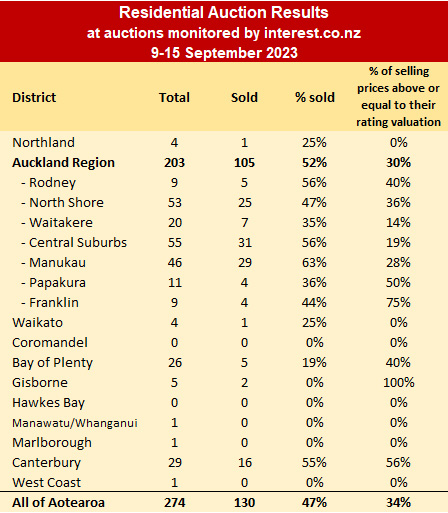

There was a good lift in residential properties being offered by auction this past week, up 12% to 274 in the auctions we monitor.

But the sales achieved did not rise, stuck at about 130. That gave an overall sales rate of 47%, down from last week's 54%, and back to winter levels.

The proportion of those that did sell, selling at or above rating valuation fell also, back to 34%.

In Auckland, the proportion selling at or above rating value was only 30%. But more than half did sell.

There was a noticeable lift in the number of North Shore auctions this week, but a rising proportion of them sold for less than rating values.

Canterbury auction levels were stable, but a few more than last week achieved rating values or more.

The lift in overall auctions reflects the season with spring traditionally bringing out more property events, more buyers and sellers, and usually more auctions. But auctions are still a specialist corner of overall market activity. In August, more than 5,500 sales were made nationwide. Using auctions for price discovery would have been only a fraction of that activity, maybe about 10%. We monitored only 1002 auctions in that month and recorded only 489 sales.

Last week's suggestion we might be seeing more 'motivated buyers' has perhaps changed this week to seeing 'motivated sellers'.

Details of the individual properties offered at all of the auctions monitored by interest.co.nz, including the selling prices and rating valuations of those that sold, are available on our Residential Auction Results page.

[Greg Ninness is on vacation.]

138 Comments

The fear of the Ponzi restart.

Vote left no Ponzi young Kiwis will have chance of owning their own home.

No one living in cars or on the street minimal social issues.

Owning your own home is a key to being a great kiwi along with being clothed and feed.

The 3 essential in live Feed them,Clothe them,House Them.

This is where we want our politicians focused.

"vote left"

I've been hearing from many people in my neck of the woods about some fairly horrific rent rises in the past few weeks (like $100-$150 a week)

Despite many pundits here over the past year assuring everyone there's no way rents can rise, because they're already too high.

Some here, are putting that down to all the immigrants. However, there's very few immigrants where I am.

So these rises are resultant of either interest rate hikes, or interest deductibility changes (likely both, maybe also healthy homes).

I'm not saying vote right, but just remember every fluffy wuffy initiative the left introduce, is going to be paid for by you.

2024 will be a year of rent inflation more so than house price inflation. That and social housing wait list inflation.

Most landlords are making less than 3% gross. So with no capital gains evident in the last 2 years and high interest rates the cost will trickle down to tenants. There is plenty of competition for rentals.

It took Labour only a year or so to figure out they're not up to practical tasks like building houses.

So instead, we get this lunacy.

The facts

We were really making serious headway into the house shortage during the covid years. Now the migration gates have been flung open again...

LOL, so the entire market produced about 40% of the number of houses Labour alone said they'd produce.

It was 100k by 2028 if I remember correctly not yearly.

I mean to be fair, the market builds the houses not the Government. Just like the market builds roads not National. Governments can only direct funding. So the only *real* way of measuring actual output is the growth from trend. Because if you work on "Kiwibuild" houses, people will go "yeah well they were getting built anyway, just stuck a KB sticker on it".

Kiwibuild in my eyes was a flop right from the beginning. Should have been an apprenticeship scheme and then a home building program off the back. They did bring out the TTAF back in 2020 so maybe they saw the error in their ways?

Governments can only direct funding.

And set all the rules......

"Here's some money, we need 100,000 houses, get on it! But you have to do it our way"

True. Now excuse my ignorance, but aside from the price caps what other rules were hugely prohibitive to Kiwibuild?

The same sorts of things prohibitive to any sort of building. Or manufacturing.

I wasn't involved in anything to do with Kiwibuild, but if it's anything like how the government is turning their state houses into healthy homes, I'd anticipate they'd insert a whole bunch of official oversight and compliance, for no gain, but more time and cost.

So not really anything unique to Kiwibuild that you can cite, except for some reckons. You may want to elaborate on "a whole bunch of official oversight and compliance" when it comes to converting State Homes into Healthy Homes, for us uninformed. Would this be because the private sector has the tendency to rip off the taxpayer when trusted to complete work without oversight?

But Kiwibuild itself does lead to the point of why it would be a good use of taxpayer funds to try build in a saturated market filled with red tape and compliance issues in general.

So not really anything unique to Kiwibuild that you can cite

No, but likely the government drastically underestimated how unproductive our house building process is, relative to their aspirations of supplying houses.

You may want to elaborate on "a whole bunch of official oversight and compliance" when it comes to converting State Homes into Healthy Homes, for us uninformed. Would this be because the private sector has the tendency to rip off the taxpayer when trusted to complete work without oversight?

Non government building usually involves oversight from the local council, and the builder (some times that may be a project manager instead). In the past 18-24 months, the government has deemed it necessary to insert 2 extra layers of oversight at a ministry level, tasked with increased oversight on H&S, compliance to specific ministry construction guidelines (at odds with the building code), and programme acceleration. The agents they have inserted into these roles generally are inexperienced, and lack practical understanding of how to build things. This is resulting in an inferior product, that takes a good 30% longer to produce.

Why they felt the need to do that, I can't really say. But the results, are inferior to the status quo.

Interesting. Thanks for providing insight.

I know you have a bent towards businesses having a default position of raping and pillaging, but they, like an employee, only have so far they can push things. Any price increase carries risk of losing business, so it's not something most businesses are able to do open slather.

On the flipside, we have a system that demands an increasing amount of compliance, at the cost of productivity. I've had to measure that over quite a few years now. Even a daily, mandated 15 minute safety briefing that's going over the same ground as yesterday, last week and last month is going to come at a cost of some 5 grand a year, per worker. And that's just one function.

There to much planning these days, and not enough doing. I think Kate said something along these lines a few weeks ago about the Department of environment or something like that having a significantly larger budget than the department that actually does the work outlined by the planning department.

Why do we need so many management layers these days? You'd think with the introduction of computers that would have reduced paperwork but we seem to have more than ever and expanding levels of bureaucracy that seem to add very little value.

What tends to happen is we set rules based on avoiding potential issues, or eliminating a problem that has cropped up.

Problem being, the entire market then has to add an additional layer of expenditure for something that might happen, or only few people are actually doing. If I cut my finger off because I'm careless, you also have to go to a "how not to cut your finger off" course, and the boss has to pay the course costs for us, as well as the lost revenue for the time we're at the course and not producing things for the business.

And you tend to end up creating entire industries that aren't contributing anything of monetary value, that need to sustain itself. A health and safety officer for instance, has to keep finding things to clamp down on, otherwise they're not needed. So the rules just get tighter and tighter.

No one really voted for this nonsense, but the vague idea of "we want to be safe at work" is something most people would agree with.

Yeah, that's probably pretty bang on for how we got to where we are now.

Thus interlaces with our productivity woes.

Productivity will drop appeasing the spiral of compliance, and the economy will have to work even harder to drive the sort of productivity investment to stand still, let alone increase. All the while, people are dissuaded from investing full stop, because the returns on the investment become more marginal, and exposed to future regulation.

I don't really know the solution to that, because on one hand, I like that something like a boom lift has to be certified, but I also think doing an electrical safety check on every electronic device in a workplace that's operating fine and doesn't show any signs of wear is overkill, given how rare it is to have an appliance explode in your face. If you want to keep operating though, you take the cost to do those checks, and add it into your pricing.

Still waiting to "pay for" leftist policies like the MDRS, NOS-UD and high density zoning that National and ACT want to kick into touch.

Or do these leftist policies not count as "fluffy wuffy" in your book?

There are squillions of townhouses being built in Christchurch, so not having the MDRS has been no impediment whatsoever to knocking down family homes and building half a dozen cheap and nasty townhouses in their place. So not supporting the ability of developers to whack them in anywhere they like (although looking at the location of some of them, it seems that they do so anyway) is hardly going to change much. If other cities and towns are not like Christchurch, then vote differently in local elections.

A significant proportion of the squillions if townhouses are being built on houses that were demolished/affected by the earthquake no?

Dry, warm rental homes = fluffy wuffy policies according to HW2, I mean painter

In my younger years, I deliberately rented shitboxes to live in, because they were cheaper, and at the end of the day perform 98% of the function of a new house.

If I'd have wanted double glazing, heat pump, etc, I'd have paid extra. That choice is going for renters, and the costs to upgrade a home, often running into the hundreds of thousands of dollars, will ultimately get worn by tenants.

My comment in general is about any extra 'benefit' the government says it's creating for the public - you can have whatever you want really, you'll just have to pay for it.

I've always found it interesting that many commenters on this site insisted that the removal of interest deductibility have absolute 0 effect on rents because “they will just charge the maximum anyway”. Although that may or may not be true for the majority of landlords, I personally know a few that had 0 intentions of raising rent for years at a time, suddenly find themselves in a financial position where they must. Now that National is getting in and phasing it out, rents will probably not drop as very little landlords hand out rent reductions. The interest deductibility law should have never been touched unfortunately, just one of Labour’s many screw-ups.

Reinstating it will lower rents, just not in the way that people imagine. Individual landlords wont drop rents on existing tenancies. But what will happen is that investors will move back to buying existing dwellings, which rent for a lot less than a brand new build. Example - a 2 bedroom 1970's crosslease flat with a garage and garden in my area rents for $450 a week. There are 2 of them currently available. A 2 bedroom brand new townhouse with no garden or garage rents for $550 a week, and there are about 20 of them available. Renters are being forced to pay an extra $100 a week for a rental due to lack of supply of cheap rentals. An increase the supply of cheaper rentals will bring rents down on aggregate. It will also lower the price of those brand new builds, as currently the benefit of the interest deduction is built into the price the developers can charge, and its paid not just by investors but also owner occupiers who want to buy one. It should also alleviate the pressure on social housing as people will be able to find rentals that they can afford.

The policy wasn't bought in to have "0 effect on rents". It was bought in to help level the playing field between investors and FHB's over time.

You confirm this when you statement "suddenly find themselves in a financial position where they must". In other words, investing doesn't stack up like it used to. Obviously these people already owned rentals, but the logic will apply for any additional purchases (less demand to buy from investors means FHB has more chance to buy and at a lower price all else being equal).

Ultimately, they will only be able to raise rent to the maximum tenants can afford, the fact they are able to raise it simply means they were not already charging maximum and there are plenty of reasons why a landlord would choose to do that e.g. keep good tenants vs risk new ones.

Leveraged "investing" has never stacked up, because it's speculating.

I stand corrected.

I don't doubt it has some effect but I think you're a discounting the effect of additional demand on the rental market. If we ship 100,000 more people into the country without building housing for them first that's going to have upward pressure on rents. We also have to consider that a lot of housing has been wrecked by the Auckland, Hawkes Bay and Nelson floods recently.

And huge rent increases aren't anything new, they have been going up for years now and in a high interest environment they would likely be going up no matter what as landlord's try to pass their costs on. Australia for example has had higher rent increases than here, yet they still have full fat negative gearing with additional tax rinsing. It's naive to think when National gets in and reinstates interest deductibility that the costs saving are going to be passed onto tenants. Even discounting Australia it seems like rents are going up everywhere we compare ourselves to, the UK, USA, Canada, etc, they are all having the same problems so pinning it all on Labour and this one policy change rings a little hollow even if it does impact the situation slightly.

And,I don't love interest deductibility as a policy but there has to be some kind of policy to reduce demand as it was getting out of control. The main issue is supply but the other side of that equation was demand, and for FHB's it's hard to compete with somebody who can fully deduct their mortgage costs and leverage equity from existing properties to pull themselves ahead. But National is going to fully let rip and ditch all of it, not bring any other kind of disincentive like a capital gains tax or LVT and watch the ponzi fire up again which I really feel isn't actually ideal for the country. Plus the revenue gained from interest deductibility isn't insignificant and could of helped take more pressure off of income taxes.

If we ship 100,000 more people into the country without building housing for them first that's going to have upward pressure on rents.

Now let me stop you right there E46, Pa1nter has already declared immigration is not the problem in a comment above, furthermore they provide the likely causes of rising rents. Please read what they say more carefully in the future to prevent yourself spreading misinformation such as the above quote which is completely illogical and poorly reasoned.

Is this sarc? Or are we now relying on Painter's declarations to establish truth?

Yes and I try to keep an open mind - Pa1nter brought to my attention the correct definition of a ponzi scheme during this thread.

Is this sarc? Or are we now relying on Painter's declarations to establish truth?

Everyone's free to make up their own minds. We can all have opinions and preferences, but there's also unavoidable commercial realities that operate irrespective of these opinions and preferences.

I don’t disagree that more demand has probably contributed to the bulk of the rent increases, however I was just spelling out my anecdote that not all Landlords want to suck out absolutely every single cent they can from tenants. My main point is really just referring to most of the commentary here I’ve seen in the past year about how removing interest deductibility won’t increase rents as landlords can’t pass on their costs. Well it turns out that they can to some degree, and will because of this very policy. Unfortunately removing interest deductibility will increase rents, reinstating interest deductibility however, will not drop rents.

Will have to take your word for it. A common trait with Landlords is pretending to be altruistic while making money. Wouldn't surprise me if your anecdotes are being disingenuous and would have in fact increased their rent regardless.

"ohhh, no no no, we weren't going to increase the rent *wink wink*. We're good people who provide a roof for needy people. The bad bad Labour Government forced us to increase rents". I suppose they dropped rents when interest rates fell, and will drop them again if deductibility is reinstated?

https://figure.nz/chart/azFwYTVvUcrcxT3m-Cn6TyuSQBZ8Kacee

Looking into it, it's a remarkably flat graph, especially when you compare it to house prices.

I don’t think them not dropping rents when rates decrease/interest deductibility reinstated is an indicator that they would have increased rent regardless of economic conditions. There could be other reasons for why they won’t drop rents, like rate and insurance increases, etc. I think you’re digging into it a little too much, all I’m simply saying is that they did not touch their tenants rent for 5 years, and because of this sudden change in policy, they have given their first ever rent increase. You’re welcome to make assumptions, I’m just merely stating an anecdote as I said.

“The interest deductibility law should have never been touched unfortunately, just one of Labour’s many screw-ups.”

The “temporary removal “ of interest deductibility law has accelerated the rent rise. That was a wake up call to all slack/nice landlords to bring the rent up to market rate. Not sure if it was done deliberately by Labour.

However, there's very few immigrants where I am.

There doesn't need to be immigrants at your specific location for the increased accommodation demand of another 100k people to be felt.

Had you not considered that there might be more demand in your area from non-immigrants because they had been displaced at the margin by immigrants pushing up rents/taking houses that otherwise would have been empty elsewhere?

While this is a potentiality, it would seem more likely it's increased holding costs for housing being passed on. The migratory floodgates havent been open long, so the flow of indigenous refugees fleeing larger centres would take longer to be felt.

I think there's a lot going into it, wages are up so higher capacity to pay, housing is taken offline from various floods reducing supply, interest deductibility affecting some investors, Airbnb and the like removing long-term rentals from the market, and increased demand from immigration. Attributing it to any one thing doesn't seem realistic.

For interest deductibility, I do think it's a somewhat flawed policy but I can understand the intention behind it in reducing demand for existing houses and giving FHBs a fighting chance to enter the housing market and own their own property. I think it should potentially scaled back and kept at 50% or 25% just to give that extra incentive to invest in new builds and bring more supply into the mix.

Otherwise replace it with a Pigouvian tax like an LVT in order to capture some of the value that's getting sucked away through rent-seeking, or failing that even a capital gains tax. It doesn't seem right to me that someone working 70 hours a week can get taxed at 39% for their labour when someone who buys a property, negatively gears it, pays zero tax, and then sells for a massive profit without paying a cent of tax. How can we expect people who work for a living to get ahead in that situation when they are at such a massive tax disadvantage?

reducing demand for existing houses and giving FHB's a fighting chance

By itself, it will do that which is why I support it. But any minor tweak done to help FHB and renters will always be blown away if you go and bring in 100,000 more competitors.

New houses almost always rent for more than an old house. We just don't have enough 'old' houses to rent because our population is increasing too quickly for the houses to age. Even if we build 30,000 more houses than we did in the last year (make a flawed assumption of 3.33 per house) for the 100,000 immigrants, rents would still be higher because all those 30,000 houses are new. We've raised standards of housing available, just a pity we cannot afford such a high standard...so will have to squeeze more into a house e.g. 3 generations under one roof will become more common along with the recent media reports of 20/30/40 in one house.

For interest deductibilty I do think it's a somewhat flawed policy but I can understand the intention behind it in reducing demand for existing houses and giving FHB's a fighting chance to enter the housing market and own their own property.

The heart of the matter is the government wants more rental properties, but won't fund them themselves. Not every landlord is doing it out of the kindness of their hearts, so need an incentive to be a landlord. Interest deductibility is one way the government chose to do that, still cheaper than buying and operating them yourself, but obviously at a cost to private home owners who have to compete for the same limited stock, and building capacity.

Really, this is a 10-20 year project if someone wanted to make serious change. With some implications for existing owners.

My feeling is the government has weighed up the pros and cons and decided they can live with not really doing much.

Well I'll counter your speculative theory with another. If Labour had not announced the interest deductability changes and healthy home standards less investors would have invested in new builds.

It would have continued to be more sensible to buy a shitty house on a decent piece of land and rent it with no upgrades to healthy home standards = less new houses built (Many FHBs can't afford the new builds as their higher construction quality comes with a pricetag). New rental builds tend to be in smaller sections and be built to better standards.

The healthy home standards are likely to have increased the quality of the rental stock on average which would account for some of the rent increase. People have the choice to rent a better quality property.

So Labour's policies are likely to have both increased the number of rental houses built than would otherwise have been the case (downward pressure on rent) and also increased the quality of the rental stock (upward pressure in absolute terms but you're also renting a higher quality product).

So bollocks to the call that the policies are bad for renters. They are bad for some landlords who were exploring the system (providing poor housing and leveraging beyond their means).

They're not 'bad' for renters, they're just not cheap.

it would seem more likely it's increased holding costs for housing being passed on

Yes, but the only reason they are able to do that is if there is enough demand.

If there are 2 identical houses for rent (one LL debt free, one LL leveraged), 1 tenant needing a house. The leveraged LL will not be able to raise rent and pass on increased holding costs from no interest deductions and higher interest costs because if they do the debt free LL will get the tenant.

I'm not arguing the holding costs have increased, they have, I'm arguing the reason they are able to pass them on is population (demand) growing faster than houses (supply).

Theres always been a deficit of rental houses though. Maybe it's just a huge coincidence with the timing, and absolutely not these costs being passed on, and people just having to accept them. Like the cost of your groceries, and anything else you buy that's faced cost increases.

Theres always been a deficit of rental houses though.

You're right, immigration has played a part in keeping it that way, hence why I advocate hitting pause like we did in covid again.

Haha, then everyone shits the bed at non-tradeable inflation.

Received 14 enquiries within 2 days for one of the rentals. Rent slightly above market rate, 9 groups turned up at the open day and some got pretty angry because they got turned down. Quite a stressful experience to be honest.

Given obtaining a need (shelter) is causing some to get 'pretty angry', can you see any problems for society going forward if demand for housing (shelter) remains more than supply?

Not enough shelters, not enough roads, infrastructures, less people want to invest in rental properties, too little too late.

I agree on the first three, but why would less people want to invest in rental properties if demand is so high?

Do you think we should pause immigration (growing the population) until we sort out these problems of "not enough shelters, not enough roads, infrastructures"?

I agree on the first three, but why would less people want to invest in rental properties if demand is so high?

Probably the same reason people aren't falling over themselves to open an egg farm.

Once the government throws up enough barriers to something, only the brave will persevere. Or whatever large entity owns the market and guides the regulations.

In either case, wouldn't it be a lack of expected return on investment after allowing for the barriers? Therefore, I was thinking if more demand, higher rent, more investors meet an acceptable return and invest (acknowledging a continuum of investor return requirements).

All the more reason population growth needs to be carefully considered because neither houses nor egg farms sprout up overnight.

Mmmm, kinda, but also no.

Some people will factor the increased compliance costs into their business model and continue trading. Others just won't be arsed with the hassle, at any price. Some won't want exposure to future regulation changes.

Overall you should see supply fall, and prices rise.

Others just won't be arsed with the hassle

Wait, what? Lazy investors and LL's - say it isn't so Pa1nter!

Overall you should see supply fall, and prices rise.

Existing houses would still be there, sold maybe to other investors at a loss so they numbers stacked up or a FHB. Less new houses built? Yes. Prices, if you mean for new builds, not sure they would rise until the rents stacked up would they (more likely not to be built per your supply fall)?

My theory is that houses should still be built in the private market for investors until land hit's zero. If land is zero and the numbers still don't stack up (including allowance for hassle and exposure to future regulations) then I guess it's social housing only from that point onwards. So, I think if the population is held where it is, more private investor rentals would be built but they wouldn't be paying anything close to today's prices for land (speculation removed).

Wait, what? Lazy investors and LL's - say it isn't so Pa1nter!

What I'm telling you are the basics for any commercial operation. Whether it's accommodation, a factory, or a service business, you establish it under a certain set of parameters, financial and other guidelines. While operators can and do absorb changes, others will fall off as the number of impediments rise.

Existing houses would still be there, sold maybe to other investors at a loss so they numbers stacked up or a FHB. Less new houses built? Yes. Prices, if you mean for new builds, not sure they would rise until the rents stacked up would they (more likely not to be built per your supply fall)?

I'm talking about rents. You know, the thing 30% or more of people have always done in NZ, even when houses were "cheap". Someone has to own the houses that get rented, and the government doesn't want to do it.

I'm talking about rents.

Oh okay, well in that case rents would fall (not rise) with my suggested pause in immigration. This would be due to flat/falling population (demand) and the same/increasing number of houses (supply). Land values would decline due to reduced demand for new builds. Build cost may decline too due to increased competition amongst builders. I don't mind deflation as I don't have debt, I can see why leveraged individuals wouldn't want it though.

Can’t pause immigration as we need more people to keep the economy going and pay tax to fund infrastructures or else no one is interested because there is no money in it.

Immigration is in place of New Zealanders the country depended on existing, that never came to be. The houses were always needed.

Why can't the people here keep the economy going and pay tax to fund the infrastructure they need?

What is special about these immigrants that they will be able to not only pay for the infrastructure they need, but also the infostructure the existing people cannot (according to you)?

A Ponzi scheme can maintain the illusion of a sustainable business as long as new investors contribute new funds.

If we continually require more and more people to keep the economy going, then doesn't that make the economy a ponzi?

Problem is many “people here” don’t want to work or think the job doesn’t pay enough so sit on their hands do nothing or move overseas hoping for a better life.

Yes the whole system is a ponzi, that’s why I kept saying nothing will really change.

Problem is many “people here” don’t want to work or think the job doesn’t pay enough so sit on their hands do nothing

Agree this is a problem, although we are always going to have to pay for them one way or another. So I say better to invest in them\train them. That might mean intensive 1 on 1 on the job training for a period of time. As for the 'doesn't pay enough', that is likely true if you're looking to buy a house and start a family. Reality is if you make it next to impossible to do those things then people will give up or look to move overseas. Until house prices are fixed (should be likely half what they are at current wage levels) then yes nothing will change.

Why do people from overseas want to come here? Higher wages for sure, but the aim is usually residence, you'll have to know them/be trusted by them to get honest answers. They don't come out of the goodness of their hearts to look after our elderly - it's without exception to better their and their family's lot in the world. What is residence? It's the infrastructure you spoke of, the education/health/legal/welfare system which is valued at hundreds of thousands of dollars. When that is on the line then sure they will be good workers, but will they pay that much in tax? Most will not.

If you're looking at inhabitants of the country from a cost perspective, straight off the bat it costs hundreds of thousands of dollars to make an indigenous adult New Zealander, before they earn a cent of tax. That's a huge amount of earning each Kiwi has to do, just to even be level with an already raised, 25 year old migrant.

Migrants generally have higher workforce participation than locals (pretty much goes for any country).

Your argument doesn't wash.

If you're looking at inhabitants of the country from a cost perspective

I'm not, employers are when they want to pay the lowest wages to the most compliant employees while letting society pick up the untrained/unemployed local costs including increased crime and homelessness due to not building accommodation for their overseas workers (so as not to displace locals out of existing houses). But sure, make it so all overseas workers are not given residence or allowed to have children / bring family with them and it would then just be about the wages. You'd still have demand e.g. RSE scheme, but nothing close to what we currently have. I'm just not prepared to tell the locals no more children, we'll be getting immigrants from now on! Here's an idea, how about we arrange our society so we can live and take care of ourselves and not drive our young away with stupid house prices and low wages as delivered by population growth.

Migrants generally have higher workforce participation than locals (pretty much goes for any country).

Yes, and I've explained why in other posts, you cannot compare apples to oranges. The don't already have residence and all that entitles them too.

Your argument doesn't wash.

Disagree. You fail to consider that the cost of raising an inhabitant is a sunk cost. You pay it anyway. You pay more if you grow the population like we have, everyone is paying more for housing, anyone with a mortgage is paying more in interest to foreign banks. Possibly billions of dollars every year is attributable to having grown the population too fast and for too long so employers could save on the wage bill. Let the scarce labour go to the most productive businesses that can pay higher wages, others shape up or fold.

I'm not

Your argument reads like a migrant won't pay as much tax to cover their cost to the state as a local.

Here's an idea, how about we arrange our society so we can live and take care of ourselves and not drive our young away with stupid house prices and low wages as delivered by population growth.

The problem is, you're not starting with a clean slate. You inherit conditions which you have to attend to, as well as try to predict the future, and try to make allowances for that also.

It's a nice idea, along with having no crime, amazing health services available to all, etc, but obviously a lot easier said than done.

You fail to consider that the cost of raising an inhabitant is a sunk cost. You pay it anyway.

Yep, and as Ive already said, migrants are in place of New Zealanders that never got birthed. Our government finances are based on a pay-as-you-go system that necessitates a continual flow of new tax earners.

Your argument reads like a migrant won't pay as much tax to cover their cost to the state as a local.

That's not what I've said. I've said the cost to the state is much higher for a migrant when you factor in residence (which an employer doesn't pay). Actually, having this discussion is pointing me closers to powerdownkiwi's view that we cannot afford ourselves at this population local or immigrant, gulp.

you're not starting with a clean slate.

Exactly, we have 25 years' worth of locals coming through the system, so pause immigration for them to come through. Then you may revert to your hypothesized low-cost model of no births and bringing in 25yo's from elsewhere. Remember we've got 100'000's of under/not utilised people on benefits that might be receptive to being told they have a place in our society.

a lot easier said than done.

Just like an LVT, it doesn't need to be a silver bullet, it just has to be an improvement from the status quo. Yes, I've acknowledged doing what I'm suggesting would be harder than getting in immigrants and would cost more initially.

Yep, and as Ive already said, migrants are in place of New Zealanders that never got birthed.

Is there a list of those that never got birthed? Do couples without children notify INZ who then approves a visa? Perhaps you'd have been closer to the truth if you said migrants are in place of NZer's that do get birthed and are on benefits and/or underemployed.

Our government finances are based on a pay-as-you-go system that necessitates a continual flow of new tax earners.

Not sure I agree it is a pay-as-you-go system, that seems a bit loose given you're complaining about my use of the word ponzi. Regardless, we have a continual flow of new tax earners since we haven't implemented your hypothetical zero-birth policy yet. However, may I remind you that the government of NZ can and indeed has in the past taxed land, so it is possible for more tax to be raised without growing the working population (e.g. overseas based owners that currently are not taxpayers). So no, the need for 'new tax earners' does not equate to a need for immigration at all.

In short, lots businesses are going to close without immigration, we need more people here to spend money. Our population is just too small.

If a business has been setup in such a way that it can't survive without immigration, then frankly that is on the business owner and their decision to speculate of future population growth.

It's not NZ's job to bail it out by handing out residence worth hundreds of thousands to people living overseas at the time the business started so it has enough customers. Perhaps the business could relocate to where there are enough people for it to trade profitably.

Our population is too small for what exactly? What will we be able to do with more people that we cannot currently do?

If a business has been setup in such a way that it can't survive without immigration,

Not 'immigration' as such, but a steady supply of both customers and staff.

Say you want to build a factory, that supplies a defined population. You are going to build something that can service that population, and possibly with a bit extra overhead. If you believed your customer base and labour supply is going to shrink, you'd either not go ahead, or build something with less capacity that's also less efficient.

“Our population is too small for what exactly? What will we be able to do with more people that we cannot currently do?”

Too small for everything.

To name a couple, we can’t even afford a better theme park than Rainbows End. Why don't anyone invest a Dream World or Movie World type of scale theme park in NZ? We don’t even have enough population to have a proper metro system in our largest city…

Also can't compete with cars for medium to long distance rail.

It's awesome in Japan, but they have train stations that process almost more passengers every day than there are people in NZ.

It's doomed either way, it we decided to go hermit kingdom and bar immigrants, even more young people will leave, because it won't offer the sort of lifestyle adolescents prefer leading (and it's already not great).

Not sure I agree it is a pay-as-you-go system

You don't have to agree, but that's what it is, by design. Current taxpayers cover the cost to the state of providing services to the entire population. When they were putting it in place, they did not pre-empt the social phenomenon of lower birth rates brought about by urbanisation .They would've assumed constant, or increasing birth rates, because that's what birth rates had been doing for centuries.

Pay as you go tax requires people earning wages, high rate of migration is depressing wages thus reducing tax revenue, on top of that the government has to throw out more and more subsidies year to cover the failure of wages to keep pace with living costs.

Your argument assumes the market will just keep paying higher wages, instead of ceasing operation, or moving.

We have jobs now that you can't get people to do for any money. If you're happy sucking pooh out of porta-loos with a hose, you can earn more than someone sitting in a cubicle with a university degree.

But that's beneath most of the population now.

Pay enough money you can find someone for anyjob, if no one wants to do it pay is too low and businesses that cannot pay are clearly not generating any value.

You can see the problem we have though, aye? There's quite a rift between "things the population wants" and "things the population are prepared to do".

Most people for instance, probably don't care much for "human resources", but they would like to use a clean toilet. But more people would rather do their job in a nice office with "human resources" written on the door, than have their arm up a sewer pipe.

You can indeed get some people to do things if you pay them enough, but it's hard for an economy to function if you have to make it a Fear Factor type scenario where the carrot has to be disproportionate to what the fair value for the role should be.

The fair value of the role is the point where the pay makes them prepared to do it that is it, i think you are confusing an exploitative business model for an economy.

If we continually require more and more people to keep the economy going, then doesn't that make the economy a ponzi?

The difference between the housing "ponzi" and an actual ponzi is that the actual ponzi has investment funds chasing an investment that is 100% illusory.

Otherwise we could say that the education system is a ponzi, because why would you build and finance a school if you weren't going to have a continual supply of new students. Or many other things that assume they'll be supported by more than one round of clientelle.

Not sure, in all ponzi schemes there might be some residual value - I'm not going to get hung up on if it's 100% or not. If it will 'crash' with new money/people entering, then it's a ponzi to me.

I actually would define some of the education sector as a ponzi - particularly the English language and part of the tertiary sector where foreign students were a major source of funds.

As for schools, that is an example of the added infrastructure costs running a population ponzi creates. We wouldn't need these additional schools if we weren't increasing the population just like where I grew up and maybe 4 out of 5 local schools have closed/merged freeing up the closed schools land, buildings and schoolhouses for other private uses (accommodation\restaurants even if on a tourist route). Less population, less school infrastructure to maintain - road etc always funded from farm rates anyway so same amount of land funding that. Not so in Auckland, which is the main population growth area. There we're having to build more schools and whole suburb infrastructure that will then need maintained/staffed etc. Not saying we shouldn't build and staff them given the population, but I am saying that this is only required due to immigration growing the population and they aren't paying for it up front and most won't pay for it throughout their working lives in tax either when the services provided are factored in. Most people in NZ are not net taxpayers and immigrants will be no different given they don't even need median wage to come.

In a Ponzi scheme, a con artist offers investments that promise very high returns with little or no risk to their victims. The returns are said to originate from a business or a secret idea run by the con artist. In reality, the business does not exist or the idea does not work in the way it is described.

The term "Ponzi scheme" exists to define a very specific sort of investment fraud.

Something like a market, be it for houses, apples, or video streaming services, cannot be a Ponzi scheme.

Would you accept 'like a ponzi' then?

I've explained what I meant when I used it, and it appears the word ponzi is being applied (even if incorrectly) more widely in everyday language now:

It's nothing like a Ponzi, because as I've said quite a few times, a Ponzi scheme has to involve an investment into something that doesn't exist.

If you really need to spice up how you refer to the housing market by interlacing a type of dubious business model (as opposed to total fraud), I guess "like a pyramid scheme" is less innacurate.

Thanks, I agree that what I'm talking about doesn't meet the strict definition. Some parts of it do fit with the requiring of new entrants, but overall, I think you're correct and I shouldn't use it for 'housing ponzi', 'population ponzi'. I don't like pyramid scheme either since it, like ponzi, includes a fraud requirement.

A pyramid scheme technically doesn't need to involve fraud, it's just that they're often marketing a product at artificially high values that the surplus is being used to filter money up the chain.

In its essence, this is not dissimilar to how our entire economic system operates, to a certain extent.

I think a pyramid scheme would be the closest definition. And you're right I think our entire economic model resembles one to an extent, our economic growth has relied heavily on a continuously expanding population, ensuring a constant influx of new participants that has driven organic growth. However, without significant technological breakthroughs, this model is inherently unsustainable and destined to falter at some point.

Realistically global birth rates will contiune to be on a downward trajectory, and the full consequences of this demographic shift remain uncertain, as it's unprecedented. While we can draw some insights from countries like Japan, South Korea, and Germany, the worldwide scale and simultaneous decline in birth rates across multiple nations will undoubtedly yield unique and unpredictable effects.

Civilisations have always had a baseline requirement for population continuity for their survival.

Added to the problem is for a long time, theres been ancillary developments also spurring on economic growth. Industrial revolution, the production line, rise of consumerism, etc. Now it seems like the bigger drivers of market value are things like the shift to sustainability, military spending, etc. This is more money being spent to try to just keep doing the same thing.

The 21st century is going to be defined by massive migrations, and migrants are going to be in increasing demand. Trouble is, many of the sources of migrants, are also facing population decline. It could very well be that their home countries start restricting the flow of emigrants in order to preserve their own societies.

There hasn't been enough housing built for our population growth since the 90's, the government has failed to supply adequate housing supply, but so has the private sector. Expecting the private sector to fill the gap is unlikely to bare any fruit as the incentives are all backwards. For property investors the incentives are too restrict supply and inflate the value of their own properties from increasing demand.

The status quo has been buying existing houses and renting them out to people who would of previously purchased their own properties, not creating new housing. The ultimate issue is their isn't enough supply and that's a hard problem to solve, the private sector has failed at it and the public sector has failed at it.

Genuinely not sure how this can be solved, the only idea I have that might shift the incentives is a land value tax as then property owners and investors would have an incentive to bring more supply online to reduce demand and land costs. Currently the majority of negative externalities from skyrocketing housing costs are placed upon non property owners who don't get any benefit from tax free capital gains. It's not a silver bullet but might go a bit to reducing the shitshow we've created for ourselves over the last 30 years or so.

It's not a silver bullet but might go a bit to reducing the shitshow we've created for ourselves over the last 30 years or so.

It has been building for decades, but still so much push back from attempting to do perfectly reasonable things such as shifting the burden off income/work and onto land so that it is incentivised to be used more productively.

No party, with perhaps the exception of NZF if you took them at face value, is even questioning the population growth narrative despite it creating an immediate demand for housing. Perhaps we should have an annual tax on existing houses (immigration levy on the rates bill?) that changes in proportion to immigration (enough to build the new houses and infrastructure required) - maybe then some more people will question what the benefit is.

Too many people needing somewhere to live is the problem.

isn't under Labour that's lead us where we are now?

The headline should have read "desperate vendors starting to be realistic "

Vote left you say.. you must be wet behind the ears

Country paying high price for Labour 'mismanagement' of economy

Do you not get this ?

Who here is convinced current buying strength forms the basis of a sustainable recovery in house prices? On the basis of progressing fixed interest rollovers, a softening job market, its looking more like a suckers market than anything sustainable. On the debt front, our economic outlook is still deteriorating and those that lend us money may soon force their hand as NZ will be viewed as a debt junkie. Restoring the days when we sold overpriced real estate to each other won't win us global praise and sustainable prosperity.

It'll turn round mate, keep your chin up. Poppy's January 2024 house buying bargain bonanza is still on, as sure as a Briscoes sale.

Yes it (a sustainable recovery) will come eventually. When are you predicting this recovery will happen Pa1nter?

Only really clever people predict when the markets going to do what.

At best, I see trends and cycles.

The recovery is here now....

From a sudden drop, sure.

At some point, somebody gonna get hurt. Somebody.

It’s not going to shoot up overnight mate.

I guess is depends how you define sustainable, you and I would say no. Prices have to fall further or rents have to rise a lot. Well Lab and Nat are sure focused on the latter with immigration atm. If you don't care whether ordinary young people have the ability to start for scratch, have a family and own a house in one lifetime, then maybe current prices are sustainable in the medium term. You literally see where is leads with the discoveries of 30-40 in one house. It's a lower standard of living for sure, but hey, house prices haven't fallen! So yeah, we could sustain house prices at this level or higher.

We might think such an outcome would be terrible, but others certainly appear more than happy to turn a blind eye to everything else provided they're better off financially (Former Auckland real estate agent and wife sentenced for doctoring Lim report to fraudulently sell leaky home (msn.com)).

As along as mortgage rates stay high (or relatively normal if you have any sort of long term memory) we are not going to see the property market "take off" as I hear many RE agents say, even with a change of Govt. We are seeing many more 'sellers' now for that exact reason, there are so many hanging on by the skin of their teeth and as each month passes more and more simply cant do it any more.

Seems unlikely we'll get prices take off in a substantive way, with lending as it is (both rates and terms).

What is harder to determine, is how substantive distressed sellers will be, relative to the total market. It'll likely come down to how 2024 shapes up, economically.

Yup it's simple math. $1m @ 2.5% = $650k @ 6% over 30 years P&I. Borrowing power is down 35%.

You could drill down and adjust with wage inflation, but that'll only compensate for the baked in reduction in borrowing power.

but is a fhb getting 6%?

@7.5% => 565k, or a 43.5% drop

@8.5% => 514k, or a 48.6% drop.

And the deposit requirements aren't helping either - at least our bank said they were no longer accepting less than 20% deposits due to the threat of negative equity within the year of purchase (at lower deposits).

The future still looks grim - and the increase in living costs is seeing an erosion in deposit saving power greater than the increase in deposit interest rates offset (at least for us - but we have dependents so are less willing to make sacrifices for the sake of a house deposit when we don't currently plan to buy).

The market is illiquid, and slow to adjust down, and I personally know people who are desperately hoping National will make their holdings viable again.

I was being very conservative with my numbers, which further illustrates how unplausible claims are of prices about to shoot off really are.

Don't forget the stress test of 9%. Which is the interest rate that FHB, and everyone else, are tested on.

To work out the buying power it should be based on the stress test rate, no?

Hopefully the DTI (once implemented), will keep a lid on things. As anything, the devil will be in the detail... but NZ is screaming out for one. I'm don't want to see investors lose their shirts, but we need a bit of common sense. I'd like to hear reasons against a DTI, because I can't see a single one?

If you restrict what people can borrow, they can't afford to buy houses, and less will be built. This is because much of the cost to produce new housing is fixed, and doesn't care how much people can lend.

That's like being on a treadmill that keeps getting faster and faster. I say implement it, and let the industry adapt around it. Like I keep hearing (and never actually seeing), we are a nation of ingenuity

That's like being on a treadmill that keeps getting faster and faster.

Have you not been viewing society in general over the past few decades?

The industry can't adapt enough, because many of your larger inputs, labour, compliance, regs, etc, aren't under it's control, and only trend towards more expensive, not less. I have a couple of builders that can knock you up a decent house for about half what the bottom legit rate is, they just won't be compliant.

Well, that and "make stuff cheaper" isn't something that gets most business owners' juices flowing. Case in point - the disproportionate amount of Tiny and Portable home builders that've gone tits up. It's a very marginal proposition, best avoided.

You sound like a politician. Listing all the reasons against proactive movements, without any actionable solutions. I really like and respect your commentary... so I'll ask you, what's the best way to improve the debt doom loop that we are in as a country. Don't say 'build more houses', because that's not going to happen in a hurry.

You sound like a politician.

Maybe, but I'm fairly involved in the construction process. Things cost what they cost.

- if you're a private individual and want to do something off the radar, it's not too bad

- if you're wanting something that adheres to residential regs, and keeps all vested parties happy, add a good 50%

- if you're wanting to do it commercially, probably double it

- if you're wanting to do something commercially, environmentally, go triple (and as of 2022, that also applies to doing work for the government)

As for the debt doom loop, I don't know a sure fire way for a mature economy that transitions from manufacturing to consumption, that doesn't ultimately end up requiring fiscal stimulus.

Ultimately the debt gets the absolute Lions share of the blame for affordability, but it's a much more complex issue. Remember about 10 years ago, when everyone was complaining about foreign buyers driving up the market? How much cheaper did housing get when they were banned?

We will find out the same thing down the road when we nerf investors. It's easier to create a scapegoat for an angry mob, than actually fix their problem.

My thought is to simply apply a high stress test that never drops below 10% for owner occupiers and never drops below 20% for investors.

DTI won't stop people need a roof over their heads.

DTI won't fix basic math that landlords will need to balance rent return neither. currently rent returns stays 4%-5% while interest rate at 6.5%. Who would want to lose 2% on their money??

LOL...130 sold in the whole of nz and that is a triumph... can the bar be set any lower?

Spruikers gonna spruik ;)

LOL someone's getting triggered... it was all meant to be crashing right now remember?

Who's triggered?😂

These are just the auctions that Interest.co monitor. Around 1,500 houses sell every week.

In light of the speculative nature of housing, DTI introduction is an awesome idea and will be a highly effective tool. It will help safeguard the financial system itself. Having adjusted their expectations of overnight capital gains, future Mum and Dad Lords will enter knowing they're providing more a social service and getting a weekly income for their efforts. Currently, there are many reluctant Lords wanting out altogether. They're financially committed, heavily leveraged and holding on for FOMO to come to the rescue. They (and rightfully so) don't want to be labelled the biggest fools.

Houses are for families to live in - not speculating on.

The DTI won't do jack to stop top 10% adding to their property portfolios and driving up prices and rents. Their "D" is low while their "I" is high enough.

Only a retrospective CGT will get them to look for better investments.

There is always going to be a top percentage (10% or otherwise) in any situation that will have the resources to do whatever they want and do well out of it. It is stupidly low rates and irresponsible lending that allow large numbers of people to jump into huge debt, with little or no experience simply because they can and have heard through a mate that you can't lose with property and everyone is doing it, that is the problem.

I actually think the opposite. Dti will have a much larger effect than a capital gains tax would as it actually limits the available credit.

Yes it will. Assume $200k household salary owns house @ $1.5m with $400k mortgage + rental $1m w/ $400k mtg. LVR = 32%. Assume rent $50k p.a. Want to buy $700k rental returning $35k. Total income = $285k p.a. DTI of 4 they can borrow $1.43m.

The 2 existing loans = $800k & new lending required of $700k to purchase new property = $1.5m. Over DTI by $70k. Assume they scrape through, any subsequent property (assume $35k rent again) can only borrow $140k.

Motivated buyers is a nice way of saying "two or more deluded buyers involved in a pissing contest pushing select properties way above reasonable value".

Most sales seem to be for reasonable values given the state of the market. But a few auctions for non-developable residentials have amazed me. The buyers seem to get seriously carried away. Not so much FOMO but MCAB (My Cojones Are Bigger). Buyer's regret must be substantial after such foolishness. Ditto a few developers doing the same and they should know better.

You are right. I think auctioneers could capitalise on this by adding into the commentary quotes like:

don’t be a pussy mate, you really going to let that loser out bid you.

could really help but up prices.

Problem is, from observation, it also accelerates the sales process for the agent.

Don't want to work too long for it.

The day a landlord holds an open day and nobody turns up is the day rent goes down.

It's supply and demand.

Total NZ population v total number of NZ houses.

Article on divorce bringing houses to market ..... sad times , life moves on market just adjusts to new normal levels.....

I've got a property going up for auction in West Harbour in Auckland. It's been crazy - big numbers turning up for open homes, thousands of hits on internet sites, and some going for their 3rd viewing.

Spring! Shouldn't it be booming??

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.