Here are my Top 10 links from around the Internet at 10am. I welcome your additions and comments below or please email your suggestions for Monday's Top 10 at 10 We embrace those who are different.

1. Elephant in the waiting room - I'm late in picking up on this, but it's well worth a link. Brian Fallow wrote an excellent column in yesterday's NZHerald looking at the amazing growth of health spending and what might happen in the future. It's not pretty. Treasury has pointed out some things can be done to improve productivity and cut costs, such as a Pharmac-type buying organisation for medical technology and innovations such as key-hole surgery. But Fallow points out the inevitable issue of rationing and user-pays lurks over the horizon, even with the suggested improvements.

1. Elephant in the waiting room - I'm late in picking up on this, but it's well worth a link. Brian Fallow wrote an excellent column in yesterday's NZHerald looking at the amazing growth of health spending and what might happen in the future. It's not pretty. Treasury has pointed out some things can be done to improve productivity and cut costs, such as a Pharmac-type buying organisation for medical technology and innovations such as key-hole surgery. But Fallow points out the inevitable issue of rationing and user-pays lurks over the horizon, even with the suggested improvements.

Intuitively they (the improvements) seem likely to provide only a limited or one-off offset to the big, intractable drivers of health costs: demographics, innovation, the dynamics of the labour market and the link between rising incomes and rising demand. But the Treasury contends that between 2002 and 2008 at least half of the increase in health spending arose from discretionary policy initiatives by the Government. They may have in mind things like moves to subsidise doctors' visits and raising the income- and asset-testing thresholds for long-term care. "Dealing with future demand pressures will ... require the Government to manage public expectations as to what the publicly funded health system can do for people." The clear implication is an expectation that people will have to fund more of their own health care. Doesn't that mean rationing access to health care by income? "Well," says de Raad, "at the moment we ration by waiting lists."2. Squid food - The mysteriously prolific Tyler Durden (s) at ZeroHedge has a detailed analysis of how Goldman (Vampire Squid) Sachs is now making squillions of dollars trading Credit Default Swaps in the absence of competitors Bear Stearns and Lehman Bros. Now we understand why Goldman lobbied so hard within government a year ago to let Bear and Lehman collapse.

One of the more useful information items in Goldman's periodic filings is granular disclosure on the firm's CDS holdings, and specifically segregated data by maturity bucket and by spread as pertains to "maximum payout and notional amount of written credit derivatives." In essence, due to the firm's monopoly in CDS inventory and, therefore, trading, this is the squid's beating heart: between buying and selling (hopefully offsetting positions) CDS in billions of dollars worth of notional daily, and being able to capitalize on wide spreads, courtesy of the extinction of such traditional competitors as Bear and Lehman, the firm will continue to make hundreds of millions in profits every day, month and quarter, due to its newly found monopolist exposure when it comes to trading CDS, both as principal and as agent.3. 'Nutrition and traffic subsidy' - Chinese farmers are so hard up they are selling their blood for US$25 a time to make money, ChinaDaily reports. HT Gertraud via email.

More than 6,000 poverty-stricken farmers in Central China's Hubei province are selling their blood on a routine basis to make extra money, with some saying it's the only way they can earn enough money to pay bills. Many have been selling their blood regularly for years to make ends meet. Presently, nearly 6,400 local farmers sell their blood - 600 cc at a time - every two weeks at the blood plasma collection station authorized by the local health bureau in Yunxian county. The farmers earn 168 yuan ($25) each time. Nearly 20,000 people have sold their blood at the station since it was established 11 years ago, China Youth Daily reported yesterday. The money earned is considered a "nutrition and traffic subsidy," according to officials.4. The deflation mystery - One of the curiosities of the last year has been the failure of massive money printing and bailouts to produce inflation. If anything, the global economy is mired in deflation. What gives? Keith Fitzgerald at Money Morning has four reasons why we have deflation rather than hyperinflation. HT Gertraud via email. They are:

- Banks are hoarding cash

- Consumers are still cutting back

- Businesses continue to cut back rather than hire new workers

- The US exports inflation to China

If China were to un-peg the yuan and let it rise by the 60% or more it's supposedly undervalued by, we'd see jump in prices here in everything from jeans to tennis shoes, toys, medical equipment, medicines, and anything else we import in bulk from China. Chances are, the shift would not be dollar-for-dollar or even dollar-for-yuan, but there's no doubt it would be significant. Many economists I've talked to privately think 25%-35% is probable. So the next time you hear a "Buy American" extremist, you might want to share this little inconvenient truth. The upshot? Any one of these factors could change at any time. And that means investors who are relying on the Fed's version that everything is okay and that the government is managing inflation may be in for a rude awakening. The only thing the Fed is doing is managing to manipulate is the data, and even then, not very well.5. Asian property bubble - Kevin Brown from the FT.com in Singapore points out the amazing price rises in Asia's apartment market at the moment. Is this helping to fuel New Zealand's property price rises as cheap US and Asian money (because of the currency pegs) floods around the world. Deja vu is so ugly...

Residential property prices are rising across much of Asia, prompting fears of a real estate bubble. Apartments are selling for staggering prices, and central banks and finance ministries have begun to rein in property-related stimulus measures. Luxury apartment prices in Hong Kong are now 30 per cent above their low point in the fourth quarter of 2008, with prices up 14 per cent just between the second and third quarter this year in favoured neighbourhoods. Similarly in Singapore, prices for private homes rose 15.8 per cent in the third quarter from the second, the first such rise in more than a year. In China, prices are up 37 per cent year-on-year. So is Asia in the grip of a bubble or just enjoying a healthy reaction to excessive gloom and doom of the end of last year? No one really knows, but some governments and central banks are taking limited pre-emptive action just in case. In Singapore, the government has shut down bank lending schemes that allowed buyers to defer mortgage payments on uncompleted developments, and hinted at land sales to increase supply.

6. Squid mine - Goldman Sach's cost of funding on its long term borrowings was 0.92% in the third quarter, the WSJ.com reported.

6. Squid mine - Goldman Sach's cost of funding on its long term borrowings was 0.92% in the third quarter, the WSJ.com reported.

All banks benefit from the Federal Reserve's zero-interest-rate policy, but Goldman Sachs Group appears to be benefiting more than most. Provided the Fed sticks to its word on keeping rates low, Goldman stands to juice its profits and bonuses for some time to come.7. Money, money money - It turns out Goldman Sachs lost money on just one day in the last quarter, FTAlphaville reported. Most days it made more than US$36 100 million a day. It's no wonder with implicit government backing and funding costs of 0.92%. And the wunderkind at Goldman believe they're worth the massive bonuses... 8. The game is rigged? - Yves Smith at Naked Capitalism has a nice take on this.

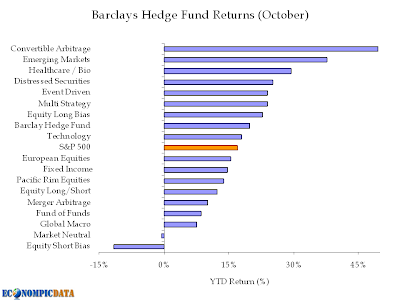

9. Have we learnt anything? - EconopicData has nice chart below on how almost all hedge funds are making money at the moment. Hmmm....could this be a bubble...OK, I have heard all the explanations, spreads are wider because there are fewer market makers, asset prices are rallying (market making firms are structurally long; it's difficult and costly to go net short on that big a balance sheet), Goldman is currently the trading kingpin.

But I still find these factoids remarkable: Goldman lost money trading only one day last quarter and only two days the prior quarter.

Now maybe I am just hopelessly out of touch, or perhaps more accurately, the Fed has created such a ridiculously favorable environment for banks and traders that if you are moderately competent, making money is like shooting fish in a barrel. But a winning streak this consistent looks like a rigged game. Is this just, ahem, "information advantages"? Greater ease in pushing markets around that have fewer players? Just a function of those monstrously wide bid-asked spreads?

My concern now is that it appears we haven't learned anything from the turmoil that happened all of 8-12 months ago. As NourielRoubini recently pointed out, the correlation of all risk assets has approached one as all assets have all moved in one direction... up. Why? One reason is the world's investors are turning to the US dollar for their carry trade currency of choice (if you haven't read it yet... READ IT). At a high level it goes like this... the dollar's decline is a one way bet. So why wouldn't a foreign investor:10. For absolutely no valid reason - Here is a video of an accordion player murdering music by Pink Floyd and Black Sabbath. HT John Burland...I thinkThe issue is that at some point the dollar will stabilize (or gain in value), increasing the "real" cost of borrowing the dollar. BUT... if the correlation of assets purchased is near one on the way up, it is sure as hell going to be that high or higher on the way down. And what happens to all these investors that are attempting to leave the same exit door at the same time? Massive re-purchasing of the dollar and massive selling of any risk asset... joy.

- Borrow the dollar at a 0% rate

- Plan to pay the dollar back at some point in the future when it is worth 10-20% less in their local currency

- Use that money to invest in ANY risk asset (as long as the asset doesn't lose more than the gain on the dollar short, the investor wins... so why not ratchet up the risk?)

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.