of companies that will be crucial to hopes of a pick-up in business investment to stimulate the world economy.

About a third of the world’s biggest non-financial companies are sitting on most of a $2.8tn gross cash pile, according to a study by advisory firm Deloitte, with the polarisation between hoarders and spenders widening since the financial crisis.

10. The return of Marx - Foreign Policy magazine has published piece saying The Working Class is about to make a return and that this is a good thing.

It is exactly because the rich and poor will look increasingly similar in Lagos and London that it's more likely that the workers of the world in 2030will unite. As technology and trade level the playing field and bring humanity closer together, the world's projected 3.5 billion laborers may finally realize how much more they have in common with each other than with the über-wealthy elites in their own countries.

They'll pressure governments to collaborate to ensure that their sweat and blood don't excessively enrich a tiny, global capitalist elite, but are spread more widely. They'll work to shut down tax havens where the world's plutocrats hide their earnings, and they'll advocate for treaties to prevent a "race to the bottom" in labor regulations and tax rates designed to attract companies. And they'll push to ensure it isn't just the world's richest who benefit from a global lifestyle -- by striving to open up free movement of labor for all, not just within countries but among them.

Sure, it's not quite a proletarian revolution. But then again, the middle class has never been the most ardent of revolutionaries -- only the most effective. The next decade won't so much see the politics of desperate poverty taking on plutocracy, as the middle class taking back its own. But it all might put a ghostly smile on Karl's face nonetheless.

14 Comments

Dilbert is an ace. As always.

Yeah loved it, hacking amazon's idea of a gyro delivering up to 5lbs sprang to mind...

Hi Mr President amazon has a delivery just for you....5lbs of C4 is a big bang.

regards

#1 The chip cards are pain and clunky to use. So I wondered why we had them. Now we see that they give control to the banks and makeit difficult for other entrants into the market. That explains that one.

And as for pay and wave. It seems banks. want to make it compulsory. But it means that merchants will have more credit card transactions with fees, than before when much of it was EFT/POS with minimal fees.

Had the banks worked out this was a new revenue stream. You betcha.

The chip cards are better than the ineffective stripe at stopping credit card details being stolen. As was the case of the 40 million credit card details stolen from Target before Christmas (there were reputedly other retail chains who had their card information stolen as well who haven't owned up yet).

#5 A smart business doesn't seek increased productivity via such things as smart phones. They seek control. Productivity does not make you money - but market control does.

In New Zealand we let this run rife. The control of such things and monopoly banks and the energy sector is just colossal. As are their profits.

#10. Yep the middle class is being screwed. And is beginning to wake up to that. It's not just workers with big hammers in the factory. Karl knew a thing or two that would assist small business people and the professional classes to work out just how they are being shafted in the current scene.

Maybe Apple are planning on using the US $ 150 billion cash and equivalents to create an i$ and provide some real competition to the entrenched and monopolistic banking industry.

Watch this space!

A lot of people think that between things like the fingerprint scanner's on new phones, and the ibeacon service for businesses, they actually are steadly putting together everything needed fora new payments system.

JB

Nice one. Made me smile. I'm writing this on a MacBook Pro and have both an iPhone and iPad. I'm deeply conflicted.

cheers

Bernard

... I thought that was called " Bitcoin " ..... oooops .... the CEO just got arrested and locked up ... probably in the Kim Dotcom wing .. ..

Dilbert .... a beaut

#1 - Many people have waited a long time for something like Facebook or Google that comes out of nowhere to whack the banking system's monopoly on payments.

But are they also about to be whacked?

http://www.reddit.com/r/Bitcoin/comments/1vd2r1/we_want_to_replace_youtube_dropbox_facebook/

We want to replace YouTube, Dropbox, Facebook, Spotify, ISPs, and more with decentralized apps based on proof of bandwidth. We need developers. Welcome to Bitcloud.

One of the many problems of certain free and open source projects in the past has been the lack of a profit incentive. With Bitcloud, nodes on a mesh network can be rewarded financially for routing traffic in a brand new mesh network. This removes the need for Internet Service Providers (Comcast, Verizon, AT&T, etc.). We can also replace many of the centralized applications on the current Internet, such as YouTube, Dropbox, Facebook, Spotify, and others with decentralized, open source alternatives. We will have to start by decentralizing the current Internet, and then we can create a new Internet to replace it.

http://www.bbc.co.uk/news/technology-25858629

Bitcloud developers plan to decentralise internet

Bitcloud aims to harness the same methods used to mine Bitcoins, to provide services currently controlled by internet service providers (ISPs) and corporations.

Individuals would perform tasks such as storing, routing and providing bandwidth, in return for payment.

"We will start by decentralising the current internet, and then we can create a new internet to replace it," they said.

http://www.wired.co.uk/news/archive/2014-01/27/maidsafe-bitcloud

Scottish company Maidsafe claims to have built a Bitcloud-like system

Unlike other cloud offerings, which utilise huge centralised data centres, this network utilises the combined resources of individual connected devices. Data are maintained in a fragmented state without accompanying metadata, and can only be restored with personal user keys. Irvine likens using the system to smashing a chair into millions of fragments and spreading them across all the planet's beaches. You'd never be able to find all those fragments and reassemble the chair, or to identify any meaningful information from a single piece. The only one who knows where all the pieces are is the individual user who scattered them in the first place. Similarly, in MaidSafe's system, only the individual user possesses the login that locates all the data fragments stored on the network. This differs from any centralised system where the physical location of data is known and, as a result, vulnerable. It all depends on what you think is safer: sitting at home under a giant padlock; or milling around anonymously on open beaches, your possessions and identifying features strewn under scattered sandcastles.

2014's Game-changing Medical Event : Researchers at the Riken Development Centre in Japan claim to have created stem cells cheaply , ethically and quickly , simply by immmersing human blood cells into a acid solution ....

.... Dr Haruko Obokuta says this appears to reprogramme the cells , leaving them open to any new function ...

The implications for re-generation of human organs or spinal nerves are astronomical ....

.... sorry , Bernard .... that was outrageously fabuously good news ..... naughty of me to shine on your gloom ..... naughty Gummy ....

cheers Gummy.

I'm feelin' chipper today.

But not confident enough to throw myself into an acid bath to clone myself.

I'd quite like to try it though on a few commenters around here...but not you gummy.

Now where's Hugh when you need him...

;)

Bernard

PS Just kiddin' Hugh... :)

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.