Economy

US employment shrinks unexpectedly; US retail sales dip; Canada PMI rises; Gulf oil supplies in crisis; metals rise; eyes on seabed mining; UST 10yr at 4.11%; gold rises while oil jumps again; NZ$1 = 59 USc; TWI-5 = 62.7

7th Mar 26, 8:37am

US employment shrinks unexpectedly; US retail sales dip; Canada PMI rises; Gulf oil supplies in crisis; metals rise; eyes on seabed mining; UST 10yr at 4.11%; gold rises while oil jumps again; NZ$1 = 59 USc; TWI-5 = 62.7

[updated]

A review of things you need to know before you sign off on Friday; retail sales improvement noticed, property rates jump, tracking impacts from Trump's war, Aussie TD's almost touch 5%, swaps up, oil up, NZD dips, & more

6th Mar 26, 3:59pm

35

A review of things you need to know before you sign off on Friday; retail sales improvement noticed, property rates jump, tracking impacts from Trump's war, Aussie TD's almost touch 5%, swaps up, oil up, NZD dips, & more

US data soft facing sharp energy cost rises; China lowers its growth target; Australia household spending growth slows; global freight rates rise; UST 10yr at 4.14%; gold eases while oil jumps; NZ$1 = 58.9 USc; TWI-5 = 62.6

6th Mar 26, 7:27am

47

US data soft facing sharp energy cost rises; China lowers its growth target; Australia household spending growth slows; global freight rates rise; UST 10yr at 4.14%; gold eases while oil jumps; NZ$1 = 58.9 USc; TWI-5 = 62.6

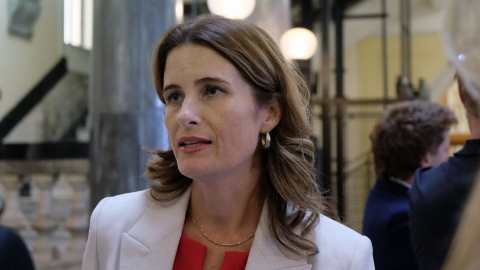

Duration and scale of Middle East conflict expected to be key factors in terms of impact on NZ economy, Finance Minister Nicola Willis says

5th Mar 26, 5:43pm

3

Duration and scale of Middle East conflict expected to be key factors in terms of impact on NZ economy, Finance Minister Nicola Willis says

A review of things you need to know before you sign off on Thursday; Kiwi Bond rates changed, ASB fined, farm profits high, retail spending firms, Crown accounts slip, Cotality can't see property gains, swaps up, NZD up, & more

5th Mar 26, 3:59pm

29

A review of things you need to know before you sign off on Thursday; Kiwi Bond rates changed, ASB fined, farm profits high, retail spending firms, Crown accounts slip, Cotality can't see property gains, swaps up, NZD up, & more

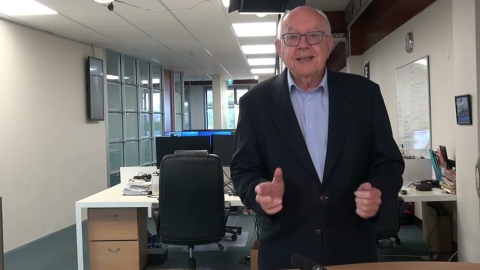

Ross Stitt sees a work revolution ahead in Australia from AI adoption that could create significant problems. Are businesses, unions, and politicians up to the task? Or will we have to look to AI agents for the solutions?

5th Mar 26, 11:26am

16

Ross Stitt sees a work revolution ahead in Australia from AI adoption that could create significant problems. Are businesses, unions, and politicians up to the task? Or will we have to look to AI agents for the solutions?

A record-high 70% of farmers responding to the twice-yearly Federated Farmers Confidence Survey say their farm is currently profitable

5th Mar 26, 10:43am

2

A record-high 70% of farmers responding to the twice-yearly Federated Farmers Confidence Survey say their farm is currently profitable

Confusion from PMIs in both the US and China; Taiwan export orders surge again; Australia GDP rises more than expected; fertiliser prices leap; UST 10yr at 4.08%; gold rises while oil eases; NZ$1 = 59.3 USc; TWI-5 = 62.9

5th Mar 26, 7:25am

11

Confusion from PMIs in both the US and China; Taiwan export orders surge again; Australia GDP rises more than expected; fertiliser prices leap; UST 10yr at 4.08%; gold rises while oil eases; NZ$1 = 59.3 USc; TWI-5 = 62.9

[updated]

Steven Hail argues New Zealand is enduring a period of economic self-harm and offers a way to end this and create a future based on hope

5th Mar 26, 5:00am

20

Steven Hail argues New Zealand is enduring a period of economic self-harm and offers a way to end this and create a future based on hope

Heated exchange in Parliament over the Government’s liquefied natural gas (LNG) plan comes as global prices surge amid escalating conflict in the Middle East

4th Mar 26, 6:20pm

22

Heated exchange in Parliament over the Government’s liquefied natural gas (LNG) plan comes as global prices surge amid escalating conflict in the Middle East

A review of things you need to know before you sign off on Wednesday; BNZ trims TD rates, Auckland median house price drops, Seascape in receivership, disgraceful KiwiSaver returns, swaps firm, NZD lower, & more

4th Mar 26, 4:07pm

27

A review of things you need to know before you sign off on Wednesday; BNZ trims TD rates, Auckland median house price drops, Seascape in receivership, disgraceful KiwiSaver returns, swaps firm, NZD lower, & more

Economists are beginning to flirt with a revolutionary idea - that the New Zealand economy might be able to grow and prosper without the traditional leg-up from the housing market

4th Mar 26, 8:55am

34

Economists are beginning to flirt with a revolutionary idea - that the New Zealand economy might be able to grow and prosper without the traditional leg-up from the housing market

Stagflation fears loom large; dairy price rise; US sentiment drops; China focuses on next 5-year plan; EU inflation up; Australia current account deficit widens; UST 10yr at 4.06%; gold drops while oil jumps; NZ$1 = 58.8 USc; TWI-5 = 62.5

4th Mar 26, 7:20am

60

Stagflation fears loom large; dairy price rise; US sentiment drops; China focuses on next 5-year plan; EU inflation up; Australia current account deficit widens; UST 10yr at 4.06%; gold drops while oil jumps; NZ$1 = 58.8 USc; TWI-5 = 62.5

Oil, LNG and KiwiSaver: What the US–Iran conflict could mean for New Zealand’s economy, and what the Government is watching

3rd Mar 26, 4:24pm

17

Oil, LNG and KiwiSaver: What the US–Iran conflict could mean for New Zealand’s economy, and what the Government is watching

[updated]

A review of things you need to know before you sign off on Tuesday; some home loan rate changes, building consents jump, car sales rise modestly, RBNZ Dashboard updated, swaps up, NZD down, & more

3rd Mar 26, 3:59pm

44

A review of things you need to know before you sign off on Tuesday; some home loan rate changes, building consents jump, car sales rise modestly, RBNZ Dashboard updated, swaps up, NZD down, & more