We are starting to see some rises in term deposit rates. The latest is by BNZ which raised six month and one year offers, but cut longer term offers.

They aren't the first to do that in this current cycle. On Thursday Westpac did the same - but ANZ didn't.

So it's worth reviewing where that leaves the relative positioning of these term deposit offers between banks - and some key non-banks.

This week's rises have been relatively modest, certainly compared to the latest Official Cash Rate (OCR) rise of 50 basis points. True, some bonus saver accounts have risen by 50 bps, but for term deposits the rises are 25 bps at most and most are less than that.

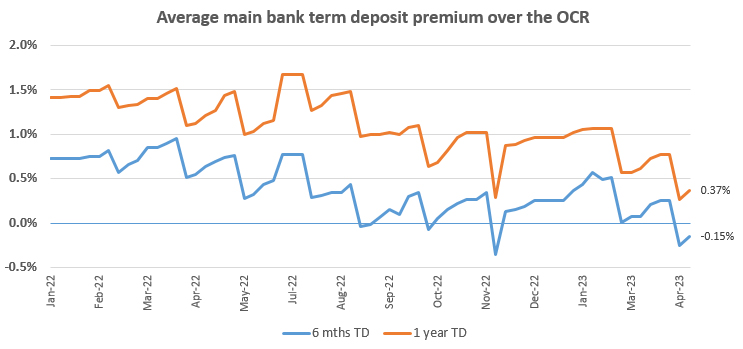

And here is an update of our March review of where the key rates from the main banks sit relative to the OCR after the April 5, OCR rate rise.

Basically the recent few increases have not been enough to even arrest the slide, let alone improve the position of savers compared to the OCR benchmark.

So savers may be better off looking at challenger banks for enhanced returns at a time of high inflation and the rising OCR.

Apart from the 6% offers from Heartland Bank and Rabobank, Liberty Financial, which has an investment-grade credit rating, offers 7% for a one year term. (Xceda's 6.50% for six months is notable too, but they do not have an investment-grade credit rating).

Since we reviewed term deposit rate levels in February, there has been relatively little movement in these rates following both the February 50 bps and April 50 bps OCR increases, and the Reserve Bank Governor's pointed remarks that banks should be passing on these rises to savers.

They are still dragging the chain.

The above chart is after this latest round of term deposit rate rises. They haven't reversed the downward trend Governor Adrian Orr was calling out. Since the low point in August, the main banks haven't improved their offers any more than the minimum OCR rate change, locking in the long gradual decline that started way back in 2015.

If the premium to the OCR was now the same as it was just at the start of 2022, then today's six month main bank offer should be more than 100 bps higher (that is 6.00% or so) and the one year term deposit offer 120 bps higher, so about 6.70%.

Some challenger banks are offering broadly fairer rates with Heartland and Rabobank both with 6% one year TD rates in the market, SBS Bank has long ended theirs, although you might argue that even these could be at the 7% level if main banks were offering a more 'normal' 6.5%.

We should also note that the Treasury hasn't yet increased its Kiwi Bond rates, which currently sit at 3.75% for six months and 4.25% for one year.

The banks will say that the lending situation does not justify higher rates. The loan demand is not there. No doubt they will be right when they look at the very large home loan market. But business demand is strong and rising according to Reserve Bank data.

Low bank term deposit offers do encourage savers to shift funds to the corporate bond market where yields on offer are well over 6% for investment grade bonds. Still this is a place most savers don't want to go. They like the short stuff. Perhaps until savers learn how to access the bond market, bank low-balling will stay.

An easy way to work out how much extra you can earn is to use our full function deposit calculator. We have included it at the foot of this article. That will not only give you an after-tax result, you can tweak it for the added benefits of Term PIEs as well. It is better you have that extra interest than the bank, especially if you are in the 39% tax bracket - PIEs are taxed at 28% flat.

The latest headline rate offers are in this table after the recent increases.

| for a $25,000 deposit April 14, 2023 |

Rating | 3/4 mths |

5 / 6 / 7 mths |

8 - 11 mths |

1 yr | 18mth | 2 yrs | 3 yrs |

| Main banks | ||||||||

| ANZ | AA- | 4.05 | 5.20 | 5.35 | 5.70 | 5.35 | 5.20 | 5.10 |

|

AA- | 3.80 | 5.00 | 5.25 | 5.50 | 5.30 | 5.30 | 5.30 |

|

AA- | 3.80 | 5.10 | 5.25 | 5.60 | 5.30 | 5.30 | 5.20 |

|

A | 3.80 | 5.00 | 5.25 | 5.40 | 5.25 | 5.25 | |

|

AA- | 4.10 | 5.20 | 5.40 | 5.70 | 5.40 | 5.30 | 5.20 |

| Other banks | ||||||||

| Bank of China | A | 4.30 | 5.40 | 5.75 | 5.85 | 5.45 | 5.40 | 5.40 |

| China Constr. Bank | A | 4.40 | 5.50 | 5.75 | 5.85 | 5.55 | 5.45 | 5.45 |

| Co-operative Bank | BBB | 3.80 | 5.10 | 5.20 | 5.55 | 5.35 | 5.30 | 5.30 |

| Heartland Bank | BBB | 4.00 | 5.50 | 5.80 | 6.00 | 5.35 | 5.30 | 5.30 |

| HSBC | AA- | 4.30 | 5.40 | 5.65 | 5.30 | 5.15 | 5.10 | 5.00 |

| ICBC | A | 4.40 | 5.50 | 5.75 | 5.85 | 5.55 | 5.45 | 5.45 |

|

A | 4.40 | 5.60 | 5.90 | 6.00 | 5.85 | 5.40 | 5.40 |

|

BBB | 3.70 | 4.80 | 5.20 | 5.35 | 5.25 | 5.25 | 5.25 |

|

A- | 4.10 | 5.20 | 5.40 | 5.50 | 5.30 | 5.30 | 5.30 |

Term deposit rates

Select chart tabs

Term deposit calculator

40 Comments

Challenger banks need to offer Term PIEs as well, else they are effectively well behind.

How much extra risk is involved with those lower credit ratings?

Quite a bit I should imagine. Other than reverse mortgages I think Heartland is predominantly in consumer finance.

What's missing in the interest info is when that credit rating was last assessed. In the case of Heartland when I last looked in the about three months it was in early 2022.

Even RBNZ website doesn't have the assessment date. A lot can happen in a year.

But the Heartland CEO was just featured in the top 10 highest paid in NZ. Surely that means it's a safe bet!? Lol

Direct call 4.6%

There is additional credit risk associated with some of the challenger banks and this requires a non-trivial additional return to compensate you for lending your money to them.

Until we have a deposit guarantee, no-one is going to be putting their money into second tier banks. The big banks know this, and therefore have no incentive to offer higher deposit rates. And even then, the proposed deposit guarantee is so low, that not much money will find its way into second tier banks, so the vast bulk of savings will remain with the big banks.

Is this not already in place? https://www.beehive.govt.nz/release/depositor-compensation-scheme-prote…

"The Deposit Takers Bill was introduced to Parliament on 22 September 2022. It is expected to come into force as law after receiving Royal Assent in mid-to-late 2023."

Don't think so

Yes, just found that on the RBNZ website. I guess I am a real maverick having a substantial amount of my savings in second tier banks then?

Would anyone suggest some are riskier/more exposed in the current climate than others? I know Rabo are a subsidiary of Deutche Bank. Maybe that's risky? What about Heartland, where do they secure their deposits?

It doesn't matter which bank you put your money with right now, first tier or second tier, you're not being sufficiently compensated for the risk. In times like these it's more important to consider return of capital than return on it. Think of deposits as part of your portfolio, and diversify accordingly.

As this legislation is coming in very shortly, is any government actually going to let NZers lose their savings (up to the 100k per bank) if a bank fails? During the GFC, the government rushed in a guarantee overnight when there were signs that there could be a run on banks. NZers lost billions of dollars of savings in finance companies only 15 years ago..

I'm honestly skeptical about deposit insurance schemes in general. Depositors in Iceland and Cyprus during the GFC learned the hard way that deposit insurance may not be worth the paper it's written on. The legislation served it's purpose, however, in convincing people to leave their money in the failing banks. Same may be true here.

"Rabo are a subsidiary of Deutche Bank" ?

You don't mean they are a Dutch bank by any chance do you?. As far as I am aware they have nothing to do with the German bank, Deutsche Bank (Which, by the way, is at death's door. Credit Suisse might have set a precedent for Deutsche to follow)

The Dutch parent no longer guarantees deposits in NZ

If Rabobank, Utrecht - which is larger than any of the Aussie banks - don't stand by their relatively small subsidiary in New Zealand, then the rest of their group will be worthless. In which case we have far more to worry about than the solvency of our registered banks.

The same applies to our other offshore owned banks. Can you imagine what, say, ANZ's reputation would be worth in the credit markets if it allowed its NZ subsidiary to sink?

Rabobank has absolutely nothing to do with Deutche Bank. It's a Dutch banking cooperative.

Until we have a deposit guarantee, no-one is going to be putting their money into second tier banks.

Well said. What is happening in the U.S. banking crisis is very relevant to this.

The issues with the second tier banks in the US has only just began - they hold the majority of commercial lending, which is what is predicted to cause more bank failures. In NZ the second tier lenders have exposure to lower quality residential, development, and commercial lending, so no matter where you look they are going to be taking some losses once this recession starts rolling.

yes you can start to see a lot more effort from the 2nd tiers looking for money now. Rabo probably the safest of them, but who knows. Many will shift to AA ratings for now.

Accessing the investment grade bond market.

Give a DIY article please interest.co!

Absolutly! Please help us jump the hurdles of the system to access better investment opportunities.

Or anything around using trusts or PIEs etc for better tax benefits.

Squirrel offering 5% with their On Call Account = very very good.

Squirrel offering 5% with their On Call Account = very very good

Return of Investment trumps Return of Investment when it comes to players like Squirrel

From their website:

"Any money that you put into your Squirrel On-Call account is held in trust for you at one of the main banks. To be 100% clear, the money isn't invested anywhere other than at a bank."

"The money is held on trust with a major New Zealand bank, which Squirrel earns interest on. We pass interest earned to savers with money in their On-Call account because we can, and more importantly, we want to."

"To be 100% clear, the money isn't invested anywhere other than at a bank."

OK. What's the point of parking money with a bank through Squirrel Bolton?

Simple. Higher return. Squirrel Online Call (no costs, no hooks, with same day access) 5.00%

Investing directly in S&P AA- Bank via P2P trustee

Equivalent products:

ANZ 2.25%

ASB 2.25%

BNZ 3.95%

Kiwi 3.85%

Westpac 2.10%

JC, exactly, be careful of the ones that pick up the customers the big banks wont lend to. The high interest rates could sink some of these clients.

Don't go for a term deposit, buy property before the end of 2023, prices rising by then...

Yeah, there is just two months to go before this forecast of yours bears truth too - yawn.

by Harvey W | 25th Jun 22, 5:13pm

Hey Fitzgerald, don't wait for 50% discount, just make sure you buy within the next 12 months- remember finally this entrenched inflation will eventually lift property values along with everything else.

This comment got me to thinking, what predictions have I made that may be wrong....

by Juzz | 17th Aug 22, 3:45pm

I'm pricing in at least 5% OCR, RBNZ will slowly warm the masses up to the idea of it over the next few months.

The thing about specific predictions is that you might be proved wrong, so that one looks a little premature, time will tell by how much🙂

I think we're already at 5.25%...

Rabo bank our Agricultural sector bank is stand alone, not part of Dutch subsidiary well credit rated. Good safe bet!

Will be safe when gov guarantee starts, until then nothing is 100% safe.

Incorrect it is a branch of Rabobank Netherlands i.e. similar status to Westpac. Essentially it is a foreign branch of the main bank so even more tied to the parent than a stand alone subsidiary of the ultimate parent. However, it is still subject to NZ banking regulations (not really that powerful) but if the parent fails the branch has no special rights regarding paying out depositors. Until the banking deposit guarantee is activated this will remain as above.

The govt's kiwibonds (4.25%) haven't gone up for a while either. So the govt can't be too hard on the banks if it hasn't moved in ages either!

By the way, the Kiwibank figure is wrong...

"If you invest your tuppence

Wisely in the bank

Safe and sound

Soon that tuppence,

Safely invested in the bank,

Will compound". ("Fidelity Fiduciary Bank", Dave Tomlinson/Dick Van Dyke)

Would you need a deposit guarantee if that bank was owned by the government....? Would the taxpayers that have funds elsewhere complain if that government bailed out its own bank and threw the other banks to the wolves....lol

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.