Here's my Top 10 links from around the Internet at 1 pm today.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #3 from the WSJ about how Xi Jingping is starting to look more and more like an old Maoist.

1. The problem with the Consumer Price Index - Yesterday's comment stream included lots of indignant denials about the death of inflation.

Many people said it was was far from dead for small businesses or households that used lots of petrol and power.

Rob Stock looks at this problem of different types of Consumers and whether the CPI is actually accurate for the likes of pensioners and beneficiaries.

It turns out Statistics NZ is looking hard at this problem.

I wonder though. My weekend column on changing spending patterns talks about how consumers adjust their behaviour to relative price changes. We're now driving less and buying more iPads because of these changes. In theory, we still have to eat and turn on the lights and the heater. We shouldn't be surprised though if we insulate more, eat different (and worse) and change the light bulbs.

Here's Stock at the Sunday Star Times:

The real experience of inflation for Maori, superannuitants, the poor and some regions is that the national CPI does not reflect their experiences because the it is skewed to reflect the experience of white, middle-income New Zealand.

That has been spelled out by a CPI Review Committee, headed by former retirement commissioner Diana Crossan, which said: "Lower-income households had the highest price change and higher-income households had the lowest price change."

Work is now under way at Statistics New Zealand to correct that by creating inflation indexes that will more accurately track cost of living increases for "sub- national" groups such as Maori, Pacific people, beneficiaries and superannuitants after recommendations to do just that fell by the wayside in 1996 and 2004.

Analysis by Statistics NZ shows the average annual inflation rate for the superannuitants sub- group, for instance, was 2.6 per cent between June 2008 and September 2012, compared with 2.35 per cent overall.

The difference was even more marked using a payment-based system, as opposed to the current "acquisitions" methodology, at 2.43 per cent compared with 1.65 per cent overall.

2. Where's the graphene? - Rebecca Clancy at the Telegraph writes about global race to find a cheap way to produce graphene, an amazing new material that is light, strong, flexible and conductive.

In theory, it could be printed with 3D printers. I haven't given up yet on the potential for new technology such as graphene, solar power and rechargeable batteries to help give global economic growth a new kick higher, despite the massive challenges of peak oil, climate change, ageing populations and falling wages shares globally.

It is lighter than a feather, stronger than steel, yet incredibly flexible and more conductive than copper. It has been hailed as “the miracle material”, its possible uses apparently almost endless.

The material is graphene, a single layer of carbon atoms forming a regular hexagonal pattern, extracted from graphite, with astonishing properties and impressive potential.

Unbreakable, foldable touch screens for mobile phones; a revolution in how drugs are administered; protective coating for everything from food packaging to wind turbines, faster computer chips and broadband; batteries of infinitely higher capacity than today’s – these are just a few of graphene’s possibilities.

3. Xi Jingping and Mao Zedong - China's new leader Xi Jingping is consolidating his grip on power. The WSJ reckons he is adopting many of the same tones and tools of Maoism, including a puritan-like drive for 'purification'. He's not keen on democratic reforms and takes a particularly nationalist view of the world. We shouldn't be surprised to see foreign companies targeted by Chinese regulators and media then...

It isn't just Mr. Xi's rhetoric that has taken on a Maoist tinge in recent months. He has borrowed from Mao's tactical playbook, launching a "rectification" campaign to purify the Communist Party, while tightening limits on discussion of ideas such as democracy, rule of law and enforcement of the constitution.

Mr. Xi's apparent lurch to the left comes as Chinese authorities prepare for the coming trial of Bo Xilai, the former party rising star who led a Maoist revival movement until his dramatic downfall last year.

Mr. Xi's attitude toward political reform is a critical issue in China today because the country may be entering a prolonged period of slower economic growth and mounting public discontent over environmental problems, patchy public services and widespread corruption.

The new Chinese leadership has sent clear signals that it plans to unveil a package of economic reforms this year to stimulate domestic consumption as an alternative growth engine to the investment and exports that have powered the economy for the past 30 years.

On the political front, however, Mr. Xi has shown no sign of considering even limited liberalization, party insiders say. "Xi is really starting to show his true colors," said one childhood friend who recalls Mr. Xi spending hours reading books on Marxist and Maoist theory as a teenager. "I think this is just the beginning."

4. 20% time is dead - This is a bit off the beaten track, but I still find it interesting. Quartz reports on how Google's '20% time', where engineers are given 'free' time to experiment, seems to have been abandoned as Google strives to keep its stock market shareholders happy.

It does make you wonder if publicly listed shareholder capitalism can really be as innovative as family or privately owned companies. The lust for short term capital gains and cash dividends or share buybacks (often funded through investment droughts and debt) seems to mitigate against long-term 'out-of-the-box' risk taking and invention.

Here’s how Google has effectively shut down 20% time without actually ending the program, says our source: First, as has been reported previously, Google began to require that engineers get approval from management to take 20% time in order to work on independent projects, a marked departure from the company’s previous policy of making 20% time a right of all Googlers.

Recently, however, Google’s upper management has clamped down even further, by strongly discouraging managers from approving any 20% projects at all. Managers are judged on the productivity of their teams—Google has a highly developed internal analytics team that constantly measures all employees’ productivity—and the level of productivity that teams are expected to deliver assumes that employees are working on their primary responsibilities 100% of the time.

5. How the wealthy keep themselves on top - Here's Tim Harford at FT.com with a provocative piece on inequality and wealth.

Between 1993 and 2011, in the US, average incomes grew a modest 13.1 per cent in total. But the average income of the poorest 99 per cent – that is everyone up to families making about $370,000 a year – grew just 5.8 per cent. That gap is a measure of just how much the top 1 per cent are making. The stakes are high.

I set out two reasons why we might care about inequality: an unfair process or a harmful outcome. But what really should concern us is that the two reasons are not actually distinct after all. The harmful outcome and the unfair process feed each other. The more unequal a society becomes, the greater the incentive for the rich to pull up the ladder behind them.

At the very top of the scale, plutocrats can shape the conversation by buying up newspapers and television channels or funding political campaigns. The merely prosperous scramble desperately to get their children into the right neighbourhood, nursery, school, university and internship – we know how big the gap has grown between winners and also-rans.

The painful truth is that in the most unequal developed nations – the UK and the US – the intergenerational transmission of income is stronger. In more equal societies such as Denmark, the tendency of privilege to breed privilege is much lower.

This is what sticks in the throat about the rise in inequality: the knowledge that the more unequal our societies become, the more we all become prisoners of that inequality. The well-off feel that they must strain to prevent their children from slipping down the income ladder. The poor see the best schools, colleges, even art clubs and ballet classes, disappearing behind a wall of fees or unaffordable housing.

The idea of a free, market-based society is that everyone can reach his or her potential. Somewhere, we lost our way.

While countries like Spain and Ireland battle to reform the boom-era mortgage lending that has left millions of borrowers at risk of losing their homes, corners of the continent better known for their sturdy finances seem to be still lending as if the financial crisis never happened.

In the AAA-rated Netherlands, home to one of the earliest and biggest bailouts of the crisis - ABN Amro's 2008 rescue ultimately cost 30 billion euros - first-time buyers can still borrow up to 105 percent of the value of their new home and can get up to five and a half times their gross salary.

A deflating housing bubble means the Dutch government is now cutting back on some of the riskier mortgage products so the maximum amount lent will fall by 2018, but still only to 100 percent. And in AAA-rated Sweden, a mortgage will outlast the youngest buyer, and their grandchildren.

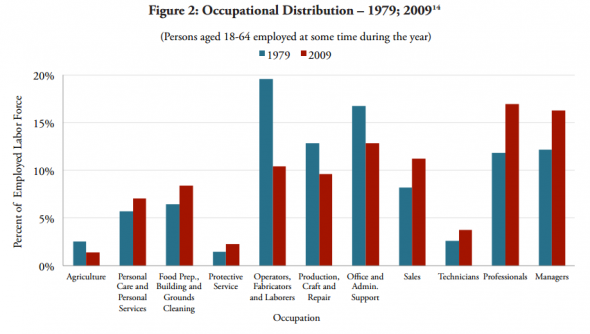

7. A hollowing out of the US middle class - Here's more via FTAlphaville on this trend, which is partly explained by the increasing use of robots and computers to replace highly paid middle class jobs, while much of the jobs growth that is happening is happening in minimum wage services sector jobs such as fast food and aged care.

8. Further to that - This book called Dancing With Robots looks useful.

In Dancing with Robots, Frank Levy and Richard Murnane make a compelling case that the hollowing out of middle class jobs in America has as much to do with the technology revolution and computerization of tasks as with global pressures like China. In so doing, they predict what the future of work will be in America and what it will take for the middle class to succeed. The collapse of the once substantial middle class job picture has begun a robust debate among those who argue that it has its roots in policy versus those who argue that it has its roots in structural changes in the economy. Levy and Murnane delve deeply into structural economic changes brought about by technology.

These two pioneers in the field (Murnane at Harvard’s Graduate School of Education and Levy at MIT) argue that “the human labor market will center on three kinds of work: solving unstructured problems, working with new information, and carrying out non-routine manual tasks.” The bulk of the rest of the work will be done by computers with some work reserved for low wage workers abroad. They argue that the future success of the middle class rests on the nation’s ability “to sharply increase the fraction of American children with the foundational skills needed to develop job-relevant knowledge and to learn efficiently over a lifetime.”

One couple believe they bought their house - at number 44 on an Auckland street - for a bargain price in a rising market. Alice and Adam Gordon bought the four-bedroom weatherboard house in Morningside for $790,000 - $40,000 above its valuation, set in July 2011.

Massey University marketing professor Henry Chung, who was born in Taiwan and whose ancestors are Chinese, said he would buy a home with a number four on the letterbox only "if I absolutely had to". Eight and six were lucky numbers.

"Four is death, and this is double death. If they changed it from 44 to 88, that would be big sales. Four definitely is a taboo.

"In quite a lot of elevators, and quite a lot of buildings in China, they don't have a fourth floor. They jump from three to five. With some very elegant, expensive apartments, rich people will particularly ask, 'Please do not have a number four, because we want a long life'."

10. Totally John Oliver signing off from his summer stint standing in for Jon Stewart.

36 Comments

#1 docuemented elsewhere.

"2.6 per cent between June 2008 and September 2012, compared with 2.35 per cent overall."

Either way its not a mega "oh my god we are going to die" inflation issue....worst case 2.6%...0.25% difference....

regards

track cost of living increases for "sub- national" groups such as Maori, Pacific people, beneficiaries and superannuitants

It would be interesting to track the Asians as well. Wonder if they are more similar to the white middle-income NZers or Maori/Pacific people.

Re #2 Bernard I like your optimism. There was a documentary on tv last night about a guyswho invented a battery sized power source that could power a whole city, but he had some enemies and Tom cruise and Cameron Diaz had to save him.

It's a competitive field by the looks of things.

Vanderlei

I like your scepticism ;)

cheers

Bernard

No 5 - I don't think it is fruitful to measure the gap.

People who structure themselves differently have a level of control over their assets that lower income earners do not have. The inequality arises from lower income earners failing to structure themselves and their personal lives appropriately. Why can't journalists get this!

For the same reason the people that don't structure themselves properly don't.

Scarfie - when people can whinge that things are unfair and then do nothing to help themselves and make their problems other people's problems (hence the existence of the large bureaucray and public service) then are they just being plain lazy?

I think you can do better than that NAE. Take the time to understand people, some simply don't operate the way you or I do. You must know of people like that in your own circles, some may seem frivilous but that isn't necessarily bad, just different. There are the caregiver types that would give any material wealth away if that had it. Start of with ESFJ and delve deeper into Myers Briggs and other work in that area.

It is the same differences that mean some journalists will simply not get it. Anyone with the Sensing function is at a distinct disadvantage in that aspect. You will find the best investigative journalists are likely INTJ personalities, Ian Wishart being one that is obvious.

Scarfie - laziness has 3 simple elements...physical, emotional and mental. People choose to put up the road blocks and stay in their comfort zones.

The great thing about life and people behaving differently is it can provide a road map to what you want and how your want life to be. You can choose to model yourself on success or failure. The middle men or more correctly people (those in Political or bureacratic positions) create their lives on the bit in between. Hence the redistribution and the structures. The structures are the little bit that the Politicians and bureaucrats leave to protect the wealth they obtain on the way.

When I read a story from a mainstream NZ journalist on the those caught up in the slavery of our tax system and the cost to those people then I know that NZ will have possibly turned a corner. Journalists do a lot of coverage on Politicians and the bureaucracy but they rarely discuss the issues that matter the most. WHY? maybe because bad news sell and they are simply looking after their market of bad news.

Failure is a fantastic teacher of lessons if we let it be and have the right attitude. If you want to learn to ride a horse you have to expect to fall off a few times on the way. Too many people simply wont get back on the horse and go for the ride. Nanny State encouraged people not to get back up on the horse as they want people staying down.

You only have to read the comments on this site and see how many people pretend to be interested in the welfare of others and yet what they keep endorsing/proposing keeps people in poverty. Anyone who uses the word equality as a means of redistribution of other people's wealth has no concept of what equality really is. Hitler was a bully who stole from people too.

"Failure is a fantastic teacher of lessons" yet we see the failure of say Hayek's school of econmics, yet its tried again and again.

No, re-distribution is a means to improve equality, getting things backwards is it seems a common austrian/libertarian trait.

Hitler was terrible extremism as was Mao and Stalin. Trying to use these examples as justifications why some socialism in a society is bad is a sick joke. ie what you are implying is any shade of grey is really black and only lilly white is accdeptable and "true". Such of course defines you in turn as an extremist...ie you wish to force ppl not to combine for their own good. The term I keep coming back to is "there is no humanity in fundimentalism".

regards

There is never a show without Punch........

Well Steven we have been re-distributing for many many years and more and more people are reliant upon it aren't they? More people are leaving the middleclass and joining the lower income arena. You wouldn't want to let people do things for themselves now would you. Socialists tend to like the sound of their own voice.

You need to learn to read things in context and understand positives and negatives. Success can be negative and positive so can failure. A definition of madness is doing the same thing over and over again expecting a different result.

We do not have SOME Socialism in society we are inundated with it. There is not one area of life or business that is not severely affected/restricted. The more users the bigger the system required.

So if you want your Socialist Society that is fine......please let me know you address so I can send you an account for all the Socialist compiance costs I incur.

I agree with the "When I read" comment. So perhaps you could add in moral and ethical laziness to the list? What I am talking about is those that are not equipped for the cognisance of these issues, whereas I think you step toward those that are cognisant but chose to wilfully overlook or ignore for whatever reason. Perhaps fear is a reason for such behaviour but is that an excuse? Whatever the reason it would be easy to judge them as deplorable.

Btw I don't know about riding a horse, but I have honed to are of falling off to a high standard.

Depends on what platform you place morals and ethics Scarfie. They can be mental and/or emotional by nature. Would they cause harm and to whom?

People use morals as a tool to manipulate others this is a form of bullying.

People could use morals for good such as a platform like the Universal Declaration of Human Rights. Those without morals would disregard such a document.

Ethics are also known as moral philosophy. They define the rules of conduct.

Poor balance in the saddle......well well......hope you have learnt to land on your feet or roll when you fall. If you keep falling off get back on and do it differently. Leg and hand position important - you'll work it out if you keep trying.

#1 Market ticker had a good piece about how increasing money supply affects the purchasing power of money...

http://market-ticker.org/akcs-www?post=220451

The CPI does not measure this... at all.

We have been brainwashed into thinking inflation = CPI..... and that if Money supply is increasing at 15%.... but the CPI is only 2%.... then everything is dandy....and we can just ignore the money supply.

If Money supply is growing at 7% /yr and wages grow at 2%/yr .... once the power of exponents kick in after a number of yrs, then the difference in those growth rates start showing up as real standard of living and cost of living issues.

No, CPI/inflation is an indicator of the health of the econonmy across all sectors. Cherry picking data to suit your mind set means you are missing part of the picture. PS houses are an investment, also they are not consumed as such, hence should not be in a basket of goods, the CPI.

As an example, Ive seen comments that Auckland grew at 16%, (thats not good), but the rest of the country grew at only 4%. 4% is hardly a big issue after 5 years of not much if any...

So OK raise the OCR to say 7%, hammer buyers and take say 10% off, make Auckland only 6%, trouble is house prices would then be declining 6% everywhere else....and ppl with a 95% LVR would be underwater in 1 to 2 years....banks would then be looking at insolvency...technically they'd have no assets, so bankrupt. That would do our economy a lot of good....really it would.

I agree on paper wealth delusions...some ppl I guess are in this camp...Im certianly not...I have no delusion in a down turn that the un-earned paper money "value" of my house simply by holding the asset will disappear....

regards

Bernard you might weave this into one of your upcoming sprays

Two opposing treasurers face off in a Q&A prelude to the upcoming AU election

Tweets

A baby boomer work-for-the-pension scheme (clever idea) is a policy in search of a party when the kiddies realise what their taxation destiny will be - and there is indeed a disconnect between having a “budget crisis” and simultaneously splurging on a Rolls-Royce maternity leave scheme that only the Greens support see:- Sydney Morning Herald

Again philosophical problems with the equality article.

There is an expanded idea of what equality means (unfair process and harmful outcome) but then it drops straight to the inference that material economics is the only means for success (between winners and also-rans).

History seems to show that free markets provide the best chance for more people to achieve their potential in more circumstances. It never promised to, never can and never will guarantee an economic outcome for all.

If equality of economic *outcome* were the sole goal of equality then we should hold up North Korea as a shining example of what to strive for. Almost everyone has an identical economic outcome across the the entirety of society in that they are almost all equally destitute except for a very tiny group.

Well said Ralph.

The redistribution system that is used to take from the haves and give to the have nots creates inequality in what one is allowed to keep from their own efforts and this inequaity is not recognised nor debated.

I suspect the very idea anyone can guarantee the *outcome* is little more than hubris.

When you say 'history" Ralph, do you mean all of history or just the post industrial revolution history?

I meant all of history.

@notaneconomist

It is less a case of taking from one group and handing to another and more of earnings being a bit more even, maybe even those doing essential but at the moment extremely poorly paid jobs, actually being paid enough to live on and those being paid hideous amounts of money that no one individual should ever need, being paid less, THAT is equality, ceasing to drive down wages is equality, because that is what has been going on and quite openly sometimes (Bill English!)

It is about being able to live on what you earn without relying on the state to top you up. It is made round to go round as the old saying goes, and those who hoard it, affect an economy adversely.

The most stable and happy societies in the world are the ones where there is, more or less, equality

Raegun - it is about choice. It is about doing your own homework.

Poor choices will have poor outcomes. Not doing your own due diligence in your own life is irresponsible.

If people want a good income then they have to do their research. They have to ensure they fill their own skill gaps etc. People also have to have desire to succeed by themselves and not be so scared about going out of their comfort zones. There is a saying that you either make excuses or make money but you can't do both at the same time.

If people are in a low paid job - they have to look at what they have to do to get out of that situation for themselves. If they expect someone else to do it for them they are short changing themselves and others and the problem magnifies.

If people choose to have a low paid job then why should I or anyone else intervene in that choice? If they want to change from a low paid job and get ahead I am more than willing to help them if they show me they are ready and willing to put in effort.

Too which countries are you referring too in your last sentence?

Hollowing out in a nutshell:

To create a middle class follow Henry Ford (circa 1914) as follows:

"There is one rule for the industrialist and that is: Make the best quality of goods possible at the lowest cost possible, paying the highest wages possible."

To destroy a middle class follow as follows:

There is one rule for the industrialist and that is: Make the best quality of goods possible at the lowest cost possible, paying the lowest wages possible.

My -my , anyone seen this story ? Watch out Foodstuffs and Progressive .... this is a common marketing ploy in NZ and widely used by the likes of Bricoes.

I wonder if Auckland City Council would go this far to protect consumers?

London - Tesco has been fined £300 000 ($468 400) by a British court for misleading consumers over the pricing of strawberries.

The case, brought by Birmingham City Council against Britain's biggest retailer, relates to the misleading price of a 400g punnet of strawberries at stores in 2011.

The strawberries were marked at half price when a higher previous price had only been charged for a short period.

Tesco apologised for the error.

"We sell over 40 000 products in our stores, with thousands on promotion at any one time, but even one mistake is one too many," said a spokeswoman for the firm.

She said that since 2011 staff had been given additional training and reminded of their responsibilities to ensure Tesco always adheres to pricing guidelines.

Bernard, i just heard that in Britain they have this thing (can't remember what its called) where if you owe more than 25,000 pound on a credit card the bank can sell your house.

The government have just reduced this to 1,000 pound so poor people stand to now loose their homes.

As they say, you take out an unsecured loan (credit card) and pay high interest rates because it is unsecured only to find out it is secured by your house.

One guy in England is having his house sold in a few weeks because he owes 6,000 pound on his credit card.

Great to be a bank

Just because it's unsecured Mike, the bank, or the plumber or the electricity company, can pursue you for the money in the best way it can. Including selling your house.

Unsecured still means you owe them money.

25,000 pound - yes they would be motivated to extract the money from you.

That fella needs to get in touch with Freemen on the Land.

"I haven't given up yet on the potential for new technology such as graphene, solar power and rechargeable batteries to help give global economic growth a new kick higher, despite the massive challenges of peak oil, climate change, ageing populations and falling wages shares globally".

You don't really get exponential growth, do you Bernard? A 'kick'? How big, in comparison to which doubling, pray tell? A 'kick' can't help 'growth' now - the next target (as always) is a doubling of the previous, at whatever % rate you think desirable. There is no way the planet doubles what it is doing now. No way. So pick your % rate, and I'll tell you just how much time you buy.

sod-all. Hubbert was 'out' by a ration of 3.4 to 3, substantial diffo. Made 3 months diffo in a 14-year prediction.

And the obvious question is : What then?

Your comment - with respect - is just silly.

PDK,

I believe you have persuaded most of us, including Bernard, by his comment, of the main theme of peak oil. We may not have quite bought in to alarmist talk of the world population not being able to be more than 2 billion within 20 years, or of the urgent need to learn how to hunt rabbits for dinner.

Apart from this timing or scale issue, a key area where it seems to me you may be blind to a message, is in the economic measurement of things. The measurements may be flawed, I accept, but my understanding is that in economic measurement terms a $100 barrel of oil is worth 5 times a $20 barrel of oil of 20 years ago (discounting any inflation effects for now). So we can be producing less in practice, but more in economic terms at the same time.

Is a $4 flat white really worth say 8 times a 50cent cup of nescafe instant? Probably not in reality, but the market says it is, so it is. Different things will have different economic values over time.

We may well have to do with less energy; although when push comes to shove pricing signals will likely cause unimaginably huge solar power fields and or other innovations.

And in economic terms the measurement can still show growth. No-one by the by, is arguing for exponential growth. And once populations stabilise or actually decline, far better measures will be on a per capita basis, where the total in either real or economic terms can decline. For now I share Bernard's view that we can aspire to grow, in economic terms at least.

And I've just ordered my rooftop solar.

Economic terms only show price not growth. Growth has to be supported by energy and can be determined by looking at other factors or outcomes related to that energy. One of those is human population growth, which has been in a steady decline for 50 years.

If pricing signals cause extra captial and energy expenditure on alternative sources then that increases the acute shortage that the price is signalling. That means more people have to go hungry while you try and fix the problem that is hungry people.

If pricing signals cause extra captial and energy expenditure on alternative sources then that increases the acute shortage that the price is signalling. That means more people have to go hungry while you try and fix the problem that is hungry people.

Scarfie, That is correct if we wait until we have an acute shortage of food, but I don't believe the developed/western world will do that, while a food crisis does not seem remotely imminent among wealthier nations. Particular countries may well have very serious stresses, if they cannot produce enough food for their own populations, and they do not produce much that other nations consider of value economically. Countries like Egypt, Pakistan, several countries in Africa and probably even India look dangerously close to that state now, I accept, and the largesse of the world may not bridge any gaps, given their now massive populations.

For the more developed world it is not obvious that time is so close; while alternative energy and energy saving investments are ramping up aggressively, it seems to me.

Stephen L - an excellent balanced view

"the economic measurement of things"

Indeed the thing is to think in terms of EROEI. Energy return from energy invested and not in $s directly though its useful..

So that $20 barrel of oil gives you say 5kwh, when its $100 a barrel you still get 5kwh. Sure it costs more but the energy output per barrel has not changed.

The problem is when we had oil at $20 one barrel of oil got 30 or more barrels out so a net of 29, today that $100 barrel of oil gets 15 barrels. So to get that 30 barrels now costs us 2 barrels, or $200....10 years ago it was $20 net is 28. Within a few years that EROEI will be 10 to 1, then the cost will be $300 for 30 with a net of 27. At this point 10 extra kwatts of energy are no longer available to the economy.

Ive said its still $100 here in the last line because we cant afford to pay much more and that is going to be the crunch, if we cant pay more the companies wont explore for it, drill it and refine it. Hubbert's peak will be assymetrical on the downside.

Good on you on the PV...

regards

So should have Bernard said this?

"I haven't given up yet on the potential for new technology such as graphene, solar power and rechargeable batteries to help the global economy by improving energy return from energy invested from renewable sources, by offsetting in part or in full, the massive challenges of peak oil, climate change, ageing populations and falling wages shares globally".

Should Bernard stop the economic speak? It doesn't seem to help him say what he wants to say.

Good discussion -

StephenL makes a good case - and I don't disagree in the main. Perhaps he's a bit optimistic re the 'more developed world' - which I see as increasingly unemployed, increasingly lesser-paid, increasingly more charged, and which is increasingly discounting the future (infrastructure decay, pollution).

Brendon - one of the problems may well be the 'speak' thing - economists and physics folk 'talking past' each other. But there's more to it than that - one of the top dogs in the Otago Uni is a physics man, yet he blandly advocated 'economic growth' at a recent book-launch. (I'd have called him - "bollocks" was what came to mind - but for the fact that the hosts were friends of mine). Comes bact to the Tertiary failure to have a combined/meshing/comparative appraisal structure.

Offsetting in "part or full" still relates to a set of finite parameters - so it still won't give you exponential physical growth. The question that remains, is 'regardless of the numerical inflation of tracked 'capital' (savings, investments, the portion of 'asset' that is inflated) what is the realtivity of the $ to the physical underwrite.

Where folk like Hughey fail, is in assuming that the mole on their left cheek (there every day since they earned their first dollar) was the reason they did the earning every subsequent day. Sure, the mole was there every earning day, and believing it was causal didn't alter things - until the earning stopped. Then the mole-believers have a problem. It would seem that most of them just want to believe that you need a bigger mole, rather than face the fact that their belief was misplaced from the get-go.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.