Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #2 from Martin Wolf on the state of the global economy at the moment. It's very sobering.

1. The German Patient - The risk of a recession in Germany is roiling the markets at the moment so this Ambrose Evans Pritchard lap around its economy is a revealing read.

There's a few mis-firing cylinders under the hood of that good looking machine.

The points about saving for its own sake and the corrosive psychology of ageing are well made.

Hard to see a way out though.

The fiscal and monetary hawks are in charge in Germany and they're foisting their madness on the rest of Europe.

It seems it will have to take some sort of political and then financial earthquake to shake them loose.

France may look like the sick of man of Europe, but Germany’s woes run deeper, rooted in mercantilist dogma, the glorification of saving for its own sake, and the corrosive psychology of ageing.

Growth has averaged 1.1pc since the beginning of the decade, placing Germany 13th out of 18 in the eurozone (or 156th out of 166 countries worldwide over the past 20 years). This chronic weakness been masked by slightly better growth since the Lehman crisis, and by the creditor-debtor dynamics of the EMU debt crisis. German looks healthy only because half of Europe looks deathly.

The Hartz IV reforms – so widely praised as the foundation of German competitiveness, and now being foisted on southern Europe – did not raise productivity, the proper measure of labour reform. Data from the OECD show that German productivity growth slumped to 0.3pc a year in the period from 2007 to 2012, compared with 0.5pc in Denmark, 0.7pc in Austria, 0.9pc in Japan, 1.3pc in Australia, 1.5pc in the US and 3.2pc in Korea. Britain has been negative, of course, but that is no benchmark.

Prof Fratzscher says the chief effect was to let companies compress wages through labour arbitrage. Real pay has fallen back to the levels of the late 1990s. The legacy of Hartz IV is a lumpen-proletariat of 7.4m people on “mini-jobs”, part-time work that is tax-free up to €450. This flatters the jobless rate, but Germany has become a split society, more unequal than at any time in its modern history. A fifth of German children are raised in poverty.

2. Managed depression - Martin Wolf writes at FT.com about the extraordinary state of the developed world's economies, which he describes as 'managed depression.'

How are we to make sense of this predicament? The answer is that it reflects a prolonged slump in aggregate demand to which policy makers have failed to craft an adequate response. Lawrence Summers, former US Treasury secretary, has even recalled the phrase “secular stagnation”, first used in the 1930s.

In my book The Shifts and the Shocks, I argue that pre-crisis trends – huge global current account imbalances, rising inequality and weak propensity to invest – had already created weak underlying demand in high-income countries. The de facto response of policy makers was toleration, if not promotion, of credit booms. When these collapsed, extraordinary policy easing was needed both to replace the lost demand impetus from the credit bubbles and to offset the drag on demand from debt overhangs, predominantly in private sectors: too many people had borrowed too much.

We can, at last, see some reasons for optimism about the US and UK. We can envisage the beginnings of a return to more normal policy, though confidence in the ability of these economies to weather normalisation cannot be strong. More radical alternatives, such as higher inflation targets and debt restructuring, may yet be needed.

3. Show us the bailout - Caixin reports China has announced it won't be bailing out any more local government financing vehicles.

We'll see.

4. Thank goodness for that - Chris Giles writes at FT that China's economy has just surpassed the United States' on a Purchasing Parity Power basis.

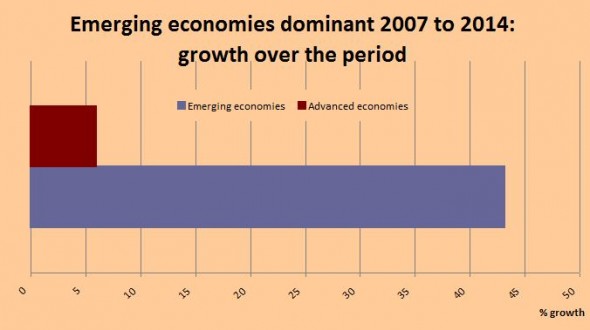

Emerging economies have provided much of the world's growth since 2007. Lucky for us.

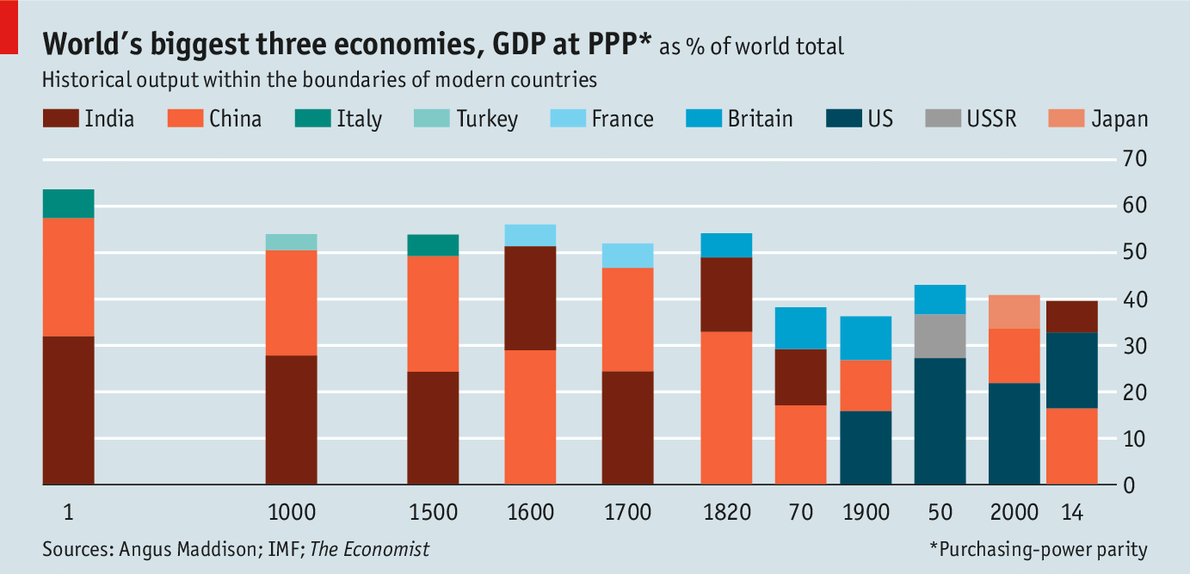

5. China's comeback - This Economist graphic charts the rise and fall and rise again of China's economy over the last 2,000 years or so.

6. Hear hear Mr Carney - Bank of England Governor Mark Carney has no sympathy for the whining of London bankers worried about being criminally liable for the failures of their banks.

They should simply resign if they don't like it, he is reported in The Telegraph as saying.

“One of the legacies of the crisis in the US and by and large in the UK was that the individuals who ran the institutions got away. They got away with their compensation packages, they got away without sanction,” Mr Carney said at an event at the International Monetary Fund’s annual meeting. “Maybe they were not at the best tables in society after that, but they’re still at the best golf courses. That has to change.”

7. The end of 'To Big To Fail'? - Meanwhile Carney gave a speech over the weekend previewing big announcements at the G20 summit in Brisbane in late November (which John Key will attend as Tony Abbott's guest).

Carney said they would be focused on trying to end Too Big To Fail banks.

Operating in a heads-I-win-tails-you lose bubble, the world's largest banks threatened the stability of the global financial system. Their bail-out using public funds undermines market discipline and goes to the heart of fairness in our societies. This cannot be allowed to continue.

It is essential that all systemically important financial institutions can be resolved when they fail: - Without the need for taxpayer support. - And without disruption to the wider financial system or real economy. That Summit will be the watershed in ending Too Big to Fail.

The first is an internationally agreed standard on the total loss absorbing capacity (or TLAC) that globally systemic banks must hold. It will be based on clear principles. But it will be much more than a list of aspirations. It will include a detailed indicative term sheet that will cover the amount; the type, and the location of that loss absorbing capacity.

Carney is talking here about a type of Open Bank Resolution system that the Reserve Bank has introduced. It essentially gives the Reserve Bank the systems so it has the option to shut down a bank over a weekend and recapitalise the bank by imposing a hair cut on term depositers. That means the Reserve Bank would write down the value of a deposit by a certain amount, perhaps 10%, to make sure the bank has enough capital. It's all there in black and white, but hardly any of the owners of New Zealand's NZ$111.8 billion in term deposits are aware of this.

This preserves the biggest figleaf in New Zealand's financial system. The banks and the Reserve Bank pretend they do not have a government guarantee and that they would use Open Bank Resolution if push came to shove. The Government pretends that the banks aren't guaranteed, although we all know the Government will step in to rescue a bank. No Prime Minister will stand up and announce hair cuts for one of the bank's term depositors as long as the Government has borrowing capacity, which it certainly does at the moment.

This means the banks and their term depositers effectively have a free government guarantee from other taxpayers. This simply isn't fair. Either the implied subsidy should be priced in the form of a deposit insurance scheme or the Open Bank Resolution system should be made explicit.

This Colmar Brunton survey for the FMA found that 52% of respondents thought term deposits were guaranteed.

It's clear the Reserve Bank and the banks have some educating to do. Both have been keen to participate in money week this week to encourage financial education. That's all good, but I'd much prefer the Reserve Bank ran a national education campaign about Open Bank Resolution which explains the possibility of hair cuts for term depositers.

It may well mean savers demand a higher return for the higher perceived risk. It may force the banks to offer hybrid type deposits which offer a layer that can be given a hair cut. This would make it all clear and transfer the effective subsidy currently being given by taxpayers in general to term depositers and banks in particular.

This is all very topical ahead of the Reserve Bank's Financial Stability Report on November 12 and the G20 meeting on November 15/16 where John Key will in theory be standing on a stage trumpeting the benefits of a type of global Open Bank Resolution scheme.

FYI for this cartoon below: I'm a Listener subscriber and it's worth it for the Slane cartoon alone, let alone the Jane Clifton and Toby Manhire columns. Subscribe here.

8. Where the young can afford to live - These sets of 'heat maps' showing where populations are rising and falling in New Zealand, and Auckland in particular, are fascinating. Aaron Schiff has done a great job of showing where the growth and loss is, and how the young have focused in the cheap apartments in the centre of Auckland and moved out of the expensive houses in the ring of suburbs around the centre.

The areas just to the west of the CBD (Freeman’s Bay, Ponsonby, etc) are especially interesting. The total population in these areas grew very little between 2001 and 2013, while the young adult population reduced significantly.

9. How NZ is drying out - Jim Salinger has done a piece for The Conversation on how New Zealand is getting drier and why.

Recent evidence confirms that New Zealand on the whole is getting dryer. And we’re beginning to understand why — increasing greenhouse and ozone-depleting gases are driving changes in the atmosphere, with impacts far beyond New Zealand.

10. Totally John Oliver on pumpkin spiced latte. Yes. Seriously. Bigger than bacon.

12 Comments

#1 So we are to think that saving is a harmful psychological condition. And Germany only looks good because everybody else looks deathly.

But hang, the deathly ones are that way because of lack of saving. ????????

Germany looks good because

(a) It has the highest manufacturing records

and

(b) It owns the banks, selling loans to it's neighbours who want to to get stuff from (a)

Cartoon. The Salvation Army will be salivating at the thought of all those houses. They already have a property empire, and have the best buildings of any social service agengy.

But. They know when to play their cards quietly.

500 years ago if Maori wanted to travel from the North Island to the South Island they all got stuck in, built a waka and sailed across.

Today, 500 years later, if the Cook Straight ferry breaks down and there is no money to fix it. the people are left stranded

Now Thats Progress

What about those aeroplane things? I hear they can be used to transport people now days, has anyone tried to fly across the Cook Straight?

If the gods had meant us to fly we would all have aeroplane tickets... (silly flightless kiwi's)

FIrst Dog in the Moon is really good political satire. The moronic Abbott Government provides plenty of material.

#8: What's with the spots in the middle of parks? Is that the homeless?

#6 Of course the bankers should be worried about personal liability. hopefully we'll see it spread to government and other employees, where duty-of-care is reasonable to be expected.

the case with the banks is not that there's risk. It's that all the banks have a cartel-like grip on the contracts they operate under. None of them accept the personal risk, for meeting the contracts under their care. And no others entering into the arena can win customers by offering a better deal to "lenders to the bank"

Number 9

Who put in that regression line?????

Looks a bit cyclical to me. Its going to get wet soon!

#6 agreed.

#7 giving investors funds a haircut to refinance Banks!!!? Once again authorities are allowing Banks to avoid accountability for their own practices. The Banks should be required by law to carry insurance for all depositors funds, but paid for by the Bank and not able to be passed on. This would help ensure that they be a little less cavalier with those funds. After all they do not seek aproval from their depositors for what they do with the funds. Banks must be made more answerable to their customers.

Not able to be passed on? That's a) unpoliceable and b) undesirable in a capitalist system. The full cost of the service should be represented in its market price for the system to work as intended.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.